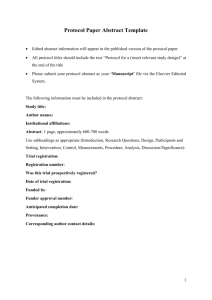

Reed Elsevier Capital Inc.

advertisement