Chapter 4: Market Entry Strategy

advertisement

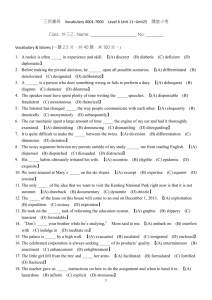

Chapter 4: Market Entry Strategy The objective of this chapter is to select appropriate tactics to enter the market and mode of international business. The decision is made after comparing all appropriate alternatives and then selecting the optimal. This chapter discusses regulatory issues and some marketing related questions. Market Entry Strategy Market Tactics Entry Evaluating Munificence/Sparsity Evaluating Hostility/Benignity Evaluating Factors Modes International Business Selection Other of Foreign Direct Investment Selection Merchandise Exports Figure 4.1: Chapter Content 52 Section 1: Selection of the Market Entry Tactics Given all the previously mentioned information, now it is important to identify the type of Taiwan market in order to formulate the market entry strategy. Previous researches found the two market variables that have the tremendous impact on the entry of a new product (Tsai, MacMillan and Low 1991) – munificence or sparse and hostile or benign. Therefore, it is vital to make market munificence/sparsity and hostility/benignity analysis. Munificence describes the size, structures and nature of the market being entered, while the hostility captures the structure and nature of the firms competing in the market. The other factors, such as market life cycle stage and threat to existing customers are also added to the discussion. Firm related factors cannot be added to this analysis, since the information regarding the firm has not been revealed yet and be discussed as well. Section 1.1: Evaluating Munificence/Sparsity Despite the fact that jewelry market in Taiwan is quite large, accounting around US$1,143 million in 2005, and upward going sales trends; however, these sales are basically coming from diamond, gold and jade jewellery. In this case the market is munificence. Amber jewellery does not enjoy such positive trends and it is very hard to find the information regarding its market size, and can be only relied on the interviews from the existing companies. The tentative conclusion can be made about the amber jewellery market in Taiwan, which is the market is sparse. Customers do not have amber buying traditions compared to above mentioned diamond jewellery, which is world-wide well-bought, gold and jade jewellery, which are bought for a special occasions and has deep roots in Chinese culture. Amber here is the same as tofu in Lithuania: only people, who know it, they will buy. 53 Therefore, like in each product market it is very important to educate the customer to make him/her to become loyal. That fact states there are potential customers, comprising the unfulfilled market. Section 1.2: Evaluating Hostility/Benignity Competition is the key to determine the market hostility. There are not many direct competitors: only few companies are selling amber jewelry, but there are some entrepreneurs, who are legally or not providing it together with other kinds of jewelry to the night and other markets. Thus, leadership in this cannot be observed and to this aspect the market is benign. However, there is a competition coming from other type jewelry and this fact makes benignity less seen providing the conclusion that it is rather hostile. Section 1.3: Evaluating Other Factors Other factors that can be considered are market life cycle and threat to existing sellers. Since a lot of people do not know about the amber and its jewelry; therefore, there cannot be claimed that the market is developed or mature. Even though that some importers are already around 10 and more years in the market, still Taiwan amber jewelry market is in the early stage. Threat to the existing sellers will be rather high because jewelry is considered as durable good, so the demand is more price elastic. 54 Section 1.4: Selecting Market Entry Tactics There are known four tactics of market entry, discussed by Block and MacMillan in “Market Entry Strategies for New Corporate Ventures”14, that are Blitzkrieg, Cavalry Charge, Strike Force, Guerrilla Tactics. These strategies are incorporated in the following so-called Aggressiveness/Focus Matrix. The objective of this matrix to compare all strategies and to choose the one that the most fits this case. Table 4.1: Market entry tactics. Blitzkrieg Factor Market Conditions Hostile Benign Munificent Sparse Market Life Cycle Early Developed Mature Threat to Existing Customers High Low Calvary Charge Strike Force Guerrilla Tactics (+) (+) (+) (-) (-) (+) (+) (-) (+) (-) (-) (+) (+) (-) (+) (-) (-) (+) (-) (-) (+) (-) (+) N (+) (+) N (+) (+) (-) (+) (-) N (+) N (+) From the matrix, which is depicted in Table 4.1, it is obvious that the most appropriate is Strike Force Approach. This strategy is non-aggressive and focused and it is appropriate for a hostile and sparse market. It is a low-key, calculated entry into a narrowly defined market. The venture can quietly enter, laying the groundwork for the further expansion. Following this tactics, the marketing issues will be addressed in the successive chapter. 14 Hills, Gerald E., ed., Marketing and Entrepreneurship. Research Ideas and Opportunities, Cincinnati, OH: Westport, 1994. 55 Section 2: Modes of International Business The goal of this section is to find the optimal mean of exporting amber jewelry to Taiwan. By saying the optimal, the meaning is least complicated, so the company could win the time and focus on the business rather than institutional issues; and the most economy, so it could have the advantage of adjusting the price. In general, there two modes of international business as means for companies to introduce their products to foreign markets: make an investment, which is called as foreign direct investment; or appoint importing agent or distributor. To accommodate the investments, Taiwan has simplified the procedures and shortened the time for related applications. Foreign investors have several options to match projected investments with the business activities and needs: 1. 100-percent owned subsidiary 2. Branch 3. Joint venture 4. Representative office 5. Liaison office. Establishing liaison office and representative office will not be discussed since it does not comply with the business strategy discussed in this thesis due to the activities limitations of previously mentioned business entities. Therefore, the Lithuanian company has three options to introduce its products to Taiwan: wholly-owned business entity (subsidiary or branch), collaborative arrangement (joint venture) and direct selling (sales representative, distributor or retailer). Despite the legal requirements, which will be discussed in subsequent sections, important points to ponder are ownership and problems associated with control. Simplified version the previously mentioned matter is presented in the following Figure 4.2 and will be 56 discussed in following sections herewith detailed introduction of the business entities types for foreign investors, procedures and the required documents for related applications. Number of Partners Many Joint Venture Importing Agent, Distributor Wholly-Owned None Equity Ownership Continuum Non-equity Figure 4.2: Comparison of entry strategies Section 2.1: Foreign Direct Investment This is the case of the market seeking foreign direct investment (FDI). In general, FDI is a type of investment that gives the investor a controlling interest in a foreign company. Control necessary has to be a 100-percent or 50-percent interest, but for sake of simplicity, here is considered 100-percent owned entity (branch or subsidiary) and 50-percent collaborative arrangement. A. Wholly-Owned Entity: Subsidiary and Branch Structures While operating abroad, company can choose among legal forms that affect decision making, taxes, maintenance of secrecy, and legal liability. So it has to decide between making that operation a legally separate company (subsidiary) and a branch. 57 1) Company Taiwan Company Act provides four categories of companies: 1. Unlimited company is the business entity organized by two or more shareholders, who bear the obligations and liabilities. 2. Limited company is the company of one or more shareholders and each being liable for an amount was contributed. 3. Unlimited company with limited liability shareholders is a hybrid business structure, where the company organized by one or more shareholders of unlimited liability and one or more shareholders of limited liability. 4. Company limited by shares is when firm is organized two or more or one government or corporate shareholders, with the total capital of the company being divided into shares and each shareholder being liable for the company in an amount equal to the total value of shares owned. Unlimited company, unlimited company with limited liability shareholders and company limited by shares are comparatively complicated business structures, requiring more resources. Since Lithuanian company is small, from above listed options there can be considered only one: set up limited company. However, there are two ways to structure unlimited company: 1. To establish 100-percent owned subsidiary, in other words Lithuanian company as a sole shareholder of the Taiwan company. 2. Align with other shareholders to form joint venture. This option will be discussed in later section. 58 2) Branch Setting a branch is a second option of 100-percent owned business entity. Taiwan Company Law grants branch of a foreign company the same rights and obligations as a domestic company, but it should get prior recognition from Ministry of Economic Affairs before staring business in Taiwan. 3) Comparison of Subsidiary and Branch Appendix 4.1 presents the similarities and differences between 100-percent owned subsidiary and branch. It obvious that subsidiary has to face more strict regulations and to set up branch office is not so complicated. Despite the complications of foundation, there are additional points draw. Legal issues. A foreign branch is a foreign operation, which is not legally separated from the parent company and is 100-percent owned by the parent entity. The main difference from the subsidiary is that subsidiary even though it is owned by the parent company, but legally it is a separate company. That fact states that the parent company has a limited liability and creditors or winners of legal suits usually do not have the access to the resources of the parent company. Public disclosure. Another factor to consider is maintenance of secrecy. Generally, the greater control the owner has the greater secrecy it can maintain. In this case branches are usually subject to less public disclose since they are covered by tight corporate regulations. Tax advantages. As mentioned in the previous section that was discussing Income tax related issues if a 100-percent foreign owned subsidiary, having head office in Taiwan, is subject to income tax for its worldwide income; while branches are considered a non-resident 59 for tax purposes and are has to pay tax for its incomes derived from Taiwan sources. However, in this case, it is not planned to set head office in Taiwan, therefore establishing subsidiary or branch Taiwan laws and regulation do not provide any tax advantages, when compare those two alternatives. On the other hand, subsidiaries are obliged to pay 20% of withholding tax. If it decides not to distribute profits, 10% surtax must be paid on undistributed profits against withholding tax. While branches are not levied any this type of taxes. In Taiwan government provides tax incentives that are mainly applicable to a company, including subsidiary of a foreign company because branch office of foreign company pays only profit-seeking enterprise income tax, after-tax profit repatriation by a branch is not subject to further income tax. This fact may increase the motivation to set up a subsidiary, but those tax incentives can be availed only for specific purposes, such as investments in research and development or personnel training and that does not correspond with previously mentioned market seeking investment. For a small Lithuanian company the best option would be to set a branch rather than subsidiary, so as it can avoid too large costs and bypass some complex regulations associated with the foundation of subsidiary as indicated in Appendix 4.2, where displayed detailed information regarding procedures, documents required and timeframe to open company and branch. B. Collaborative Arrangement: Joint Venture Structure Joint venture is a type of foreign direct investment, when at least two companies share the ownership of a new established company. There might be several companies involved in this kind of establishment, that then called a consortium, but here it is not discussed due to the 60 relatively small amount of investment, and only considered the collaboration arrangement between Lithuanian and Taiwanese firm. As mentioned before, for sake of simplicity, if forming joint venture, the best option for small Lithuanian company is to find a local partner for the purpose to set up limited company, while other structures (unlimited company, unlimited company with limited liability shareholders and company limited by shares) better applicable larger firms to consider. Therefore, in order to set up joint venture as a limited company structure, companies have to follow regulations related to the limited company. Joint venture allows both parties equally participate in company control and provides some advantages compared to other structures: Spread and reduce costs. To sell abroad the company will incur some fixed costs, thus aligning with another firm will help to reduce them. Learn from other companies. Collaborating is an opportunity to learn about operating methods, home market so that company’s own competencies will broaden or deepen, making it more competitive in the future. Gain location-specific assets. Lithuania and Taiwan are different in their cultural, political, competitive and economic environment and those environments can become barriers for company to enter and operate alone. Local partner could help to conquer providing distribution network and competent workforce. These assets would be difficult for Lithuanian company to access on its own. On the other hand, there might emerge some issues regarding this type of collaborative arrangement. Collaboration’s importance to partners. One partner may give more management attention to joint venture compared to the other. If things go wrong, the active partner will start 61 accusing passive part for its lack of attention. On the other hand, less active partner might blame active one for making poor decisions. Different objectives. Although companies form joint ventures because they have complementary capabilities, but over time their objectives may evolve and contradict each other. In this case, one part may want to invest more in order to increase amber jewelry sales, the other part might not be willing be aggressive and continue enjoy stable income. Control problems. When there are two companies involved, there are always disputes arising regarding the management since those parties have different objectives. Differences in culture. Apart from the language barriers, there are some also behavioral practices affecting the business. Particularly in this case, when two companies are coming from different cultures, western represented by Lithuanian partner, and eastern represented by Taiwanese company. Differences associated with the culture might arise in power distance, the way how people process information and tasks. In Lithuania there is lower power distance compared to Taiwanese companies, where people have little consultation between superiors and subordinates and usually autocratic or paternalistic management style is employed. The other difference is related to the way how people obtain information and how they perform tasks. Lithuania is categorized as low-context culture, where most people consider relevant only firsthand information. They spend little time on small talk and say things directly. Taiwan is a high-context culture: most people think that peripheral information is valuable to decision making and say things indirectly. In addition, there are differences between Lithuanians and Taiwanese on how they understand working environment. This is individualism versus collectivism situation: in general Lithuanians are individualists preferring low dependence on the organization, personal time and challenges: while Taiwanese are more collectivists, they are loyal and/or dependent on the organization, like 62 working in teams. Therefore, there might emerge comprehension and communication problems that will impede decision making and task implementation. Despite the above mentioned problems, setting joint venture Lithuanian will have to pass similar procedures as in the case of establishing subsidiary and that fact makes it even less attractive compared to the alternative associated with the branch set. To conclude the best option from discussed alternatives associated with investments is to open a branch office so as it does not require so many resources, including time and efforts, for a small Lithuanian company to introduce amber jewelry to Taiwan. Moreover, setting the branch the company still can employ local people to deal with customers and proceed marketrelated actions, but compared to joint venture no local equity will be involved, so problems associated with control might be avoided or at least minimized. If the branch will be employing local employees, cultural differences are imminent, but the consequences will not be so excruciating because they will be kept at the lower level of company’s hierarchy. Section 2.2: Merchandise Exports The last alternative of introducing products to Taiwan is through third-party intermediaries. Exporting may be either direct or indirect. Direct selling will occurs when goods will be sold to an independent party outside Lithuania, while indirect selling will be when they will be sold to an intermediary in the domestic market, which later will sell the goods in Taiwan. Since due to the nature business of Lithuanian company, appoint Export Management Company or export trading company is not very presumable, there is a direct selling option left to discuss through. 63 Direct selling can be proceeded through sales representative, distributor, retailer and final end user. However, in Taiwan people are lack of knowledge about amber jewelry, thus, marketing activities has to be organized to eliminate that problem. Marketing activities can be carried out through sales representative or distributor. Important points to consider regarding each potential sales representative or distributor in Taiwan: 1. The size and capabilities of its sales force 2. Sales record 3. Analysis of its territory 4. Current product mix 5. Facilities and equipment 6. Marketing policies 7. Customer profile 8. The principles it represents and the importance of the inquiring company to its overall business 9. Promotional strategies. Section 3: Final Decision Regarding Mode of International Business The final discussion which mean of exporting to employ is to decide whether to set up a branch office or to deal with sales representative or distributor. Obviously, the last alternative elevates the final price or narrows down company’s profit margin; however, for the time being this is the best option because of not sufficient financial resources. Even though there is always a risk and uncertainty how efficient sales representative or distributors will handle their obligations and duties, on the other hand, Lithuanian company can avoid some fixed costs when setting up a business entity in Taiwan, and in case of failure it will not lose as 64 much as having business. This approach also supports Strike Force tactics since foreign companies are always more conspicuous compared to locals. Relying on distributor will not cause so much turbulence in the market as Lithuanian company entering by itself. However, in this situation cultural differences and problems associated with them are inescapable, but solution to this problem can be to employ native Lithuanian to work in Taiwanese company, who obtains knowledge about Taiwan so to help to overcome undesirable circumstances. In the case of success, it can refer to the following path: 1. Short-term Strategy: carry export procedures through sales representative or distributor. 2. Long-term Strategy: establish business entity in Taiwan. The mentioned entry strategy is the least risky because at the first point it can quickly enter, and exit in the case of failure. This path is not something new and serious companies always raise the question of internal versus external handling their operations and this question attributes to the evolution of strategy in the internalization process. 65