Implementation and Evolution of

Liability Driven Investing Strategies

Guided by the asset/liability strategy known today as liability driven investing (LDI), many pension plan fiduciaries have become more aware of the

nature and extent of pension benefit liabilities, and have taken concrete steps to mitigate the interest rate and other risks of liabilities in their portfolios. Extensive discussions around this strategy have pointed to a distinguishing aspect of today’s LDI programs: there is no single ”one-size-fitsall” approach. Pension plans differ in their funded status, ratio of active to inactive employees, and nature of their benefit formulae. In addition, plans

may be closed to new participants and may have frozen the benefits for current participants. Given these variables, fiduciaries adopt LDI approaches

appropriate to their particular circumstances. Therefore, two plans of similar asset size may have very different LDI strategies.

Typical approaches to LDI involve altering the

fixed income portion of the portfolio to improve

the match between the interest rate exposure

of the assets and the interest rate risk of liabilities. Common examples include adopting a

longer-duration, longer-maturity fixed income

benchmark for the portfolio’s fixed income

investments and/or using derivative instruments to extend the duration of the fixed

income allocation. The choice of approach

remains a subject of debate among pension

fiduciaries, and the issues are becoming well

understood. This article focuses on two other

important aspects of LDI that are perhaps less

understood: the pace and timing of the implementation of an LDI solution, and the ways in

which an LDI portfolio’s asset allocation and

structure should evolve in future years, both in

response to changes in market conditions and

in consequence of changes in the nature and

structure of the pension liability.

Timing of LDI Implementation

Many investors believe that “locking in” a

pension liability at today’s perceived low

interest rates is less than optimal. However,

leaving a large un-hedged risk exposure open

to market fluctuations is equally sub-optimal.

Pension plan fiduciaries considering an LDI

strategy recognize that the plan beneficiaries

are exposed to substantial risks arising from

the interest rate mismatch between plan

assets and pension liabilities. In considering

timing of the execution of an LDI strategy, fiduciaries should evaluate: (1) risk tolerance,

specifically, how large is the current

asset/liability duration mismatch and how

much risk is appropriate for both the short- and

long-term; (2) potential transaction cost

savings of phasing in an LDI program vs. a

more rapid execution; and, (3) the strength of

the fiduciaries’ short-term investment view

relative to the risk that is borne during the transition period.

In evaluating these factors, we believe most

plan fiduciaries will find few compelling arguments for phasing-in an LDI implementation

over lengthy periods. Only the largest pension

plans might impact market prices by implementing LDI rapidly, which may argue for a

more gradual approach by those plans due to

potential transaction cost benefits.

Active fixed income managers engaged in

interest rate anticipation strategies will typically take only 1-2 years of duration risk exposure even on a strongly held view. Pension

fiduciaries who carefully examine the size of

the asset/liability mismatch in the pension

plan – typically many years of duration, the

absolute size of the liability, and the consequences of an adverse outcome in interest

rates – should quickly conclude that the larger

risk is in delaying the inception of an LDI

strategy not in implementing too quickly.

In short, once plan fiduciaries decide that an

existing risk exposure is too large, the objective should be to reduce that risk to acceptable

levels as soon as reasonably practicable.

Future Portfolio Evolution

As mentioned earlier, the funded status of a

plan is a significant variable that can determine an appropriate LDI program. In general

(recognizing that it is dangerous to generalize),

overfunded plans – and particularly plans

whose funded status exceeds 110% – tend to

adopt LDI strategies that emphasize liability

hedging over asset growth. An overfunded plan

will often make substantial allocations to fixed

income (70-90%), emphasize direct investments in long-maturity bonds, de-emphasize or

avoid derivative instruments, and allocate only

modestly to equity and other higher-risk returnoriented investments. This is especially true for

closed and frozen plans that no longer need

high growth targets to cover the annual benefit

accruals due to active participant’s service cost

of employment.

Conversely, underfunded pension plans are

more likely to adopt growth-oriented

approaches. An underfunded plan pursuing an

LDI strategy will more often have smaller allocations to fixed income (30-50%), greater use

of derivatives to extend the duration of the

fixed income investments, and larger allocations to equity and other higher-risk returnoriented investments.

Regardless of the initial asset allocation

weights, fiduciaries should be prepared to

adapt the LDI approach to the changing evolution

of the plan’s funded status. The central case for

most pension plans is that growth in plan assets

will increase the funded status over time, calling

for a shift in target asset allocation weights to

fixed income from equity and other higher-risk,

return-oriented investments as the plan’s funded

status improves. Since equities are often the

source of such growth, this involves selling

stocks to buy bonds and doing so more aggressively than demanded by a simple rebalancing to

a fixed target asset allocation weight, because

the target itself is shifting.

To a loose approximation, the evolution of a

successful LDI strategy over time should be

similar to managing the risk of so-called "lifecycle" funds now so popular in defined contribution pension schemes. In particular, a successful

LDI strategy should reduce risk over time, similar

to the way that a life-cycle fund reduces risk as

the defined contribution participant ages.

Pension plan fiduciaries adopting an LDI program

should realize that they are committing to a

dynamic process that may contrast with prior

practices. Some pension plan managers have

traditionally viewed a funding surplus as an

opportunity to take more risk in pursuit of higher

returns, an approach that, especially in the

absence of a liability hedge, led many plans from

liabilitiessets

Often overlooked is how the LDI strategy should

evolve over time as a result of paying benefits

and/or because of successfully meeting the

asset growth targets. Planning for such an evolution is particularly important for closed and

frozen plans where benefit payments can be

larger than the combination of the annual accretion of the liability due to employee service and

interest costs. In these cases, and in the absence

of adverse market movements, the liability

shrinks over time and, under an LDI strategy, the

pension surplus grows over time (or, equivalently, the pension deficit shrinks).

In such instances, a policy of paying out benefit

payments preferentially from the portion of the

portfolio holding the equity and other higher-risk,

return-oriented investments acts to reduce

pension surplus volatility and increase the

liability hedge efficacy over time, while simultaneously maintaining or improving the plan’s

funded status.

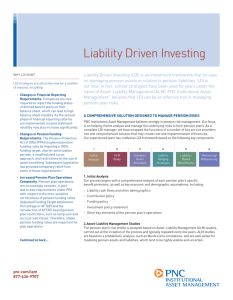

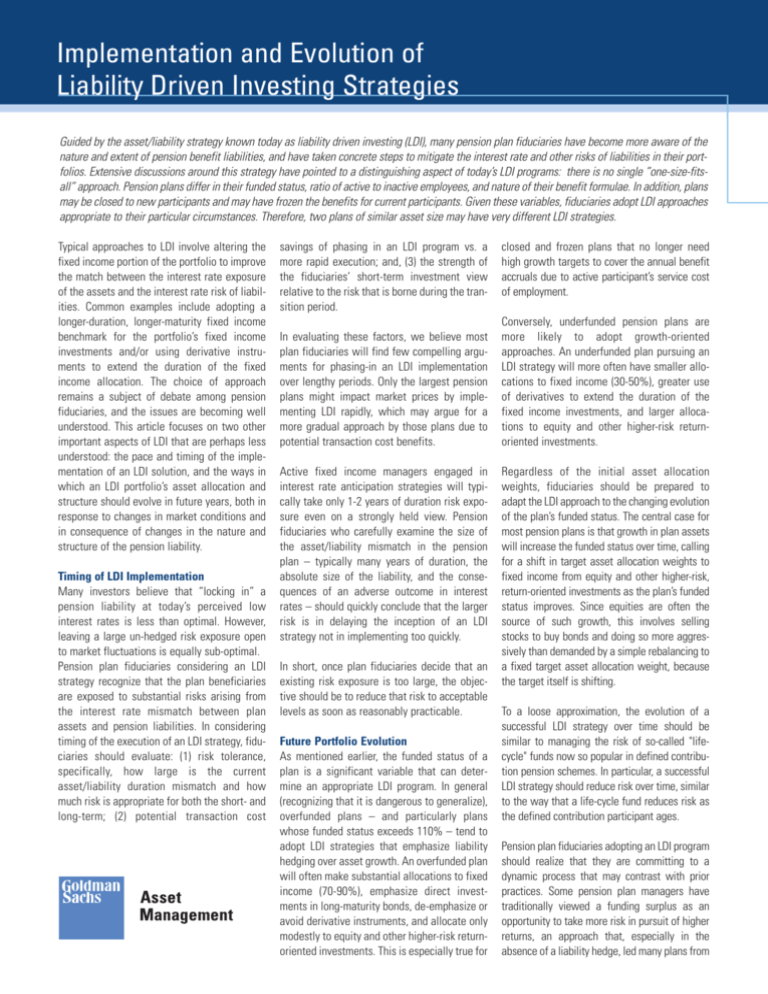

We can illustrate with an example using a

hypothetical $1 billion pension plan, fully

funded today, pursuing an LDI strategy that

invests 30% in equity and other higher-risk,

return-oriented investments earning a targeted

8.5% annual return and 70% in fixed income

assets having a duration equal to that of liabilities and expected to earn 5% annually, which

matches the liability discount rate. In effect,

the LDI strategy is set up to hedge 70% of the

interest rate risk of the pension liability and the

assets as a whole are expected to grow at a rate

of approximately 1% in excess of the interest

cost of the liabilities. Absent distributions, the

funded status would be expected to improve

from fully-funded (100%) to 105% funded in five

years, the fixed income assets would be

expected to grow in line with liability accretion,

and the LDI strategy would continue to hedge

70% of the liability risk. For convenience, we

assume a closed and frozen plan, which is not

accruing any meaningful service costs.

In the more realistic case where regular distributions to pension beneficiaries are occurring, the

hypothetical plan’s future funded status and

liability hedge effectiveness will depend upon

how those distributions are funded. For illustration, we assume annual distributions of $75

million. If the distributions are funded 70% from

the fixed income assets and 30% from the equity

and other higher-risk, return-oriented investments, reflecting the initial asset allocation, then

the equity/bond split will deteriorate over time

from 30/70 initially to 35/65 after five years as a

result of the higher expected growth rate in the

equity and other higher-risk return-oriented

investments. Alternatively, if the distributions

are funded 60% from the fixed income assets

and 40% from the equity and other higher-risk

return-oriented investments, the equity/bond

split remains at 30/70, and the liability hedging

effectiveness improves from 70% initially to

75% after five years time reflecting the improvement in funded status.

Ideally, the distribution policy should reflect a

desire to hedge more of the liability risk as the

plan’s funded status improves. For example, if

distributions are even more preferentially funded

from the equity portion, say 50% from fixed

income and 50% from equity and other higherrisk return-oriented investments, then the liability

hedging effectiveness improves from 70%

initially to 80% after five years, the equity/bond

asset split moves from 30/70 initially to 25/75

after five years, and the plan’s funded status

Exhibit I: Illustrative Example

of LDI Strategy

1200

Present Value / Market Value ($ millions)

surplus to deficit early in this decade. In an LDI

program, a funding surplus should be viewed as

a prime opportunity to reduce risk.

Liability Present Value

Fixed Income Assets

Equity & Other Assets

1000

800

600

400

200

0

2008

2009

2010

2011

2012

2013

These examples are for illustrative purposes only and are not actual results. If any assumptions used

do not prove to be true, results may vary substantially.

would be expected to improve from fully-funded

(100%) to 106% funded after five years. [This

example is shown for illustration in Exhibit I.]

In summary, liability driven investing has been

embraced by the pension community and

pension plan fiduciaries are making independent decisions concerning the targeted level of

growth in the plan and the degree of risk exposure – generally seeking to maintain an excess

growth of plan assets over plan liabilities,

while substantially reducing the net interest

rate risk from liabilities. Once the decision is

made to pursue an LDI strategy, we see little

benefit from delaying its implementation,

recognizing at the same time that an LDI

strategy is a dynamic process and not a static

asset allocation. Over time, and as growth

targets are realized, an LDI strategy will generally seek increasing risk reduction as the plan

becomes more fully funded. Important in this

process is the planning of how to meet future

benefit payments, with benefits generally paid

out preferentially from the equity and other

higher-risk, return-oriented investments.

For more information, visit

gsamldi.gs.com

This material is provided for educational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell securities. Opinions expressed are current opinions as of the

date appearing in this material only. No part of this material may, without GSAM’s prior written consent, be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that

is not an employee, officer, director, or authorized agent of the recipient. This information discusses general market activity, industry or sector trends, or other broad-based economic, market or political

conditions and should not be construed as research or investment advice. This material has been prepared by GSAM and is not a product of the Goldman Sachs Global Investment Research (GIR) Department.

The views and opinions expressed may differ from those of the GIR Department or other departments or divisions of Goldman Sachs and its affiliates. Investors are urged to consult with their financial advisors

before buying or selling any securities. This information may not be current and GSAM has no obligation to provide any updates or changes. The strategy may include the use of derivatives. Derivatives often

involve a high degree of financial risk because a relatively small movement in the price of the underlying security or benchmark may result in a disproportionately large movement in the price of the derivative

and are not suitable for all investors. No representation regarding the suitability of these instruments and strategies for a particular investor is made.

Copyright © 2008, Goldman, Sachs & Co. All rights reserved. (10506.OTHER)