Thailand and the Hamburger Crisis (1)

advertisement

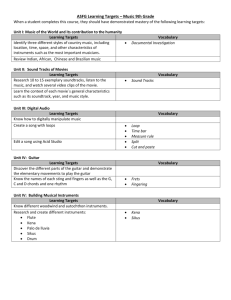

Thailand and the Hamburger Crisis (1) Thanet Kongprasert The global economy after the second quarter of 2008 experienced turbulences caused by high inflation rates, which had, in turn, resulted from the steep rises of the prices of crude oil and consumer products, including food. No sooner had the situation begun to register some improvements in August than a great disaster ensued in mid-September, and that was the outburst of the sub-prime mortgage crisis in the United States. This crisis resulted in many giant financial institutions facing huge losses and severe illiquidity. Some of them had to close down or remained in a shaky position, causing widespread damaging consequences for all concerned. Dubbed a “hamburger crisis”, the magnitude of whose severity has also led some to call it a “global financial tsunami”, this crisis actually started on 16 September 2008, only two days after Lehman Brothers, the world’s fourth largest investment bank, had declared bankruptcy, and the U.S. Federal Reserve had rushed to the rescue of the financial system by providing the world’s largest insurance company, American International Group (AIG), with an emergency loan of $8.5 billion (the United States government announced later that it would extend the loan ceiling to $150 billion). What had happened to Lehman Brothers and AIG caused an immediate and acute chaos in the global financial market. Stock market indices all over the world made rapid plunges, whereas the global liquidity severely shrank. The situation prompted the central banks of the countries in four continents to pump liquidity into the currency exchange system. The prices of consumer products also experienced deep fluctuations. All these severe consequences have created widespread anxiety that the world might plunge into an economic depression that is even more damaging than the Great Depressions of the 1930s—an event that is still vivid in our memory. As Alan Greenspan, former chairman of the U.S. Federal Reserve, voiced his concern, this crisis is like a “financial tsunami”, a “once-in-a-century” financial crisis. Causes of the Hamburger Crisis The starting point of this crisis was the busting of the real estate bubble, because real estate prices had been inflated to a point where no one would risk buying properties at prices higher than when they had been purchased. This situation initially had an impact on the debtors’ ability to make mortgage loan payments under real estate purchase agreements, and then the impact spread to the financial sector. The immediate cause was the two large mortgage companies in the United States that provided loans and guaranteed lending for home mortgages by members of the general public – The Federal Home Loan Mortgage Corporation (FHLMC, or “Freddie Mac”, as it is popularly known), and The Federal National Mortgage Association (FNMA, or “Fannie Mae”, as it is popularly dubbed) – that faced acute financial difficulties in mid-2008. Their situation was the result of the burst of the real estate bubble because of the deep plunges in real estate prices. When the loan debtors were unable to pay their home mortgage installments, or intentionally evaded their obligations under mortgage agreements, a large number of seized properties inundated the real estate market. This state of affairs forced the prices further down. As these two giant mortgage companies 1 had jointly provided loans or guaranteed mortgage debts whose value amounted to about $12 trillion (Thailand’s GDP is equivalent to a mere one-fourth of $1trillion), the financial damages that followed are truly extensive. These problems and damages, however, have not been confined to the loan-providing companies, but have quickly extended to other financial institutions, because the two financial institutions relied on securitization; that is, issuing credit instruments that were actually tied to mortgage-backed securities (MBSs) for sale to numerous financial companies and institutions in the United States as well as abroad. It was speculated that this kind of securitization would result in higher returns than those that could be expected from the purchase of government bonds. When Freddie Mac and Fannie Mae incurred financial difficulties, the financial institutions that had invested in these fixed income securities, such as commercial banks, investment banks, insurance companies, provident funds, mutual funds, and hedge funds have been adversely affected. The problem has been worsened by the innovation of modern financial paper instruments; that is, new forms of credit instruments have been issued that are tied to mortgages, for example, credit default swaps (CDSs). This kind of credit instrument is a derivative serving as a financial insurance against credit instruments issued by various enterprises (including financial institutions, municipalities, universities, schools, airports, museums, student loan funds, and SMEs) going into default. Many financial institutions issue this type of credit instruments, including investment banks, insurance companies, and monolines. The issuers of CDSs will guarantee the payment of both the principals and interests to the CDS holders in case of bad debts. These credit instruments have been assessed by credit rating institutions in accordance with the credit ratings of the companies that guarantee them. Mostly enjoying high credit ratings, these CDSs have become popular since 2001, and their popularity has steadily been on the rise, resulting in the increase in their overall value from $100 billion in 2000 to $6.4 trillion at the end of 2007 (higher than the world’s GDP that stood at $54.3 trillion). Many financial institutions have issued CDSs as guarantees for credit instruments that rely on mortgage-backed securities. When problems occur in the mortgage market, and the issuers of credit instruments are unable to pay their debts, the CDS issuers have to make financial compensations to CDS holders. When defaults become extensive (because real estate prices have gone to a level where the loan debtors realize that it is now longer profitable to continue to pay the mortgage installments), the CDS issuers face growing financial burdens that eventually affect their liquidity and capital resources. As a consequence, the CDS credit ratings are lowered, and this, in turn, results in the fall in the values of credit instruments. All those financial institutions that hold these credit instruments have to write them down, leading to the decrease of their capital resources, and their financial positions might be so problematic that they have to close down. Also shouldering rising financial burdens, the financial institutions that are CDS issuers have found themselves in a similar situation. The problems faced by Lehman Brothers and AIG have partly come from their financial obligations to CDS holders. In addition, the problems have been further complicated by financial innovators, who invented another type of financial instrument in 1987. This new form of financial instrument became rapidly popular, and has since become an important credit instrument of fixed income securities. This financial product is called collateralized debt obligations (CDOs), which are created by pooling a large number of credit instruments (the number sometimes being as large as 500-600) and then dividing them into three groups: the first group consists of low-risk credit instruments, such as credit instruments belonging to the U.S. government, or those of businesses with high 2 credit ratings; the second group comprises medium-risk credit instruments; and the third group includes high-risk, or relatively high-risk credit instruments. Credit instruments belonging to the last group are often referred to as “toxic wastes”, whose financial returns depend on the levels of their risks. High-risk credit instruments yield higher returns than those with lower risk levels. Here the situation is similar to that of CDSs, in that there are among CDOs those that are tied to mortgage-back securities; the whole group thus becomes risk-loaded and its value is accordingly reduced, even though almost all CDOs in the group have no serious problem. This situation adversely affects the financial position of the CDO issuers as well as those who have invested in them, and the financial problem that has been thus induced rapidly multiplies. The steady rise in real estate prices in the United States during 1997-2006 resulted in a 124-percent price increase. This state of affairs attracted a large number of home buyers seeking credits in the home mortgage market. Even though some of the home buyers fully realized that their incomes were not enough to cover the mortgage installments, they believed that with the prospect of the real estate prices becoming higher in the future, they could extend the credit ceiling. In addition, there were speculators who bought homes only with the intention of selling them later with higher prices. Together with the policy of the U.S. Federal Reserve to increase financial liquidity, credits in the real estate sector were readily available. Financial institutions are normally willing to issue loans to high-credit customers who have a high debt-servicing capacity, the chance of these customers going into default in repaying their installment loans being very low. However, with the competition among the financial institutions for customers in the home mortgage market becoming increasingly intense, loans were eventually extended to highest-risk customers, who were called “ninja”, i.e., those with “no income, no job, and no assets”. Moreover, the credit conditions were extremely relaxed. Examples of this type of easy credits include the “interest-only adjustable-rate mortgages” (ARMs) that allowed the customers to pay only the loan interests during the initial phase; and the payment option loans with a very flexible repayment, that includes the possibility for the unpaid interests to be added up to the principal. This kind of practice by the financial institutions is not totally unreasonable: their insufficient attention to risks was due to the strong belief that they would be able to deflect their risk burdens to others through securitization. That is, they would pool all those credits together and then transform them into mortgage-back securities (MBSs). Once they have sold out these MBSs, the financial institutions would transfer all their credit risks from their own accounts to investors who purchased these credit instruments. The bubble in the real estate market was inflated to an unprecedented extent, with multiplication and complicated interconnections shares, corporate bonds, as well as various kinds of credit instruments in the U.S. financial market. All these factors eventually blew up the bubble, creating a domino-effect damaging consequences starting from the serious financial difficulties of the two giant mortgage companies – Freddie Mac and Fannie Mae – then extending to the financial institutions that issued CDSs, and eventually to investment banks such as Lehman Brothers as well as giant insurance companies like AIG. In the period prior to the outburst of the crisis in September 2008, Lehman Brothers had accumulated CDS financial obligations that amounted to $440 billion. When the financial institutions that were CDS issuers were in such a situation, various businesses were no longer in a position to provide credit instruments, becoming thereby unable to continue their normal business transactions. The problem escalated to all sectors of the U.S. economy, then to Europe, and finally to all parts of the world. This is because investors all over the world were holders of 3 U.S. credit instruments. For instance, the Central Bank of the People’s Republic of China was in possession of credit instruments issued by Freddie Mac and Fannie Mae that amounted to a total value of $380,000 million. Likewise, 36 local councils in Australia had used many million Australian dollars of their taxpayer money to invest in CDOs. หมวด: economy Key words: Hamburger Crisis, real estate bubble, Lehman Brothers, American International Group (AIG), The Federal Home Loan Mortgage Corporation (FHLMC, or “Freddie Mac”), The Federal National Mortgage Association (FNMA, or “Fannie Mae”) Thanet Kongprasert 4