OUTLOOK

2014

BMO Asset Management Inc.

BMO Asset Management Inc.

Outlook 2014

We would like to take this opportunity to provide our capital markets outlook and recommended asset

allocation for 2014. Our asset allocation process is chaired by Paul Taylor, Chief Investment Officer of

Fundamental Canadian Equities, and includes the expertise of a team of seasoned investment

professionals, focused on creating long-term value for our clients.

A Brief Reflection On 2013

Throughout 2013 we maintained our overweight position in equities and in particular U.S. equities,

supported by our expectations of stronger growth prospects in the U.S. versus Canada, coupled with

strengthening business, consumer and investor sentiment south of the border. As 2013 progressed,

our assumptions were validated by an improving global economic environment which resulted in solid

equity returns. The S&P500 Index, the benchmark for the U.S stock market, significantly outperformed

its Canadian counterpart, the S&P/TSX Composite Index. Meanwhile, underperformance of fixed

income since the second quarter of 2013 confirmed our decision to maintain an underweight position

in this asset class.

Outlook For 2014

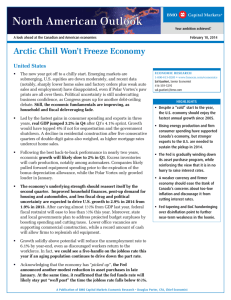

Overall, we expect a continued rebound in global economic growth in 2014. As Exhibit 1 illustrates,

there has been a significant shift in global growth dynamics over the past 18 months. The Global

Purchasing Manager Index (PMI), gauging manufacturing sentiment and reflecting trend changes in

final demand, points to momentum in economic activity across a number of developed and emerging

markets. PMIs are highly correlated with changes in real GDP and often used as leading indicators of

economic growth due to higher reporting frequency and occasionally providing some lead time for

changes in other economic indicators. As economic growth is one of the key drivers of stock market

performance, PMIs suggest accelerating synchronized global growth in 2014.

Page 1 of 6

BMO Asset Management Inc.

Outlook 2014

Leading Indicators Suggest a Continued Improvement In Economic Backdrop

Jul-12

Aug-12

Sep-12

Oct-12

Nov-12

Dec-12

Jan-13

Feb-13

Mar-13

Apr-13

May-13

Jun-13

Jul-13

Aug-13

Sep-13

Oct-13

Nov-13

Dec-13

Exhibit 1

Global

48.4

48.1

48.8

48.8

49.6

50.1

51.4

50.9

51.1

50.4

50.6

50.6

50.8

51.6

51.8

52.1

53.1

53.3

US

50.5

50.7

51.6

51.7

49.9

50.2

53.1

54.2

51.3

50.7

49.0

50.9

55.4

55.7

56.2

56.4

57.3

57.0

Eurozone

44.0

45.1

46.1

45.4

46.2

46.1

47.9

47.9

46.8

46.7

48.3

48.8

50.3

51.4

51.1

51.3

51.6

52.7

France

43.4

46.0

42.7

43.7

44.5

44.6

42.9

43.9

44.0

44.4

46.4

48.4

49.7

49.7

49.8

49.1

48.4

47.0

Germany

43.0

44.7

47.4

46.0

46.8

46.0

49.8

50.3

49.0

48.1

49.4

48.6

50.7

51.8

51.1

51.7

52.7

54.3

UK

45.2

49.6

48.1

47.3

49.2

51.2

50.5

47.9

48.6

50.2

51.5

52.9

54.8

57.1

56.3

56.5

58.1

57.3

Italy

44.3

43.6

45.7

45.5

45.1

46.7

47.8

45.8

44.5

45.5

47.3

49.1

50.4

51.3

50.8

50.7

51.4

53.3

Norway

48.9

49.0

49.4

49.3

50.6

50.2

50.4

48.3

50.5

48.8

52.3

46.2

48.2

53.1

52.4

53.4

54.1

51.6

China

50.1

49.2

49.8

50.2

50.6

50.6

50.4

50.1

50.9

50.6

50.8

50.1

50.3

51.0

51.1

51.4

51.4

51.0

contraction

neutral

expansion

While the global economy continues to grow below potential and there are some

Canada

persistent headwinds on the domestic front, the Bank of Canada expects the Canadian

economy to reach full capacity by 2016. We expect inflation to remain low despite the recent

depreciation of the Canadian dollar, preserving the purchasing power of Canadian consumers. In fact,

a weaker Canadian dollar should help avoid deflation risks while supporting export-oriented industries.

In addition, low short- and medium-term interest rates should continue to encourage lending,

particularly as fears of a correction in the housing market are starting to ease. At the same time,

businesses anticipate a modest improvement in sales over the next 12 months and plan larger

investment spending.

Page 2 of 6

BMO Asset Management Inc.

Outlook 2014

United

States

Although the most recent employment report indicated somewhat soft conditions in the

labour market in December, it is unlikely that this weakness will persist. Gains in U.S.

employment were solid last October and November, while manufacturing sentiment was up sharply

in the latter part of 2013 pointing to strengthening business sentiment on a trend basis. Meanwhile,

solid Q3 and Q4 growth – amid strong consumption demand – suggests that the recovery in the U.S.

is gaining traction, which should be further supported as fiscal headwinds fade. Overall, gradually

improving labour and housing market conditions in the U.S., combined with solid equity returns in

2013, continued to strengthen households’ balance sheets and should contribute to higher levels of

consumer confidence and spending in 2014. At the same time, cash-rich businesses are now more

likely to engage in higher capital spending amid a stronger economic outlook. As a result, we expect

above-consensus real GDP growth in the U.S. (3.2% year-over-year) and a rebound in the equity

market after soft performance in January.

As economic data in Europe continues to improve and conditions in the credit market

Europe

have become more stable, the region – and in particular developed Europe – offers a

compelling investment opportunity. Credit spreads in the periphery, reflecting perceived riskiness of

local bonds, declined substantially in 2013, easing borrowing costs and improving liquidity conditions

while providing a better environment for economic expansion in 2014. In addition, progress toward a

banking union should help support investor sentiment.

Accommodative monetary policy lifted Japanese equities in 2013 and should provide

Japan

continued support in 2014. However, a new consumption tax that will be implemented

in early Q2 could potentially limit the benefits of the Bank of Japan’s bond-buying program.

We expect China’s real GDP growth around 7.5-8% in 2014, supporting demand for

China

commodities. This should reflect the government’s efforts to support gradually deceler-

ating growth and recent reforms that should boost consumer spending.

Page 3 of 6

BMO Asset Management Inc.

Outlook 2014

Emerging

Markets

As we expect long-term interest rates in the U.S. to continue to rise modestly and the

U.S. dollar to strengthen relative to emerging market (EM) currencies, EM assets

denominated in local currencies could continue to witness outflows. As foreign portfolio investment is

an important source of financing for many developing economies, this will likely translate into a higher

degree of divergence in economic growth amongst emerging markets. However, export-oriented

emerging markets should benefit from weaker local currencies, which should partially offset the impact

of lower capital inflows or outright outflows.

Valuation

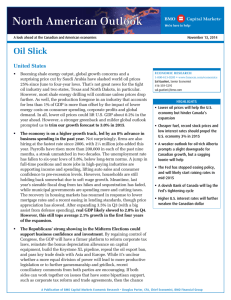

As the global economic recovery continues to gain traction since the great financial crisis, investor

sentiment remains on an upward trajectory, resulting in the current multi-year equity bull market.

Moreover, as fixed income began to underperform in 2013, owing to rising longer-term interest rates,

the bond sell-off provided a tailwind for inflows into stocks and raised concerns over equity valuation.

However, we believe that fears of overvalued North American stocks will likely subside as improving

consumer and business sentiment should result in increased spending on goods and services and

support corporate earnings. Our technical valuation analysis shows that the trailing 12-month

S&P500’s P/E multiple is well within its historical norm (Exhibit 2). This suggests that despite the

strong equity rally in North America in recent years and particularly in 2013, there is little evidence of

overheating in the stock market, offering more upside potential.

Page 4 of 6

BMO Asset Management Inc.

Outlook 2014

U.S. Equities Appear To Be Fairly Valued

Exhibit 2

S&P500: Historical PE

35

30

25

20

15

10

5

0

Jan-55

Jan-62

Jan-69

PE ratio

Jan-76

Jan-83

Hist average

Jan-90

Jan-97

Jan-04

Jan-11

hist avg +/- rolling 5yr stand. deviation

Source: BMO AM Inc., Bloomberg

On the European front, equities continue to be attractive from a valuation perspective as they have

not fully benefitted from the global economic recovery due to the Eurozone debt crisis. However, in

the latter part of 2013, economic growth began to gain momentum while leading indicators suggest a

continued, albeit gradual, economic rebound in early 2014, which should lift local equity prices.

Investment Strategy

Exhibit 3 demonstrates our investment strategy with respect to various geographic regions and asset

classes. Our model portfolio reflects our preference for equities over fixed income in 2014. Our largest

overweight continues to be in U.S. equities, followed by non-North American developed countries,

with the remainder in Canadian stocks owing to our expectations of relative economic and equity

Page 5 of 6

BMO Asset Management Inc.

Outlook 2014

performance in these regions. We continue to focus on higher quality companies with solid growth

prospects and reasonable valuations which should continue to generate attractive risk-adjusted

returns.

While we maintain an underweight position in fixed income due to our expectations of gradually rising

longer-term interest rates, we recommend a higher allocation to corporate bonds. In addition to

providing diversification benefits to our model portfolio, we expect Canadian credit spreads to narrow

in 2014, suggesting outperformance of this asset class relative to government bonds.

Exhibit 3

BMO AM Inc. Balanced Model Portfolio Positioning

Cash

Fixed Income

International Equity

US Equity

Canadian Equity

% 0

5

10

15

20

BMO AM Inc. Balanced Model Portfolio

Page 6 of 6

25

30

35

Blended Benchmark

40

45

50

We wish our clients, partners and prospects all the best for 2014 and

thank you for your continued support!

For more information about our line-up of Equity, Fixed Income, Currency and ETF solutions, please contact:

Marija Finney

Senior Vice President, Head of Institutional Sales & Service

Tel: (416) 359-5003 marija.finney@bmo.com

Disclosure/Disclaimer

TM/® Trade-marks/registered trade-marks of Bank of Montreal, used under licence

The information provided herein does not constitute a solicitation of an offer to buy, or an offer to sell

securities nor should the information be relied upon as investment advice. Past performance is no

guarantee of future results.

All Rights Reserved. The information contained herein: (1) is confidential and proprietary to BMO Asset

Management Inc. (“BMO AM”); (2) may not be reproduced or distributed without the prior written consent

of BMO AM; and (3) has been obtained from third party sources believed to be reliable but which have

not been independently verified. BMO AM and its affiliates do not warrant or make any representations

regarding the use or the results of the information contained herein in terms of its correctness, accuracy,

timeliness, reliability or otherwise, and do not accept any responsibility for any loss or damage that

results from its use.

® Registered trade-mark/trade-marks of Bank of Montreal, used under license.