Final Net Investment Income Tax Regulations Relax

advertisement

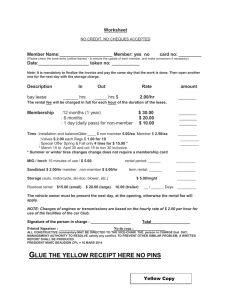

December 2013 Final Net Investment Income Tax Regulations Relax Self-Rental Income Rules Beginning in 2013, a new 3.8 percent tax on certain net investment income came into effect. On November 26, 2013, the IRS issued final regulations on most aspects of this new 3.8 percent net investment income tax (“NIIT”) and how it applies to individuals, estates, and trusts. The final regulations clarify the provisions applicable to self-rental arrangements. As this new guidance has been released very late in the first year to which this tax applies, very little time remains for 2013 tax planning related to this tax. Fortunately in the selfrental area, the rules have been relaxed and the urgency to take any action before the end of 2013 has been alleviated. What Is Net Investment Income? Net investment income includes dividends, taxable interest, annuities, royalties, rents, and net gains from the sale of investments other than income derived in the ordinary course of a trade or business. In addition, passive activity income from investments in which the owner does not actively participate, as historically determined under IRC Section 469, is also subject to this tax. Deductions that are properly allocated to these sources of income or gain would reduce the amount subject to this NIIT. Rental Activities and Activity Grouping Under the passive activity loss rules, rental operations are always treated as passive activities unless a specific exception can be met. An exception does exist if the direct or indirect owners of the rental property lease this property to a non-rental trade or business activity. If the business activity is held in a pass-through tax entity (such as an LLC, partnership, or S corporation), its owners were able to make a one-time election to combine the rental activities with the trade or business activities so long as the activities grouped together constituted an appropriate economic unit. The proposed regulations permitted taxpayers to make another one-time “fresh start” election to adopt a more advantageous grouping if they are subject to this new net investment income tax. Final regulations confirm this “fresh start” grouping election will be available. However, the regulations stress that this new grouping election may only be available at the owner level if the taxpayer meets the income threshold to be subject to this new tax (generally modified adjusted gross income in excess of $200,000 for single taxpayers and $250,000 for married taxpayers filing jointly) and has net investment income. However, if the taxpayer does not have any net investment income tax liability, the regrouping is not justified and will not be allowed. This fresh start grouping election would be made on either an affected taxpayer’s 2013 or 2014 income tax return. 1 Application of the NIIT on Self-Rental Income It is typical for business owners to establish a separate entity such as an LLC to own property that is rented to a related trade or business entity, especially if they materially participate in the trade or business activity. This is considered a self-rental arrangement. The proposed regulations did not provide a bright line test regarding taxation of self-rental income. It appeared that self-rental income would be subject to this 3.8 percent tax even though the rental income from property leased to a trade or business in which the taxpayer materially participates is treated as not from a passive activity under the IRC Section 469 passive activity regulations. This is because the rental activity may not separately meet the “trade or business” requirement especially if there was a net lease arrangement, although this conclusion was not crystal clear in the 2012 proposed regulations. In such circumstances, it was suggested to convert the lease arrangements to gross leases as one of the few planning techniques to meet this trade or business requirement in order to avoid the NIIT. This self-rental aspect of proposed regulations was heavily criticized. Final regulations issued in late November 2013 eliminated this uncertainty and stated that, in situations in which self-rental income is treated as nonpassive, the rental income will be deemed to be derived in the ordinary course of a trade or business and, therefore, exempt for NIIT purposes. The self-rental income is treated as nonpassive where the taxpayer leases the property for use in an activity in which the taxpayer materially participates, or when the activity is properly grouped with an active trade or business activity. This exclusion would also apply to any gain from the disposition of this property. In light of this clarification, there is no requirement to convert triple net leases to gross leases to avoid the NIIT. Income Tax Benefits of Gross Leases Remain It may still be advisable to convert net leases to gross leases for two other advantageous income tax reasons. First, if the rental property is sold or otherwise disposed at a loss, the ability to claim an ordinary (vs. capital) loss under IRC Section 1231 is only available if this property is used in a trade or business activity. Second, in order to be eligible to have the opportunity to elect to reduce the basis of depreciable real property used in trade or business in lieu of recognizing cancellation of indebtedness income under Section 108(c), the rental property must be used in a trade or business. Given the complexity of the final regulations under Code Sec. 1411, taxpayers should consult with a tax advisor well-versed in these rules to ensure their exposure to this new tax is minimized. For more information on this topic, please contact your Plante Moran client service representative. If you have any questions, please contact your tax advisor or Dean Rocheleau 877.622.2257 ext. 67239 dean.rocheleau@plantemoran.com George Riddering 877.622.2257 ext. 34065 george.riddering@plantemoran.com Mike Monaghan 877.622.2257 ext. 64943 mike.monaghan@plantemoran.com The information provided in this alert is only a general summary and is being distributed with the understanding that Plante & Moran, PLLC is not rendering legal, tax, accounting, or other professional advice, position, or opinions on specific facts or matters and, accordingly, assumes no liability whatsoever in connection with its use. 2