A deep understanding of the relationship between

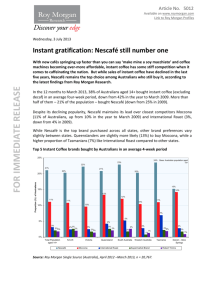

advertisement

Roy Morgan Business Single Source (Finance) A deep understanding of the relationship between individual businesses and their financial needs. The only business survey in Australia which allows analysis of the full scope of business financial services needs and behaviour, providing a deep understanding of customers on both a business and consumer level. Key Benefits The linkage of numerous aspects of business finances with activities, attitudes etc. provides a multitude of invaluable strategic insights. Not only can an organisation’s profitable business customers be analysed by their business finance (banking, insurance, wealth management) relationship, satisfaction and product mix, but the same depth of analysis can also be conducted for its noncustomers to assist with growth strategies. Key insights of the Roy Morgan Business Single Source (Finance): • Key Performance Indicators. How is your organisation performing overall in business banking, insurance, merchant servicing, international trade and business superannuation? • Segment Value and Profiles. Which are the most valuable business customer segments and what are their key characteristics? • Loyalty. What is the percentage of customers that deal only with one institution versus multiple institutions? How long has that relationship existed? • Relationship Manager and Business Banker. How satisfied are your customers with their relationship managers? How does this compare to competitors relationship managers? • Share of Wallet. Are you gaining or losing share of your business customers’ wallets? • Channel Usage. How is channel use changing among your business customers and the broader market? • Product Cross-Sell. How effective are your cross-sell efforts and how well does it compare with competitors? • Profitability. Understanding the profitability implications of servicing your target segments based on their value. • Mergers and Acquisitions. What will be the effect of mergers, acquisitions and alliances in terms of business customer value and cross-sell potential? • Communications. Which communications will be most effective in reaching your target markets? • Customer Satisfaction. Does your organisation’s business banking satisfaction leave you vulnerable to customer defection? • Brand. What is the strength of your brand in the business financial services market? • Business and Consumer Overlap. Which relationship influences the other? Roy Morgan Business Single Source (Finance) With more than13,000 business finance decision makers surveyed each year, this is the ideal single source model for Australian businesses, covering all industries and sizes of businesses. It provides an integrated and holistic understanding of businesses; their size, performance, expectations, confidence, financial needs, telecommunications activity and media consumption. In addition to detailed information about the business, Roy Morgan Business Single Source is the only survey that links with the Roy Morgan Consumer Single Source, Australia’s largest face-to-face consumer survey, incorporating over 50,000 interviews conducted each year. This linkage provides an unprecedented unified view of a customer, linking their business finances to their consumer finances. This is a key benefit for the Micro and Small Business segment, which represents more than 80% of businesses in Australia (turnover < $1 million). How are these customers treated? How do they want to be treated? Which relationship influences the other? CONSUMERS BUSINESS CUSTOMERS Methodology The methodology is a mix of Telephone (Computer Assisted Telephone Interviewing), Online (Computer Assisted Web Interviewing) and Face to Face (Computer Assisted Personal Interviewing), with the data weighted to the Australian Bureau of Statistics (8165.0). The sample includes businesses from every industry, size and locality in Australia. Roy Morgan Business Single Source (Finance) Ready made reports provide a snapshot of the Business Finance Market. This unique Business Financial Services Currency Report provides a regular authoritative view of the Australian Business Financial Services market (including information on Business Banking, Superannuation, Insurance etc), tracking the financial performance of major financial institutions, as well as providing non-financial information to assist in creating a holistic view of business owners in terms of their behaviour, media consumption and preferences. Business Financial Services Currency Report Currency Report Business Banking Market Overview Cover To Come Please direct any queries to finance@roymorgan.com Roy Morgan Research – 401 Collins Street, Melbourne VIC 3000 Telephone: (03) 9629 6888 © Roy Morgan Research The monthly Business Banking Satisfaction Report tracks and benchmarks the performance of individual Financial Institutions and the overall market, providing actionable insights to identify opportunities and develop new strategies. The report provides analysis across a range of business sizes, from micro businesses through to large businesses. Roy Morgan Business Single Source Corporate Awareness Deposits Cards Business Superannuation Insurance Types Main Financial Institutions Image of MFI Loans Detailed Information Satisfaction with Institution Meeting Product Needs (Deposits, Cards, Loans, Insurance, Business Superannuation, International Trade, Merchant Services) MFI Switching/ Intention Amount in Deposit Accounts Value of Transaction Last Month Amount Borrowed Channels Consideration Reasons for Switching MFI Length of Time with Institution Amount Carried Forward Amount Outstanding Relationship Manager or Business Banker Business and Consumer Relationships Opinions of Financial Institutions Likelihood of Recommending Institution International Trade Merchant Services Investment Strategy Business Confidence & Performance Head Office: 401 Collins Street Melbourne VIC 3000 Phone: +61 3 9629 6888 Fax: +61 3 9224 5387 Email: finance@roymorgan.com www.roymorgan.com RoyMorganBusinessSingleSource(Finance)Scr200112 Relationship with Institutions Business Profile Segmentation