PDF - Roy Morgan Research

advertisement

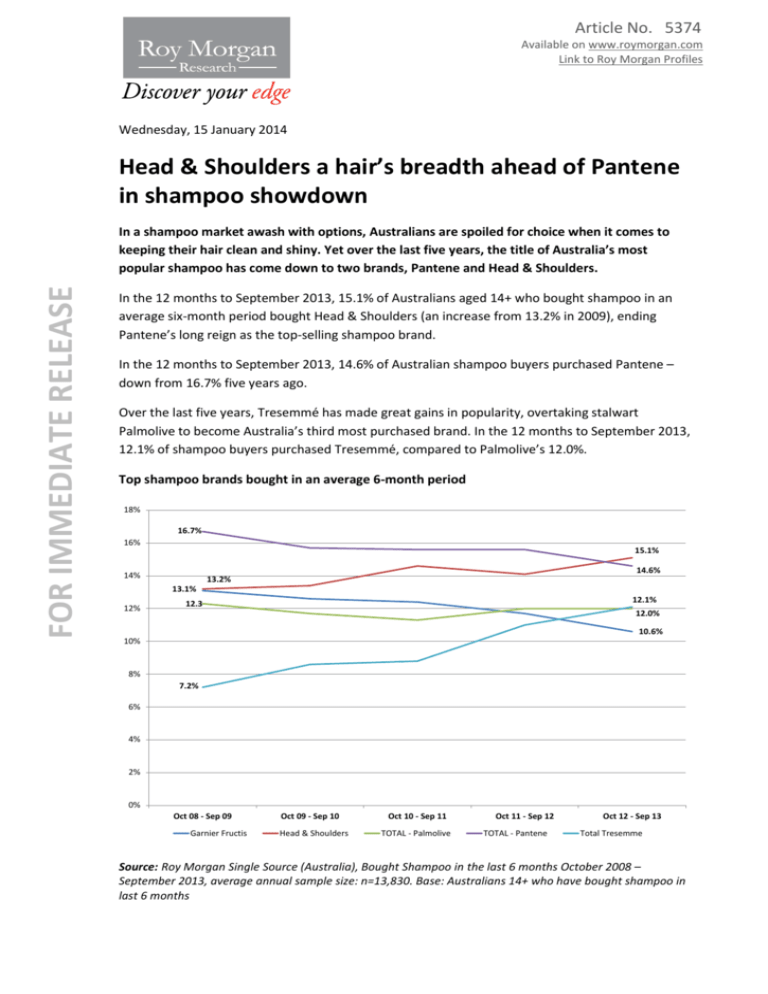

Article No. 5374 Available on www.roymorgan.com Link to Roy Morgan Profiles Wednesday, 15 January 2014 Head & Shoulders a hair’s breadth ahead of Pantene in shampoo showdown RELEASE IMMEDIATE RELEASE FOR IMMEDIATE FOR In a shampoo market awash with options, Australians are spoiled for choice when it comes to keeping their hair clean and shiny. Yet over the last five years, the title of Australia’s most popular shampoo has come down to two brands, Pantene and Head & Shoulders. In the 12 months to September 2013, 15.1% of Australians aged 14+ who bought shampoo in an average six-month period bought Head & Shoulders (an increase from 13.2% in 2009), ending Pantene’s long reign as the top-selling shampoo brand. In the 12 months to September 2013, 14.6% of Australian shampoo buyers purchased Pantene – down from 16.7% five years ago. Over the last five years, Tresemmé has made great gains in popularity, overtaking stalwart Palmolive to become Australia’s third most purchased brand. In the 12 months to September 2013, 12.1% of shampoo buyers purchased Tresemmé, compared to Palmolive’s 12.0%. Top shampoo brands bought in an average 6-month period 18% 16.7% 16% 15.1% 14.6% 14% 13.2% 13.1% 12% 12.1% 12.3 12.0% 10.6% 10% 8% 7.2% 6% 4% 2% 0% Oct 08 - Sep 09 Garnier Fructis Oct 09 - Sep 10 Head & Shoulders Oct 10 - Sep 11 TOTAL - Palmolive Oct 11 - Sep 12 TOTAL - Pantene Oct 12 - Sep 13 Total Tresemme Source: Roy Morgan Single Source (Australia), Bought Shampoo in the last 6 months October 2008 – September 2013, average annual sample size: n=13,830. Base: Australians 14+ who have bought shampoo in last 6 months Article No. 5374 Available on www.roymorgan.com Link to Roy Morgan Profiles As for so many consumer products, the popularity of certain shampoo brands varies between men and women. Roy Morgan Research has found that while Head & Shoulders is the most popular brand in Australia, this is primarily due to its popularity among male shampoo buyers (21.1% of whom have bought it in an average six months). Pantene’s overall popularity owes much to the fact that it’s favoured by 17.4% of female shampoo buyers. RELEASE IMMEDIATE RELEASE FOR IMMEDIATE FOR Shampoo preferences also differ between different age groups. Head & Shoulders is the most popular brand for Australians under 35, while Pantene is the preferred brand for those aged 35+. Angela Smith, Group Account Manager - Consumer Products, Roy Morgan Research, says: “It is interesting to see that even in such a brand-saturated market, the leading brands within each different age and gender group remain consistent. “However, gender and age are broad categories and Roy Morgan’s in-depth new profiling tool, Helix Personas, can assist marketers to refine their search for a more targeted market. “For instance, 21.6% of Aspiring Immigrants — typically young, ethnically diverse families living in metropolitan areas — have bought Head & Shoulders Shampoo in the last six months, compared to 15.1% of Australian shampoo buyers. On the other hand, 22.2% of Making the Rent individuals — low income, suburban singles often living at home with their parents — have bought Pantene in the last six months, a significantly higher rate than the national average.” For comments or more information please contact: Angela Smith, Group Account Manager - Consumer Products Office: +61 (2) 9021 9101 Angela.Smith@roymorgan.com Related research reports View our extensive range of Shampoo Buyers Profiles, including the Head & Shoulders Buyers Profile, Pantene Buyers Profile and more. These profiles provide a broad understanding of the target audience, in terms of demographics, attitudes, activities and media usage in Australia. About Roy Morgan Research Roy Morgan Research is the largest independent Australian research company, with offices in each state of Australia, as well as in New Zealand, the United States and the United Kingdom. A full service research organisation specialising in omnibus and syndicated data, Roy Morgan Research has over 70 years’ experience in collecting objective, independent information on consumers. In Australia, Roy Morgan Research is considered to be the authoritative source of information on financial behaviour, readership, voting intentions and consumer confidence. Roy Morgan Research Article No. 5374 Available on www.roymorgan.com Link to Roy Morgan Profiles is a specialist in recontact customised surveys which provide invaluable and effective qualitative and quantitative information regarding customers and target markets. Margin of Error RELEASE IMMEDIATE RELEASE FOR IMMEDIATE FOR The margin of error to be allowed for in any estimate depends mainly on the number of interviews on which it is based. Margin of error gives indications of the likely range within which estimates would be 95% likely to fall, expressed as the number of percentage points above or below the actual estimate. Allowance for design effects (such as stratification and weighting) should be made as appropriate. Sample Size 5,000 7,500 10,000 20,000 50,000 Percentage Estimate 40%-60% ±1.4 ±1.1 ±1.0 ±0.7 ±0.4 25% or 75% ±1.2 ±1.0 ±0.9 ±0.6 ±0.4 10% or 90% ±0.8 ±0.7 ±0.6 ±0.4 ±0.3 5% or 95% ±0.6 ±0.5 ±0.4 ±0.3 ±0.2