Integrating Finance and Strategy for Value Creation

advertisement

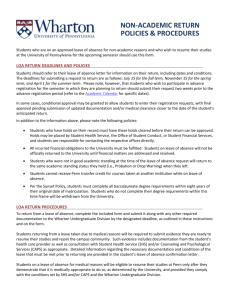

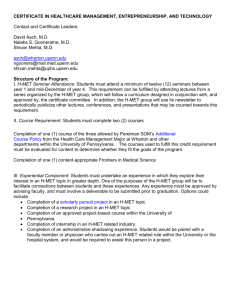

FINANCE & WEALTH MANAGEMENT Integrating Finance and Strategy for Value Creation PROGRAM OVERVIEW FOR INFORMATION AND APPLICATION In Integrating Finance and Strategy for Value Creation, Wharton professors provide you with an understanding of financial management and help you to determine which financial factors build or erode value in your organization. (55) 9172 2180 (01 800) 288 0723 informacion@seminarium.com.mx Building on the principles learned in Finance and Accounting, this financial education program is designed to give you a broader perspective on finance and explain the interaction between finance and the various functions of an organization. You will learn to: www.seminarium.com.mx SESSION TOPICS Among the 11 varied Integrating Finance and Strategy program sessions, topics include: • Understand the impact of strategic decisions on value creation • Learn the latest corporate financial policies and practices • Explore issues such as capital structures, cost of capital, diversification, risk, capital budgeting and acceptable ROI • Capital Structure and the Cost of Capital • Examine non-financial factors that contribute to value and evaluate their financial consequences • Mergers • Company Diversification Policy • Real Options EXPERIENCE • Growth and Value Through Integrating Finance and Strategy, you will learn how to use finance as a strategic tool, developing a mindset for positive return. You’ll also understand the process of value creation and how best to implement it so that it becomes a part of your corporate culture. Faculty will share instructional case studies that illustrate how companies attempt to create shareholder value. They will also introduce you to new perspectives and techniques that will challenge your own approach and encourage you to consider alternative solutions. WHO SHOULD ATTEND Integrating Finance and Strategy is a logical next step after learning the basics of finance and accounting. This program attracts: • Senior managers who want to understand the impact their decisions have on shareholder value • Finance executives who need to gain a broader perspective or to deepen their financial knowledge • Executives who seek an in-depth examination of financial management practices CP-FM-1013 www.execed.wharton.upenn.edu • +1.800.255.3932 (U.S. or Canada) • +1.215.898.1776 (worldwide) • execed@wharton.upenn.edu EXECUTIVE EDUCATION FACULTY Itay Goldstein, PhD Professor of Finance, The Wharton School Research Interests: Corporate finance, financial fragility and crises John Percival, PhD Adjunct Professor of Finance, The Wharton School Integrating Finance and Strategy for Value Creation PARTICIPANT COMMENTS AND FEEDBACK “Rarely will you find a week-long class (or any class) that will challenge your most fundamental, deep-rooted beliefs about business, finance, and how to measure it. Great instructor enthusiasm, very professional.” — VP, Technology Firm Michael Roberts, PhD Professor of Finance, The Wharton School David Wessels, PhD Adjunct Assistant Professor of Finance, The Wharton School “This course challenged me to think ‘outside of the box’ relative to financial strategy and subsequent decision making. It is a good course for those individuals who are involved in value management for their company and determining a means to grow market share by ‘changing the game’.” — VP, Customer Service & Engineering, Telecom. Co. “For a nonfinancial individual, who is however contributing to business decisions, the course raises awareness and improves thinking to better able you to challenge and judge the issues placed before you. A well-planned course with flow of logic and a developing theme through the week.” — VP, Regulatory CV, Pharmaceuticals Co. CP-FM-1013 www.execed.wharton.upenn.edu • +1.800.255.3932 (U.S. or Canada) • +1.215.898.1776 (worldwide) • execed@wharton.upenn.edu John Percival John Percival Evening Prep: Airbus A3XX (A), Diageo Lunch Evening Prep: Coka-Cola Itay Goldstein Capital Structure Itay Goldstein Capital Structure Group Case Discussion: Diageo Dinner David Wessels The Role of Growth in Value Creation David Wessels The Role of Growth in Value Creation John Percival Strategic Applications of Discounted Cash Flow John Percival Evening Prep: Bridgestone John Percival Integrating Finance & Strategy: Coca-Cola John Percival Integrating Finance & Strategy: Coca-Cola Group Case Discussion: CocaCola David Wessels Valuing Uncertainty Using Real Options David Wessels Valuing Uncertainty Using Real Options DAY 4 John Percival Mergers and Acquisitions: Bridgestone John Percival Mergers and Acquisitions Group Case Discussion: Bridgestone DAY 5 David Wessels, PhD Adjunct Assistant Professor of Finance, The Wharton School Michael Roberts, PhD Professor of Finance, The Wharton School Itay Goldstein, PhD Professor of Finance, The Wharton School John Pecival, PhD Adjunct Professor of Finance, The Wharton School FACULTY Integrating Finance and Strategy for Value Creation SAMPLE AGENDA: Program start and end times are subject to change. Please DO NOT make travel arrangements based on this agenda. For more details, please contact Customer Care at +1.215.898.1776 or execed@wharton.upenn.edu Evening Prep: Teletech Corporation John Percival Optional Session: Capital Budgeting John Percival Working Capital and Cash Flow John Percival EVA and Growth John Percival Shareholder Value: Leading for Value Divisional Performance: Teletech Case Strategic Applications of Discounted Cash Flow: Airbus A3XX (A) John Percival Risk Diversification and Cost of Capital Overview of Financial Mgmt Emerson Electric John Percival Group Case Discussion: Airbus A3XX (A) Group Case Discussion: Teletech Corporation Breakfast Program Overview and Intro. DAY 3 DAY 2 DAY 1 EDUCATION EXECUTIVE EXECUTIVE EDUCATION