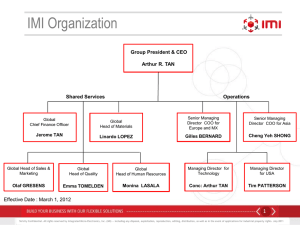

profile of directors - Tan Chong Motor Holdings Berhad

advertisement