Subjective Belief, Crash Perception, and Cross&Sectional Stock

advertisement

Subjective Belief, Crash Perception, and

Cross-Sectional Stock Return

George P. Gaoy

Cornell University

Zhaogang Songz

Federal Reserve Board

Liyan Yangx

University of Toronto

This Draft: June 2015

Abstract

Recent studies show investors form incorrect beliefs about stock market crash. We investigate the pricing implications of such biased beliefs for cross-sectional expected stock returns.

We construct a stylized model that characterizes stock returns in equilibrium being proportional to investors’ subjective beliefs on stock crash (ex-ante crash perceptions). Such crash

perceptions contain a market-driven systematic component (co-crash perception) and a stockspeci…c component (idiosyncratic crash perception). We suggest option-based measures of crash

perceptions and …nd they are strongly connected to pessimistic beliefs re‡ected in the survey

forecasts of aggregate economy and …rm prospects. Crash perceptions are strongly priced, with

average annual Sharpe ratios of 0.9 and 1.1 on long-short hedge portfolios formed on co-crash

and idiosyncratic crash perceptions, respectively.

Keywords: Belief, crash perception, co-crash, idiosyncratic crash

JEL classi…cations: G11; G12; G23

The analysis and conclusions set forth are those of the authors and do not indicate concurrence by the Federal

Reserve System.

y

Samuel Curtis Johnson Graduate School of Management, Cornell University. Email: pg297@cornell.edu; Tel:

(607) 255-8729.

z

Board of Governors of the Federal Reserve System, Mail Stop 165, 20th Street and Constitution Avenue, Washington, DC, 20551. E-mail: Zhaogang.Song@frb.gov.

x

Rotman School of Management, University of Toronto, Canada. Email: liyan.yang@rotman.utoronto.ca; Tel:

(416) 978-3930.

1

Introduction

Investors’ subjective beliefs a¤ect asset prices and returns. Prior theoretical studies have shown

investors’biased subjective beliefs about mean growth rates of endowment, earnings, or investment

can account for many empirical regularities of stock returns and volatilities (Barberis, Shleifer, and

Vishny (1998); Daniel, Hirshleifer, and Subrahmanyam (1998); Cecchetti, Lam, and Mark (2000);

Scheinkman and Xiong (2003); Brunnermeier, Gollier, and Parker (2007); Alti and Tetlock (2014);

Barberis, Greenwood, Jin, and Shleifer (2014)). Intuitively, however, the subjective belief is most

likely to be biased about tail (or crash) risks of the economy, as the very infrequent nature and hence

the limited sample of crash events make it impossible for investors to learn the objective crash risk

(Weitzman (2007)). Such a biased belief on crash events can have important pricing implications

given the extreme impact of potential tail events. Several recent studies including Gennaioli,

Shleifer, and Vishny (2012, 2013), Baron and Xiong (2014), and Jin (2014) have investigated

how incorrect crash risk beliefs a¤ect the aggregate stock market return and …nancial instability.

However, little is known about the pricing implications of biased subjective beliefs on crash risk for

cross-sectional stock returns. Our paper attempts to …ll in this gap.

There are (at least) two potential aspects of subjective beliefs about stock crash (crash perception) for the cross section of expected stock returns. First, incorrect beliefs of crash risk can

occur on the aggregate market level. Such biased beliefs will impact stock returns through the

e¤ect on the stochastic discount factor. Second, and importantly, incorrect beliefs of crash risk can

also happen on individual …rm level, independent of the crash risk belief on the aggregate market.

For example, outside investors tend to believe (and overestimate) that …rm managers will withhold

or delay bad news for extended periods and stock price will crash when the bad news are …nally

released (Jin and Myers (2006); Bleck and Liu (2007); Hutton, Marcus, and Tehranian (2009);

Kothari, Shu, and Wysocki (2009); Kim and Zhang (2013)). This biased belief about stock crash,

resulting from …rm-level information asymmetry, is likely to be independent of the market crash

perception. Moreover, it can have substantial heterogeneity across individual …rms because of their

heterogeneous information disclosure and opaqueness. The …rst aspect above — the market-level

crash perception — seems to have pricing implication naturally. For the second aspect, however,

it remains unclear how, if at all, the …rm-speci…c crash perception is priced in the cross-sectional

1

stock returns.

In this paper, we conduct a comprehensive analysis of the pricing implications of biased beliefs

about crash risk, at both the aggregate market and individual stock level, for the cross-sectional

stock returns. We …rst motivate our study by constructing a stylized model in which a representative agent’s subjective beliefs on both the aggregate market crash risk and individual …rm crash risk

are di¤erent from their corresponding objective crash probabilities. In particular, the agent assigns

larger probabilities to the disaster events of consumptions and dividends that have almost zero

occurring probabilities. The larger probability she puts on the crash event captures the perception

of crash risk. Since the representative agent maximizes the utility under her subjective belief, the

model shows that in equilibrium individual stock returns are functions of not only the traditional

objective aggregate crash risk, but also the following two components of crash perception: (1) a systematic component, dubbed co-crash perception, which captures the covariation between a stock’s

crash conception and the market’s crash perception; and (2) a stock-speci…c idiosyncratic component, dubbed idiosyncratic crash perception, which captures the part of stock crash perception that

is unexplained by the market.

Our main task is then to empirically test how systematic and idiosyncratic components of crash

perception a¤ect cross-sectional expected stock returns. However, measuring investors’subjective

belief empirically about stock crash is generally hard, if not impossible. A recent work, Greenwood

and Shleifer (2014), uses various surveys to extract investor expectations of future stock market

returns. An ideal measure of stock crash belief can be constructed should similar surveys on tail

probabilities of individual stocks are available. Unfortunately, this type of crash-event surveys is not

readily available. Instead, in our empirical exercise, we employ both the individual options on the

U.S. common stocks and the S&P 500 index options from January 1996 through December 2012 to

construct measures of crash perception at both the individual stock level and the aggregate market

level. Our measures of crash perception rely on out-of-the-money (OTM) put options that are

most informative about investors’perception of stock crash.1 Building on the model-free implied

volatility studies in Britten-Jones and Neuberger (2000), Carr and Wu (2009), and Du and Kapadia

(2012), such crash perception measures have volatility risk purged and depends exclusively on the

1

We also construct our measure of perceived crash risk by combining both OTM calls and puts together. Results

with this alternative measure are similar.

2

left tail of the jump measure embedded in OTM puts. Speci…cally, this measure is a weighted

average of OTM put option prices across moneyness, with higher weights on deeper OTM puts. As

a result, this measure is expected to mainly capture the perception of crash risk rather than the

objective crash risk given the rare nature of crash events associated with deep OTM puts.2

Admittedly, our crash perception measures based on option prices do not exclude preference

(risk premium) components by construction and may be polluted by them. To corroborate these

crash perception measures mainly capturing subjective belief on crash risk, we show they are

strongly connected to pessimistic beliefs re‡ected in the survey forecasts of future aggregate and

…rm-level economic conditions. In particular, we use the economist forecasts on real GDP growth

from the Blue Chip Financial Forecasts (BCFF) data and the …nancial analyst forecasts on …rm

earnings from the I/B/E/S earnings forecast data. We measure the extent of pessimistic beliefs

across forecasters using the forecast skewness as well as lower percentile. At the aggregate market

level, we …nd the market crash perception is higher as the economists form more pessimistic (and

less optimistic) beliefs on future real output. At the …rm-level, we …nd stocks with higher crash

perception are those about which the analysts formed more pessimistic beliefs in terms of the …rms’

future earnings and growth. Moreover, at both market and individual stock levels, the negative

relation between crash perception and forecast skewness becomes stronger as the average belief is

tilted more to the left tail. Overall, these results uphold our crash perception measures as capturing

the subjective belief on stock crash risk strongly.

We then conduct our main empirical analysis regarding the pricing implications of crash perception. We show that co-crash perception is strongly priced in the cross section of stock returns.

When portfolios are formed monthly, the di¤erence in equal-weighted returns between the portfolios

with the highest and lowest co-crash is 1.08% per month (with a Newey-West t-statistic of 2.7).

The return spread based on value-weighted portfolios is of similar magnitude, albeit less statistically signi…cant at 1.06% per month (with a t-statistic of 1.7). The return pattern associated with

perceived co-crash is strongest at monthly portfolio formation: the signi…cance of return spreads

between high and low perceived co-crash stocks becomes dissipated at quarterly and semi-annual

formation frequencies.

2

Using option prices to construct skewness measures, Conrad, Dittmar, and Ghysels (2013, p. 86) argue that

“options re‡ect a true ex ante measure of expectations.”

3

Idiosyncratic crash perception has an even stronger explanatory power on cross-sectional stock

returns. When portfolios are monthly formed, return spreads of high-minus-low perceived idiosyncratic crash portfolios are 0.91% and 1.08%, respectively, when stock returns are equal and value

weighted. These spreads are at least three standard errors from zero. Furthermore, in contrast to

co-crash, the e¤ect of perceived idiosyncratic crash on future stock returns is not short-lived. In

fact, the return spreads between high and low idiosyncratic crash perception stocks at quarterly,

semi-annual, and annual portfolio formation frequencies are not only statistically signi…cant but

also economically large, ranging from 0.83% (with a t-statistic of 2.3) to 1.45% per month (with a

t-statistic of 3.7).

Are return variations driven by co-crash and idiosyncratic crash perceptions distinct from each

other, as predicted by our stylized model? We perform an analysis of two-way sequentially sorted

portfolios. Controlling the perceived co-crash, the return spread of high-minus-low perceived idiosyncratic crash portfolio remains strong and signi…cant, and vice versa. Hence, both co-crash and

idiosyncratic crash perceptions are important determinants of cross-sectional stock returns and neither one dominates. Moreover, we show that excess returns of long-short hedge portfolios formed

on perceived co-crash and idiosyncratic crash are robust to risk adjustment using a set of traditional risk factors, including the market, size and book-to-market factors (Fama and French (1993)),

the momentum factor (Carhart (1997)), the short-term return reversal factor (Jegadeesh (1990)),

and the market liquidity risk factor (Pastor and Stambaugh (2003)). For example, the standard

Fama-French-Carhart four-factor alphas of these hedge portfolios vary from 0.80% to 0.99% per

month.

To examine whether the excess return earned on crash perception is merely compensation that

investors require for bearing their losses when crash shocks are realized (i.e., risk premium for

the objective crash risk implied from ex-post historical crash shocks), we conduct two detailed

checks. First, we study whether the returns on crash perception are simply premiums for crash

risks associated with macroeconomic downturns and liquidity crunches. We collect a set of market,

liquidity, macroeconomic, and disaster risk factors, including the market excess return, PastorStambaugh (2003) and Hu-Pan-Wang (2013) liquidity factors, market volatility, default risk, and

term spread. We …nd that these liquidity and macroeconomic risk factors generally cannot explain

the return spreads between low and high crash perception portfolios. Instead, the perceived co-crash

4

and idiosyncratic crash long-short portfolios provide hedges against market downturns. Second, we

collect a set of variables of (or potentially related to) crash risk based on historically realized crash

events of stocks, including the downside market beta (Ang, Chen, and Xing (2006)), tail risk beta

(Kelly and Jiang (2014)), co-skewness (Harvey and Siddique (2000)), co-kurtosis (Dittmar (2002)),

hybrid tail risk (Bali, Cakici, and Whitelaw (2014)), maximum daily return (Bali, Cakici, and

Whitelaw (2011)), idiosyncratic volatility (Ang et al. (2006)), and idiosyncratic skewness (Boyer,

Mitton, and Vorkink (2010)).3 Results from Fama-MacBeth (1973) cross-sectional regressions show

that none of these variables drives the return variations associated with crash perception. Overall,

ex-ante crash perception is distinct from crash risk implied from ex-post crash shocks in a¤ecting

cross-sectional stock returns.4

Because our measures of crash perception rely on stock options, we also investigate whether

the existing option-based variables in the literature could drive our results. These variables include

implied volatility slope (Yan (2011)), volatility spread (Cremers and Weinbaum (2010)), implied

volatility smirk (Xing, Zhang, and Zhao (2010)), option-to-stock volume ratio (Johnson and So

(2012)), implied volatility innovation (An et al. (2014)), and risk-neutral moments of volatility,

skewness, and kurtosis (Conrad, Dittmar, and Ghysels (2013)). Our results are robust to these

option-based …rm characteristics. Furthermore, we examine a set of option-based tail risk factors

(such as implied volatility skewness and high-order moment risk) and …nd these factors cannot explain our results, reinforcing the unique role of our measure in investigating the pricing of subjective

belief about crash risk.5

As discussed above, our option-based crash perception measures are certainly imperfect in

capturing subjective beliefs because option price contains both preference and belief elements.

Although we cannot completely preclude the preference element, in our regression analysis, cocrash and idiosyncratic crash perception remain both economically and statistically signi…cant

in presence of control variables of co-skewness, co-kurtosis, idiosyncratic skewness, and return

3

A recent study by Bollerslev, Todorov, and Li (2013) decompses the market beta into the jump and continuous

components, and shows that the former is priced in the cross section of stock returns while the latter is not.

4

One may argue that due to the peso problem, our results only show the pricing of objective crash risk and

do not imply the distinction of subjective crash risk. Though plausible, this interpretation is inconsistent with the

observation that the return spread of high-minus-low crash perception portfolios is signi…cantly positive during most

crisis periods, including the recent …nancial crisis that is fairly extreme in the history of the U.S. economy.

5

The robustness of our results to the funding liquidity variables and implied volatility slope also implies that

returns of crash perception portfolios are not merely driven by …nancial intermediary constraints (Bollen and Whaley

(2004); Garleanu, Pedersen, and Poteshman (2009); Chen, Joslin, and Ni (2013)).

5

maximum, which are shown in prior studies to capture investor preferences (Harvey and Siddique

(2000); Dittmar (2002); Mitton and Vorkink (2007); Barberis and Huang (2008); Boyer, Mitton,

and Vorkink (2010); Bali, Cakici, and Whitelaw (2011)). Furthermore, among the cross-section of

our sample stocks, we …nd high crash perception forecasts less negative return skewness or downside

volatility in the future, using measures of negative coe¢ cient of skewness and down-to-up volatility

in Cheng, Hong, and Stein (2001). These evidence, in addition to the signi…cant relation between

crash perception and pessimistic survey forecast, corroborate our option-based measures re‡ecting

investors’subjective beliefs about stock crash risk to a large extent.

Our paper contributes to the recent literature on the biased/distorted belief of crash risk that

mainly focuses on the aggregate stock market as discussed above, as well as the disaster risk literature including Barro (2006), Gabaix (2012), Wachter (2013) among others. Moreover, di¤erent from

recent studies such as Spitzer (2006), Chollete and Lu (2011), Bali, Cakici, and Whitelaw (2014),

Chapman and Gallmeyer (2014), Kelly and Jiang (2014), and Chabi-Yo, Ruenzi, and Weigert

(2014) that examine the pricing of objective tail risk for cross-sectional stock returns, we focus on

the pricing of the subjective belief about crash risk. Our empirical evidence strongly suggests the

importance of incorrect crash risk belief on explaining cross-sectional stock return variation, which

is consistent with theoretical predictions in the dynamic general equilibrium model of Jin (2014).

The remainder of the paper is organized as follows. Section 2 illustrates the pricing of biased

subjective beliefs about crash risk and constructs the measures of crash perception. Section 3

examines relations between crash perception and subjective belief. Section 4 provides our key

…ndings that both co-crash and idiosyncratic crash perceptions are priced in the cross section of

U.S. stock returns. Section 5 provides robustness checks. Section 6 concludes.

2

Ex-ante Crash Perception: Motivation and Measure

In this section, we …rst present a parsimonious theoretical approach to formalize the idea of subjective beliefs about crash risk (crash perception). Then we discuss how to use options to measure

crash perception.

6

2.1

A theoretical perspective of crash perception

The main contribution of our paper is empirical. Hence, the model we present in the following is very

stylized and is used only as a guidance to construct variables and design empirical strategies later.

The essence of the model is to demonstrate how both systematic and idiosyncratic components of

crash perception can be priced in equilibrium.

Environment

We consider a pure exchange economy with two dates (t = 0; 1). There is one

consumption good and one representative agent. At date 0, the representative agent chooses consumption plans and asset allocations, subject to the standard budget constraint, to maximize

!

1

~1

C

C

0

b

;

E

+ 1

1

1

where

> 0 is the relative risk aversion coe¢ cient, and C0 > 0 and C~1 > 0 are the agent’s

b ( ) refers to an expectation operator

consumption at dates 0 and 1, respectively. The operator E

with respect to the agent’s subjective beliefs (perceptions), which will be speci…ed shortly.

The tradable assets include a risk-free asset, many risky assets (stocks), and derivatives either

on portfolios or on individual risky assets. The risk-free asset is in zero net supply, and we use Rf

to denote its gross return, which is an endogenous constant in equilibrium. A typical risky asset

n

o

~ i;1 2 R2 . We

i, which has a net supply of one share, is a claim to a dividend stream Di;0 ; D

++

~i =

denote its price by Pi , and so the gross return on stock i is R

to denote logarithmic quantities; that is, c0

log C0 , di;0

~ i;1

D

Pi .

log Di;0 , rf

We use lower case letters

log Rf , and r~i

~i,

log R

and so on.

Technology

The data generating processes for the aggregate endowments (consumptions) and for

dividends on stock i admit a structure with disaster risks as formalized by Barro (2006). Speci…cally,

the consumption growth rate

c~

c~1

c0 and the dividend growth rate

d~i

d~i;1

di;0 are

generated as follows:

c~ = gC +

d~i = gi +

C~

"i

i~

7

+ J~C ;

+

~ + J~i ;

i;J JC

(1)

(2)

where gC > 0 and gi > 0 are constants, ~ and ~"i follow standard normal distributions with a

correlation coe¢ cient of ! i = Corr (~; ~"i ), and J~C and J~i represent downside jumps:

8

8

>

>

< 0;

< 0;

with prob. 1 qC ;

with prob. 1 qi ;

~

~

JC =

and Ji =

>

>

: LC ;

: Li ;

with prob. qC ;

with prob. qi ;

with LC > 0, Li > 0,

i;J

> 0, qC

0 and qi

(3)

0.

As in Barro (2006), the random variables ~ and ~"i represent ‡uctuations in the normal periods,

while the random variables J~C and J~i pick up low probability disasters (J~C and J~i are mutually

independent and they are independent of ~ and ~"i ). In these disaster events, consumptions or

dividends jump down sharply. The constants LC > 0 and Li > 0 capture the sizes of the downside

jumps, and qC

0 and qi

0 are their occurring probabilities. The parameter

i;J

> 0 controls

how dividends co-move with consumptions in events of large downside consumption jumps. As we

will explain later,

i;J

corresponds to the systematic component of crash perception in our empirical

analysis. Parameters gC > 0 and gi > 0 represent the average growth rates of consumption and

dividends in normal periods, respectively.

Beliefs

We assume that the representative agent’s subjective belief assigns larger probabilities to

the disaster events of consumption and dividends. We make this assumption for several reasons.

First, the recent psychology literature suggests that people often overestimate the likelihood of rare,

extreme events.6 Disaster events exactly share these two features of low probability and extreme

outcomes. Second, the di¤erence between subjective and objective probabilities could be due to the

fact that investors have extremely limited information about the objective crash risk (Weitzman

(2007)). This view is particularly true from an ambiguity-aversion perspective. The literature

suggests that ambiguity is appropriate when decision makers lack enough information to assess the

relevant distribution over payo¤s (Heath and Tversky (1991); Epstein and Schneider (2008)). Since

crashes are rare events, it is arguable that traders do not have enough information to form a prior.

Under Gilboa and Schmeidler’s (1989) max-min ambiguity aversion preferences, traders will choose

the most pessimistic view for crash events, which e¤ectively assigns larger probabilities to these

6

For example, Barberis (2013, ps. 611-612) summarizes: “A very rough, …rst-pass summary of the psychology

literature, then, is that a person’s thinking about a tail event is subject to two forces: an event whose true probability,

unknown to the individual, is 0:001, say, will …rst be judged more probable than it actually is— to have probability

0:002, say— and will then be weighted by even more than 0:002 in the individual’s decision making: by (0:002), say,

where (0:002) > 0:002, and where the exact value of (0:002) can be determined from the probability weighting

function.”

8

events. Finally, Albagli, Hellwig, and Tsyvinski (2014) construct a noisy rational expectations

equilibrium model and show that when traders learn information from prices, the tail risk is larger

under the marginal investor’s subjective belief than under the objective probability, which therefore

endogenously generates our assumption.

Formally, in the representative agent’s mind, he understands that the consumption growth rate

d~i are generated by (1)-(3), but he thinks that J~C =

c~ and the dividend growth rate

with a probability q^C > qC and that J~i =

Li with a probability q^i > qi . Two explanations are

qC that he puts on the event of J~C =

in order. First, the extra weight of q^C

LC

LC captures

how much the representative agent overestimates the event that the aggregate consumption jumps

down signi…cantly, which is his subjective belief about market-wide crash. Given that parameter

i;J

in (2) controls the intensity that stock i’s dividends are subject to this overestimation of

downside consumption jumps, we use

i;J

to theoretically capture the systematic component of

crash perception, dubbed “co-crash perception”. Second, the extra weight of q^i

on the event of J~i =

qi that he puts

Li describes how much the representative agent’s subject belief about stock

i’s crash that is not driven by the aggregate-level market crash, which we use to theoretically

capture the …rm-level idiosyncratic component of crash perception, dubbed “idiosyncratic crash

perception”.

Asset prices

According to Cochrane (2005, p. 17), up to a Taylor approximation, the following

pricing equation holds for any asset under the representative agent’s subjective belief:

b R

~i

E

where

Rf

= ^ i;

^

c c;

(4)

d R

~ i ; c~

Cov

and ^ c = Vd

ar ( c~) ;

(5)

Vd

ar ( c~)

d ( ; ) and Vd

where Cov

ar ( ) are the covariance and variance operators under the agent’s belief.

^

i; c

=

Historical data are generated under the objective probability speci…ed by (1)-(3). So, if we

de…ne the consumption beta

i; c

and risk premium

c

according to the objective probability,

~ i ; c~

Cov R

i; c

=

and

V ar ( c~)

c

= V ar ( c~) ;

(6)

by (4), we then have:

~ i = Rf +

E R

i; c

^

c+

i;

c

^c

9

i; c c

h

~i

+ E R

b R

~i

E

i

:

(7)

That is, the average return on stock i is determined by the traditional risk factors (Rf +

i; c c ),

adjusted by terms re‡ecting the misperceptions of disaster risks.

i

We de…ne the price-dividend ratio as fi DPi;0

. Direct computation shows:

h

i

i;J d

^

^c

~

~

=

V

ar

J

V

ar

J

;

c

C

C

i; c

i; c

fi

i

h

i

1 h

~i

b R

~i

b ( di ) = 1 E i;J J~C + J~i

b i;J J~C + J~i :

E R

E

E ( di ) E

E

fi

fi

b J~i = Li (^

Plugging the above two expressions into (7) and noting that E J~i

E

qi qi )

yield:

~ i = Rf +

E R

i; c c

+

i;J

fi

h

Vd

ar J~C

V ar J~C + E J~C

b J~C

E

i

+

1

Li (^

qi

fi

qi ) : (8)

The second and third terms in (8) show that, for a given price-dividend ratio fi , the ex~ i increases with the co-crash perception

pected stock return E R

crash perception (^

qi

^

^

i; c c

~i

term E R

i; c c

i;J

and with the idiosyncratic

qi ). Alternatively, in view of equation (7), a high

b R

~ i , while a high (^

E

qi

~i

and a high E R

b R

~ i in (7).

E

In addition, increasing

i;J

and (^

qi

i;J

leads to both a high

qi ) results in a high adjustment

qi ) will lower price-dividend ratio fi , which further in-

~i

creases the expected stock return E R

in (8). To see this, by the pricing formula (4), we can

compute:

fi = E egi

which decreases with

i;J

gC +

and (^

qi

"i;t+1

i~

C ~t+1

h

b e(

E

i;J

i

)J~C E

b eJ~i ;

qi ). This is because both co-crash and idiosyncratic crash

perceptions lower the representative agent’s perception about the stock’s future dividends. To sum

up, we have the following proposition.

~ i on stock i is determined by

Proposition 1 In the model economy above, the expected return E R

the risk-free rate Rf , compensations for the traditional consumption risk

i; c c ,

and compensations

for the subjective belief about crash risks. In addition, the misperception compensation increases

with both the co-crash perception

2.2

i;J

and with the idiosyncratic crash perception (^

qi

qi ).

Measures of crash perception

Options re‡ect traders’subjective beliefs through equilibrium. We use individual equity OTM put

options and the S&P 500 index OTM put options to quantify each stock’s crash perception and the

10

market’s crash perception, respectively. We follow the methodology used in Gao, Gao, and Song

(2013), which develops a rare disaster concern index to measure hedge fund performance. In this

section, we describe intuitions behind the measure of a stock’s crash perception, and decompose it

into a systematic component (co-crash perception) and a stock-speci…c component (idiosyncratic

crash perception). Our discussions focus on empirical estimates, option data, and sample descriptive

statistics.

2.2.1

Option-based measures

To set the stage, we …rst discuss how to estimate the total crash perception for each individual

…rms and the market. In the next section, we discuss how to decompose a …rm-level total crash

perception into systematic co-crash and idiosyncratic crash perceptions. Essentially, the crash

perception measure equals the price di¤erence between two option-based replication portfolios of

variance swap contracts that deliver payments equal to the extent of stock/market price variations

over a period [t; T ].7 The …rst accounts for price variations induced by jumps associated with mild

price movement and the second incorporates price variations induced by jumps associated with

extreme price movement (i.e., stock crash).

In principle, both upside and downside jumps can contribute to stock price variations over the

period [t; T ] (e.g., the extreme deviation of time-T stock price ST from time-t price St ). We focus on

downside crash events associated with unlikely but extreme negative stock price jumps, motivated

by studies showing that investors are more concerned about downside price swings (Liu, Pan, and

Wang (2005); Ang, Chen, and Xing (2006); Barro (2006); Gabaix (2012); Wachter (2013)). In

particular, the price of the …rst replication portfolio is

Z

1

2er

P (St ; K; T )dK;

IV

2

K<St K

the price of the second replication portfolio is

Z

2er

1 ln (K=St )

P (St ; K; T )dK;

V

K2

K<St

and the measure of total crash perception (T CR) is de…ned as

Z

2er

ln (St =K)

T CR V

IV =

P (St ; K; T )dK;

K2

K<St

where r is the constant risk-free rate,

7

T

(9)

t is the time-to-maturity, St is the stock price at

See Carr and Wu (2009) for detailed discussions of variance swap contracts and replication portfolios.

11

time t, and P (St ; K; T ) is the time-t price of the OTM put with strike price K and maturity date

T . Under general assumptions on the stock price process (e.g., Merton (1976)), T CR captures

all of the high-order (

3) moments of the price jump distribution with negative sizes. A close

inspection of (9) shows that T CR is a weighted average of OTM put prices across moneyness with

higher weights on deeper OTM puts. As a result, this measure is expected to mainly capture

the perception of crash risk rather than the objective crash risk given the rare nature of the crash

events associated with deep OTM puts. We note that T CR is equal to a crash insurance price

under no-arbitrage conditions only.

The methodology above can be equally applied to an index. Therefore, we can follow the same

methodology to empirically estimate the aggregate market’s crash perception. In the end, for each

month t, we can compute a measure T CRi;t for stock i’s total crash perception, and a measure

T CRM KT;t for the market’s total crash perception.

2.2.2

Co-crash and idiosyncratic crash perceptions

We use a regression approach to decompose each stock’s total crash perception into a systematic

component (co-crash) and a stock-speci…c component (idiosyncratic crash). The former captures

the sensitivity of a stock’s perceived crash to the market’s perceived crash, whereas the latter

captures a stock’s perceived crash that is unexplained by its covariation with the market. In

particular, we perform the following rolling-window time series regression for each stock at the end

of month m:

T CRi;t = ai +

i

T CRM KT;t + "i;t ; for t = m; m

1; :::; m

23;

(10)

where T CRi;t is the estimated total crash perception of stock i in month t, and T CRM KT;t is the

estimated market’s total crash perception in month t, both through equation (9). The co-crash

perception of stock i is the estimated regression coe¢ cient

i

and the idiosyncratic crash perception

of stock i is the estimated regression intercept ai .

In relation to our theoretical perspective in Section 2.1, the market-level total crash perception

T CRM KT measured in equation (10) re‡ects the subjective belief about the aggregate consumption

crash q^C

qC in the model. Similarly, the stock-level total crash perception T CRi measured in

equation (10) re‡ects the subjective belief about individual stock crash, which is, in the model

12

economy, jointly determined by

i;J

(^

qC

qC ) and q^i

qi ; and as a …rst-order approximation in

empirical setting, these two components are estimated as regression coe¢ cient and intercept in

equation (10).

2.2.3

Descriptive statistics

Our sample consists of CRSP common stocks (with share codes 10 or 11) that have available

OptionMetrics OTM puts from January 1996 through December 2012. Table 1 presents summary

statistics. Overall, we have 4545 optionable stocks in history, ranging from 1564 stocks in 1996

to 1658 stocks in 2012. These stocks on average are mid- and big-cap stocks: the pooled average

of monthly market equity is 8.34 billion and that of size decile ranking is 6.2 (decile breakpoints

are determined using only NYSE stocks). In addition, these stocks have active option and stock

trading activities.8 For example, the average stock turnover rate is 25:2% per month and the

average trading volume of all types of option contracts is 47; 720 per month (each equity option

contract corresponds to 100 shares).

To estimate stocks’crash perception, we use daily data of U.S. equity options and clean them

by a few …lters, such as removing observations where option prices violate no-arbitrage bounds.

We then select only OTM put options with maturities longer than 7 days and shorter than 60

days and generate a 30-day implied volatility curve. Equipped with the implied volatility curve to

compute the option prices, we then estimate the total crash perception according to a discretization

of equation (9) on each day. After obtaining these daily estimates, we take the daily average over a

month to obtain T CRi;t , which we further decompose via equation (10) into perceived co-crash

i

and idiosyncratic crash ai in each month. As the crash perception measures are based on variance

swap contracts, it is conceivable that they may di¤er by their scales of volatility levels across

stocks. To obtain measures that are robust to the scale di¤erence in volatility levels, we divide

T CRi;t by the daily standard deviation over the month t, and ai by the standard deviation of

regression residuals "i;t .9 We use these normalized measures in all our empirical analysis that are

8

In Appendix 2, we report summary statistics of daily open interest of individual equity options. OTM options

are not illiquid. For example, the median of daily open interest for OTM puts that protect a 5% price drop in future

14-60 days is 219 contracts over our sample period 1996-2012. A recent paper, Muravyev and Pearson (2014), actually

show that transaction costs of equity options are lower than those meausred by conventional bid-ask spreads.

9

Within a month, we require at least 15 non-missing daily estimates available in order to calculate the daily

average and standard deviation.

13

cross-sectionally comparable. We note that co-crash perception

i,

as a correlation measure, does

not depend on volatility levels of stocks and hence no further normalization is needed. Last, to

ensure that we have a reasonable number of observations in estimating regressions (10), we require

stocks to have at least 18 months of total crash perception measures available.

Table 2 reports summary statistics of stock-level total crash, co-crash, and idiosyncratic crash

perceptions. We observe large cross-sectional variations of a stock’s crash perceptions. For example,

the idiosyncratic crash perception varies from 0.1 (the bottom one percentile) to 4.9 (the top one

percentile) over the full sample, from -0.01 to 5.2 over the …rst half sample, and from 0.2 to 4.5

over the second half sample.

3

Crash Perception and Subjective Belief

In this section, we investigate how well our option-based measures capture biased subjective beliefs

on stock crash risk. We document strong connection between crash perception measures and

pessimistic beliefs of economic agents in survey forecasts of both aggregate economic conditions

(such as real GDP growth) and individual …rm prospects (such as earnings). These forecasts are

ex-ante and re‡ect beliefs of important market participants. Hence, the strong connection points to

our crash perception measures as capturing the subjective belief about stock crash risk reasonably

well. Moreover, we also study whether a …rm’s …nancial disclosure (such as readability and tone) is

related to stock’s crash perception, from an investor’s perspective. Finally, we ask whether crash

perception can correctly “forecast future crashes” in terms of conditional skewness of stock return

distribution.

3.1

3.1.1

Subjective Belief in Survey Forecasts

Market crash perception

We obtain the U.S. real GDP forecasts from the Blue Chip Financial Forecasts (BCFF) survey

published by Aspen Publishers. The GDP forecasts are for quarter-on-quarter growth expressed

at annualized rate (in percentage). Each month, the BCFF surveys a large number of economists

from banks, broker-dealers, consulting …rms, etc. During our sample period from January 1996

through December 2012, on average there are 56 forecasters providing one-quarter-ahead GDP

14

forecasts per month (the minimum number of forecasters is 40 in March 2001 and the maximum

is 91 in October 2012). At the end of each month, we calculate the skewness of these forecasts

(across individual forecasters) that captures how pessimistic the forecasters are in their beliefs on

the future aggregate economy relative to the average belief.10 We also use the 10th percentile of the

forecasts that captures the subjective belief of the excessively pessimistic forecaster as an additional

measure. Finally, we compute the regular consensus (median) and the dispersion (standard deviation) measures as well as the interquartile range (the di¤erence between 75th and 25th percentile)

of these forecasts.

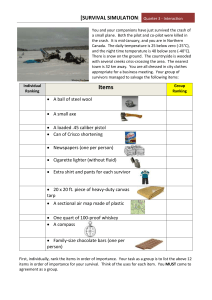

Figure 1 presents monthly time series of the market’s total crash perception and three forecast

summary statistics, skewness, 10th percentile, and dispersion. The market-level crash perception is

estimated via equation (9) using the S&P 500 index OTM put options. We observe that when the

market perceives higher level of crash risk for next month, the professional forecasts of the future

real GDP growth display more negative skewness and lower 10th percentile. That is, the market

crash perception is strongly connected with the pessimistic belief on the aggregate economy. We

also …nd positive correlation between the market crash perception and forecast dispersion, implying

that forecasters tend to disagree more when they are more pessimistic.

We then perform a time series regression analysis to formally describe the contemporaneous

relation between the market’s crash perception and the professional forecasters’ beliefs on real

output. Table 3 presents regression results in detail. In model speci…cation (1), we run the following

regression

T CRM KT;t = Intercept +

The coe¢ cient

1

1 Skewnesst

+

2 M axf0;

Skewnesst g + "t :

(11)

captures the average relation between forecast skewness and market crash per-

ception, whereas the coe¢ cient

negative estimate -0.20 of

1

2

captures this relation conditional on a negative skewness. The

(with a Newey-West t-statistic of -2.7) implies that the market crash

perception is signi…cantly consistent with an excessively pessimistic subjective belief on the aggregate economy. Moreover, this negative relation between market crash perception and forecast

skewness is stronger conditional on a negative skewness: the coe¢ cient estimate -0.27 of

10

2

(that

We note that the BCFF provides forecasts of the mean future real GDP growth across various professional forecasters. Hence, they are not forecasts on crash risk. Nonetheless, the forecast skewness across individual forecasters

captures the extent of the pessimistic subjective beliefs relative to the concensus belief, which can re‡ect the belief

on crash risk of the "tail forecaster".

15

remains in the regression only when Skewnesst < 0 ) dominates the

1

estimate for the average rela-

tion. In addition, the model speci…cations (5) and (7) also show the signi…cant consistency between

the market crash perception measure and subjective belief of the strongly pessimistic forecaster.

Other model speci…cations con…rm the expected relation between crash perception and consensus

forecast and forecast dispersion. Overall, our option-based market crash perception measure is

strongly connected to the subjective belief regrading the future aggregate economy.

3.1.2

Stock crash perception

We further investigate whether our crash perception measures of individual stocks capture investors’

subjective beliefs on stock crash risk. We extract …nancial analyst one-year-ahead earnings (FYR1)

forecasts and long-term-growth (LTG) forecasts from I/B/E/S. These non-stock-price-based variables are less likely to contain agents’ preferences and are “cleaner” to tease out the belief element of stock crash risk. At the end of each month, we collect each analyst’s most recent (and

valid) forecasts and then calculate the cross-sectional skewness among all analysts’ forecasts (we

require at least …ve available forecasts in estimating skewness). Table 4 presents the results from

cross-sectional regressions of stocks’ total crash perception on analyst forecast skewness. These

cross-sectional regressions are similar to the regression (11) in including both the Skewness and

M axf0; Skewnessg to gauge the relation between crash perception measures and subjective beliefs in di¤erent scenarios. The stock-level crash perceptions are estimated via equation (9) using

individual stock’s OTM put options. Similar to Fama and MacBeth (1973), we run regressions

at each point of time and report time-series averages of regression coe¢ cients (and Newey-West

t-statistics).

The …rst two columns of Table 4 show the negative relation between stock crash perception and

analyst forecast skewness – a high crash perception measure is signi…cantly consistent a strongly

pessimistic subjective belief on …rms’future earnings and growth. Moreover, this negative relation

is strengthened when the analysts’beliefs are pessimistic on average. For example, the regression

coe¢ cient capturing the relation between crash perception measures and FYR1 forecast skewness

(conditional on being negative ) is -1.25, dominating the regression coe¢ cient -0.54 for the average

relation. Overall, these cross-sectional results on stock crash perception are similar to those from

the previous section on market crash perception, corroborating the signi…cant consistency between

16

our crash perception measures and subjective beliefs about stock crash risk.

3.2

Accounting disclosure

As discussed in the Introduction, when a …rm discloses its …nancial information in a non-transparent

way (for example, little readability in its annual report), investors hold strong (distorted) subjective

belief that managers withhold bad news that can lead to future stock crash even if the managers did

not do so. Moreover, when the tone of a …rm’s …nancial disclosures is less favorable (for example,

the contextual information conveyed in the narrative R&D disclosure is negative), investors tend

to form beliefs on the lack of …rm’s growth opportunities and its poor performance in the future.

In a nutshell, the increased information asymmetry between managers and investors, particularly

when investors discern opaque and/or negative textual information from …rms’ disclosures, can

induce investors to form biased subjective beliefs on stock crash risk. Therefore, measures of the

readability of …rm …nancial disclosures and the tone in narrative R&D disclosures can proxy for

subjective beliefs on stock crash risk to some extent. In this section, we document close relations

between our option-based crash perception measures and these readability and tone measures,

providing further evidence that the our crash perception measures capture the biased subjective

belief on crash risk well.

The results in columns (3) – (9) of Table 4 show the signi…cant positive relation between

stock crash perception and various readability measures of …nancial disclosures, including the Fog

index, the length of …lings, the document …le size, and the number of unique words (see variable

details in Li (2008), Merkley (2013), and Loughran and McDonald (2014)). In addition, …rms with

less positive tone in narrative R&D disclosures have signi…cantly higher stock crash perception;

and interestingly such a relation doesn’t show up if we check the tone of non-R&D disclosures.11

With respect to the textual measures of positive, negative, and uncertain tones based on the

summary data for all 10-K variants (see details in Loughran and McDonald (2011)), we also …nd

signi…cant positive associations between crash perception and negative/uncertain tone, and negative

association between crash perception and positive tone.

11

We would like to thank Feng Li, Ken Merkley, and Bill McDonald to make their data available to us.

17

3.3

Forecast future return skewness

Can stocks’total crash perception indeed predict future crashes in the cross section? In this section,

we study how, if at all, our crash perception measures relate to future return skewness. Such an

exercise can shed light on whether the crash perception measures capture biased subjective belief

on crash risk or objective crash risk. Following Chen, Hong, and Stein (2001), we measure a stock’s

crash risk ex post by the negative coe¢ cient of skewness (NCSKEW) and down-to-up volatility

(DUVOL). These measures are estimated using the stock’s daily (log) returns in excess of valueweighted CRSP market returns. An increase in NCSKEW or DUVOL indicates more “crash prone”

or left skewed return distribution. Table 5 presents results of cross-sectional regressions of stocks’

NCSKEW or DUVOL measured over a future k-month horizon on their total crash perception

measured as of month t.

Results are striking. Crash perception measures signi…cantly predict future return skewness but

in an opposite way to what the correct beliefs of stock crash will suggest. In the case of 6-month

forecast horizon, for example, stocks with high crash perception today in fact have realized less

negative return skewness or downside volatility in the future. The regression coe¢ cients to predict

NCSKEW and DUVOL are -0.136 and -0.030, respectively, both are at least three standard errors

from zero. These results provide supporting evidence on the incorrect subjective beliefs of crash risk

on individual stocks, which is an essential feature in our stylized model in Section 2 to characterize

how crash perception is priced in equilibrium.12

4

Crash Perception and Cross-Sectional Stock Returns

In this section, we examine the pricing of crash perception in the cross-sectional equity returns. We

…rst present a set of portfolio analysis to illustrate the economic signi…cance of crash perceptions in

expected returns. We then perform a regression-based multivariate analysis that allows us to control

a large set of …rm characteristics and factors that are likely correlated with our crash perception

measures.

Our empirical tests focus on the systematic component (co-crash) and the stock-speci…c com12

We also conduct a similar exercise of market crash perception predicting future market return skewness. Although

we also obtain negative coe¢ cients, none of them is statistically signi…cant, which suggests the limited statistical power

in performing market-wide time series predictive regression.

18

ponent (idiosyncratic crash) of stock crash perception that are shown to to directly a¤ect expected

stock return (Proposition 1). Nevertheless, as an initial evidence on stock crash perception being

priced in the cross section, we perform the analysis on total crash perception (TCR). We monthly

form decile portfolios from January 1996 through November 2012, hold them for one month, and

calculate both equal-weighted (EW) and value-weighted (VW) returns.13 Decile 1 (10) consists of

stocks with the lowest (highest) total crash perception, and the “High-Low”long-short hedge portfolio consists of going long on stocks in decile 10 and going short on stocks in decile 1. Portfolios

are well diversi…ed since on average each decile has 132-133 stocks. Appendix 3 presents detailed

results. We observe an increasing return pattern from low-TCR stocks to high-TCR stocks. On

a value-weighted basis, for example, the monthly return spreads between high and low perceived

total crash deciles are 0.56% (with a Newey-West t-statistic of 2.4).

4.1

Returns on co-crash and idiosyncratic crash perception portfolios

To set the stage, we …rst examine the characteristics of stocks with high levels of crash perceptions.

Table 6 presents …rm characteristics of decile portfolios formed on crash perception (Appendix 1

provides a brief description of characteristic variables). We monthly rank stocks into ten groups

according to their co-crash (Panel A) and idiosyncratic crash perceptions (Panel B), and then

calculate the equal-weighted average of …rm characteristics within each group. Compared with low

co-crash stocks, high co-crash stocks have lower book-to-market equity, lower idiosyncratic return

volatility, higher return kurtosis, lower negative earnings surprise, and lower level and uncertainty of

analyst long-term growth forecasts. Similar to high co-crash stocks, high idiosyncratic crash stocks

also have lower book-to-market equity, idiosyncratic volatility, and negative earnings surprise than

low idiosyncratic crash stocks. Interestingly, stocks with high idiosyncratic crash perceptions are

return winners and have much lighter tails (sample kurtosis based on realized historical returns)

within the past one year. In addition, these stocks have slow sales growth over the past three years,

and among these stocks, we see optimism but also high disagreement in analysts’long-term growth

forecasts.

Overall, our sample includes economically important stocks on the U.S. equity market. Portfo13

CRSP monthly delisting returns are used whenever available; if not, we use the historical industry average of

delisting returns.

19

lios formed on investors’subjective beliefs of stock crash risk display strong heterogeneity in various

…rm characteristics, which provides an interesting task in studying stock returns and performing

asset pricing tests.

We now turn our main focus to portfolios formed using co-crash and idiosyncratic crash perception. Similar to the portfolio analysis above, we rank stocks into ten deciles according to their

perceived co-crash and idiosyncratic crash, and also construct long-short hedge portfolios. To get a

complete picture of our results, we consider portfolio formation at monthly, quarterly, semi-annual,

and annual frequencies. At a monthly formation, for example, we form deciles at the end of each

month from December 1997 through November 2012, and hold portfolios for one month; at a quarterly formation, we form deciles at the end of each quarter from 1997Q4 through 2012Q3, and

hold portfolios for three months; and so on. The …rst date of constructing portfolios is at the end

of December 1997 because OptionMetrics data start in January 1996 and we require a 24-month

horizon to run regression (10) and estimate the co-crash and idiosyncratic crash perceptions. Each

decile on average contains 65-66 stocks. We report both equal-weighted (EW) and value-weighted

(VW) portfolio returns.

To estimate risk-adjusted abnormal returns (alphas), we use the Fama-French (1993) three

factors augmented with the Carhart (1997) momentum factor, the Fama-French-Carhart factors

augmented with the Jegadeesh (1990) short-term reversal factor, the Pastor-Stambaugh (2003) market liquidity risk factor, and the Fung-Hsieh (2001) seven factors including option-based lookback

straddles and macro-based default risk and term risk factors.

4.1.1

Univariate sorts

Table 7 presents returns on perceived co-crash portfolios. When portfolios are monthly formed,

equal-weighted low (high) perceived co-crash stocks earn -0.11% (0.96%) per month and the return

di¤erence is 1.08% per month (with a Newey-West t-statistic of 2.7). The return spread based on

value-weighted portfolios is of similar magnitude, albeit less statistically signi…cant, at 1.06% per

month (with a t-statistic of 1.7). Risk-adjusted abnormal returns of the high-minus-low perceived

co-crash portfolios are economically large, varying from 0.96% per month (benchmarked on the

Fama-French-Carhart four-factor model) to 1.6% (benchmarked on the Fung-Hsieh seven-factor

model). This return pattern associated with co-crash perception is strongest at monthly portfolio

20

formation: the signi…cance of return spreads becomes dissipated at quarterly and semi-annual

formation frequencies.

Table 8 presents returns on perceived idiosyncratic crash portfolios. Three main results arise.

First, stocks with high idiosyncratic crash perception earn signi…cantly higher excess returns than

stocks with low idiosyncratic crash perception. For example, when portfolio formation is at a

monthly frequency, return spreads of high-minus-low perceived idiosyncratic crash portfolios are

0.91% and 1.08%, respectively, when stock returns are equal and value weighted in portfolios.

These spreads are at least three standard errors from zero. Second, these return spreads are largely

driven by going long in stocks with high perceived idiosyncratic crash (decile 10): equal- and

value-weighted monthly excess returns are 1.20% (with a t-statistic of 2.2) and 1.0% (with a tstatistic of 2.4), respectively. Lastly, the e¤ect of perceived idiosyncratic crash on predicting future

stock returns is not short-lived. In fact, the return di¤erences between high and low perceived

idiosyncratic crash stocks at quarterly, semi-annual, and annual portfolio formation frequencies are

not only statistically signi…cant but also economically large, ranging from 0.83% (with a t-statistic

of 2.3) to 1.45% per month (with a t-statistic of 3.7). Results of abnormal returns based on di¤erent

benchmark factors do not change our conclusions.

To examine whether our return results come from a particular sub-sample period, we calculate

year-by-year annual returns and Sharpe ratios of long-short portfolios formed on co-crash and

idiosyncratic crash perceptions. Figure 2 presents these results (see details of long-short portfolio

construction therein). The outperformance of high perceived co-crash and idiosyncratic crash stocks

is not restricted to a particular year. Interestingly, during years of negative returns from investing

in co-crash perception portfolios, returns from investing in idiosyncratic crash perception portfolios

are positive, and vice versa. Overall, the averages of annual returns of long-short perceived co-crash

and idiosyncratic crash portfolios are 12.9% and 10.9% over the 15-year sample from 1998 through

2012, and the averages of annual Sharpe ratios are 0.89 and 1.07.

4.1.2

Double sorts

To investigate the respective power of perceived co-crash and idiosyncratic crash in explaining

cross-sectional expected returns, we perform an analysis on two-way sequentially sorted portfolios.

Table 9 reports equal-weighted return results of these double-sorted 5

21

5 portfolios (each portfolio

on average contains 26-27 stocks). Value-weighted returns are qualitatively similar (results are

available upon request).

In Panel A, we rank stocks into 25 portfolios …rst on perceived co-crash and then on perceived

idiosyncratic crash. After we control the e¤ect of co-crash perception, the average returns of

perceived idiosyncratic crash portfolios monotonically increase from the bottom quintile (0.23%

with a t-statistic of 0.4) to the top quintile (1.10% with a t-statistic of 2.1), and the return di¤erence

between these two quintiles is 0.87% per month (with a t-statistic of 3.2). In addition, the e¤ect

of idiosyncratic crash perception is stronger among stocks with low co-crash: the return spread of

high-minus-low perceived idiosyncratic crash portfolios is signi…cant at 1.1% per month among the

bottom quintile of perceived co-crash, whereas it is insigni…cant at 0.55% among the top quintile

of perceived co-crash. Results of abnormal returns benchmarked on the Fama-French-Carhart four

factors are qualitatively similar.

In Panel B, we rank stocks into 25 portfolios …rst on perceived idiosyncratic crash and then

on perceived co-crash. In the presence of idiosyncratic crash perception, the average returns of

perceived co-crash portfolios also monotonically increase from the bottom quintile (0.22% with a

t-statistic of 0.3) to the top quintile (1.19% with a t-statistic of 2.3), and the return di¤erence

between these two quintiles is 0.97% per month (with a t-statistic of 2.2). Turning to the e¤ect of

co-crash perception within each idiosyncratic crash quintile, we …nd no signi…cant return spreads

among stocks with high idiosyncratic crash perception (0.13% with a t-statistic of 0.2), whereas we

…nd much larger return spreads among stocks with low idiosyncratic crash perception (1.08% with

a t-statistic of 1.8). These results are consistent with implications from our empirical procedures

of decomposing a stock’s perceived total crash into a systematic component (co-crash perception)

and a stock-speci…c component (idiosyncratic crash perception).

In summary, our analysis on double-sorted portfolios suggests that both co-crash and idiosyncratic crash perceptions are important determinants of cross-sectional stock returns and neither

one dominates the other.

4.2

Crash perception and realized crash shocks

In this subsection, we investigate how subjective belief about crash risk (ex-ante crash perception)

is di¤erent from objective crash risk implied from ex-post historical crash shocks in a¤ecting cross22

sectional stock returns.

First, we study whether stocks with high crash perception earn higher expected returns simply

by being more exposed to liquidity and macroeconomic risk factors. We use two market-wide

liquidity risk factors, the Pastor-Stambaugh (2003) market liquidity innovation and the monthly

change of Hu-Pan-Wang (2013) “noise” measure. Macroeconomic risk factors include the market

volatility risk (measured as the monthly change in CBOE Volatility Index (VIX)), the term risk

(measured as the monthly change in the term spread between the US 10-year bond yield and 3month T-bill rate), and the default risk (measured as the monthly change in the default spread

between the Moody’s Aaa and Baa corporate bond yield). We also use the CRSP value-weighted

market excess return as the market factor.

The …rst six columns of Table 10 present the factor exposure of perceived co-crash and idiosyncratic crash portfolios with respect to the liquidity and macroeconomic risk factors.14 Stocks

with high co-crash and idiosyncratic crash perceptions are generally not exposed to liquidity and

macroeconomic shocks (decile 10 portfolios have economically small and statistically insigni…cant

exposure to the majority of these factors). Moreover, we observe that liquidity and macroeconomic

factors are usually not signi…cant in explaining the return spreads between low and high perceived

crash risk portfolios: factor loadings are less than one standard error from zero most of the time.

One exception is the negative loading of equal-weighted perceived co-crash hedge portfolio (i.e.,

High-Low portfolio) on the Hu-Pan-Wang liquidity risk factor (-0.008 with a t-statistic of -2.5).

However, the loading of the perceived idiosyncratic crash hedge portfolio on this factor is positive (0.007 with a t-statistic of 1.8), which goes in a wrong direction to explaining return spreads

earned on idiosyncratic crash perception. Regarding exposure to market risk, perceived co-crash

and idiosyncratic crash hedge portfolios in fact provide hedges against market downturns: their

loadings on the market factor are all negative (from -0.47 to -0.11) and most are signi…cant. These

results deliver evidence that portfolio returns on crash perceptions are not merely compensations

for bearing losses during macroeconomic downturns and liquidity crunches.

Second, to examine whether return patterns associated with crash perception are solely the

manifestation of realized crash shocks on stock markets, we perform a set of Fama-MacBeth (1973)

14

For brevity, we only report results of deciles 1, 5, and 10, and the long-short hedge portfolios. The results of all

deciles are available upon request.

23

cross-sectional regressions by including variables related to stocks’tail distributions based on historical observations.

Panel A of Table 11 provides results of regression coe¢ cients and Newey-West (1987) t-statistics

when we regress stocks’realized excess returns in month t + 1 on crash perception measures and

various subsets of the explanatory variables as of month t. To reduce measurement errors in stocks’

crash perception (e.g., co-crash) and make regression coe¢ cients comparable across di¤erent model

speci…cations, we use each stock’s crash perception decile rankings as regressors when performing

cross-sectional regressions at each point of time (see Table 6 for details of decile portfolio construction).

The existing literature documents that the cross-sectional return variation is associated with

downside market risk (downside market beta) (Ang, Chen, and Xing (2006)), idiosyncratic volatility

(Ang et al. (2006)), systematic and idiosyncratic skewness (Harvey and Siddique (2000)), systematic kurtosis (Dittmar (2002)), a stock’s lottery characteristic measured by maximum daily return

(Bali, Cakici, and Whitelaw (2011)), hybrid tail covariance risk (Bali, Cakici, and Whitelaw (2014)),

and tail risk beta (Kelly and Jiang (2014)). In all regression speci…cations, the coe¢ cients on total

crash, co-crash, and idiosyncratic crash perceptions are positive and statistically signi…cant. Moreover, the magnitudes of these coe¢ cients do not vary much across di¤erent speci…cations, which

implies that return spreads between the top and bottom deciles of crash perception are similar in

the presence of various tail measures based on historical observations. Additionally, the seventh

column of Table 10 shows no signi…cant exposure of crash perception portfolios with respect to the

Kelly and Jiang (2014) stock market tail risk factor. These results provide corroborating evidence

that the e¤ect of subjective belief about crash risk on expected stock return is not simply captured

by stock crash risk implied from realized historical crash events.

4.3

Crash perception and option information

As our measure of subjective belief is based on out-of-the-money put options, it is imperative to

check whether the ex-ante crash perception has been fully captured by well-known option-based

variables that describe risk-neutral moments and account for volatility risk, jump risk, informed

trading in option markets, and slow information incorporation in equity markets. These option

characteristics are shown to have return predictability in various studies (Cremers and Weinbaum

24

(2010); Xing, Zhang, and Zhao (2010); Yan (2011); Johnson and So (2012); An et al. (2014);

Conrad, Dittmar, and Ghysels (2013)).

In Panel B of Table 11, we control for a set of option-based variables, including option-tostock volume ratio, at-the-money implied volatility, slope of implied volatility, among others. In all

speci…cations, the coe¢ cients of co-crash and idiosyncratic crash perceptions remain positive and

signi…cant, and are quantitatively similar across di¤erent controls of option-based variables. For

example, returns spreads between the top and the bottom deciles of perceived co-crash range from

0.79% (0.00079 10 in speci…cation (4)) to 0.92% (0.00092 10 in speci…cation (6)) per month; and

those of perceived idiosyncratic crash range from 0.74% to 0.88%. These results strongly support

that our measures of systematic and stock-speci…c components of subjective belief about crash risk

are not simply manifestations of option-based variables on implied volatility and informed trading.

Furthermore, the last four columns of Table 10 also report factor exposure of crash perception

portfolios with respect to a set of S&P 500 index-option-based factors, including the implied volatility skewness (Xing, Zhang, and Zhao (2010)) and the high-order moment risk of variance, skewness,

and kurtosis (Bakshi, Kapadia, and Madan (2003)).15 We observe that these option-based factors

are rarely signi…cant in explaining the return spreads between low and high crash perception portfolios. One exception is the negative loading of the equal-weighted perceived co-crash hedge portfolio

on the risk-neutral variance (-0.947 with a t-statistic of -2.0). However, the positive loading of the

perceived idiosyncratic crash hedge portfolio on this factor (0.565 with a t-statistic of 1.9) goes in

a wrong direction to explaining the return spread of perceived crash risk portfolios. Overall, these

results show that a stock’s crash perception is priced in the cross-section, and this e¤ect cannot be

explained by option-based variables that have been proposed in the literature.

4.4

Crash perception and other …rm characteristics

We complete our regression analysis by controlling for explanatory variables that account for commonly used …rm characteristics. These variables include size and book-to-market equity (Fama and

French (1992)), past short- and intermediate-term returns (Jegadeesh (1990); Jegadeesh and Tit15

In an (unreported) analysis, we also use other option-based disaster risk factors such as the slope of implied

volatility (Yan (2011)), the implied volatility spread (Cremers and Weinbaum (2010)), ATM implied volatility, and

the delta-hedged option return spreads between S&P 500 index OTM and ATM puts. Our results are robust to all

these factors.

25

man (1993)), net stock issuance (Ponti¤ and Woodgate (2008)), operating accruals (Sloan (1996)),

and illiquidity (Amihud (2002)). We report regression estimates in Panel C of Table 11. Results

of the …rst four regression speci…cations con…rm our above-mentioned baseline portfolio results. In

the remaining speci…cations (5) and (6), the coe¢ cients on total crash, co-crash, and idiosyncratic

crash perceptions are all positive and statistically signi…cant, showing that the explanatory power

of subjective belief about crash risk for cross-sectional stock returns is not subsumed by commonly

used …rm characteristics.

5

Robustness Checks

In this section, we investigate industry e¤ects behind …rm-level crash perception and check alternative measures of crash perception.

5.1

Industry e¤ects

Are there any industry e¤ects driving stock return patterns associated with crash perception? In

this subsection, we …rst examine industry compositions among stocks with the highest perceived

co-crash and idiosyncratic crash.

Figure 3 presents a time series of industry composition within the two top deciles of co-crash

and idiosyncratic crash perception. Particularly, we look for industries with the highest likelihood

of being ranked into these top deciles at the end of each month of portfolio formation (see Figure

3 for details).16 We group stocks into the Fama-French 12-industry classi…cation according to

their Standard Industry Classi…cation (SIC) codes. The …gure suggests that to some extent the

investors’ belief about stock crash is industry wide. There are some industries that are more

likely than others to enter into portfolios with the highest crash perception, and importantly, such

industry compositions are also time-varying in response to changing macroeconomic conditions.

For example, industry 7 (telephone and television transmission) accounts for the largest fraction

among stocks with the highest perceived co-crash during the earlier sample period 02/1999-03/2000,

whereas industries 10 (healthcare and medical equipment) and 11 (…nance) dominate the largest

fractions during the later sample periods 07/2006-01/2009 and 03/2009-02/2011, respectively.

16

In Appendix 4, we report summary statistics regarding the likelihood of the Fama-French 12 industries that are

ranked within each perceived co-crash decile and each perceived idiosyncratic crash decile.

26

Because of industry common components behind the crash perception of individual stocks, we

further investigate whether our …ndings are completely explained by industry e¤ects. We perform

two additional analyses: (1) industry-neutral portfolios formed on crash perception; and (2) standard portfolios formed on industry-adjusted crash perception. For brevity, we discuss the main

results below and the full set of tables is reported in the Appendix.

To construct industry-neutral portfolios, we …rst sort stocks into ten groups based on their

crash perception within each of the Fama-French 12 industries, and then form ten decile portfolios

by combining stocks across industries. These portfolios are industry neutral because decile 1 (10)

contains stocks with the lowest (highest) perceived crash from each industry. Compared with the

main results in Tables 7 and 8, we …nd that return patterns associated with crash perception are not

completely attributed to industry e¤ects, particularly at monthly frequency of portfolio formation.

Return spreads of high-minus-low perceived co-crash and idiosyncratic crash portfolios, for example,

range from 0.52% to 0.82% per month (with t-statistics varying from 1.7 to 2.6). Detailed results

are shown in Appendix 5.

To construct portfolios based on industry-adjusted perceived crash risk, we …rst demean each

stock’s crash perception by industry, and then rank stocks into ten decile portfolios according to

their demeaned measures. Results are qualitatively similar to those of industry-neutral portfolio

analysis. For example, at monthly formation, return spreads of high-minus-low perceived co-crash

and idiosyncratic crash portfolios range from 0.49% to 0.93% per month (with t-statistics varying

from 1.6 to 2.4). Detailed results are shown in Appendix 6.

5.2

Alternative measures of crash perception

In the main analysis, we use the OTM put prices to capture the subjective belief of crash risk

(rather than the objective crash risk). The …rst alternative approach is to combine both OTM

calls and puts together in constructing a measure of crash perception, similar to that described

in equation (9). This measure concerns the protection against the unlikely but extreme downside

net of upside price movement. Panel A of Appendix 7 shows that excess returns of high total

crash/co-crash/idiosyncratic crash are signi…cantly higher than those of low crash stocks under this

alternative measure of crash perception. For example, equal-weighted return spreads of high-minuslow perceived total crash, co-crash, and idiosyncratic crash portfolios are 0.40%, 0.73%, and 0.70%

27

per month, respectively, all statistically signi…cant. Value-weighted return spreads are of similar

magnitudes.

Throughout the paper so far, we measure crash perception over next month. As a robustness

check on horizon, we also measure crash perception over the next two months, using options with

maturities longer than 30 days and shorter than 90 days to generate a 60-day implied volatility

curve. Panel B of Appendix 7 presents excess returns of crash perception portfolios. Results are

similar to those in our baseline analysis. Equal-weighted return spreads of high-minus-low perceived

total crash, co-crash, and idiosyncratic crash portfolios are 0.39%, 0.91%, and 0.85% per month,

respectively, all statistically signi…cant. Value-weighted return spreads are of similar magnitudes.

6

Conclusion

In many scenarios, economic agents do not know the true probability of future events and make

decisions based on the biased subjective beliefs. In this paper we explore the pricing implications

of the di¤erence between perception (the subjective belief) and truth (the objective probability) in

the context of stock crash risk. We believe stock crash risk is an ideal setting for testing the pricing

implications of the perception for two reasons. First, crash events are rare and traders may have a

di¢ cult time forming a correct belief. Second, option price data are readily available on individual

stocks, which re‡ect traders’subjective beliefs through equilibrium.

We use out-of-the-money put options on both the S&P 500 Index and individual equities to

measure two components of crash perception: perceived co-crash, a systematic component capturing

the covariation between a stock’s crash perception and the market’s crash perception; and perceived

idiosyncratic crash, a stock-speci…c component capturing the part of stock-crash perception that