JOINT FASB AND IFRS REVENUE RECOGNITION STANDARDS

advertisement

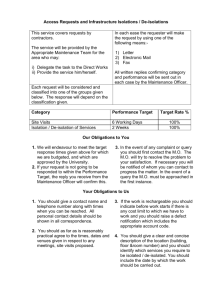

ACCOUNTING AND COMPLIANCE JOINT FASB AND IFRS REVENUE RECOGNITION STANDARDS EDWARD OPALL, CPA Back in college in the 1980s, it was understood that change was inevitable and the best course was to embrace it. The watchword was always: “Learn, adapt, and evolve or be left behind.” There is no question that the world has only gotten more complicated since then, and the proliferation of new accounting pronouncements is a prime example. Though frequently frustrating, most people have become comfortable with adapting to more complexity and constantly changing methods of doing work. One thing that has remained constant throughout this period has been the accounting standards on revenue recognition for the construction industry. These accounting standards have been in place since 1981 and had been widely used in practice long before that time. They logically captured the nuances of the financial arrangements and the inherent business issues in the industry. But that is soon to change. As a result of increased globalization in business, the governing boards responsible for Generally Accepted Accounting Standards (GAAP) in the United States and International Financial Reporting Standards (IFRS) have been working to create unified international accounting standards. Their project began in 2002. Revenue recognition is one of many topics covered in this joint project. The proposed revenue recognition standard would provide one generic standard for all industries, eliminating GAAP’s industryspecific standards. This new standard will replace the current standard, ASC 605-35, “Revenue Recognition for Construction Type Contracts.” The coming change is not necessarily designed to correct inherent flaws in EDWARD OPALL is a director in the Construction and Real Estate practice group in the Philadelphia office of EisnerAmper, LLP. the current method, but rather to react to changes in the world at large. Background When the Financial Accounting Standard Board (FASB) issued its first exposure draft, “Revenue Recognition (Topic 605): Contracts with Customers” in 2010, there were significant and fundamental changes in store for the construction industry. Fortunately, over a thousand comment letters from industry leaders, the accounting profession, and other industry stakeholders convinced FASB to revisit the topic. In November 2011, FASB re-issued its exposure draft and improved the proposed standards by aligning the goal of standard revenue recognition across industries with a principlesbased approach, while retaining much of the current construction industry practices. Since the proposed standard is applicable for all industries utilizing “contracts” with customers, the challenge has been to be sure that changes to accommodate the construction industry fit within the principles promulgated for all industries. At a meeting on 11/6/13, the FASB Board concluded its review of the 2011 exposure draft, with the minor revisions agreed to since that time, and directed its staff to draft the final standards. The final standards are expected to be issued in the first quarter of 2014, and will become effective for periods beginning after 2016 for public entities and after 2017 for private entities. Upon adoption of the proposed standards, contractors will be required to modify any prior periods presented in comparative statements in order to present full/or modified retrospectively presented financial statements. The current standard mandates percentage of completion accounting for revenue recognition for long-term contracts, and presumes that contractors are able to make reasonable estimates of 1ST QUARTER 2014 REAL ESTATE TAXATION 83 Over a thousand comment letters convinced FASB to revisit the first exposure draft. 84 project costs.1 That mandate will remain under the proposed standards. Contractors will encounter certain changes in accounting practices for contracts using the cost to cost method, as well as major changes to their disclosure requirements. Fundamentally however, the manner in which the industry accounts for contract revenue will remain intact. Before focusing on the ultimate changes in store, it is important to review the situation until now. The June 2010 exposure draft introduced the following core principles,2 which remain the foundation of the proposed standards: • Identify the contract with the customer. • Identify the separate performance obligations in the contract. • Determine the transaction price. • Allocate the transaction price to the separate performance obligations. • Recognize revenue when performance obligations are satisfied. Major problems from the 2010 exposure draft (hereinafter the “original proposal”) were identified through the public comment process: 1. Depending on the level of granularity, all contracts in the construction industry contain multiple performance obligations. One could conceivably view each building, phase, section, or subcontract as a separate performance obligation. The original proposal implied that companies would be required to disaggregate each contract element/obligation for accounting purposes. 2. It was unclear whether companies could use the percentage of completion method using a cost to cost approach as a means of recognizing revenue over the course of a project because the proposed standard recommended the output method (units produced).3 3. Accounting for variable contract prices (unapproved or unpriced change orders, incentive payments, and claims) would have been less conservative than current practice. The original proposal required contractors to estimate the value of unresolved contract issues recognized using a probability-weighted approach. 4. The original proposal added significant disclosure requirements: tabular reconciliation of beginning and ending contract assets and liabilities each year, the expectation of when ending performance obligations will be satisfied, the opening and closing liabilities for onerous performance obligations, and a summary of significant judgments and changes in judgments REAL ESTATE TAXATION 1ST QUARTER 2014 used in determining the satisfaction of performance obligations. Since contractors are continually updating their project estimates, these disclosures show the impact of changing estimates on reported revenue. 5. The original proposal deemed warranties as separate performance obligations, so one must defer recognition of a portion of total contract revenue. Without abandoning the core principles previously established, the 2011 exposure draft (the “revised proposal”) produced clarifications and revisions to the proposed standards. The changes are major improvements for the construction industry: 1. The revised proposal allows bundled performance obligations.4 This is the ability to bundle performance obligations when multiple goods or services are highly interrelated and a business provides a significant service of integrating multiple goods and services into the combined item. This change allows for the most construction contractors to presume that the unified contract would remain the only performance obligation for revenue recognition. 2. “Input” is also important.5 The revised proposed standards eliminate the presumption that the output method (units completed, progress toward completion) is preferable to the input method (cost to cost, labor hours) for measuring progress toward satisfying performance obligations. Percentage of completion using cost to cost (input method) would be allowed with certain exceptions noted below. 3. Conservative reporting is encouraged.6 FASB revised the proposed standards for estimating the value of unapproved change orders, potential incentive payments, and claims in the total contract value to encourage conservative reporting of uncertain elements of the contract amount. The proposed standards provide that these estimates would be determined using either a probability-weighted approach or the “most-likely” estimate. The “most likely” estimate method is appropriate in the construction industry, where the outcome choices are likely to be binary rather than one of a range of outcomes. In addition, the revised proposal states that entities use judgment to determine when variable consideration is “reasonably assured.” This revision brings the proposed standard more in line with the current standard. 4. Disclosure requirements have been scaled back. The revised proposal will still require robust revenue recognition disclosures for public ACCOUNTING AND COMPLIANCE EXHIBIT 1 Revenue and profit with $100 of costs ‘not depicting the transfer of goods or services.’ Costs to date Total estimated project costs Percent complete Total contract amount Revenue to be recognized Job costs recognized Less costs directly expensed or capitalized Gross profit (loss) to be recognized Current standard (all project costs excluded) $ 200 $ 1,200 17% $ 1,500 $ 250 (200) $ and non-public companies. However, FASB eliminated the requirement of tabular reconciliations of beginning and ending contract information for private companies.7 During its 2013 deliberations, FASB eliminated entirely the requirement for tabular reconciliations of liabilities for onerous performance obligations.8 5. Warranties would be handled differently. The revised proposal provided for warranties to be accounted for in a manner similar to the current standard. If the customer has the option to purchase the warranty separately, it would be a separate performance obligation to be accounted for separately. If the warranty was merely an assurance that the entity’s past performance would be as specified in the contract, it does not constitute a separate performance obligation.9 Significant changes As a result of the revised exposure draft of 2011, subsequent additional public comments, and further deliberations of the board during 2012 and 2013, there are fewer fundamental changes from the original proposal for construction contractors. However, the following issues will constitute major changes from the current standards. Contract costs. Contractors that calculate revenue using the percentage of completion on the cost to cost approach will face a fundamental change. The proposed standard will remove certain categories of costs (see below) so they will not be in the numerator and denominator to calculate the percentage completed. The change in calculation will defer recognition of revenue on projects and make revenue reporting more conservative. The result will be lower revenue recognized during the early stages of a project. ACCOUNTING AND COMPLIANCE – 50 Proposed standard (certain project costs excluded) $ 100 $ 1,100 9% $ 1,500 $ 136 (100) $ (100) (64) The current standard provides a self-correcting mechanism in accounting for diminished profit due to unrecovered costs under the percentage of completion method. Once identified, the diminished profit would already have been in the cost incurred to date (numerator) and the total estimated project costs (denominator). The percentage presumably would be higher due to the higher numerator. Thus, when applied to the contract price, revenue is recognized earlier than would be permissible under the proposed standards. For a sample calculation using the current and proposed standards at an early point in the project, with $100 of costs described as “not depicting the transfer of goods or services,” see Exhibit 1, above. The proposed standard would exclude three categories of costs from the calculation.10 1. Costs that do not accurately depict the transfer of control of goods or services (such as costs of 1 2 3 4 5 6 7 8 9 10 The five steps remain the foundation of the proposed standards. ASC 605-35-25-60. FASB Exposure Draft, “Revenue Recognition (Topic 605),” 6/24/10, paragraph 2. The cost to cost formula for finding the percentage of completion it the total of all costs recorded to date on a project or job, divided by the total estimated amount of costs that will be incurred for that project or job. Revised FASB Exposure Draft, “Revenue Recognition (Topic 605),” 11/14/11, paragraph 29. Id., paragraphs 44-46. Id., paragraphs 55, 81-84. Id., paragraph 130. “Project Update: Revenue Recognition: Summary of Decisions Reached to Date (as of October 30, 2013),” available at www.fasb.org/cs/ContentServer?site=FASB&c=FASBContent_C&pagename=FASB%2FFASBContent_C%2FProjectUpdatePage&cid=1175801890084#summary. Revised FASB Exposure Draft, supra note 4, paragraph IG12. Id., paragraphs 93-96. 1ST QUARTER 2014 REAL ESTATE TAXATION 85 wasted materials, labor, or other resources). The proposed standard would require idle time charged to projects expensed to an allocated labor account. 2. Costs to obtain a contract will be expensed as incurred. The proposed standard would require that costs to bid a project be expensed rather than included in job costs. 3. Direct costs of fulfilling a contract (such as commissions or mobilization costs) are capitalized and amortized if they related directly to a contract, relate to future performance, and are expected to be recovered. The proposed standard would require companies to accumulate these early costs, remove them from job cost, and record these costs as a prepaid expense that will be written off over the life of the project. Presumably, this will result in a minimal difference to net earnings. Applying these changes in practice will be difficult, since most companies’ contract reporting and job cost reporting systems are not set up to account for the proposed changes without manual journal entries. For management purposes, companies would not want to lose track of these costs and their association with particular projects due to external reporting requirements. Changes to disclosures. The proposed standards would require significant changes to the footnote disclosures. Their objective would be to enable users of financial statements to understand the nature of a company’s contracts with customers, significant judgments used for applying the standards, and assets recognized and amortized from the costs to fulfill contracts. 11 12 13 86 Id., paragraphs 114-116. Id., paragraph 117. Id., paragraphs 118-119. REAL ESTATE TAXATION 1ST QUARTER 2014 Contracts. Contractors would be required to disclose their various types of contracts, durations of contracts, and timing of transfers of work in process.11 Public companies would be required to provide tables and non-public companies would need to disclose qualitatively. Public companies would be required to disclose tables that distinguish between revenue from work performed during the year and revenue recognized due to cumulative changes in estimates from work performed in prior years.12 Contractors would be required to disclose descriptions of how performance obligations are satisfied, significant payment terms, and types of warranties and related obligations.13 Companies would be required to disclose the aggregate amount of backlog, which would be distinguished between approved contract balances and the amount of unapproved change orders. Conclusion For those who have followed the deliberations on this new standard for the last several years, it has been interesting to see how the process evolved. FASB and IASB developed a very theoretical model containing the principles needed to accomplish their mission. The first effort in 2010 had many deficiencies that made it impractical to use. Because of the strong pushback, a more workable exposure draft was issued. The end result is a standard that appears to be acceptable. Implementation of these changes by each company will be challenging as accounting policy decisions would need to be made, followed by changes to internal processes and controls, and accounting software will need to be revised to efficiently capture the needed information. At least the industry will have several years to digest the final standards and prepare for the necessary changes. n ACCOUNTING AND COMPLIANCE