www.cunucuarubiano.com

advertisement

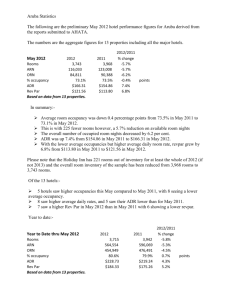

Tropical isolation at its purest, closed to Aruba’s east coast beach cove. This elegant eco escape is an intimate hideaway set in a ruggedly beautiful landscape. Great deal of our inspiration is drawn from the island we live on; it’s exotic colors and light, its flora and fauna, its history, culture and people. www.cunucuarubiano.com To : Prospective Investors Re : Safe Investment Opportunity in a unique Hotel "Cunucu Arubiano" Eco-and-Beach-Resort. Date : February 2011 Cunucu Arubiano (CA) is a new, ECO-reso rt 1 on Aruba. For a brief idea of the concept please visit www.cunucuarubiano.com. We opened in February 2009, and since May 2009 are officially affiliated to Small Luxury Hotels of the World (www.slh.com). In 2009, for the third year in a row, SLH has been rated by high net-wo rth consumers 2 as “Best of the Best” among 22 luxury hotel brands. This survey is conducted yearly by the Luxury Institute 3. SLH outscored such renowned luxury brands as the Peninsula, and Ritz Carlton. A 2 pages copy of this report is attached. 4 Based on the industry indicato rs, feedback from our guests , and visib le opportunities, I have decided that the timing is right to move-on with the 2nd phase of the project. The first phase consists of 3 free standing casita’s, with a swimming-pool, breakfast area and kitchen. Hence we are operating CA currently as a Bed & Breakfast. But industry experts, travel journalists and writers, leading periodicals such as Brides Magazine, Caribbean Travel & Life, Flair Magazine of Canada, e.a., all of whom have already visited CA, are encouraging us to complete the 2nd phase soonest, since “a full-fledged resort is more appealing to all markets, thus much easier to sell”. The expansion-plan: Convert Cunucu Arubi ano from a “ Bed & Breakast”, to a Full-Fl edged Resort, with Beach Access! (1). Purchase of the adjoining property land of approximately 25.000m2 from my parents. Family price of Afl. 40-45,- m2. This will accordingly provide for immediate “equity” in the form of market overvalue. Please see accordingly also the Balance Sheets of CA, attached. This property -land includes the Aruban-Donkey-Sanctuary (www.arubandonkey.org). (2). Construction of 12-15 additional casita's, and 1 pool, ready for operations 5. Currently there are 3 casita's in operation with 1 pool (first phase). In total the reso rt will have 3 swimming-pools (see point 3). (3). Revamping of Sta. Lucia 4 into a lobby, small spa, and theme restaurant (to be outsourced). Sta. Lucia 4 houses "Villa Nechi Klimpiek" whom was the "Boswachter" of Sta. Cruz. In short, an authentic, turn of the century old-Aruban-style house with stunning views over half the island. There is also a pool at Sta. Lucia 4. In essence, once completed Cunucu Arubiano will have a "luxury -ratio" of 1 pool for every 5 casita's. 1 Dr. Sam Cole has recommended t he Aruban Government as far back as the early 1990’s to diversify the t ourism portfolio towards “boutique hotels” – as these categories of hotels attract a much more affluent market. 2 North American consumers with average weighted household income of US$ 343,000.00, and US$ 3.2 million in household net worth. 3 The Luxury Institute is the uniquely in dependent and impartial ratings and research institution that is the trusted and respected voice of t he high net-worth consumer. 4 Please go to www.tripadvisor.com. Find Cunucu Arubiano. Some Reviews are attached herewith. 5 Maximum estimation. The estimated to tal financing required to realize points 1-3 is Afl 6.0 million 6. This is inclusive of the Afl 650m loan currently on the first phase of Cunucu Arubiano. Also inclusive of the Afl 500m loan on Sta. Lucia 4. Combined, both properties have an over-value today of about Afl 1 million. As Developer-owner I am committing accordingly Cunucu Arubiano, Sta. Lucia 4 as hard -equity. As well as the p roperty land (point 1), which, at a purchase price of Afl. 40-45,- would have an immediate overvalue (equity) when appraised. As -temporary- security to ensure quality construction, and completion of the p roject within budget, Banks require of Afl 2 million (approx. U$ 600-thousand). Upon satisfactory completion of phase 2 this guarantee will be released . This period should take no longer than 18 months! The target is 1 year. The risk fo r the Investor is minimum. The probability of a down -sid e scenario is close to zero. All that the project needs is a temporary b ridge. Nevertheless, to help me realize this unique project, I am prepared to grant you 40% shares in Cunucu Arubiano Development Co. N.V. Post-completion of the construction I estimate that the reso rt will be appraised conservatively at around Afl 10 million. Face value your shares would accordingly immediatel y be worth at least Afl 4 million. And your investment, albeit you had no direct cash -outlays, will be backed by realestate! The deal is sound. The timing fo r real-estate construction is very good. Contractors are seeking jobs. Let’s take advantage of this recession wh ich in fact is a “b lessing in disguise” for real-estate construction. The only “catch” is that I would appreciate agreeing on a 1 st option to buy-back (a portion of) the shares within a time-frame of 3 years, and against a pre-determined price. Yours faithfully, CUNUCU ARUBIANO DEV. CO. N.V. _____________________________ Edmond (Eddy) L. Paris, MA, MBA Managing Director www.slh.com www.cunucuarubiano.com 6 The budget is taken on a “high-side” to ensure that unforeseen expenses or possible delays beyond control are accounted for. Budget Breakdown (estimations): Afl 1.1m for the purchase of the propert y land of approx. 25.000m2. Including notary expenses and t ransfer taxes. Afl 1.5m for the construction of 13 casita’s. Including all FF&E, 1 additional pool, and landscaping. st Afl 1.15m pay-off balances on Sta. Lucia 4 and Cunucu Arubiano 1 phase. Afl 400-thousand to revamp Sta. Lu cia 4 int o a Luxury spa, lobby, restaurant, etc. Afl 785-thousand overdraft-facility to guarantee 1-year repayment of the loan until the resort can generate it’s own cash-lfo Balance for Marketing! - bank fees, and “buffer” for pre-opening expenses, unforeseen, emergencies, modifications, etc. Current Balance Sheet of Cunucu Arubiano Development Co. N.V. Cash FF&E Automobile SLH 50.000,00 150.000,00 35.000,00 20.000,00 Long-term loan Long-term loan 650.000,00 500.000,00 Total LT Liabilities Land & Casita's Sta. Lucia 4 Total Assets 1.150.000,00 1.590.000,00 950.000,00 2.795.000,00 EQUITY 1.645.000,00 Total Equity and Liab. 2.795.000,00 Note: Value of Land & Casita's, and Sta. Lucia 4 (phase 1) are based on Appraisal repo rts Cunucu Arubiano, Balance Sheet after completion of Phase 2: 16 Casita's, Lobby / Spa, etc. Cash 50.000,00 Long-term loan FF&E Automobile SLH 700.000,00 35.000,00 20.000,00 Land & Casita's (phase 1) Sta. Lucia 4 1.590.000,00 950.000,00 Land (overwaarde) Sta. Lucia 4 (overwaarde) 2.750.000,00 1.650.000,00 13 additional Casita's 2.500.000,00 6.000.000,00 Total LT Liabilities 3 EQUITY Total Assets 10.245.000,00 Total Equity and Liab. 6.000.000,00 4.245.000,00 10.245.000,00 Notes: 1. Land of approx 25.000m2 will be purchased at approx Afl 40 p/m. But realistically speaking, it will be appraised at around at least Afl 110, per m2 as that is the average price on Aruba, and for "greenfield"land. But this land will be developed: in principal the overwaarde will be worth more. 2. Because of the expertise of E. Paris, the Casita's can be built at attractive prices, but an Appraiser will see the value of the physical plant and not what was paid (in labor) to build the Casita's. 3. Because of the positive Equity and total Assets value exceeding total Liabilities for a Loan to value ratio of 59%, the lending-Bank can be reasonably persuaded to release the Pledge of the Investor. 4. Further to point 3, once the resort is completed, and assuming that for whatever unforeseen reason the lending Bank must foreclose, the Balance Sheet shows that there is ample collateral to call upon before having to make any claim on the Pledge of the Investor. DRAFT CUNUCU ARUBIANO, 16 casita's Profit & Loss Projections Stated in Aruba florins To show Breakeven Rate Days Revenues (notes: 1-4) 5 Other income (restaurant) 6 Other income (spa) Gross Profit Year 1 US$ 270,0,40 TARGET Year 2 US$315,0,60 Year 3 US$ 345,0,70 1.128.358,08 1.974.626,64 2.523.134,04 60.000,00 62.500,00 64.900,00 36.000,00 37.080,00 38.192,00 1.224.358,08 2.074.206,64 2.626.226,04 Year US$ 375,80% 3.134.328,00 65.000,00 57.835,00 3.257.163,00 Expenses 7 Personnel Marketing (SLH) Sales (road-shows, 8 convention,etc.) 9 Utilities Cable TV / Wi-fi Internet Crystal Pool Insurances Netcor N.V. (Internet, website) ATCO (trash-container) Office Repairs & Maintenance, Grounds Vehicle and Transportation 10 Depreciation Estimated annual Amort 11 (note: 3) 325.000,00 26.000,00 335.000,00 26.000,00 345.000,00 26.000,00 325.000,00 26.000,00 24.000,00 95.000,00 18.500,00 10.400,00 15.000,00 22.000,00 97.850,00 18.750,00 10.700,00 15.500,00 18.000,00 100.785,00 19.000,00 11.020,00 15.850,00 10.000,00 100.785,00 18.500,00 11.020,00 15.000,00 1.500,00 2.160,00 12.000,00 1.500,00 2.225,00 12.360,00 1.500,00 2.292,00 12.730,00 1.500,00 2.292,00 12.730,00 19.500,00 58.500,00 97.500,00 97.500,00 7.500,00 7.750,00 9.000,00 7.000,00 783.900,00 783.900,00 783.900,00 783.900,00 Total Operating Expenses 1.340.460,00 1.392.035,00 1.442.577,00 1.411.227,00 Earning From Operations -116.101,92 1.845.936,00 682.171,64 1.183.649,04 Notes: (1). Revenues of year 1 is based on a monthly rate of US$ 270,- and 40% occupancy (3). Revenues of year 3 is based on a monthly rate of US$ 345,- and 70% occupancy (5-6). Rental is conservative. Landlord can also opt for a percentage of sales revenues in addition to fixed rent. (7). 1 Manager, 1 Office Manager, 2 Housekeepers, 1 Handyman, 2-3 Stagiares, 1 Utility worker. (7). Yearly attendance ofCaribbean Hotels Hotels Marketplace, product-presentation for wholesalers, sales calls, etc. (8). Landscaping will be irrigated mostly with "brakish"-water brought to the surface by traditional windmills (which fit with the concept of "Cunucu") (10). Based on a 12 years mortgage-loan of Afl 6 million and interest rate of 8.0% (2). Revenues of year 2 is based on a monthly rate of US$ 315,- and 60% occupancy (4). Keeping in mind that: → Guests have paid in 2009 already a rack rate of US$ 345,- and claim this to be a "good value" → The average occupancy for Aruba hotels is 72% → With only 15 rooms it's very reasonable that occupancy percentages of 72% is achievable → An occupancy percentage of 80%, with average rates of over US$ 375,- are very reasonable. (9). Depreciation will reduce the taxable income but is not a source of cash (11). Taxes. As incentive, the Government allows for the incorporation of an "Imputatie" company, whereby hotels with an average yearly rate of over US$ 200 pay less than 10% on profit tax IntendedDISBURSEMENT Schedule: 1 2 3 4 Equity Recapture Sta. Lucia 4 Equity Recapture Cunucu Arubiano Bank fees on loan of Afl 6m Purchase of 25.000m2 property land (including Notary and Transfer taxes) 5 Revamping of Sta Lucia 4 6 Architectural and General preconstruction 7 13 casita's (including land-prep) 8 Beach access, etc. 9 FF&E casita's # Utilities (possib ly Trafo) # General landscaping and infra # Pre-opening marketing # Unforeseen # 1st year repayment of facility 6.000.000,00 500.000,00 650.000,00 50.000,00 1.100.000,00 400.000 50.000,00 1.500.000,00 Can be less 25.000,00 390.000,00 200.000,00 Can be less 300.000,00 100.000,00 Can be less 100.000,00 BUFFER 654.000,00 BUFFER 6.019.000,00 Mr. Edmond (Eddy) L. Paris, B.Sc., MA, MBA Mr. Paris has extensive experience in Corporate Financing, Banking, Tourism Development, Marketing, and General Management. Mr. Paris wo rks fluently in English, Papiamento, Dutch, and Spanish. Date of birth: September 26, 1969 (41 years of age). Nationality: Dutch. Home address: Marg rietstraat 1, Oranjestad, Aruba. Tel: (297) 739.3339. E-mail: eparis@cunucuarubiano.com, or, edmond.paris@bancodicaribe.com. From 1988 to 1996 Mr. Paris wo rked in all divisions of the Hospitality and tourism industry, on Aruba and in the US. After completing his Bachelor of Science at the Florida International University in No rth Miami, FL in 1993, Mr. Paris was hired as acting sales-manager for the Aruba Sonesta Ho tels (today the Aruba Renaissance Hotels). Stationed in Coral Gables, FL, M r. Paris travelled to more than 13 States in the US conducting product presentations to wholesalers, travel agents, attending road -shows, salescalls, IATA conventions, etc. together with the Aruba Tourism Authority offices in the US (FL and NJ), and also the Aruba Hotels and Tourism Association member hotels. In 1995 M r. Paris obtained a graduate d egree in Business Communications and Public Relations at the European University (EU) in Europe. From 1995 to 1996 Mr. Paris was the sales-manager and acting director of sales for Latin America and Europe, fo r the then newly opened, 400- rooms Aruba Marriott Hotel, travelling to Colombia and Venezuela to contract with tour-operato rs e.a. From 1996 to 2002 M r. Paris was in banking, where he set-up various marketing departments for the ABC-islands. In early 1999 M r. Paris returned to EU to complete a second graduate degree; an MBA in International Business and Financing. From late 1999 to late 2002 M r. Paris was a corporate finance manager, and member of the bank’s credit-committee. From 2002 to 2003 M r. Paris lead the complete architectural planning, financing, and construction supervision of the new dealership fac ility of Aruba’s largest car importer-distributor, and successively was it’s general managing directo r from 2004 to 2006. See also www:cordiaaruba.com. In late 2006 M r. Paris started the construction of a p lan he had d rafted in 1992; develop Aruba’s first eco-cultural boutique reso rt. Cunucu Arubiano Eco-Resort (CA) was accordingly opened in 2009. Small Luxury Hotels of the World (www.slh.com), which is perhaps the lead ing luxury hotel group in the world, soon welcomed affiliation of CA (www.cunucuarubiano.com) to it’s coveted line-up of unique hotels around the world. During the development of CA Mr. Paris also was a consultant to a South-American bank which successfully incorporated it’s off-shore operations on Aruba in late 2009. In medio 2009 Mr. Paris returned to banking, in the capacity of Manager Corporate Accounts. Integrity and loyalty are core personal virtues of Mr. Paris, yet Mr. Paris considers balanced change essential for personal and professional gro wth. Resume of Mr. Edmond (Eddy) L. Paris, MBA Date of birth: Sep tember 26, 1969 (40 years of age). Nationality: Dutch. Management Positions Owner –Managing Director of Cunucu Arubiano Development Company N.V. – owner of Cunucu Arubiano Eco-Resort (www.cunucuarubiano.com), which is affiliated to Small Luxury Hotels of the World (www.slh.com). 2006-Current. General Managing Dir ector – GCA Auto Sales N.V., GCA Store & Lock N.V., and GCA Aruba N.V.: Jan. 2004 - July 2006. GCA stands for Garage Cordia Aruba N.V, and is the largest dealer on Aruba, fo r Toyota and Lexus automobiles. Established in 1968, employ ing over 75 persons, with yearly group sales exceeding Afl 45 million (US$25 million). Manager / Staff Positions: Manager Corporate Accounts – Banco di Caribe Aruba N.V. – 2009 - Current. Member of the bank’s credit committee. Project and Finance Manager for GCA Aruba N.V., 2002-2003. Negotiated a substantial and single digit loan (then a first on Aruba), for the construction of GCA’s new auto-dealership facility. Complete planning of the new facility, supervision of the construction and proper funds allocation (Afl millions) thereof. Corporate Financing Manager – Interbank Aruba N.V., 1999- 2002. New loans development, supervision of an assigned credit-portfolio. Member of the Bank’s Credit Committee. Marketing and Public Relations Officer – Interbank Aruba N.V., 1996-1999 (planned interruption of 6 months in 1999 to complete MBA-degree) Marketing Manager – Europe and Latin American– Aruba Marriott Reso rt, 1995- 1996. Acting North-American Sales Manager – Aruba Sonesta Hotels, Miami, Flo rida, 1993. Academic Education: Master of Business Administration (MBA) in International Business Management. Degree obtained in 1999 from the European University in Europe (www.eu runi.edu). Master of Arts (M A) in Business Communication and Public Relations. Degree obtained in 1995 from the European University in Europe. Bachelor of Science in Hotel and Tourism Management. Degree obtained in 1993 from the Florida International University in Miami, Florida. NIBE Diploma’s (Dutch Institute for Banking): Rechtwijzer, Inleiding Bankbedrijf en Organisatie. Other interests: Golf (16 hdcp.). Studying Dutch-law. Member, past Treasurer of Aruba LIONS Club. Professional referenc es: Mr. Angel Bermudez, tax-attorney, Partner and managing director of Ernst and Young Aruba and Curacao, Board-Member GCA Aruba NV (angelb@cura.net). Mr. Richard S. Arends, Senior Advisor to the Minister of Finance and Prime Minister of Aruba. Mr. Oswaldo A. Armitano, Managing Directo r BBA-Bank Aruba NV. Mr. Hans Schnog, Owner-Managing Director Co rdia Aruba Group NV. More references availab le upon request. The right way to the future! For further information please contact the broker-office on Aruba: Mr. John Brinkhaus HCE – Advisor Real Estate,-Investment - Appraisal-Mortgage-Pension & Insurance. Office Aruba Facsimile Cell phone Skype name +31 850020555 +31 848328615 +297 7374809 john-brinkhaus info@caribbeanestate.nl www.caribbeanestate.nl