Kraft Foods Inc in Packaged Food

advertisement

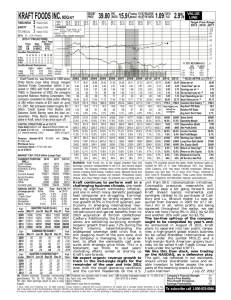

Kraft Foods Inc in Packaged Food - World April 2010 Downloaded from www.warc.com Scope of the Report Packaged Food: Kraft Foods Inc © Euromonitor International Scope • This profile on Kraft Foods Inc covers the company’s packaged food operations, focusing on its growth prospects for the 2009-2014 period. Disclaimer Much of the information in this briefing is of a statistical nature and, while every attempt has been made to ensure accuracy and reliability, Euromonitor International cannot be held responsible for omissions or errors Figures in tables and analyses are calculated from unrounded data and may not sum. Analyses found in the briefings may not totally reflect the companies’ opinions, reader discretion is advised Learn More To find out more about Euromonitor International's complete range of business intelligence on industries, countries and consumers please visit www.euromonitor.com or contact your local Euromonitor International office: London + 44 (0)20 7251 8024 Vilnius +370 5 243 1577 Chicago +1 312 922 1115 Dubai +971 4 372 4363 Singapore +65 6429 0590 Cape Town +27 21 552 0037 Shanghai +86 21 63726288 Santiago +56 2 915 7200 Downloaded from www.warc.com 2 Packaged Food: Kraft Foods Inc © Euromonitor International Strategic Evaluation Competitive Positioning Market Assessment Confectionery Opportunitites Bakery Products Opportunities Dairy Products Opportunities Brand Strategy Operations Recommendations Downloaded from www.warc.com 3 Strategic Evaluation Packaged Food: Kraft Foods Inc © Euromonitor International Key Company Facts Kraft Foods becomes the top global packaged food company Headquarters Illinois, USA • Kraft Foods has been the second largest packaged Regional Involvement Global food company in the world throughout the 2001-2008 Present in most period. The takeover of Cadbury gives Kraft the top Sector Involvement categories of the position in global packaged food, with a joint market packaged food market value share of 3.5%, based on 2008 market data. Global packaged food value share 2.5% (3.5% with (2008) Cadbury) • The company is active in a wide range of packaged Packaged food value growth: 3.1% CAGR 2001-2008 food categories, but its main focus is biscuits, (US$ - 2009 fixed exchange rate) (8.2% with Cadbury) chocolate confectionery and cream cheese. • Kraft Foods enjoys a global profile, but North America still accounted for 55% of its packaged food retail value sales in 2008. The Cadbury acquisition has resulted in a more balanced geographic presence between developed and developing markets, but still 77% of the joint entity’s food retail value are generated in North America and Western Europe. Kraft Foods benefits from new leadership • Growth has been driven by a mixture of organic and acquisition-led development, with Danone’s biscuits business and Cadbury its most recent purchase. • After the divestment of its North American frozen pizza business to Nestlé in January 2010, and with the completion of the Cadbury integration, Kraft begins a new chapter of operations with a focused, rationalised portfolio and restructured management. Kraft Foods Inc Downloaded from www.warc.com 4 Strategic Evaluation Packaged Food: Kraft Foods Inc © Euromonitor International Kraft Foods’s Diverse Packaged Food Operations Kraft’s Packaged Food Retail Value Sales Breakdown by Category Before and After the Cadbury Acquisition** Note: * Others include the following categories: Frozen processed food, Oils and fats, Spreads, Snack bars, Canned/preserved food, Meal replacement products, Pasta, Dairy products and Ice cream ** % figures based on 2008 market data Downloaded from www.warc.com 5 Strategic Evaluation Packaged Food: Kraft Foods Inc © Euromonitor International Financial Assessment Key Financial Indicators FY 2009 Net revenue (US$ mn) Operating income (US$ mn) Net earnings (US$ mn) Operating margin Net margin FY 2008 % growth 40,386 41,932 -3.7 5,524 3,843 43.7 3,028 2,893 4.7 13.7% 7.5% 9.2% 6.9% 49.2 8.7 Net revenue impacted by volume decline • The fall in 2009 net revenues was mainly driven by volume declines across all reportable segments, except US Beverages and US Convenient Meals, in part due to the discontinuation of less profitable product lines. • The unfavourable foreign currency exchange rate fluctuations against the US dollar also negatively impacted reported net revenues. Operating income largely improves • Strong contributors to the near 44% increase in operating income were Kraft Food Developing Markets and US Convenient Meals and the decrease in input costs, which was the result of lower raw material costs, although partially offset by higher manufacturing costs during 2009. With the completion of the Restructuring Programme in 2008, restructuring costs were also significantly reduced. Frozen Pizza Divestiture • In January 2010, Kraft sold its North American Frozen Pizza assets to Nestlé for US$3.7 billion, which includes the DiGiorno, Tombstone and Jack’s brands in the US and Delissio brand in Canada and the California Pizza Kitchen trademark licence. • The divestment of the North American frozen pizza division was made on the basis of the narrow geographic reach of the business and Kraft did not have the infrastructural synergies to expand it to international markets. However, during the recent recessionary quarters, the division had benefited from the strengthening consumer trends of trading down from fresh/chilled to frozen items and from dining out to eating in. However, Nestlé’s offer in cash for the division was judged to be good value and was accepted as Kraft needed to raise its bid to succeed in acquiring Cadbury. Acquisition of Cadbury • Kraft’s 5-month long takeover battle for Cadbury ended with an improved price offer, valuing the company at around £11.9 billion (US$19.4 billion), offering 840 pence a share, including 500 pence in cash and the rest in stock. Outlook 2010 • In the short term, Kraft expects to deliver organic net revenue growth of 4% (which was 1.5% in 2009) and 79% long-term EPS growth. Downloaded from www.warc.com 6 Strategic Evaluation Packaged Food: Kraft Foods Inc © Euromonitor International SWOT – Kraft Foods Strong brand portfolio Comprehensive category coverage Low level of innovation • Kraft Foods has an • Kraft Foods has a diverse • An under investment in impressive brand portfolio. Labels such as Oreo, Milka and Philadelphia and now Cadbury enjoy a high-profile presence in core markets and are amongst the so-called ‘billion dollar’ brands. The company also has strong local brands. Stronger emerging markets presence product portfolio, spread across a range of packaged food categories and geographical markets, which acts as a cushion against the contraction of one particular category or region. • Alongside all other innovation has held back Kraft Foods in recent years, allowing it to fall behind rivals and placing it under harder competitive pressures, in particular from private label in selected categories. Strengths Weaknesses Opportunities Threats Further expansion in impulse channels • Asia Pacific, Latin America • Kraft Foods is well and Eastern Europe all hold growth opportunities for Kraft Foods, especially with the strengthened growth platforms the Cadbury acquisition brings, in markets such as India. Core operations in lowhealth profile categories positioned to benefit from the growth of a snacking culture as increasingly busier consumer lifestyles drive the expansion of the impulse retail market. It has the brand equity and setup to exploit this trend. Cool economic market environment packaged food manufacturers, Kraft also made strong health and wellness pledges. However, the company is highly associated with its operations in categories such as confectionery and biscuits and cream cheese which does not afford a particularly high healthy image. Rising input costs • The post-recessionary • Although Kraft's large outlook for Kraft Foods‘s core developed markets is poor as maturity and waning consumer spending power are set to limit growth. The pressure on margins is set to increase. scale of operations has beneficial effects on its production costs it does not make the company immune from the impacts of fluctuating raw material and commodity prices. Downloaded from www.warc.com 7 Strategic Evaluation Packaged Food: Kraft Foods Inc © Euromonitor International Key Strategic Objectives and Challenges Forming optimal operational synergies with Cadbury Focus on core categories • With the purchase of Danone’s biscuits business and • Kraft Foods is shifting its focus to newly defined core Cadbury, Kraft’s ongoing acquisition strategy illustrates its objective of establishing strong growth platforms in categories where it can benefit from operational synergies and large economies of scale. The company’s objective is to unify the enlarged Kraft/Cadbury entity under the umbrella of Kraft's existing operational framework. Kraft has announced that from six months of completing the acquisition, it would have formalised all decisions regarding a new executive team and the efforts to combine the manufacturing network. categories of confectionery, snacks and impulse food. It has made large-scale acquisitions, such as Danone’s biscuits business and Cadbury, and has also divested non-core operations including Post cereals and the North American frozen pizza business. However, Kraft Foods needs to further rationalise its portfolio, especially by cutting low-margin, under-performing lines. Further cuts in terms of strategically ill-fitting brands, for example, segments resistant to global expansion, are both necessary and likely to occur in the short term. Expansion in emerging markets Investing in product quality, marketing and innovations • With the recent acquisition of Cadbury, Kraft Foods has •One of the strategic pillars of Kraft Foods is to further greatly expanded its reach in emerging markets, although it is still highly dependent on developed markets, particularly North America. With the bleak forecast for this region and Western Europe, it is imperative that the company expands its international infrastructure, especially in the development of its cheese and biscuits operations, which are more reliant on North America than the confectionery business. With the Cadbury takeover it has both newly established and strengthened growth platforms from which to further expand in makets like India and Latin America. improve quality, marketing and innovations across all food categories. The company announced it was launching around 20 food products in the first few months of 2010, along with a number of portion-controlled options, which include products such as Planters Flavour Grove Nuts, while better-for-you Planters NUT-rition line will now include an Antioxidant Mix and Omega-3 Mix. •Intense innovation in tune with reigning food trends and adequate communication of the added-value, health benefits will be the key to success in Kraft’s portfolio improvement. Downloaded from www.warc.com 8 Packaged Food: Kraft Foods Inc © Euromonitor International Strategic Evaluation Competitive Positioning Market Assessment Confectionery Opportunitites Bakery Products Opportunities Dairy Products Opportunities Brand Strategy Operations Recommendations Downloaded from www.warc.com 9 Competitive Positioning Packaged Food: Kraft Foods Inc © Euromonitor International Kraft Foods Improving Performance Fuelled by Acquisitions C A B Note: * Kraft’s and Cadbury’s joint performance back-trended to 2008 data A Kraft Foods fails to keep pace B Kraft’s negative performance is with the market as its mass-market strongly impacted by the divestment positioning is not best suited to a of its sugar confectionery business, strong trend for premiumisation. A which included the popular Altoids reluctance to innovate compounds and Life Savers brands, to Wrigley. its problems. C With two global-scale acquisitions, Danone’s biscuit and cereal division and its most recent target, Cadbury, Kraft’s performance is well above the global packaged food market. Downloaded from www.warc.com 10 Competitive Positioning Packaged Food: Kraft Foods Inc © Euromonitor International Packaged Food Competitive Landscape Packaged Food - Top 10 Global Companies Company 2004 2005 2006 2007 2008 Kraft/ Cadbury Nestlé SA 2008 % *3.5 1 1 1 1 1 3.2 2 2 2 2 2 2.5 3 3 3 3 3 2.0 PepsiCo Inc 4 4 4 4 4 1.8 Mars Inc 6 6 6 7 5 1.5 Danone, Groupe 5 5 5 5 6 1.3 Cadbury Plc - - - - 7 1.0 Kellogg Co 8 8 8 8 8 0.8 9 9 9 9 9 0.6 23 22 10 10 10 0.6 Kraft Foods Inc Unilever Group General Mills Inc Lactalis, Groupe Note: a Provisional market value share; acquisition is expected to be completed by mid-2010 Kraft takes top position in global packaged food • There was no movement in the top four positions of the global packaged food rankings over the 20042008 period. Nestlé maintained its position atop of the fragmented market; however, Kraft’s takeover of Cadbury will relegate Nestlé to second position. • After a long-standing status quo at the top of the global packaged food market, Kraft’s acquisition of Cadbury will have an impact on the overall packaged food competitive landscape. As well as taking the leading position in the market, the gap between the top two players and the rest of the market will widen, which is likely to prompt the mid-weight companies into action, such as collaboration on a global/regional level or further large-scale acquisitions, depending on financial capabilities. Further potential market movements • Currently mid-weight, financially capable players are likely to have to make large-scale, strategic acquisitions in order to avoid marginalisation in the consolidating market. • Although Unilever, Mars and Danone have made large financial commitments in recent years, with the purchase of Sara Lee’s personal care unit, Wrigley and Royal Numico, respectively, further high-value acquisitions will likely remain on the agenda. For example, Danone has been linked to American dairy giant, Dean Foods. Downloaded from www.warc.com 11 Competitive Positioning Packaged Food: Kraft Foods Inc © Euromonitor International Intense Acquisition Policy Accelerates Global Growth • Over the 2001-2008 period, Nestlé has maintained the leading position in global packaged food and increased its market share by 30 basis points, to 3.2%. Company growth was driven by both organic development and large-scale acquisitions, such as Gerber, Novartis’s baby food arm. While Kraft and Unilever have remained second and third largest packaged food players, they saw their global market value shares decrease by 30 and 60 basis points, respectively, over the same period. Although the Cadbury acquisition will give Kraft the top position in global packaged food, it will need to accelerate growth further in order to maintain that status in the long term. • Outstanding growth driven by acquisitions • Amongst the top packaged food players, Lactalis, Mars and Cadbury posted the best growth rates over the 20012008 period, which was predominantly the result of aggressive acquisition policies. • Cadbury has focused on expanding in high-margin categories, such as premium chocolate (acquisition of Green & Black’s, 2005) and medicated confectionery (Halls, 2002). Meanwhile, Lactalis concentrated on geographic market expansion and turned its attention towards Eastern Europe, where its core category, dairy products, is expected grow at the second fastest rate in the world, at a CAGR of 3%, over the 2009-2014 period. Downloaded from www.warc.com 12 Competitive Positioning Packaged Food: Kraft Foods Inc © Euromonitor International Still Highly Fragmented Global Packaged Food Market Even global-scale acquisitions drive slow consolidation in the vast packaged food market • Despite the recent large-scale mergers and acquisitions in many packaged food categories (e.g. Danone–Royal Numico, Nestlé–Gerber in baby food, Mars-Wrigley and Kraft-Cadbury in confectionery), the overall market remains highly fragmented, with the top 10 companies’ total value share only fractionally growing over the 2001-2008 period, by one percentage point, to 15.8%, taking the Kraft/Cadbury merger into account and back-trending it to 2008 as one entity. • Given the large size of the global packaged food market, worth an estimated US$1.9 trillion in 2009, a gain of just one percentage point in value share would require a staggering US$18.5 billion increase in global sales. Private label expected to remain strong in current climate • Private label, in developed markets especially, poses significant levels of competition to most branded products manufacturers, and this is set to intensify due to the negative impact of the current recessionary economic environment on consumers’ price-sensitivity. As a result, steeper growth in private label’s value share can be expected in the short to medium term. Downloaded from www.warc.com 13 Packaged Food: Kraft Foods Inc © Euromonitor International Strategic Evaluation Competitive Positioning Market Assessment Confectionery Opportunitites Bakery Products Opportunities Dairy Products Opportunities Brand Strategy Operations Recommendations Downloaded from www.warc.com 14 Market Assessment Packaged Food: Kraft Foods Inc © Euromonitor International Increased Exposure to Emerging Markets • Kraft Foods‘s core market is North America, but the region is predicted to post low growth over the 2009-2014 period, making emerging market expansion imperative. A similarly downbeat outlook in Western Europe underlines the importance of the company expanding its presence in more dynamically growing emerging regions. The acquisition of Cadbury gives a strong boost to Kraft especially in Latin America and Middle East and Africa. • The developing world is set to drive packaged food growth in the short term. Latin America is expected to lead the fastest growth rankings and Kraft Foods combined with Cadbury is well placed, ranking third, to tap into this potential. The company is similarly positioned to exploit above average growth in Eastern Europe. • The outlook for Asia Pacific is bright and given the size of the market further expansion is worth pursuing. The joint Kraft/Cadbury entity held a value share of just over 1% in 2008, to still rank outside the top five packaged food companies in the region. • Prospects also exist in Middle East and Africa, which is also expected to set the pace in terms of growth, although the market is currently small. Kraft‘s presence was relatively minor before the Cadbury acquisition, but with the integration of Cadbury it becomes the third largest packaged food player in the region. Downloaded from www.warc.com 15 Market Assessment Packaged Food: Kraft Foods Inc © Euromonitor International Building Strong Positions in Core Categories • Kraft Foods has a diverse packaged food portfolio, covering a wide range of product categories. Its core interests are bakery products, dairy products and – after the integration of Cadbury - confectionery, which together contributed a combined 75% of packaged food revenue in 2008, worth US$46.2 billion in retail value terms. • Kraft’s most recent acquisitions into bakery products (Danone biscuits division) and confectionery (Cadbury), shows the company’s focus areas and where it concentrates resources and benefits most from economies of scale and operational synergies. As a result of these global-scale acquisitions Kraft became the leading global player in both categories, with retail value shares of 3% and 15%, respectively, in 2008. • The company has the brand equity to further tap into the potential of dairy products. Opportunity lies in further expansion of its cross-category brand expansion, coupled with wellbeing and functional-led product development. This strategy could also be used to exploit growth in dried processed food, sweet and savoury snack and snack bars. Opportunity Zone Downloaded from www.warc.com 16 Packaged Food: Kraft Foods Inc © Euromonitor International Strategic Evaluation Competitive Positioning Market Assessment Confectionery Opportunitites Bakery Products Opportunities Dairy Products Opportunities Brand Strategy Operations Recommendations Downloaded from www.warc.com 17 Confectionery Opportunities Packaged Food: Kraft Foods Inc © Euromonitor International Competitive Confectionery Landscape Confectionery – Top 10 Global Companies 2004 2005 2006 2007 2008 2008% share Kraft/Cadbury - - - - - *15.0 Mars Inc 2 2 2 2 1 14.8 Cadbury Plc - - - - 2 10.4 Nestlé SA 3 3 3 3 3 7.7 Hershey Co, The 4 5 5 5 4 4.9 Kraft Foods Inc 5 7 7 6 5 4.6 Ferrero Group 7 6 6 7 6 4.4 Perfetti Van Melle Group 8 8 8 8 7 2.9 Chocoladefabriken Lindt & Sprüngli AG 9 9 9 9 8 2.0 Lotte Group 10 10 10 10 9 1.6 Storck KG, August 11 11 11 11 10 1.4 Company Note: *Provisional market value share; acquisition is expected to be completed by mid-2010 Downloaded from www.warc.com 18 Confectionery Opportunitie Packaged Food: Kraft Foods Inc © Euromonitor International Intensifying Competition in Confectionery Kraft/Cadbury rise to the top • After the significant Mars/Wrigley merger in 2008, the global confectionery market has seen further consolidation with Kraft’s takeover of Cadbury. Based on 2008 market share data, the integrated Kraft/Cadbury confectionery entity would take top position in the global confectionery market. Mars’s short-lived top confectionery position • Before the acquisition of Wrigley, Mars saw its share of global confectionery decline over the years as a result of a heavy reliance on the sluggish US market, a mass-market orientated portfolio in a climate of premiumisation and the lack of a significant presence in the growing gum category. • As a result of the acquisition, Mars regained the leading position in global confectionery, immediately bolstered its geographic scope and gained a very strong position in gum. However, as the result of further industry consolidation it is likely to slip back to second position in the global market. Nestlé’s becomes a more distant third player • Nestlé became a more distant third player in global confectionery, which could prompt the company into a defensive move of increasing the size and scale of its confectionery operations on a global level. • In recent years, Nestlé has continued to focus on the premium confectionery segments. It has launched several dark and super-premium chocolate ranges, designed by Pierre Marcolini, which are sold exclusively in Nespresso boutiques to further emphasise the premium essence of the products. Downloaded from www.warc.com 19 Confectionery Opportunitie Packaged Food: Kraft Foods Inc © Euromonitor International Acquisition-Driven Growth Boosts Confectioners’ Performance 25 25,000 20,000 US$ mn rsp % CAGR 2001-2008 20 15,000 15 10,000 10 5,000 5 0 0 % CAGR 2001-2008 Retail Value Sales 2008 (US$ mn rsp) Top 10 Global Confectionery Players' Performance - 2001-2008 Note: * Shows combined 2008 Kraft/Cadbruy confectionery revenues and % CAGR. Note: * **%* CAGR 2001-2008 of Cadbury Plc is calculated as the confectionery performance of Cadbury of Schweppes 2001-2007for and2001-2007 Cadbury Plc for % CAGR 2001-2008 of Cadbury Plc is calculated as the confectionery performance Cadbury for Schweppes 2008 and Cadbury Plc for 2008 • Companies posting a CAGR approaching or • Growth of companies with less intense exceeding 10% are all the results of intense acquisition policies, with the exception of Lindt & Sprüngli. • Cadbury has integrated various operations it has acquired since 2002, such as Novartis’s medicated confectionery division, Green & Black’s and Intergum. Meanwhile, Mars has integrated the global operations of Wrigley. • The other driving force in confectionery was the premiumisation trend. Both Lindt & Sprüngli’s and Ferrero’s premium-minded portfolios have been benefiting from the trend in recent years. acquisition activities and slow expansion in emerging geographic markets fell behind over the 2001-2008 period. • Kraft Foods has refocused its attention on confectionery with its takeover of Cadbury. The acquisition elevates Kraft’s growth to the highest rate amongst the top 10 confectioners. • Hershey and Ferrero also expressed interest in Cadbury, with the same objective of instant international expansion and growth acceleration; however, they ultimately did not contest Kraft’s offer for Cadbury. Downloaded from www.warc.com 20 Confectionery Opportunitie Packaged Food: Kraft Foods Inc © Euromonitor International Cadbury Widens Kraft’s Geographic Reach • The acquisition of Cadbury gave Kraft’s confectionery operations a better balanced geographic mix between developed and developing markets, although the combined share of North American and Western European retail value sales remained at 55%. However, its exposure has increased in North America and decreased in Western Europe. Competition in both developed regions is fierce from well-established, domestic confectionery conglomerates, such as Mars/Wrigley and Hershey in North America, and Nestlé and Ferrero in Western Europe. • Kraft’s Asia Pacific confectionery revenues in 2008 were just over US$100 million, but with the integration of Cadbury it is expected to exceed US$1.4 billion. However, over 50% of this retail value is generated in just two national markets: Japan and India. China, the region’s most attractive confectionery market, accounts for around 8% of the joint entity’s confectionery revenues. Although China is forecast to grow at a more modest rate than India, at a CAGR of 4% over the 2009-2014 period, in absolute value terms it will account for over 50% of Asia Pacific confectionery market growth over the same period. The next step in Kraft’s strategy should be to focus on strengthening its position in the Chinese market, potentially with further acquisitions/partnerships to gain a larger slice of this dynamic market. Kraft's Confectionery Market Presence by % CAGR 2009-2014 Region and Growth Opportunities 2009-2014 3.5 3 2.5 2 1.5 1 0.5 0 -0.5 Middle East and Africa Eastern Europe Opportunity Zone Asia Pacific Western Europe Latin America Australasia 0 North America 20,000 Market size 2008 (US$ mn rsp) 40,000 60,000 Solid bubbles show Kraft's regional confectionery market share before the acquisition of Cadbury , same colour empty bubble indicates joint regional confectionery market share , range displayed: 0.4-32.4% Downloaded from www.warc.com 21 Confectionery Opportunitie Packaged Food: Kraft Foods Inc © Euromonitor International Balanced Confectionery Portfolio • Kraft Foods‘s indigenous confectionery portfolio was composed almost entirely of chocolate confectionery, which accounted for about 98% of its confectionery revenues. Tablets were its main revenue source (over 50% of sales in 2008), with countlines and boxed assortments its secondary streams. Its portfolio was led by Milka, Toblerone, Terry’s and Côte d’Or, giving it an upscale, mass-market position. • The acquisition of Cadbury has balanced out the portfolio to 57%, 16% and 27% across chocolate, sugar confectionery and gum, respectively. Chocolate confectionery generates the highest proportion of confectionery revenues, very much in line with the global market, where chocolate accounts for some 55% of overall confectionery retail value sales. • Kraft’s most relevant category enhancements were in gum and sugar confectionery. The newly acquired Cadbury gum operations account for nearly 29% global market value share, and the portfolio contains the world’s largest gum label, Trident. The category is also expected to post the most dynamic growth rates within confectionery as it is benefiting from oral health trends. Although overall global sugar confectionery is expected to grow moderately, Cadbury’s good position in the functionally enhanced, higher margin medicated confectionery segments gives Kraft a strong competitive edge in the category. Kraft's Confectionery Market Presence by Category and Growth Opportunities 2009-2014 % CAGR 2009-2014 2.5 2.0 Gum Chocolate confectionery Opportunity Zone 1.5 1.0 0.5 Sugar confectionery 0.0 0 20,000 40,000 60,000 Market size 2008 (US$ mn rsp) 80,000 100,000 Solid bubbles show Kraft's confectionery market share by category before the acquisition of Cadbury , red outline indicates joint regional confectionery market share , range displayed: 0.1-28.7% Downloaded from www.warc.com 22 Packaged Food: Kraft Foods Inc © Euromonitor International Strategic Evaluation Competitive Positioning Market Assessment Confectionery Opportunitites Bakery Products Opportunities Dairy Products Opportunities Brand Strategy Operations Recommendations Downloaded from www.warc.com 23 Bakery Products Opportunities Packaged Food: Kraft Foods Inc © Euromonitor International Emerging Markets Offer Best Opportunities in Biscuits • Following the acquisition of Danone’s biscuits business, bakery products – with biscuits accounting for about 95% of retail value sales in the category - became Kraft Foods‘s largest packaged food category (until the integration of Cadbury is fully completed by mid-2010, which will then make confectionery Kraft’s largest food operation), accounting for around 27% of revenue in 2008. • Kraft Foods‘s domestic North American market offers rather limited potential in biscuits, with sales set to be affected by a continued rise in consumer health awareness, and a resultant trend towards healthier snacks, and market maturity, with fierce competition a major factor. The category is expected to perform little better in Western Europe, although the overall size of the market still makes it attractive. • Emerging markets are set to drive biscuits growth, with Asia Pacific and Latin America topping the fastest-growth rankings. The size of the Asia Pacific market suggests the prospect of greater return on investment in comparison with others, although the company has the standing across the board to exploit growth. Downloaded from www.warc.com 24 Bakery Products Opportunities Packaged Food: Kraft Foods Inc © Euromonitor International Plain & Savoury Biscuits Potential for Kraft Foods • The sale of the Post cereals business in 2008 has placed even greater emphasis on biscuits at Kraft Foods. Sweet biscuits represents almost two thirds of Kraft Foods‘s biscuit sales, with plain biscuits and sandwich biscuits the main focus, both generating around 30% of sales. Taken together, cookies and chocolate coated biscuits further contribute more than 25%. • Plain biscuits holds the most potential for Kraft Foods, with a strong market presence in the category in all regions, led by its Nabisco and LU labels. Cookies is also in the opportunity zone; although a smaller market, the company is still well placed with its Chip Ahoy! brand and has the resources to exploit the potential. Filled biscuits also offers opportunities, although less so than plain biscuits and cookies, with return on investment likely to be lower. • Kraft leads the global savoury biscuits and crackers category, with a 24% value share in 2008, well positioned to benefit from the positive growth forecast for the category. Five out of the top 10 global savoury biscuits and crackers brands are owned by Kraft, with Ritz and Nabisco occupying the top two positions. Downloaded from www.warc.com 25 Bakery Products Opportunities Packaged Food: Kraft Foods Inc © Euromonitor International Kraft Foods Consolidates its Top Spot in Biscuits Kraft Foods leads global biscuits • Kraft Foods is a long-term fixture atop global biscuits, with its acquisition of Danone’s biscuits business in 2007 and of a smaller number of assets from United Biscuits in 2006, consolidating an already strong global position. • While benefiting from Danone’s exit in terms of ranking, Kellogg has lost share steadily in biscuits, as a result of a stronger focus on snack bars and cereals and an overexposure to developed markets. • Campbell Soup has benefited from an ability to tap into key premium and wellbeing trends as well as United Biscuits’s decision to divest a number of brands in 2006. • The acquisition of Kamps and Harry helped increase Barilla’s market share over the 2003-2006 period, although an over-reliance on Western Europe has caused its market value share to stagnate at almost 2% since 2003. Emerging market players enjoy rapid rise • Argentina-based Arcor has made the most dramatic ascent within the global rankings, rising from outside the top 30 to eighth position in 2007. Forward momentum has been fuelled by a mixture of organic and acquisition-led expansion, largely within Latin America, including deals with Wal-Mart and Danone. • M Dias Branco is another emerging world player which rose quickly up the rankings, with the company in its current form spinning off from its parent in 2005. The Brazil-based manufacturer has benefited from rising consumer spending power in the region. Biscuits - Top 10 Global Companies, 2004-2008 Company Kraft Foods Inc Kellogg Co Campbell Soup Co United Biscuits (Holdings) Plc Nestlé SA Barilla Holding SpA M Dias Branco SA Comércio e Indústria Arcor SAIC PepsiCo Inc Ezaki Glico Co Ltd 2004 1 3 5 4 6 7 2005 1 3 5 4 6 7 36 10 11 10 11 13 2006 1 3 4 5 6 7 13 10 9 12 2007 1 2 3 4 5 6 13 7 8 10 2008 1 2 3 4 5 6 7 8 9 10 2008 % share 18.7 4.5 3.1 2.9 2.3 1.8 1.6 1.5 1.3 1.2 Downloaded from www.warc.com 26 Bakery Products Opportunities Packaged Food: Kraft Foods Inc © Euromonitor International Strong Presence in the US but Outlook Poor Long-standing leadership position in US biscuits • The US is Kraft Foods‘s largest biscuits market, accounting for 39% of its category sales in 2008, worth about US$4.4 billion. Sweet biscuits is the larger revenue source, at around 61% of total biscuits retail value sales in the US. • Kraft Foods leads biscuits in the US, a position it has held for some time, with a 41% value share in 2008. It is some way ahead of major rival Kellogg (23%). • The US biscuits market showed little growth of late, with sales hit by a strong trend for healthier snacking, market maturity and waning consumer spending power. Growth initiatives in the category • Sweet biscuits has been affected particularly badly as a result of the widespread perception of these products as unhealthy. Savoury biscuits and crackers showed a little more life, thanks largely to a stronger compatibility with wellbeing-led product innovation. • Kraft Foods has looked to tap into this trend, with the launch of Golden Harvest Toasted Chips, containing half a portion of daily fruit. Nevertheless, its share fell in 2008 highlighting a relative dearth of activity in this area and the cannibalistic impact of offering such a wide range of brands: Oreo, Nabisco and Chips Ahoy! head up a considerable portfolio. The outlook for the US biscuits market is poor, with sweet biscuits set to be almost static and savoury biscuits and crackers faring not much better. A continuing trend for healthier eating and poor economic conditions are key factors in the downbeat forecast. Kraft Foods would do well to rationalise its brand portfolio. In conjunction with this move, a greater focus on wellbeing-led innovation would be valuable, concentrating resources on flagship brands. The company would also be well served by expanding its upmarket offering, although it will have to tread carefully in terms of its pricing policy as consumer spending power is likely to remain depressed. Downloaded from www.warc.com 27 Bakery Products Opportunities Packaged Food: Kraft Foods Inc © Euromonitor International Kraft’s US Biscuit Presence by Category Downloaded from www.warc.com 28 Bakery Products Opportunities Packaged Food: Kraft Foods Inc © Euromonitor International Kraft's Asia Pacific Biscuits Retail Value Sales by Core Markets and Growth Prospects - 2009-2014 800 8.0 600 6.0 400 4.0 200 2.0 0 0.0 US$ mn rsp % CAGR 2009-2014 Strong leading position in Asia Pacific biscuits • The acquisition of Danone’s biscuits business has markedly strengthened Kraft Foods‘s position in biscuits in Asia Pacific, which became its largest emerging market (about 10% of biscuits sales in 2008). • The buyout has reinforced Kraft Foods‘s number one position, ahead of troubled Lotte and Ezaki Glico, which have both been steadily losing share. Notably, it has diluted its exposure to the downbeat Japanese market, where the company has been struggling. Further expansion in SEA markets • China is Kraft Foods‘s largest market (47% of sales in 2008). Its acquisition activity has reinvigorated its waning presence atop of the marketplace. • Kraft Foods also moved to the top of the Indonesian and Malaysian biscuits markets, overtaking a group of local and regional producers in both countries. • The purchase also changed Kraft Foods‘s dynamics in its core sweet biscuits, with plain biscuits overtaking sandwich biscuits to become the chief revenue stream. Driving trends • Emerging markets are driving growth in Asia Pacific biscuits, with increased spending power, greater urbanisation and a growing trend for Western products all contributing to rising demand. Sweet and savoury biscuits have both been performing well. Kraft's retail value sales 2008 (US$ mn rsp) A Stronger Force in Vibrant Asia Pacific Biscuits % CARGR 2009-2014 The outlook for biscuits in Asia Pacific is bright, with the growth of a snacking culture, underpinned by rising consumer spending power, set to drive forward momentum. Emerging markets are set to fuel growth and Kraft Foods is well positioned to tap into this potential with strong positions in China and Indonesia. Outside of these core markets, the company would do well to target India and Vietnam, which are also expected to perform robustly in the short term. In terms of product offer, some rationalisation is required to help the company avoid cannibalisation, while flavour-led development, with a particular nod to chocolate and milk flavours, is set to be a key innovation trend and one the company should look to exploit. Downloaded from www.warc.com 29 Packaged Food: Kraft Foods Inc © Euromonitor International Strategic Evaluation Competitive Positioning Market Assessment Confectionery Opportunitites Bakery Products Opportunities Dairy Products Opportunities Brand Strategy Operations Recommendations Downloaded from www.warc.com 30 Dairy Products Opportunities Packaged Food: Kraft Foods Inc © Euromonitor International Emerging Regions Offer Dynamic Growth, Off Smaller Base • Kraft Foods‘s presence in dairy products is focused very strongly in cheese (nearly 90% of revenue, worth US$9.2 billion in 2008). The company is the global leader in cheese and its sizeable portfolio is led by the Kraft and Philadelphia labels. It has a strong bias towards the developed world, with North America alone representing nearly three quarters of its revenue, and Western Europe and Australasia bringing this figure up to 90% of revenue. • Emerging markets offer dynamic growth in cheese, although off smaller bases, with Latin America set to lead the way by some distance. The combination of this outlook and the relatively good size of the market makes this an opportunity worth pursuing. The same can be said of Eastern Europe, while the smaller size of Asia Pacific and Middle East and Africa make them less of a priority. • The forecasts for North America and Western Europe are very modest, with market maturity, fierce competition and declining consumer confidence key factors. However, the size of the markets, in particular the latter, make development worth pursuing nevertheless. Downloaded from www.warc.com 31 Dairy Products Opportunities Packaged Food: Kraft Foods Inc © Euromonitor International Kraft Remains in Top Position but its Market Share Shrinks 2004 2005 2006 2007 2008 Cheese – Top 10 Global Companies, 2004-2008 2008 % share 1 1 1 1 1 8.5 2 2 2 2 2 5.9 Bongrain SA 3 3 3 3 3 3.0 Bel, Groupe 4 4 4 4 4 2.5 Arla Foods Amba 5 5 5 5 5 2.0 Saputo Inc 7 7 6 6 6 1.1 Hochland AG 8 8 7 7 7 1.1 Valio Oy 9 9 9 8 8 0.9 13 10 8 9 9 0.8 - - - - 10 0.8 Company Kraft Foods Inc Lactalis, Groupe Parmalat Group Royal FrieslandCampina NV Kraft’s cheese strategy misses key driving trends • The top five players of the highly-fragmented global cheese market were unchanged over the 2004-2008 period, with Kraft Foods leading the field throughout. • The US company, however, lost share steadily throughout the period as its largely mass-market processed offer was ill-suited to a strong trend for premium, unprocessed products. Acquisition and product development drives growth of French players • Second-placed French manufacturer Lactalis closed the gap on Kraft Foods significantly. It benefited from a considerable amount of acquisition activity, although overexposure to the very competitive Western European market slightly reversed its progress in 2008. • Bongrain, another French company, benefited from the trend towards premium cheeses, developing its ranges, including Coeur de Lion. • Fourth-placed Bel Groupe, yet another French player, performed more modestly, although the acquisition of the Boursin label from Unilever in 2007 helped it gain share. • Arla enjoyed steady growth, with it benefiting from a trend towards gourmet cheeses in Western Europe. Meanwhile, Saputo benefited from the trend towards premium cheese in North America, nearly doubling its global dairy products sales between 2001 and 2008. Downloaded from www.warc.com 32 Dairy Products Opportunities Packaged Food: Kraft Foods Inc © Euromonitor International Kraft's US Chese Retail Value Sales by Category and Growth Prospects 2009-2014 2.5 3,100 3,050 2 3,000 2,950 1.5 2,900 1 2,850 2,800 % CAGR 2009-2014 Core activities in processed cheese • Kraft Foods‘s cheese presence is based primarily in processed cheese, which accounts for nearly two thirds of its cheese revenue. • Processed cheese is split nearly evenly between spreadable and unspreadable processed cheese. • Kraft Foods is the global number one in processed cheese and its portfolio is headed by the Philadelphia, Kraft and Kraft Singles brands. • The company is also ranked second in unprocessed cheese in the world, including top spot in hard cheese. • By far Kraft Foods‘s largest cheese market is the US, which grew sharply in recent years as manufacturers have passed on increases in milk prices to customers and as gourmet cheese became more popular. As a result, unprocessed cheese has been much the stronger segment. • Processed cheese-focused Kraft Foods dominates the market but has lost share in recent years, partly due to its inability to tap meaningfully into the demand for premium cheese, and despite efforts to tap into wellbeing trends. However, its huge marketing spend has protected it to some extent from market forces and the further encroachment of its most immediate rivals. Kraft's retail value sales 2008 (US$ mn rsp) Kraft Foods the Wrong Side of Key Trend in US Cheese 0.5 2,750 2,700 0 Processed cheese US$ mn rsp Unprocessed cheese % CAGR 2009-2014 Kraft Foods would do well to consider further shifting its cheese portfolio to unprocessed cheese if it is going to reinvigorate its market presence in the short term. Unprocessed cheese is set to drive market growth as consumers continue to favour gourmet and premium-minded products. Some rationalisation would also benefit the company, which has a heavyweight portfolio. Within processed cheese, further focus on wellbeingled innovation would be wise. Downloaded from www.warc.com 33 Packaged Food: Kraft Foods Inc © Euromonitor International Strategic Evaluation Competitive Positioning Market Assessment Confectionery Opportunitites Bakery Products Opportunities Dairy Products Opportunities Brand Strategy Operations Recommendations Downloaded from www.warc.com 34 Brand Strategy Packaged Food: Kraft Foods Inc © Euromonitor International Strategy Focused on Cross-Sector and Value Innovations • Kraft Foods has a huge portfolio covering a wide range of categories. However, it has laid out a growth strategy that focuses on biscuits, chocolate confectionery and cream cheese. Moreover, via global acquisitions in both biscuits and confectionery, Kraft Foods has increased its scale of operations in two of its main focus categories. The company is concentrating on two core brand strategies within its largely mass-market product portfolio. • Kraft Foods has increased its focus on cross-sector expansion as it has exploited the equity of its core labels. It is extending key categories such as cheese and processed meats into larger, faster-growing ready meals and snacking alternatives in line with growing consumer trends. For example, it is marketing products such as its Kraft Natural Chunks to more efficiently target the fast-growing snacks category. • Kraft Foods is stepping up its investment in innovation, an area which it has been accused of neglecting in the past. A major goal is to improve its time to market speed. Breaking down this strategy, it has increased its focus on wellbeing. Kraft announced that it has more premium kinds of offering in its pipeline, but chose to just hold these in abeyance while the economy shows sings of recovery. In the short term, the focus is on innovations of snacking, health and wellness products and continued focus on value. Downloaded from www.warc.com 35 Brand Strategy Packaged Food: Kraft Foods Inc © Euromonitor International Philadelphia Global Number One Processed Cheese Label Philadelphia retains its top processed cheese position • Philadelphia is the number one global processed cheese brand and the number two overall cheese label, behind stable-mate Kraft. This status gives it a top 10 ranking in dairy products (8th in 2008) and a 30th position in overall packaged food. Sluggish recent performance • Philadelphia’s performance of late has been underwhelming, losing share at the top of processed cheese, although not position in this category or overall cheese. It has, however, slipped down the global dairy products and packaged food rankings. • Three key factors lie behind the malaise. Firstly, the brand, like processed cheese on the whole, has been ill-suited to the trend for gourmet cheese. Secondly, it has suffered from a degree of cannibalisation, with four Kraft Foods brands in the global processed cheese top five. Lastly, the brand is overexposed to weakening developed markets, in particular North America. • However, the brand’s performance has not been disastrous, benefiting from heavyweight marketing, and to a lesser extent, prices rises, driven by an increase in milk costs. Downloaded from www.warc.com 36 Brand Strategy Packaged Food: Kraft Foods Inc © Euromonitor International Milka, Kraft’s Largest Confectionery Label Milka maintains its third place in global chocolate confectionery • Milka is Kraft Foods‘s leading confectionery brand, ranked third in global chocolate confectionery with a value share of nearly 3%. • Milka’s ranking is underpinned by leading positions in Western Europe and Eastern Europe, with Germany by far its leading market, contributing around 40% of revenue. • Milka’s performance in recent years has been steady, just outpacing the global chocolate confectionery market over the 2001-2008 period. Better performance in emerging markets • Emerging market gains have been the key growth driver, with the brand performing well in Eastern Europe and Latin America. It has also benefited from heavyweight marketing. • However, historically, Milka has been notably outpaced by more upmarket rivals, with its mass-market standing restricting its growth opportunities, in particular in key markets. Tellingly, it under-performed the Western European market between 2001 and 2008 despite upmarket innovations, such as the launch of a caramel-flavoured line. Downloaded from www.warc.com 37 Brand Strategy Packaged Food: Kraft Foods Inc © Euromonitor International Cadbury's Dairy Milk, New Asset to Kraft’s Portfolio Cadbury Dairy Milk Brand Retail Value Sales Performance - 2004-2008 12 1,600 1,400 1,200 1,000 800 600 400 200 0 10 8 6 4 % y-o-y growth confectionery brand is Cadbury's Dairy Milk. The brand’s sales are strongly focused on tablets, which accounted for 95% of the brand’s total confectionery value sales in 2008. Strong growth • Cadbury's Dairy Milk’s confectionery value sales increased by over 4% in 2008 year-on-year. • Ongoing expansion in emerging markets also played an important part in growing sales, particularly in Asia Pacific and the Middle East and Africa. • In the UK, Cadbury launched Dairy Milk as a fairtrade certified product, and the deal with the Fairtrade Foundation in mid-2009 represented the first mass-market chocolate brand in the world to use fairtrade cocoa. The move offers good growth potentials in line with ever strengthening ethical trading trends. Further opportunities • Impulse ice cream offers further room for development, especially as the brand expands in emerging markets. The category has a projected global CAGR of over 2% over the 2009-2014 period, with over 3% in Asia Pacific and near 4% in Latin America. • Flavoured milk drinks also presents a potential way forward for the brand, as through its name and “glass and a half full” strapline, Cadbury's Dairy Milk already has strong associations with dairy products. • Concentrating on focus brands and leveraging across categories suggests a shift to a core brand would make sense for future development. Retail value sales 2008 (US$ mn rsp) • Recently acquired Cadbury’s largest chocolate 2 0 US$ mn rsp % y-o-y growth Downloaded from www.warc.com 38 Brand Strategy Packaged Food: Kraft Foods Inc © Euromonitor International Oreo the World’s Number One Biscuit Brand Challenging market conditions in core North American markets • Oreo is the world’s number one biscuits brand, a status based on its leadership in sweet biscuits and a position that gives it a top five place in bakery products, overtaking Keebler from Kellogg in 2007 to take fifth place. • Despite an underwhelming performance of late, directly related to the weakness of its core North American market, mass-market Oreo has weathered the healthier eating and premium trends reasonably well to date, benefiting from wellbeing-led innovation and heavyweight marketing. • Oreo has also been helped by the degree to which it dominates sweet biscuits in North America, and in particular its main sandwich filled segment. That said, sales growth in this market slowed in 2008, underlining increasingly challenging conditions. New product innovation • Most recently, Kraft Foods has focused on expanding Oreo’s segment coverage, launching a soft snack version of the brand, Oreo Cakester, in the US in 2008. While conditions in its core market are set to remain difficult, the brand could benefit from recession as consumers downgrade their treats to products such as biscuits. Downloaded from www.warc.com 39 Packaged Food: Kraft Foods Inc © Euromonitor International Strategic Evaluation Competitive Positioning Market Assessment Confectionery Opportunitites Bakery Products Opportunities Dairy Products Opportunities Brand Strategy Operations Recommendations Downloaded from www.warc.com 40 Operations Packaged Food: Kraft Foods Inc © Euromonitor International Focus on Enhanced Production Capacity Territory Number of facilities USA 46 Canada 8 European Union 42 Central and Eastern Europe, Middle East and Africa 30 Enhancing production capacity • In 2008, Kraft completed its 5-year restructuring programme, which included the objectives of leveraging global scale, lowering costs and optimising production capacity. Within the programme, the company announced the closure of 35 facilities and the eliminations of approximately 18,600 positions. • This restructuring programme does not include changes with the latest large-scale acquisition of Cadbury and disposal of the North American frozen pizza business. • Country specific investments in enhanced production Latin America 15 Asia Pacific 18 Total: 159 capacity: Investments in French biscuit and cereal unit • Kraft has been investing EUR3.2 million to improve its plant capacity in Picardy, Northern France, looking to increase the production of the company's French biscuit and cereal unit Lu France. Bulgaria the Southeast European production centre Worldwide production and distribution infrastructure • In 2009, Kraft invested about US$27 million in the Svoge • In 2009, Kraft Foods had 159 factories in 46 countries chocolate factory, north of Sofia, making Bulgaria a around the world. Recently, the company announced the regional production centre. As a result of the enhanced closure of two facilities in Central and Eastern Europe, production capacity, Kraft Foods Bulgaria expects to Middle East and Africa, one facility in Latin America and increase exports to Greece, Romania, Macedonia, two plants in Asia Pacific. The company also owns 313 Serbia, Turkey, Ukraine and Hungary. With new distribution centres and depots worldwide. production lines, the factory will reach a capacity of 100,000 chocolate units a day. . Downloaded from www.warc.com 41 Packaged Food: Kraft Foods Inc © Euromonitor International Strategic Evaluation Competitive Positioning Market Assessment Confectionery Opportunitites Bakery Products Opportunities Dairy Products Opportunities Brand Strategy Operations Recommendations Downloaded from www.warc.com 42 Recommendations Packaged Food: Kraft Foods Inc © Euromonitor International Wider Geographic Reach, More Streamlined Categories Emerging market expansion Strengthening focus on core categories • Despite the recent acquisition of Cadbury, Kraft Foods is While Kraft Foods has started to focus on its core categories and brands, its portfolio remains overweight and in need of further trimming. Cannibalisation has hindered the company’s performance in recent years and now Kraft Foods needs to further rationalise its portfolio, with mass-market, low-margin brands the obvious starting point for the process. The divestment of the Post cereals and North American frozen pizza businesses and its recent large-scale acquisitions in the core biscuits and confectionery categories suggest the company is indeed moving in this direction. still strongly exposed to developed markets, in particular North America. With the outlook for this region and Western Europe downbeat, it is imperative that the company invests in expanding its international infrastructure, especially for the sake of its cheese and biscuits operations. These are more acutely reliant on developed markets than confectionery, which enjoys a much better profile in the developing world. Kraft Foods can approach such a move with optimism, possessing the brand equity and operational synergies to succeed. Better balance of mass and premium • Kraft Foods‘s largely mass-market focus has restricted its growth of late. While it has invested in major acquisitions and premium-led innovation, further spending is required in the short term. The global recession resulted in a resurgence in popularity of mass brands, but this is likely to be limited to key brands, in particular those with an upper-mass leaning. In addition, private label products are set to be major competitors to mass brands. Over the long term the company needs to achieve a stronger product mix, giving over more of its portfolio to higher margin products. Wellbeing-led innovations of its snack-food operations Kraft Foods lags behind major players in the wellness arena, notably trailing rivals such as Danone and Nestlé. While its most recent acquisition of Cadbury gives Kraft opportunities to benefit from oral health trends, via its newly acquired gum portfolio, it still needs to invest considerably and bring wellbeing to the fore in terms of the innovation strategy for its snack food operations. The fact that the company chose to focus on categories that do not easily lend themselves to healthier eating will not make such development easy, but the realignment of its portfolio with wellness trends over the long term is vital. Downloaded from www.warc.com 43 Packaged Food: Kraft Foods Inc © Euromonitor International Contact Euromonitor To find out more about Euromonitor International's complete range of business intelligence on industries, countries and consumers please visit www.euromonitor.com or contact your local Euromonitor International office: London Chicago Singapore Shanghai Vilnius Dubai +44 (0) 20 7251 8024 +1 312 922 1115 +65 6429 0590 +86 21 63726288 +370 5 243 1577 +971 4 609 1340 Downloaded from www.warc.com 44