The

A Publication of Newsmax & Moneynews

High Income Factor

Unlocking Powerful Strategies to Achieve Superior Returns

Tom Hutchinson, Editor

Vol. 4, No. 10 / October 2014

A Tsunami of Profits: Ride the Global

Wave Everyone Else Has Missed (So Far)

“It’s like déjà vu all over again.” — Yogi Berra

T

he term “déjà vu” is a French term meaning

“already seen.” It is used to describe a common

sensation or strong feeling that a current experience

or event has already happened to you in the past.

I’m sure you’ve experienced the sensation at

some point. I know I have. It’s a bizarre feeling you

get when you do something

and your brain tells you that

this exact thing has happened

before. A person can get a

similar sensation by looking

though today’s headlines.

“The stock market is in

a precarious situation lately.

While the European debt

crisis seems to have subsided

for now, an even worse catastrophe could erupt at

any time. And there’s another looming problem

in the United States, as political wrangling in

Washington, D.C., is pushing us closer to a debt

showdown, all while uncertainty over upcoming

elections is causing both parties to punt on highprofile issues. On the geopolitical front, there is

growing speculation that Israel will attack Iran.”

Wait a minute . . . that’s not today’s news. That’s

actually from old notes of mine written in the fall

of 2012. Sorry about that, let’s try this again:

“A lot of uncertainty surrounds the current

market. Politicians are pushing key legislation to

the absolute deadline, and no one knows what will

happen when the Federal Reserve begins rolling

back its stimulus program — any timeline of which

“

is unclear — leaving investors dumping more

defensive income-oriented stocks and funds for fear

of rising interest rates. On the geopolitical front,

tensions in Syria have Western nations on edge.”

Wait, I did it again. That was a note from the

fall of 2013. That’s not going to help us, is it? Now

I’ll do the fall of 2014, I promise.

“The stock market is making new all-time highs

(as of this writing) amid

a resurgent U.S. economy,

although concerns persist

about what will happen

once the Federal Reserve

stimulus is officially off

the table later this year.

Meanwhile, geopolitical

tensions increasingly threaten

to derail the market. It seems

all but certain that the United States will have to

increase military action against ISIS in Iraq and

Syria. At the same time, the crisis in Ukraine is

getting worse as Russian troops have entered the

country. These tensions, along with the economic

sanctions imposed on Russia, are tipping a very

fragile European recovery back toward recession. At

the same time, many emerging market economies

are struggling, and Brazil has actually fallen into

recession. Investors worry how long the U.S. market

can forge higher while the rest of the world is in

such bad shape.”

See the glaring similarities in all of those

narratives? Of course, I pulled those old paragraphs

out for a reason — I wanted to illustrate the point

that there are reasons for worry and doubt about

We can achieve better

results by paying more

attention to longer-term

bankable trends than

short-term headwinds.

”

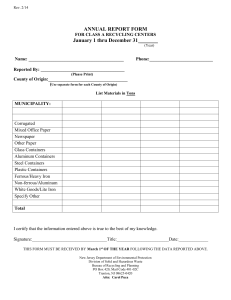

Percent of total

Chart 1

what’s immediately around us. Like a hedge maze,

the market every single year.

you can’t see the exit route from where you’re

Reiterating the concerns of recent years puts

standing.

today’s headlines in better perspective. In the prior

When we’re asked about the situation in

examples, let’s take a look and see how the S&P

the market, the country or even the world, we

500 went on to perform amid all that uncertainty

automatically think of current events. There’s

and trepidation.

increasing instability overseas, the world economy

One thing’s for sure:

Timeframe

S&P 500

(Sept. 3 to Sept. 3)

Return

is still in a funk but the U.S. economy is improving.

Overemphasizing the

2012–2013

17%

There is increasing speculation about when the

negative headlines of the

2013–2014

23%

Federal Reserve will raise interest rates and if stocks

day would’ve served as a

2012–2014

43%

are overvalued.

poor guide for investors.

All those things are true, and relevant. But the

Of course, that isn’t to say that the market always

bigger picture is lost in that thinking. Macro trends

goes up regardless of the issues. Market corrections

drive the longer term, not micro trends. We live in

happen and the market will most certainly sell off

an unprecedented time. The world has radically

again at some point.

transformed in just the last 20 years.

I also don’t dismiss the global political

I remember when my wife and I moved into

tensions as hogwash. A crisis could easily escalate

our first home in 1992. We didn’t own a computer

to a point where the market cannot ignore it,

or a cellphone. And we were by no means unusual.

sending stock prices reeling. It’s very possible that

We were a young couple living in the New York

by the time you read this, a global crisis could

metropolitan area. At that time very few people

have already knocked the market down. It can

owned such things.

happen that fast.

Now, of course, it’s difficult to imagine not

The point is, there are always risks to the

using the computer, the Internet, or email. I use

market in the short term. We can achieve better

these things every day. It’s how I make my living.

results by paying more attention to longer-term

Technology has transformed the world in

bankable trends rather than the short-term

less than a generation. But perhaps the most

headwinds that come and go every single year.

pronounced difference in the world over this time

Income investors in particular are generally longterm oriented and should consider the

Emerging-Market Share, World GDP

bigger picture.

50

What do I mean? Well, this month

I’ve identified a company that’ll directly

benefit from the continuing and

45

inevitable rise of global trade. This is

one of the most powerful trends in the

world . . . and very few people are paying

attention right now.

40

The stock pays a secure and growing

5.2 percent yield. Profits are positioned

to grow in a big way in the quarters and

35

years ahead. And the stock is dirt-cheap

at a time when U.S. stocks are generally

pricey. This long-term winner is ripe for

plucking.

’93

’95’00’05’10

’12

The Rising Global Tide

Admittedly, it can be hard to see

the bigger picture. We tend to take in

2

The emerging market countries’ share of world GDP has increased

drastically since just the early 1990s, now representing about 50

percent of the total.

SOURCE: IMF

TheHighIncomeFactor.com

October 2014

Index

Chart 2

is the stratospheric increase in economic

Volume of World Trade

growth.

150

Since World War II, the globe

had been divided into two spheres of

influence, Communist and free. The

100

United States, Western Europe, and Japan

80

completely dominated global economic

activity. The communist world and the

60

rest of the free world added little to global

production and trade. Then came the end

of the Cold War, with the fall of the Berlin

40

Wall and the collapse of communist

Eastern Europe.

30

’91 ’93’95’97 ’99 ’01 ’03’05’07’09 ’11 ’13

What a difference 20 years makes.

After the Cold War, the world essentially

As shown in this index of world trade volume, the level of merchandise

traded throughout the globe has more than tripled since the early

embraced capitalism and the number of

1990s.

active participants skyrocketed. Economic

SOURCE: Netherlands Bureau for Economic Policy Analysis

production from emerging markets

primarily in China, India, and the rest of Asia

economic output creates the ability to grow more

exploded.

and at a faster pace. The rate of increase in world

In 1990, emerging market countries produced

production has accelerated exponentially in recent

about 20 percent of global economic output (of a

years, and most of the increase in global production

much smaller total). Today, these countries account

since 1990 has occurred in the past 10 years.

for over 50 percent. (See Chart 1.)

In 2005, gross world product was $31.3 trillion

In fact, this year the collective GDP of

(again in constant 1990 dollars). That amount

developing nations has eclipsed that of the

grew to $45.7 trillion by 2012, a massive 46 percent

developed world. From this year forward, emerging

increase in global economic output in just seven

markets will account for the majority of global

years, and this was despite the interruption of the

economic output.

financial crisis.

The effect on the global economy has been

It may seem like we’re mired in a rough patch

incredible. In 1990 the gross world product (total

in the global economy. But in the grander scheme

amount of goods and services produced in a given

of things, we’re in the middle of a golden age of

year by all nations) totaled $27.5 trillion. By 2012

global economic expansion.

that amount increased to $45.7 trillion (in constant

Even more pronounced than the increase

1990 dollars).

in global economic production has been the

Today, the economic output of the world has

consequential explosion in the volume of world

nearly doubled in a generation. Since 1990, the

trade. (See Chart 2.) Obviously, as more goods and

world has produced as many goods and services as

services are produced, they need to be sold. All

it did from the beginning of time until 1990!

the increased production has found its way into

But just as success breeds more success, increased

About

Tom Hutchinson

I’ve worked in finance my entire career, from the back office of a Wall Street firm to the floor of the New

York Mercantile Exchange learning how markets work. Eventually, I became a financial adviser where I met

with thousands of investors and managed the portfolios of hundreds over the course of about 15 years. I

left my career as a financial adviser, writing for The Motley Fool as well as StreetAuthority LLC, researching

companies, industries, and markets. In The High Income Factor, I can bring you the full benefit of my years of

investing experience.

October 2014

Moneynews.com3

the global marketplace.

Chart 3

Stuck in the Mud

Global GDP Growth, 2010–2014

4.5%

4.0%

While the global economy recovered

strongly after the financial crisis, it went

3.5%

into a bit of a funk the past several years.

3.0%

As the Chinese economy matures, its GDP

2.5%

growth has slowed from the torrid 10

2.0%

percent per year pace of the past couple of

decades to about 7 to 7.5 percent over the

1.5%

past couple of years.

1.0%

At the same time, as we noted earlier,

2010

2011

2012

2013

2014

much of Europe is mired in recession as

The World Trade Organization (WTO) states that world merchandise

trade growth, after averaging about 5.3 percent per year for the past 20

the European Union works through its

years, slowed to just 2.3 percent in 2012 and 2.1 percent in 2013.

debt crisis, and many emerging market

SOURCE: Bloomberg, U.S. Global Investors

countries struggle with structural issues.

and even stronger growth beyond that.

Global GDP is slowing from its pace in 2010

and 2011, as shown in Chart 3. The level of global

The WTO is already seeing a pickup in world

merchandise trade has also taken a hit over the past

merchandise trade volume. From an average of just

two years. The World Trade Organization (WTO)

2.2 percent per year growth over the past two years,

states that world merchandise trade growth, after

the organization forecasts trade growth to more

averaging about 5.3 percent per year for the past

than double in 2014 to 4.7 percent. It also expects

20 years, slowed to just 2.3 percent in 2012 and 2.1

trade volume further increasing to 5.3 percent

percent in 2013.

growth in 2015, which is the average over the past

The global slowdown is very apparent in nontwo decades.

U.S. stocks. The S&P 500 has vastly outperformed

Recent events have muted the global

global markets as measured by the iShares MSCI

turnaround story. Yet the growing economy is here

EAFE (EFA), which tracks the benchmark MSCI

to stay. In fact, it is a trend so powerful that it will, I

global stock market index. In fact, the return of the

believe, define the current era in years to come.

S&P 500 has tripled that of the MSCI index return

While anything is possible, of course, it is

over the past five years.

reasonable to surmise that the recent global

No wonder it seems that everybody is down

slowdown has already bottomed, or is close to it.

in the dumps about foreign markets and foreign

It is also not likely that the dominance of the U.S.

stocks. You can see why the credo in recent years

market will continue for that much longer. It’s a

has been that the United States is the place to be.

good bet that global GDP, and consequently world

But I think it’s a mistake to get too caught

merchandise trade growth, will improve in the

up in the moment. The global economy won’t

months and years to come.

stay down forever. With a longer-term view, the

The good news is, plays on global growth and

recent slowdown is just a minor blip in the longworld trade have gotten cheap. At a time when

term uptrend. In fact, things appear to be turning

most U.S. stocks look expensive, I like the idea of

around already.

investing at much lower prices ahead of a powerful

Encouraging Signs

long-term trend.

Estimates for global GDP growth (according

A Shopping Lesson

to the Conference Board) are for acceleration to

In preparation for a vacation this past summer

3.3 percent in 2014 from 2.9 percent last year,

I had to go shopping for some new clothes. My

although The World Bank forecasts just 2.8 percent

wardrobe mainly consists of Christmas and

growth for the year. However, the World Bank is

predicting a sizable pickup next year to 3.5 percent

birthday presents and it was high time I got serious

4

TheHighIncomeFactor.com

October 2014

about the summer clothes situation.

I went shopping for summer clothes in late July

and early August and I noticed that everything was

on sale. Nobody wants to buy summer clothes in

mid-summer, it seems. The stores were trying to get

rid of the summer stuff so they could bring the fall

clothes out.

Just about everything I bought was on sale. But

it’s not as though the clothes were worth any less.

After all, it will be summer again one day. In just

a few months the stores will be rushing to get rid

of the spring clothes to bring out the full-priced

summer clothes I just bought at a discount.

It’s just that the timing was wrong, or in my

case, right. The world just didn’t value the clothes

very highly at the time I bought them.

This is a great lesson for investing. Just like

stores that value clothes according to the timing

of the fashion seasons, investors price stocks

according to the latest headlines. By finding

companies that are poised to benefit from

bankable trends rather than constantly changing

circumstances, we can often find bargains in great

investments.

Profit From the Rise in Global Trade

So, as an investor, how do you play a rise in

global growth and trade?

Generally, I don’t like investing in foreign

markets, especially emerging markets. There are

just too many issues like odd politics, currency

issues, and even weather problems that make

investing directly in a country or its stocks highly

unpredictable.

The thing is, most of the global growth is in

emerging markets, but investments in these areas

are rarely good for income investors. Things may

change in the future, but my experience with

emerging markets is that they’re volatile. When

they rise they really take off — an ETF that tracks a

country could be up 100 percent or 200 percent in

just a couple of years. Then the market crashes and

does nothing for the next five to seven years.

In my experience it has not been a good

practice to try to invest in emerging markets

early, before they start moving up, because you

may be too early, waiting years before the positive

move. Instead, it’s better to buy in once they are

October 2014

definitively on the move. I wouldn’t even worry

about missing the first 30 or 40 percent of an

uptrend because there is usually a lot more upside

beyond that. (That’s a big reason such investments

are good momentum plays or short-term trades,

not necessarily good income investments. )

As I’ve mentioned in previous issues, my

favorite way to play global growth is instead

through U.S. companies that benefit from business

overseas. But even then, individual companies

often have individual peculiarities that could

mute the benefit of increased global trade. For

example, many global companies sell soda or farm

equipment or cereal. There could be reasons, like

rising commodity prices or increased competition,

that could mean such companies wouldn’t benefit

as expected from a global growth pick-up.

So to play this global trade trend more directly,

you want a company that benefits purely and

directly from the simple occurrence of an increase

in global trade.

Usually, the standard play on global growth

has always been shipping. The ability of seagoing

vessels to transport enormous weight cheaply

makes it the mode of choice to transport goods

around the globe. In fact, ships are responsible

for roughly 90 percent of goods exchanged

throughout the world.

But the problem with shipping stocks is that

they can be quite volatile and often don’t pay

stable or predictable dividends. The exception

is existing High Income Portfolio position and

dry bulk shipping company Navios Maritime

Partners (NMM). That company is highly unusual

in the industry because the bulk of its earnings

GET A 30% INCREASE

IN RETIREMENT INCOME

Guaranteed Income for Life*

Find out how a lifetime income stream

can secure your retirement.

Get the Annuity Primer: Guaranteed Income For Life

plus the “10 Annuity Pitfalls to Avoid” report FREE!

Online: CrownAtlantic.com/811

* See website for details

Toll-free: 855-221-4544

Moneynews.com5

pick at a glance

textainer group holdings limited (tgh)

security type: Common Stock

industry: Container renting and leasing

price: $35.00 (as of Sept. 9, 2014)

52-week range: $34.00–$41.07

yield: 5.2%

profile: Textainer is the largest lessor of containers by

fleet size in the world.

positives

•Containers are a less

volatile way to play global

trade than shipping.

•Revenues from long-term

contracts are a highly

dependable backdrop

from which to pay

dividends.

•Textainer is the best in

class, and the current

industry lull creates an

excellent entry point for

longer-term investors.

risks

•Instability in the Middle

East and Russia or

somewhere else could

derail the global recovery

and put pressure on TGH.

•Increasing competition

and shipping industry

consolidation present

secular headwinds for the

company.

shippers on long-term contracts of five to eight

years. Revenues are highly predictable and the

assets are low risk. From 2005 until the end of

2013, the average profit margin for container

shipping lines was about 10 percent. Not bad —

but container leasing companies averaged profit

margins of 40 percent over the same period.

Textainer (TGH) is the world’s largest lessor

of intermodal containers, leasing over 2 million

containers to more than 400 shipping lines. The

Bermuda-based company has existed since 1979

and its initial IPO was in 2007.

The company is also involved in managing

containers for third parties and buying and selling

new and used containers. But the main focus of

the business is leasing out containers to shipping

customers, which accounts for 85 percent of

revenues. These containers are mostly purchased

(77 percent of them) and then leased out for

contracts of five to eight years, usually. In fact, 76

percent of Textainer’s assets are on long-term leases

(as of June 30).

The solid long-term nature of the leases is key.

It provides bankable and dependable revenue from

contracts with guaranteed rates that isn’t derailed

by short-term dips and spikes in the global trade

environment. Of the company’s top 25 customers,

19 are among the world’s leading shipping

lines. These companies typically run more stable

businesses and have superior credit.

Because of the dependable nature of revenue,

the industry remained profitable throughout the

financial crisis — Textainer continued to maintain

the same quarterly dividend without interruption,

Chart 4

are in long-term contracts, which makes earnings

predictable despite the short-term ups and downs

of the industry.

Aside from Navios, there is a much better way

to play international trade growth besides shipping

— containers.

An intermodal container is a standardized

and reusable steel box used to transport and store

goods. Intermodal means that the containers can

be moved from one mode of transport to another;

for example, from ship to rail or truck. I’m sure

you’ve seen these things on the backs of semis on

the highway. If you’ve ever driven by a

Textainer (TGH) Stock Price, 2009–2014

port, you may have noticed vast numbers

of these containers stacked atop each

$40

other.

$35

Massive amounts of world goods

$30

traded are transported in them because

$25

they’re a good idea. You ship goods,

$20

unload them, and put them right on

$15

a truck. It makes delivering products

’09

’10’11 ’12’13 ’14

efficient and easy.

Textainer was founded in 1979 and has been trading since 2007. After

Companies that deal in containers

the overall market lows of 2009, it has gained in price, although it’s still

undervalued at its current levels and represents a high-yield bargain.

tend to have a stable business. The reason

SOURCE: Yahoo Finance

is that containers are usually leased to

6

TheHighIncomeFactor.com

October 2014

a claim that not many dividend payers can make.

The company’s container portfolio consists

primarily of dry freight (85 percent) with a smaller

but fast-growing presence in refrigerated freight

(12 percent) and some specialty containers (3

percent) for extra-large and heavy shipments.

Textainer manages the container assets through

their typical 12-to-15-year life cycle. According to

the company, revenue achieved through containers

consists of the initial lease period (55 percent)

and then the mid-life or contract-renewal phase

(30 percent), and finally the disposition of sale

(15 percent), where historically the company has

recouped 40 to 50 percent of the initial cost.

Basically, TGH offers an essential staple of

global trade at a point in history when trade is on

the uptrend. The company is also one of the best in

its business, if not the best. Textainer is the lowest

cost and most profitable per employee operator of

its peers.

Eyeing the Price History

While TGH has an excellent track record since

its October 2007 IPO, the stock has struggled of

late. In the past two years (as of early September

for purposes of this calculation), the stock price

remained flat while the S&P 500 soared more than

40 percent. This recent underperformance is in

stark contrast to the longer-term track record.

Since the IPO, $10,000 invested in TGH

(with dividends reinvested) would have grown

to over $30,000 for an annualized return of

17.53 percent. Over the same period, the overall

market, as measured by the S&P 500, would’ve

turned a $10,000 investment into only $12,880, an

annualized return of 3.67 percent.

The recent problems have been twofold: a

sluggish global economy and lower container

leasing and sale prices. The global economy

woes have hurt demand while easy financing for

competitors has flooded the market with extra

containers. Pricing has been the primary reason

that Textainer’s earnings per share have taken a hit.

In 2013 EPS fell 19 percent from 2012, and in the

first half of 2014 they were 5 percent lower than

the first half of 2013.

But there is reason to believe that the

challenging industry conditions have reached a low

October 2014

point. As I mentioned above, the global economy

may pick up from here and perhaps strongly,

creating more demand for the containers. Also, the

easy credit terms in the industry, often providing

credit to much smaller and less financially secure

competitors, is unlikely to last long. Higher interest

rates would also put a damper on borrowing and

curb the supply.

The stock has lost about 9 percent so far this

year and returned just 6.6 percent over the past

year compared to a 25 percent return for the

market. TGH as of this writing is about 14 percent

below its 52-week high, selling at just 10.37 times

earnings, compared to over 18 times for the S&P

500. The stock is also trading at lower price/book,

price/sales, and price-to-cash-flow ratios than its

five-year averages. And over those five years TGH

provided an average annual return of 24.6 percent.

The Dividend

Meanwhile, the stock provides a stellar 5.20

percent yield at the current price. In other words,

you get paid to wait for the container market to

inevitably rebound. As a Bermuda-based company,

there is no withholding tax and dividends are

subject to the maximum 15 percent rate in the

United States.

There is also an impressive record of dividend

growth. The quarterly payout of $0.47 per share, or

$1.88 annually, is 135 percent higher than in 2007.

Textainer has grown the dividend by increasing

cash flow at a compound average growth rate

(CAGR) of 23 percent per year from 2008 through

2013. Dividends have expanded at a 15.76 percent

per year clip over the past five years.

Capital expenditure (CAPEX) should drive

more dividend raises in the future. The company

develops its business in two primary ways:

acquiring new containers or acquiring smaller

companies in a very fragmented market. Textainer

invested about $2.5 billion in CAPEX between

2008 and the end of 2013, and $600 million in the

first half of 2014.

As a result of the ongoing investments in new

containers and additional business, the company

grew lease rental income by 7 percent year over

year in the first half despite the challenging

industry conditions. The company was also able

Moneynews.com7

to lower interest rates on debt and lower funding

costs. Textainer continues to expand and cut costs

as container prices and global trade levels are

poised to recover.

Conclusion: Textainer pays a strong and

growing dividend. It is a company well

positioned to benefit from the all but certain

trend of increased global trade in the years

ahead. The current industry lull creates an

excellent entry point for the stock, a good value

in an otherwise higher-priced market, and a

great way to diversify outside of the United

States. I recommend Textainer (TGH) at or

under $40 for the Wealth Builder Portfolio.

Portfolio Update: Big News From

Kinder Morgan

On Aug. 10, oil and gas pipeline giant

Kinder Morgan (KMI) announced a corporate

consolidation plan that will involve parent KMI

buying out its subsidiaries for $71 billion. The

company will purchase Wealth Builder Portfolio

position Kinder Morgan Energy Partners (KMP),

as well as El Paso Pipeline (EPB) and Kinder

Morgan Management (KMR).

The market loved it. All four stocks have been

up big since the announcement, with KMP shares

rising 18 percent since then (as of this writing).

So what is this deal about, and is it still worth

holding? Let’s take a closer look.

The deal is expected to close in December and,

as of the closing, KMP will no longer trade. Each

KMP shareholder will receive 2.1931 shares of KMI

and $10.77 in cash for each share of KMP owned.

Current holders of KMP will no longer own a

master limited partnership (MLP) but rather a

regular corporation. The new company will be the

third-largest energy company in the country next

to Exxon Mobil (XOM) and Chevron (CVX).

Currently as an MLP, KMP enjoys special

tax incentives. The partnership pays no tax at

the corporate level, provided 90 percent of

income is paid out to shareholders in the form of

distributions. The MLP is able to pay out money

that ordinary companies lose to taxes and it is thus

able to offer a higher yield. KMP currently yields

5.8 percent even after the run-up in price.

8

Why is Kinder Morgan abandoning the

MLP structure? The Kinder Morgan companies

are in an unusual position. The United States is

currently undergoing a massive boom in oil and

gas production (see the April 2014 issue). As an

energy infrastructure company primarily involved

in the piping and storage of oil and gas, KMP is

seeing a massive growth in demand for its services.

To accommodate the production expansion,

KMP currently has a backlog of about $17 billion

in expansion and growth projects over the next

several years.

But there’s a problem . . . the incentive

distribution rights (IDRs).

IDRs in a partnership structure give the general

partner (in this case KMI) an increasing share of

the distributions a partnership generates. They’re

called incentive rights because they’re designed

to incentivize a general partner to rapidly grow

distributions from the limited partner.

The IDRs work for a while. But when a

company grows distributions beyond a certain

point, they become a major problem.

As the limited partner increases distributions,

the general partner is entitled to a greater

percentage of the distribution as certain thresholds

are crossed. When an MLP is around for a long

time and successful, its distribution goes well past

the highest threshold level where the GP gets 50

percent of the payout.

Here’s a look at KMPs distribution structure.

Kinder Morgan Energy Partners

Incentive Distribution Rights

Note: General partner is Kinder Morgan; minimum quarterly

distribution is $0.15125; latest quarterly distribution is $1.39.

Low

High

LP Unitholders

GP Units/IDRs

Tier 1 $0.151250 $0.151250 98.00% 2.00%

Tier 2 $0.151250 $0. 178750 85.00% 15.00%

Tier 3 $0.178750 $0.233750 75.00% 25.00%

Tier 4 $0.233750 —

50.00% 50.00%

In the early 1990s, KMP was one of the very

first major MLPs on the market. As you can see

from the table, when the company was new and

paying quarterly distributions of about $0.15

per share, it only had to fork over 2 percent

of distributable cash flow to KMI. Even when

TheHighIncomeFactor.com

October 2014

distributions rose over $0.20 per share, it only had

to pay 25 percent of the portion of the distribution

greater than $0.17875.

But KMP continued to grow the distribution

for a long time. Now, the quarterly distribution

is $1.39 per share. The partnership has to pay 50

percent of the distribution in excess of $0.233750

per share to KMI. That’s too much.

To put it in simpler terms, for every quarterly

distribution of $1.39 KMP pays to shareholders,

it has to pay over $0.60 to KMI. That means that

it has to give away more than 43 percent of the

distributable cash flow it generates.

KMP can only keep a little more than half

of what it earns. KMP shareholders can only

receive about half the partnership’s cash flow in

distributions. The IDRs have become a massive

cash flow burden.

As a result, the $17 billion in expansion projects

are only half as profitable as they otherwise would

be. KMP simply has too much cash flow burden

to generate a powerful return from the expansion

opportunities ahead.

The deal was done primarily to rectify the IDR

problem. Similar moves have been done before

by other MLPs. Magellan Midstream Partners

(MMP) and Enterprise Product Partners (EPD)

both bought out their GP in order to get rid of the

IDRs. However, both those companies remained

MLPs. Kinder Morgan is taking a different route

and converging into a regular corporation.

The Corporate Route

To make a long story short, KMI is opting

for the corporate rather than the MLP structure

because it better accommodates the massive new

investments that lie ahead. A regular corporation

has more options for raising money and can

reinvest its earnings. And according to analysts at

RBC, the Kinder Morgan empire will be able to cut

its cost of capital nearly in half by eliminating the

cash distribution obligations.

The new company will have tax advantages

to offset the loss of MLP tax incentives.

Through depreciation deductions (plant and

equipment will be priced as new assets after

the consolidation) and write offs for expansion

expenses, KMI estimates it will have about $20

October 2014

billion in deductions over the next several years.

The bottom line is that for those who own

KMP stock, your holding will morph from a high

income/low growth investment to a moderate

income/high growth investment. KMI estimates a

payout of $2 per share in 2015, which translates to

a little more than 4 percent. KMP currently pays

5.82 percent.

However, the new KMI estimates dividend

growth of 10 percent per year from 2015 to 2020,

compared to an estimated 5 percent distribution

growth for KMP. The new KMI will also have a

greater likelihood of capital appreciation.

Investors who must generate a higher level

of income may wish to look elsewhere. However,

those who can tolerate the lower income and

have an interest in appreciation over time have a

tremendous opportunity. KMI is perched in front

of a huge trend that will enable the company to

grow earnings and the dividend for years to come.

The market sees the opportunity, which

explains the run-up. For now, I recommend that

we keep our shares of KMP through the transition,

although I will continue to monitor the situation

and let you know if conditions change and warrant

a sale.

Best Buys of the Month

“Best buys” comprise what I think are

especially good values among all the holdings in

our portfolio as we go to press. The picks are not

necessarily those with the cheapest price compared

to their recommended “buy in” level.

What they are, however, is a good guideline,

especially for those new to the High Income Factor

newsletter. They’re the answer to the question, “If

I were just starting to invest in the High Income

Factor Portfolio, which securities would I buy

first?”

OCTOBER BEST BUYS

Price*

52-Week Range

Yield

Ventas Inc. (VTR)

Security

$64.75

$54.89–$69.09

4.48%

Main Street Capital (MAIN)

$32.38

$28.69–$35.72

6.11%

Brookfield Infrastructure Partners (BIP)

$41.87

$35.58–$42.83

4.59%

*As of Sept. 9, 2014

Ventas Inc. (VTR)

Ventas is one of the largest real estate

investment trusts (REITs) investing in healthcare

Moneynews.com9

properties and seniors housing in the United States

and Canada. The main reason to buy this stock is

that the REIT is positioned in front of a massive,

undeniable trend: The number of older people in

the population is exploding and will continue to

do so for decades.

The vastly larger multitudes of older people

will demand the services and properties that Ventas

has. With a tailwind like that, VTR has a big edge

up on most other investments. It has also provided

an average annual return of 23 percent per year

over the past 15 years. And earnings growth is

accelerating.

The company has been growing its portfolio

of properties at a rapid pace in recent years

to accommodate the increasing demand for

healthcare and seniors housing. Since 2011,

the busy REIT has made almost $16 billion in

acquisitions.

While such fast-paced expansion can be a

concern in a few cases — some companies can

experience growing pains and make missteps along

the way — the strategy appears to be working

well for Ventas. The pace of its profit growth has

increased from historic averages since the buying

spree. Second-quarter earnings were better than

expected as funds from operations (FFO) increased

11 percent from last year and revenues grew 10

percent year over year.

The fact that VTR is a defensive business with

solid growth prospect that pays a solid yield should

make it a winner in any environment. Ventas is a

buy at or under $65 per share.

Main Street Capital (MAIN)

MAIN is, in my opinion, the best company at

what it does. The business development company

(BDC) invests in growing businesses that are

underserved by traditional lenders. The stock offers

both high income and growth by investing in highinterest loans and equity stakes.

The stock has been a phenomenal performer,

posting an average annual return of 30 percent

over the past three years. But Main Street Capital

is also ideally suited for the current environment.

This BDC invests in smaller and fast-growing

companies that tend to do better as the overall

economy improves, and its portfolio of adjustable10

rate and short-term loans provides excellent

protection against rising interest rates.

The stock also does something that income

investors love: It pays dividends every single

month. The recently boosted dividend is $0.17 per

share, a 6 percent hike over last year. MAIN has

also been paying special dividends in addition to

the regular payout. The stock paid an extra $0.80

last year and an extra $0.275 per share so far this

year. Main Street Capital a buy at or under $32 per

share.

Brookfield Infrastructure Partners (BIP)

There is a massive need for additional and

improved infrastructure throughout the world,

both in developed and emerging markets. And

Brookfield Infrastructure Partners is at the

forefront of that need, with infrastructure assets all

over the globe.

Every time I write about this company, I list

an example of the properties it owns. And its

impressive enough that I’m going to do it again

here. Among its assets it has:

•The sole railroad network in Southwest

Australia;

•Chilean utilities that generate 98 percent of the

country’s electricity;

•Toll roads that serve as crucial transportation

arteries in Brazil and Chile, covering over 3,200

kilometers;

•Ports throughout Europe and in China;

•Natural-gas storage terminals in Canada.

These are high-quality properties that don’t go

out of style. In fact, they are desperately needed for

a society to function.

They are also long-life assets that generate

remarkably stable and growing cash flows. The

company also has plenty of opportunity for growth

given the additional infrastructure needs all over

the world. BIP has a sizable backlog of projects

right now.

It’s great to have it both ways; the company

is both defensive and fast-growing. The stock has

provided an average annual return of 27 percent

over the past five years and there’s every reason

to believe it will continue to outperform going

forward. Brookfield’s stock is a buy up to $42 per

share.

TheHighIncomeFactor.com

October 2014

The High Income Factor Portfolio

THE HIGH INCOME PORTFOLIO

Ticker

Entry Date

Entry Price

Recent Price

Buy at or

Under

Current

Yield

Effective

Yield

Dividend

Pay Date

Total

Return

Navios Maritime Partners

NMM

01-Mar-12

$16.37

$20.23

$17.50

8.75%

10.81%

11/13/14

59.26%

Terra Nitrogen

TNH

01-Apr-12

$249.75 $146.36 HOLD

9.80%

5.75%

12/3/14

-21.57%

FLY Leasing Limited

FLY

27-Nov-12

$11.97 $14.22 $16.00

6.19%

7.35%

11/20/14

31.08%

Teekay LNG Partners LP

TGP

20-Dec-12

$38.30 $42.50 $42.00

6.35%

7.05%

11/8/14

24.20%

Recommendation

Prospect Capital

PSEC

26-Feb-13

$11.06 $10.34 $11.50

12.88%

12.04%

9/25/14

10.05%

Main Street Capital

MAIN

21-Aug-13

$29.21 $32.38 $32.00

6.11%

6.78%

9/15/14

20.03%

Buy at or

Under

Current

Yield

Effective

Yield

Dividend

Pay Date

Total

Return

10/30/14

46.31%

THE WEALTH BUILDER PORTFOLIO

Recommendation

PepsiCo

Ticker

Entry Date

Entry Price

Recent Price

PEP

01-Apr-12

$66.74 $91.42 $72.00

2.87%

3.93%

Eli Lilly

LLY

01-Apr-12

$40.48 $64.44 $52.00

3.04%

4.84%

10/9/14

76.41%

Williams Partners

WPZ

01-May-12

$57.30 $54.80 $58.00

6.61%

6.32%

11/12/14

22.86%

Vodafone

VOD

27-Sep-12

$28.72 $33.26 $34.00

4.84%

5.61%

9/22/14

16.90%

Intel

INTC

27-Nov-12

$19.98 $34.91 $27.00

2.58%

4.50%

12/3/14

84.94%

Philip Morris

PM

04-Feb-13

$87.00 $83.83 $87.00

4.49%

4.32%

10/14/14

1.46%

Riocan REIT

REI-UN.TO

20-Mar-13

$26.97 $24.51 $29.00

5.78%

5.25%

9/15/14

10.74%

General Mills

GIS

19-Apr-13

$49.94 $53.17 $50.00

3.08%

3.28%

12/3/14

9.87%

KMP

22-May-13

$88.50 $92.86 $95.00

5.82%

6.10%

11/14/14

13.27%

Kinder Morgan Energy Ptnrs

Brookfield Infrastr Ptnrs

BIP

03-Jun-13

$36.00 $41.87 $42.00

4.59%

5.33%

10/28/14

21.96%

Health Care REIT

HCN

15-Aug-13

$60.00 $67.22 $60.00

4.73%

5.30%

11/20/14

17.95%

Realty Income

O

18-Dec-13

$39.14 $44.63 $40.00

4.92%

5.61%

11/21/14

18.04%

HSBC Holdings

HSBC

27-Jan-14

$52.98 $53.15 $60.00

3.76%

3.78%

11/19/14

4.18%

Verizon

VZ

21-Feb-14

$47.27 $48.90 HOLD

4.34%

4.48%

11/3/14

4.55%

Northern Tier Energy

NTI

26-Mar-14

$26.00 $25.32 $28.00

6.48%

6.31%

11/28/14

3.29%

Ventas, Inc. Magellan Midstream Ptnrs#

Deere &

Company#

buy Textainer Group Holdings#

VTR

23-Apr-14

$64.42 $64.75 $65.00

4.48%

4.50%

12/1/14

1.63%

MMP

—

—

$82.04 $65.00

—

—

—

—

DE

—

—

$82.25 $80.00

—

—

—

—

TGH

—

—

$35.00 $40.00

—

—

—

—

Current

Yield

Effective

Yield

Dividend

Pay Date

Total

Return

INCOME STRATEGIES PORTFOLIO

Recommendation

Blackrock Enhanced Cap Fund

Barclays 7.75 Preferred

PowerShares Preferred

Ticker

Recent Price

Buy at or

Under

Entry Date

Entry Price

CII

01-Jan-12

$12.50 $15.24 $13.00

7.87%

9.60%

9/30/14

47.09%

BCS-PC

27-Sep-12

$25.52 $25.60 Hold

7.97%

7.99%

10/16/14

16.94%

PGX

24-Oct-12

$14.84 $14.42 Hold

6.07%

5.90%

10/8/14

6.78%

Osterweis Strategic Income OSTIX

25-Sep-13

$11.80 $11.98 $12.00

4.99%

5.07%

9/18/14

2.62%

BKLN

25-Sep-13

$24.77 $24.64 $25.00

4.09%

4.07%

10/8/14

2.80%

PowerShares Sr Loan Port

SPDR BarCap ST HY Bnd SJNK

25-Feb-14

$31.03 $30.26 $32.00

4.88%

4.76%

9/15/14

-0.40%

People’s United Financial

PBCT

25-Aug-14

$14.90 $14.90 $15.00

4.43%

4.43%

11/17/14

0.00%

Duke Energy

DUK

—

—

$73.79 $69.00

—

—

—

—

Notes on all portfolios: In order to receive the dividend payment, you will need to own the stock several weeks before the pay date. The “Total Return” column includes all reinvested

dividends at concurrent recommended buy prices. Returns calculated based on a purchase of $1,000 of the security on the listed entry date and price. The “Effective Yield” column

reflects the yield investors receive assuming they bought at the entry price and followed all subsequent recommendations. #Denotes recommendation not yet purchased. To see the

chart of previous “sold” positions, subscribers can log onto www.highincomefactor.com (under the “Portfolio” tab). All chart data is as of close September 9, 2014.

Closing Thoughts

October 2014

Moneynews.com11

The

High Income Factor

The High Income Factor is a monthly publication

of Newsmax Media, Inc., and Newsmax.com. It is

published at a charge of $109.95 for print delivery

($99.95 for digital/online version) per year through

Newsmax.com and Moneynews.com.

The owner, publisher, and editor are not responsible

for errors and omissions. Rights to reproduction and

distribution of this newsletter are reserved.

Any unauthorized reproduction or distribution of

information contained herein, including storage

in retrieval systems or posting on the Internet, is

expressly forbidden without the consent of Newsmax

Media, Inc.

For rights and permissions, contact the publisher at

P.O. Box 20989, West Palm Beach, Florida 33416.

To contact The High Income Factor, to change email,

subscription terms, or any other customer service related

issue, email: customerservice@newsmax.com, or

call us at (888) 766-7542.

© 2014 Newsmax Media, Inc. All rights reserved.

Newsmax and Moneynews are registered trademarks

of Newsmax Media, Inc. The High Income Factor is

a trademark of Newsmax Media, Inc.

Financial Publisher

AARON DEHOOG

Editorial Director/Financial Newsletters

JEFF YASTINE

Senior Financial Editor

TOM HUTCHINSON

Art/Production Director

PHIL ARON

DISCLAIMER: This publication is intended solely

for informational purposes and as a source of data

and other information for you to evaluate in making investment decisions. We suggest that you

consult with your financial adviser or other financial

professional before making any investment. The

information in this publication is not to be construed, under any circumstances, by implication

or otherwise, as an offer to sell or a solicitation to

buy, sell, or trade in any commodities, securities, or

other financial instruments discussed. Information

is obtained from public sources believed to be reliable, but is in no way guaranteed. No guarantee of

any kind is implied or possible where projections of

future conditions are attempted. In no event should

the content of this letter be construed as an express

or implied promise, guarantee or implication by or

from The High Income Factor, or any of its officers,

directors, employees, affiliates, or other agents that

you will profit or that losses can or will be limited

in any manner whatsoever. Some recommended

trades may (and probably will) involve commodities,

securities, or other instruments held by our officers,

affiliates, editors, writers, or employees, and investment decisions by such persons may be inconsistent

with or even contradictory to the discussion or

recommendation in The High Income Factor. Past

results are no indication of future performance. All

investments are subject to risk, including the possibility of the complete loss of any money invested.

You should consider such risks prior to making any

investment decisions. See our Disclaimer, as well as

a list of stocks that the Senior Financial Editor owns

by going to highincomefactor.com.

12

Closing Thoughts

I believe strongly in investing ahead of a trend. When I was

young, I had a boss who told me and my financial adviser co-workers

something I still haven’t forgotten. He said that when the market is

booming, you only have to do things half right and you’ll be fine.

But when the market stinks, the marketing, customer contacts, and

everything else it takes to run the business have to be done at least

90 percent right.

In the same vein, a company positioned in front of a strong

trend will face a smoother path to success. The market will be more

forgiving. If the company has a bad quarter, the stock won’t get hit

that hard. If the stock price falls, it should quickly recover because

investors will understand the company is in the right place at the

right time. The advantage a strong trend can give an investment is

precisely the edge we need to generate large returns over time.

I also believe in buying companies cheap. Buying at a good price

makes generating solid returns far easier. The encouraging returns

also motivate investors to stay invested longer, which is usually a

more successful strategy.

Textainer (TGH) is both cheap and positioned in front of a

powerful trend. The level of global trade will continue to grow

strongly over time and drive its profits. Meanwhile, the stock is

inexpensive because most investors are too influenced by the latest

headlines. So we can target smart investments by seeing the bigger

picture, while everybody else is looking the other way.

Actions to Take Now

Action No. 1: Buy Textainer (TGH) at or under $40 for the

Wealth Builder Portfolio.

Action No. 2: Visit www.highincomefactor.com to find past

monthly issues and weekly updates. (For password assistance, contact

my team at 800-485-4350 or customerservice@newsmax.com.)

Sincerely,

Tom Hutchinson

To renew or subscribe to this newsletter, please go to

www.moneynews.com/offer

TheHighIncomeFactor.com

October 2014

E x c l u s i v e

E v e n t

Join

Steveat Forbes

the

2015 Newsmax Economic Forum

RSVP for this exclusive event!

You are invited to join Steve Forbes,

chairman and editor-in-chief of Forbes Media,

for the 2015 Newsmax Economic Forum at the

Waldorf Astoria Hotel in New York City.

Our experts will also discuss the best places for

you to invest in the coming year, including gold

and other precious metals, so you can prosper

during these uncertain times.

Along with Steve Forbes, the 2015 Newsmax

Economic Forum will feature Newsmax CEO

Christopher Ruddy, Robert Wiedemer,

editor of the Aftershock Investor Report, Bill

Spetrino, editor of The Dividend Machine, Tom

Luongo, editor of the Resolute Wealth Letter,

Andrew Packer, editor of the Ultimate Wealth

Report, Tom Hutchinson, editor of The High

Income Factor, and many more investment and

economic experts.

Space Is Strictly Limited to 100 Guests.

The panel will discuss “The Reckoning

Ahead” as the United States faces an end to the

Federal Reserve’s stimulus programs, rising

interest rates, and a stock market that could be

poised for another historic collapse.

Due to the exclusivity of this event, we

expect the limited number of seats to sell out

immediately, so reserve your spot now!

the 2015

Newsmax Economic Forum

Date: December 4-5, 2014

Location: W

aldorf Astoria Hotel

New York City

RSVP Today!

Go Online to: www.Newsmax.com/NEF

or Call: (888) 766-7542