Oct 2014 24th October`14

advertisement

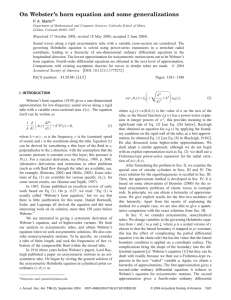

-Ramaswami Kalidas (a) To every Listed Company (b) Every Public Company with paid up share capital of Rs. 10 Crore or more (Section 203 read with Rule 8 of Companies [Appointment & Remuneration of Managerial Personnel] Rules, 2014) Applicability shall extend also to Private Company which is a subsidiary of a Public Company. Paid up Share Capital – u/s 2[64] refers to an aggregation of money credited as paid up. Hence includes preference capital also. Is applicability of Section 203 prospective? No. Appointment of KMP is mandatory from April 1, 2014. Clear from Second proviso to Section 203[3] which says: “Provided that whole time KMP holding office in more than one Company at the same time on the date of commencement of this Act, shall, within a period of six months from such commencement, choose one Company in which he wishes to continue to hold the office of KMP”. Approach of MCA to contraventions by Companies post April 1, 2014 to be seen. Position of persons occupying office of CS, MD, prior to 01.04.2014 As there was no concept of KMPs under old Act, these persons have to be appointed by Board as KMPs immediately after 01.04.2014. Prior to appointment, Nomination Committee to recommend . . KMP defined u/s 2[51] means : (a) The Chief Executive Officer or the Managing Director or the Manager (b) The Company Secretary (c) The whole-time director (d) The Chief Financial Officer and (e) Such other officer as may be prescribed. Residuary Clause not yet extended through Rules. Does CEO have to be a Director? No Section 2[18] defines CEO “An officer of the Company who has been designated as such by it.” Hence remuneration of CEO (if not part of Board), Company Secretary and CFO not subject to regulation under Section 197 read with Schedule V. Status of Company Secretary Vide Notification dated June 9, 2014 MCA have mandated appointment of CS in Private Companies with Capital above Rs. 5 Crore. However he will not be a KMP. Can chairman of Board be MD or CEO ? No. Except in case of Companies with a Capital of Rs. 100 Crore and turnover of Rs. 1000 Crore with multiple lines of Business which has appointed CEOs for such lines or (i) Where the Articles provide for such appointment In line with philosophy followed in the West. Can same person hold dual positions? No express prohibition as per the Act Section 203[3] contemplates same person holding position as KMP in Subsidiary also. Third proviso u/s 203[3] contemplates same person being appointed MD in two Companies with unanimous consent of the Board of other Company. Precedence available when Section 383A was introduced in 1975 in old Act. KMP to be appointed only at meeting of Board and not through circulation or by committee KMPs functioning as Directors in other Companies should seek approval of Board for continuance. KMP in two Companies Second proviso to Section 203[3] – persons holding positions in two Companies to abdicate for one Company within six months of the Act. MD of one Company can be MD in another. Flaw in drafting of Section 203[3] – Should have stated “subject to third proviso hereunder”. Vacancy in office of KMP To be filled up in six months Penalty for Non Compliance Fine up to Rs. 5 lakh Every Director & KMP liable for fine upto Rs. 50,000/ Continuing Offence – Penalty Rs. 1000 per day. Obvious flaws in the law: A)Exemption to private Companies even with Capital above Rs 10 Crore.-Strange! B)No provision regarding educational qualifications for CFO-Weird!!! Thank You