BPI: Financing Facilities for Energy Projects

Financing Facilities for Energy

Energy Investment Forum

Cebu City September 27, 2012

BPI Today

• 3 rd largest bank in the Philippines in terms of assets - Php892B • 2 nd in terms of deposits, loans and trust • Largest bank in terms of market capitalization Php65B • Largest sales network - 813 branches - 2,721 ATMs - 13 business centers - 21 remittance offices

BPI’s Ownership

Ayala Corporation

Real Estate Ayala Land Electronics & Information Technology Financial Services Infrastructure Manila Water Telecommunications Globe Social Commitment Ayala Foundation Banking -Ayala Corp : 34% - DBS : 21% Insurance

Subsidiaries

Bank of the Philippine Islands BPI Capital BPI Leasing Santiago Land Dev’t BPI Family Savings BPI Direct Savings BPI International Finance BPI Foreign Exchange BPI Express Remittance BPI Europe, PLC Ayala Plans, Inc BPI/MS Insurance BPI Operations Mgmt BPI Computer Systems

Sustainable Energy Finance Program

BPI-IFC Partnership

First local bank to leverage on IFC’s expertise in Sustainable Energy Finance January 2008 SEF Advisory Phase I

-Energy Efficiency in

Commercial Bldgs.

-Internal capacity building

September 2009 SEF Advisory Phase II

- EE in Commercial /

Industrial

- Renewable energy

- Market Awareness December 2009 Risk Sharing Agreement SEPT 2011 SEF III

Philippine Energy Situation

• Philippines’ electricity costs one of the highest in Asia • Energy deficiency in the remote areas • Overall Philippine energy supply shortfall • Heavy dependence on fossil fuels

BPI - Sustainable Energy Finance

BPI-SEF promotes private and public sector financing in the following areas: • Energy Efficiency • Renewable Energy • Cleaner Production • Waste to energy Other energy projects like coal (outside of SEF)

SEF Product Structure

• Technical Advisory - Walkthrough energy audit/ feasibility studies assessment • Financial Advisory - Equity and debt financing, customized financing package and structure, syndication, supply chain linkage, etc.

How we work with clients..

Exploratory meeting; Introductory meeting Submission of energy consumption and equipment data/project information memorandum

BPI will assist you in your energy investment by providing an appropriate financing program for your project.

Conduct walk thru energy audit/validate financial and technical data

Client Decision

Compute potential savings for EE project and prepare financing recommendation for RE project Presentation of results to client

AO goes through usual Financing Procedures

Financing Options

Loan

Borrower buys asset Borrower has legal title to asset Asset mortgaged to lender Generally, lender finances 50 %

Lease

Lessor buys equipment from vendor Lessor owns the equipment financed No CM fees; simpler documentation Generally, lessor finances 80%

ESCO Approach: Energy Performance Contract

CLIENT

Performance Guarantee Energy Savings as Loan Repayment

ESCO Banks/FIs

Guaranteed savings or shared savings model

Basic EE/RE Financing Structure

• Energy Efficiency

- simpler structure than RE and other PF projects - loan tenor can be up to 7 years - security includes performance guarantees, assignment of contract receivables, etc. • Renewable Energy - limited or non-recourse loan payable out of project cashflows - loans can be from 10-15 years - DE Ratio: 70:30 - Security Arrangements: i. Project assets ii. Assignment of Receivables iii. Third party guarantees

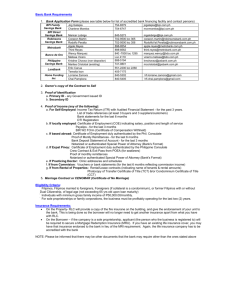

Purpose

Project : Green Resort Hotel

To achieve Global Eco Certification Technology Energy efficiency, water efficiency & waste management Investment Cost Loan Savings Php400Million (US$89 Million) Php230Million (US$5 Million) Energy: 30% ; Water: 40% ; 0% waste Savings/yr Payback 641,738 kwh/yr & 700,000 gallons of water / yr Less than 5 years

Geo-Cooling System •Natural outdoor warm air fluxes •External air inlet •Ground level air path for cooling •Cooler air chimney outlet •Apartments cross ventilation •Roof level hot air expulsion

Project: Green Building

Investment Cost Loan Energy Savings Payback Php300 Million (US$7 Million) Php180 Million (US$4 Million) 32% in air-conditioning 20% in overall consumption Less than 4 years Geo-Cooling System: 1 . Natural outdoor warm air fluxes 2. External Air inlet 3. Ground level air path 4. Cooler air chimney outlet 5. Apartment cross ventilation 6. Roof level hot air expulsion

Project: Hospital’s Solar Cooling System

Purpose Borrower Investment Cost Financing Savings Payback To reduce energy cost on HVAC system for auditorium Private Hospital Php10 Million (US$222 K) Leasing 50% = 183,000 KWh/yr Php2 Million/yr (US$36K) 6 years

Project: Municipal waste to energy

• First RDF plant with 128K MT capacity • JV between private sanitary landfill owner and technology provider • 10-yr supply contract with Cemex Investment Cost Php300 Million (US$7 Million) Fuel Production Displaced 50% of coal requirements = 41,952 MT; fuel savings Php2.1 B annually GHG Emission Reduction 19,089 tons CO2 emissions/ year

BPI Head Office Case

• Building more than 30 years old • Investment Grade Audit conducted in 2008 •Average electricity of Php7.22/kwh (US$0.16) Existing Proposed Savings HVAC: R22 3 x 418TR, 1.4 kW/TR R134a 3 x 400TR, 0.93 kW/TR Investment: Php69M (US$2M) US$ 136 K Php 6M/yr Payback: 9 years

Other BPI Support on Energy Projects

• 8MW Cabulig Run-of-river power plant Php770M • 20MW Maibarara Geothermal power plant Php900M • 2 green buildings for LEED and BERDE certification Php1.4B • Solar Rooftop System, 2 x 500kwp Php70M • 600 MW Masinloc Coal power plant US$715M • 82 MW Circulating fluidized bed coal power plants in Cebu and Iloilo

Other Energy Project Initiatives

• Government MOU for more energy efficient government buildings - piloting Esco approach for 5 government buildings - energy savings to be retained in govt. agency as payment to EEPC • Tie-up with EE vendor and Utility

9/F Ayala wing, BPI Building 6768 Ayala Avenue, Makati City Email: bpi_sef@bpi.com.ph Tel: (632) 845-5855 Fax: (632) 845-5935

mbpalou@bpi.com.ph nabiason@bpi.com.ph