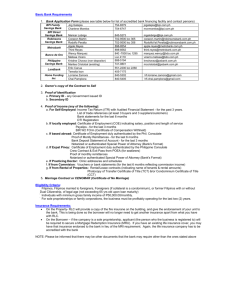

standard document cover sheet

advertisement