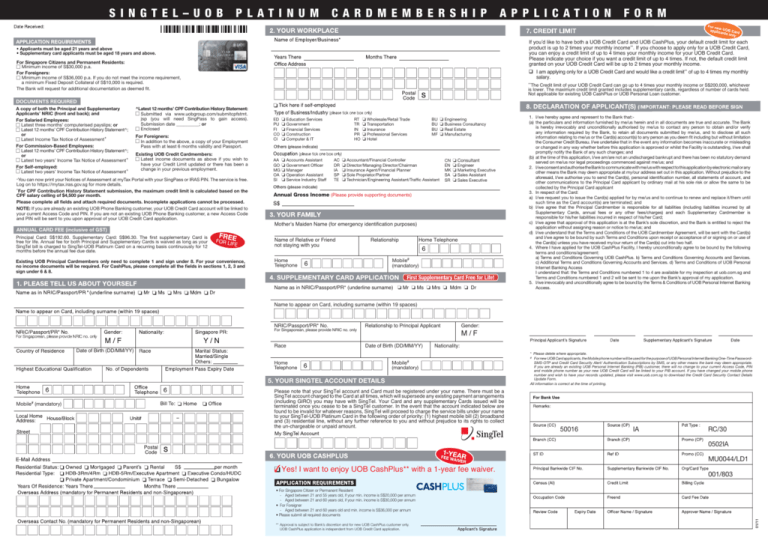

singtel–uob platinum cardmembership application form

advertisement

S INGTEL–UO B PLATI NUM CARDM EM BERSH IP A P P L IC AT IO N FO R M If you’d like to have both a UOB Credit Card and UOB CashPlus, your default credit limit for each product is up to 2 times your monthly income^^. If you choose to apply only for a UOB Credit Card, you can enjoy a credit limit of up to 4 times your monthly income for your UOB Credit Card. Please indicate your choice if you want a credit limit of up to 4 times. If not, the default credit limit granted on your UOB Credit Card will be up to 2 times your monthly income. I am applying only for a UOB Credit Card and would like a credit limit^^ of up to 4 times my monthly salary. • Applicants must be aged 21 years and above • Supplementary card applicants must be aged 18 years and above. For Singapore Citizens and Permanent Residents: cMinimum income of S$30,000 p.a. For Foreigners: cMinimum income of S$36,000 p.a. If you do not meet the income requirement, a minimum Fixed Deposit Collateral of S$10,000 is required. The Bank will request for additional documentation as deemed fit. The Credit limit of your UOB Credit Card can go up to 4 times your monthly income or S$200,000, whichever is lower. The maximum credit limit granted includes supplementary cards, regardless of number of cards held. Not applicable for existing UOB CashPlus or UOB Personal Loan customer. ^^ DOCUMENTS REQUIRED A copy of both the Principal and Supplementary Applicants’ NRIC (front and back); and For Salaried Employees: c Latest three months’ computerised payslips; or c Latest 12 months’ CPF Contribution History Statement^; or c Latest Income Tax Notice of Assessment+ For Commission-Based Employees: c Latest 12 months’ CPF Contribution History Statement^; or c Latest two years’ Income Tax Notice of Assessment+ For Self-employed: c Latest two years’ Income Tax Notice of Assessment+ ^Latest 12 months’ CPF Contribution History Statement: c Submitted via www.uobgroup.com/submitcpfstmt. jsp (you will need SingPass to gain access). Submission date __________; or c Enclosed For Foreigners: c In addition to the above, a copy of your Employment Pass with at least 6 months validity and Passport. Existing UOB Credit Cardmembers: c Latest income documents as above if you wish to have your Credit Limit updated or there has been a change in your previous employment. + You can now print your Notices of Assessment at myTax Portal with your SingPass or IRAS PIN. The service is free. Log on to https://mytax.iras.gov.sg for more details. ^ For CPF Contribution History Statement submission, the maximum credit limit is calculated based on the CPF salary celling of $4,500 per month. Please complete all fields and attach required documents. Incomplete applications cannot be processed. NOTE: If you are already an existing UOB Phone Banking customer, your UOB Credit Card account will be linked to your current Access Code and PIN. If you are not an existing UOB Phone Banking customer, a new Access Code and PIN will be sent to you upon approval of your UOB Credit Card application. ANNUAL CARD FEE (inclusive of GST) AA o Accounts Assistant GO o Government Officer MG o Manager OA o Operation Assistant SI o Service Industry Staff BU o Engineering BU o Business Consultancy BU o Real Estate MF o Manufacturing RT o Wholesale/Retail Trade TR o Transportation IN o Insurance PR o Professional Services HO o Hotel ED o Education Services PU o Government FI o Financial Services CO o Construction CI o Computer & IT AC o Accountant/Financial Controller DR o Director/Managing Director/Chairman IA o Insurance Agent/Financial Planner SP o Sole Proprietor/Partner TE o Technician/Engineering Assistant/Traffic Assistant CN o Consultant EN o Engineer MK o Marketing Executive SA o Sales Assistant SR o Sales Executive Annual Gross Income (Please provide supporting documents) Mother’s Maiden Name (for emergency identification purposes) Principal Card: S$192.60. Supplementary Card: S$96.30. The first supplementary Card is free for life. Annual fee for both Principal and Supplementary Cards is waived as long as your SingTel bill is charged to SingTel-UOB Platinum Card on a recurring basis continuously for 12 months before the annual fee due date. Name of Relative or Friend not staying with you Existing UOB Principal Cardmembers only need to complete 1 and sign under 8. For your convenience, no income documents will be required. For CashPlus, please complete all the fields in sections 1, 2, 3 and sign under 6 & 8. Home Telephone Relationship Home Telephone Mobile# (mandatory) Name as in NRIC/Passport/PR* (underline surname) o Mr o Ms o Mrs o Mdm o Dr 1. I/we hereby agree and represent to the Bank that:(a) the particulars and information furnished by me/us herein and in all documents are true and accurate. The Bank is hereby irrevocably and unconditionally authorised by me/us to contact any person to obtain and/or verify any information required by the Bank, to retain all documents submitted by me/us, and to disclose all such information relating to me/us or the Card(s) account(s) to any person as you deem fit including but without limitation the Consumer Credit Bureau. I/we undertake that in the event any information becomes inaccurate or misleading or changed in any way whether before this application is approved or whilst the Facility is outstanding, I/we shall promptly notify the Bank of any such changes; and (b) at the time of this application, I/we am/are not an undischarged bankrupt and there has been no statutory demand served on me/us nor legal proceedings commenced against me/us; and 2. I/we consent and authorise the Bank to communicate with me/us with respect to this application by electronic mail or any other means the Bank may deem appropriate at my/our address set out in this application. Without prejudice to the aforesaid, I/we authorise you to send the Card(s), personal identification number, all statements of account, and other communications to the Principal Card applicant by ordinary mail at his sole risk or allow the same to be collected by the Principal Card applicant 3. In respect of the Card: a) I/we request you to issue the Card(s) applied for by me/us and to continue to renew and replace it/them until such time as the Card account(s) are terminated; and b) I/we agree that the Principal Cardmember is responsible for all liabilities (including liabilities incurred by all Supplementary Cards, annual fees or any other fees/charges) and each Supplementary Cardmember is responsible for his/her liabilities incurred in respect of his/her Card; c) I/we agree that approval of this application is at the Bank’s sole discretion, and the Bank is entitled to reject the application without assigning reason or notice to me/us; and d) I/we understand that the Terms and Conditions of the UOB Cardmember Agreement, will be sent with the Card(s) and I/we agree to be bound by such Terms and Conditions upon receipt or acceptance of or signing on or use of the Card(s) unless you have received my/our return of the Card(s) cut into two half. 4. Where I have applied for the UOB CashPlus Facility, I hereby unconditionally agree to be bound by the following terms and conditions/agreement: a) Terms and Conditions Governing UOB CashPlus. b) Terms and Conditions Governing Accounts and Services. c) Additional Terms and Conditions Governing Accounts and Services. d) Terms and Conditions of UOB Personal Internet Banking Access I understand that: the Terms and Conditions numbered 1 to 4 are available for my inspection at uob.com.sg and Terms and Conditions numbered 1 and 2 will be sent to me upon the Bank’s approval of my application. 5. I/we irrevocably and unconditionally agree to be bound by the Terms & Conditions of UOB Personal Internet Banking Access. Name to appear on Card, including surname (within 19 spaces) NRIC/Passport/PR* No. Relationship to Principal Applicant Race Date of Birth (DD/MM/YY) For Singaporean, please provide NRIC no. only Home Telephone M/F Nationality: Mobile# (mandatory) 5. Your singtel account details Mobile# (mandatory) Please note that your SingTel account and Card must be registered under your name. There must be a SingTel account charged to the Card at all times, which will supersede any existing payment arrangements (including GIRO) you may have with SingTel. Your Card and any supplementary Cards issued will be terminated once you cease to be a SingTel customer. In the event that the account indicated below are found to be invalid for whatever reasons, SingTel will proceed to charge the service bills under your name to your SingTel-UOB Platinum Card in the following order of priority: (1) highest mobile bill (2) broadband and (3) residential line, without any further reference to you and without prejudice to its rights to collect the un-chargeable or unpaid amount. * Please delete where appropriate. # For new UOB Card applicants, the Mobile phone number will be used for the purpose of UOB Personal Internet Banking One-Time PasswordSMS-OTP and Credit Card Security Alert/ Authentication Subscriptions by SMS, or any other means the bank may deem appropriate. If you are already an existing UOB Personal Internet Banking (PIB) customer, there will no change to your current Access Code, PIN and mobile phone number as your new UOB Credit Card will be linked to your PIB account. If you have changed your mobile phone number and wish to have your records updated, please visit www.uob.com.sg to download the Credit Card Security Contact Details Update Form. All information is correct at the time of printing. 50016 IA RC/30 0502IA MU0044/LD1 Yes! I want to enjoy UOB CashPlus** with a 1-year fee waiver. 001/803 • For Singapore Citizen or Permanent Resident - Aged between 21 and 55 years old, if your min. income is S$20,000 per annum - Aged between 21 and 60 years old, if your min. income is S$30,000 per annum • For Foreigner - Aged between 21 and 60 years old and min. income is S$36,000 per annum • Please submit all required documents **Approval is subject to Bank’s discretion and for new UOB CashPlus customer only. UOB CashPlus application is independent from UOB Credit Card application. 01/11 Date of Birth (DD/MM/YY) Gender: UOB Credit Cards Funds Transfer Application Form Yes, I want to enjoy UOB Credit Card Funds Transfer at 0% p.a. (Please tick ONE box only.) Approved Funds Transfer Amount o o # Tenor Processing Fee EIR# S$10,000 or more 6 months 1.5% 3.21 % p.a. S$5,000 to less than S$10,000 6 months 2.0% 4.28 % p.a. S$500 to less than S$5,000 6 months 2.5% 5.34 % p.a. S$500 or more 12 months 5.0% 5.77 % p.a. The effective interest rate (EIR) is calculated based on an approved funds transfer amount of S$10,000 with 3% monthly minimum payment and full payment of the funds transfer amount outstanding at the end of the promotional period. Effective interest rate is subject to compounding if the monthly finance charges are not paid in full. NRIC/Passport No. Bank to transfer to UOB Credit Card Funds Transfer Terms And Conditions Please read these Terms and Conditions carefully. A Principal Cardmember (“Applicant”) may, subject to the Terms and Conditions herein, apply to transfer the funds from his/her UOB Credit Card account to his/her bank/credit card/credit line account(s) held with any bank in Singapore (“Funds Transfer”), under the UOB Credit Card Funds Transfer promotion (“Promotion”). 1. The Funds Transfer facility shall only be available to Principal Cardmembers and cannot be deposited into any account with an overdraft facility held with United Overseas Bank Limited (the “Bank”). 2. The approved Funds Transfer amount (“Approved Amount”) is subject to the outstanding balance on the Applicant’s UOB Credit Card account(s), including amounts transferred, processing fees (if any) and service fees chargeable (where applicable) provided such amount does not exceed the available permanent combined credit limit of all the Applicant’s UOB Credit Card account(s). 3. The Bank may, on its approval of each Funds Transfer application, open an account in the name of the Applicant and credit the Approved Amount to this account. The Bank shall not credit the Approved Amount to any third party account or an account that is denominated in a currency other than Singapore dollars. 4. Should the amount that the Applicant request to transfer together with any processing fee charged (if any), exceed the available credit limit on his/her UOB Credit Card account(s) at the time of the application, the Approved Amount to be transferred will be determined by the Bank at its sole discretion and its decision shall be final and binding. 5. The promotional interest rate (“Promotional Interest Rate”) is applicable only to the Approved Amount and not to existing outstanding balances or amounts subsequently incurred on the Applicant’s UOB Credit Card account(s). The Promotional Interest Rate is valid from the date the Bank approves the Funds Transfer request (“Promotion Period”) and ends when the Approved Amount is fully paid or on the last day of the promotional tenor, whichever is earlier. Thereafter, the prevailing interest rate of 24% p.a. shall apply or such other rates as the Bank may stipulate from time to time at its absolute discretion. 6. This Promotion is set up as a funds transfer account (“Account”) in the Applicant’s UOB Credit Card account. All payments received by the Bank shall be applied in any manner or order of priority at the Bank’s sole discretion notwithstanding any requests of appropriation by the Applicant or any other person making such payment on behalf of the Applicant. The Bank has the absolute right to apply payments received by it in the following manner: • All unpaid interest, fees and charges, outstanding funds transfer balances shown in any previous statement(s) of account(s). • All unpaid interest, fees and charges, outstanding funds transfer balances shown in the current statement of account(s). Payments made to the Account in the Applicant’s UOB Credit Card account(s) will reduce the most recent outstanding funds transfer amount transferred pursuant to this Promotion (after it has been reflected in the Applicant’s statement of account) before reducing any other outstanding funds transfer amount or existing balances or amounts subsequently incurred. 7. The Bank shall ordinarily require a minimum of five business days (excluding Saturdays) to process the Funds Transfer request or such other period as the Bank may determine from time to time at its sole discretion. 8. The Applicant shall continue to make payment until his/her selected bank/credit card/credit line account(s) has been credited. The Bank bears no responsibility for any overdue payment or interest incurred arising from any delay in the Funds Transfer. In addition, any charges, fees, interest or losses incurred by the Bank in connection with the Applicant’s Funds Transfer, including without limitation, any fees and charges howsoever imposed by the bank or financial institutions of the Applicant’s other bank/ credit card/credit line account(s) shall be borne solely by the Applicant. 9. The Bank reserves the right to amend, add or vary any of these Terms and Conditions at any time and from time to time without giving the Applicant prior notice. 10. The Bank’s decision on all matters relating to this Promotion and/or the Funds Transfer shall be at the Bank’s discretion and shall be final and binding on the Applicant. 11. By participating in this Promotion, the Applicant agrees to be bound by the Terms and Conditions herein. The existing Terms and Conditions governing the UOB Cardmembers Agreement (“Credit Card Agreement”) will continue to apply. In the event of any inconsistency between these Terms and Conditions and the Credit Card Agreement, these Terms and Conditions shall prevail. Please refer to uob.com.sg for the full set of the Credit Card Agreement. 12. Upon any early repayment and/or Account closure, the Applicant will be liable for the full outstanding amount. Note: Funds Transfer amounts are not eligible for UNI$, SMART$, Cash Rewards, KrisFlyer, Asia Miles and Cash Rebates. Declaration & Agreement: By signing this application, I, the Principal Cardmember: (i) represent and warrant that all information provided by me in this application is true and complete; (ii) authorise UOB to conduct credit checks and verify information given in this application with any party without reference to me; (iii) authorise UOB to pay the above named credit issuing company/bank such amount that UOB may approve; and (iv) acknowledge and agree that the Funds Transfer shall be subject to the UOB Credit Card Funds Transfer Terms and Conditions as stated above. Source Code: TOPF03 United Overseas Bank Limited Co. Reg. No. 193500026Z Date 03/11 Principal Cardmember’s Signature (as per UOB’s record)