Blue Marble Research

Research. Events. Asset Management.

The Macro Strategist

A Synthesis of Key Global Macro Economic, Thematic, and Financial Market Trends

Vinny Catalano, CFA

May 11, 2015

Upcoming Blue Marble Research Events

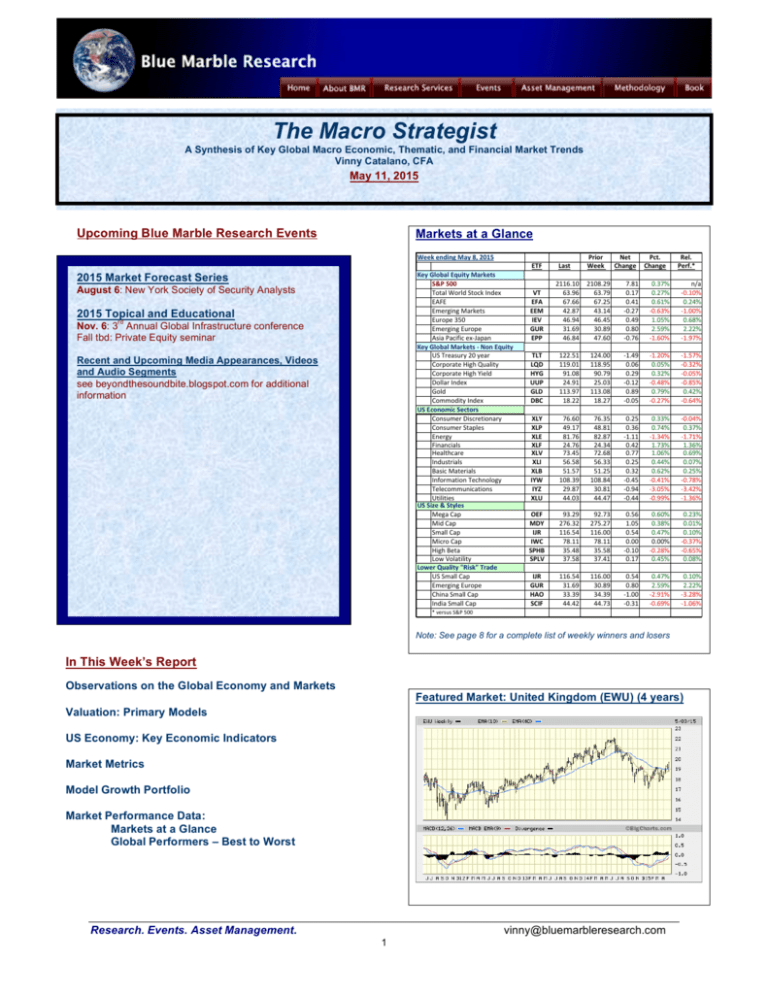

Markets at a Glance

!""#$"%&'%($)*+$,-$./01

!

D"+$E:4F*:$;GH'6+$)*3#"6?

IJ2$1//

/01.2!30425!61078!9,5:;

=>?=

=B:4CD,C!E.48:1F

=G40H:!*@&

=B:4CD,C!=G40H:

>FD.!I.7DJD7!:;<K.H.,

D"+$E:4F*:$)*3#"6?$O$54%$;GH'6+

L6!/4:.FG4M!"&!M:.4

N04H04.1:!ODCP!QG.2D1M

N04H04.1:!ODCP!RD:25

S022.4!9,5:;

T025

N0BB05D1M!9,5:;

NI$;74%4U'7$I"7643?

N0,FGB:4!SDF74:1D0,.4M

N0,FGB:4!61.H2:F

=,:4CM

?D,.,7D.2F

O:.21P7.4:

9,5GF14D.2F

U.FD7!E.1:4D.2F

9,J04B.1D0,!/:7P,020CM

/:2:70BBG,D7.1D0,F

L1D2D1D:F

NI$I'X"$J$I6+:"?

E:C.!N.H

ED5!N.H

6B.22!N.H

ED740!N.H

ODCP!U:1.

V0W!X02.1D2D1M

>4["3$PH*:'6+$\9'?#\$<3*&"

L6!6B.22!N.H

=B:4CD,C!=G40H:

NPD,.!6B.22!N.H

9,5D.!6B.22!N.H

2015 Market Forecast Series

August 6: New York Society of Security Analysts

2015 Topical and Educational

rd

Nov. 6: 3 Annual Global Infrastructure conference

Fall tbd: Private Equity seminar

Recent and Upcoming Media Appearances, Videos

and Audio Segments

see beyondthesoundbite.blogspot.com for additional

information

Y!Z:4FGF!6[I!@&&

;<=

23'43

!""#$

>*?6

5"6$

@A*%("

2768

@A*%("

9":8

2"3B8C

K<

;=L

;;)

M;K

EN9

;22

"##$%#&

$*%($

$)%$$

A"%')

A$%(A

*#%$(

A$%'A

"#&'%"(

$*%)(

$)%"@

A*%#A

A$%A@

*&%'(

A)%$&

)%'#

&%#)

&%A#

<&%")

&%A(

&%'&

<&%)$

&%*)+

&%")+

&%$#+

<&%$*+

#%&@+

"%@(+

<#%$&+

,-.

<&%#&+

&%"A+

<#%&&+

&%$'+

"%""+

<#%()+

<><

>PQ

RSE

NN2

E>Q

QT@

#""%@#

##(%&#

(#%&'

"A%(#

##*%()

#'%""

#"A%&&

##'%(@

(&%)(

"@%&*

##*%&'

#'%")

<#%A(

&%&$

&%"(

<&%#"

&%'(

<&%&@

<#%"&+

&%&@+

&%*"+

<&%A'+

&%)(+

<&%")+

<#%@)+

<&%*"+

<&%&@+

<&%'@+

&%A"+

<&%$A+

V>S

V>2

V>;

V>=

V>K

V>M

V>T

MS!

MSW

V>N

)$%$&

A(%#)

'#%)$

"A%)$

)*%A@

@$%@'

@#%@)

#&'%*(

"(%')

AA%&*

)$%*@

A'%'#

'"%')

"A%*A

)"%$'

@$%**

@#%"@

#&'%'A

*&%'#

AA%A)

&%"@

&%*$

<#%##

&%A"

&%))

&%"@

&%*"

<&%A@

<&%(A

<&%AA

&%**+

&%)A+

<#%*A+

#%)*+

#%&$+

&%AA+

&%$"+

<&%A#+

<*%&@+

<&%((+

<&%&A+

&%*)+

<#%)#+

#%*$+

&%$(+

&%&)+

&%"@+

<&%)'+

<*%A"+

<#%*$+

Y;=

)QS

MZ9

M!@

I2RT

I2>K

(*%"(

")$%*"

##$%@A

)'%##

*@%A'

*)%@'

MZ9

EN9

RLY

I@M=

$

##$%@A

*#%$(

**%*(

AA%A"

!

("%)*

")@%")

##$%&&

)'%##

*@%@'

*)%A#

##$%&&

*&%'(

*A%*(

AA%)*

!

!

&%@$

#%&@

&%@A

&%&&

<&%#&

&%#)

&%@A

&%'&

<#%&&

<&%*#

!

!

!

&%$&+

&%*'+

&%A)+

&%&&+

<&%"'+

&%A@+

&%"*+

&%&#+

&%#&+

<&%*)+

<&%$@+

&%&'+

!

&%A)+

"%@(+

<"%(#+

<&%$(+

&%#&+

"%""+

<*%"'+

<#%&$+

Note: See page 8 for a complete list of weekly winners and losers

In This Week’s Report

Observations on the Global Economy and Markets

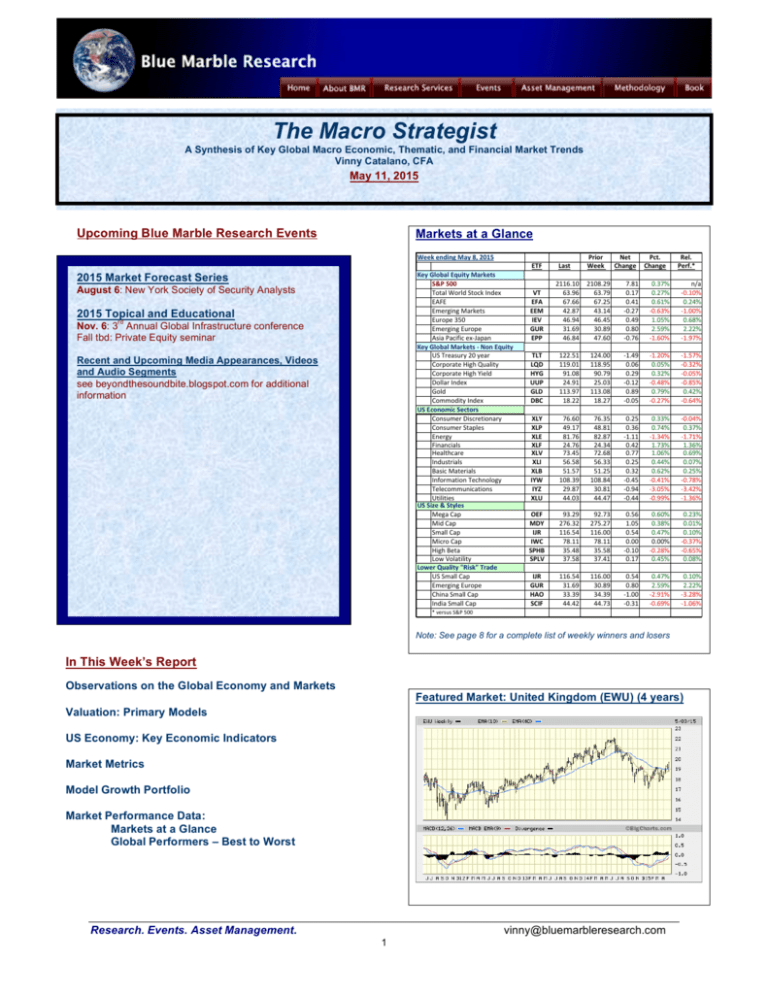

Featured Market: United Kingdom (EWU) (4 years)

Valuation: Primary Models

US Economy: Key Economic Indicators

Market Metrics

Model Growth Portfolio

Market Performance Data:

Markets at a Glance

Global Performers – Best to Worst

Research. Events. Asset Management.

vinny@bluemarbleresearch.com

1

Blue Marble Research

Research. Events. Asset Management.

Observations On The Global Economy and Markets

Conventional Thinking In Unconventional Times

“BOTH financiers and economists still get the blame for the 2007-2009 financial crisis: the first group for

causing it and the second for not predicting it. As it turns out, the two issues are connected. The

economists failed to understand the importance of finance and financiers put too much faith in the models

produced by economists.

If this seems like an ancient debate, and thus irrelevant to today's concerns, it is not. The response of

central banks and regulators to the crisis has led to an economy unlike any we have seen before, with

short-term rates at zero, some bond yields at negative rates and central banks playing a dominant role in

the markets. It is far from clear that either economics or financial theory have adjusted to face this new

reality.”

http://www.economist.com/blogs/buttonwood/2015/05/finance-and-economics

So writes The Economist in a recent commentary articulating several key aspects of those concerns

expressed in prior Blue Marble Research reports. The points noted in the commentary, along with those

related to the changed market structure and the interconnected, interdependent conditions of the global

economic and financial markets, as well as other areas of exceptional circumstances, should not be

ignored and dismissed just because earnings and interest rates tilt the valuation models toward a bullish

reading.

Now, all of this would not be an issue were it not for the fact that the most bullish among us show little to

no signs of concerns related to the current extraordinary circumstances. In the events I have conducted

and participated in and in the numerous readings and commentaries I have read, the bullish story by

some can only be described as one living in the land of sanguinity.

“Climbing a wall of worry” is the justification for the rising tide of global equities. Yet, as The Economist

commentary goes on to note, “The use of quantitative easing (QE) to stabilise economies has made it a

lot easier to service debts and indeed has prompted many to argue that deficits are irrelevant in a country

that borrows in its own currency and has a compliant central bank. Very little of the pre-crisis debt has

been eliminated; it has just been redistributed onto government balance sheets.”

Shouldn’t this be a concern on multiple levels, one that trumps the standard valuation process so many

traditionally-oriented investors rely on? Shouldn’t this (and many other exceptional factors) be taken into

account and cause one reliant on traditional financial and valuation models to have pause? For some, the

answer is yes but they are far in the minority.

Investment Strategy Implications

Last Friday’s US employment data along with the conservative party’s win in the UK virtually guarantees

a further upward run into the target 2150 to 2250 for the S&P 500, mostly like this summer. At that point,

an assessment as to the quality and strength of that run will help determine the probabilities of a serious

market correction this fall.

Until then, investors are advised to participate to the fullest extent prudently possible in the expected run

up to all-time highs in equity prices ever mindful of the extraordinary circumstances the current

environment presents and how much more risk there is embedded in it.

***

Research. Events. Asset Management.

vinny@bluemarbleresearch.com

2

Blue Marble Research

Research. Events. Asset Management.

Primary Valuation Models

Market Models: Modified Fed Equity Valuation Model, Earnings Estimates

Modified Fed Model

Current Levels

Analysis

S&P 500

2116.10 Exp. Return 11% Zone Calculation

10 Yr. Tsy

2.15%

19.57 Ave. P/E Ratio

2349 Ave. S&P 500 price level

Data as of May 8, 2015

11.00% Ave. potential return

5.14% Ave. Earnings Yield

2.15% 10 yr US Tsy rate

Earnings yield minus 10 yr US Tsy rate

2.99%

5 wk trend

1-May

24-Apr

17-Apr

10-Apr

3-Apr

S&P 500

2108.29

2117.69

2081.18

2102.06

2066.96

EY

5.16%

5.14%

5.23%

5.18%

5.26%

Wkly change

Est. Ave. P/E

-0.05%

19.57

-0.18%

-0.16%

0.15%

-0.13%

0.03%

19.50

19.59

19.25

19.44

19.12

10 yr EY-10 yr

2.12%

3.04%

1.92%

3.22%

1.85%

3.38%

1.95%

3.23%

1.90%

3.36%

The model's math

: The earnings yield is found by taking the 10 year US Treasury rate then

increasing or decreasing it progressively to achieve an 11% average expected return

which coincides with the estimated consensus operating earnings for the next 12 months.

(The est. next 12 months consensus operating earnings for the S&P 500 is $120.)

This figure is then subtracted from the current 10 yr rate to achieve the spread result

e.g. the higher the spread, the more bullish the conclusion.

Comment and Analysis

The oscillation continues with price, earnings and

interest rates pushing valuation levels above and

below the upper end of the range for strong P/E

expectations and the upper end of the range for

normal times for the earnings yield to 10 year US

Treasury rate spread.

S&P 500 operating earnings: Actual and Forecast

Quarterly

Rolling

P/E at

Yr over yr

Time Period Quarterly

12 mos current px % change

1Q12A

$25.39

2Q12A

$25.69

3Q12A

$26.05

4Q12A

$26.36 $103.49

1Q13A

$26.62

$104.72

4.84%

2Q13A

$26.72

$105.75

4.01%

3Q13A

$27.91

$107.61

7.14%

4Q13A

$29.43 $110.68

11.65%

1Q14A

$27.60

$111.66

3.68%

2Q14A

$29.72

$114.66

11.23%

3Q14A

$30.04

$116.79

7.63%

4Q14A

$30.56 $117.92

17.95

3.84%

1Q15E

$26.73

$117.05

18.08

-3.15%

2Q15E

$28.99

$116.32

18.19

-2.46%

3Q15E

$30.39

$116.67

18.14

1.17%

4Q15E

$31.91 $118.02

17.93

4.42%

1Q16E

$28.33

$119.62

17.69

6.00%

2Q16E

$30.73

$121.36

17.44

6.00%

3Q16E

$32.21

$123.19

17.18

6.00%

4Q16E

$33.82 $125.10

16.92

6.00%

A = actual, E = estimated

Annual

2012

$103.49

2013

11.65%

$110.68

2014E

3.84%

$117.92

2015E

4.42%

$118.02

2016E

6.00%

$125.10

Yr end to

yr end

% change

6.95%

6.54%

0.08%

6.00%

Note: Earnings estimates for 2014 and 2015 are based on projections provided by

S&P Capital IQ. Estimates for 2016 are made assuming an 6% year over year growth rate.

Conclusion

Friday’s US employment data along with the UK election results helped push valuation levels back to the

higher end of their valuation ranges. And so it goes – provided earnings do deliver as the year

progresses, which the table below suggests is embedded in the thinking of many investors in the mid and

small cap areas.

***

Featured table: US Size Earnings Growth Expectations

Research. Events. Asset Management.

vinny@bluemarbleresearch.com

3

Blue Marble Research

Research. Events. Asset Management.

Macro Economic Analysis: Pulse of the US Economy

!"#$%&$'()*)+,($-*.,(/0)12

%&$'()*)+,($3""4$56"/.7$8/#$99$:$8/#$9;<$=>9;

B)*2"*2C2

B)*2"*2C2$D/*E"

F1,)1

#

#

#

8)*./#<$8/#$99<$=>9;

!"#$%&"'#()#*+","$-+#-,.-+%/"'0#%'*#*12*+/*.

G@<A#

#

GH<?##/"#G@<H#

#

GH<B#

#

A<B#>

A<H#>

A<;#>

A<=#>

6A<B#>#/"#A<P#>

A<;#>#/"#A<K#>

6A<B#>#/"#A<?#>

6A<?#>#/"#;<A#>

A<G#>

A<=#>

A<;#>

6A<?#>

K6C12./#<$8/#$9@<$=>9;

I'".F+*'#I'-+*#C,.*1#6#3-,%E#W*$%,.X#787#+9%,:*

I'".F+*'#I'-+*#C,.*1#6#3W#*1#M"".#%,.#*,*':4

IIC#6#3W#*1#M"".Y#*,*':4#Z#/'%.*#0*'J-+*0

A<B#>

A<;#>

A<B#>

6A<;#>#/"#A<=#>

A<A#>#/"#A<B#>

A<;#>#/"#A<B#>

A<B#>

A<B#>

A<B#>

R1,./#<$8/#$9;<$=>9;

C,.F0/'-%E#I'".F+/-",#6#787#+9%,:*

U%2%+-/4#(/-E-\%/-",#O%/*#6#[*J*E

7%,FM%+/F'-,:#6#787

U",0F$*'#)*,/-$*,/#LO*F/*'08(#"M#7-+9N

A<A#>

KP<=#>

A<B#>

GH<P#

6A<?#>#/"#A<=#>

KP<;#>#/"#KP<K#>

A<A#>#/"#A<=#>

G?<H##/"#GP<A#

6A<@#>

KP<=#>

A<;#>

GH<G#

1+.

/

B/

B/

B--

5(0C/G

B)*2"*2C2

B)*2"*2C2$D/*E"

F1,)1

F1,)1$D"H,2".

=I9$J

=I9$J

;<=#>#/"#?<@#>

A<B#>

6A<;#>

;LI@

;LIA

;LIL$

;MI;$

HK<H##/"#HG<;#

H=<A##/"#HK<H#

HG<B#

H@<H#

3".*"2./#<$8/#$M<$=>9;

!",M%'$#2'".F+/-J-/4#6#Q8Q#+9%,:*#6#)RRO

(,-/#E%T"'#+"0/0#6#Q8Q#+9%,:*#6#)RRO

:9IO$J

;I>$J

:9IO$J

@IM$J

6B<H#>#/"#6;<B#>

?<P#>#/"#H<@#>

6B<B#>

=<;#>

6B<;#>

=<B#>

K6C12./#<$8/#$L<$=>9;

U",0F$*'#U'*.-/#6#787#+9%,:*

P=>I;$Q

P9;IO$Q

V;=<A#D#/"#VBA<A#D

V;H<H#D

V;=<P#D

R1,./#<$8/#$A<$=>9;

!",M%'$#I%4'"EE0#6#787#+9%,:*

(,*$2E"4$*,/#O%/*#6#[*J*E

I'-J%/*#I%4'"EE0#6#787#+9%,:*

I%'/-+-2%/-",#O%/*#6#E*J*E

RJ*'%:*#]"F'E4#S%',-,:0#6#787#+9%,:*

RJ#^"'_`**_#6#REE#S$2E"4**0

==N<>>>$

;I@$J

=9N<>>>$

M=IA$J

>I9$J

N@I;$612

==><>>>$

;I@$J

==N<>>>$

M=IL$J

>I=$J

N@I;$612

;PAYAAA##/"#??HYAAA#

H<?#>#/"#H<H#>

;KAYAAA##/"#??AYAAA#

@B<K#>#/"#@B<K#>

A<;#>#/"#A<?#>

?=<H#9'0#/"#?=<@#9'0

;B@YAAA#

H<H#>

;BGYAAA#

@B<K#>

A<?#>

?=<H#9'0

PHYAAA#

H<H#>

G=YAAA#

@B<K#>

A<B#>

?=<H#9'0

:1);

>?@

6A

CA

DE8

(+=

DB6

6<8=

8)*./#<$8/#$@<$=>9;

3%+/"'4#5'.*'0#6#787#+9%,:*

KC"2./#<$8/#$9=<$=>9;

!3CD#)$%EE#DF0-,*00#52/-$-0$#C,.*1

#

3".*"2./#<$8/#$9N<$=>9;

O*/%-E#)%E*0#6#787#+9%,:*

O*/%-E#)%E*0#E*00#%F/"0#6#787#+9%,:*

S12"'/#I'-+*0#6#787#+9%,:*

C$2"'/#I'-+*0#6#787#+9%,:*

!"#$%&'#%(%)*#&+,-%$./&01$-$*/,&2(3*#".%$&4!'+025&6789

!"#$%&'"(&$()

*+,

*+-.

*+-/

*+0*

56%7"'8%(9"(9:9

0

,

5;'8%(9"(9:9'<%#'(+=>

3

0

4

.

?"@%A'8%(9"(9:9

B*

.

B1

B0

C""D@E'F";

B0

,

B*

B8:G:@=;$7"

B0

B,

B*

?/20$3""47$8/#$@$:$8/#$A<$=>9;

1+2

0

4

B*

B0

B-,

KC"2./#<$8/#$;<$=>9;

I7C#)*'J-+*0#C,.*1

C)7#)*'J-+*0#L,",#$%,FM%+/F'-,:N

1+-1

.

.

.

.

B-,

1+00

.

.

.

.

B-,

F%;"H'IJKLM'G"=9:#"9'#"!%#;"&'7"#9:9'"N!"O;"&'#"9:@;9P'

1+03

.

.

.

.

B-,

4+1

.

.

.

.

B-,

4+-0

.

.

.

.

B-,

4+-3

.

.

.

.

B-,

4+04

.

.

.

.

B-,

:1);

6789

A

B<

D66

(+=

D8B

8789

6<

9A

DBA

(+=

D8A

-0/

0-,

B-01

(+=

6

'

K"9:@;9'=#"'O%(9$&"#"&'=6%7"+!%9$;$7"'%#'6"@%A+(")=;$7"'6=9"&'%(';Q"$#'!%;"(;$=@'$G!=O;';%'O%#!%#=;"'"=#($()9'=(&+%#';Q"')"("#=@'"O%(%G$O'"(7$#%(G"(;P'

5@@'R%#"O=9;9'=#"';=D"('=9'%R';Q"'9;=#;'%R';Q"'A""D'=(&'(%;'=&S:9;"&'R%#'@=9;'G$(:;"'OQ=()"9P

US Economic Comment and Analysis

The second quarter erosion in the MERSI continues while the absolute level of growth remains well within

the range of slow and steady progress.

Conclusion

Slow and steady as she goes. Diffusion indices (PMI and ISM) along with the employment data show an

expanding US economy with little to no signs of meaningful deterioration.

Results may be below expectations but growth at a slower pace than expected is not a contraction.

***

Featured chart: US Personal Income (10 years)

Research. Events. Asset Management.

vinny@bluemarbleresearch.com

4

Blue Marble Research

Research. Events. Asset Management.

Market Metrics

A Weekly Scan of Key Trends and Momentum of Major Markets

Long term (4 years): EAFE (EFA) – Mega Trend positive, momentum both positive: MACD and DMI

Short term (6 months): EAFE (EFA) –Trend neutral, momentum mixed: MACD negative, DMI positive

Divergences: EAFE (EFA) versus various EU countries – Divergences minimal, Italy (EWI) and Spain

(EWP) the laggards

Research. Events. Asset Management.

vinny@bluemarbleresearch.com

5

Blue Marble Research

Research. Events. Asset Management.

Model Growth Portfolio (MGP)

Last Week’s Portfolio Performance

!""#$"%&'%($)*+$,-$./01

89%($:;7'3'"4

DE$E"C39@4$F$G%&743@'"4

"#$%&'()*+,%-)(.,#$/)0

***9(./,:

"#$%&'()*=./>:(%

***@:#A/:*"#$%&'()*=./>:(%

C$()D0

***F,:*CG&,>*H*=()I,-(%

K,$/$-,/:%

L(/:.M-/)(

***N,#.(-M

O$P&%.),/:%

***@:#A/:*O$Q)/%.)&-.&)(

***R/.()*9(%#&)-(%

N/%,-*S/.(),/:%

***@:#A/:*S/.(),/:%

O$Q#*T(-M

T(:(-#'

U.,:,.,(%

****@:#A/:*U.,:,.,(%

E7T$K93*5

=59T*5$)*@#"34

O$P,/

CVKC

C&)#>(*7J5

E'\"$F$E3+5"4

=HW*J55*X#Y*Z#:/.,:,.0

9&%%(::*2555

=&A*T#./:[*X#$D*CG&,.,(%

E29@3_G%?"@4"$:;7'3'"4

$#$(

\(.[*X#$D*CG&,.,(%

Z9%$:;7'3+$>94'3'9%4

^9BB9&'3'"4_Q*@&$[44"34

@#:P

N'd"&$G%C9B"_^7@@"%C'"4

$#$(

\(.[*\#$*CG&,.,(%

K93*5$G%?"43"&$>94'3'9%4

E+B<

I8J

I6K

I8>

LIG

I8:

G:M

I8N

I8O

GPP

I8G

G=N

>QR

I8P

)IG

GJ!

GJM

I8D

SIG

!"'(23'%(4

)#3<$

)=>

!(3<!

!(3<!

123456

43556

83556

;3?56

23556

B3556

B3556

?3556

23556

143256

;3556

183;56 153556

23556

153856

?3556

23556

23556

73256

53556

53556

1;3?56 1J3556

23756

23556

73556

13556

23556

0//<//U ,0<//U

!""#5+$6"47534

!#5+

)#3<

6"37@%

!(3<

53776 53586

53;;6

$</

53?86 535?6

13186

$</

E13786 E53116

E137J6

$</

13?76 532B6

13546 53146

237?6

$</

53886 535J6

E53426

$</

53726

$</

53426 53526

534B6

$</

E53816 E535B6

E735J6 E535?6

E53;;6 E53576

53416

$</

*

/<VVU

)=> 6"5*3'?"$>"@A9@B*%C"

!(3< )=>$H(3<$?4<$)#3$H(3<

53526

53526

53586

$</

53516

53576

535;6

$</

E535;6

E53516

E53576

$</

53146

E53126

53116

53556

535J6

$</

53576

E53526

E53516

$</

53516

$</

53556

E53526

53556

$</

E53546

53526

E53546

53516

E53516

53576

53516

$</

/<.WU

X/</YU

*

:KN$@"37@%$?4<$EF>$1//$

53526

53446

53556

53286

53556

534B6

>GZ

:N[

G:O

23556

53556

53556

13576

53416

135J6

E>8O

G!)

83556

23556

,]<//U

538J6 *

53JJ6 *

$

53556

,]<//U

=8`

23556

53?;6

53526

53826

$

53556

23556

]0<//U

53556

53556

E537?6

53526

53516

*

*

535B6

531B6

*

*

/</YU

>"@A9@B*%C"$^9Ba*@'49%4

EF>$1//$?4<$)9&"5$=@9H32$>9@3A95'9$

EF>$1//

/<VYU

6'4#$*&b743"&$@"37@%

)=>

6'4#

/<V.U

/<YY

!*N(D,$$,$D*V%%(.*S,]*/%*#Q*V>),:*17^*251J

[&b$6"3

/<c.U

EF>$1//

/<VYU

)=>

/<V.U

Z"3

X/</1U

Z"3

/</1U

Performance Data: Year to Date Returns – Absolute and Risk-adjusted

!"#$%&'()*('&+,)*(#&%'#

1234

567

7(+-$/)E,/> ?((.%@

3A34

"#$

%#&#'(

)*%+,

%#')#'(

'*/),

%#'0#'( 1)*+',

%#-%#'(

'*&/,

(#'#'( 1)*0&,

(#+#'(

)*&-,

ABC

2>I1J

)*%+,

-*)+,

'*-0,

-*/&,

'*.),

-*--,

DBC

2>I1J

'*&),

-*.),

-*).,

&*%(,

-*0-,

&*)%,

897)422

?((.%@

,K:

)*-.,

'*0),

1)*..,

'*0(,

1)*%%,

)*&0,

ABC

2>LMJ

)*-.,

'*..,

'*)),

-*0(,

-*&',

-*/+,

DBC

2>LMJ

)*/&,

-*&&,

'*&%,

&*).,

-*/(,

&*)-,

*(%:'-;()7(+<$+=>

?((.%@

ABC

"#$

2>MIJ

)*'.,

)*'.,

1)*'),

)*).,

)*'+,

)*-0,

1)*&., 1)*'-,

1)*-., 1)*%',

1)*)(, 1)*%/,

DBC

2>MIJ

)*/0,

)*(0,

)*0(,

)*&/,

)*)0,

)*)-,

Research. Events. Asset Management.

*-#.)!/0&#'(/)*('&+,)*(#&%'#

567

!

*-#.)!/0

?.%@)*(' "(':F ?.%@)*('

"#$

2>NLO

,K:

)*%+,

)*0&

)*//,

'*/),

)*0(

-*'&,

1)*+',

)*00 1'*)(,

'*&/,

)*00

'*00,

1)*0&,

)*00 1)*.(,

)*&-,

)*00

)*%-,

ABC

3>3PJ

)*//,

-*0.,

'*0%,

&*(',

-*(/,

-*.0,

897)422 ?((.%@ ABC

DBC ?.%@)*(' :%GH:

:%GH:

3>3PJ

"#$

"#$

2>I4J

'*+(,

)*-.,

)*&0, )*&0,

&*.+,

'*0),

)*%&, )*+),

-*.&, 1)*.., 1)*)/, )*0%,

%*0),

'*0(,

)*)-, )*0/,

&*0(, 1)*%%, 1)*(', )*-(,

%*'/,

)*&0,

)*)(, )*-.,

DBC

:%GH:

2>I4J

'*--,

'*/(,

'*(.,

'*/',

'*'),

'*'%,

vinny@bluemarbleresearch.com

6

Blue Marble Research

Research. Events. Asset Management.

MGP Comments

A trade off for the MGP with the absolute performance trailing the broad market by 5 basis points while

the risk-adjusted results beat the broad market by 5 basis points.

On an individual position the strong underweight in Financials had the biggest impact at -12 basis points.

All others were plus or minus a few basis points.

Model Growth Portfolio: Re-balancing

It’s hard to justify much change when performance results are satisfactory. Matching the market on an

absolute basis and beating it on a risk-adjusted one suggests the strategy in place is the appropriate one.

That being said, an increase in the overall equity exposure in anticipation of a further rise in the global

equity markets into this summer seems advisable.

Accordingly, an initial 2% position in IJR (S&P 500 small cap) is being recommended at this time.

(see item below)

***

Featured Portfolio Position: S&P 500 Small Cap (IJR)

Market Intel

From a Mega Trend perspecitve, IJR

is bullish, however, both momentum

indicators (MACD and DMI) are

neutral.

While

this

might

be

concerning, the expectation of a

further run up in equity prices should

erase the weak momentum trends.

Valuation

IJR has a slightly above market P/E of

21, which is not surprising given the

growth expectations (see page 3) and

risk profile of the sector.

Risk

IJR has an above market beta of 1.11, again consistent with the higher growth and risk profile for the

sector.

Dividend Yield

The modestly below market dividend yield at 1.31% versus the S&P 500’s 1.91% is a pleasant surprise.

Conclusion

IJR is a good summer run-up to all-time highs play with many US domestic traders comfortable with the

idea of being in a US centric sector with above expectations in growth and a strong US dollar

environment.

Research. Events. Asset Management.

vinny@bluemarbleresearch.com

7

Blue Marble Research

Research. Events. Asset Management.

Market Data: All Markets Weekly Performance – Best to Worst

Note: All indices listed should be assumed to be US related unless obviously otherwise. All results are price based only and in US dollars.

!

3

.

G

2

D

0

@

!1

!!

!!3

!.

!G

!2

!D

!0

!@

-1

-!

--3

-.

-G

-2

-D

-0

-@

31

3!

333

3.

3G

32

3D

30

3@

.1

.!

..3

..

.G

.2

.D

.0

.@

G1

G!

GG3

G.

GG

G2

GD

G0

G@

>?

2!

223

2.

2G

22

2D

20

2@

D1

D!

DD3

D.

DG

!"#$%"&'()*#)+(),

2(,/&/#&3#),/&

"#$%#&'()

56%7)689(#$8*#&:;<

?)AB:)685)'

>6A&:#)A(E&8*#&:;<

H&I(J%

K:)L(6

*N&:;(#;8*B:%O&

>B'A:()

QR(6&

K(%A&JR

K:)L(68TN)668Q)O

*N&:;(#;8U)A(#8>N&:(J)

C#(A&$8V(#;$%N

>;:(7B'(#&''

K:(A('R8W%B#$

U)A(#8>N&:(J)8.1

T(6E&:

PB''()

=(#)#J()6'

P&;(%#)68K)#Y'

S%N&7B(6$&:'

>;:(JB6AB:&8"#$&I

5:&&J&

T[&$('R8V:%#)

":&6)#$

K:%Y&:8+&)6&:'

*)'A&:#8*B:%O&

T%J()68H&$()

5&:N)#<

"#'B:)#J&

>B'A:)6()#8+%66):

56%7)68=(#)#J()6'

56%7)68Q%#'BN&:8TA)O6&'

S&)6ARJ):&8W:%E($&:'

U):;&8Q)O\8+%[8"#$B'A:()6'

Q6%B$8Q%NOBA(#;

"#E&:'&88CT8Z:&)'B:<

S&)6ARJ):&

*B:%O&83G1

"#$()

WR):N)J&BA(J)6'

P&A)(6(#;

^)O)#

P&)68*'A)A&

H&$(J)68+&E(J&'

"#A&:#&A

"A)6<

P&)68*'A)A&

5%6$

Q%#'BN&:8TA)O6&'

T[&$&#

ZB:Y&<

56%7)68H)A&:()6'

*>=*85:%[AR

?&A[%:Y(#;

TN)668Q)O85:%[AR

P&)68*'A)A&

K)'(J8H)A&:()6'

56%7)68CA(6(A(&'

4@64

T%`A[):&

P&)68*'A)A&

H&;)8Q)O

H($8Q)O85:%[AR

PB''&668-111

Q)#)$()#8+%66):

U):;&8Q)O8X)6B&

>&:%'O)J&8a8+&`&#'&

TN)668Q)O

T%6):8*#&:;<

TaW8G118U%[8X%6)A(6(A<

TaW8U%[8X%6)A(6(A<

"#$B'A:()6'

CT8b8TaW8G11

H&A)6'8)#$8H(#(#;

456

*"+,

=>?

C?5

5*F

*99

*9M

5CP

*9,

*QS

"KK

KP=

5HU

*9C

H,,

=FK

"U=

TUX

PTF

FU=

">Z

FSK

+K>

5P*V

=FT

*"PU

">"

*TP

T,QU

*95

">V

=F>

"F5

VF"

"S=

+">

TV]]

ZK=

FUX

"*X

W"?

"S*

FPZ

*9^

P9P

"S"

=+?

*9"

P*M

5U+

FUW

*9+

ZCP

HF"

*=5

=!.

"^Z

X?_

FUK

^F"

46@

=!G

"]P

,*=

"^V

"9H

=FQ

"X*

"Z>

"^P

V9Z

TWUX

TWUX

FU"

TW]

FH*

7%,/

25.70

12.07

14.13

63.50

59.97

37.19

31.69

17.45

43.65

352.14

18.30

53.30

19.65

57.04

151.66

32.91

15.76

20.24

24.76

35.43

35.80

22.36

12.65

119.80

40.16

43.24

20.36

20.18

30.38

50.16

79.33

59.72

94.44

130.62

181.85

30.99

25.39

73.45

46.94

21.52

172.45

99.17

13.14

90.62

118.90

67.10

15.63

60.08

113.97

49.17

34.42

47.15

60.71

73.50

38.87

128.11

80.48

51.57

47.83

67.66

100.88

76.36

93.29

169.95

122.64

82.22

95.16

121.75

116.54

86.85

37.58

37.58

56.58

211.62

28.64

')-#)

.(/&

'0/1

3((8& 9:%;<( 9:%;<(

-./0.

1/02

3/.24

!!/20

1/3@

3/3.4

!3/D!

1/.3/124

2!/D!/D0

-/004

G0/33

!/2.

-/0!4

32/-!

1/@0

-/D!4

31/0@

1/01

-/G@4

!D/1.

1/.!

-/.!4

.-/2.

!/1!

-/3D4

3../11

0/!.

-/3D4

!D/00

1/.-/3G4

G-/!1

!/-1

-/314

!@/-1/.3

-/-.4

GG/00

!/!2

-/104

!.0/G0

3/10

-/1D4

3-/-@

1/2!/@-4

!G/.D

1/-@

!/0D4

!@/0D

1/3D

!/024

-./3.

1/.!/D34

3./03

1/21

!/D-4

3G/-G

1/GG

!/G24

--/11/3.

!/G.4

!-/.D

1/!0

!/..4

!!0/!1

!/D1

!/..4

3@/2!

1/GG

!/3@4

.-/2D

1/GD

!/3.4

-1/1@

1/-D

!/3-4

!@/@1/-2

!/3!4

31/11

1/30

!/-D4

.@/G2

1/21

!/-!4

D0/.!

1/@!/!D4

G@/1.

1/20

!/!G4

@3/30

!/12

!/!.4

!-@/-!

!/.!

!/1@4

!D@/@1

!/@G

!/104

31/22

1/33

!/104

-G/!1/-D

!/1D4

D-/20

1/DD

!/124

.2/.G

1/.@

!/1G4

-!/31

1/-!/134

!D1/2@

!/D2

!/134

@0/-1

1/@D

1/@@4

!3/11/!1/@-4

0@/0!

1/0!

1/@14

!!D/0D

!/13

1/0D4

22/G.

1/G2

1/0.4

!G/G1

1/!3

1/0.4

G@/G@

1/.@

1/0-4

!!3/10

1/0@

1/D@4

.0/0!

1/32

1/D.4

3./!0

1/-.

1/D14

.2/03

1/31/204

21/31

1/.!

1/204

D3/1!

1/.@

1/2D4

30/21/-G

1/224

!-D/-@

1/01/2.4

D@/@0

1/G1

1/234

G!/-G

1/31/2-4

.D/G.

1/-@

1/2!4

>A1BC

?1DE

?1>EF

!11/-D

1/2!

1/2!4

DG/@1

1/.2

1/2!4

@-/D3

1/G2

1/214

!20/@G

!/11

1/G@4

!-!/@D

1/2D

1/GG4

0!/D0

1/..

1/G.4

@./22

1/G1

1/G34

!-!/!2

1/G@

1/.@4

!!2/11

1/G.

1/.D4

02/.G

1/.1

1/.24

3D/.!

1/!D

1/.G4

3D/.!

1/!D

1/.G4

G2/33

1/-G

1/..4

-!1/D1/@1

1/.34

-0/G1/!1/.-4

!"

!!

!@

!6

@7

!"

@K

@?

@8

@4

@"

@!

@@

@6

67

63

6K

6?

68

64

6"

6!

6@

66

377

373

37K

37?

378

374

37"

37!

37@

376

337

333

33K

33?

338

334

33"

33!

33@

336

3K7

")"

3KK

3K?

3K8

3K4

3K"

3K!

3K@

3K6

3?7

3?3

3?K

3??

3?8

3?4

3?"

3?!

3?@

3?6

387

383

38K

38?

388

384

38"

38!

38@

386

347

Research. Events. Asset Management.

#$%&'()$*(+%,-./

:;<='$%

A$*$B'C'(D'B

GHI()$*

L=$<M%,<M(N$CC'.(O&%CP

#$%&'((

J,-(R%$BC*,%.C

),BC;O'%(JHC<%'.H,B$%S

TH&/(DH'=I

2$.'%(>'C,;%<'C

R,.$=(2,%=I(W.,<M(0BI'X

TH&/(DH'=I

WO$==()$*(1$=;'

U%HY$.'(Z[;H.S

W*$HB

W-HCC(E%$B<

G'.$=C(R,.$=(>'.;%B

E%$B<'

VH=

GHI()$*(1$=;'

ZO'%&HB&(G$%M'.C(L,BI

+=,_$=(0B`,(R'</

W.''=

0BY'C.O'B.(+%$I'(),%*5

0B`,(R'</

+=,_$=(R'='<,O

GH<%,()$*

G$=$SCH$

Z;%,aJ,==$%

),$=

)/HB$(a(>'$=(ZC.$.'

0B`,(R'</(c(R'='<,O

),OO,IH.S(0BI'X

WcU(TH&/(L'.$

ZO'%&HB&(G$%M'.C(WO$==()$*

L>0)(0BI'X

0B`,%O$.H,B(R'</B,=,&S

),**'%

U%'`'%%'IC

J,==$%(0BI'X

G'IH$

0C%$'=

R0UC

0BY'%C'(>;CC'==(K777

+=,_$=(0B`%$C.%;<.;%'

6789:;<:&=>9?8@A

T,B&(Q,B&

0BIH$(WO$==()$*

U'%;

)$B$I$

^=.%$(W/,%.(L$CH<(G$.'%H$=C

W'OH<,BI;<.,%C

R$H-$B

)/HB$(a(T$=.'%(^WF(

WHB&$*,%'

W,=$%(ZB'%&S

^.H=H.H'C

ZO'%&HB&(GHI(Z$C.(c(b`%H<$

0BY'%C'(WO$==()$*

E%,B.H'%(G$%M'.C

ZO'%&HB&(bCH$(U$<H`H<

VH=(W'%YH<'

^W(R%'$C;%S(K7(S'$%

ZB'%&S

VH=(Z[;H*(c(W'%YH<'C

+,=I(GHB'%C

bCH$(U$<H`H<('XaA$*$B

Q,%'$

b;C.%$=H$

W,;./(b`%H<$

VH=(c(+$C(ZcU

)/HB$(a(WcU

)/HB$(a(ERWZdFHB/;$(K4

)/HB$(WO$==()$*

R'='<,OO;BH<$.H,BC

012

:#>

EFD

GJD

L#Q

116.43

50.26

81.16

276.32

370.04

2116.10

0DR

F#D

TD+

UTV

1R

A:Q

0AW

UWU

Z2U

EFE

>A\

Z2]

^WV

0AA

ZGL

012

W#F

#]J

345

0FU

02)

Z2G

EFZ

QV#

RbV

F#Q

JL)

WUTL

Z2F

LQE

0D2

AA)

U+F

^^U

ULW

0W#

R0U

>2G

0+E

66=

Z2T

W)0E

ZU^

Z2)

WG:

#=E

Z2R

U+A

Z2W

Rb:

F#^

+bE

WLL

E>:

+GE

V0T

R#R

F#Z

0Z\

+JF

ZUU

Z2D

Z2b

Z\b

0ZV

+F)

EF0

TbV

0D\

157.09

76.60

91.08

25.30

63.96

39.44

117.56

11.98

36.32

104.46

8.10

27.54

20.42

131.48

112.92

99.88

35.76

119.01

109.32

64.86

78.11

13.68

110.14

13.68

25.53

43.03

18.22

35.48

47.60

40.68

108.39

35.13

14.71

24.91

26.53

18.30

113.25

14.84

43.63

42.87

23.86

44.42

30.68

28.93

26.16

56.57

16.44

33.57

13.57

47.04

44.03

71.08

50.66

13.92

93.04

38.57

122.51

81.76

53.22

19.97

46.84

59.98

22.94

69.04

77.20

95.64

50.51

33.39

29.87

33456!

4757!

@75@4

K!45K!

?"@5"8

)*"(!+),

34"54K

!"5?4

675!6

K45KK

"?5!6

?65?8

33!5?3

3356"

?"5K!

3785?K

@576

K!543

K7587

3?35?!

33K5@?

665@K

?45!8

33@564

3765K!

"85@"

!@533

3?5"@

337534

3?5"6

K454!

8?537

3@5K!

?454@

8!5!4

875@8

37@5@8

?45K6

385!@

K457?

K"5"!

3@587

33?5@6

3856?

8?567

B.+"B

K857K

885!?

?7567

K6538

K"5?!

4!578

3"54@

??5@!

3?5"6

8!586

8858!

!35@3

435K7

3857@

6853K

?657K

3K8577

@K5@!

4?564

K75K!

8!5"7

"353"

K?584

!75"K

!657"

6@574

435@7

?85?6

?75@3

758"

7536

75?3

3574

3587

-+!"

754!

75K4

75K6

757@

753!

7537

75K4

757K

7574

7538

7573

757?

757K

7533

7576

757"

757K

757"

7574

7577

7577

7577

a7573

a7573

a7578

a757!

a7574

a7537

a7534

a753"

a7584

a753"

a757!

a753K

a7538

a7537

a75"8

a7576

a75K!

C(+)a753"

a75?3

a75KK

a75K3

a75K3

a758!

a7538

a75?7

a753K

a7584

a7588

a75!?

a7548

a753"

a357@

a7584

a3586

a3533

a75!?

a75?7

a75!"

a353@

a7543

a354@

a35@"

aK583

a35K6

a3577

a7568

75879

75?69

75?@9

75?@9

75?@9

(+.-/

75?"9

75??9

75?K9

75?K9

75K!9

75K49

75K39

753!9

75389

753?9

753K9

75339

75379

757@9

757@9

757"9

757"9

75749

75749

75779

75779

75779

a75739

a757!9

a753"9

a753"9

a75K!9

a75K@9

a75?39

a75?69

a75839

a75849

a758!9

a758@9

a754K9

a75489

a754"9

a75"79

a75"K9

C(+D./

a75"!9

a75"69

a75!39

a75!K9

a75@79

a75@K9

a75@89

a75@!9

a75@@9

a75649

a75669

a357K9

a35749

a35389

a35349

a35349

a35K79

a35?89

a35?49

a358@9

a35"79

a356?9

aK53!9

aK5K89

aK5?49

aK58"9

aK5869

aK5639

a?5749

vinny@bluemarbleresearch.com

8

Blue Marble Research

Research. Events. Asset Management.

Key Assumptions and Methodologies

As always: Investors are advised to take in to consideration the volatile nature of the markets. Accordingly, any portfolio adjustments

should be exercised with the greatest of care. This report is limited to a once per week publishing schedule. However, investors are

not so restricted enabling entry and exit points that, if properly implemented (e.g., sell into rallies during the first wave of a bear),

should result in better performance results.

Pick your spots to ease in and out of positions. Exploit the situation to the best of your ability. Be practical with your tactical.

Essential to all analytical tools are the key assumptions that underlie them and the methodologies employed. The

following describes the major key assumptions to the analytical tools and the methodologies employed in this report.

Macro Economic Analysis (MERSI – Macro Economic Reports Surprise Indicator)

Earnings (cash flows) are one of the key fundamental-analysis inputs upon which valuation (and therefore investment) decisions are

made. The fundamental premise of the MERSI is that, in the aggregate, current earnings expectations incorporate the consensus

view. Therefore, whenever macro economic reports come in above or below consensus expectations, economists might change

their outlook and/or earnings come in above or below expectations, which in turn will likely cause individual company analysts to

adjust that macro economic component of their industry and company forecasts thereby resulting in higher or lower earnings

forecasted and/or higher or lower expected growth rates. Since this process occurs with a meaningful lag, investors can gain a

competitive advantage by anticipating changes to earnings and/or growth rate forecasts as the above or below consensus

reports are filtered into the forecasts.

Valuation Models

The Market Derived models – DCF and Modified Fed – both use the market’s present price and attempt to derive what the

fundamentals would have to be in order to match the market’s current price level.

Note: Because the equity markets are a discounting mechanism and assuming that they are somewhat efficient, the Market Centric approach

employed by the following two valuation models starts with what the market says is fair value – which is its current price. From this investors then ask

the following questions, “Does the data and implied conclusions fit the overall analysis? What does the market say the fair value should be? Do I agree

with that conclusion?” By starting with the market, this process is, in effect, a form of reverse engineering the valuation process.

About the models: The Best Fit Market Model takes a direct and simple approach to determining valuation – take the current price level of the S&P

500 and match it against operating earnings and P/E levels (both current and future). The Modified Fed Model is a bit more complex in that it looks at

the interplay between price, earnings, and interest rates.

Modified Fed Model Key Assumptions:

1 - Equity Markets adhere to the weak form of the Efficient Market Hypothesis and are generally efficient. Therefore, on any given

day the market values itself based on its historical expected return of 11% (average of 10% and 12%).

2 - Risk is dynamic and changes according to credit spreads, volatility, and investor sentiment.

3 - Markets are dynamic and in a constant state of change. Valuation levels are, therefore, calculated daily to relfect this state of

constant change.

4 - Changes in interest rates effect valuation levels, which are reflected above in the form of the average P/E ratio.

5 - Light Blue shaded areas signify zones approximating a 12% expected/required return for large cap stocks.

Market Intelligence: Key Assumptions and Rules

Long Term Indicator: Mega Trend

Near Term Indicators

* Price relative to the 50 and 200 day moving averages

Momentum & MACD

* 50 day moving average relative to the 200 day moving average

* Momentum confirmaton/non-confirmation

* Slope of the 50 moving average and 200 day moving average

* MACD mvoing averages crossover

* Direction Guide: Deteriorating = 50 day downwardly sloped, 200 day flat to downwardly sloped; Intact = 50 and 200 day upwardly sloped or flat to upwardly sloped.

* Direction Guide: Improving = 50 day upwardly sloped, 200 day flat to upwardly sloped.

Mega Trend Moving Averages Principle

* Price relative to its 50 and 200 day exponential moving averages.

* 50 day moving average relative to its 200 day exponential moving average.

* Slope of the 50 moving average and 200 day exponential moving average.

Short Term Indicator: Slow Stochastic

* Overbought >80, Oversold <20

*Data source: Yahoo Finance. Note: Percent from moving averages may differ from that sourced from BigCharts.com, which is the primary source used

in the analysis portion above.

Usefulness of indicators

Mega Trend helps identify the longer term direction. Both near and short term indicators help with timing

***

Methodologies

Combining both fundamental and technical analysis, the report seeks to capitalize on the benefits each discipline provides.

Using its GEM (government, economy, and the markets) and Global Thematic analysis, the report is a weekly examination of the

key macro trends and themes impacting the investment markets. The research methodology provides a comprehensive approach

to investment strategy by incorporating the critical variables within each area of analysis.

The purpose of the report is to provide insights to investors and other interest parties. The investment goals of the insights are: Earn

a positive return, Minimize risk, Outperform the market.

The Macro Strategist Report predominantly employs ETFs (Exchange Traded Funds) in its Model Growth Portfolio (MGP), as they

provide the sectors and styles exposure needed to build a cost-effective diversified portfolio.

Research. Events. Asset Management.

vinny@bluemarbleresearch.com

9

Blue Marble Research

Research. Events. Asset Management.

About “The Effective Investor Report”

The Effective Investor Report is a weekly investment strategy perspective produced by Blue Marble Research and

part of the Blue Marble Research Advisory Service.

The Effective Investor Report is designed to provide investors with a guide toward sound investment strategies.

Published 48 times a year, The Effective Investor Report is available on an annual subscription basis of $250 per

year.

***

The information found within this report was prepared from data we believe to be reliable but is not guaranteed by us as being

accurate and does not purport to be a complete statement or summary of available data. Such information and any views or

opinions expressed herein are not to be considered as an offer to sell or a solicitation of an offer to buy securities of the sectors or

styles covered by this report. Opinions expressed are subject to change without notice. Past results are no indication of future

results. The portfolio recommendations contained in this report are meant as an investment guide. All investors are advised to

consult their financial advisors when making investment decisions. Some of the sectors and styles mentioned in this report are the

recipients of trends and themes that might vary from those noted in this report.

Vincent Catalano certifies that all of the views expressed in this research report accurately reflect his personal views regarding any

and all of the subject securities or issuers. Neither Vincent Catalano nor any member of his family hold positions listed in the Model

Growth Portfolio. Accounts managed by Blue Marble Research Advisory typically do hold most to all of the positions listed in the

Model Growth Portfolio. Information regarding the portfolio management services of Blue Marble Research Advisory is available

upon request. Some of the data used in this report come from various sources including but not limited to the Wall Street Journal

On-line, Big Charts, Standard and Poors, and Finance.Yahoo.com.

Note: The Model Growth Portfolio (MGP) and the S&P 500 performance data are reflected on a price change

basis only. Dividends and their reinvestment are not factored into the returns. Asset allocation decisions and

their effects are not factored into the returns. Returns are calculated on weekly chain-linked basis and may

differ from the returns calculated using other methods. Market weightings are adjusted when portfolio

changes are made. Transaction expenses and other fees are not included in the return results.

Special Note re alpha: Throughout its existence, the MGP has always maintained a below average risk level.

The alpha listed is not a risk adjusted number but the absolute return difference between the MGP and the

S&P 500. If the MGP reflected its true risk, the MGP alpha would be considerably higher than noted.

***

Copyright © 2015 Blue Marble Research Advisory. All rights reserved.

Research. Events. Asset Management.

vinny@bluemarbleresearch.com

10