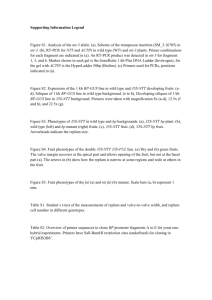

Fruits & Vegetables

advertisement