Management Discussion and Analysis

advertisement

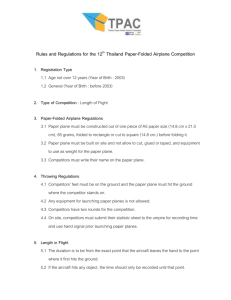

Management Discussion and Analysis For the first six-month Financial Results Ended June 30, 2011 Note: This Management Discussion and Analysis (MD&A) was made to disclose information and the vision of the management in order to assist investors to better understand the company's financial status and operation. It also supports the "Good Corporate Governance Project" of the Securities and Exchange Commission (SEC). An English version of the MD&A has been prepared from the Thai version. In the event of a conflict or a difference in interpretation between the two languages, the Thai version shall prevail. The objective of this MD&A is to present the information and the explanation of financial status and operating results as of the date hereof. However, the information provided in this MD&A may vary if any factors or situation are changed in the future; the investors are, therefore, required to have their own discretion regarding the usage of this information for any purpose. For further detail, please contact Investor Relations Section of the Electricity Generating Public Company Limited at Tel: 662-998-5145-7 or Email: ir@egco.com MD&A_6M_E_Final Management Discussion and Analysis 1. Executive Summary Significant events for the first six-month of 2011 are summarized as below: - EGCO has been awarded the lincenses for 2010 Firm Small Power Producer Cogeneration projects from Electricity Generating Authority of Thailand (EGAT) in accordance with the resolution of the Energy Regulatory Commission. The projects are TJ Cogen, TP Cogen and SK Cogen, with installed capacity of 125 MW each. - On March 1, 2011, EGCO aquired a 12.50% interest in Xayaburi Power Company Limited (Xayaburi) from CH.Karnchang Public Company Limited. Xayaburi plans to develop a 1,285 MW run-of-river hydroelectric project on the Mekong River in Laos PDR. The commercial operation date is currently scheduled for January 2019. - On March 25, 2011, EGCO completed the acquisition of an additional 26.125% interest in Quezon Power (Philippines) Limited Co. (Quezon) bringing EGCO’s total ownership interest in Quezon to 52.125%. In addition, EGCO completed the acquisition of 100% of the outstanding shares of Pearl Energy Philippines Operating Inc. (PEPOI), previously named Covanta Philippines Operating Inc. (CPOI), the entity which provides operation and maintenance services to Quezon through a long-term Operation and Maintenance Agreement. EGCO is structured as an investment holding company and has Rayong power plant, which generates and supply electricity, as an operating company (IPP1). EGCO has invested in a number of subsidiaries and joint ventures as follows: 1. Subsididiaries which can be categorized into 2 businesses: Power Generation Khanom Electricity Generating Co., Ltd. (KEGCO) IPP EGCO Cogeneration Co., Ltd. (EGCO Cogen) SPP2 Roi-Et Green Co., Ltd. (Roi-Et Green) SPP Others EGCO Engineering and Service Co., Ltd. (ESCO) O&M3 Egcom Tara Co., Ltd. (Egcom Tara) Water PEPOI O&M North Pole Investment Co., Ltd. (North Pole) Holding Co. 1 IPP: Independent Power Producer SPP: Small Power Producer 3 O&M: Operating and Maintenance 2 MD&A_6M_E_Final 2 2. Joint Ventures in Power Generation business Gulf Electric Public Company Limited (GEC) Gulf Cogeneration Co., Ltd. (GCC) Nong Khae Cogeneration Co., Ltd. (NKCC) Samutprakarn Cogeneration Co., Ltd. (SCC) Gulf Yala Green Co., Ltd. (GYG) Gulf Power Generation Co., Ltd (GPG) BLCP Power Co., Ltd. (BLCP) Natural Energy Development Co., Ltd. (NED) (Under construction) Nam Theun 2 Power Co., Ltd. (NTPC) Conal Holdings Corporation (Conal) Western Mindanao Power Corporation Southern Philippines Power Corporation Alto Power Management Coporation Quezon Holding Co. SPP SPP SPP SPP IPP IPP SPP IPP Holding Co. SPP SPP O&M IPP In addition, EGCO holds 18.72% of the outstanding shares in East Water Resources Development and Management Public Company Limited (East Water). East Water is a listed Thai company and EGCO’s position is held as long-term financial investment in marketable securities. As of June 30, 2011, EGCO, the Rayong power plant, each subsidiary and each joint venture company in EGCO’s portfolio, are hereinafter collectively referred to as EGCO Group. In total, the EGCO Group holds interests in 14 operating plants, totaling 4,417.30 MW (equity share). EGCO Group has a 12.27% market share in Thailand out of a total installed capacity of 31,446.71 MW1. Capacity of 3,861.53 MW from the Group’s operation plants is contracted with EGAT under long-term Power Purchase Agreements (PPAs). EGCO Group’s consolidated net profit for the six-month period ended June 30, 2011 was Baht 2,973 million, a decrease of Baht 1,381 million or 32% compared to the same period of last year. This is mainly due to the decline in electricity sales of KEGCO and BLCP from a lower Base Availability Credit as well as an increase of Rayong power plant’s cost of sales due to major maintenance. 1 Source: EGAT MD&A_6M_E_Final 3 2. Report and Analysis of the Operating Results This report contains the analysis of the financial statements of EGCO Group as follows: Unit : Million Baht Total Revenues Total Expenses NCI * Profit (Loss) FX Share of Profit (Loss) Net Profit EGCO and Subsidiaries Power Generation Others 6M11 6M10 6M11 6M10 3,641 4,135 348 396 (3,615) (3,337) (287) (287) (28) (44) (17) (15) (2) 754 44 94 5 20 (21) 3 754 64 73 Joint Ventrues Power Generation 6M11 6M10 2,906 2,906 3,527 3,527 Total 6M11 3,989 (3,902) (45) 42 25 2,906 2,973 % 6M10 Change 4,531 (12%) (3,624) 8% (59) (24%) 848 (95%) (21) (221%) 3,527 (18%) 4,354 (32%) *NCI is Non-Controlling Interests EGCO Group’s net profit for the first six-month period of 2011 ended June 30, 2011 was Baht 2,973 million, representing a decrease of Baht 1,381 million or 32% compared to the same period of last year. This is mainly due to the decline in KEGCO and BLCP’s electricity sales as results of its reduced Base Availability Credit (according to the PPA) as well as an increase of Rayong power plant’s cost of sales due to major maintenance. The earnings before finance costs, tax, depreciation, amortization and gain (loss) from foreign exchange (FX) (EBITDA) for the first six-month of 2011 was Baht 4,592 million, representing a decrease of Baht 1,482 million or 24% as compared to the same period of 2010, in which the EBITDA was Baht 6,075 million. The gross profit from subsidiaries was Baht 940 million, down by Baht 784 million or 45%, as a result of lower electricity sales by KEGCO and higher maintenance cost at Rayong power plant when compared to the same period of last year. Key Profitability Ratios were as follows: - Gross Profit Ratio was 25.01% - Operating Profit Ratio was 15.17% - Net Profit Ratio was 43.12% - Earnings per share (EPS) was Baht 5.65 - Return on Equity (ROE) was 5.35% MD&A_6M_E_Final 4 The net profit ratio was reported at 43.12%, lower than the same period of 2010 ratio of 54.03% mainly due to the decreases in the profit from BLCP KEGCO and Rayong power plant. 2.1 The Analysis of EGCO and Subsidiaries in Power Generation business The first six-month results of 2011 are as follows: - Total revenues were Baht 3,641 million, a decrease of Baht 494 million or 12%. - Total expenses were Baht 3,615 million, an increase of Baht 278 million or 8%. - Gain on FX was Baht 5 million. The details are as follows: Total Revenues, Total Expenses and FX: Total Revenues Total Expenses NCI Profit (Loss) FX Net Profit Unit : Million Baht EGCO Rayong KEGCO 6M11 6M10 6M11 6M10 6M11 6M10 184 150 1,153 1,298 1,164 1,529 (534) (390) (1,055) (932) (1,012) (1,053) (350) (240) 98 366 152 476 5 (345) (240) 98 366 152 476 EGCO Cogen Roi-Et Green Total 6M11 6M10 6M11 6M10 6M11 6M10 1,003 1,002 137 156 3,641 4,135 (932) (880) (82) (82) (3,615) (3,337) (13) (24) (15) (20) (28) (44) 58 98 40 54 (2) 754 2 (2) 5 58 100 40 52 3 754 - EGCO’s total revenues of Baht 184 million increased by Baht 34 million or 23% due to higher interest income and service income from joint ventures. The total expenses of EGCO were Baht 534 million, an increase of Baht 144 million or 37% mainly from higher consulting fee for project development and interest expense. - Sales of electricity were Baht 3,415 million, representing a decrease of Baht 533 million or 13%. The decrease were results of KEGCO and Rayong power plant’s electricity sales decreased by Baht 365 million and Baht 143 million, respectively, caused by a decrease in the charges for capacity payments from EGAT. These changes were in accordance with the capacity payment formula calculated on a "Cost Plus Basis" under the PPAs and in line with the company's projections. Sales of Electricity: 6M11 1,127 1,159 995 134 3,415 Rayong Power Plant KEGCO EGCO Cogen Roi-Et Green Total Sales of Electricity MD&A_6M_E_Final 5 6M10 1,270 1,524 1,000 154 3,948 Unit : Million Baht % change (11%) (24%) (0.47%) (13%) (13%) - Cost of sales totaled Baht 2,636 million, an increase of Baht 250 million or 10% from an increase of Rayong power plant’s cost of sales by Baht 207 million due to major maintenance as planned. Cost of Sales: 6M11 929 769 870 68 2,636 Rayong Power Plant KEGCO EGCO Cogen Roi-Et Green Total Cost of Sales 6M10 721 747 842 76 2,386 Unit : Million Baht % change 29% 3% 3% (10%) 10% 2.2 The Analysis of Subsidiaries in Other business The first six-month results of 2011 are as follows: - Total revenues were Baht 348 million, a decrease of Baht 48 million or 12%. - Total expenses were Baht 287 million, a decrease of Baht 0.26 million or 0.09%. - Gain on FX was Baht 20 million. The details are as follows: Unit : Million Baht Total Revenues, Total Expenses and FX: Total Revenues Total Expenses NCI Profit (Loss) FX Net Profit ESCO 6M11 6M10 147 266 (137) (220) 10 46 20 (21) 30 25 Egcom Tara 6M11 6M10 139 130 (69) (67) (17) (15) 53 48 53 48 PEPOI 6M11 6M10 62 (44) 18 (0) 18 - North Pole* 6M11 6M10 (37) (37) (37) - Total 6M11 348 (287) (17) 44 20 64 6M10 396 (287) (15) 94 (21) 73 *Major transaction in North Pole is expense of Withholding Tax of dividend incomes from foreign projects. - Service income amounted to Baht 205 million, down by Baht 57 million or 22%, resulting mostly from ESCO’s lower maintenance service income and lower spare part sales to overseas power plant totaling Baht 119 million, meanwhile, higher service income from PEPOI totaling Baht 62 million due to the acquisition and stating recognition in Q2/2011. - Cost of services was Baht 143 million, a decrease of Baht 46 million or 24% which was in accordance with the decrease in service income of ESCO. MD&A_6M_E_Final 6 2.3 The Analysis of Joint Ventures in Power Generation business Share of Profits from Joint Ventures for the fisrt six-month results of 2011 totaled Baht 2,906 million, decrease by Baht 621 million or 18%. The details are as follows: Share of Profits (Losses) incld. FX: GEC Group * GPG BLCP NED NTPC Conal Quezon Total Share of Profits (Losses) incld.FX * GEC Group consists of GCC NKCC SCC and GYG 6M11 122 703 1,145 (14) 490 68 392 2,906 6M10 186 963 1,703 (11) 289 121 276 3,527 Unit : Million Baht % change (34%) (27%) (33%) (22%) 70% (44%) 42% (18%) Share of profits (Losses) decreased mainly from - A decline in electricity sales of BLCP from a lower Base Availability Credit - GPG’s major maintenance outage. Meanwhile, - Electricity sales of NTPC increased as a result of full recogonition this period and the acquisition of an additional 10% stake in te company which was completed in September 2010, compared to the same period of last year which commercial operated in March 2010. - Share of profit from Quezon increased due to the acquisition of an additional 26.125% stake in March 2011. MD&A_6M_E_Final 7 3. Report and Analysis of Financial Position 3.1 Asset Analysis As at June 30, 2011, the total assets of EGCO Group amounted to Baht 70,866 million, an increase of Baht 3,826 million or 6% from December 31, 2010. The important details are as follows: Unit : Million Baht 80,000 70,866 70,000 67,040 Q2 2011 2010 60,000 50,000 37,464 40,000 30,712 30,000 20,000 13,780 14,796 7,933 11,402 10,000 11,689 10,130 0 Total Assets Cash,ST & LT Interests in JVEs Investment include use as collateral Property, Plant and Equip (net) Others 1) Cash and deposits at financial institutions, short-term and long-term marketable securities include use as collateral were Baht 7,933 million or 11% of the total assets, down by Baht 3,469 million or 30%. This resulted mainly from investments in subsidiaries and joint ventures of Baht 6,294 million. In addition, dividends from joint ventures and others totaled Baht 1,909 million and net cash receipts from financing activities of Baht 700 million. 2) Interests in joint ventures recorded under the equity method in the consolidated financial statements as at June 30, 2011 amounted to Baht 37,464 million or 53% of the total assets, up by Baht 6,752 million or 22%. The major change can be defined as follows: 2.1) An increase in share of profit from interests in joint ventures amounting to Baht 2,906 million. 2.2) An increase in share capital of joint ventures totaling Baht 5,938 million. 2.3) Dividends received from GEC, BLCP, Conal and Quezon by Baht 2,282 million. 2.4) Loss from translation adjustments totaling Baht 190 million. 3) Property, plant and equipment (net) totaled Baht 13,780 million or 19% of the total assets, down by Baht 1,017 millon or 7% mainly from the depreciation and amortization. MD&A_6M_E_Final 8 4) Other assets were Baht 11,689 million or 16% of the total assets, up by Baht 1,559 million or 15% mainly from an increase in the right of long-term operation and maintenance agreement (PEPOI), dividends receivable from joint ventures and trade receivables from a related party. 3.2 Liability Analysis As at June 30, 2011, EGCO Group's total liabilities were Baht 14,028 million, which was Baht 2,316 million or 20% higher than the amount as at December 31, 2010. The total liabilities consist of the following items: 1) Long-term loans and debentures totaled Baht 12,060 million, or 86% of total liabilities, up by Baht 2,500 million or 26% mainly coming from the drawdown of Baht 3,043 million in long-term loans. Meanwhile, debenture repayment of KEGCO totaling Baht 497 million and longterm loan repayments for EGCO Cogen and Roi-Et Green also occurred during the quarter. The details are as follows: - USD loan in the amount of USD 112 million - Yen loan in the amount of Yen 516 million - Baht loans in the amount of Baht 8,414 million Maturity of long-term loans and debentures as at June 30, 2011 Within 1 Year 1-5 Years > 5 Years Total EGCO 10,808 281 11,089 EGCO Cogen 201 571 772 Unit : Million Baht Roi-Et Green 39 160 199 Long-term loans are secured liabilities over land, buildings, power plants and equipment of subsidiaries. The subsidiaries were also required to maintain cash reserves as at June 30, 2011 totaling Baht 139 million for debt service obligations. 2) Other liabilities amounted to Baht 1,967 million or 14% of total liabilities, down by Baht 184 million or 9%. 3.3 Shareholders' Equity Analysis As at June 30, 2011, Shareholders' Equity amounted to Baht 56,337 million, which was Baht 1,517 million or 3% higher than the amount as at December 31, 2010. This was mainly from the net profit in the consolidated financial statements which amounted to Baht 2,973 million. Meanwhile, the dividend declared totaling Baht 1,448 million. MD&A_6M_E_Final 9 The analysis of the company's capital structure as at June 30, 2011 can be summarized as follows: Liabilities were Baht 14,028 million or 19.79% Shareholders' equity was Baht 56,839 million (include NCI) or 80.21%. Key financial ratios were as follows: - Debt to equity ratio was 0.25 times, higher than 0.21 times at the end of 2010. - Book value per share was Baht 107.01, higher than Baht 104.13 at the end of 2010. 4. Report and Analysis of Cash Flow Position Cash Flow Statement shows the change in cash flow from operating activities, investing activities and financing activities at the end of the accounting period, and indicates the ending balance of the cash and the cash equivalents. As at June 30, 2011, the ending balance of cash and cash equivalents was Baht 5,294 million, which was Baht 2,455 million lower than the amount as at December 31, 2010. The details of the sources and uses of funds are as follows: - Net cash received from operating activities totaled Baht 1,301 million. This was comprise of cash from operating activities of Baht 1,612 million and payment for working capital of Baht 311 million. - Net cash payment for investing activities was Baht 4,439 million mainly due to investment in joint ventures totaled Baht 6,294 million. Meanwhile, dividend received from joint ventures and others totaled Baht 1,909 million. - Net cash received from financing activities was Baht 700 million. This came mainly from EGCO’s debt drawdown of Baht 3,043 million. Meanwhile, the dividend payment to shareholders totaling Baht 1,495 million, the debentures repayment of KEGCO totaling Baht 497 million, the interest payments of Baht 242 million and the loan repayments for EGCO Cogen and Roi-Et Green totaled Baht 107 million. As at June 30, 2011, the company’s liquidity ratios were as follows: - Current ratio was 14.50 times, compared to 10.26 times in 2010. - Quick ratio was 6.64 times, compared to 5.59 times in 2010. MD&A_6M_E_Final 10