A Review of the Accounting Cycle

Accounting

Changes and

Error

Corrections

1

Learning Objectives

Understand the three different types of accounting changes that have been identified by accounting standard setters.

Recognize the difference between a change in accounting estimate and a change in accounting principle, and know how a change in accounting estimate is reflected in the financial statements.

2

Learning Objectives

Determine if a change in accounting principle requires a cumulative adjustment relating to its effect or a restatement of prior-periods’ financial statements, and be able to compute the necessary adjustment.

Determine when a change in reporting entity has occurred, and understand the disclosure requirements associated with this change.

3

Learning Objectives

Recognize the various type of errors that can occur in the accounting process, understand when errors counterbalance, and be able to correct errors when necessary.

Describe the differences between the

U.S. approach to accounting changes and error corrections and the international standard found in IAS 8.

4

Why Are Accounting

Changes Made?

A company, as a result of experience or new information may change its estimates of revenues or expenses.

Due to changes in economic conditions, companies may need to change methods of accounting to more clearly reflect the current economic situation.

Accounting standard-setting bodies may require the use of a new accounting method or principle.

5

Why Are Accounting

Changes Made?

The acquisition or divestiture of companies may cause a change in the reporting entity.

Management may be pressured to report profitable performance. Making accounting changes can often result in higher net income, thereby reflecting favorably on management.

6

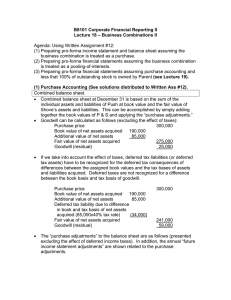

Effect of SFAS No. 106

7

Company

IBM

Gen. Electric

Bell Atlantic

PepsiCo

The Coca-Cola Company

Tiffany & Co.

One-Time Charge

(in millions)

$2,263

1,799

1,550

357

7

6

Categories of Accounting

Changes

Change in accounting estimate

Change in accounting principle

Change in reporting entity

8

Change in Accounting Estimate

• Employ current and prospective approach.

• Report current and future financial statements on new basis.

• Present prior periods as previously reported.

• Make no adjustments to current period opening balances.

• Present no pro-forma data.

9

Change in Accounting Estimate

10

Examples of areas where changes in accounting estimates often are needed:

• Uncollectible receivables.

• Useful lives of depreciable or intangible assets.

• Residual values for depreciable assets.

• Warranty obligations.

• Quantities of mineral reserves to be depleted.

• Actuarial assumptions for pensions or other postemployment benefits.

• Number of periods benefited by deferred costs.

Change in Accounting Principle

11

• Report cumulative effect on income statement after extraordinary items .

• Criteria for change: change only if the new principle is preferable:

– provides more useful information.

– is less costly per benefit.

Changes in Accounting Principle-12

Disclosure Requirements

• Report current year’s income components on the new basis.

• Report the cumulative effect of the adjustment, net of tax, on the income statement.

• Present prior period financial statements as previously reported.

• Include pro-forma information as if the change were retroactive--direct and indirect effects.

• Present earnings per share data for all prior periods presented.

Change in Accounting Principle--

Example: Basic Data

13

• AlphaTronics, Inc. has decided to change depreciation methods from double-declining balance to straight-line.

The income results are summarized as:

– Net difference

– Tax effect

– Net effect on income

$173

(52)

$121

Change in Accounting Principle--

Example: Income Statement

AlphaTronics, Inc.

Partial Income Statement

Income from continuing operations $500

Cumulative effect of change in accounting principle (net of $52 income tax effect)

Net income

121

$621

Note: pro-forma information should also be disclosed if available.

14

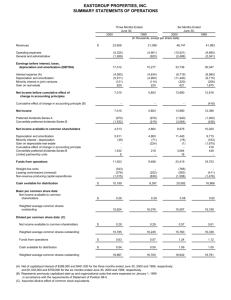

Sample Partial Income Statement

15

Income from continuing operations

Extraordinary gain, net of income taxes of $30,000

Cumulative effect on prior years of change in accounting principle--change to the straight-line method of depreciation from double-declining-balance method, net of taxes of $39,300

Net income

$560,000

70,000

91,750

$721,700

Exceptions to General

Rule--Situations

A change from LIFO method of inventory pricing to another method.

A change in the method of accounting for long-term construction contracts.

A change to or from the “full cost” method of accounting used in extractive industries.

Changes made at the time of an initial distribution of company stock.

16

Retroactive Restatement

Several FASB statements require retroactive restatement.

Adjust Retained Earnings and the prior year’s income for the effects of the change.

Pro-forma information is not required.

17

Exceptions to General

Rule--Change to LIFO

• Change to LIFO--past records often inadequate to prepare pro-formas.

• Beginning inventory becomes first LIFO layer.

• No cumulative effect adjustment is required.

18

Change of Principle and

Change of Estimate

If there is both a change in principle and a change in estimate for an item, the event is treated as a change in estimate .

19

Change in Reporting Entity

20

• Employ retroactive approach.

• Restate financial statements for all prior periods presented.

• Disclose, in year of change, effect on income from continuing operations, net income, and earning per share data for all periods presented.

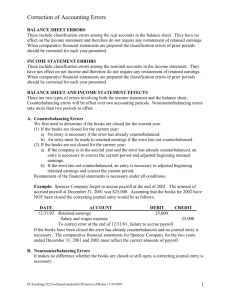

Error Correction--

Types of Errors

Errors discovered currently in the course of normal accounting procedures.

Math errors.

Posting to the wrong account.

Misstating an account.

Omitting an account from the trial balance.

21

Error Correction--

Types of Errors

Errors limited to balance sheet accounts.

Debiting Accounts Receivable instead of Notes Receivable.

Crediting Interest Payable instead of Notes Payable.

Debiting an investment account instead of Land when property was purchased for plant expansion.

22

Error Correction--

Types of Errors

Errors limited to income statement accounts.

23

Debiting Office Salaries instead of Sales Salaries.

Crediting Rent Revenue instead of Commissions

Revenue.

Error Correction--

Types of Errors

Errors affecting both income statement accounts and balance sheet accounts.

24

Debiting Office Equipment instead of Repairs Expense.

Crediting Depreciation

Expense instead of

Accumulated Depreciation.

Errors--Automatically

Counterbalanced

Errors in the income statement that are not detected are automatically counterbalanced in the following fiscal period.

25

Errors--Not Automatically

Counterbalanced

Except for merchandise, errors in the balance sheet are inaccurately stated until such time as correcting entries are made.

26

Error Correction

• If detected in current period, before books are closed:

– Correct the account through normal accounting adjustment.

• If detected in subsequent period, after books are closed:

– adjust financial records for effect of material errors.

– make adjustment directly to

Retained

Earnings.

27

Example: Error Correction

28

• In 2001, the accountant for Jackman

Enterprises, Inc. forgot to record

$5,000 of depletion at an iron mine

Jackman owns.

• Record the 2003 correcting entry.

Retained Earnings

Mineral Rights--Iron Mine

5,000

5,000

Error Correction--Disclosure

29

• If comparative statements are provided, apply correction retroactively to prior years.

• Restate beginning balance of Retained Earnings for first period presented if error extends beyond.

• Disclose and explain error correction in notes.

The End

30