23 Jan 2014 - AIMS of Bangladesh Limited

advertisement

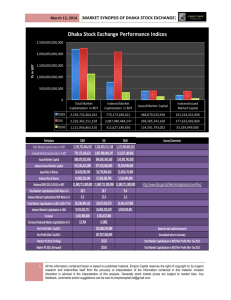

B a n g l a d e s h Weekly Market Review J a n u a r y 2 3, 2 0 1 4 DSEX & DS30 reorganized The Dhaka Stock Exchange (DSE) on January 19, 2014 restructured two price indices DSEX and DS-30 in accordance with the DSE Bangladesh Index Methodology designed and developed by Standard and Poor's (S&P). Earlier the DSE on January 28, 2013 introduced two new indices DSE Broad Index (DSEX) and DSE-30 Index (DS30) on the basis of freefloat method. DSEX replaced the DSE General Index (DGEN) while DS-30 replaced the DSE-20 index. To meet the eligibility criteria of DSEX each of the stocks must have above Tk100m float-adjusted market capitalization along with Tk1m six-month Average Daily Value Traded (ADVT) as of the rebalancing reference date. Additionally, the eligible stocks are required to trade at least half of normal trading days each month for the three months prior to the rebalancing reference date. The index will be rebalanced once in a year based on year-end closing. On the other hand, the DS30 index will be reconstituted twice in a year based on half-yearly trading performance. Stocks having Tk500m float-adjusted market capitalization, Tk5m three-month ADVT and positive net income based on latest four quarters report as of the rebalancing reference date would be eligible for this selective index. The number of constituents from the banks, financial institutions, insurance sector and real estate sub-sector is limited at 5 each and 10 combined for the DS30 index. Twenty three new companies Fareast Finance, Eastern Cables, Renwick Jajneswar, National Tubes, Bengal Windsor Thermoplastics, Bangladesh Building Systems, AMCL (Pran), Rahim Textile, Ambee Pharma, The Ibn Sina, Libra Infusions, Global Heavy Chemicals, JMI Syringes and Medical Devices, Central Pharmaceuticals, Hakkani Pulp and Paper, Samorita Hospital, Information Services Network, Purabi General Insurance, Pragati Insurance, Prime Insurance, Sunlife Insurance, Usmania Glass and Berger Paints has been included in the DSEX. With the latest inclusion total number of companies in the DSEX stand at 226. On the other hand, four existing companies Kay & Que, Midas Finance, CVO Petrochemical and Rahima Food were adjudged disqualified to remain under the index. DSE at the same time has qualified four new companies United Commercial Bank, Delta Life Insurance, Orion Pharma and Renata to join the DS30 index following the criteria developed by S&P. The companies to be excluded from this blue-chip index are Beximco, Khulna Power Company, Square Textiles and Southeast Bank. Shariah Index launched The Dhaka Stock Exchange (DSE) introduced a new index‘DSEX Shariah Index’ (DSES) on January 20, 2014. Listed companies which qualify on the basis of Islamic Shariah are included in the index. The base point of the index is 1,000. Following the standards 77 companies of different sector have been chosen for the Shariah index but their names has not been publicly without disclosed. It has been designed & developed with assistance from the Standard and Poor's (S&P). The index will be rebalanced on monthly basis as per the annual reports. Listed companies under the bourses key index, DSEX, would be eligible for the Shariah index after fulfilling the required conditions. However, exclusion from DSEX will automatically exclude a company from the DSEX Shariah Index. 755th Issue Year 16 No. 11 Banks to maintain CRR & SLR separately Bangladesh Bank (BB) has moved to ensure maintenance of the Cash Reserve Requirement (CRR) and the Statutory Liquidity Ratio (SLR) separately by the commercial banks aiming to facilitate effective implementation of its monetary policy. BB issued a directive in this regard under the Bank Company (Amended) Act 2013, asking all banks to maintain the CRR and SLR separately in a new prescribed format from February 01, 2014. The day-end balance of the account maintained with BB in the Bangladesh Taka is considered as the CRR. According to the rules, banks are allowed to maintain the CRR at 5.50% on daily basis of the average total demand and time liabilities (ATDTL), but the bi-weekly average has to be 6% of the same ATDTL. Every schedule banks has to maintain the SLR in the form of assets in cash or gold or in the form of un-encumbered approved securities, the market value of which shall not be less than such portion of its total demand and time liabilities as prescribed by the central bank from time to time. From February 01, 2014, conventional banks will have to maintain SLR at 13% daily while the Shariah-based Islamic banks and Islamic Shari'ah-based banking of conventional banks will have to maintain 5.50% SLR of their average total demand and time liabilities. For the purpose of maintenance of CRR and SLR, demand and time liabilities will include all on-balance sheet liabilities excluding paid-up capital and reserves; loans taken from BB; credit balance in profit and loss account; inter-bank items; repo, special repo and any kind of liquidity support taken from the central bank. The banks will have to submit the monthly statements of maintenance of the CRR and the SLR in the newly prescribed formats to the Department of Off-site Supervision (DOS) within the 10th of the following month. Penal interest (bank rate plus 5%) and penalty will be charged according to the instructions of Bangladesh Bank Order, 1972 and the DOS directive for CRR related issues. On the other hand, penalty will be charged at the prevailing special repo rate on the amount by which the SLR falls short daily. NSE India ranked top globally The National Stock Exchange (NSE) of India retained its position as the world's largest bourse among 51 peers in terms of number of equity trades for the second consecutive year in 2013, according to World Federation of Exchanges (WFE). Shenzhen Exchange of China overtook the New York Stock Exchange (NYSE) as the second largest bourse. Another Chinese bourse, the Shanghai Stock Exchange, moved up to fourth place from sixth in 2012, while the Nasdaq dropped two places to fifth. Others in the top 10 include Korea Exchange (6th), Japan Exchange Group-Tokyo (7th), BSE, India (8th), Canada's TMX Group (9th) and London SE Group (10th). Lock-in relaxed for bonds In order to make the bond market vibrant and attractive the government has withdrawn the one-year lock-in period existing for foreign investors. Earlier the Bangladesh Government Treasury Bonds (BGTBs) purchased by a foreign investors or Non-Resident Bangladeshi (NRB) could not be resold within one year of purchase. Removal of the cap would generate overseas interest on the local bonds, it is expected. Foreign investors, particularly institutions, have invested around Tk9b in BGTBs since April 2013 through Standard Chartered Bank. ASSET & INVESTMENT MANAGEMENT SERVICES OF BANGLADESH LIMITED Unique Trade Center (UTC), Level 6 (SW), 8 Panthopath, Karwan Bazar, Dhaka 1215, Bangladesh Tel : +(880-2) 913 6432–4 (Three Lines), Fax : +(880-2) 913 6162–3 (Two Lines) e-mail : hello@aims-bangladesh.com; web: http://www.aims-bangladesh.com The week’s data runs 16 January to 23 January 2014 Stock Market Movement This Week Last Week +/- % PE 1790.29 1838.70 -2.63 18.4 6663.74 6829.30 -2.42 14.5 15391.56 15734.46 -2.18 16.6 21133.56 21063.62 0.33 15.1 27002.89 26913.85 0.33 12.9 This Week Last Week +/- % 4702.66 4519.36 4.06 36,983,350,701 26,067,607,206 41.87 2,264,529,015,053 2,176,121,356,319 4.06 217 216 74 72 8 10 Global Markets S&P 500 FTSE 100 Nikkei 225 SENSEX KSE 100 DSE Indicators DSE Broad Index Total Turnover, Tk Market Capital, Tk No of Issue Gain No of Issue Loss No of Unchanged Issues Top Gainers Weighted avg. Closing Price (Tk) Last Week Company ICB AMCL Islamic MF IPDC IFIL Islamic MF 18.60 20.00 6.10 108.90 122.00 120.90 105.70 42.50 5.90 5.60 Prime Islami Life Ins. Progressive Life Ins. Meghna Life Ins. Dutch Bangla Bank Northern Gen. Ins. ICB Emp. Prov. MF Prime Bank 1st MF Top Losers This Week 23.00 24.30 7.40 129.60 144.50 142.70 124.40 49.90 6.90 6.50 Change % 23.66 21.50 21.31 19.01 18.44 18.03 17.69 17.41 16.95 16.07 Turnover (Tk) 19,417,000 76,718,000 52,509,000 75,207,000 36,709,000 237,319,000 93,161,000 124,351,000 14,769,000 17,710,000 Weighted avg. Closing Price (Tk) Last Week This Week Change % Turnover (Tk) 134.40 16.00 10.00 11.20 10.20 9.60 9.90 1009.90 72.60 39.90 98.30 12.90 8.10 9.30 9.00 8.60 8.90 911.10 65.80 36.80 -26.86 -19.38 -19.00 -16.96 -11.76 -10.42 -10.10 -9.78 -9.37 -7.77 166,952,000 7,495,000 1,815,000 2,343,000 850,000 158,000 131,000 1,394,000 347,397,000 793,656,000 Company Rupali Life Ins. Meghna Condensed Meghna PET Imam Button Dulamia Cotton Shyampur Sugar Zeal Bangla Sugar Stylecraft Bangladesh Building Appollo Ispat Sectoral Index & Turnover Sectoral Index Turnover (Tk.M) Sector This Week Bank Cement Ceramic Engineering Food & Al. Fuel & Pow. Insurance IT Jute Misc. Mutual Fund NBFI Paper Pharma Service Tannery Telecom Textile Travel & Leis. 402.88 355.08 599.31 1664.71 1895.75 3143.19 1416.72 220.54 380.58 731.10 562.33 1281.98 368.83 979.79 902.08 733.91 2301.63 1317.73 758.04 Last Week 391.57 330.82 578.74 1649.52 1887.08 3050.34 1382.13 215.85 376.41 720.16 526.35 1237.68 374.37 927.34 881.49 716.89 2262.63 1245.66 745.68 Change Change This Week Last Week % % 2.89 7.33 3.56 0.92 0.46 3.04 2.50 2.17 1.11 1.52 6.84 3.58 -1.48 5.66 2.34 2.37 1.72 5.79 1.66 3412.22 2241.18 191.70 4867.85 953.47 5165.52 3436.56 350.65 11.00 766.77 1335.04 3223.11 5.22 3450.45 159.34 1029.84 979.40 4257.94 952.66 2154.43 58.38 1280.83 74.98 157.84 21.45 5360.26 -9.19 893.13 6.76 2971.18 73.85 1685.22 103.92 259.33 35.21 8.51 29.23 554.85 38.19 543.55 145.61 1804.15 78.65 4.57 14.20 2938.84 17.41 132.47 20.28 588.28 75.06 660.59 48.26 3276.57 29.95 478.03 99.29 Technical Talk The stock market is continuing with the upbeat mood, the fourth week in a row. Out of its five trading sessions, market went down in only one session while gained in four trading sessions. The benchmark general index DSEX, touched a new high since the January 28, 2013 launch to hit 4702.66 on January 23, 2014. Last week DSE introduced a new index‘DSEX Shariah Index’ (DSES). Mozaffar Hossain Spinning Mills Limited made its debut on January 21, 2014 with Tk40 open price; it traded within Tk40-48 band on that day and closed at Tk45.30. DSE Broad Index (DSEX) reached at 4702.66 points increased by 183.30 points or 4.06% from the previous week. Total turnover reached at Tk36983.35m with 41.87% increase from the last week’s Tk26067.61m. On the other hand, market capitalization increased by 4.06% and stood at Tk2264.53b ($29.26b) at the weekend against Tk2176.12b. DSE-30 has moved upward by 71.32 points (4.48%) and closed at 1664.01 points against 1592.78. Last week’s weighted average Market PE was 16.61 which was 4.04% higher than previous week’s 15.96. During the week, DSE General Price Index was above both 9 and 18-day moving average line. Top Turnover Companies Company Padma Oil Company Meghna Petroleum LankaBangla Finance United Commercial Bank Olympic Industries Volume Value (Tk) 3,365,700 4,388,300 11,137,500 28,432,700 4,681,500 1,135,554,000 1,117,024,000 867,578,000 828,285,000 817,407,000 % of total 3.07 3.02 2.35 2.24 2.21 In million Top 10 Market Capital Grameenphone Square Pharma BATBC Titas Gas ICB 286,399 113,704 101,868 83,391 70,400 Islami Bank Lafarge Surma Cement ULC Padma Oil Pubali Bank 52,544 48,778 46,125 34,882 30,436 Category wise Turnover TURNOVER (Category) A B N Z 89.52% 3.72% Commodity Price 2.78% This Week 1269.40 19.74 107.88 Gold (USD/t oz.) Silver (USD/t oz.) Brent Crude Oil (USD/bbl.) Exchange Rate This Week TT USD EUR GBP AUD JPY CAD SAR 77.40 104.31 127.92 67.77 0.73 69.08 20.53 3.97% BC 78.40 106.74 130.24 69.35 0.76 70.71 21.01 Last Week 1251.70 20.27 106.33 Last Week TT 77.40 104.88 126.38 67.86 0.73 70.42 20.53 Change % 1.41 -2.61 1.46 Change % BC 78.40 107.31 128.68 69.46 0.76 72.08 21.01 TT BC 0.00 -0.54 1.22 -0.13 0.00 -1.90 0.00 0.00 -0.53 1.21 -0.16 0.00 -1.90 0.00 Based on Standard Chartered selling rates to public in Taka. Notes: USD-US Dollar, GBP-Great Britain Pound, AUD-Australian Dollar, JPY- Japanese Yen, CAD-Canadian Dollar, SAR-Saudi Riyal. Last Public Offerings Company Emerald Oil Industries Subscription Period Sponsor (M.Tk) IPO (M.Tk) January 06-12, 2014 200.00 Matin Spinning Mills Ltd. January 26-30, 2014 1261.70 Hwa Well Textiles (BD) February 17-23,2014 200.00 Private Placement (M.Tk) ASSET & INVESTMENT MANAGEMENT SERVICES OF BANGLADESH LIMITED Unique Trade Center (UTC), Level 6 (SW), 8 Panthopath, Karwan Bazar, Dhaka 1215, Bangladesh Tel : +(880-2) 913 6432–4 (Three Lines), Fax : +(880-2) 913 6162–3 (Two Lines) e-mail : hello@aims-bangladesh.com; web: http://www.aims-bangladesh.com