Scorecard for Boustead Holdings Berhad

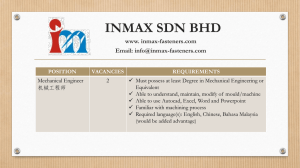

advertisement