Chapter 17: Process Costing system

advertisement

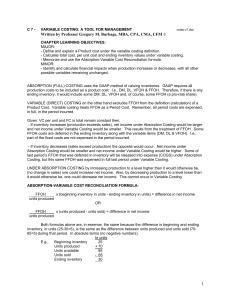

Chapter 6: Process Costing system Introduction: As we learn from chapter 5, There are two types of product costing systems which used in accumulating product cost in manufacturing firms. 1- Job Costing System نظام تكاليف األوامر االنتاجية 2- Process Costing System )نظام تكاليف العمليات (المراحل The type of industry determining which system is used Job Costing System Is a product costing system in which costs are assigned to batches or job orders of production Assign costs to Distinct units of product or service Used when the firm produce distinct bath of production called job order Like: Film Production , Building House Aircraft Manufacture Process Costing System Accumulates the costs of a production process and assigns them to the products that comprise يشكلthe organization's output. assign costs to masses ( Similar units) and compute unit cost on an Average base Used by companies that produce large number of identical units Like: Chemicals, Microchips, Gasoline Beer, Textiles In This chapter we will use process costing system in determining: 1- Product cost [ cost per unit produced] 2- Cost of goods sold [ units sold * cost per unit] 3- Cost of ending inventory [ units in ending inventory * cost per unit] Nature of process costing system: 1- there are many stages to produce the product Cost of goods sold Page 1 of 12 Ehab Abdou (+965 97672930) Chapter 6: Process Costing system Determining Product cost [Cost per unit] The determination of product cost [total product cost] and then the cost per unit produced depending in three cases: Case 1: Zero beginning and Ending work in process inventory At this case the unit cost can be averaged by dividing total cost in a given accounting period by total units produced in that period. Cost per unit = Total department cost . Number of units completed and transferred out Exercise 1 The following data extracted from Nour Co. which has a two manufacturing departments ( Assembly and Testing ), books for the month of January 2011, show the followings: Physical units for January 2011 Work in process beginning inventory (Jan 1) Started during January Completed and transferred out during January Work in process, Ending inventory (Jan 31) 0 Units 400 Units 400 Units 0 Units Total Costs For January 2011 Direct material Conversion costs Total assembly department costs added during Jan $32,000 $24,000 $56,000 Requirement 1- Compute the cost per unit completed and transferred to the Testing Department during January 2004? Answer: Cost per unit = Total assembly department cost . Number of units completed and transferred = 56,000 / 400 = $140 per unit This case shows that: in a process costing system , unit costs can be averaged by dividing total cost in a given accounting period by total units produced in that period. Because each unit is identical Page 2 of 12 Ehab Abdou (+965 97672930) Chapter 6: Process Costing system Case 2: Zero Beginning But some ending work in process inventory : وفي هذه الحالة يجب إتباع خمسة خطوات وهي 12345- Units to be accounts for ( Summarize the flow of physical Units ) Equivalent units ( Compute output in term of equivalent unit ) Total cost Cost per equivalent unit Assignments of costs Meaning of Equivalent units: ( ) الوحدات المعادلةor ( ) الوحدات المتجانسة وهي كمية المخرجات التامة التي تأخذ نفس القدر من المدخالت للوحدات غير التامة وحدة تامة01 ) يمثلها%01 وحدة غير تامة ( تامة بنسبة011 : مثلا وحدة تامة01 = 1200.*011 ) يمثلها%00 وحدة غير تامة ( تامة بنسبة011 : ومن الملحظ ) DM , C C ( يجب حسابها لكل نوع من المدخالت حيث قد تختلف نسب االستفادة منEquivalent Units أن مدن تكداليف%01 حيث قدد تحلدل الوحددات المنتجدة نلدب نلديبها كدامالم مدن المدواد بينمدا تحلدل فقدل نلدب . التحويل Exercise 2 The following data extracted from Nour Co. which has a two manufacturing departments ( Assembly and Testing ), books for the month of February 2004, show the followings: Physical units for February 2004 Work in process beginning inventory (Jan 1) Started during January Completed and transferred out during January Work in process, Ending inventory (Jan 31) 0 Units 400 Units 175 Units 225 Units The 225 partially assembled units are fully processed with respect to direct materials, an assembly department supervisor estimates that the partially assembled units are on average 60% complete from the respective of conversion costs. Total Costs For February 2004 Direct material Conversion costs Total assembly department costs added during Jan $32,000 $18,600 $50,600 Requirement 1- Compute the cost of goods completed and transferred to the refining Department during February. Note: Degree of completion in this department (Direct material 100% , Conversion cost 60%) Page 3 of 12 Ehab Abdou (+965 97672930) Chapter 6: Process Costing system Answer: Physical Units 1- Physical Units to account for: Work In process, Beginning + Started During the Year = Units To account for 2- Equivalent Units : * Started And Completed * Work In process, Ending Direct Material Conversion costs 0 400 400 175 225 175 225 225*100% = Total Equivalent Unit 3- Total Costs: * For Work In process, Beginning * Costs Added in Current Period = Total Cost To account for 4- cost per Equivalent unit 225*60% 500 400 310 0 50,600 50,600 0 32,000 32,000 0 18,600 18,600 32,000/400= 5- Assignment costs * Started and completed (175 U) 24,500 24,500 Total cost of units completed * Work In process, ending (225 u) Total Work in process, end 26,100 = Total cost to account for 175 135 18,600/310= 80 60 175*80 14,000 175*60 10,500 225*$80 18,000 135*$60 8,100 50,600 Student Notes: 1- Very important formula: W.I.P Page 4 of 12 beg + Started = Completed + W.I.P end Ehab Abdou (+965 97672930) Chapter 6: Process Costing system Case 3: Some beginning and some ending Work in process inventory ) أوAverage Method ( وفي هذه الحالة يجب اختيار طريقة من طرق تدفق التكاليف المعروفة وهي ) FIFO ( Average method cost طريقة متوسط التكلفة: أوالا نتبع نفس خطوات الحل كما في حالة وجود مخزون انتاج تحت التشغيل آخر الفترة فقل Exercise 3-1: At the beginning of march 2004, Nour Co. had 225 partially assembled DG-19 units in the assembly department, it started production of another 275 units in march,2004 , data for assembly department for march are: Physical units for march: Work in process, beginning inventory ( March 1 ) 225 units Direct material ( 100% completed ) Conversion costs ( 60% completed ) Completed and transferred out during March 275 Units 400 Units Work in process, ending inventory ( March 31 ) 100 Units Started during March: Direct material ( 100% completed ) Conversion costs ( 50% completed ) Total costs for March 2004 Work In process, beginning inventory Direct materials ( 225 equivalent units * $80 per unit ) $18,000 Conversion costs ( 135 equivalent units * $60 per unit ) $ 8,100 Direct material cost added during march Conversion cost added during march Total costs to account for Page 5 of 12 $26,100 $19,800 $16,380 $62,280 Ehab Abdou (+965 97672930) Chapter 6: Process Costing system Physical Units 1- Physical Units to account for: Work In process, Beginning + Started During the Year = Units To account for 2- Equivalent Units : * Started And Completed * Work In process, Ending Direct Material 225 275 500 400 100 400 100 100*100% = Total Equivalent Unit 3- Total Costs: * For Work In process, Beginning * Costs Added in Current Period = Total Cost To account for 4- cost per Equivalent unit Conversion costs 400 50 100*50% 500 500 450 26,100 36,180 62,280 18,000 19,800 37,800 8,100 16,380 24,480 37,800/500= 24,480/450= $75.60 $54.40 5- Assignment costs * Started and completed (225 U) Total cost of units completed * Work In process, ending (225 u) Total Work in process, end = Total cost to account for Page 6 of 12 52,000 52,000 10.280 62.280 400*$75.60 30,240 400*$54.40 21,760 100*$75.60 7,560 50*$54.40 2,720 Ehab Abdou (+965 97672930) Chapter 6: Process Costing system First In First Out ( FIFO) طريقة الوارد أوالَ صادر أوالا: َ ثانيا نتبع نفس خطوات الحل كما في طريقة متوسل التكلفة ولكن االختالف يكون في الخطوة الثانية وهي الخاصة حيث يتم حسابها بالتفليل نلب حسب األول فداألول وكدذلع نندد إجدرال نمليدةEquivalent units بتحديد Assignments of cost ربل التكلفة Physical Units 1- Physical Units to account for: Work In process, Beginning + Started During the Year = Units To account for 2- Equivalent Units : * Started And Completed (400 Units) ■ From Beginning WIP Direct Material Conversion costs 225 275 500 225 0 225*0% ■ Started and Completed 175 175 175*100% * Work In process, Ending 90 225*40% 100 175 175*100% 100 50 500 275 315 26,100 36,180 62,280 0 19,800 19,800 0 16,380 16,380 100*100% = Total Equivalent Unit 3- Total Costs: * For Work In process, Beginning * Costs Added in Current Period = Total Cost To account for 4- cost per Equivalent unit 19,800/275= 16,380/315= $72 $52 5- Assignment costs * Started And Completed (400 Units) Cost forwarded ■ From Beginning WIP (225 units) 26,100 4,680 0 0*$72 ■ Started and Completed (175 units) 21,700 90*$52 12,600 175*$72 * Work In process, Ending 52,480 9,800 Page 7 of 12 9,100 175*$52 7,200 100*$72 = Total cost of units completed 4,680 2600 50*$52 62,280 Ehab Abdou (+965 97672930) Chapter 6: Process Costing system Use the following information for the next 3 questions. Salmon Manufacturing Company uses a process costing system. Direct materials are added at the beginning of the process. During January, Department Q had a beginning inventory of 2,000 units, 25% complete for conversion costs. During the month 14,000 units were started and there were 1,000 units in ending inventory, 60% complete for conversion costs. 2. Using FIFO process costing, the equivalent units for direct materials for the month were a. 13,600 b. 14,000 c. 16,000 d. 15,600 3. Using weighted average process costing, the equivalent units for direct material for the month were a. 13,600 b. 14,000 c. 16,000 d. 15,600 4. Using weighted average process costing, the equivalent units for conversion costs for the month were a. 14,100 b. 14,000 c. 16,000 d. 15,600 Physical Units 1- Physical Units to account for: Work In process, Beginning + Started During the month = Units To account for 2- Equivalent Units : * Started And Completed (15,000) From Beginning WIP Direct Material 2,000 14,000 16,000 2,000 0 2,000*0% From Started During Month 13,000 13,000 13,000*100% * Work In process, Ending 1,000 Page 8 of 12 16,000 1,500 2,000*75% 13,000 13,000*100% 1,000 1,000*100% = Total Equivalent Unit Conversion costs 14,000 600 1,000*60% 15,100 Ehab Abdou (+965 97672930) Chapter 6: Process Costing system Use the following information for the next 3 questions. Salmon Manufacturing Company uses a process costing system. Direct materials are added at the beginning of the process. During January, Department Q had a beginning inventory of 2,000 units, 25% complete for conversion costs. During the month 14,000 units were started and there were 1,000 units in ending inventory, 60% complete for conversion costs. 2. Using FIFO process costing, the equivalent units for direct materials for the month were a. 13,600 b. 14,000 c. 16,000 d. 15,600 3. Using weighted average process costing, the equivalent units for direct material for the month were a. 13,600 b. 14,000 c. 16,000 d. 15,600 4. Using weighted average process costing, the equivalent units for conversion costs for the month were a. 14,100 b. 14,000 c. 16,000 d. 15,600 Physical Units 1- Physical Units to account for: Work In process, Beginning + Started During the month Direct Material 2,000 14,000 = Units To account for 16,000 2- Equivalent Units : * Started And Completed 15,000 15,000 15,000*100% * Work In process, Ending 1,000 Page 9 of 12 16,000 15,000 15,000*100% 1,000 1,000*100% = Total Equivalent Unit Conversion costs 16,000 600 1,000*60% 15,600 Ehab Abdou (+965 97672930) Chapter 6: Process Costing system Use the following information for the next 8 questions. Hendrix, Inc. employs a process costing system. Direct materials are added at the beginning of the process. Here is information about July’s activities: On July 1: Beginning inventories = 750 units, 60% complete Direct materials cost = $5,925 Conversion costs = $4,095 During July: 15,000 units started Direct materials added = $150,000 Conversion costs added = $83,520 On July 31: Ending inventories = 1,500 units, 40% complete 7. Using the FIFO method, the number of units started and completed in July was a. 14,250 b. 15,000 c. 13,500 d. 15,750 8. Using the FIFO method, the number of equivalent units of conversion costs was a. 14,400 b. 14,550 c. 14,850 d. 14,700 9. Using the FIFO method, the cost per equivalent unit for materials used during July was a. $9.90 b. $9.80 c. $11.11 d. $10.00 10. Using the FIFO method, the cost of goods completed and transferred out during July was a. $225,150 b. $225,060 c. $213,300 d. $213,000 11. Using the weighted average method, the number of equivalent units of material was a. 15,750 b. 14,250 c. 15,000 d. 13,500 12. Using the weighted average method, the cost per equivalent unit for conversion costs was a. $5.80 b. $5.90 c. $6.00 d. $6.10 13. Using the weighted average method, the cost of the goods completed and transferred out was a. $225,150 b. $225,060 c. $213,300 d. $213,000 Page 10 of 12 Ehab Abdou (+965 97672930) Chapter 6: Process Costing system 14. Using the weighted average method, the cost of the ending work in process inventory for July was a. $18,480 b. $18,540 c. $18,330 d. $18,390 15. On September 1, Kelita Company had 20,000 units in process, which were 30% completed. Materials are added at the beginning of the process. During the month 160,000 units were started and 170,000 completed. Ending work in process was 50% complete. By what amount would the equivalent units of materials differ if weighted average were used instead of FIFO? a. 20,000 more b. -0c. 6,000 more d. 14,000 less 16. Assume that ending work in process is 8,000 units, 20% complete, and that 20,000 units were started during the month. The beginning work in process was 75% complete. Materials are added at the beginning of the process, and the cost of materials are added during the month was $61,500. Using the weighted average method, materials are allocated at $4.00 per equivalent unit. The cost of material included in the beginning work in process from last month was a. $18,500 b. $20,000 c. $34,500 d. None of the above Page 11 of 12 Ehab Abdou (+965 97672930) Chapter 6: Process Costing system Physical Units 1- Physical Units to account for: Work In process, Beginning + Started During the month = Units To account for 2- Equivalent Units : * Started And Completed (14,250) From Beginning WIP Direct Material Conversion costs 750 15,000 15,750 750 0 750*0% From Started During Month 13,500 13,500 13,500*100% * Work In process, Ending 1,500 3- Total Costs: * For Work In process, Beginning * Costs Added in Current Period = Total Cost To account for 13,500 13,500*100% 1,500 1,500*100% = Total Equivalent Unit 300 750*40% 600 1,500*40% 15,750 15,000 14,400 10,020 233,520 0 150,000 0 83,520 243,540 150,000 83,520 4- Cost per Equivalent unit 150,000 15,000 10.00 5- Assignment costs * Completed From Beginning 10,020 1,740 83,520 14,400 5.80 0 0×$10.34 Fron Started 213,300 135,000 13500×$10 Total cost of units completed * Work In process, ending 300×$5.80 78,300 13500×$5.80 225,060 18,480 15,000 1500×$10 Total Work in process, end 1,740 3,480 600×$5.80 18,480 243,540 Page 12 of 12 Ehab Abdou (+965 97672930)