Volume 1 Issue 2 - Competition Law Scholars Forum

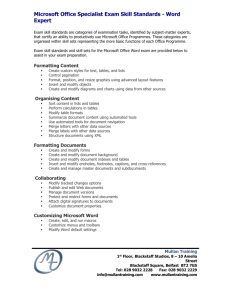

advertisement