Advertisements Of Life Insurance And Annuities Model Regulation

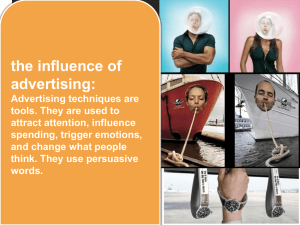

advertisement