Key Points for August 24, 2006 - WVU College of Business and

advertisement

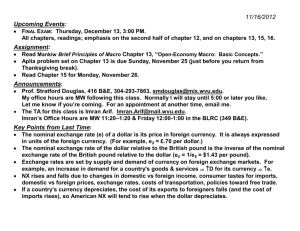

12/02/2010 Upcoming Events: FINAL EXAM: Mon, Dec 13, 3:00 PM. Chapters 2, 4-13, 15, 16. Assignment: Read Chapter 15. Chapter 16 for Tuesday. Aplia Chapters 13 & 15 problem sets due this Sunday Dec 5, at 11:00 PM. Announcements: Today’s office hours are as usual, 4:00 – 5:00. Key Points From Last Class: Net Exports = NX = Exports – Imports = Trade Surplus if positive, Trade Deficit if Negative. NX rises and falls due to changes in consumer tastes for imports, domestic vs foreign prices, exchange rates, domestic vs foreign income, costs of transportation, policies toward free trade. If a country’s currency depreciates, the cost of its exports to foreigners falls (and the cost of imports rises), so American NX will tend to rise when the dollar depreciates. Net Capital Outflow = NCO = (Acquisition of Foreign assets by Americans) minus (Acquisition of American assets by Foreigners). NX = NCO because goods & services not traded for other goods and services must be traded for foreign assets. In an Open Economy, S = I + NCO, which means that domestic savings are invested domestically or abroad. (Equivalently, I = S NCO, so domestic investment is paid for by domestic saving plus foreigners’ inflowing savings.) Govt Budget Deficits lower Savings, and therefore promote (though they don’t exactly cause) Trade Deficits (NCO<0). The nominal exchange rate (e) of a dollar is its price in foreign currency. It is always expressed in units of the foreign currency. (For example, e$ = £.70 per dollar.) The nominal exchange rate of the dollar relative to the British pound is the inverse of the nominal exchange rate of the British pound relative to the dollar (e£ = 1/e$ = $1.43 per pound). Exchange rates are set by supply and demand of currency on foreign exchange markets. For example, an increase in demand for a country's goods & services D for its currency e. Current Class Outline: XIII. Open-Economy Macro: Basic Concepts A. The International Flows of Capital and Goods B. International Prices: Real and Nominal Exchange Rates C. Purchasing Power Parity (PPP) Link to GDP Components Spreadsheet Trading Partners: Census Bureau Data Trade Data: St. Louis Fed, Balance of Payments Where does Santa live? Foreign Holdings of US Treasury Securities; Federal Debt Outstanding Nominal Exchange Rates (CNN Money) Exchange Rate Data: St. Louis Fed Exchange Rates Float Bag (Campmor, NJ) Float Bag (MEC, Canada) 1.01 x (80/65) = 1.24 Canadian float bags per US float bag. Big Mac Table XV. Aggregate Demand and Aggregate Supply A. B. C. D. E. Three Key Facts Explaining Short-Run Economic Fluctuations The Aggregate Demand Curve The Aggregate Supply Curve Two Causes of Economic Fluctuations NBER Business Cycle Duration Table US Trade Deficit, as a Percentage of GDP (-NX/GDP x 100) Source: St. Louis Fed. Sri Lankan historical average inflation rate = 11% Short term fluctuations are hard to predict . . . . . . and lots of variables move together: Unemployment rises when output falls. Today's iClicker Questions Go ahead and answer this first question now. 1) Suppose that the exchange rate of the US dollar goes from 6 Chinese Yuan to 8 Yuan per dollar. This represents _________ of the dollar, and is ______ news for U.S. companies seeking to export goods and services to China. a) a depreciation; bad news. b) an appreciation; good news. c) a depreciation; good news. d) an appreciation; bad news. 2) Suppose that a bottle of Dos Equis beer costs 10 pesos in Tijuana, Mexico and $2 a few miles away in San Diego, California. If the exchange rate of the dollar is 10 pesos, where is Dos Equis beer more expensive? a) Tijuana, since you could buy 2 beers in San Diego for the price of one beer in Tijuana. b) Beer is equally expensive in both locations. c) San Diego, since you could buy 2 beers in San Diego for the price of one in Tijuana. d) San Diego, since you could buy 2 beers in Tijuana for the price of one in San Diego. 3) Suppose that a bottle of Dos Equis beer costs 10 pesos in Tijuana, Mexico and $2 a few miles away in San Diego, California. If the exchange rate of the dollar is 10 pesos, which of the following business plans is most likely to make money? a) Use pesos to buy beer in Tijuana and sell beer for dollars in San Diego. b) Use dollars to buy beer in San Diego and sell beer for pesos in Tijuana. 4) If a bottle of Dos Equis beer costs 10 pesos in Tijuana, Mexico and $2 a few miles away in San Diego, California, and the nominal exchange rate of the dollar is 10 pesos, what is the real exchange rate of beer? a) 10 x (10/2) = 50 pesos per beer. b) .10 x (10/2) = ½ Mexican bottles per US bottle. c) 10 x (2/10) = 2 Mexican bottles per US bottle d) A Dos Equis in Tijuana is identical to a Dos Equis in San Diego, so the real exchange rate is 1 (i.e., one for one). 5) If you start a large-scale business importing Mexican beer for sale in the US, as suggested above, you will probably cause the price of beer in Mexico to _____ and the price of beer in San Diego to ______. a) Rise, Fall. b) Fall, Rise. c) Rise, Rise. d) Fall, Fall. 6) If you start a large-scale business importing Mexican beer for sale in the US, as suggested above, what will be the effect on the nominal exchange rate of the peso? a) Increased supply of pesos, causing the peso to depreciate. b) Increased demand for pesos, causing the peso to depreciate. c) Increased supply of pesos, causing the peso to appreciate. d) Increased demand for pesos, causing the peso to appreciate.