Key Accounting Policies

advertisement

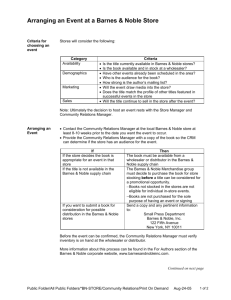

Team Members: Seth Nitschmann: seth.a.nitschmann@ttu.edu EJ Quilter-Whitley: Edward.j.quilter-whitley@ttu.edu Ricky Wegner: ricky_weg@hotmail.com Jing Wang: jing.wang@ttu.edu Conway Hwang: cons3@hotmail.com April 28, 2005 1 Table Of Contents ² 1. Executive Summary 5 2. Business and Industry Analysis 8 2.1 Business and Industry overview 8 2.2 Five Forces Model 8 2.2.1 Rivalry Among Existing Firms 8 2.2.2 Threat of New Entrants 11 2.2.3 Threat of Substitute Products 11 2.2.4 Bargaining Power of Buyers 12 2.2.5 Bargaining Power of Suppliers 12 2.3 Trends 13 2.4 Revenues 14 2.5 Key Success Factors 16 2.6 Conclusion 17 3. Accounting Analysis 17 3.1 Key Accounting Policies 18 3.2 Accounting Flexibility 19 3.3 Strategy Analysis 20 2 3.4 Quality of Disclosure 23 3.5 Qualitative 23 3.6 Quantitative 24 3.7 Potential Red Flags 24 4. Ratio Analysis & Forecast 25 4.1 Financial Ratio Analysis 25 4.2 Sustainable Growth Rate 26 4.3 Time Series Trend 27 4.3.1 Financial Ratios 27 4.3.2 Liquidity 28 4.3.3 Profitability 29 4.3.4 Profitability Analysis 29 4.4 Cross Sectional Analysis 30 4.4.1 Liquidity Ratios 30 4.4.2 Profitability Ratios 32 4.4.3 Capital Structure Ratios 34 4.5 Liquidity 35 4.6 Profitability 36 3 4.7 Capital Structure 37 4.8 Forecast Analysis 38 4.8.1 Income Statement 38 4.8.2 Balance Sheet 41 4.8.3 Statement of Cash Flows 43 4.9 Conclusion 43 5. Valuation Analysis 44 5.1 Valuation Preface 44 5.2 Methods of Comparables 45 5.3 Intrinsic Valuation Method 45 5.3.1 Cost of Capital Estimation 45 5.3.2 Free Cash Flows 50 5.3.3 Discounted Residual Income 51 5.3.4 Abnormal Earnings Growth 52 5.3.5 Summary of Results 53 6. Recommendation 54 7. Sources 56 8. Appendix 57 4 Barnes & Noble (BKS) Company Valued Investment Recommendation stock ticker and exchange SELL Date of valuation 4-11-05 $34.86 EPS forecast 52 week price range $24.77 - 37.58 FYE 2004 2005 2006 Revenue (2004) 4.87B EPS 1.7 1.83 1.68 2007 1.59 market capitalization 2.41B AEG 0.05 0.01 -0.28 -0.21 industry shares outstanding 70.27M your co average Valuation Ratio Comparison Dividend yield N/A 3 month avg daily trading volume percent institutional ownership $16.59 ROE 9.73% ROS 8.81 15.56 10.13 3.61% Valuation Estimates Est. 5 year EPS growth Rate Ke estimated 20.22 71.40% Book value per share(mrq) Cost of Capital Estimates Trailing P/E Forward P/E Actual Current Price (April 1, 2005) Beta 0.811 Ke $34.19 Ratio Based Valuations 5.64% P/E Trailing 20.21 P/E Forward 15.55 PEG Forward Dividend Yield Published Beta Kd WACC 0.557 1.22 N/A M/B 0.0725 0.054 Intrinsic Valuations Discounted Dividends $36.92 Residual Income $15.44 Abnormal Earnings Growth $15.44 Long-run residual income perpetuity 5 N/A Free cash flows 1.0 Executive Summary Recommendation – Overvalued Security We believe the current market price for Barnes and Noble (BKS) is overvalued. We feel this way because two of the three intrinsic valuation models we used stated that Barnes and Noble was significantly overvalued. Both the residual income and free cash flow models shows that Barnes and Noble is priced to high. Current Financial Position Barnes and Noble for the past five years have had steadily increasing net income. Even with the increasing of total liabilities, the increasing of total revenue has been able to offset the growing debt. Current Strategy Barnes and Noble current strategy is to help them self by expanding the current book market thus increasing their own market share. Too get this accomplished Barnes and Noble will keep expanding their flagship stores to more neighborhoods across the country. Also, with each stores well trained management aware to their ever changing the surroundings only the most marketable books will be sold in each area. Along with that, well researched and highly visible locations Barnes and Noble to continue to grow and be a house hold name. 6 Risk Barnes and Noble has minimum risk due to the somewhat clam retail book industry. With the beta of 0.557, Barnes and Noble is significantly less risky than the market as a whole. Valuation Based on Barnes and Noble’s valuation models, the company’s stock price is overvalued. Using abnormal earnings growth and residual income model, we arrived at a target price around $16.00 per share. Right now, Barnes and Noble’s stock is trading at a price of $35.00 per share which we came to a conclusion that it is overvalued. Competitors Barnes and Noble is the leading bookseller in the country, with that being said, Barnes and Noble must still be aware of other competitors in the market. A few of Barnes & Noble’s largest competitors are Borders Group, Inc., Amazon.com, and Book-a-Million. For Barnes and Noble to stay in the market, the company would need to increase their diversity. Examples of this are Barnes and Noble’s current market share in the video game, DVD, and music cd industry. 7 2.0 Business and Industry Analysis 2.1 Company and Industry Overview Barnes and Noble is the largest bookseller in the country. Other than selling books, Barnes and Noble also owns and operates game stop, a video game store, and entertainment software stores. This project is designed to analyze Barnes and Noble in relation to its other competitors in the industry. We plan on doing this by using the five forces model which includes current competitors, new entrants, alternative products, customer bargaining power, and supplier bargaining power. 2.2 Five Forces Model 2.2.1 Competitive Force One: Rivalry Amongst Existing Firms Barnes and Noble is currently one of the top companies in a highly competitive market. The companies that they compete with are not only just in book stores but on the internet also. When trying to find out were there is a competitive advantage Barnes and Noble does separate themselves in certain ways. Everyone is selling the same books just different ways. Were Barnes and Noble separates themselves is by selling video games, DVD’s, computer software, and Music. 8 Barnes and Noble has been getting away from cyclical sales by being more diverse in what they sale. Instead of just having bulk sales at the beginning of a semester with books sales, they sale things you will need throughout the year. Since the window for selling books is not that big they have to compete with discount. Barnes and Noble currently takes anywhere from 20 to 30 percent off books. The current competitors in this market are Amazon.com, Books-AMillion Inc, Borders Group Inc, and other small business in the industry. They are also in competition with mass merchandisers stores such as WalMart and Costco. Another market they are competing with are specialty retail that offer books in special subject areas. So to sum it all up Barnes and Noble is competing with anyone that sales books, music, DVD’s and, etc. Now, to compete with internet based companies, Barnes and Noble is in agreements with AOL, MSN, Google, and TM. They are hoping that these high traffic areas will drive people to Barnes and Noble. (See Appendix 2.1) 9 BKS AMZN BAMM BGP AMZN = Amazon.com Inc BAMM = Books-A-Million Inc BGP = Borders Group Inc (MI) Industry = Retail (Specialty) 10 2.2.2 Competitive Force Two: Threat of New Entrants The threat of new entrants of the retail book industry is fairly low. Big firms such as Barnes and Noble, Borders, Books-A-Million, and Amazon.com are the major competitors in the business today. For this firm to build revenue, it is important for them to establish an economy of scale. New entrants hardly ever have a chance to compete with big players such as Barnes and Noble, Amazon.com, Borders, or any other established retailers because they may have to force their prices down which puts pressure on profits in the long-run. Also, Barnes and Noble, Borders, and Amazon.com have first movers advantage because early created firms such as those three will have a guaranteed cost advantage over the new entrants. 2.2.3 Competitive Force Three: Threat of Substitute Products The threat of substitutes in the book store market is reassembly low. One reason there is not much of a market for substitutes in this industry, is that there are no exact substitutes. The threat of substitutes depends of price and relative performance of competing products. The closest thing to book stores is television, Internet articles, and radio which cannot compare directly in price, or performance. The only cost for television and radio is the one time purchase price for the product, and cost for internet articles can be 11 as little as your monthly subscription for the internet. The only threat from the substitutes is the customer willingness to switch is so easy anybody can do it from the comfort from their own home. 2.2.4 Competitive Force Four: Bargaining Power of Buyers Two factors that determine the bargaining power of buyers are price sensitivity and relative bargaining power. Books being Barnes and Nobles main product leave them with low differentiation and low switching costs for the consumers. Competitors such as discount book stores, used book stores, and websites such as Amazon.com offer the consumers with an alternative for the same product at the same or cheaper prices. This leaves the buyer with high price sensitivity. Because there is a high number of book suppliers and discount book stores along with low switching costs, consumers have high relative bargaining power. In all, consumers in the book industry and of Barnes and Noble have high bargaining power. 2.2.5 Competitive Force Five: Bargaining Power of Suppliers Barnes & Noble is a company that sells books, magazines, music, video games, and entertainment software either in store or through the internet. However, most of its revenues are come from the book sells. On the supply side, first, Barnes & Noble stocks over 100.000 unique book titles in 12 stores and over 1 million unique titles in warehouse, which is more than any of it’s competitors do. Also, its huge inventory contains over 40,000 publisher imprints. The last marketing element is the lowest price it offers to customers. After all, Barnes & Noble gains supply bargaining power by offering books that can not be found anywhere else at prices that can not be matched. 2.3 Trends The importance of companies to identify the trends of their customers is of the utmost importance. Barnes and Noble have done this by studying a community prior to opening a store and adjusting its title selection accordingly. Also, another example of how Barnes & Noble studies trends is after a store opens, mangers have instructions for father adjusting the selection to better fit the lifestyles and beliefs of the local community, and adding local writers to the shelves. The company also thinks the location of its stores in relation to its customers strengthen its position in the market and increase its franchise value in the eyes of the customer. 13 2.4 Revenue Barnes and Noble is the nation’s largest bookseller. As of January 31, 2004 Barnes and Noble operates 842 bookstores and 1514 video-game and entertainment-software stores. During fiscal 2003, the company’s share of the consumer book market was approximately 16 percent giving them their main source of revenue at almost 4.8 billion dollars. The vast majority of this revenue comes from in store sales and the rest coming from internet sales. Other revenue comes from their 64 percent ownership in Game Stop. With consumer spending in the book market expected to increase at a compound annual growth rate of 2.8 percent, from approximately 18.8 billion dollars in 2002 to approximately 21.6 billion dollars in 2007, future revenue is looking bright. 14 15 2.5 Key Success Factors Barnes and Noble is well know and very successful in the book selling department of their stores. What people don’t know are the other things they have done to make them so successful. These things include DVD’s, CD’s, computer software, and video games. They have extended store hours and put their department in high traffic places to make it more convenient. To compete in the internet industry Barnes & Noble also started to sell their book’s online to help better compete with Amazon and Books-A-Millions Inc. Barnes and Noble’s ability to compete in all these fields and still be so widely known is amazing. There brand is well known and internet companies are to trying to jump on board. Another key success factor has to how Barnes & Noble has the ability to compete with discount book stores by cutting prices. When competing with Wal-Mart and Costco you have to be able to compete with cheap books. Barnes and Noble take 20 to 30 percent off books sold in their stores. In conclusion, Barnes and Noble is one the most highly respected books stores there is. They are growing everyday not only with acquiring more assets, but also by expanding their costumer base. They have opened up to the internet with AOL and MSN to compete in the internet market 16 which is expanding rapidity. Barnes and Noble to this day, is making it easier for anyone to get a book, DVD, CD, computer software, or video game. Barnes and Noble has a very high customer satisfaction rate and makes it as convenient as possible for customers. 2.6 Conclusion Barnes and Noble is a widely recognized company that has continued to grow and gain market share. They are very competitive and at the top of the book market. After looking at the five forces model, it is easy to understand how Barnes and Noble stacks up so well to its competitors. Barnes and Noble’s ability to recognize current market trends has kept them in touch with the local communities and has gained them stronger customer loyalties. With an increasing revenue stream Barnes and Noble looks to continue to grow and expand. 3.0 Accounting Analysis In this section we discuss both qualitative and quantitative method to evaluate the credibility of Barnes and Noble’s financial statements. This consists of key accounting policies, degree of accounting flexibility, strategy analysis, quality of disclosure, and potential “red flags.” Undo accounting 17 distortions was omitted because all of the financial statements appear to be transparent and not misleading. 3.1 Key Accounting Policies The Company’s fiscal year is comprised of 52 or 53 weeks, ending on the Saturday closest to the last day of January. Barnes and Noble’s financial statements are prepared in accordance with accounting principles generally accepted in the United States. The preparation of these financial statements require management to make estimates and assumptions in certain circumstances that affect amount reported in the accompanying consolidated financial statements and related footnotes. Barnes and Noble consider cash and cash equivalents to be any short-term, highly liquid instruments purchased with an original maturity of three months or less. Revenue from sales of the company’s products is recognized at the time of sale. Sales returns are recognized at the time returns are made. Barnes and Noble use several methods of accounting for their merchandise inventories. These are stated at the lower of cost or market. The cost is determined primarily by the retail inventory method on the firstin, first-out or FIFO basis. They use this method for 77 percent and 82 percent of the Company’s merchandise inventories as of January 31, 2004 and February 1, 2003. Merchandise inventories of GameStop, Barnes & 18 Noble.com, and Calendar Club represent 19 percent and 12 percent of merchandise inventories as of January 31, 2004 and February 1, 2003. These inventories are recorded based on the average cost method. The remaining merchandise inventories are valued on the last-in, first-out or LIFO method. Barnes and Noble’s property and equipment are carried at cost, minus the accumulated depreciation and amortization. For financial reporting purposes, the straight-line method of depreciation is used for the assets estimated useful life. Barnes and Noble use different methods strictly for tax purposes. For instance, maintenance and repairs are expensed as they are incurred. On the other hand, improvements and remodeling costs are capitalized. Barnes and Noble reviews its long-lived assets for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable in accordance with Statement of Financial Accounting Standards (SFAS) No. 144, Accounting for the Impairment or Disposal of Long-Lived Assets . 3.2 Degree of Accounting Flexibility As a bookseller company, Barnes and Noble is the only one with a fully operational multi-channel strategy – with retail locations from coast to coast and an online subsidiary, Barnes and Noble.com. In that case, it has an 19 average degree of flexibility in choosing different accounting policies and estimates in certain circumstances that affect amounts reported in the accompanying consolidated financial statements. For example, as the balance sheet shows, Barnes and Noble has a large amount of accounts receivable recorded each year from its retail price stores, which means a low likelihood that materially different amounts would be reported. Also, it has an option on how to depreciate or amortize intangible assets, such as goodwill. During 2002, the company adopted statement of Financial Accounting Standards No. 142, “Goodwill and other Intangible Assets.” (2003 Annual Report) Changes in market conditions, among other factors, could have a material impact on testing unamortizable intangible assets. According to the accounting policies we described above, there could be some difference between actually and estimably results by using of assumption as to future uncertainties. In addition to innovations in retailing, Barnes and Noble has also expanded its approach to bookselling and the products it offers through its self-publishing program, that’s why it chooses FIFO in comparison to LIFO. 3.3 Strategy Analysis Barnes and Noble’s accounting policies compared to competitors such as Amazon and Books-A-Million are very similar. Barnes and Noble 20 Inc. is engaged in the retail sale of trade books (generally hardcover and paperback consumer titles, excluding educational textbooks and specialized religious titles), mass-market paperbacks (such as mystery, romance, science fiction and other popular fiction), children’s books, off-price bargain books and magazines. Barnes and Noble overall follows GAAP but uses non-GAAP for financial measures. Non-GAAP policies provide consistent and comparable measures to help investors understand Barnes and Noble’s current and future operating results. On February 4, 2001, the Company adopted Statement of Financial Accounting Standards No. 133, “Accounting for Derivative Instruments and Hedging Activities” (SFAS 133), as amended, which requires that all derivative instruments be recorded on the balance sheet at their fair value. The impact of adopting SFAS 133 on the Company’s consolidated financial statements was not material. Under an agreement ending February 2, 2003, Barnes and Noble uses an interest rate swap as a derivative to modify the interest characteristics of its outstanding floating rate long-term debt, to reduce its exposure to fluctuations in interest rates. Barnes and Noble’s accounting policy is based on its designation of such instruments as cash flow hedges. 21 Barnes and Noble do not enter into such contracts for tentative purposes. The swap has a notional amount of $55,000. The effective portion of the gain or loss on the derivative instrument is initially reported as a component of comprehensive loss in Barnes and Noble’s Statement of Shareholders’ Equity, and later reflected in earnings in the period in which the related transactions occur. In the first quarter of 2001, Barnes and Noble recorded an unrealized loss of $(649), net of taxes. No incompetence was recognized in the first quarter of fiscal 2001 related to these instruments. Also, other expenses of $5.4 million in the first quarter of 2001 was primarily due to $4.5 million in legal and settlement costs associated with the lawsuit brought by the American Booksellers Association (ABA) and $1.0 million in equity losses in iUniverse.com. Other expense of $2.5 million in the first quarter of 2000 was due to equity losses in iUnivere.com. Merchandise inventories are stated at the lower of cost ore market. Cost is determined using the retail inventory method on the FIFO basis for 82 percent, 83 percent, and 82 percent of Barnes and Noble’s merchandise inventories. The remaining merchandise inventories are valued on the LIFO method. All cost are recorded based on the average cost method. 22 3.4 Quality of Disclosure The beginning of Barnes and Nobles most recent 10-k (2004), describes a book selling giant. Not only is the report in-depth, it has more than adequate information concerning the inner workings o the corporation. It also shows Barnes and Noble’s ownership in three other companies that are all at the top in their respected markets. The report goes on to describe, in detail, many of the different sectors that have to do with each of their companies and Barnes and Noble. Also, the 10-k states that their have been no changes or disagreements on accounting and financial disclosure. 3.5 Qualitative Merchandising and marketing is one of the sectors of Barnes and Noble that is described in-depth. The 10-k states that before a store opens, Barnes and Noble studies the community and other demographics so they may better customize the title selection with offerings from the area local publishers and authors. Expansion is another topic that is described in detail and is very interesting to many potential investors because of the predicted growth. According to Veronis, an Industry Forecast company, U.S. consumer spending on books is predicted to jump from $18.8 billion in 2002 to $21.6 billion in 2007. The 10-k also includes a section on industry background covering e-commerce. This section explains why 23 BarnesandNoble.com is in a very hot and ever expanding market to feather increase in revenues for Barnes and Noble. 3.6 Quantitative The 10-k provides adequate financial statements that include the three major statements: Income statement, balance sheet, and the statement of cash flows. The Income statement provided shows the basic multi-step income statement that shows positive net income for the last three years. The balance sheet also contains the basics, all of the company’s assets, liabilities, and equity. To finish up with the statements, the statement of cash flows contains a very precise outlook of how Barnes and Noble has allocated its cash flows. 3.7 Potential Red Flags When looking at the balance sheet, income statement, and statement of cash flows there were no substantial changes or numbers indicating bad accounting. The fourth quarter is not yet reported and when observing the third quarter everything looked good. After going through the 10-k and 10-q we have come up with the conclusion that Barnes and Noble is very transparent with their information and do not try to obscure or hide anything. As far as undoing accounting distortions there were not any red flags. 24 4.0 Ratio Analysis and Forecast The purpose of this section is to analyze the financial conditions of Barnes and Noble and to forecast their company’s financial conditions for the next ten years. In addition to computing Barnes and Noble’s ratios we will also find competitors ratios along with the industry average. By doing this we can find out where Barnes and Noble stands compared to the rest of the industry and where Barnes and Noble needs improvement. The ratio analysis will allow us to dissect Barnes and Noble ratio by ratio to find out their weaknesses and their strengths. This helps us to create underlying information for investors and shareholders with information that is readily available for the public. This will allow us to find trends in each of the ratios and to also help with forecasting. It helps with forecasting so that we don’t over guess the rates at which they are growing. 4.1 Financial Ratio Analysis The goal of financial analysis is to assess the performance of the firm in the context of its stated goals and strategy. Ratio Analysis involves assessing how various items on a firm’s financial statements relate to one another. Ratio Analysis of Barnes and Noble’s past and present success will provide a solid foundation for predicting the company’s future performance. 25 In this section, you will find previous annual data filed with the SEC used to perform a ratio analysis of Barnes and Noble. This Information will be used to find various liquidity, profitability, and capital structure ratios which will then allow for an evaluation of Barnes and Noble itself and as well as its main competitors in the book and game industry. Of Barnes and Noble’s competitors, Amazon.com, Books-A-Million, and Borders Group Inc. have been chosen to represent their market. In the ratio analysis we will use several methods to compare each of the numbers. First, will be the time-series comparison in which ratios for the firm will be compared over several years. Next, will be the cross-sectional comparison. Here ratios of Barnes and Noble will be compared to the ratios of the other firms in the industry, such as the firms listed in the above paragraph. Last, we will use this information to do a financial statement forecasting. 4.2 Sustainable Growth Rate The Sustainable Growth rate is used to evaluate the firm’s ratios in a comprehensive manner. They use the “SGR” to find out their growth without having to change its profitability and financial policy. Also, keep in mind that the “SGR” is used only as a benchmark at which a firm can be evaluated. After calculating the SGR we found that, Barnes and Noble on 26 record have shown no dividend payouts. So, we have come to the conclusion that the Return on Equity equals the SGR. 4.3 Time (Time Series) Trend 4.3.1 Financial Ratios 2004 2003 2002 2001 2000 Current Ratio 1.52 1.53 1.40 1.56 1.35 Quick Asset Ratio 0.38 0.32 0.18 0.12 0.09 Accounts receivable TO 3.71 4.64 7.39 7.05 6.10 128.83 132.42 131.78 142.63 162.01 7.92 8.04 10.80 8.41 10.94 Liquidity Analysis Inventory TO Working Capital Turnover Profitability Analysis 27 Capital Structure Analysis Debt to Equity Ratio 0.46 0.52 0.67 1.09 0.76 Debt Service Margin 0.87 0.83 1.03 0.23 0.58 16.40 12.28 6.76 2.50 9.77 Times Interest Earned 4.3.2 Liquidity Overall, Barnes and Noble’s Liquidity is positive analysis. Our Current Ratio has shown some ups and downs but has been very consistent for us. After analyzing is Quick Asset Ratio we have found that they are not in good standing as far as their credit goes. This shows that their Ratio’s are very low but are improving year by year. Our Accounts Receivable is very low, and shows that Barnes and Noble are bad about turning their credits in to cash. Their Inventory stays in storage to long but this could also have to do with how seasonal book selling is. Their biggest inventories is college books that are really only sold twice a year. An increase in sales and working capital has caused a decrease in working capital. 28 4.3.3 Profitability Gross profit on sales has been consistently in the positives. Expense ratio also has a positive affect along with net profit margin. These are the things that we used to look at the efficiency in are company. So our efficiency was positive with only one drop in Net Profit Margin in 2001. Our asset turnover over the years has been positive and has increased almost every year or stayed consistent. This positive production in the Asset Turnover shows that they can support their sales volume. For every Dollar invested in 2004 they had 1.70 of sales. Thanks to the Asset Turnover staying consistent and net profit Margin increasing it has been favorable to their Return on Asset ratio. (See Appendix 4.1) 4.3.4 Profitability Analysis Barnes and Noble capital structure shows that they get their assets efficiently. Except for one year in 2001 their debt-to-equity ratio has been under 1. This shows that they have been doing a good job with their equity financing. In 2004 Barnes and Noble had .46 in liabilities for every dollar of equity. Barnes and Noble Times Interest Earned have shown that their 29 earnings have almost doubled from 2000 to 2004. This also proves that Barnes and Noble is creditworthy, because their Times Interest Earned is incredibly higher in 2004 then in 2000. (See Appendix 4.2) 4.4 Cross Sectional (Benchmark) Analysis 4.4.1 Liquidity Ratios: (See Appendix 4.3) Current Ratio Barnes & Noble has a higher current ratio than Borders Group, but lower on compared to Books-A-Million. Even the trend has been slightly decreasing over the past five years and the company still has enough assets to cover their current liability. Although they have enough if they keep this trend they are going to see themselves falling quickly. Quick Asset Ratio All three companies are doing poorly on the quick asset ratio, since the number is below one. Barnes & Noble has fallen down a lot after year 2001, and so do competitors. However, Barnes & Noble still keep declining while both competitors are arising in 2004. This is saying that the value of Barnes and Noble is going down and that they do not have enough assets to pay off their liabilities. 30 Days Supply of Receivables Days supply of receivables, compare to Borders Group and Books-AMillion, Barnes & Noble’s number has appear decline since 2002, which is would not indicated any trouble for the company. This does tell us that compared to the rest of the industry that we are better are at collecting are accounts receivable. Barnes and Noble turn receivables into cash fast. Days Supply of Inventory Days supply shows how much inventory the company is holding in term of days. Barnes & Noble is holding fewer inventories than both competitors, and it is very efficient in managing their inventory. This tells us that not only are we lower then every one else but we also do not hold are inventory in stock very long. In the other words, it is good to have a low Days Supply of Inventory ratio. Working Capital Turnover Barnes & Noble seem in the mid position between two competitors, lower than Borders Group, but higher than Books-A-Million. The number is not stabled and appears upward in 2004. It is better to increase their current assets in order to make the working capital turnover smaller. This tells us 31 that Barnes and Noble have a lot more current liabilities then current assets. This in any business is no good and they need to improve in the area. 4.4.2 Profitability Ratios: (See Appendix 4.4) Gross Profit Margin The variation between Barnes & Noble and Borders Group, on the gross profit margin is very small and there is no real advantage for anyone. Barnes and Noble are leading their competitors in this category and just need to keep improving. Although Barnes and Noble is not that high they still are improving and that is a positive for this ratio. Operating Expense ratio Operating expense ratio, the higher the percentage, the less efficient a company is running. As the chart shows above, Barnes & Noble has the lowest ratio. Barnes and Noble are not too bad with keeping cost down. This also has a lot to do with selling books and they don’t make them. Net Profit Margin In 2003, Barnes & Noble and Borders Group were falling together. Especially, Barnes & Noble turn out a negative number, which means they 32 don’t have very much money in hand. This means that Barnes and Noble are selling more then they are collecting. This usually means that there is a lot of accounts receivable out there. Asset Turnover Barnes & Noble has higher asset turnover than the other two companies before 2003, and staying fallen below Borders Group. Barnes and Noble are fine in that their sales are exceeding their totals assets. This means that we have enough resources to produce are volume. Return on Asset Barnes & Noble has shown a decrease line in 2003 than its competitors. After that, it became arising from -0.02 to 0.05 in 2004, the highest number over past four years. These numbers show that their operating efficiency is not very good at all. This also shows that almost every year their profitability has deteriorated. Finally Between 2003 and 2004 it made a significant jump and hopefully is still on the rise. 33 Return on Equity The rate of return on equity chart show that Barnes & Noble has about the same fluctuations as their return on asset for the past five years. They still have decreased number in 2003 and increased in 2004. This shows that the owners’ profitability was not that high and finally took a turn for the better in 2004. Overall, this shows that the owners interest in total assets in not very high. 4.4.3 Capital Structure Ratios: (See Appendix 4.5) Debt To Equity Ratio There has been a slight increase in this debt to equity ratio over the past five years that means debt has become a larger portion of total financing. Compared to its competitors, Barnes & Noble has the lowest ratio while it’s arising in 2003. This shows that Barnes and Noble have had enough owners’ equity to pay for their total liabilities. Debt Service Margin From 2000 to 2002, Barnes & Noble has large number of debt service margin than its competitors. During year of 2003, it suddenly fallen from 34 1.03 to 0.23, which their ability to make the payment is decreased. They have only been at more then one dollar per long term debt in these past five years. They don’t have the adequate amount of cash to pay installments on their long term debts. Times Interest Earn Barnes & Noble trends downward slop from 2000 to 2003 show that they are doing better than Borders Group, while Books-A-Million stay relatively low from year to year. Since 2004, Barnes & Noble may have sufficient money to cove the interest payment on their long term debts. Besides the increase between 2003 and 2004 they are being very consistent and have improved most of the time. 4.5 Liquidity Liquidity refers to how much of a company’s assets are, or are easily converted to cash or cash equivalents. A company without enough liquidity can have problem of paying its short-term debts or finding enough cash to finance unexpected business opportunities. Overall, Barnes & Noble has a positive liquidity analysis. The current ratio has changed slightly over the past five years. Through the quick asset 35 ratio is another liquidity ratio that indicates a company’s ability to quickly payoff current assets if the need arises. Typically this number should be greater than 1; however, as you can see from the table above, it trend to increased each year, but still above one. The accounts receivable turnover ratio and days supply of receivables are close related. For Barnes & Noble, as the accounts receivable turnover ratio rises the days supply of receivables goes down. Also, inventory turnover and days of supply inventory looks stable for recently years. The inefficient working capital has shown sales has been decreased since current assets and current liability have not changed much, but still stays positive. 4.6 Profitability Gross profit margin is gross profit divided by sales, and it is stable as the table showed us. Operating expense ratio is stayed on 22%, stable as same as the gross profit margin, except year of 2001 has the highest number—25%. Net profit margin tells what percentage of sales was retained by the company as net income. Obviously, it sharply increased from – 1% in 2001 to 3% in 2004, and this is good indicator for Barnes & Noble. A higher number of asset turnover suggests that the company is producing large sales volume in relation to its assets. Barnes & Noble’s asset turnover has been going up and down from 2000 to 2004. It increased from 1.44 in 2000 to 36 1.86 in 2003, and decreased to 1.70 in 2004. Return on asset and return on equity both have increased over past five years. Positive return on equity shows the profitability of the owner’s interest in total assets in Barnes & Noble. 4.7 Capital Structure Barnes & Noble experienced a decline in debt to equity in 2004 from 2001, which is a good indicator for the company. It dropped from 1.09 in 2001 to 0.46 in 2004. Also, this decrease indicates that debt has become a smaller proportion of total financing. The debt service margin ratio illustrates how well a company is able to cover the yearly payments on their long tern debt. Barnes & Noble has an unchanged debt service margin as the table shows. The increase in time interest earned ratio indicates that Barnes & Noble’s income from operations is more adequate to cover required interest charges. 37 4.8 Forecast Analysis 4.8.1 Income Statement In order for us to forecast Barnes and Noble’s financial information, we needed to figure out the percentage change from one year to the next. The best tool to forecast the future is the past. By saying past, we used Barnes and Noble’s 10k income statement starting from 1999 to 2003. To start off, we reviewed our income statement and selected sales, cost of goods sold, gross profits, and net earnings to forecast. Based on what we have looked up on finance.yahoo.com, it said that in the year of 2004, Barnes and Noble’s sales would increase by 3.9%. The website also said that in the year 2008, the company would take an 8.9% hit. After that, we came together and decided that because of what happened, we predicted the percentage sales for the next seven years. As you can see in the table 1 below, we predicted that sales would grow at an average of 12.5% after 2006. Table 1 2004 2005 2006 2007 2008 $6,159,300,525 $6,251,690,033 $5,695,289,620 $6,549,583,063 $7,335,533,030 38 2009 2010 2011 2012 $8,289,152,324 $9,449,633,650 $10,583,589,688 $11,641,948,657 2013 $12,689,724,036 The next list of numbers that we forecasted are cost of goods sold and gross profits. To get the gross profit, we took the dollar amount from the cost of goods sold for the past five years and average them out. We came up with a growth of 11% per year of goods sold. To calculate an 11% growth rate for 2004, we took the cost of goods sold of 2003 and multiplied it by 1.11. We did this step for the next 10 years. After calculating the dollar amount for the forecasted years, we took the sales and subtracted cost of goods sold to get the gross profit. Table 2 below is an example of what we did. 39 Table 2 2003 2004 2005 2006 $5,951,015,000 $6,159,300,525 $6,251,690,033 $5,695,289,620 sold) $4,323,767,000 $4,712,906,030 $5,231,325,693 $5,231,325,693 Gross Profits $1,627,248,000 $1,446,394,495 $1,020,364,340 $463,963,927 Sales (Cost of goods The last set of numbers we forecasted for the income statement is net earnings. Net earnings stayed mostly constant in the past but in year 2000 it dipped down into the red of a recorded net loss of 52 million dollars. This was because of the dot com bubble burst. Other than that, we took the other four years and came up with an average of a 4% growth rate pre year. We took that 4% and multiplied it from the year 2003 to get the forecasted dollar amount for 2004. We executed the same step for the next 10 years to achieve our forecasting number. Table 3 below will show you a little example of what we did. 40 Table 3 Net Earnings 2003 2004 2005 2006 $151,853,000 $157,927,120.00 $164,244,205 $170,813,973 151,853,000 * 1.04 = 157,927,120 157,927,120 * 1.04 = 164,224,205 164,224,205 * 1.04 = 170,813,973 4.8.2 Balance sheet Forecasting is a very difficult and highly sensitive process. When using such large numbers, such as the ones in the Barnes & Noble balance sheet, even a few percent off can grow into a hundred million dollar mistake. That is why we have based our forecast growth rates on Barnes & Nobles past numbers, because like mentioned earlier the best predictor of the future is the past. To help forecast the fourth quarter numbers for the 2004 balance sheet, a lot of attention was paid to the 2003 numbers. At the end of the third quarter on the 2003 balance sheet total assets, total liabilities, total equity were all a few percent less than the 2004 numbers. So by comparing the 41 2003 year end total to the third quarter numbers of 2004 I was able to estimate that it would grow by roughly 8 %. As demonstrated in table 4. Table 4 2003 2004 Total current assets $2,193,489,000 $2,456,707,680 Total Liabilities $2,247,635,000 $2,427,445,800 $1,259,659,000 $1,360,431,720 Total shareholders equity The main focus of the balance sheet forecasting was on the must essential, and highly visible of the balance sheet accounts. I feel that total current assets and total non-current assets which together equal total assets is a vital element of the overall value of the balance sheet. Largely based on the previous five years of Barnes & Noble’s Balance Sheets there is a slow growth of total assets. A conservative sustainable growth rate 8% was used in forecasting the total assets for the next ten years. A similar philosophy was used in the forecasting of all the liabilities and equity sections of the balance sheet. Please see forecasted balance sheet located in appendix at end of report. 42 4.8.3 Statement of Cash Flows The forecasts on our statement of cash flows are derived from the estimates used on the income statement and balance sheet. Using the growth rates and patterns on these statements, we were able to calculate and forecast the future cash flows for Barnes and Noble. Therefore, all of the forecasts are in accordance with the other financial statements and gave us a better overview helping us make the best estimates possible. Potential errors may arise from fluctuations or miscalculations in the other financial statement forecasts which would carry over to the statement of cash flows. Other fluctuations may be a result of certain or rare economic trends 4.9 Conclusion After analyzing Barnes and Noble, with their ratios and the industries, we have come to the conclusion that Barnes and Noble has some advantages and some disadvantages in the industry. The ratios have also told us that they are very competitive and are one of the big dogs in the industry. As the fall and spring semester in college roll around, Barnes and Noble is at the top. They have done things like expand outside of just walking in and buying books to just turn on your computer. Things look bright and Barnes and Noble if they keep improving at this rate will always be on top. 43 5.0 Valuations Analysis 5.1 Valuation Preface After forecasting financial statements for Barnes and Noble, for the next ten years, we then tied them into are calculation models to estimate the value of equity. We are going to base these values on assumptions of future performance. The main reason for making these valuations, besides the value of the company, is to find out if our stock is an attractively priced security. We will judge the weights of the valuations by which model comes closest to the market price of are company. Even though one valuation might come closer than another; the other valuations are still important to have a broad range of variables. These values can also determine where we think most of the value of the firm lies, either in the assets already in place, or in the Barnes and Noble's future. The valuation methods we will be using are the following: Method of Comparables, Discounted Free Cash Flows, Discounted Residual Income, and Abnormal Earnings Growth. We will not be using the Discounted Dividends model further explained why later. 44 5.2 Methods of Comparables Valuation The method of comparables valuation was performed using current share prices and shares outstanding. This method requires that several close competitors of Barnes & Noble be used to compute rations and then be averaged. It is non-intrinsic model that is least reliable because it takes only the competitions information and neglects all firm specific data. Also, the method of the comparables valuation is not considered to be one of the most accurate measures, as it can be seen by the range of values. The P/E ratio conveys what price investors will pay for every dollar of earnings. In this case, Investors are willing to pay $20.22 for every dollar that the Barnes and Noble earn. The trailing P/E multiple implies that Barnes & Noble’s stock, priced at $34.19. That is overvalued by $16.76, and the P/B ratio implies the company overvalued by more than $0.84. (See Appendix 5.1) 5.3 Intrinsic Valuation Method 5.3.1 Cost of Capital Estimation To estimate cost of equity (Ke), cost of debt (Kd), and the weighted average cost of capital (WACC), we took historical prices from 45 finance.yahoo.com and plugged those numbers in an excel spread sheet. To get the percentage of total liabilities, we divided each liability by the total liability before MI. The table below shows the example of how we got the percentage of total liabilities for accounts payable. Table 1 Percent of Total Liabilities 1/31/2004 Current Liabilities: Accounts payable $858,068,000 42.47% Accrued liabilities $583,773,000 28.89% $1,441,841,000 71.37% Long-term debt $300,000,000 14.85% Deferred income taxes $170,066,000 8.42% Other long-term liabilities $108,441,000 5.37% Total current liabilities total liab before MI $2,020,348,000 We then looked on Edgar scan and obtain the computed interest rate. We took each interest rate and multiplied it by the percentage of total liabilities to get the value weighted rate. Table 2 below shows an example of what we did. Barnes and Noble have an abnormally high percent of 46 liabilities because currently they are opening many new locations across the United States. Table 2 Computed Percent of Total Interest Rate Liabilities Value Weighted Rate 0.0588 42.47% 0.02497 0.026 28.89% 0.00751 71.37% 0.0525 14.85% 0.00780 0 8.42% 0.00000 0.063 5.37% 0.00338 After obtaining the entire value weighted rate, we took the sum of those numbers and came up with our cost of debt. The way we achieve the cost of equity is by using the CAPM model and the CAPM series excel sheet. (As seen below) 47 Ke = CAPM = Rf + B( Rm – Rf ) Ke = .03207 + 1.38(.03) Ke = 7.346% Average Beta Estimate R-Squared 0.810873 8.0744970% Estimated Ke Risk Yahoo Free Published Rate Beta 0.03207 5.640% Estimated Cost of Debt 4.37% short horizon 0.2867 Historical Estimated Ke 4.067% R^2 0.806% shorter horizon beta 48 0.577 Market Risk Premium 0.03 1.3794812 Estimated Ke 7.346% R^2 5.455% The way we obtained the weighted average cost of capital, we calculated the value of debt and the value of equity of the firm. Vd / Vd + Ve = Value of Debt of the firm 2,247,635,000 / 2,247,635,000 + 1,259,659,000 = .64 Ve / Ve + Vd = Value of Equity of the firm 1,259,659,000 / 1,259,659,000 + 2,247,635,000 = .36 WACC = Vd / (Vd+Ve) (Kd) + Ve / (Ve+Vd) (Ve) WACC = .64 (.0437) + .36 (.0746) WACC = .0548 49 5.3.2 Free Cash Flows After computing and evaluating the Free Cash Flows we come to the conclusion that, Are market price is smaller then are intrinsic value of the stock. This method carries the more weight in the overall valuation of Barnes and Noble. We used year 2013 cash flow to calculate the terminal value. Our forecasts have shown an increasing trend and the future looks bright. Are estimated share price when using this model is 36.92. We used a weighted cost of capital of 5.4%. After we calculated that are intrinsic values was higher then the market price we assumed that either a higher weighted cost of capital, or a negative growth to come closer to the intrinsic value. (See appendix) Discounted Dividends When trying to calculate this model we came to the conclusion that it was impossible. The reason why is, because Barnes and Noble does not pay dividends. This is the main factor in not trying to compute the Discounted Dividends model. 50 5.3.3 Discounted Residual Income Model Sensitivity Analysis g Ke 0 0.02 0.05 0.1 0.03 $51.57 $104.52 N/A N/A 0.05 $26.53 $30.15 N/A N/A 0.07 $16.30 $15.69 $12.50 N/A 0.09 $10.93 $9.74 $5.74 N/A 0.11 $7.73 $6.60 $3.51 $42.98 The discounted residual income model finds the companies estimated value per share by using their cost of equity, which Ke= 7.25%. Our analysis found an estimated price $15.44 per share compared to the actual price of $34.38 per share, which the actual price was twice larger than the estimated price. For this valuation method we conclude that the firm is overvalued, because the actual price is higher than our estimated price. In order to validate our assumption, we performed a sensitivity analysis compare other possible cost of equity’s and growth rates. When growth rate equals 0, increase 2% of cost of equity leads a large number decreases. 51 5.3.4 Abnormal Earnings Growth Model Using the Abnormal Earning growth model the value of the firm’s equity is expressed as the sum of its book value and discounted forecasts of abnormal earnings. This model takes into account the present value of the investment opportunities of the dividends paid to shareholders. It does not include actual dividend payments (because BKS does not pay dividends), but they are considered to be found in the earnings per share. The abnormal earnings are computed as the earnings per share plus any dividend investment opportunities. Afterwards the normal earnings are subtracted to find any abnormal earnings. The abnormal earnings are then discounted back and set up as a continuing perpetuity to find the value of each share. This model can be found in the Appendix. Using a cost of equity of 7.25%, this model gave us a present share value of $15.44. This can be compared to the actual share price of $34.38. Because Barnes and Noble do not pay dividends, it is hard to say how effective and accurate this model actually is. 52 Sensitivity Analysis g 0 Ke 0.02 0.05 0.1 0.03 $21.34 $21.34 N/A N/A 0.05 $18.30 $18.30 N/A N/A 0.07 $15.73 $15.73 $15.73 N/A 0.09 $13.57 $13.57 $13.57 N/A 0.11 $11.73 $11.73 $11.73 $11.73 Conducting a sensitivity analysis test showed that with Ke equaling .03, gave the closest estimate to the actual share price. This conflicts with our estimated Ke of .0725 which showed a value of approximately 15 dollars per share. With no dividends being paid and our cost of equity giving a considerably low price per share, we have concluded that this method considers Barnes and Noble overvalued. We do not consider this model to be a sufficient way of valuing the company and would need further research, because of the absence of dividends. 5.3.5 Summary of results The valuation models used to help find the estimated value per share offer a comprehensive and in-dept picture into the inner workings of Barnes and Noble. Based on the valuation models used, Barnes and Noble 53 is currently over valued in the residual income and abnormal earnings growth models. While the discounted free cash flows offers a fairly accurate depiction of the current market price being only about a point and half above the price set by the market. Unfortunately, we were not able to use the discounted dividends method because of the simple fact that Barnes and Noble does not pay dividends. But, even without a full arsenal of valuation methods; the valuation as a whole should be accurate and reliable. The differences in the market price and what has been calculated by our valuation models are most likely do to a couple of reasons. First, the market is forever changing, so theoretically even with a perfect valuation of a company; the next day if the market is open their will be a change in the value of the firm therefore throwing off the model. Second, in the valuation models used, forecasting numbers was necessary. When forecasting, the possibility of human error always exist, whether it is in the estimated future cash flows, our in the forecasted earnings per share. With that being said we are very confident with what we believe is a slightly over valued firm. 6.0 Recommendation Due to our confidence and in the strength of our valuation models, we feel Barnes and Noble are over valued in the market. With two of are three models used showing the company as over valued and the other one 54 as only slightly under valued that’s what we base this decision on. Even with our recommendation of overvalued Barnes and Noble will continue to grow in what seems to be the ever expanding world of internet sells. We recommend selling Barnes and Noble. 55 7.0 Sources 1. Barnes and Noble homepage. www.barnesandnoble.com 2. www.barnesandnobleinc.com 3. http://finance.yahoo.com 4. http://edgarscan.pwcglobal.com 5. www.msnbc.com 6. www.ruetors.com 56 8.0 Appendix 2.1 DIRECT COMPETITOR COMPARISON BKS AMZN BAMM BGP Industry Market Cap: 2.44B 14.56B 159.33M 2.04B 657.85M Employees: 40,000 7,800 2,700 15,000 4.35K 12.90% 33.80% 4.00% 6.20% 11.20% 6.55B 6.92B 434.61M 3.85B 953.73M 27.70% 23.15% 26.89% 27.70% 36.13% 519.86M 516.15M 21.10M 323.40M 80.76M 5.15% 6.36% 1.33% 5.73% 3.48% 158.04M 588.45M 2.36M 131.90M 32.58M EPS (ttm): 2.032 1.386 0.131 1.652 1.00 PE (ttm): 17.05 25.75 74.35 16.43 22.10 PEG (ttm): 1.32 1.58 1.25 1.44 1.16 PS (ttm): 0.37 2.30 0.38 0.54 0.56 Rev. Growth (ttm): Revenue (ttm): Gross Margin (ttm): EBITDA (ttm): Oper. Margins (ttm): Net Income (ttm): Finance.yahoo.com 57 4.1 DIRECT COMPETITOR COMPARISON BKS AMZN BAMM BGP Industry Market Cap: 2.44B 14.56B 159.33M 2.04B 657.85M Employees: 40,000 7,800 2,700 15,000 4.35K 12.90% 33.80% 4.00% 6.20% 11.20% 6.55B 6.92B 434.61M 3.85B 953.73M 27.70% 23.15% 26.89% 27.70% 36.13% 519.86M 516.15M 21.10M 323.40M 80.76M 5.15% 6.36% 1.33% 5.73% 3.48% 158.04M 588.45M 2.36M 131.90M 32.58M EPS (ttm): 2.032 1.386 0.131 1.652 1.00 PE (ttm): 17.05 25.75 74.35 16.43 22.10 PEG (ttm): 1.32 1.58 1.25 1.44 1.16 PS (ttm): 0.37 2.30 0.38 0.54 0.56 Rev. Growth (ttm): Revenue (ttm): Gross Margin (ttm): EBITDA (ttm): Oper. Margins (ttm): Net Income (ttm): Finance.yahoo.com 58 4.2 Profitability Analysis 2004 2003 2002 2001 2000 Gross Profit Margin 27% 27% 27% 28% 29% Operating Expense Ratio 22% 22% 22% 25% 22% 3% 2% 1% -1% 4% 1.70 1.76 1.86 1.71 1.44 Return on Assets 4% 3% 2% -2% 5% Return on Equity 12% 10% 7% -7% 15% Net Profit Margin Asset Turnover 59 4.3 Current Ratio: 2000 1.52 BKS 1.47 BGP 1.8 BAMM 2001 1.53 1.42 1.83 2002 1.40 1.3 1.79 2003 1.56 1.19 1.82 2004 1.35 1.17 1.74 Current Ratio 2.00 1.80 Value 1.60 1.40 BKS 1.20 BGP 1.00 BAMM 0.80 0.60 0.40 0.20 0.00 2000 2001 2002 2003 2004 Years Quick Asset Ratio BKS BGP BAMM 2000 0.38 2001 0.32 2002 0.18 2003 0.12 2004 0.09 0.41 0.33 0.24 0.12 0.11 0.1 0.1 0.12 0.13 0.14 Quick Asset Ratio 0.45 0.40 0.35 BKS Value 0.30 BGP 0.25 BAMM 0.20 0.15 0.10 0.05 0.00 2000 2001 2002 Years 60 2003 2004 Days supply of receivables BKS BGP BAMM 2000 3.71 2001 4.64 2002 7.39 2003 7.05 2004 6.10 9.03 8.36 7.8 7.85 7.91 6.2 7.38 8.4 10.2 13.02 Days Supply of Receivables 14.00 12.00 Value 10.00 BKS BGP 8.00 BAMM 6.00 4.00 2.00 0.00 2000 2001 2002 2003 2004 Years Days supply of inventory BKS BGP BAMM 2000 128.83 2001 132.42 2002 131.78 2003 142.63 2004 162.01 168.86 173.11 180.38 181.34 182.64 234.39 241.39 231.11 233.07 224.66 Days Supply of Inventory 300.00 250.00 BKS Value 200.00 BGP BAMM 150.00 100.00 50.00 0.00 2000 2001 2002 Years 61 2003 2004 Working Capital Turnover BKS BGP BAMM 2000 7.92 6.80 4.41 2001 8.04 7.68 3.93 2002 10.80 10.10 4.23 2003 8.41 15.06 4.02 2004 10.94 17.61 4.3 Working Captial Turnover 20.00 18.00 Value 16.00 14.00 BKS 12.00 BGP 10.00 BAMM 8.00 6.00 4.00 2.00 0.00 2000 2001 2002 Years 62 2003 2004 4.4 Gross Profit Margin BKS BGP BAMM 2000 0.27 2001 0.27 2002 0.27 2003 0.28 2004 0.29 0.28 0.27 0.27 0.28 0.28 0.24 0.23 0.24 0.23 0.23 Gross Profit Margin 0.35 0.30 Value 0.25 BKS BGP 0.20 BAMM 0.15 0.10 0.05 0.00 2000 2001 2002 2003 2004 Years Operating Expense Ratio BKS BGP BAMM 2000 0.22 0.94 0.96 2001 0.22 0.95 0.98 2002 0.22 0.95 0.98 2003 0.25 0.95 0.98 2004 0.22 0.94 0.97 Operating Expense Ratio 1.20 1.00 BKS Value 0.80 BGP BAMM 0.60 0.40 0.20 0.00 2000 2001 2002 Years 63 2003 2004 Net Profit Margin BKS BGP BAMM 2000 0.03 0.03 0.02 2001 0.02 0.03 0.03 2002 0.01 0.03 0.09 2003 -0.01 0.01 0.07 2004 0.04 0.03 0.01 Net Profit Margin 0.10 0.08 BKS 0.06 Value BGP BAMM 0.04 0.02 0.00 2000 2001 2002 2003 2004 -0.02 Years Asset Turnover BKS BGP BAMM 2000 1.70 1.51 1.61 2001 1.76 1.54 1.44 2002 1.86 1.56 1.5 2003 1.71 1.62 1.43 2004 1.44 1.57 1.41 Asset Turnover 2.00 1.80 Value 1.60 1.40 BKS 1.20 BGP 1.00 BAMM 0.80 0.60 0.40 0.20 0.00 2000 2001 2002 Years 64 2003 2004 Return on Assets BKS BGP BAMM 2000 0.04 0.06 0.03 2001 0.03 0.07 0.01 2002 0.02 0.06 0.02 2003 -0.02 0.04 0.02 2004 0.05 0.06 0.03 Return on Assets 0.08 0.07 Value 0.06 0.05 BKS 0.04 BGP 0.03 BAMM 0.02 0.01 0.00 -0.01 2000 2001 2002 2003 2004 -0.02 -0.03 Years Return on Equity BKS BGP BAMM 2000 0.12 0.12 0.05 2001 0.10 0.12 0.01 2002 0.07 0.1 0.03 2003 -0.07 0.05 0.02 2004 0.15 0.13 0.05 Return on Equity 0.20 0.15 BKS 0.10 Value BGP BAMM 0.05 0.00 2000 2001 2002 -0.05 -0.10 Years 65 2003 2004 4.5 Debt to Equity Ratio BKS BGP BAMM 2000 0.46 1.13 1.18 2001 0.52 1.20 1.50 2002 0.67 1.28 1.42 2003 1.09 1.39 1.37 2004 0.76 1.39 1.36 Debt to Equity Ratio 1.60 1.40 Value 1.20 BKS 1.00 BGP 0.80 BAMM 0.60 0.40 0.20 0.00 2000 2001 2002 2003 2004 Years Debt Service Margin BKS BGP BAMM 2000 0.87 0.38 0.38 2001 0.83 0.33 0.11 2002 1.03 0.41 0.25 2003 0.23 0.22 0.08 2004 0.58 0.30 0.12 Debt Service Margin 1.20 1.00 BKS Value 0.80 BGP BAMM 0.60 0.40 0.20 0.00 2000 2001 2002 Years 66 2003 2004 Times Interest Earned 2000 2001 16.40 12.28 BKS 23.63 4.93 BGP 5.23 2.01 BAMM 2002 6.76 4.34 2.45 2003 2.50 4.10 2.03 2004 9.77 9.28 3.28 Times Interest Earned 25.00 20.00 BKS BGP Value 15.00 BAMM 10.00 5.00 0.00 2000 2001 2002 Years 67 2003 2004 5.1 Method of Comparables Forward Trailing P/B Name Symbol PPS EPS P/E P/E ratio PEG Books-A-Million Inc BAMM 9.03 N/A 12.74 N/A 1.12 1.02 Borders Group Inc BGP 26.51 1.77 12.23 15.02 1.83 1.05 Barnes & Noble Inc BKS 34.19 1.69 15.56 20.22 2.1 1.22 SUM 69.73 3.46 40.53 35.24 5.05 3.29 AVERAGE 17.77 1.77 12.49 15.02 1.47 1.035 68 5.2 Free Cash Flows Free Cash Flow (to firm) Banres and Noble 2004 2005 2006 2007 2008 2009 2010 2011 2012 $585,393,700 $673,202,755 $774,183,168.00 $890,310,643.00 $1,023,857,240.00 $1,177,435,826.00 $1,354,051,200.00 $1,557,158,880.00 $1,790,732,712.00 ($310,955,645) ($311,266,601) ($311,577,867) ($311,889,445) ($312,201,335) ($312,513,536) ($312,826,049) ($313,138,875) ($313,452,014) 274,438,055 361,936,154 462,605,301 578,421,198 711,655,905 864,922,290 1,041,225,151 1,244,020,005 1,477,280,698 0.949 0.900 0.854 0.810 0.769 0.729 0.692 0.657 0.623 260377661.290 325799749.036 395083390.780 468685758.366 547100362.965 630860628.434 720543780.594 816775076.999 2003 Cash Flow from Operations Cash Provided (Used) by Investing Activities Free Cash Flow (to firm) discount rate (5.4% WACC) Present Value of Free Cash Flows Total Present Value of Annual Cash Flows Continuing (Terminal) Value (assume no growth) Present Value of Continuing (Terminal) Value Value of the Firm (end of 2003) Book Value of Debt and Preferred Stock Value of Equity (end of 2003) Estimated Value per Share 4,165,226,408 1401594590.133 920,232,412 5,085,458,820 $2,247,635,000 2,837,823,820 36.92 Book Value Per Share $36.92 Actual Price per share $34.38 Ke WACC 0.0725 0.0539955 69 5.3 Abnormal Earning growth Abnormal Earnings Growth Value 2003 EPS DPS 1 2 2004 2005 2006 $1.70 $0.00 $1.83 $0.00 $0.00 $1.83 $1.82 $1.68 $0.00 $0.00 $1.68 $1.96 DPS invested at 7.25% Cum-Dividend Earnings Normal Earnings Abnormal Earning Growth (AEG) 3 4 Forecast Years 2007 2008 $1.59 $0.00 $0.00 $1.59 $1.80 $1.86 $0.00 $0.00 $1.86 $1.71 5 6 2009 2010 $1.92 $0.00 $0.00 $1.92 $1.99 $1.79 $0.00 $0.00 $1.79 $2.06 $0.01 ($0.28) ($0.21) $0.15 ($0.07) ($0.27) PV Factor 0.932 0.756 PV of AEG $0.01 ($0.25) ($0.17) $1.70 ($0.58) Core EPS Total PV of AEG Continuing (Terminal) Value $0.00 PV of Terminal Value Total PV of AEG $1.12 Average Perpetuity Capitalization Rate (perpetuity) Value Per Share Ke g 0.0725 pv fv 0.0725 0 $15.44 15.716 Ke Actual Price per share $34.38 70 0.869 0.811 0.705 0.657 $0.12 ($0.05) ($0.18) 71 72