Enager Industries, Inc.

advertisement

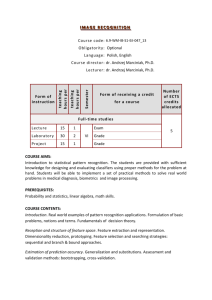

University of Waterloo Enager Industries, Inc. Akua Acheampong, Lori Chin Suey, Kieng Iv, Tara Mathanda, Hubert Sy Issues Summary Enager Industries (“Enager”) is a relatively young company that has three divisions – Consumer Products, Industrial Products, and Professional Services. Currently, the divisions are classified as investment centres measured using return on assets (ROA). The company as a whole has not been able to meet ROA targets despite increases in earnings per share and return on equity over the past year. Two of the divisions in particular have not been able to achieve the company-wide return on asset target of 12%. The purpose of this report is to evaluate the current performance measurement system and how it has been implemented. In addition, there is tension between divisional managers due to the performance measurement system. Recommendations have been provided relating to the ROA targets, evaluation of proposed projects, and the use of the balanced scorecard to evaluate divisions. New Product Proposal Sarah McNeil, product development manager in the Consumer Products Division of Enager, recently proposed a new project that was rejected by Henry Hubbard, Chief Financial Officer. Even though the project had an estimated $0.15 increase on Earnings per Share (EPS), it was rejected because it did not show a return on assets of 15%, which is the current hurdle rate. The project is estimated to have $390,000 in earnings before interest and taxes (EBIT) with an incremental asset base of $3,000,000. This computes to a return on asset (ROA) of 13%, which is lower than Henry’s required return for any new projects. Sarah’s new project should not have been rejected, as the gross required rate of return of the company is 12%. This takes into account the marginal cost of debt, which is fairly high because of Enager’s recent debt financing interest rates, and the marginal cost of equity, 1 shareholders’ required rate of return. If a project has a 12% ROA then the net present value of the project would be $0 -the 12% is the internal rate of return for Enager. If a project exceeds 12% ROA, then it should be pursued as it will increase the value of Enager. The proposed project has a 13% ROA, which is higher than the internal rate of return, and should have been accepted, not rejected. Inferences from Statement of Cash Flows Please see Appendix A for the cash flow statement and related schedules. When analyzing the cash flow statement for 1993, a few inferences could be made. The 1993 net cash flow from operating activities is $14,826,000 and the income quality ratio was 1.221, which indicates that a large percentage of their net income is being realized in cash. The highly positive number indicates strong operational performance and ability to generate cash flows from operations. The net cash flow from investment activities is $(28,158,000), which indicates that longterm fixed assets are being purchased for expansion of operations. Of the $28,158,000 spent, $25,230,000 was used to purchase plant and equipment. The poor 1993 return on assets can be partially attributed to this large increase in fixed assets, which accounted for the majority of the increase in assets, along with the moderate increase in net income of $1,249,0002. These inputs resulted in a gross incremental ROA of 9.1%3, which is lower than the 1992 gross ROA of 9.5% and lower than the required 12% for projects to “breakeven”. This is why 1993 ROA was lower than 1992 ROA. 1 Income Quality Ratio =Operating Cash Flows/Net Income =14,286/12153 Change in Net Income = 1993 Net Income – 1992 Net Income = 12,153,000-10,904,000=1,249,000 3 Gross Incremental ROA= Change in EBIT/Change in Assets=(18414+2928-16521-1728)/(226257192096)~9.1 % 2 2 The net cash flow from financing activities for 1993 is $13,257,000. This means that they have financed about half their capital expenditures, which total $28,158,000, with external capital. The other half of the capital expenditures was financed through operating cash flow. The impact of the large increase in debt financing was evident in the income statement. The income statement showed that Enager had paid an additional $1,200,000 of interest in 1993 when compared to 1992 figures. The average interest rate or cost of debt in 1992 was 4.6% and in 1993 was 5.7%4. This substantial increase in interest rate directly affects net income which in turns affected the ROA for 1993.There was also a large issuance of common shares, worth $6,320,000, and this was accompanied with a large amount of cash dividends paid in 1993 of nearly the same amount, $6,285,000. A breakdown by division would be helpful, as it would allow for deeper analysis and understanding of the performances of each division. In the analysis of the company-wide cash flow statement, it was clear that there were some investments that did not have a high enough actual ROA. By having a breakdown of each division, it would help in determining which divisions are making poor investments and which divisions are making financially sound investments. As well, a breakdown would help in determining which divisions are performing the best operationally. Currently the operating section of the cash flow statement indicates that Enager is doing well in managing its day-to-day cash flows and is able to finance its current operations. However, it is likely that some divisions are not performing as well as others in this portion of the cash flow statement, as company-wide ROA has dropped year over year. Inferences from Comparative Balance Sheet and Income Statement 4 Average interest rate=Interest expense/Long-term debt 3 Please see Appendix B for comparative balance sheets, income statements, and financial ratios. Balance Sheet inferences • Investments in plant, equipment and other assets that are significantly higher than depreciation have been made suggesting that Enager is investing in new assets to generate more revenue rather than just replacing old assets. However, this had a negative impact on ROA since the percentage increase in net income is much lower than the percentage increase in total assets. This suggests that the additional assets may not have generated as much revenue as expected. • The accounts receivable increased 14% from 1992 to 1993, which suggests that Enager has been more willing to extend credit in order to attract more customers. The accounts receivable as a percentage of total assets (~21%) also indicates that credit sales is a significant part of Enager’s business. • The significant increase (15%) in inventory suggests that Enager is anticipating higher sales in the future or was unable to sell its entire budgeted inventory. • Enager took on 22% more long-term debt in 1993, which may have been used to finance its plant, equipment and other assets. From the year-over-year change in interest expense in the income statement, the new long-term debt has a very high (~9%) interest rate. This suggests not only higher interest rate levels in the economy but possibly a negative change in Enager’s fundamentals that the market has priced into its debt. • Enager has also issued more equity, to possibly finance its capital expenditures. • Deferred income taxes also increased substantially as a percentage of total assets from 4 1992 to 1993. This is negligible, however, since it is only about 1.3% of total assets. Income Statement inferences • Sales had a mediocre rise when compared to the increase in capital expenditures. Profitability ratios showed only a little positive change except for ROA, which fell. • COGS rose by a smaller percentage than sales, which contributed, to the positive change in gross margin. • Total expenses rose by a smaller percentage than gross margin, which contributed, to the rise in net income. • Additional debt did not seem to have lowered Enager’s effective tax rate. Overall, Enager as a firm seems to rely more on smaller expenses, lenient credit policies and cost cutting rather than growth in order to maintain profitability. Also, the Consumer Products and Industrial Products divisions may be weighing down the explosive growth in the Professional Services division. Investment Centre Implementation Issues and Solutions In implementing the investment center concept, Randall and Hubbard decided to measure each of the division’s performance based on its return on assets, which is calculated as the division’s net income divided by its total assets. Also, Hubbard demanded that each division try to provide a return of 12% on its assets for 1992 and 1993. He also decided that all new investments must have a 15% return in order for it to be approved as the firm’s current ROA was only 9.4%. 5 Implementation Issues Solutions Require a minimum 15% ROA to accept a project Accept any projects with a positive net present value in order to help increase firm value – meaning any project with a return on investment higher than the cost of capital. Management should use residual income (or EVA) to analyze the profitability and return of projects, in addition to, or in replacement of, ROA. This is aligned with only accepting positive net present value projects. This also leads to better goal congruence, as divisions are not rejecting projects that are lower than their historic return on assets that may be good for the performance of the firm but bad for the performance of the division. EVA as a performance measurement would also lead to less perceived unfairness between the divisions. Since different EVAs are not very comparable across divisions, managers will be more focused on its operating efficiencies. Example. The Consumer Products proposal for a new product with a calculated ROA of 13% should be accepted as it is above the firm’s internal rate of return of 12%. As well, using residual income (or EVA) would result in the acceptance of this project, as it would yield a positive EVA or residual income. Each division is required to Different costs of capital can be used for each division attain the same target ROA of depending on the risk of each project and nature of 12%, even though they are business. The cost of capital can be obtained by engaged in diverse business observing the cost of equity capital of equivalent public activities and each division has companies that engage in similar business activities as a different level of risk. each of the divisions. Example. Consumer Products division is probably less risky than the Industrial Products division as they are the most mature whereas the Industrial Products division is very sensitive to the success of individual projects. Therefore, a higher return on investment will be required for projects in the Industrial Products division to offset this risk. The calculation of company Calculate both the company-wide ROA and the divisional wide ROA is based on EBIT, ROA based on EBITDA for the performance measurement while the calculation of purposes. As senior management focus divisional divisional ROA is based on net managers on operational issues rather than corporate income. This creates an headquarter planning, such as tax and debt financing. inconsistency in performance measurement. The calculation of ROA for performance measurement includes corporate Senior management should focus divisional managers on operational issues rather than reducing corporate headquarter expenses, these items should not be 6 administrative expenses arbitrarily allocated based on divisional revenue. included in the calculation. If included, it should be allocated based on another metric that more closely measures use of administrative expenses by each division. Example. Professional Services division most likely utilizes more administrative services, such as human resources, as they employ more human capital. Therefore they should be allocated more of the corporation administrative services expenses. The calculation of ROA for The gross book value should be used for the ROA performance measurement calculation to prevent some from continuing to use old includes the net book value of machines for the purposes of increasing their ROA. property, plant, and equipment. This incorporates depreciation, which decreases asset value overtime. Example. If the net income is held constant, ROA will be higher as the assets reach the end of its useful life because of the decrease in the asset base due to depreciation. This reduces the ability to compare one division to the other, since the asset base will differ depending on the useful life of those assets. This may provide incentive for managers to keep old machines and sacrifice quality in order to have a higher ROA. Tension created between the From making the above changes, divisional managers three divisions. should perceive the performance measurement system to be more equitable and fair. This will reduce tension between the divisional mangers. Also measuring managers based on the balance scorecards created will also reduce tension, as the system would be perceived as more equitable since they are division specific. Example. The Industrial Products divisional manager would not be only concerned with ROA, but many other measures, in which the purchase of fixed asset is looked at in a positive light. 7 The Balanced Scorecard for Each Division Customer Products Division Innovation and learning Perspective Internal Business Perspective Customer Perspective Financial Perspective Measures Importance of Measure • Innovation measured by the number of new product released in the year and the percentage of sales spent on research and development. • Employee growth measured by number of training days per employee in the manufacturing area in the year and number of creative workshops for entire division • Quality measured by number and frequency of product returns, and first pass yields on products produced. • Given that the housewares and kitchen items are a mature industry, the need for new differentiating products that spark renewed demand is vital. • The number of days that an employee trains and is able to better perform their manufacturing job, will reduce inefficiencies and cost, which is also key in a mature industry • Creativity is key to the design of new products, and it can come from any member in the division, not just the design team. • Quality is very important to the long run profitability of the company, especially with products that are used on a daily basis such as housewares and kitchen items. Product returns show customer dissatisfaction with the product that may be quality related. • Producing a high quality product the first time will reduce inefficiencies in the production line and avoid the suck costs embedded within defect products. • The higher the market share, the more profitable the company. This metric will enable Enager to thwart any threats to market share early on. • Given the medium life of a more houseware and kitchen items, customer loyalty is key because it will result in numerous purchases over the customer’s lifetime. This is especially true given the fact that houseware and kitchen items are often given as gifts. • Long term earnings and the survival of a corporation in the long run is largely dependant on its ability to earn a return on its investment. • Sales growth is important to measure the quantitative effects that the other qualitative measures have on profitability. • Market Share of household/kitchen products • Customer loyalty measured by repeat purchases of kitchen products, customer referrals, and sales to customers as percentage of total requirements for the same product/similar type products. • Return on investment measured residual income • Sales revenue growth measured by percentage increase from the prior year. 8 Industrial Measures Importance of Measure Products Division Innovation • Innovation measured as • The ability to develop one of a kind product to and percentage of sales customer specifications lies in the division ability to Learning spent on capital purchase cutting edge technology to do so. A lack Perspective expenditures for of investment in this area will lead to an inability to cutting edge machinery cater to customer needs. for tool manufacturing • Given the constant investment in new equipment, it • Employee growth is important to ensure that employees are trained measured by # of adequately to use the equipment, in order to ensure training days per timely production and reduce error. employee in the year • Capacity Utilization, • Considering there are high fixed costs in this Internal Business considering the fixed division due to the constant capital expenditure perspective costs (ex. Capital investments, utilization rates are important to expenditure) are high in ensure that the division is working at an efficient this division pace to offset those fixed costs. • Number of times • With contracts spanning several months, it is production and delivery important that the job be finished quickly in order schedules were not to be able to take on new contracts as they arise. met. It is also important to customer satisfaction, that customers are getting the machine tools when they need them by. • Customer satisfaction • Given the nature of the industry, the division is Customer Perspective measured by customer likely to have a few large customers rather than surveys and complaints. many small ones. As such, customer satisfaction is important because it means that if they have other needs for specific machine tools in the future they will use Enager again, and they may refer our company to others. • Return on investment • Long-term earnings and the survival of a Financial Perspective measured by return on corporation in the long run is largely dependent on investment ratio. its ability to earn a return on its investment. This • Net Income as ratio for this division is important because of the compared to prior heavy capital expenditures requirement. It needs to be monitored to ensure that the purchased years assets are earning an adequate return. • Given the demand of customers for our services can vary immensely, net income needs to be monitored to ensure that division is still able to cover its own costs as an independent division. 9 Professional Measures Services Division Innovation and • Employee growth learning measured by number of Perspective professional development days per employee in the year Internal Business perspective • • • Customer Perspective • Financial Perspective • • Capacity Utilization, in terms of sold time relative to available professional hours On-time deliver measured by percentage that deadlines set by clients for services were met Quality measured by customer complaints Customer loyalty measured by the sales to the customer as a percentages of the customers total requirements for the same produce or services Return on investment measured by residual income Sales revenue growth measured by percentage increase from the prior year. Important of Measure • Given that the nature of the services provided depend on employees technical skills and knowledge, keeping up to date up new technologies regarding planning, engineering’s, as well as laws and regulations is key to the quality of the division’s offerings • Important to measure that the talent base acquired through employees is be utilized to full potential, and it also serves to provide disincentives for shirking. • Given the legal nature surrounding the “environmental impact” studies, prompt delivery of reports and services is important to customer satisfaction. • Quality of service is vital especially in a service industry. • There is a high profit potential in being the only provider of professional services for planning, architecture, and engineering for a given corporation. This loyalty should be measured in order to recognize if it is ever decreasing. • Long-term earnings and the survival of a corporation in the long run are largely dependent on its ability to earn a return on its investment. This ratio for this division is important because of the heavy capital expenditures requirement. It needs to be monitored to ensure that the purchased assets are earning an adequate return. • Sales growth is important to measure the quantitative effects that the other qualitative measures have on profitability. 10 The following represents cause and effect relationships between the measures within each balance scorecard. Customer Products Division • Fostering manufacturing skills Innovation and Leaning Internal Business • High first pass yield rates • High quality products that are not returned by customers • Customer satisfaction Customer • Customer loyalty to brand • Sales revenue growth Financial Innovation and Learning • Fostering creativity • Creation of new products • Increased customer loyalty and satisfaction Customer Financial • Sales revenue growth • Increased return on investment 11 Industrial Products Division Innovation and Learning • Training for Manufacturing Skills • Spending on cutting edge technology Internal Business • Full capacity utilization for machinary • Delivery schedules meet • Customer satisfaction increased Customer Financial • Return on assets increased through higher utilization • Net income increased Professional Services Division Innovation and Learning Internal Business • Increase technical abilities employees through training • Increse quality of work produced • Increase customer satisfaction and loyalty Customer • Increase sales revenue growth Financial Other recommendations for Randall and Hubbard 1. Investigate into why the cost of debt has increased substantially from 4.6% to 9%. 2. Investigate other forms of financing that may be cheaper than the current long-term long debt. 3. Due to the increase in account receivables, look into determining the collectability of the receivables and calculating allowance for doubtful accounts. 4. Tightening credit terms in order to prevent potential future cash flow problems. 5. Evaluate managers based on proposed balanced scorecards. 6. Consider expansion/contraction of business divisions based on new performance measures and the balanced scorecard. 7. Proceed with the one-day day company off off-site retreat in order to foster knowledge sharing and cooperation and to boost morale morale. 12 Appendix A ENAGER INDUSTRIES, INC. Statement of Cash Flows For the Year Ending December 31st 1993 Operating Section Net Income (Loss) Add/Deduct Non-cash items Amortization Increase in Accounts Receivable Increase in Inventory Increase Accounts Payable Decrease in Taxable Payable 1 Increase in Deferred Income Taxes Net Cash from Operating Activities $ 12,153 $ $ $ $ $ $ 9,864 (5,757) (9,915) 7,698 (495) 1,278 Investing Section 2 Purchase of Property, Plant and Equipment Purchase of Long-term Investments Net Cash from Investing Activities $ $ Financing Section Issuance of Common Shares 3 Issuance of Long-term Debt 4 Cash Dividends Paid Net Cash from Operating Activities $ $ $ $ 14,826 $ (28,158) $ 13,527 $ $ $ 195 4,212 4,407 (25,230) (2,928) 6,432 13,380 (6,285) Change in Cash for 1993 Beginning 1993 Cash Balance 5 Ending 1993 Cash Balance 1 Assuming Deferred Income Taxes is a Current Liability Assuming no disposition of long-term assets 3 Please see Schedule 1 and assuming no early retirement of debt 4 Please see Schedule 2 5 Matches 1993 Balance Sheet Cash Amount 2 Schedule 1 - Change in Long Term Debt 1993 Long-Term Debt Balance $ 46,344 Add: Current Portion of Long-Term Debt $ 4,902 Less: 1992 Long-Term Debt Balance $ 37,866 Change in Long-Term Debt Beginning Retained Earnings Add: 1993 Net Income Less: Ending Retained Earnings 1993 Cash Dividends Paid $ 13,380 $ 6,285 Schedule 2 - Cash Dividends Paid $ 67,659 $ 12,153 $ 73,527 13 Appendix B ENAGER INDUSTRIES, INC. Comparative Balance Sheets For 1992 and 1993 (thousands of dollars) As of December 31 1992 1993 Change % Change Assets Current assets: Cash and temporary investments Accounts receivable Inventories $4,212 41,064 66,486 $4,407 46,821 76,401 $195 $5,757 $9,915 4.63% 14.02% 14.91% Total current assets 111,762 127,629 $15,867 14.20% Plant and equipment: Original cost Accumulated depreciation 111,978 38,073 137,208 47,937 $25,230 $9,864 22.53% 25.91% Net Investments and other assets 73,905 6,429 89,271 9,357 $15,366 $2,928 20.79% 45.54% $192,096 $226,257 $34,161 17.78% $29,160 3,630 0 $36,858 3,135 4,902 $7,698 ($495) $4,902 26.40% -13.64% 32,790 1,677 37,866 44,895 2,955 46,344 $12,105 $1,278 $8,478 36.92% 76.21% 22.39% 72,333 94,194 $21,861 30.22% 52,104 67,659 58,536 73,527 $6,432 $5,868 12.34% 8.67% 119,763 132,063 $12,300 10.27% $192,096 $226,257 $34,161 17.78% Total assets Liabilities and Owners’ Equity Current liabilities: Accounts payable Taxes payable Current portion of long-term debt Total current liabilities Deferred income taxes Long-term debt Total liabilities Common stock Retained earnings Total owners’ equity Total liabilities and owners’ equity 14 ENAGER INDUSTRIES, INC. Comparative Income Statement For the years ending 1992 and 1993 (thousands of dollars, except earnings per share figures) Year Ended December 31 Sales COGS Gross margin Other expenses: Development Selling and general Interest Total Income before taxes Income tax expense Net income Earnings per share (1,500,000 and 1,650,000 shares outstanding in 1992 and 1993, respectively) 1992 1993 Change % Change $212,193 162,327 $222,675 168,771 $10,482 $6,444 4.94% 3.97% 49,866 53,904 $4,038 8.10% 12,096 19,521 1,728 12,024 20,538 2,928 ($72) $1,017 $1,200 -0.60% 5.21% 69.44% 33,345 35,490 $2,145 6.43% 16,521 5,617 18,414 6,261 $1,893 $644 11.46% 11.47% $10,904 $12,153 $1,249 11.45% $7.27 $7.37 $0.10 1.38% Financial Ratios 1992 Accounts receivable turnover* 2.58 AR/Total assets 21.38% Deferred income taxes/Total assets 0.87% Gross profit margin 23.50% Net profit margin 5.14% ROA 5.68% ROE 9.10% * Assumes that approximately 50% of sales is on credit 1993 2.38 20.69% 1.31% 24.21% 5.46% 5.37% 9.20% 15