Incorporating

Official Board Markets

Paper, Packaging and Fiber Market News and Prices for North America

Jul. 24, 2015 | Vol. 37, No. 28

Graphic paper demand in North

America has dropped 48% since

the turn of the century.

Assess machine conversion

challenges at

www.risi.com/NAConversion

DID YOU KNOW...

…that copying or electronic forwarding of this publication is illegal

in virtually every country around the

world? We rely on subscription fees

to support our worldwide editorial

team. Illegal copying hurts our ability to bring you the very best news

-- and may even subject you to a fine.

Discounts are available for groups

of five or more new subscribers from

the same company. Contact us at

www.risi.com/contact for more information. For general subscription and

other inquiries, email info@risi.com.

After a month of incomplete worldwide chemical market pulp producer data, full "World 20"

inventory and shipment figures returned with June results after Brazilian bleached eucalyptus

kraft (BEK) came back into the fold.

Overall market pulp inventories declined one day-of-supply in June to bring levels to 34

days, with bleached softwood kraft (BSK) down a day into balanced levels and bleached hardwood kraft (BHK) down two days to 38 days, according to figures the Pulp and Paper Products

Council (PPPC) released on July 23.

Separately, the global BHK market is set to deal with an unexpected supply shock after

Asia Pacific Resources International (APRIL) closed down its big 1.5 million tonnes/yr BHK

line at Rizhao, China, due to a drought.

The Rizhao closure, expected to last until October, came a week after the firm closed a

smaller 300,000 tonnes/yr line leading to 1.8 million tonnes and about 5% of global BHK supply being shuttered when market conditions were just

››› continued on page 8

Neenah's $120 million purchase of FiberMark would

be the specialty/technical firm's fourth deal since 2012

Neenah Paper continued its expansion in specialty and technical paper products, signing

a definitive agreement to acquire FiberMark for $120 million in a move that the company

believes will help it grow in premium luxury packaging.

The deal, if completed as planned by July 31, would be Neenah Paper's fourth acquisition

since 2012 and second one in technical products in three years. Last year, Neenah Paper

acquired Crane & Co's technical materials div, which included a plant in Pittsfield, MA. The

other two acquisitions involved premium uncoated fine papers: Wausau Paper's colors and

premium papers unit and Southworth's business papers brand.

For the deal to be completed, Neenah Paper is purchasing the outstanding equity of ASP

FiberMark from an affiliate of American Securities.

From FiberMark, Neenah Paper adds further capability in the premium packaging, a

segment the company has expanded in over the last few years. With annual sales of more than

››› continued on page 6

$160 million, FiberMark is a specialty coater and

Despite 5% decline in US shipping sack volume and

with more imports, multiwall paper market stable

This Week:

IP Springfield set for

$100 million upgrade

2

K-C reports 4% drop on

consumer tissue prices

5

Drought, prices cause

Howe Sound news shut

5

Packaging Focus World stocks fall one day as Brazilian BEK figures

return; supply shock expected from Rizhao shut

2-4

US shipping sack deliveries for the first half are down 5% from a year ago, with imports of

paper sacks from Canada, Mexico, and Brazil a major factor, according to the latest industry

statistics. But the multiwall sack kraft paper market has been quiet on pricing this year on most

fronts including pricing after major industry consolidation in 2014, according to contacts.

"I've been expecting something might happen with prices because of the decline in sack

volume this year, but it has been very quiet," one sack converter said.

US shipments of unbleached multiwall sack kraft paper for the first half of this year are

down 22% from a year ago, with some of this weakness possibly from "bleeding" of some

multiwall paper into other kraft paper statistical categories, one contact noted.

Total US unbleached kraft paper shipments for the first half were up 0.4% from a year ago

-- a strong performance for this long-declining grade sector -- and were helped by strength in

bag and sack grades, up 14%, and kraft converting paper, 5.2% higher, according to American

Forest & Paper Association (AF&PA) statistics.

››› continued on page 2

Pa c k a g i n g F o c u s

Containerboard

PCA exceeds earlier 2Q

profit guidance, helped

by fast DeRidder ramp

Packaging Corp of America (PCA) reported

slightly higher operating earnings for the second quarter, helped by improved performance

of its big DeRidder, LA, containerboard mill.

Excluding special items, second quarter

net income reached a record $116 million

($1.18/share) compared with net income of

$114 million ($1.16/share) on flat sales of

$1.5 billion. The result exceeded the company's prior guidance by $0.15/share.

"We had an outstanding quarter operationally in both our mills and box plants,

which increased earnings significantly over

prior guidance," said CEO Mark Kowlzan

in the company's earnings announcement.

"The benefits from improvements made at

the DeRidder mill, during its first quarter outage, were realized faster than expected, which

allowed further grade optimization in our containerboard mill system," Kowlzan added.

Faster than expected ramp up.

PCA missed consensus first quarter earnings estimates partly because of 22 days of

downtime at DeRidder. The downtime resulted from extensive optimization work to

the mill's pulp mill, energy system, and two

paper machines.

The work followed last fall's conversion of the D-3 machine from newsprint to

production of 355,000 tons/yr of containerboard. The first quarter outage took six days

longer than expected because of "problems"

with vendor-supplied equipment for the

615,000 tons/yr D-1 linerboard machine,

Kowlzan said.

The D-3 machine produced 79,000 tons

(875 tons/day) in the second quarter, including 59,000 tons of kraft linerboard and

20,000 tons of recycled corrugating medium. This helped PCA reduce its outside

purchases of containerboard by 56,000 tons

from the second quarter of 2014.

Within 80% of target. "We are basically in the 80% range of reaching our 1,000

tons/day for the D-3 machine," Kowlzan

told analysts.

"D-3 has proven to come on very quickly" and is producing a 75%/25% mix of linerboard to medium, he said. The machine

was originally expected to produce more

medium.

D-3 is scheduled to go down again for

13 days in September for the installation

of six new dryer cans, rather than the originally expected four, which is to help the machine achieve its 1,000 tons/day target and

reduce cost. The company still believes D-3

2

will contribute $60 million of EBITDA,

Kowlzan said.

"The ability to produce virgin, high-performance linerboard grades on D-3 plus the

improvements on D-1 allowed us to make

more lightweight and specialty grades at

DeRidder and shift other (heavier weight

grades) to our Counce, TN, and Valdosta,

GA, linerboard mills," Kowlzan said. "This

resulted in record productivity on a tons/day

basis and lower cost at all three mills."

Box shipments up 2.1%. Corrugated

box shipments were up 2.1% on a total and

per work day basis over "a very strong" second quarter last year," exec VP Tom Hassfurther told analysts. He said profitability

was helped by a "richer mix," achieved partly from migrating former Boise box plants

to higher-value added corrugated business.

The company said EBITDA margins in

its packaging business increased to 23.4%

in the second quarter of 2015 from 22.6%

a year ago.

The fourth largest North American containerboard and corrugated box producer,

PCA acquired Boise for nearly $2 billion

in October 2013. From Boise, PCA added

containerboard capacity in DeRidder and

Wallula, WA, along with corrugated plants,

and uncoated freesheet and specialty paper

capacity at three mills including Wallul

Four board firms report. Next week

on July 29, North America's two largest

containerboard and box companies, International Paper and WestRock, will report their

second-quarter earnings as will Smurfit

Kappa Group and Kapstone.

• PCA said that its board of directors

has authorized the repurchase of an additional $150 million of the company’s

outstanding common stock. Together with

remaining authority under previously announced programs, PCA may repurchase

about $205 million of additional shares, the

company said this week. The timing and

amount of repurchases will be determined

by the company.

IP planning $100 million

upgrade to Springfield, OR,

kraft linerboard mill

International Paper's (IP) request for a fiveyear property tax waiver for a proposed $101.6

million upgrade to its Springfield, OR, kraft

linerboard mill was approved by the local city

council and county commissioners.

The exemption would save IP more than

$8.5 million in property taxes on the upgraded equipment over a five year period,

the Eugene Register-Guard reported.

IP said that it is planning to replace the

headbox of the mill's No. 2 linerboard ma© 2015 RISI, Inc. All rights reserved

chine and the floor of one of its boilers. If

the company approves the plan, the project

would begin in September and be completed in 2016.

A single 256-in. trim Beloit Bel Bond

paper machine with an extended nip press

runs at the mill. The PM 2 is capable of

producing 635,000 tons/yr of mainly standard and lightweight unbleached kraft linerboard, and some white-top linerboard,

according to RISI Mill Intelligence. The

mill's No. 1 linerboard PM was shut down

in 2001.

The proposed upgrade will not add jobs

beyond the estimated 400 temporary contract workers for the project. But a company

official told the Register-Guard the upgrade

would offer "long and reliable operation" of

the 66-year old mill.

Under the exemption, IP could reduce

the mill complex's workforce by up to 20%

but the company said it has no plans for any

job cuts.

The company also agreed that any new

hires during the five-year period on average would receive more than 150% of Lane

County's average annual wage of $38,353 -or $58,530/yr. The mill's average employee

annual compensation, including wages and

most benefits, is $95,882, according to the

local newspaper.

Last IP West Coast mill. Springfield

is IP's only major containerboard mill on the

West Coast. IP acquired the mill in 2008 as

part of its $6 billion acquisition of Weyerhaeuser's containerboard, packaging, and

recycling business. The company shut the

Albany, OR, mill acquired in the same deal

in late 2009.

The mill is the highest cost mill in IP's 16mill US industrial packaging system and is the

only other IP mill besides Mansfield, LA, mill

that makes some white-top linerboard.

RISI Analytical Cornerstone estimates

Springfield's cash cost for making unbleached kraft linerboard at $330-340/ton

and its cost for white-top at more than $500/

ton, excluding delivery. Both are on the

high end of the industry cost curve, according to RISI Mill Intelligence.

SHIPPING SACK IMPORTS FLOW

‹‹‹ continued from page 1

US sack shipments down 5%. US

finished shipping sack shipments for the

first half of this year were down 5% to

1.18 billion sacks, according to the Paper

Shipping Sack Manufacturers Association

(PSSMA).

"Domestic sack demand has been strong

for building materials end uses for the first

PPI PULP & PAPER WEEK/July 24, 2015

P a c k a g i n g F o c u s , continued

half of this year, up about 3.6%," said PSSMA pres Dick Storat. "But agricultural and

food end users were down about 5%. Minerals were off 20%, partly due to lower demand

from the oil industry for drilling sand."

Apparent US purchases of paper multiwall sacks (with imports included) were

down a more modest 2% through May.

Jump in paper sack imports. Imports of converted multiwall (MW) paper

sacks through May were up 16% from a

year ago due to the strong US dollar and

sluggish growth in other countries, making

the US market an attractive target, contacts

said.

On the other hand, imports of laminated

woven (LW) sacks were down 24% for the

first half "with imports from China no longer creating havoc" because of antidumping duties that were first imposed in 2008,

one contact claimed. China, however, still

accounts for 10% of total US laminated woven and paper sack imports.

"Laminated woven sacks may also be

maturing in ability to grow in certain markets like pet food," one contact said.

Overall US laminated sack demand was

down about 5% through May this year, although domestic LW sack manufacturers,

which in some cases also make paper sacks,

were able to increase shipments fractionally

and capture market share from imports.

Total sack imports (paper multiwall +

laminated woven) were up a more modest

5.4% through May, according to the PSSMA and based on US trade statistics.

Brazilian imports up 74%. Paper

multiwall sack imports from Canada, which

account for more than 40% of total US sack

imports (MW + LW), were up almost 14%

through May. Imports from Mexico, which

supplies about 13% of total US sacks,

jumped almost 18%.

But the biggest increase was from Brazil, where the domestic economy is in recession, the Real has dropped 17% against the

US dollar this year, and two new kraft paper

machines plus some sack converting lines

were added.

Brazilian sack shipments to the US are

up 74% this year, raising some eyebrows in

the US sack industry. Brazil now accounts

for about 5% of total US sack imports (13

million sacks).

Also, some of the converted sacks coming over the border from Mexico (33 million sacks) are reportedly from a large new

multiwall plant that is using Chilean paper,

one contact said.

The Brazilian sacks are imported at an

average value of $285/thousand sacks compared with a global average US import value of $348/thousand, according to US trade

data. Mexico's sacks are coming in at $325

and Canada's sacks at $344/thousand sacks.

PPI PULP & PAPER WEEK/July 24, 2015

US KRAFT PAPER STATISTICS -- FIRST HALF 2015

(000 tons)

Unbleached

Shipments

Multiwall

Bag and sack

Converting

Exports

Imports

Mill inventories (ended June 30)

Operating rate

Bleached

Shipments

Operating rate

Total kraft paper

2015

First half

2014

% chg

794

200

407

187

90

80

63

n.a.

791

256

357

177

110

87

55

n.a.

0.4%

-21.7

13.9

5.2

-18.2

-8.3

14.1

56

n.a.

850

62

n.a.

852

-8.9

-0.3

Source: American Forest & Paper Assn.

More sack imports, which tend to be

heavier valve type bags, are arriving from

Europe, including from Germany and the

Netherlands, the trade statistics indicate.

US paper prices stable. But so far,

the softness in US shipping sack cutup from

the surge in converted sack imports has not

translated into any weakness in prices for

multiwall kraft paper, according to contacts.

"Multiwall paper has been one of the

brighter spots this year," one contact said.

"If any oversupply develops, mills can just

shift machines to producing lightweight

kraft linerboard."

North American producers last raised

prices on extensible and natural multiwall

kraft paper by $50/ton in the spring of 2014

in the USA. Natural sack kraft paper (50 lb)

is reportedly selling around the $750-775/

ton range, net of discounts, in the USA. Extensible sells in the $900-$1,000 range domestically -- though most high-performance

extensible paper is exported for cement

packaging and other end uses.

Tolko,

Canfor,

and

KapStone's

Longview, WA, mill are the only North

American producers of high-performance

extensible sack kraft paper.

Competitive export market. US

exports of unbleached kraft paper, mainly

extensible multiwall, declined 18.2% to

110,000 tons in the first half of this year, according to US trade data compiled by the

AF&PA. Imports of unbleached kraft paper

were down 8.3% to 80,000 tons over the

same period.

US export producers such as KapStone

have been facing "headwinds" from the

strong dollar, slowing economies and construction markets in Asia, Latin America

and the Middle East, and the West Coast

© 2015 RISI, Inc. All rights reserved

port slowdown earlier this year that ended

in February, according to contacts.

Pricing in export markets for B-grade

paper in some developing markets is in the

mid-$700/tonne range, contacts told PPI

Europe. Global markets have also become

more competitive because of slow demand

in Europe -- the major exporting region -and rise of the dollar that turned producers

in Europe, Russia, and Brazil much more

cost competitive.

"Dollar-priced paper has had to come

down in price when contracts open up to be

competitive with paper sold in Euros," one

contact noted. "So exchange rates have created downward pressure on dollar prices."

European price hike difficult. Major European producers such as Mondi and

BillerudKorsnas announced up to Euro 60/

tonne price hikes on unbleached sack kraft

paper for June/July, and implemented about

Euro 20 of the increase with negotiations

still in progress, PPI Europe reported.

The main reason the increase did not

achieve targeted levels has been slow demand in Europe during the seasonally

strong summer period, according to PPIE.

Eurosac recently reported deliveries of

finished sacks in Europe were down 2.2%

through April, from deliveries in 2014

through April.

Few waves from consolidation.

The biggest structural change in the North

American market last year was global industry leader Mondi's acquisition of Graphic Packaging's nine sack plants and Pine

Bluff, AR, mill to become the largest and

only integrated North American shipping

sack converter.

Hood Packaging added to its position

last year as the second largest producer by

acquiring four Bemis multiwall plants. El

3

P a c k a g i n g F o c u s , continued

Dorado Packaging acquired Greif's two

multiwall plants plus an Arkansas independent converter (which provided the name

for the new business).

Mondi's new leadership role in the US

market has not caused many waves, despite some earlier apprehension, according

to contacts. One converter, however, noted

paper quality from its 150,000 tons/yr Pine

Bluff mill has "noticeably improved" since

the acquisition.

Brown bag & sack growing. US

unbleached kraft bag and sack paper shipments jumped almost 14% to 822,000 tons

on an annualized basis for the first half -which would be the highest level in about

25 years, according to AF&PA statistics.

"Demand for lighter weight (30-33 lb)

unbleached paper has been benefiting from

the shift of McDonald's and other fast food

chains from bleached and plastic bags to

brown paper bags," one contact said.

Another factor helping growth may be

municipal and state bans on plastic bags although many such ordinances require consumers to pay for each paper bag and are

probably providing more of a boost for plastic polywoven returnable bags, according to

some contacts.

Heavier weight unbleached kraft grocery

bag paper is reportedly selling in the $590650/ton range, net of discounts, one contact said. Recycled bag paper from recently

converted newsprint machines is reportedly

selling at lower price levels. More of the bag

market shifted to 100% recycled bag paper,

with kraft mills shifting more to higher value

multiwall and kraft converting grades.

• Union workers at KapStone's 1.1

million tons/yr Longview, WA, kraft paper

and containerboard mill on July 22 rejected

the company's latest offer, according to the

union. About 68% of voting members rejected the offer, down from 99% against the

first of two earlier offers, according to the

Longview Daily News. Union workers said

they are continuing to meet with KapStone

to resolve various sticking points that include health care, seniority rules, and other

issues. "Just like the company, we'd like to

get a labor agreement, but we don't have

one yet, so we're preparing for the worst,"

a union VP told the newspaper. KapStone

said it will run the mill -- at least the mill's

largest kraft paper and containerboard PMs

-- if the union strikes.

Conference

Top CEOs, challenges,

issues are focus points for

RISI North America event

From challenges to innovation and strategies from top industry CEOs, RISI's 30th

4

annual North American Forest Products

Conference runs on Sept. 28-30 in Chicago.

The event includes PPI's annual global

awards dinner on Sept. 28 as well as a special packaging buyers' seminar, a full-day

on Sept. 29 of industry speakers on key topics, and RISI economists' two-year forecasts

as well as a special Housing Demand panel

discussion on Sept. 30. The conference is at

the InterContinental hotel.

The first full day on Tuesday, Sept. 29,

features the presenting of the 2015 RISI

North American CEO of the Year award to

Graphic Packaging's David Scheible, who

has led the company through a significant

financial recovery that included eight acquisitions and creating a more integrated boxboard company, according to analysts who

voted for Scheible.

After the award ceremony, Scheible

is to speak for about 20 minutes and then

join a CEO panel discussion that includes

Glatfelter's Dante Parrini and WestRock's

Steve Voorhees. Voorhees recently became

the top executive at WestRock, which was

developed from one of the industry's largest

M&A deals that combined RockTenn with

MeadWestvaco this month.

Other presenters include analysts who

will detail key market dynamics and impacts in pulp and paper, containerboard/boxboard, and forest products. The analysts are

UBS's Gail Glazerman on financial metrics

in pulp and paper, Deutsche Bank's Debbie

Jones on containerboard and boxboard, and

RBC Capital Markets' Paul Quinn on forest

products' businesses.

McKinsey & Company Dir of Knowledge Peter Berg and American Forest & Paper Association pres/CEO Donna Harman

will speak on broad-based topics critical to

the industry, with Berg on issues and solutions, and Harman on regulations, trade, and

legislation. Also in the session with Berg

and Harman are RISI Principal Economist

for Lumber Bob Berg and RISI Director

for Macroeconomics David Katsnelson.

Berg will discuss US housing demand, and

Katsnelson global economic growth and

factors.

Further, Berg will lead the special Housing Demand discussion on Sept. 30 at the

start of the day. Panelists include the National Association of Home Builders' Chief

Economist David Crowe and Wells Fargo

Managing Director for Industrials Investment Banking Charles Spiggle.

Looking toward the short-term future,

Brazilian Tree Industry (Iba) pres Elizabeth

de Carvalhaes will discuss GMO eucalyptus tree growth potential in Brazil as well as

sustainability efforts. De Carvalhaes in May

© 2015 RISI, Inc. All rights reserved

was selected as the new president for two

years of the International Council of Forest and Paper Associations. University of

Maine professor Mike Bilodeau will report

on the potential for nanocellulose, following the first commercial plant started up in

the USA this year and FP Innovations Research Leader for Market Research David

Fell will consider the future for construction

in terms of demographics and lumber type.

Conference information and registration

is at http://events.risiinfo.com/north-american-conference/registration.

Packaging news briefs

Graphic Packaging reported adjusted

net income excluding special charges for

the second quarter of $61.3 million ($0.19/

diluted share) compared with $66.0 million

($0.20/share) a year ago. Adjusted EBITDA

of $192.1 million compared with $190.8

million in the prior year. Adjusted net sales

increased $48.1 million, up 4.8% from a year

ago, excluding sales from divested businesses. “We delivered on our expectations

despite continued soft demand in key end

markets,” said chmn/CEO David Scheible.

“Although market volumes remain challenging, we continue to post strong results,”

with adjusted EBITDA margins improving

to 18.2% from 17.1% in the year ago period… After completing the acquisition of

Burgo’s Mantova mill in Italy, Pro-Gest

recently said it plans to convert the mill’s

newsprint machine to 420,000 tonnes/yr

of containerboard production by August

2016, PPI Europe reported. The company

is in negotiations with suppliers and plans

to make testliner and recycled corrugating

medium in a basis weight range of 70-140

g/m2, according to a spokesman. The cost

of the project is expected to be about $165

million, the company said. Pro-Gest signed

a binding offer to acquire the Mantova mill

at the end of March. The 160,000 tonnes/

yr newsprint mill has been idle since February 2013. Pro-Gest runs 620,000 tonnes/

yr of recycled containerboard capacity in

Europe, according to RISI estimates. In the

USA, five newsprint machines since early

2013 were converted to containerboard and

or packaging paper production... Bemis

signed an agreement to acquire the rigid

plastic packaging operations of Emplal Participações, a Brazilian manufacturer of plastic packaging for food and consumer applications. The firm operates two facilities in

Brazil and generated $75 million in 2014.

PPI PULP & PAPER WEEK/July 24, 2015

Tissue

K-C grows North American

volume by 5%, and reports

4% decline in average pricing

In possibly its deepest quarterly price drop

in years, Kimberly-Clark' (K-C) reported a

4% decline in its consumer tissue prices in

North America in the second quarter, vs second quarter 2014's average.

Even with the 4% price decline, the company reported that consumer tissue sales

were flat and volume actually increased 5%.

"Volumes rose high-single digits in bathroom tissue, with benefits from increased

promotion shipments on Cottonelle. Volumes increased low-single digits in facial

tissue and paper towels." the company reported on July 23.

K-C is the second or third largest tissue paper producer in North America with

Procter & Gamble, behind Georgia-Pacific.

Major producers have not officially

increased consumer tissue product pricing following a formal announcement four

years ago in North America. The US's second largest private label producer, Clearwater Paper, did announce a consumer tissue

increase for August and First Quality tried

one last year. No others were known to be

out with increases as of last week on consumer tissue. In After-from-Home tissue,

North American producers implemented a

price increase last year.

Producers, including the largest, did increase prices unofficially since second quarter 2013 by reducing sheet counts and roll

sizes. During that period, major producers

also appeared to increase national advertising for their products both on television as

well as with specialized inserts.

K-C's chmn and CEO Thomas Falk told

analysts on July 23 that, in consumer tissue,

"competitive activity has probably picked

up just a little bit."

"We are continuing to do well with Cottonelle and have seen that take off ... (and)

Scott Tissue is also continuing to do well in

the market," he said. "So probably, maybe

the competitive frequency has picked up

just a bit and you are seeing that a little bit

in the pricing number."

He added that some of the lower pricing

resulted from "promotional (and advertising

spend) timing. And so I wouldn't necessarily

say that the uptick this quarter [in ad spend]

was fully reflective about what's happened

in the market. Some of it had more to do

with timing of promotions than the overall

market activity."

• Wausau Paper appointed Rob

Yanker to its board of directors, effective

immediately. Yanker is one of the company's nominees for election at its 2016 Annual Meeting of Shareholders. Yanker is a

PPI PULP & PAPER WEEK/July 24, 2015

dir emeritus at McKinsey & Company.

Yanker worked at McKinsey for 27 years,

from 1986 to 2013, in the industrial, consumer, and telecommunications sectors.

Newsprint

With price drop, drought,

Paper Excellence shuts down

Howe Sound newsprint mill

Citing local drought conditions and declining prices, Paper Excellence shut down its

newsprint machine and related thermomechanical pulp production at its Howe Sound

Pulp & Paper (HSPP) mill in Port Mellon,

BC, on July 23, cutting 264,000 tons/yr of

capacity and 180 jobs.

The shut represents about 4.2% of total

North American newsprint capacity and

36% of the mill's workforce of 505. The

company will continue to produce northern

bleached softwood market pulp (NBSK),

with capacity of about 428,000 tonnes. The

mill was the 7th largest of 10 North American newsprint producers.

"In light of the extreme drought conditions experienced since May, the decision

to cease paper operations was advanced to

help conserve water supply," the company

said in a release. "The future of our mill lies

with our strong pulp and green energy opportunities that will continue to grow."

"With newsprint and value added newsprint prices declining, combined with a

shrinking market that is expected to continue, HSPP undertook an extensive review

process to look at other product options, and

found that either our equipment and furnish

was not suitable nor could it be easily and

economically modified, or that the markets

could support demand for those new products," the statement added.

The company noted the "steady annual

decline" in the standard newsprint and high

brite newsprint markets, and that prices are

expected to continue to decline. It also cited

increasing variable costs at the mill including electricity and wood.

News price down 16.5%. The standard 30-lb newsprint is $505/tonne this

month – its lowest level in 5 ½ years. The

$505 level also was $20 less than the standard newsprint price in the US East, according to PPI Pulp & Paper Week's Price

Watch. The $505 this month is 16.5% less

than it was a year ago.

From its demand peak in 2000, North

American newsprint demand dropped 70%

to four million tonnes in 2014, according

to RISI's North American Graphic Paper Forecast – 5-Yr. report published last

month.

In the last three years, newsprint capacity has declined from permanent shuts of ma© 2015 RISI, Inc. All rights reserved

chines as well as conversions. In 2013 and

2014, conversions to containerboard and

packaging paper were completed on both

the PMs at SP Fiber Technology's Dublin,

GA, mill as well as one of SP's machines at

the Newberg, OR, mill, and also by Atlantic

Packaging at its Whitby, ON, mill.

Paper Excellence acquired the Howe

Sound mill from former venture partners

Canfor and Oji Paper in 2010. The mill

opened in 1909 and was acquired by Canfor in 1951, with the joint venture formed

in 1988. A Valmet 324.4-in-width newsprint

machine was added in 1991.

Final plan to come. Paper Excellence

said a final plan has not been completed on

the paper mill assets but potential for other

uses for the site or its equipment continue to

be considered.

Unifor Local 1119, which represents

workers at the mill, said the closure was "a

shock to us all" and said it would work to

secure possible jobs for displaced workers

at other Paper Excellence mills in British

Columbia. The company's BC pulp mills

are in Chetwynd, Mackenzie, and Skookumchuck. Paper Excellence restarted the

Chetwynd mill on July 7. The mill had been

idle since 2012.

The union noted the shutdown was related to the dwindling supply of water in a

lake that feeds the mill.

"By closing the paper functions as soon

as possible, the company hopes to stretch

the water supply for pulp and power to

avoid temporary closures of those sections

of the mill," Unifor said.

Trade

DOC interim ruling on

SC paper imports from

Canada expected on July 28

Port Hawkesbury Paper, in an update on a

US countervailing duties trade case against

supercalendered (SC) paper imports from it

and other producers in Canada, said it expects an interim ruling by the US Dept of

Commerce (DOC) on July 28 that could include preliminary duty.

In a July 22 letter, Port Hawkesbury pres

of sales Tom Gallagher said the Nova Scotia

mill was preparing for a site visit from DOC

representatives in early August.

"This visit will allow us to further prove

the points of our legal case," he said.

Gallagher said the DOC selected Port

Hawkesbury and Resolute Forest Products

for investigation, and Irving and Catalyst

Paper will be subject to average or nominal

duties.

The case was filed by UPM's Madison

Paper Industries and Verso in March.

5

Specialty Papers

Appvion, then Koehler set

5-7% pricing increases on

thermal POS receipt paper

Two of the world's largest thermal paper

producers were out with price increases in

the last week, with North America's largest,

Appvion, announcing a 5% to 7% increase

for its POS papers, effective Sept. 1, and

Germany's Koehler Paper Group out with

5-7 % increases in North and South America, effective Oct. 1.

Koehler is the No. 2 largest thermal producer in the world and Appvion No. 3, behind Japan's Oji and Kanzaki.

"The increase is due to strong demand

and increases in input costs, and applies to

domestic and international customers," Appvion said, of its global pricing increase.

Appvion's 7% increase is for Alpha 400

2.1 and Alpha 400 2.3, and its 5% rise is for

Alpha 800 2.4 and Alpha 800 3.4, Alpha

820 2.4 and Alpha 820 3.4, and POS Plus

600-2.4.

If successful in the more than 220,000

tons/yr USA POS market, the increase

would be the first one in the USA on thermal

POS receipt paper in more than 2 1/2 years.

The increases follow an 11% decline in

pricing for 48- and 55-g coated thermal POS

receipt paper in the USA -- after reaching its

NORTH AMERICAN PRINTING/WRITING PAPER STATISTICS

JUNE 2015

Uncoated mechanical

Shipments

Operating rate

Imports

Demand

Uncoated freesheet

Shipments

Operating rate

Imports

Demand

Coated freesheet

Shipments

Operating rate

Imports

Demand

Coated mechanical

Shipments

Operating rate

Imports

Demand

Total printing & writing

Shipments

Operating rate

Imports

Demand

(000 tonnes)

June

% chg.

2015

year ago

Year-to-date

2015

% chg.

year ago

270

90

20

269

-13.8%

90 1

-52.9

-18.1

1,656

89

134

1,647

-12.4%

90 1

-19.3

-13.3

654

92

90

716

4.4

89 1

8.9

7.7

3,846

90

499

4,148

-2.0

92 1

3.7

0.0

258

85

80

332

-6.4

92 1

10.6

-2.2

1,549

85

450

1,950

-6.9

92 1

3.5

-3.5

204

87

31

228

-15.0

89 1

48.9

-8.4

1,305

92

186

1,436

-9.2

88 1

21.4

-6.4

1,386

89

222

1,544

-4.8

89 1

1.5

-2.3

8,356

89

1,269

9,181

-6.3

91 1

2.7

-4.4

Mill Inventories

(000 tonnes)

Uncoated mechanical

Uncoated freesheet

Coated freesheet

Coated mechanical

Total printing & writing

June

2015

207

623

481

157

1,468

May

2015

214

631

485

149

1,479

June

2014

232

657

397

161

1,446

Tonne change

from

from

month ago year ago

-7

-25

-8

-33

-3

84

-7

-4

-12

22

1. Operating rate, not a percentage change. r=revised.

Source: Pulp and Paper Products Council.

6

© 2015 RISI, Inc. All rights reserved

highest ever level in early 2013, according

to PPI Pulp & Paper Week's price report.

There's "no price pressure at this point,"

said a paper supplier at the end of this week.

"I am betting the price increase holds at

some level at different points between Sept

1 and Nov 1. The current jumbo roll price is

unsustainable for each manufacturer based

on input costs, freight, resale and currency,"

the contact said.

• Kohler Kravis Roberts is bidding

for NCR, CNBC reported this week. Thoma

Bravo and Blackstone have been previously

mentioned in reports as being interested in

acquiring NCR, which designs and sells

ATM and retail store customer POS checkout systems that run receipt paper.

• Monadnock Paper Mills said it expanded its EnviPortfolio of fiber-based line

to "replace plastics across a broad range of

applications and end-uses in retail, hospitality and other consumer-facing markets," the

company said. Launched in 2012, the EnviPortfolio papers in the Envi line are FSC

certified, manufactured carbon neutral with

Green-e Certified 100% renewable electricity (RECs). The line includes Envi Card

Stock, a 100% recyclable wood fiber alternative to PVC and PLA used in gift, loyalty,

promotional, and membership cards; Envi

Wet Strength Label; 100% PCW Envi Tag

and Ticket; and Envi Folding Box Board,

which is up to 100% PCW and is an 18 pt

white paper stock used for secondary packaging for luxury fragrance and cosmetics.

"Sustainability is ingrained in our everyday

business practices, and we are proud to offer alternatives to plastic," said Monadnock

chmn and CEO Richard Verney. "Consumers are seeking brands that are socially responsible so we are offering this new sample book to make it easier for designers and

brand owners to source more sustainable

solutions." A copy of the EnviPortfolio is

at Monadnock's website at http://mpm.com/

news/announcing-the-new-enviportfolio/.

NEENAH TO BUY FIBERMARK

‹‹‹ continued from page 1

finishing company with a "strong presence

in luxury packaging," according to reports.

A Neenah Paper official said the main

gain from FiberMark is its "complementary

capabilities that can drive future growth

(coating, saturating and heavier weight base

papers, as well as excellent design and prototyping) -- especially in premium packaging."

"The key overlapping end markets include premium packaging, decorative covers/security papers, labels and tape," the

official added.

Also, "They have a more complete portfolio of heavier weight papers, which supports some premium packaging end markets

PPI PULP & PAPER WEEK/July 24, 2015

that we are not in today. They have a variety

of other grades and markets, many of which

overlap where we are present today and

some that are new," the official said.

Like Neenah, FiberMark sells actively

outside North America from two paper mills

and four converting-only facilities. Still,

both firms generate a majority of their revenue (60% for Neenah) in North America.

Growing in luxury packaging.

Luxury packaging is a more than $45 million business at Neenah Paper and company

CEO John O'Donnell earlier this year said

the business was growing rapidly, and was

up by 20% in 2014. Neenah's luxury packaging is focused on bags and papers for

major brand and product names in clothing,

jewelry, and other products.

Neenah Paper would combine with FiberMark and gain in premium packaging

while the firm also pushes ahead on growing in technical products in the USA.

Filtration project in Wisconsin.

Neenah's largest end-use market for its products is in transportation filtration. O'Donnell

earlier this year said the business has been

growing at double-digit rates. Its transportation filtration business holds a commanding share in Europe that Neenah Paper now

wants to try to replicate in North America.

O'Donnell said the company expects its demand to exceed capacity for the products in

two to three years. As a result, Neenah Paper

will convert an uncoated papers machine in

Wisconsin by first quarter 2017 to filtration paper from uncoated specialty paper.

Also, it will start up an advance saturating

plant for filter paper at the Wisconsin mill

site that would produce safe flare-retardant

filters and greater dust holding capacity in

its products. The company's flare-retardant

air filter is in Ford's top-selling F-150. The

firm expects to spend $45 million this year

on the Wisconsin project.

With FiberMark's annual sales of more

than $160 million, Neenah Paper's total

revenue would total at least $1.06 billion,

based on estimates. The company's 2014

sales were $902.7 million, vs $696.0 million in 2011, before Neenah completed

three acquisitions and a partnership with

Italian premium paper producer Gruppo

Cordenons.

Neenah Paper has grown revenue by

30% and doubled income from continuing

operations the last three years, to $68.7 million from $29.3 million in 2011. Neenah

reported gross profit of $177.2 million last

year, vs $125.4 million in 2011. Also, Neenah Paper's share was up almost 200% late

this week, at $60.91/share on July 23, compared with $21.24 in late July 2011.

Spun off to K-C shareholders in November 2004, the company's market capitalization and enterprise value today is about

$1.02 billion and $1.2 billion, respectively.

It is now owned primarily by institutional

MONTH IN STATISTICS

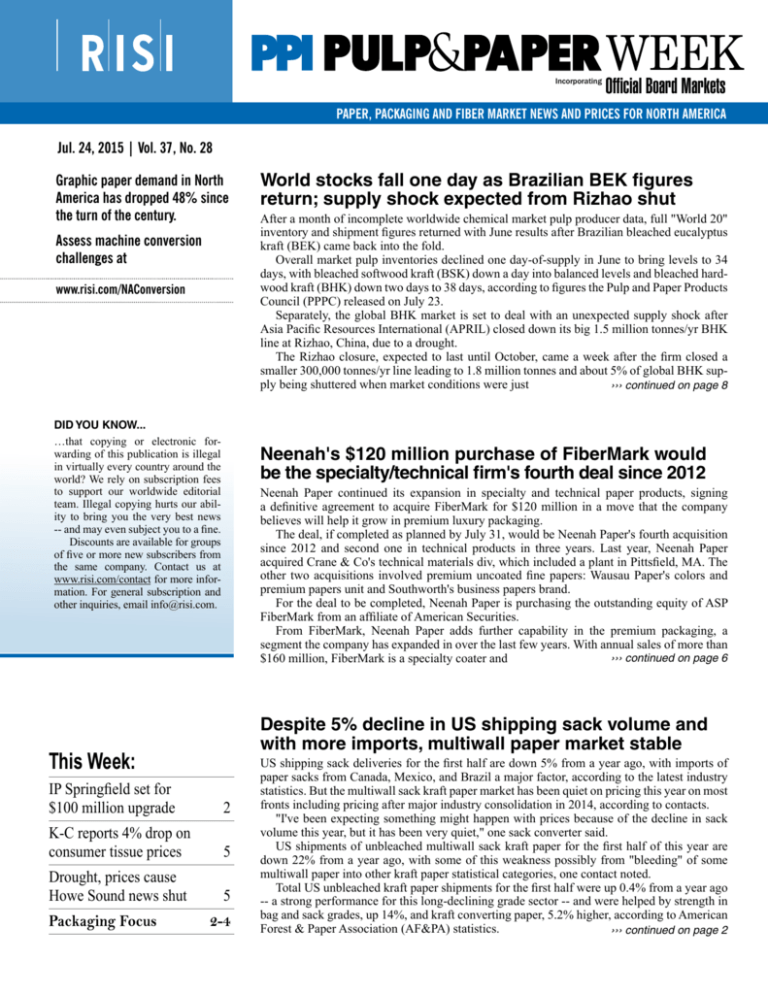

US paper and board production was down 0.7% year-to-date

through May at 32.58 million tons (vs 2014 production through May),

according to the American Forest & Paper Association. May's

total was 6.597 million tons, down 1.9% vs May 2014's total.

In May, production gainers included corrugating medium,

which was up by 3.0%, tissue up by 1.7%, and unbleached kraft

boxboard up 3.9%.

Paperboard's May operating rate average was 96.2%, down from

97.2% in April, and paper's was 84.7%.

For year-to-date, linerboard production was up by 2.3% and

corrugating medium 3.2%. That put containerboard production

up by 2.6% year-to-date. Also, liquid packaging and food

service boxboard and tissue were up 0.3% and 2%, respectively,

year-to-date. The largest declines year-to-date were in newsprint,

down 21.2%, and coated printing and writing papers, down

7.9%. Further, coated mechanical paper production was down

10.8% year-to-date.

PAPER & PAPERBOARD PRODUCTION

Newsprint

Uncoated mechanical

Coated paper

Uncoated freesheet

Tissue

Unbleached kraft papers

Total paper

Linerboard

Corrugating medium

SBS boxboard

Unbleached kraft boxboard

Liquid packaging/food service board

Recycled boxboard

Total paperboard

Total paper and paperboard

May

May

May

May

May

May

May

May

May

May

May

May

May

May

May

Current

Month

157

116

456

624

639

132

2,411

2,152

870

184

226

263

185

4,186

6,597

US paper and paperboard production

millions of tons*

7.1

6.8

2015

6.6

6.3

2014

6.1

5.8

Jan

Mar

May

Jul

Sep

Nov

* Not seasonally adjusted.

same month

year ago

188

143

516

655

629

132

2,550

2,154

845

196

218

262

190

4,174

6,723

% chg.

2015/14

-16.5%

-18.9

-11.6

-4.7

1.6

0.0

-5.5

-0.1

3.0

-6.1

3.7

0.4

-2.6

0.3

-1.9

YTD

2015

740

616

2,450

3,258

3,126

656

12,252

10,510

4,254

868

1,024

1,294

897

20,332

32,584

YTD

2014

939

661

2,661

3,389

3,066

658

12,795

10,271

4,123

868

1,032

1,289

931

20,010

32,805

% chg.

2014/13

-21.2%

-6.8

-7.9

-3.9

2.0

-0.3

-4.2

2.3

3.2

0.0

-0.8

0.4

-3.7

1.6

-0.7

n.a. = not available. SBS: solid bleached sulfate. Linerboard and medium totals are for both virgin and recycled contents.

Note: Figures in 000 short tons unless otherwise listed. n.a.=not available. 1. American Forest & Paper Assn.

PPI PULP & PAPER WEEK/July 24, 2015

© 2015 RISI, Inc. All rights reserved

7

and mutual fund companies, with the largest

shareholders being Royce & Associates, Allianz Asset Management, Black Rock, and

Wells Fargo.

Interestingly, following the spin-off,

Neenah Paper in 2006 acquired FiberMark's

technical and specialty papers business in

Germany.

"We've got the financial strength and

employee talent to continue executing our

strategy to serve our customers well, grow

in specialty niche markets, and deploy capital in ways that add value for our shareholders," the company official said this week.

RIZHAO SHUT RAISES CONCERN

‹‹‹ continued from page 1

beginning to unravel in China that often

leads pricing cycles globally (P&PW, July

17, p. 1).

Force majeure. Market participants

first informed P&PW of Rizhao's impending closure on July 21, a day after APRIL

Rizhao issued a letter to customers announcing "force majeure" after the City of Rizhao

in Shandong province in eastern China, cut

off water supplies to all industrial companies to preserve supplies for residents.

In a letter sent to customers obtained

by P&PW, APRIL said the municipal government of Rizhao began a "Water supply

Control Program" starting in mid-June, but

drought conditions worsened and its pulp

mills were now cut off:

"City Rizhao have to cut all water supply to all industrial companies in Rizhao

(to) protect all human being needs. Under

such kinds of pressure, our No. 1 line shut

down on July 13, and No. 2 line would be

shut down from July 23," the letter said.

"We apologize (and) inform all of our customers that we could not honor all pending

contracts now."

APRIL hopes to receive enough water to restart production in October, and in

the meantime will try to shift some volume

from the Indonesian market to China, the

letter noted. If the two lines remain closed

for three months, it'll reduce BHK output by

an estimated 444,000 tonnes.

For competitors of APRIL, which some

in China call Asia Symbol, the unexpected

supply crunch led to a sudden reversal in

market behavior. Last week, the BSK market was crashing in China and market contacts reported $40/tonne or so drops vs June

levels and most saw $10 or bigger drops

potentially in BHK grades. Once news of

APRIL's Rizhao closure emerged, BHK

producers that were quietly cutting prices

suddenly stopped.

8

WORLD MARKET PULP STATISTICS -- JUNE 2015 *

5,000

World Producer Inventories

4,500

4,000

3,500

3,000

2,500

2010

2011

2012

2013

2014

2015

Note: Statistics represent 80% of capacity, and exclude China, Russia, and Indonesia. *Month-end

stocks divided by average daily shipments in the last three months.

Source: Pulp and Paper Products Council.

(000 tonnes)

June

2015

4,055

97

WORLD

Shipments

Utilization (ship.-to-cap.)

Shipments by grade

Bleached softwood

Bleached hardwood

Shipments by destination

North America

W. Europe

China

Rest of World

Producer inventories

Days of supply * -- all grades

Bleached softwood

Bleached hardwood

YTD

2015

23,007

92

YTD % chg

2015/14

4.1

2.0

1,923

1,997

11,171

11,062

0.6

8.0

661

1,217

1,061

1,116

June

2015

34

29

38

3,767

7,185

5,619

6,436

May

2015

35

30

40

1.7

0.4

11.8

3.5

June

2014

33

25

40

PULP INVENTORIES OF CONSUMERS AND PORTS -- JUNE 2015

European consumers

European ports

June

2015

582

981

(000 tonnes)

May

2015

573

1,018

April

2015

653

1,011

% chg

2015/14

6.8%

-5.3

Source: Utipulp (European consumer inventories for 11 countries), Europulp (inventories at ports for

eight countries). *n.a. = not available.

"We are still negotiating but things

look better due to the production troubles

of Rizhao mill," said a contact at a BEK

producer regarding July prices in China,

shortly after RISI's Shanghai bureau broke

news on the closure. "Unfortunately this

became public once we had already made

some small concessions."

'Completely different behavior.'

Other producers that had dragged out negotiations on July business and refused to

cut prices suddenly had a new swagger for

Chinese customers. After June BEK effective list prices closed at $675 in China,

price variance soared against a backdrop of

© 2015 RISI, Inc. All rights reserved

some producers cutting levels with certain

customers and others holding flat. BEK discounts between net and effective list prices

are generally 3-5% in China, sometimes

higher, while NBSK has remained 1.5-3%.

"We should see completely different

market behavior" now that the closure is

underway, another BEK producer source

said this week, who reported unchanged

July prices in China. "There were a lot of

rumors in China last week about … long fiber prices. We have a different view."

The sudden stabilizing in BHK prices

in China could have a knockdown effect

in other markets. For example, BEK proPPI PULP & PAPER WEEK/July 24, 2015

ducer contacts now expect to complete their

increases to Europe to an $810 list level,

while sources on both the buy- and sellsides in North America report a $900 effective list locked in that P&PW reported as a

preliminary price last week.

BHK operating rates surge? The

loss of 1.8 million tonnes at Rizhao impacts

China the most. But BHK producers globally are likely to redirect tonnes to China

now, reducing the leverage of buyers who'd

hoped to begin punching at BEK prices in

their own markets, contacts said.

"BHK demand in China has weakened

lately and local resale prices of BHK have

declined markedly in recent weeks. We

have been looking for an operating rate for

the BHK market of 92-93% in the months to

come," said RISI's VP of Fiber Kurt Schaefer in a July 22 research note to clients.

"Now that will likely be 95% or higher,

which can't help but put upward pressure

on prices. At this point, prospects for falling

BHK prices over the next several months

have probably been dashed."

But a US buyer contact believed that's a

problem for Asia, not US buyers. "Rizhao

is unfortunate for Asian buyers," said the

contact, who nevertheless reported BEK at

$900 this month and no near-term opportunity to drive down prices.

US spot pressure remains. Softwood grades could be a different story despite a one day-of-supply reduction in global BSK supply, though, because US NBSK

markets are flush with spot supplies at lower

prices.

"Depends on location… if you go into

the (Midwest) corridor you get into the

$580-590 range. I've got big tonnage deals"

available, the source added. If big volume

gets transacted at a $580 net delivered price

it'll likely result in US NBSK spot prices declining beyond the $590-620 net delivered

levels a week ago. Spot prices have posted a

cumulative $20 drop since June 30, according to P&PW polling. That's average a huge

37% delta to this month's preliminary effective list price of $980, which held flat.

BHK stocks reverse. During the

blackout month of May, when Brazil's IBA

withdrew data, BHK inventories had posted

a two day-of-supply increase. In June, a

month that ended the second quarter and

one in which BEK producers often unload

big shipments for financial reasons, stocks

shot back down two days, leaving World-20

stocks of BHK at 38 days.

A PPPC official said they obtained BHK

data from Brazilian producers directly, but

industry sources said not all Brazilian producers reported, and at least one firm hasn't

been reporting data all along. That means at

least some BEK data will likely have to be

estimated even if the PPPC is able to continue reporting BHK results each month

instead of the quarterly basis IBA proposed.

Poll: Stocks down 288,000 tonnes.

Still, with all data getting released with June

results, World 20 producer inventories' one

day-of-supply decrease corresponded to an

estimated 168,000-tonne drop month-overmonth, according to a P&PW poll of industry

analysts. That's more than double the typical

decline for June recorded over the past 10

years, and after May stocks were confirmed

at 4.503 million tonnes dropped estimated

producer inventories down to 4.335 million

tonnes through the end of June.

• Arauco, coming under heavy pressure from Chinese customers to lower market pulp prices, closed its July allocation

of bleached radiata pine down $40/tonne,

to $635/tonne net CFR, a company official

told P&PW. Arauco, whose executives and

agents took longer than usual to close July

prices, hammered out agreements with key

customers to close its August allocation early, with an additional $10 decline to $625

net CFR on August shipments, a company

executive said on July 23 in China. The firm

Wipe out damages.

No one knows paper logistics better than WSI.

We partner with some of the world’s largest

producers to help them operate their supply

chains more efficiently and more reliably.

What can WSI do for you?

PPI PULP & PAPER WEEK/July 24, 2015

Integrated Logistics

Supply Chain Solutions

inquiryPPI@wsinc.com | 920.831.3700 | www.wsinc.com

© 2015 RISI, Inc. All rights reserved

9

closed its July allocation for unbleached

kraft pulp at $600/tonne net, unchanged vs

June levels. The firm didn't close its July

allocation or announce an August price

through late this week.

• Two Canadian market pulp producers reshuffled their most sr executives this

week, with Mercer International and

Fortress Paper announcing new CEOs.

Mercer International's Jimmy Lee stepped

down on July 20 as pres/CEO, replaced

by CFO David Gandossi. Lee will be exec

chmn of the company's board. Fortress

Paper is promoting Yvon Pelletier to pres/

CEO, effective Oct. 1. Outgoing CEO

Chadwick Wasilenkoff will move to a

newly created exec chmn position, where

he'll "focus on strategic initiatives to unlock

value for shareholders and to improve the

balance sheet," Fortress said in a statement.

News briefs

One of the US's largest check printers,

Deluxe, reported second-quarter net sales

increased 7.5% to $435.9 million. Deluxe's financial services revenue increased

19.1% and included the results of Wausau

Financial Systems which was acquired in

October 2014. For checks, the company

reported revenue of $40.9 million declined

5.1% "primarily to the secular decline in

check usage and the elimination of marketing expenditures that no longer met the

company's return criteria, partially offset

by higher conversion rates from email marketing offers and an improved call center

incentive plan," the company said. The

check unit's operating income increased

9.4% year-over-year to $15.2 million due

to a "higher mix of reorders and lower costs

which more than offset lower order volume," the company said… Consumers

for Paper Options along with Consumer

Action and National Consumer League

groups urged the US Securities and Exchange Commission (SEC) this week to rescind a new proposed rule allowing mutual

funds to no longer mail shareholder reports

and other investment information. Instead,

the information would be available online.

"Rule 30e-3 would make it more difficult

for many investors to access the reports

they need to make informed investment

decisions," said the three organizations in

their joint comments. "While we recognize

the trend towards a more digital world, it

is critical that government efforts to 'modernize' information delivery do not disenfranchise Americans who need or want

resources in paper format."… Pearson is

selling the Financial Times news group

to Japanese business media company Nikkei for $1.3 billion.

10

Supplier news

Reports

BASF will form a global business unit

combining all of its pigments activities effective January 2016. BASF's pigment business generates sales of about Euro1 billion.

The new global business unit will likely be

headquartered in the Ludwigshafen, Germany area… Barry-Wehmiller signed an

agreement letter this week to acquire the

Bielomatik group associated with the paper processing product line of Bielomatik

Leuze. Bielomatik manufactures paper processing equipment including sheeters, and

machines for wrapping, stacking, and packing, and makes stationery and binding machines incorporating binding technologies.

The combination is expected to be finalized

in upcoming months, Barry-Wehmiller said

in a release. Bielomatik's paper processing

product line that cuts, binds, finishes and

wraps paper is to merge with US-headquartered BW Papersystems, a supplier to the

paper and board sheeting, paper converting,

and corrugating industries. BW Papersystems, with Bielomatik, will employ more

than 1,600 workers globally and generate

revenue of more than $400 million… The

Chemours Company, which calls itself

the world's largest titanium dioxide producer, compled its spin-off from DuPont as an

independent, publicly traded corporation.

"We think of Chemours as a 200-hundredyear-old start-up," said Chemours pres/

CEO Mark Vergnano in a release.

RISI has created a new business division

called RISI Analytics that will formally

combine mill benchmarking cost information into price forecasts, the company said

this week. "By providing clients with cost

benchmarking data in our forecasts, along

with the tools to use it in their own analyses,

we will provide substantially better insight,"

said RISI Sr VP of analytics (formerly Economic Analysis and Mill Intelligence) Jon

Rager. "Analyzing the underlying manufacturing cost structure is critical to understanding what drives prices." "RISI economists

have long incorporated data from our cost

benchmarking service into their models.

However, we have never exposed that data

directly in our forecasts before," Rager said.

RISI CEO Charles Rutstein said the goal for

RISI Analytics is to provide "an integrated

view on cost drivers" and, ultimately, provide customers the "objective insight they

need to make the best business decisions."

The combined service will include all fiber,

graphic paper, and packaging coverage. Existing RISI clients will see differences in

their short-term forecasts this month, and

medium- and long-term forecast subscribers will see differences starting in October.

Customers of RISI forecast services will

gain access to RISI's cost benchmarking

services based on the regions, grades, and

the Economic Analysis products covered by

their subscription.

Copyright 2015 by RISI, Inc. All rights reserved. Reproduction in any form whatsoever forbidden without express permission

of copyright owner. PPI Pulp & Paper Week and Pulp & Paper Week are trademarks of RISI, Inc. and are registered in the

US Patent and Trademark Office.

Staff

Will Mies, Editorial Director, containerboard, kraft paper....................................................... wmies@risi.com; 510.922.8035

Greg Rudder, Editor, recovered paper, tissue, uncoated freesheet/specialty p-w............grudder@risi.com; 510.922.9504

Chris Cook, Deputy Editor, newsprint, coated, uncoated mechanical p-w............................ccook@risi.com; 510.922.1475

James McLaren, Sr. News Editor, boxboard....................................................................jmclaren@risi.com; 510.922.8816

Bryan Smith, Deputy Editor, global pulp..............................................................................bsmith@risi.com; 510.922.9012

Chris Lyddan, Contributing Editor, wood fiber, timber.........................................................clyddan@risi.com; 804.240.9227

Teresa Wann, Director of Production......................................................................................twann@risi.com; 510.735.9805

Paul Blackwood, Digital Publishing Specialist...........................................................pblackwood@risi.com; 781.734.8935

Editorial offices

1999 Harrison Street, Suite 2010, Oakland, CA 94612. Phone 510.922.8816, fax 510.879.7642

Subscriptions and customer service

Call 866.271.8525 (US & Canada) or 32.2.536.0748 (outside the US & Canada); visit www.risi.com/ppw (new subscriptions);

email info@risi.com; fax 781.734.8998, or mail to PPI Pulp & Paper Week, PO BOX 288, Bedford MA 01730-0288

Advertising

PPI Pulp & Paper Week accepts advertising. For information on pricing and availability, contact Misty Belser at

+1.919.285.2800, email mbelser@risi.com or Monica Zaskiewicz at +1.770.373.3002, email mzaskiewicz@risi.com.

Published 48 times per year on a weekly basis, except for four weeks (January, July, November, and December). Canadian

GST Permit 124513185.

Executives

Charles Rutstein..................................................................................................................................Chief Executive Officer

Matt Graves.......................................................................................................................................... Senior Vice President

Todd Petracek................................................................................... Vice President, Pulp & Paper, News, Markets & Prices

© 2015 RISI, Inc. All rights reserved

PPI PULP & PAPER WEEK/July 24, 2015

Determine containerboard conversion potential

for North American graphic paper machines

RISI’s North American Containerboard Conversion Study indentifies top

conversion candidates and potential impact on packaging papers markets.

North American graphic papers producers have been forced to remove close to 1.8 million tonnes of

capacity per year to keep pace with market decline. Consequently, many are eyeing more profitable

containerboard and packaging papers markets. With this study, you can:

VË Understand impact on competitive landscape, pricing and sources of supply containerboard markets

VË 7jÝËWÄÍËW¬?ÁÄÄËËM?ÄjaËË-.¾ÄË

ÄÍËjW?Á~Ë?aËÁjÜjÝËÍÁ?ÍÄËwËÄÍËwj?ÄMjË

conversion candidates

VË ?ßãjËÁÄË?ÄÄW?ÍjaËÝÍËËÜjÄÍjÍ

VË ÝËÝËÖWËW?¬?WÍßËÄËjßËÍËMjËWÄjaÊWÜjÁÍjaË?aËÝßË

VË ajÍwßË?ÍjÁ?ÍÜjË~Á?ajÄËwÁËWÜjÁÄË?aËÁjÜjÝËÄÖ?ÁjÄËwÁËj?WË

Request more information at www.risi.com/NAConversion