How do you value a cross-border investment? Q3 2013

August 2013

How do you value a crossborder investment?

Q3 2013

As part of Grant Thornton we, in the Complex Asset Valuations Advisory

Services (CAVAS) team, are often asked by clients "how do you value a crossborder acquisition or project?". This periodic publication aims to address this

question by providing the results of our empirical study for the international cost

of capital and through this, present benchmark parameters for companies

operating in several countries.

In a world where all markets are fully integrated

and accessible, investing abroad is measured by the

expected return of financial assets on a world

market portfolio. In a global environment,

investors need to be compensated for their

exposure to foreign currency. As a consequence,

the expected return, or cost of capital, must

include the influence of exchange rates, different

tastes for consumption across countries and

barriers to foreign investment.

We, in the CAVAS team, perform an international

analysis of cost of capital, covering developed,

emerging and frontier market countries. The

analysis is carried out thanks to three different

models and the data and the methodologies

applied are compliant with the most recent

guidelines in the field of the international theory

valuation1.

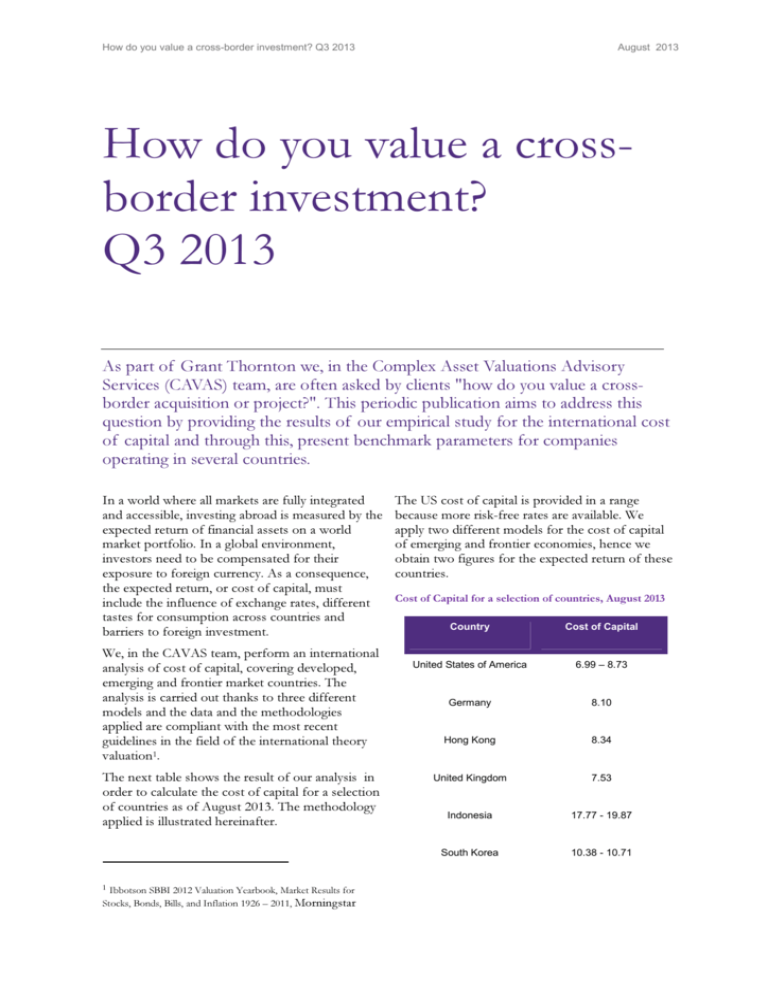

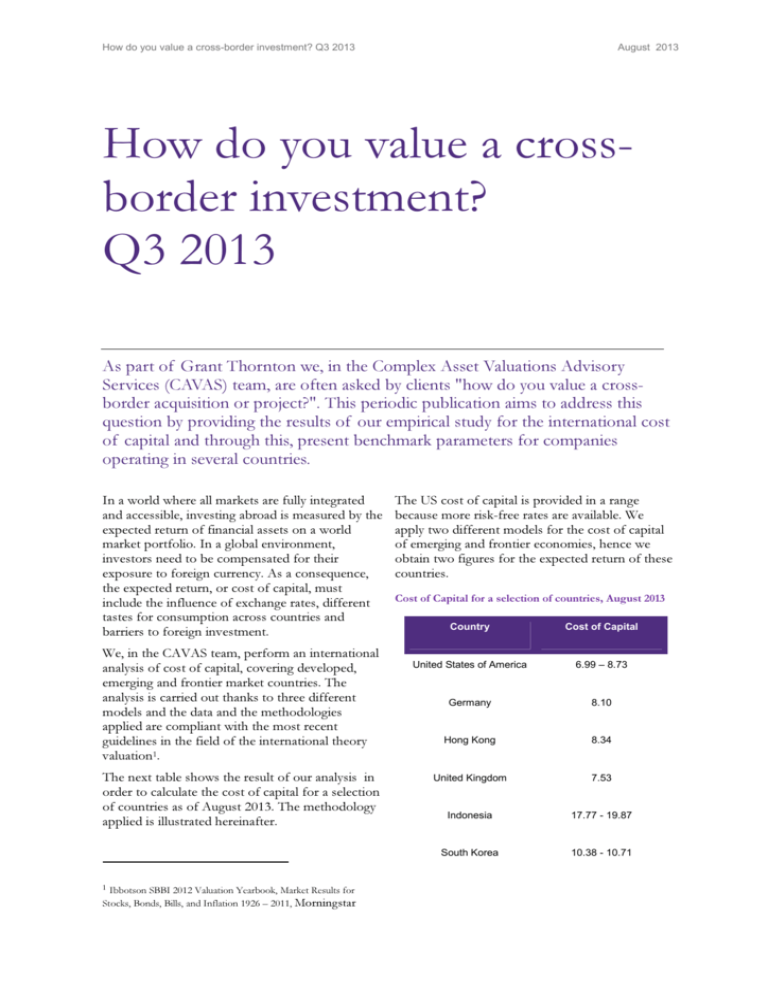

The next table shows the result of our analysis in

order to calculate the cost of capital for a selection

of countries as of August 2013. The methodology

applied is illustrated hereinafter.

1

Ibbotson SBBI 2012 Valuation Yearbook, Market Results for

Stocks, Bonds, Bills, and Inflation 1926 – 2011, Morningstar

The US cost of capital is provided in a range

because more risk-free rates are available. We

apply two different models for the cost of capital

of emerging and frontier economies, hence we

obtain two figures for the expected return of these

countries.

Cost of Capital for a selection of countries, August 2013

Country

Cost of Capital

United States of America

6.99 – 8.73

Germany

8.10

Hong Kong

8.34

United Kingdom

7.53

Indonesia

17.77 - 19.87

South Korea

10.38 - 10.71

How do you value a cross-border investment? Q3 2013

All data contained in this document are for

information purpose only.

August 2013

We then compute the cost of equity for each

country c, given the risk-free rate and the world

equity risk premium according to the relation:

= + ∗ ௐ

Methodology

The initial choice in computing the cost of capital

in an international setting, when all information is

available, is the International Capital Asset Pricing

Model (ICAPM) developed by Stulz (1981, 1995).

The application of this model depends on the

availability of the risk-free interest rate for each

country.

The next table shows our results for the beta

parameter and the equity risk premium for the US

and the world as of August 2013.

US beta, US ERP and World ERP, August 2013

ࡱࡾࡼ

ࢼ

ࡱࡾࡼ

ࢁࡿ,ࢃ

ࢁࡿ,ࢃ

ࢃ

When this data is not available, the Country Credit

Risk Model is applied. This model was formulated

5.03%

0.8926

5.63%

by Erb, Harvey and Viskanta in 1995 to overcome

the lack of data. In this context the expected return

is calculated according to the credit rating scores of

each country.

The resulting beta states that the US market is less

risky than the world market whose value is 1. For

Lastly, we propose an additional model by

the purpose of clarification, when the beta is

adjusting the ICAPM to take into account the

greater than 1, the country is considered more

possibility of the country default risk.

risky than the world market.

The international market data provided by MSCI

The following graph depicts the estimated country

Inc., formerly Morgan Stanley Capital

betas for a selection of developed countries and

International, are the main inputs of our study.

for the world.

The country risk scores are supplied by PRS

Agency and they are available for many countries

on a monthly basis back to 1984.

Estimated betas for a sample of developed countries,

August 2013

The Capital Asset Pricing Model (CAPM)

developed by Sharpe (1964) and Lintner (1965)

can be expanded to include the equity markets of

all countries of the world. To convert the CAPM

to a country-specific international format, the

model is modified so that the risk-free rate and

the beta are specific to the country being analysed

and the equity risk premium is calculated on a

worldwide basis.

We regress the MSCI US monthly returns against

the monthly returns of the world index over the

last five years and applying the arithmetic average,

which is more appropriate for an additive model

than a geometric mean. The resulting beta

parameter ௌ,ௐ is then used as an input for the

computation of the equity risk premium of the

world ௐ as follows:

ௐ = ௌ ⁄ௌ,ௐ

2.0

1.8

1.6

1.4

1.2

1.0

0.8

0.6

0.4

0.2

0

Belgium

Canada

Denmark

France

Germany

Greece

Hong Kong

Ireland

Italy

Japan

Netherlands

New Zeland

Singapore

Spain

Sweden

Switzerland

United Kingtom

United States

World

International CAPM

The highest beta is reported for Greece. Japan,

Switzerland, United Kingdom and the United

States are less risky than the world market.

We also compute the regression statistics, shown

in the next table, to obtain an indication of the

confidence level in our beta measures. In

particular, we report the minimum and maximum

How do you value a cross-border investment? Q3 2013

August 2013

value for each statistic for the period July 2008 –

August 2013 over all developed countries.

based on all countries' data and logarithmic

returns.

Statistics for developed countries,

July 2008 – August 2013

Country Risk Scores and Cost of Capital for Emerging

Markets, August 2013

intercept

beta

R squared

Emerging Markets

t-statistic

t-statistic

Country risk score

0.72 – 1.80

0.63 – 0.96

8.79 – 35.78

57.7 – 83.7

-2.43 – 2.19

Expected return

Country Credit Rating Model

A simple and forward-looking measure of risk is

the country credit rating. This measure of risk is

correlated with future equity returns and with

market volatility and it is computed taking into

account the political, financial and economic

information for each country.

The Country Credit Risk Model (CCRM) is based

on a regression model that relates market returns

with country credit ratings. The rating is the

independent variable and the historical equity

returns are the dependent variable. The expected

return of the country c in the period t is given by

= + ୡ,௧ିଵ ௧ିଵ + where is the regression intercept, ୡ,௧ିଵ is the

regression coefficient for the country credit rating

of the prior period, ௧ିଵ is the country credit

rating in the prior period − 1 and is the error

term of the regression.

The above regression equation allows us to

estimate the expected return of any country, given

its country rating, regardless of whether the

country has available return data.

We are also able to compute the expected return

for each country according to different benchmark

markets. For example, the expected return for

Argentina (classified as a frontier market) is

obtained based on all countries' data and on

frontiers' markets.

The following tables show the minimum and the

maximum values of the country risk scores and the

expected return for the emerging and frontier

markets, respectively. The regression results refer

to the period February 1984 – August 2013 and are

26.44% – 10.93%

Country Risk Scores and Cost of Capital for Frontier

Markets, August 2013

Frontier Markets

Country risk score

Expected return

55.5 – 68

28.3% – 8.67%

Modified International CAPM

We suggest modifications to the standard ICAPM

to capture the potential default risk of the country,

which is especially important for emerging and

frontier markets.

The credit spread (CS) is added to reflect the credit

quality of each country and its maturity is chosen

according to the risk-free interest rate as follows:

ୡ = + ∗ ௐ +

The traditional ICAPM beta can be modified to

deal with low correlation of markets across

countries. The adjusted beta for each country is

given by

= ∗ ⁄ௌ

where σ is the volatility and ρ is the correlation

parameter. This adjustment allows us to avoid a

double-counting error in the sense that economic

and political developments may affect a country's

credit spread and the volatility of its equity market.

How do you value a cross-border investment? Q3 2013

August 2013

Why Grant Thornton?

Grant Thornton is one of the world's leading organisation of independent assurance, tax and advisory

firms. These firms help dynamics organisations unlock their potential for growth by providing

meaningful, forward-thinking advice. Proactive teams, led by approachable partners in these firms, use

insights, experience and instinct to understand complex issues for privately owned, publicly and public

sector clients and help them to find solutions. More than 38,000 Grant Thornton people, across over

100 countries, are focused on making a difference to clients, colleagues and the communities in which

we live and work. The UK Grant Thornton member firm provides services to over 40,000 privately

held business public interest entities and individuals. It is led by more than 185 partners and employs

nearly 4,200 of the profession's brightest minds.

Why CAVAS?

We are financial engineering, modelling and valuation professionals, with advanced degrees in

quantitative disciplines and practical experience in the analysis and valuation of complex and illiquid

assets. Our team has access to software packages and programming languages as well as marketleading databases, which allow us to produce valuations of portfolios of securities.

Furthermore we always customise our offering to provide you with a cost-effective and appropriate

solution that reflects the level of service you require. We have the ability to model and value complex

securities and provide you with all key measures of risk.

Key Contacts

Dr James Dimech-DeBono

CAVAS Lead Partner

Cevik Erbay

Associate Director

Fernanda D'Ippoliti

Manager

T +44 (0)207 865 2595

E james.dimech-debono@uk.gt.com

T +44 (0)207 865 2477

E cevik.erbay@uk.gt.com

T +44 (0)207 184 4431

E fernanda.dippoliti@uk.gt.com

© 2013 Grant Thornton UK LLP. All rights reserved.

‘Grant Thornton’ means Grant Thornton UK LLP, a limited liability partnership. Grant Thornton is a member firm of Grant Thornton

International Ltd (Grant Thornton International). References to ‘Grant Thornton’ are to the brand under which the Grant Thornton

member firms operate and refer to one or more member firms, as the context requires. Grant Thornton International and the member

firms are not a worldwide partnership. Services are delivered independently by member firms, which are not responsible for the services

or activities of one another. Grant Thornton International does not provide services to clients. This publication has been prepared only

as a guide. No responsibility can be accepted by us for loss occasioned to any person acting or refraining from acting as a result of any

material in this publication.

www.grant-thornton.co.uk