Harvesting Value From Entrepreneurial Success

advertisement

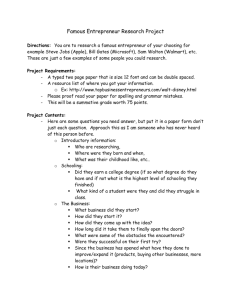

Harvesting Value From Entrepreneurial Success John W. Kensinger, John D. Martin, and J. William Petty September 2000 John W. Kensinger is Professor of Finance, College of Business Administration, University of North Texas, Denton TX John D. Martin holds the Carr P. Collins Chair in Finance, Hankamer School of Business, Baylor University, Waco TX J. William Petty is Professor of Finance and holds the W.W. Caruth Chair in Entrepreneurship, Hankamer School of Business, Baylor University, Waco TX For presentation at the annual meeting of the Financial Management Association, Seattle, Washington, Session 189 (8:30-10:00 AM—Room 609) Saturday, October 28, 2000. Harvesting Value From Entrepreneurial Success Abstract We recommend ways for an entrepreneur to derive liquidity from the business, with or without selling it. In today’s financial arena there are a variety of ways in which a private business can harvest liquidity to meet its own needs for growth, the consumption requirements of its founder, or the challenges of tax and estate planning. In order to achieve its full potential, a company should be able to continue through its business lifecycle, whether or not that matches the human lifecycle of its founder. So long as leadership succession can be arranged, the business’ lifecycle can determine the course of the company. Indeed, selling the business is optimal only if there is a strategic buyer willing to pay a premium above the business’ stand-alone value; or if the founder wants to withdraw from the business, and has no preferred successor. Introduction Many entrepreneurs fail to realize the full benefits of their labors through a successful harvest. They may earn a living from the firm’s operations, yet remain “asset rich but cash poor”—chronically short of liquidity from their investment of capital and effort. Seeing a clear route toward the harvest—that is, gaining liquidity from entrepreneurial investments of money and effort—also is of prime importance to outside investors, who typically have a priori expectations about their investment that include either taking the firm public or being acquired by another business. We recently conducted a series of interviews with entrepreneurs, venture capitalists, investment bankers, and advisors who have been intimately involved in the harvesting process, and this article reflects our distillation of their experience.1 Harvesting is more than selling a business and leaving it behind. It is about unlocking liquidity, reducing risk, or creating options. One commentator advises, “Build a great company, but do not forget to harvest … keep harvest options open and think of 1 The authors gratefully acknowledge the resources devoted by the Financial Executives’ Research Foundation in support of this effort. The results are published in Petty, Martin, and Kensinger (1999). harvesting as a vehicle for reducing risk and for creating future entrepreneurial choices and options, not simply selling the business.”2 Few events in the life of the entrepreneur, or for the firm itself, are more significant than the harvest. From the entrepreneur’s perspective, though, selling is about more things than money, involving personal and non-financial consequences as well. Even an entrepreneur who realizes an acceptable monetary value for a firm may be disappointed with the overall lifestyle consequences of the sale. Overview of the Harvest To gain insight into how one might prepare for the harvest, let us first consider the basic methods for harvesting a business venture, then examine how to prepare well for each method. These include liquidating the business’ assets, tapping the business’ borrowing capacity, selling the company as a going concern, or establishing a public market for the stock via an initial public offering. • • • In some cases the value of the business resides primarily in the assets it holds—then an orderly liquidation is the route to harvesting the value held in the business (or, a buyer acquires the firm because it is worth more dead than alive and can be sold piecemeal). In other cases the business is worth more as a going concern—then the most attractive price often arises when another firm in the same or related business acquires the company (a strategic buyer may envision synergies that enhance the value of the combined firms). When no such strategic relationship exists between acquirer and acquisition, the value typically is based on expectations of future cash flows discounted to present value. In some cases, the managers or other employees might be the ones willing and able to make the most attractive offer via a management buyout (MBO), an employee stock ownership plan (ESOP) or similar leveraged arrangement. Place Exhibits 1 and 2 nearby A successful harvest is facilitated by a steady focus on building net worth for the equity investors—ideally throughout the life of the business (see Exhibit 1 for a listing of available harvest methods and Exhibit 2 for a summary of entrepreneurs’ reactions to the 2 See Timmons (1994). Page 2 harvest)). There must be something about the business that someone else would be willing to pay to acquire—after all; this is about finding what is marketable in the business. Are the assets the business buys readily marketable? Do these assets have alternative uses? Are the business’ cash flows stable and comfortably predictable (so they form a sound basis for borrowing)? Are the cash flows durable (or will they likely dry up soon)? Does the business have growth potential? Would its products fit soundly within the distribution channels of a competitor (or vice versa)? Does it have established brand identity? Are the employees more productive in this business than they would be in any other? Can the entrepreneur convince potential stock purchasers that he or she has a vision that could be realized with capital from public markets? These questions reflect core issues involved in the various harvest methods—and just one affirmative answer may be sufficient to indicate progress toward gaining liquidity. Financial contracting—the process of determining how cash and risk are to be shared among owners and investors—requires estimates of a venture’s value and an assumed horizon date for the harvest.3 Further, founders and early-stage investors can be viewed as purchasing call options on the harvest proceeds; and the option characteristics are especially apparent when staged commitments are involved, as in venture capital arrangements.4 Measuring the value of a firm when the stock is not publicly-traded is difficult—hence a major advantage from going public is to establish a basis for financial contracting. It is even more difficult to forecast the value a startup might have five to ten years into the future (the problem is one of assessing value when information is incomplete or conflicting). Crafting a harvest strategy can be done long before the need materializes. Several of our interviews emphasized the need to begin early for a successful harvest. One 3 See Sahlman (1988). Option valuation models require measurement of current value, the potential for the value to change up or down, and the time span of the option 4 Page 3 entrepreneur said: “If you are raising money to grow your business, the people who put that money in are always concerned about how to exit; and you need to have that mindset unless you expect to die in the CEO chair. The worst of all worlds is to realize, for health or other reasons, that you have to sell the company right now.” Yet, whenever the offer is based upon what the buyer can borrow using the business as collateral, the potential yield from the harvest may reflect just the amount that can be borrowed against expected cash flows for a limited time into the future. For example, common practice now limits ESOP loans to terms from five to eight years. Limits on the time horizon of borrowing may handicap the ability to realize the full liquidity potential within a business, when using any method based upon borrowing against the future cash flows of the business. If the cash flows from established operations are the primary thing someone else is willing to pay for, one cannot expect the offered price to include a premium for future growth or other intangibles the entrepreneur may believe the business possesses. Many entrepreneurs view the initial public offering as the most desired form of harvest—but its applicability as a harvest strategy depends upon a fortuitous conjunction of the lifecycles of business and entrepreneur, and upon the personality of the entrepreneur. An IPO is a transitional event for a growing firm that needs access to the public capital markets for its expanding capital requirements; but, it may be many years after the IPO before the entrepreneur will be able to sell a substantial portion of his or her stock. So the firm must be at the beginning of a sustainable growth phase in its business lifecycle, while the entrepreneur does not need to retire any time soon. Also, public disclosure demands and the requirements of investor relations make the life of an executive in a public corporation sometimes very different from that of a founder in a private company. In a recent study of computer software CEOs who took their firms public, each respondent was asked to reflect back to the start-up stage of the company and rank the probability that the firm would use one of five alternative harvest strategies at some point in Page 4 the future.5 Thirty percent of the CEOs assigned the highest probability to being acquired by a larger company; five percent thought a leveraged buyout by employees would occur; and, despite the odds for such an outcome, sixty-five percent considered an initial public offering as their most likely harvest strategy. These results are supported by another recent survey of one hundred chief executive officers of newly-public companies in which more than half said they planned from the initial start-up phase that they would eventually go public.6 In fact, though, an IPO rarely comes to pass as a general rule. (Perhaps these surveys to some extent reflect a self-fulfilling prophecy, as their samples are drawn from companies that successfully went public.) Harvest Methods That Do Not Require Publicly-Traded Equity Most often, the harvest is accomplished without establishing a public market for the company’s equity. Let us consider these methods first, before considering the possibility of going public. Merging or Being Acquired Indeed, the most potentially lucrative route is an acquisition motivated by strategic considerations. Then the acquirer is motivated by the value perceived to be added to the newly-expanded firm by the target’s inclusion—and the perceived synergies may add substantially to the offer, above the target’s stand-alone value. In our interviews, venture capitalists consistently touted this as a desirable outcome sometimes preferable to going public. Often, the strategic courtship is serendipitous. One of the entrepreneurs we interviewed told of a chance meeting at a trade show when he demonstrated his product to the head of marketing from a large producer of computer games. The resulting deal was consummated in a matter of weeks—at a price far higher than the entrepreneur had ever 5 See Holmburg (1991). Page 5 dared imagine! This provided the initial investment for his next company. Other entrepreneurs told similar stories of fortuitous events. Can an entrepreneur guide a firm so that it becomes a premium attraction for addition to another company’s portfolio of holdings? Indeed, to a significant extent a successful outcome can result from intentional enhancements. Some creativity is required, of course. Most important, though, is a thorough understanding of the company’s products, markets, customers, suppliers, and competitors. Competitors are perhaps the first group that comes to mind when thinking about potential acquirers; but customers or suppliers may also be good candidates, with potential synergies from integrating forward or backward. In our interviews, investment bankers and venture capitalists alike advised that more time should be spent analyzing the buyer’s needs than contemplating the attributes of the seller. Very simply, think about why your company should have value to another firm. “Don’t hesitate to approach the CEO of the buying firm,” one advised. “Even though the CEO represents the interests of the buying firm, he has no reason to be anything but honest with you during the purchase process; for he needs the post-acquisition firm to operate successfully and for this he needs your full cooperation and good will.” Beech Aircraft Company, for example, successfully enhanced its attractiveness; resulting in its acquisition by Raytheon, previously a supplier of components to Beech. Beech’s primary stockholder at the time was the founder’s widow, who wanted to retire and had significant estate-planning issues. She also wanted to leave a strong company as a legacy for her husband, so there were non-pecuniary issues too. Brand identity was strong, with a solid reputation for product quality, but the product line was dominated by aging designs. In 1979 Beech invested heavily in developing a revolutionary design (dubbed “Starship”) that used all-composite construction, fully computerized flight 6 See Hyatt (1990). Page 6 instruments, jet-fan power, and the then-radical canard architecture (on a canard aircraft, the main lifting wing is at the rear, with the horizontal stabilizer mounted on the nose). Most of the investment went into computer-aided design facilities and factory automation for handling composite materials on a large scale (which have many alternative uses). This effort attracted new engineering talent and revitalized the company to such an extent than within three years Beech attracted significant attention as a strategic acquisition with several potential suitors. The result was a successful sale to Raytheon within three years of launching the Starship project (Raytheon was the primary supplier of cockpit instruments, communications equipment, and navigation aids for the Starship project). Those familiar with aviation will know that the Starship itself had a very brief production run, but the technologies developed during that effort have enhanced the organization in a variety of ways. Moreover, Mrs. Beech’s goals were met in spades, regardless of what eventually happened with the Starship design—that product was a springboard into new technologies, not an end in itself. A caveat is in order, though: the entrepreneur should think carefully about whether it will be realistic to stay with the company through the transfer of ownership. The very qualities that made the business founder a successful entrepreneur often make it difficult for him or her to work for a new owner. In fact, we found on several occasions that the entrepreneur quickly became disillusioned and left soon after the acquisition. Sale With Value Based On Cash Flows In a sale that does not involve strategic relationships between buyer and seller, most buyers of private firms rely on some multiple of earnings or cash flow to assess value. The various approaches may use net income, operating income, or earnings before interest, taxes, depreciation and amortization (EBITDA), to value the business at the harvest. For instance, a multiple of EBITDA is commonly used to estimate firm value. Outstanding debt is then subtracted to determine the value of the firm’s equity. The various approaches can be generalized to include two basic perspectives in valuation. Both hold that cash flows are Page 7 the primary value driver. The theoretically correct approach is to discount cash flows to present value. Common practice, though, is to find a “market” multiple that computes value as a multiple of annual cash flow. Venture capitalists and investment bankers in our interviews describe the estimation of cash flow as the “science” part of valuation. They describe the “art” of valuation as finding the right set of comparable companies upon which to base their arguments for a particular multiple. A relatively high multiple, presumably, reflects growth potential; although this is admittedly an imprecise measurement. Increasing and Stabilizing the Firm’s Free Cash Flows For firms in their growth phase the free cash flows7 may be negative, requiring frequent infusions of cash into the firm from owners, creditors or venture capitalists. As a firm or its industry matures, growth opportunities decline, resulting in increased free cash flows. At some point, an entrepreneur and other equity investors may recognize that the potential sales growth has slowed or even halted. This event generally occurs as a natural consequence of maturing markets where competition has removed any growth opportunities with prospective returns greater than the firm’s cost of capital. If free cash flow from established operations forms the primary basis for the business’ market value, actions aimed at stabilizing cash flows could enhance the harvest. Then the focus becomes efficient use of resources, with innovation limited to upgrades necessary to keep established products competitive. Employee incentives aimed at promoting efficient use of capital—such as Economic Value Added—reach their maximum potential at this phase in the business’ life. Cash flow stability is particularly important if the potential buyer is able to pay little more than the amount that can be borrowed against expected future cash flows of the 7 A firm’s free cash flow represents the amount of cash that could be distributed to its investors after all business needs (for operations and expansion) have been met. Free cash flow equals operating profits, plus depreciation, minus positive NPV investments. Interest, debt repayment and corporate income taxes are Page 8 business, with loan terms restricted to a limited number of years into the future. (In current practice, terms from five to eight years are common—with terms longer than ten years being rare unless physical collateral is pledged.) If potential loan proceeds define the offer price, there is little potential for value to reflect growth opportunities or any other intangible things that cannot be used for collateral. If the best offer price clearly reflects a limited segment of expected future cash flows, the entrepreneur need not sell unless he or she is ready to retire with no preferred successor; or simply wants to move on to other activities. Access to the same liquidity could be obtained by tapping the borrowing potential in the business’ own name. This is the value-maximizing path for the entrepreneur, who then has access to the same amount of liquidity as would come from a sale, while retaining whatever residual value might remain after the repayment period has elapsed. Also, when growth slows or halts, free cash flows could be harvested gradually. This course would accomplish the harvest more slowly than could be done via borrowing, but might reduce the cost and ease the challenges of tax planning. The goal of harvesting is to maximize the after-tax proceeds for the company’s owners and investors. Tax planning may be challenging when substantial amounts are withdrawn from the business over a short time horizon; although retirement accounts, trusts, family corporations, and other remedies may be helpful. (Indeed, the business may be effectively converted into an investment trust without going through a tax event such as a sale or cash withdrawal, a potentially desirable course if all equity owners are family members.) Borrowing or withdrawing cash have two potential advantages. First, the owners who are not ready to sell can begin harvesting while still retaining ownership. Second, the strategy does not depend on finding an interested buyer and spending time and energy negotiating the sale. A potential disadvantage for the entrepreneur who is simply tired of considered to be part of the free cash flow, because they could be made available to investors through financial restructuring. Page 9 day-to-day operations, though, is that retaining ownership and working to maintain competitive advantage for an extended time may be asking for too much patience. If other qualified leadership not is available, the strategy may be too emotionally draining and ultimately be less advantageous than a sale. Recognizing the opportunity for creativity in this area, some investment groups are developing financing approaches that more fully recognize the needs of exiting owners within firms that have potential long-term value.8 In such cases, a standard leveraged sale might fall short of potential value. To capture a portion of this niche, these investors have created the so-called “Private IPO”—despite the name, these are not public offerings at all, but are more like leveraged buyouts. They involve institutional investors taking equity positions in partnerships that acquire and operate carefully selected private companies. In order to be a candidate, the business must be perceived as possessing sustainable competitive advantage with stable cash flows, or substantial growth potential. A good fit with other business units and asset pools of the partnership would also be attractive. Orderly Liquidation An orderly liquidation does not necessarily mean the business would be shut down in the immediate future. Even if growth has stalled, competitive advantage may continue for a time. Shutdown need not occur until economic rents have ceased, and the continuing return from the investment in the business is no longer competitive. Assets such as equipment or real estate might be sold and replaced with leased assets—allowing the business to continue operating after the owner has partially harvested its accumulated value. Financial contracting to accomplish this would be straightforward once cash flows have been stabilized. Indeed, it might be good preparation for this stage if the entrepreneur initially established the asset pools as legal entities separate from the 8 One such group is Heritage Partners, of Boston. Page 10 business, thus facilitating tax management and estate planning.9 One of the estate-planning issues often encountered, in fact, is the need to provide liquidity for estate taxes and other distributions after the owner’s death when there is a preferred successor for the business. Then structures that facilitate asset liquidation without jeopardizing the business’ viability could be very important. In certain cases it might even be possible to spin off or sell some of the business’ assets into a special-purpose limited partnership capable of borrowing against its own expected cash flows. (When such an entity is able to obtain debt on terms that give the lender no recourse to the cash flows of the parent, the arrangement is called “project finance.”)10 For example, we talked with the president of a pharmaceuticals company that had recently gone public, asking for insight into the company’s decision to use R&D Limited Partnership (RDLP) financing to fund human clinical trials for a new compound. “That’s simple,” he said. “We needed $80 million for the clinical tests. Our total equity capitalization is only $20 million so we couldn’t issue enough new stock; and we don’t have the cash flows to support that kind of debt. The institutional investors are comfortable with RDLPs, and we don’t have to start paying until the new drug goes to market.” If growth opportunities have dried up, and declining sales are anticipated, inventories become an additional focus for the harvest. An entrepreneur we interviewed related his experience in such a situation. He told us, “I was amazed to see how much cash you can get out of a business.” His company had been in aggressive growth mode for several years when the business environment shifted suddenly due to a competitor’s innovation. The company 9 For example, the entrepreneur might purchase real estate in his or her own name, and rent it to the business. Rents can even be defined as a percentage of business revenue (this is common, for instance, in restaurant properties). Such separation of asset holdings could have significant tax and estate planning advantages, compared with keeping these assets in the business’ name and later seeking ways to distribute the proceeds from their sale as dividends or taxable business profits. Page 11 could not raise the funds needed to completely redesign its microcomputer products, and the investors decided to accomplish an orderly liquidation. The chief marketing officer was the first senior executive to leave. Cost control became a primary focus, with the chief financial officer and chief operating officer played critical roles. The chief executive brought in a liquidation specialist recommended by the company’s primary bank lender. Asset sales proceeded. All operating decisions were aimed at generating cash. Many of the customers who had installed the product wanted to continue using their equipment and valued product support. This provided a viable market for inventory at the business to be converted into spare parts and sold for stockpiling. A year later all debt had been repaid, with enough left over so the equity investors earned a profit. The entrepreneur used his proceeds to start another business. This entrepreneur told us: “In this phase, your checkbook is the most important management tool. Forget the balance sheet, income statement, and that sort of thing. All that matters is what you can put into your checkbook.” Management Buyout (MBO) Given the empirical evidence of increased efficiencies produced from an MBO and the proven longevity of these benefits, an MBO should be considered a potentially viable means for transferring firm ownership—both for small businesses as well as large ones.11 While the managers within many entrepreneurial businesses frequently have a strong interest and incentive to buy the business, they often lack the financial capacity to do so. A leveraged MBO can provide the needed liquidity. If an MBO is used to consummate the sale, the seller may be asked to provide loan guarantees, or accept debt as part of the payment package. The deal must then be 10 Project financing offers many opportunities for providing private companies with liquidity. For an extended discussion of the many possibilities in real estate, energy, minerals, forestry, R&D, and other applications, see Kensinger Martin (1988). Page 12 structured to minimize potential conflicts of interest. Specifically, if the new owners have placed little of their own money in the deal, they may be inclined to take risks that are not in the best interests of the selling entrepreneur; they very simply have nothing to lose if the company fails. Also, if the terms of the deal include a so-called “earnout” in which the payments depend in part on the subsequent profit performance of the company, the buying owners have an incentive to do things that lower the firm’s profits during the earnout period. Thus, the entrepreneur needs to take great care in structuring the deal; otherwise, there may likely be a disappointing outcome. In addition to their recent popularity in the U.S., management buyouts have come to be used in Europe as well. In Europe, the venture capital industry has had a significant role in management buyouts, especially for smaller firms. A study of 182 venture-backed MBOs of European firms found the same improvement in operating efficiencies and longevity as did researchers in the U.S. Also, European managers who undertake MBOs typically anticipate their exit to be in the form of a public offering, but almost invariably the firm is sold to a third party.12 Employee Stock Ownership Plan (ESOP) Small and middle-sized firms have been the primary sponsors of ESOPs.13 There are tax advantages with ESOPs that are not available in other harvest methods.14 Also, the research to date suggests that ESOPs have been effective in increasing productivity by linking employee compensation to company performance, and by giving employees a role in management through their voting rights as shareholders. For instance, using both Tobin’s q and accounting performance variables, a recent study found that average 11 For an analysis of the operating effects of smaller-firm MBOs, see Wright, Thompson, Robbie, and Wong (1992). For a discussion of large-firm MBOs, see Kaplan (1989) and Kaplan (1991). 12 See Wright, Robbie, Romanet, Thompson, Joachimsson, Bruining, and Herst (1992). 13 See Englander (1993). 14 For a detailed discussions, see Chen and Kensinger (1985) and Bruner (1988). Page 13 performance significantly increases after establishing or expanding an ESOP.15 Finally, sale to employees sometimes results from the entrepreneur’s desire to see the firm continue with as little change as possible after the founder has taken a reduced role. Insert Exhibit 3 nearby. The basic arrangement for a leveraged ESOP is shown in Exhibit 3. There need be only three principal participants in the arrangement: the employer corporation, the lender, and the ESOP. An ESOP trust borrows from the lender on behalf of the ESOP and buys common stock from the employer corporation or from the exiting owners. The trust subsequently services the debt from dividends and contributions that the employer pays into it. Such dividends are fully tax-deductible, and other contributions are deductible up to a maximum of 25 percent of payroll.16 So it is possible for principal as well as interest payments to be tax deductible for the employer corporation. As the debt is retired, shares of stock are taken out of the trust and credited to the participants’ accounts in the ESOP. The employer corporation has equity financing and will be making tax-deductible payments to service it. In case the employer corporation is unable to make sufficient payments into the trust to service the debt, the lender would have recourse only to the assets held in trust for the Employee Stock Ownership Plan. While an ESOP benefits the entrepreneur by providing a market for selling stock, it also carries with it some tax advantages that make the approach attractive to owner and employee alike. The benefits include the following: • • 15 16 If the ESOP owns at least 30 percent of the firm after purchasing its shares, the seller can avoid current tax on the gain by using the proceeds to buy other securities. Thus the business can be converted into a diversified investment portfolio without capital gains taxation (this is often referred to as the “rollover” feature). The dividends that a business pays on the stock held by the ESOP are allowed as a tax-deductible expense; that is, the dividends are treated like interest expense for tax purposes. See Park and Song (1995). Internal Revenue Code, Section 415, paragraph 19,566. Page 14 Employee ownership is not a panacea, and shouldn’t be prescribed indiscriminately. Selling all or part of the company to the employees works only when it resolves conflicts that otherwise would exist between the owners and employees in such a way that both groups are better off. While advocates argue that employee ownership provides improved motivation, leading to greater effort and reduced waste, the value of greater effort varies significantly from firm to firm depending on the situation. Transferring Ownership Within the Family Most transfers of ownership within family-owned companies relate to an older generation exiting the firm at retirement and/or to facilitate estate-planning needs of the older generation. A secondary reason for ownership transfers is to give incentives to other family members. Three factors must then be kept in balance: liquidity for the exiting family members, continued availability of capital for company growth, and maintenance of control. In a recent study, a sample of entrepreneurs who had already transferred ownership or were planning to do so were asked to indicate the relative importance of these three issues in making their decisions. Eighty-five percent of the respondents viewed maintaining control of the company as very important. About 45 percent considered providing capital for the firm’s future growth and meeting the personal liquidity needs of family members as being very important.17 The survey also asked how the transfer would be financed, with the following responses: Method of Financing Inter-Family Transfers Gift: Seller Financing: Acquirer’s personal financing: Third-party financing: Other: 17 Prevalence 38% 24% 14% 12% 12% See Upton and Petty (1998). Page 15 The owners indicated that their financing of choice leans more to debt than equity. The right to convert from debt to equity on the part of the investor, either through conversion rights or warrants, was essentially non-existent in the transitions that had already occurred. For the planned transfers, 23 percent of the respondents expecting to use third-party financing thought such features would be part of the financing arrangement. For the firms having been involved in a transition, however, such sweeteners for investors were for all practical purposes non-existent. The ownership generation exiting the firm in many cases apparently had sufficient personal liquidity not to require external financing. For others, the transition was financed from the firm’s operating cash flows, but that can only come at the expense of limiting the firm’s growth opportunities. Moreover, for those that did seek out third party financing, the primary source of financing was the traditional banker. For many, there is no other option; but possibly some owners assign a high priority to maintaining control, at the expense of future growth. Mezzanine Financing Mezzanine loans are similar to convertible bonds, although there need not be a public market for the stock at the time of the financing. The lender makes an intermediate term loan (five to eight years) and receives warrants to purchase common stock. In the case of a company with attractive growth potential that has not yet established a steady cash flow, the lender may extend an additional line of credit upon which the borrower can draw to make interest payments. In such a case, the mezzanine loan is like a zero-coupon convertible bond. A mezzanine loan is also very much equity, even though it is called debt (hence the term “dequity” has been coined to describe it).18 A mezzanine loan can provide a substantial infusion of capital to finance growth on terms very similar to equity financing, without incurring the costs associated with going Page 16 public. Indeed, it has been demonstrated that selling common stock with a money-back guarantee is exactly equivalent to issuing debt with warrants attached.19 Going Public To appeal to the public markets the firm must have a compelling business story. Furthermore, to be a good IPO candidate a firm must possess potential for great success, that requires funding from the public capital market. Perhaps the greatest misconception held by entrepreneurs is that the IPO is the end of the line. They often take the view that by taking their firm public through an IPO they have “made it”. The fact is that going public is but one transition in the life of a firm, and it isn’t right for every firm. One of the entrepreneurs we interviewed said, “Maybe the biggest surprise is that the public offering is a beginning, not an end. Use the best experts you can, at an early stage. Don't try to do it alone, because it's a demanding process that can distract you from your business.” Why Go Public? Taking the company’s stock public provides immediate capital, plus facilitating future capital accession. A recent study polled CEOs of firms that had gone public to query the importance of seventeen possible motivations for the public offering.20 These CEOs clearly consider financing future growth as the primary impetus for going public. The factors receiving the highest percentage of “very important” responses are as follows: 18 The term “dequity” is attributed to Williamson (1988). See Chen and Kensinger (1988). 20 See Holmburg (1992). 19 Page 17 Reasons for Going Public Factor Raise capital for growth: Raise capital to increase working capital: Facilitate acquiring another firm: Enhance the firm’s ability to raise capital: Establish a market value for the firm: Response of Very Important 85% 65% 40% 35% 35% While the process of going public may be frustrating, the eventual outcome generally is positive. In a survey of firms listed on the French Second Marche (Secondary Market), most CEOs expressed great satisfaction with their decision to go public.21 The owners thought the external image of the firm was improved in the eyes of the suppliers, customers and others after the offering, along with an increased effectiveness in the level of communications, strategy and other internal management-related factors. They disliked, however, the fluctuations in the firm’s share price, which they did not believe reflected firm performance. Despite evidence to the contrary, many perceive that the capital market is myopic, management is pressed for short-term performance, and so can not look to the shareholder’s long-term best interests.22 In our own interviews, we also heard strong endorsement of the enhanced standing conveyed by the fact that the stock is publicly traded. One entrepreneur said that going public was his intention from the very beginning of the company, and that the status of being a public corporation in the United States greatly facilitates his company’s interactions with Asian suppliers (and these suppliers closely follow the stock price as an indicator of the company’s success). Pitfalls of Going Public The IPO process can be one of the most exhilarating, but frustrating and exhausting experiences an entrepreneur will encounter. Entrepreneurs frequently discover that they do 21 22 See Desroches and Belletante (1992). See Jones, Cohen, and Coppola (1992). Page 18 not like being exposed to the vicissitudes of public capital markets and to the prying questions of public market investors.23 We learned that going public takes much time and energy from the firm’s management team and can be very distracting, frequently resulted in a loss of managerial focus and leading to slumping performance. Furthermore, uncertainties accompanying the impending sale of the company often lead to lowered employee morale. Many entrepreneurs underestimate the time and energy involved in selling their company. This stress leaks down throughout the organization, as employees become anxious about the prospect of a new owner. One of the entrepreneurs we interviewed told us that he and his team “took our eyes off the ball” and let earnings drop, resulting in their first attempt to go public being aborted. They waited another year before their subsequent successful attempt, and counted themselves very lucky to have had a second chance. Besides the cost in time, stress, and underwriting fees, the underpricing of IPOs is a long-recognized concern in the finance literature (on average, the price of the stock rises rapidly after the initial sale, stabilizing at a level that averages 15% above the price received by the issuing firm—this on top of underwriter spreads and fees).24 In a survey of the Inc. 100, the CEOs who had participated in public offerings indicated they spent thirty-three hours per week on the offering for twenty weeks; many consider the cost of the IPO process to be excessive and exorbitant. Several found themselves not being understood and having little influence in the decisions being made. Several expressed disillusionment with investment bankers, and the entire process. At some point, the owners wondered where they had lost control of the process.25 Our own interviews with entrepreneurs include a mixture of sentiment, with several expressing admiration for the investment bankers’ professionalism; yet others relating the impression 23 24 See Sutton and Beneddetto (1990). See, for example, Brealey, Myers, and Marcus (1999): pp. 373-375. Page 19 that investment bankers are too “deal oriented”—overly focused on getting the deal done, regardless of what that entailed. These concerns may reflect the shift in power that occurs during the IPO process. When it begins, the entrepreneur is in control. After the prospectus has been prepared and the road show is underway; however, the entrepreneur is no longer the primary decisionmaker. The investment banker is now in control—on turf that is foreign to many entrepreneurs. Finally, the financial marketplace takes over, and ultimately it is the market that dictates the final outcome. In addition to the issue of who controls the events and decisions in the IPO process, one other matter is important—understanding the investment banker’s motivations in the IPO process. Stated differently, who is the investor banker’s primary customer? Clearly, the issuing firm is rewarding the underwriter for the services being performed through the fees paid and a participation in the deal. But, the investment bank also working for its customers on the other side of the trade—who it will deal with in many subsequent issues.26 The High Cost of Going Public The empirical evidence on the pricing of IPOs is puzzling for those who otherwise believe in efficient capital markets (see Exhibit 4 for a summary of the major findings). Anomalies are interrelated in the following sense: periods of excessive investor optimism appear to create “windows of opportunity” during which many firms rush to market (lending some credence to the impression expressed by several entrepreneurs in our interviews that timing and luck are important elements of successfully going public). Yet another cost of going public arises from the underwriter’s need to meet the “due diligence” rules established by the Securities Act of 1933. 25 26 These rules mean that the See Brokaw (1993). See Sahlman (1988). Page 20 underwriter must not only incur the cost of becoming informed about the fledgling company, but also face the threat of a lawsuit from disgruntled stockholders if the fledgling fails. The underwriter, then, is offering a kind of “soft” money-back guarantee. Another explanation for the high cost of going public is the expense investors must incur to become well informed about the fledgling company. They will pay the price of becoming informed only in anticipation of a sufficiently large expected profit. The problem can arise with any form of external financing, and its essence can be explained fairly simply. Managers often possess valuable information about the business that cannot be unambiguously communicated to the capital market.27 Several studies, identify informational asymmetry as a significant contributing factor for the high cost of going public.28 ) In initial public offerings, informed investors will submit more purchase orders for underpriced offers than for overpriced offers, with the result that uninformed investors (who wind up with the residual) will receive a relatively larger portion of shares in overpriced offers and a relatively smaller portion of shares in underpriced offers. Over several offers, therefore, the uninformed investors can expect to receive more than their fair share of dogs and less than their fair share of good deals. To fully subscribe an issue when a large proportion of investors consider themselves to be uninformed therefore requires a greater degree of underpricing than would be the case if ignorance were less widespread. Reducing the Cost of Going Public Innovators have experimented with arrangements that reduce the downside risk normally associated with equity investments by providing a “money-back guarantee.” In 27 Leland and Pyle (1977) first described informational asymmetry cost. One potential barrier to communication is the need to keep competitors in the dark in order to maintain the competitive advantage that makes the firm potentially profitable. Whenever such an informational asymmetry exists, managers face a problem. If new claims against the firm are sold in the capital market, they will be undervalued due to the lack of complete information. That is, their market value will be less than their fair value. 28 See Ritter (1987), Rock (1986), and Beatty and Ritter (1986). Page 21 this arrangement, the newly issued shares can be “put” back to the issuer.29 The new investors buy “units” composed of a share of common stock and a “right” provided by the issuing corporation. The right entitles the unit-holder to claim more stock if the market price of the stock falls below a stated level. For instance, at a predetermined time, say at the end of two years, the issuer guarantees to support a floor value for each unit-holder’s position. In the event that the market value of the stock has risen above the stated floor value, nothing happens. If the market value has fallen below the floor, however, the issuer is obligated to make up the difference by giving unit holders additional common shares.30 Exhibit 6 provides a summary of how a money-back guarantee was used to facilitate equity financing needed by a family business in order to fund raw materials and working capital for a major new contract. A potential difficulty arises when the new issue of puttable stock is not backed by a strong, well-known entity. One solution is to arrange for a major bank to back the guarantee by issuing an irrevocable letter of credit (for a fee, of course). Such an approach takes advantage of the bank’s economies of scale in information processing, which can reduce the cost of becoming informed. Concluding Remarks In order to achieve its full potential, a company should be able to continue through its business lifecycle, whether or not that matches the human lifecycle of its founder. In today’s financial arena there are a variety of ways in which a private business can harvest liquidity to meet its own needs for growth, the consumption requirements of its founder, or the challenges of tax and estate planning. So long as leadership succession can be arranged, the business’ lifecycle can determine the course of the company. 29 For a discussion of the origins and use of puttable common stock, see Chen and Kensinger (1988). For example, if the market value were $10 per share of common stock upon maturity and the guaranteed floor were $15, the rights would entitle their holders to claim 50 new shares of common stock for every 100 rights they held. 30 Page 22 Exhibits Exhibit 1: Available Methods of Harvest: Orderly Liquidation: Generating cash becomes the primary goal of the business: • Sell assets; replace via lease arrangements if necessary • Spin off project financing arrangements • Withdraw free cash flows gradually Debt Issue Bond the business’ cash flows • Borrow against future cash flows from the business • Use Mezzanine financing (debt with warrants included) Private sale: Sell for cash, debt, or equity to: • Another company or group of investors • Management, frequently through a leveraged management buyout • Employees, usually in the form of an Employee Stock Option Plan • Family members (such as an inter-generational transfer from the owner to his or her children) Acquisition: Be acquired by or merged into another, usually larger, company • Strategic acquisition, involving perceived synergies and premium price • Non-strategic acquisition, price based upon value of assets or expected cash flows IPO: Take the company public through a public stock offering Page 23 Exhibit 2: Entrepreneurs’ Assessments of the Harvest Experience • • • • • • • To gain some insight into this process, Petty, Bygrave, and Shulman (1994) collected a sample of acquisition transactions of privately-held companies reported in Mergerstat Review between 1984 and 1990.31 The sample was limited to acquisitions valued between $5 million and $100 million. Also, 278 venture-backed companies that were acquired between the years of 1987 and 1990 were identified through the Venture Economics database. This database includes the names of venture capitalists who participated in the financing of the ventures. For all firms background information about the buyer, seller, and the acquisition was collected from the Dow Jones News Retrieval Service. The issues addressed in the study fell into one of three areas: (1) the decision to sell, (2) the selling process, and (3) the post sale. Using these issues as guidelines, phone interviews were conducted for a limited sample of entrepreneurs. Some of the conclusions reached from the interviews were as follows: For some of the entrepreneurs, there was significant disappointment with the acquisition process and the final outcome. They came to realize that the firm served as the base for much of what they did, both in and out of the business arena. This sentiment existed more with owners of the low-tech firms, especially service firms, than with the high-tech companies. The most prevalent reason for selling the company related to estate planning and the opportunity to diversify the owner’s investments. A second reason for the sale related to the need to finance future growth. The harvest did provide the long-sought-after liquidity, but some entrepreneurs found managing money more difficult, and less enjoyable, than they had expected, and less rewarding than operating their own company. The disillusionment of selling the firm was particularly evident when the entrepreneur continued in the management of the company, but under the supervision of the acquiring owners. The differences in corporate culture became a significant problem for both companies involved in the transaction, but more so for the selling entrepreneur. A number of the selling owners were disappointed in the advice they received from “experts.” After the fact, they wished they had talked to other entrepreneurs who had experienced the sale of a company. Most entrepreneurs relied on their staff and advisors to determine a fair price for their company. Thus, they would talk in terms of cash flows and earnings, most often the capitalization or multiple of the earnings or cash flows, and seldom the present value of future cash flows. However, most of the entrepreneurs felt they had a sense of what they would accept for the firm, and that instinct had a greater influence than did the supporting computations. Most often, price was not a serious issue. There is considerable down-side risk if the acquisition is not consummated. During the negotiations, management’s focus shifts from company operations to consummating the sale. Members of the existing management team may be promised promotions after the acquisition, which do not occur should the negotiations fail. Hence, there is a real risk of loosing part of the management team and certainly taking several months to regain the firm’s focus. 31 See Petty, Bygrave, and Shulman (1994). Page 24 Exhibit 3: Harvesting Via The Leveraged ESOP 1. Employer company guarantees payment of loan. Firm Lender 2. ESOP borrows money from lender. 5. Firm makes annual contribution for employee stock purchase 6. ESOP makes payment on loan. ESOP 4. Stock sent to ESOP for benefit of employees. 3. Cash from loan used to buy owner's stock. Current Owner Adapted from Daniel R. Garner, Robert R. Owen, and Robert P. Conway, The Ernst & Young Guide to Raising Capital, New York: John Wiley & Sons, 1991, p. 282. The Initial Public Offering (IPO) Page 25 Exhibit 4: Understanding the IPO Market When contemplating a public offering, the entrepreneur needs to understand the basic nature of the new-issues market. There is a large volume of research whose principal findings are summarized below: • New issues on average are significantly underpriced at the offering. The first-day rate of return for investors purchasing a new issue averages 10 to 15 percent.32 These results are even more pronounced for smaller companies (underpricing for IPOs totaling 10 million or less averages 30%). Price per share also matters—the average initial stock price run up for IPOs with an offering price of less than $3.00 per share is 42.8 percent, whereas the average initial return on IPOs with an offering price of $3.00 or more averages 8.6 percent.33 Moreover, underpricing persists in every country with a stock market, although the amount of underpricing differs among countries.34 • There are periods of higher average initial returns known as “hot issue” markets.35 There are cycles in both volume of new issues and magnitude of first-day returns.36 The cycles in underpricing make next month’s average initial return predictable based upon the current month’s average with reasonable accuracy.37 Likewise, a high-volume month is more likely to be followed by another high-volume month.38 • New issues tend to underperform for up to five years after the offering.39 . For IPOs during the period 1975 to 1984, the total return from the end of the first day of trading to three years later was 34.5 percent, compared to the return on the NYSE of 61.9 percent .40 Yet, firms that issue during low-volume periods typically experience neither high initial price run-ups nor subsequent long-run underperformance.41 Again these findings were more pronounced for younger firms.42 Also, the earnings per share of companies going public typically grow rapidly in the years before going public, but then decline after the IPO.43 32 See Ibbotson (1975). See Chalk and Peavy (1987). 34 See Loughran, Ritter, and Rydqvist, (1994). 35 Hot issue markets were first identified by Ibbotson and Jaffe (1975). 36 See Ibbotson, Sindelar, and Ritter (1994). 37 The first-order autocorrelation of monthly average initial returns is 0.66. 38 The autocorrelation here is 0.89. 39 See Loughran (1993). 40 See Ritter (1991). 41 See Ibbotson, Sindelar, and Ritter (1994). 42 See Hanley and Ritter (1993). 43 See Jain and Kini (1994). 33 Page 26 Exhibit 5: The chronology of a public offering Steps in the process: • The management decides to go public. • An investment banker is selected to serve as the underwriter, who in turn brings together a group of investment houses called a syndicate to help sell the shares. • A prospectus is prepared. • The managers, along with the investment banker, go on the road to tell the firm's story to the brokers who will be selling the stock. • On the day before the offering is released to the public, the decision is made as to the actual offering price. • All the work, which by now has taken months, comes to fruition in a single event—offering the stock to the public and seeing how it is received. During this process, the firm's owners and managers will be answering such questions as: • What do we need to do in advance of going public? • What are the legal requirements? • Who should be responsible for the different activities and how should we structure our "team" to make it all happen? • How do we choose an investment banker? • How do we determine an appropriate price for the offering? • How is life different after we are a public company? Page 27 Exhibit 6: The Arly Merchandise Company Example of Puttable Stock The simple expedient of equity with a money-back guarantee was pioneered in 1984 by Arley Merchandise Company, a small New England maker of custom draperies and upholstery. Having just won a large contract to supply a major hotel chain, it needed to boost its equity capital and sought to accomplish an initial placement of $6 million worth of stock. Because the company was still an unknown, however, Arley’s owners could not persuade an investment banker to underwrite the stock at a price that was acceptable to them. They wanted at least $8 per share, but the investment banker believed $6 was as high as the public market would go. A solution was found by offering the new equity in “units” consisting of a share of stock plus a money-back guarantee (or put option) that would allow the investor to sell the stock back to the company on the second anniversary of the initial offering, for the original price. Each unit consisted of a share of common stock with a “right” providing the option to sell the stock back to the company for cash or notes. The Arley units were offered at $8 each, with accompanying rights for investors to “put” their stock back to the company for $8 per share two years later. Cash settlements were promised to small shareholders, but holders of large blocks could be paid off in senior subordinated notes paying 128 percent of the 10-year Treasury bond rate. The units were offered in November 1984, and the stock began trading on the American Stock Exchange, as puts, in December. Thereupon, just as the investment bankers had predicted, the price quickly stabilized at $6 per share. The Boston Stock Exchange, meanwhile, made a market in the separated puts and the whole units. Through their willingness to lay themselves on the line in order to protect the initial buyers of the stock, Arley’s original owners translated their confidence in the company’s prospects into a higher stock price, overcoming the underpricing problem for their IPO. Their story ended happily, too, for the stock was trading at $10 by the time the second anniversary arrived; so no one asked for their money back. Page 28 References Randolph Beatty and Jay Ritter, “Investment Banking, Reputation, and the Underpricing of Initial Public Offerings,” Journal of Financial Economics Vol. 15 (1986), pp. 21332. Richard A. Brealey, Stewart C. Myers, and Alan J. Marcus, Fundamentals of Corporate Finance 2nd Edition (New York: Irwin McGraw-Hill, 1999). L. Brokaw, “The First Day of the Rest of Your Life,” Inc. Vol.15 No.5 (1993): p. 144. Robert F. Bruner, “Leveraged ESOPs and Corporate Financing,” Journal of Applied Corporate Finance Vol.1 No.1 (1988): pp. 54-66. Andrew Chalk and John Peavy, “Initial Public Offerings: Daily Returns, Offering Types and the Price Effect,” Financial Analyst Journal Vol. 27 No. 4 (1987): pp. 65-69. Andrew Chen and John Kensinger, “Financing Innovations: Tax-deductible Equity,” Financial Management 14 (Winter 1985), pp. 44-51. Andrew Chen and John Kensinger, “Puttable Stock: A New Innovation in Equity Financing,” Financial Management Vol. 17 (Spring 1988): pp. 27-37. D.W. Englander, “Cashing Out Through ESOPs,” Small Business Reports Vol.18 No.10 (1993): pp. 43-45. J. Desroches and B. Belletante, “The Positive Impact of Going Public on Entrepreneurs and Their Firms: Evidence from Listing on the ‘Second Marche’ in France,” Frontiers of Entrepreneurship Research, N. C. Churchill, W.D. Bygrave, J.C. Covin, D.L. Sexton, D.P. Slevin, K.H. Vesper, and W.E. Wetzel, Jr, editors, (Wellesley, Mass.: Babson College Press, 1992): pp. 466-480. K.W. Hanley and J.R. Ritter “Going Public” in The New Palgrave Dictionary of Money and Finance, Peter Newman, editor (London England: Macmillan Press Reference Books, 1993). S.R. Holmburg, “Value Creation and Capture: Entrepreneurship Harvest and IPO Strategies,” Frontiers of Entrepreneurship Research. ed. N. C. Churchill, W.D. Bygrave, J.C. Covin, D.L. Sexton, D.P. Slevin, K.H. Vesper, and W.E. Wetzel, Jr. editors, (Wellesley, Mass.: Babson College Press, 1991): pp. 191-204. S.R. Holmburg, “Value Creation and Capture: Entrepreneurship Harvest and IPO Strategies,” in Frontiers of Entrepreneurship Research, N. C. Churchill, W.D. Bygrave, J.C. Covin, D.L. Sexton, D.P. Slevin, K.H. Vesper, and W.E. Wetzel, Jr, editors, (Wellesley, Mass.: Babson College Press, 1992): pp. 191-204. H. Hyatt, “The Dark Side of Going Public,” Inc. Vol. 12 No. 6 (May 1990): pp. 46-56. R.G. Ibbotson, J.L. Sindelar, and J.R. Ritter, “The Market’s Problems With the Pricing of Initial Public Offerings” Journal of Applied Corporate Finance Vol. 7 No. 1 (Spring 1994): pp. 66-74. Page 29 Robert G. Ibbotson, “Price Performance of Common Stock New Issues,” Journal of Financial Economics Vol. 2 No. 3 (1975): pp. 235-272. Robert G. Ibbotson, and Jerold F. Jaffe, “Hot Issue Markets,” Journal of Finance Vol. 30 No. 4 (1975): pp. 1027-1042. B. Jain and O. Kini, “The Post-Issue Operating Performance of IPOs,” Journal of Finance Vol. 49 No. 5 (1994): pp. 1699-1726. S. Jones, M.B. Cohen, and V.V. Coppola “Going Public” in Eds. W.A. Sahlman and H.H. Stevenson, editors, The Entrepreneurial Venture (Boston: Harvard Business School Publications, 1992). S. Kaplan, “The Effects of Management Buy-outs on Operating Performance and Value,” Journal of Financial Economics Vol. 24 (October 1989): pp. 217-54. S. Kaplan, “The Staying Power of Leveraged Buyouts,” Journal of Financial Economics Vol. 29 (May 1991): pp. 287-313. John W. Kensinger and John D. Martin, “Project Financing: Raising Money the OldFashioned Way,” Journal of Applied Corporate Finance Vol.1 No.3 (Fall 1988) pp. 69-81. Haim Leland and David Pyle, “Informational Asymmetries, Financial Structure, and Financial Intermediation,” Journal of Finance Vol. 32 (May 1977), pp.371-87. T. Loughran, J. Ritter, and K. Rydqvist, “Initial Public Offerings: International Insights,” Pacific-Basin Finance Journal, Vol. 2 No.3 (March 1994): pp. 165-199. T. Loughran, “NYSE vs. Nasdaq Returns: Market Microstructure or the Poor Performance of IPOs?” Journal of Financial Economics Vol 33 (1993): pp. 241-260. Park, S., and M.H. Song, “Employee Stock Ownership Plans, Firm Performance, and Monitoring by Outside Blockholders.” Financial Management, Vol.24 No.4 (1995): pp. 52-65. J. William Petty, John D. Martin, and John W. Kensinger, Harvesting Investments in Private Companies (Morristown NJ: Financial Executives’ Research Foundation, 1999). J. W. Petty, B.E. Bygrave, and J.M. Shulman, “Harvesting the Entrepreneurial Venture: A Time for Creating Value,” Journal of Applied Corporate Finance, Vol. 7 No. 9 (1994) pp. 48-58. Jay Ritter, “The Long-run Performance of Initial Public Offerings,” Journal of Finance Vol. 46 No.3 (1991): pp. 3-27. Jay Ritter, “The Costs of Going Public,” Journal of Financial Economics Vol. 19 (1987), pp. 269-282. Kevin Rock, “Why New Issues are Underpriced,” Journal of Financial Economics Vol. 15 (1986), pp. 187-212. Page 30 W.A. Sahlman, “Aspects of Financial Contracting in Venture Capital” Journal of Applied Corporate Finance, Vol. 1 No. 4 (Summer 1988) pp. 23-36. D.P. Sutton and M.W. Beneddetto, Initial Public Offerings. (Chicago: Probus Publishing Company, 1990). J. Timmons, New Venture Creation (Chicago: Irwin, 1994). Nancy Upton and William Petty, “Funding Options for Transferring the Family-Held Firm: A Comparative Analysis,” Hankamer School of Business Working Paper, Baylor University, Waco TX, 1998. Oliver E. Williamson, “Corporate Finance and Corporate Governance,” Journal of Finance Vol. 43 (1988): pp. 567-91. M. Wright, S. Thompson, K. Robbie, and P. Wong “Management Buy-outs in the Short and Long Term” Frontiers of Entrepreneurship Research, (Wellesley, Mass.: Babson College Press, 1992) pp. 302-316. M. Wright, K. Robbie, Y. Romanet, S. Thompson, R. Joachimsson, J. Bruining, and A. Herst December 12-14, 1992. “Realizations, Longevity and the Live-cycle of Management Buy-outs and Buy-ins: A Four-Country Study.” Presented at the EFER 92 Forum, London Business School. Page 31