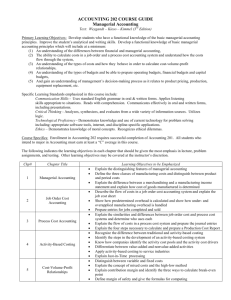

Activity-Based Cost Systems for Management - E-Book

advertisement