Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

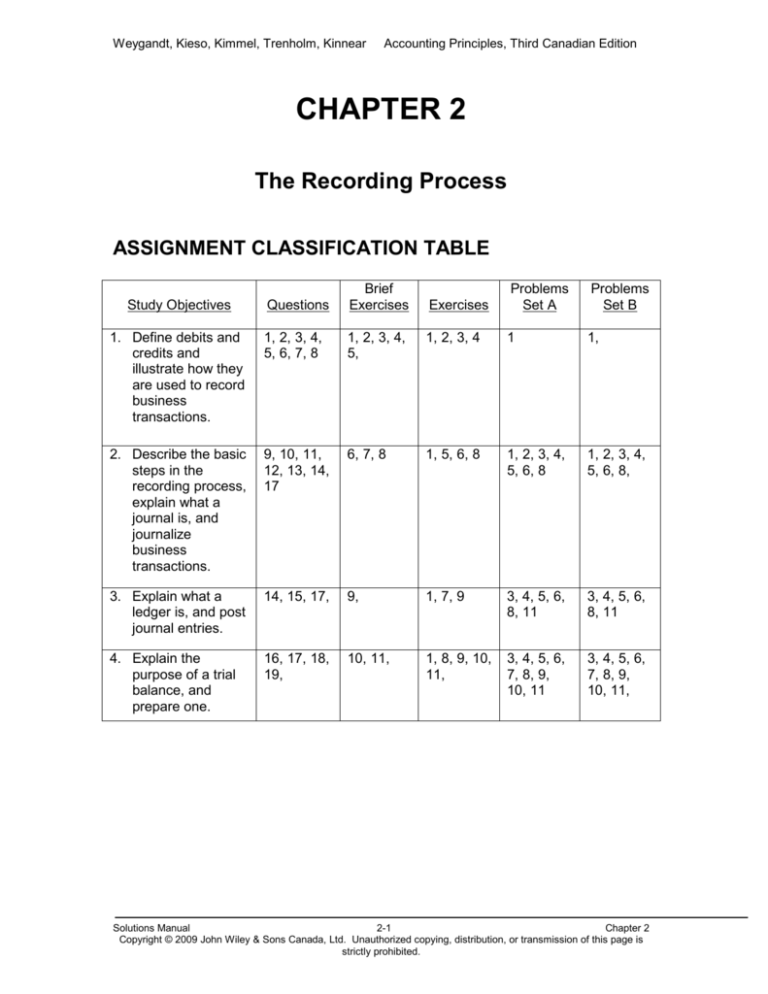

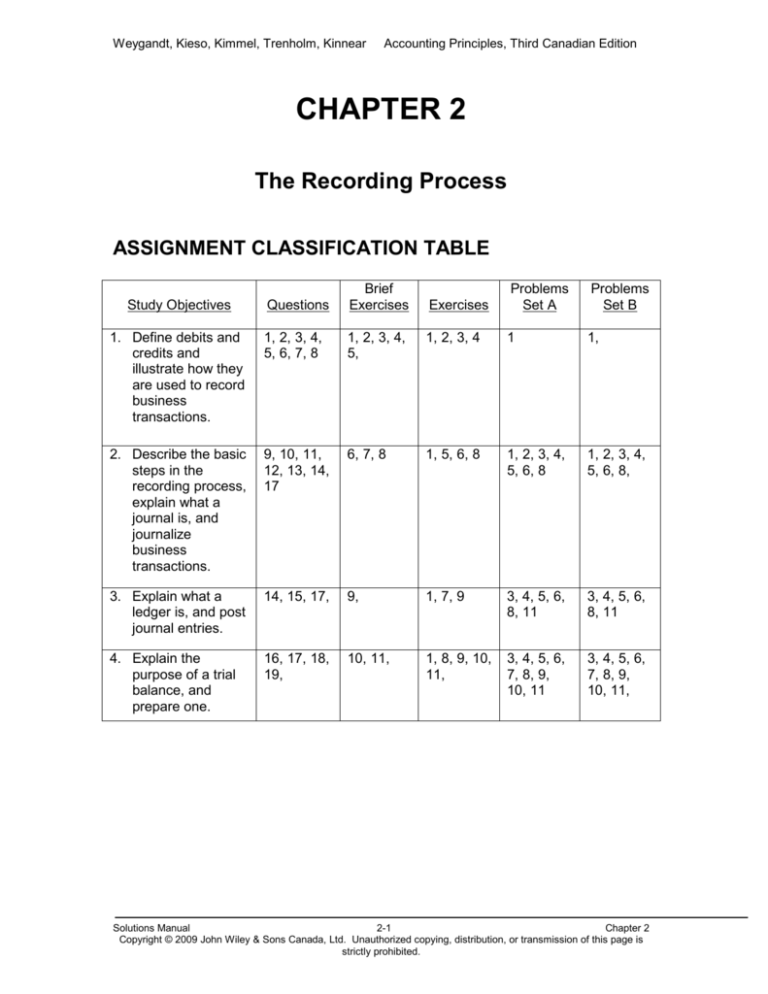

CHAPTER 2

The Recording Process

ASSIGNMENT CLASSIFICATION TABLE

Questions

Brief

Exercises

Exercises

Problems

Set A

Problems

Set B

1. Define debits and

credits and

illustrate how they

are used to record

business

transactions.

1, 2, 3, 4,

5, 6, 7, 8

1, 2, 3, 4,

5,

1, 2, 3, 4

1

1,

2. Describe the basic

steps in the

recording process,

explain what a

journal is, and

journalize

business

transactions.

9, 10, 11,

12, 13, 14,

17

6, 7, 8

1, 5, 6, 8

1, 2, 3, 4,

5, 6, 8

1, 2, 3, 4,

5, 6, 8,

3. Explain what a

ledger is, and post

journal entries.

14, 15, 17,

9,

1, 7, 9

3, 4, 5, 6,

8, 11

3, 4, 5, 6,

8, 11

4. Explain the

purpose of a trial

balance, and

prepare one.

16, 17, 18,

19,

10, 11,

1, 8, 9, 10,

11,

3, 4, 5, 6,

7, 8, 9,

10, 11

3, 4, 5, 6,

7, 8, 9,

10, 11,

Study Objectives

Solutions Manual

2-1

Chapter 2

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

ASSIGNMENT CHARACTERISTICS TABLE

Problem

Number

Description

Difficulty

Level

Time

Allotted (min.)

1A

Perform transaction analysis and journalize transactions.

Simple

15-20

2A

Journalize transactions.

Simple

20-30

3A

Journalize transactions, post, and prepare trial balance.

Moderate

40-50

4A

Journalize transactions, post, and prepare trial balance.

Moderate

55-65

5A

Journalize transactions, post, and prepare trial balance.

Moderate

55-65

6A

Journalize transactions, post, and prepare trial balance.

Moderate

80-90

7A

Prepare financial statements.

Simple

25-35

8A

Journalize transactions, post, and prepare trial balance.

Moderate

65-75

9A

Prepare financial statements.

Simple

25-35

10A

Analyze errors and effects on trial balance

Moderate

25-35

11A

Prepare correct trial balance.

Complex

30-40

1B

Perform transaction analysis and journalize transactions.

Simple

15-20

2B

Journalize transactions.

Simple

20-30

3B

Journalize transactions, post, and prepare trial balance.

Moderate

40-50

4B

Journalize transactions, post, and prepare trial balance.

Moderate

55-65

5B

Journalize transactions, post, and prepare trial balance.

Moderate

55-65

6B

Journalize transactions, post, and prepare trial balance

and financial statements.

Moderate

80-90

7B

Prepare financial statements.

Simple

25-35

8B

Journalize transactions, post, and prepare trial balance.

Moderate

65-75

9B

Prepare financial statements

Simple

25-35

10B

Analyze errors and effects on trial balance

Moderate

25-35

11B

Prepare correct trial balance

Complex

30-40

Solutions Manual

2-2

Chapter 2

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

BLOOM’S TAXONOMY TABLE

Correlation Chart between Bloom’s Taxonomy, Study Objectives and End-ofChapter Material

Study Objective

1. Define debits

and credits and

illustrate how

they are used to

record business

transactions.

2. Describe the

basic steps in

the recording

process, explain

what a journal

is, and

journalize

business

transactions.

3. Explain what a

ledger is, and

post journal

entries.

4. Explain the

purpose of a

trial balance,

and prepare

one.

Knowledge

Q2-4

Q2-5

Q2-6

BE2-2

BE2-3

E2-1

E2-2

E2-3

Q2-10

Q2-12

E2-1

Application

BE2-1

E2-4

P2-1A

P2-1B

Q2-9

Q2-11

Q2-13

BE2-6

Q2-14

Q2-17

BE2-7

BE2-8

E2-5

E2-6

E2-8

P2-1A

P2-2A

P2-3A

P2-4A

P2-5A

P2-6A

P2-8A

E2-1

E2-1

BYP2-1

Broadening Your

Perspective

Comprehension

Q2-1

Q2-2

Q2-3

Q2-7

Q2-8

BE2-4

BE2-5

Q2-14

Q2-15

Q2-17

BE2-9

E2-7

E2-9

P2-3A

P2-4A

P2-5A

P2-6A

P2-8A

Q2-19

Q2-16

Q2-17

BE2-10

BE2-11

E2-8

E2-9

E2-11

P2-3A

BYP2-2

BYP2-3

BYP2-4

Analysis

Synthesis

Evaluation

P2-1B

P2-2B

P2-3B

P2-4B

P2-5B

P2-6B

P2-8B

P2-11A

P2-11B

P2-3B

P2-4B

P2-5B

P2-6B

P2-8B

P2-4A

P2-5A

P2-6A

P2-7A

P2-8A

P2-3B

P2-4B

P2-5B

P2-6B

P2-7B

P2-8B

Q2-18

E2-10

P2-9A

P2-10A

P2-11A

P2-9B

P2-10B

P2-11B

BYP2-5

Solutions Manual

2-3

Chapter 2

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

ANSWERS TO QUESTIONS

1.

The balance in total Owner’s Equity should not equal the balance in the

Cash account. The balance in Owner’s Equity is increased by investments

made by the owner and earnings retained in the business. It is decreased

by withdrawals made by the owner. Investments and withdrawals would

normally be made in cash, although noncash assets can also be invested

or withdrawn. The earnings component would include earnings calculated

on an accrual basis and therefore would not equal the entries to the Cash

account.

2.

Jos is incorrect. The double-entry system merely records the effect of a

transaction on the accounting equation. A transaction is not recorded

twice; it is recorded once, with a dual effect on the equation.

3.

Kim is incorrect. A debit balance only means that debit amounts exceed

credit amounts in an account. Conversely, a credit balance only means

that credit amounts are greater than debit amounts in an account.

Whether a debit or credit balance is favourable or unfavourable depends

on the type of account being considered.

4.

(a) Asset accounts are increased by debits and decreased by credits.

The normal balance of an asset account is a debit balance.

(b) Liability accounts are decreased by debits and increased by credits.

The normal balance of a liability account is a credit balance.

(c) Owner's equity accounts are increased by owner’s investment and

revenues and decreased by owner’s drawings and expenses.

(1) The owner’s capital account is increased by credits and

decreased by debits. Its normal balance is a credit.

(2) Revenue accounts are increased by credits and decreased by

debits. The normal account balance of a revenue account is a

credit.

(3) The owner’s drawings account is increased by debits and

decreased by credits. Its normal account balance is a debit.

(4) Expense accounts are increased by debits and decreased by

credits. The normal account balance of an expense account is

a debit.

Solutions Manual

2-4

Chapter 2

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

QUESTIONS (Continued)

5.

Assets are on the left side of the basic accounting equation and liabilities

and owner’s equity are on the right side of the basic accounting equation.

Since debits are on the left side, and assets are also on the left side, the

normal balance of an asset is a debit balance.

Since credits are on the right side and liabilities are on the right side, the

normal balance of a liability is a credit balance. The same is also true for

owner’s capital. Revenues increase owner’s equity and therefore also

have a credit balance. But expenses and drawings are decreases to

owner’s equity and thus have a debit balance.

6.

(a)

(b)

(c)

(d)

(e)

(f)

(g)

(h)

Accounts Receivable—asset—debit balance

Accounts Payable—liability—credit balance

Equipment—asset—debit balance

Rent Expense – owner’s equity – debit balance (since it is a reduction

of capital)

Drawings—owner's equity—debit balance (since it is a reduction of

capital)

Supplies—asset—debit balance

Unearned Revenue—liability—credit balance

Cash—asset—debit balance

7.

(a) Debit Equipment and credit Accounts Payable

(b) Debit Cash and credit Unearned Revenue

(c) Debit Utilities Expense and credit Cash

8.

(a)

(b)

(c)

(d)

(e)

(f)

Accounts Payable—both debit and credit entries

Accounts Receivable—both debit and credit entries

Cash—both debit and credit entries

Drawings—debit entries only

Rent Expense—debit entries only

Service Revenue—credit entries only

Solutions Manual

2-5

Chapter 2

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

QUESTIONS (Continued)

9.

The basic steps in the recording process are:

(1) Analyze each transaction. In this step, business documents are

examined to determine the effects of the transaction on the accounts.

This basic step must be done by people in both a computerized and

manual system.

(2) Enter each transaction in a journal. This step is called journalizing and

it results in making a chronological record of the transactions. In a

computerized system, “journals” are kept as files, and “accounts” are

recorded in computerized databases.

(3) Transfer journal information to ledger accounts. This step is called

posting. Posting makes it possible to accumulate the effects of

journalized transactions on individual accounts. In computerized

accounting systems, posting usually occurs automatically right after

each journal entry is prepared. The system finds obvious errors in the

recording process.

10.

Two examples of business documents that are analyzed when journal

entries are being prepared are 1) Utility bill, 2) Sales slip (note that there

are many other possible answers to this question).

11.

(a) Effect on cash (b) Effect on owner’s equity

Transaction

Performing printing services

No impact

Increase (Revenue)

Issuing the monthly bills

No impact

No impact

Collecting amounts due

Increases

No impact

12.

Notes Payable can extend for longer terms than Accounts Payable and

often include interest. In addition, Notes Payable are usually supported by

a written promise to repay.

Accounts Payable are amounts owed by the company from purchases

made on account from suppliers. Accounts Receivable are amounts due

to the company from sales made on account to customers. Accounts

Payable are a liability to the company while Accounts Receivable are an

asset.

13.

The accounts that could be credited are Revenue, Accounts Receivable

and Unearned Revenue. Revenue would be credited for a cash sale.

Accounts Receivable would be credited when a customer makes a

payment on account. Unearned Revenue would be credited when a

customer pays in advance.

Solutions Manual

2-6

Chapter 2

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

QUESTIONS (Continued)

14.

Debits and credits could be recorded directly in the ledger; however, this

is not the recommended practice. The advantages of using the journal

are:

1. It discloses in one place the complete effect of a transaction.

2. It provides a chronological record of all transactions.

3. It helps to prevent or locate errors, because the debit and credit

amounts for each entry can be readily compared.

The advantage of the last step in the posting process is to indicate that

the item has been posted, and to provide a cross-reference.

15.

The entire group of accounts maintained by a company, including all the

asset, liability, and owners' equity accounts, is referred to collectively as

the ledger. A chart of accounts lists the accounts and account numbers

that identify their location in the ledger. The numbering system used to

identify the accounts usually starts with the balance sheet accounts and

follows with the income statement accounts. The chart of accounts is

important, particularly for a company that has a large number of accounts,

because it helps organize the accounts and identify their location in the

ledger.

16.

A trial balance is a list of accounts and their balances at a given time. The

primary purpose of a trial balance is to prove the mathematical equality of

debits and credits, after all journalized transactions have been posted. A

trial balance also facilitates the discovery of errors in journalizing and

posting. In addition, it is useful in preparing financial statements.

17.

The proper sequence is as follows:

1. The business transaction occurs. (b)

2. Information is entered in the journal. (c)

3. Debits and credits are posted to the ledger. (a)

4. A trial balance is prepared. (e)

5. Financial statements are prepared. (d)

18.

(a) The trial balance would not balance, because there were two debits

for $750 and no credits. The debits do not equal the credits.

Accounts Payable should have been credited, not debited, for $750.

(b) The trial balance would balance, because the debits ($1,000) and

credits ($1,000) are equal. But both the Service Revenue and the

Accounts Receivable balances would be incorrect as the credit should

have been recorded as a credit to Accounts Receivable not Service

Revenue.

19.

The company should use “December 31” on its trial balance. The trial

balance is prepared at a specific point in time.

Solutions Manual

2-7

Chapter 2

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

SOLUTIONS TO BRIEF EXERCISES

BRIEF EXERCISE 2-1

Accounts Receivable

8,000

5,210

6,340

2,750

2,390

Debit Bal. 3,990

Accounts Payable

220

560

175

355

Credit Bal.

390

710

850

640

BRIEF EXERCISE 2-2

(a)

Debit

Effect

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

Accounts Payable

Accounts Receivable

Cash

Computer Equipment

J. Takamoto, Capital

J. Takamoto, Drawings

Notes Payable

Prepaid Insurance

Rent Expense

Salaries Expense

Service Revenue

Unearned Revenue

Decrease

Increase

Increase

Increase

Decrease

Increase

Decrease

Increase

Increase

Increase

Decrease

Decrease

(b)

Credit

Effect

Increase

Decrease

Decrease

Decrease

Increase

Decrease

Increase

Decrease

Decrease

Decrease

Increase

Increase

(c)

Normal

Balance

Credit

Debit

Debit

Debit

Credit

Debit

Credit

Debit

Debit

Debit

Credit

Credit

Solutions Manual

2-8

Chapter 2

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

BRIEF EXERCISE 2-3

1.

2.

3.

4.

5.

6.

7.

8.

Debit

Credit

Credit

Debit

Debit

Credit

Debit

Credit

BRIEF EXERCISE 2-4

June 1

2

3

4

12

22

25

29

Account Debited

Cash

Equipment

Rent Expense

Prepaid Insurance

Accounts Receivable

Cash

No entry required

Accounts Payable

Account Credited

D. Ing, Capital

Accounts Payable

Cash

Cash

Service Revenue

Accounts Receivable

Cash

Solutions Manual

2-9

Chapter 2

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

BRIEF EXERCISE 2-5

(a)

Basic Analysis

Aug. 1 The asset Cash is

increased; the owner's

equity account A. Fisher,

Capital is increased.

4 The asset Prepaid

Insurance is increased;

the asset Cash is

decreased.

(b)

Debit-Credit Analysis

Debits increase assets:

debit Cash $7,000.

Credits increase owner's

equity: credit A. Fisher,

Capital $7,000

Debits increase assets:

debit Prepaid Insurance

$1,900. Credits decrease

assets: credit Cash $1,900.

16 The asset Cash is

increased; the revenue

Service Revenue is

increased.

Debits increase assets:

debit Cash $950. Credits

increase revenues: credit

Service Revenue $950.

27 The expense Salaries

Expense is increased;

the asset Cash is

decreased.

Debits increase expenses:

debit Salaries Expense

$750. Credits decrease

assets: credit Cash $750.

29 The asset Cash is

decreased; A. Fisher,

Drawings is increased.

Debits increase Owner's

Drawings: debit Drawings

$500; Credits decrease

assets: credit Cash $500.

Solutions Manual

2-10

Chapter 2

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

BRIEF EXERCISE 2-6

The basic steps in the recording process are:

(1)

(2)

(3)

Analyze each transaction. In this step, business

documents are examined to determine the effects of the

transaction on the accounts.

Enter each transaction in a journal. This step is called

journalizing and it results in making a chronological record

of the transactions.

Transfer journal information to ledger accounts. This step

is called posting. Posting makes it possible to accumulate

the effects of journalized transactions on individual

accounts.

Solutions Manual

2-11

Chapter 2

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

BRIEF EXERCISE 2-7

June 1

2

3

4

12

22

Cash ..................................................... 5,500

D. Ing, Capital .................................

5,500

Equipment ........................................... 3,000

Accounts Payable ...........................

3,000

Rent Expense ......................................

Cash ................................................

500

Prepaid Insurance ...............................

Cash ................................................

800

Accounts Receivable ..........................

Service Revenue .............................

350

Cash .....................................................

Accounts Receivable......................

350

500

800

350

25

No entry required—not a transaction

29

Accounts Payable ............................... 3,000

Cash ................................................

350

3,000

Solutions Manual

2-12

Chapter 2

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

BRIEF EXERCISE 2-8

Aug.

1

4

16

27

29

Cash ..................................................... 7,000

A. Fisher, Capital ............................

7,000

Prepaid Insurance ............................... 1,900

Cash ................................................

1,900

Cash .....................................................

Service Revenue .............................

950

Salaries Expense ................................

Cash ................................................

750

A. Fisher, Drawings ............................

Cash ................................................

500

950

750

500

BRIEF EXERCISE 2-9

Cash

Aug. 1

7,000 Aug. 4

16

950

27

29

Aug 31 Bal. 4,800

1,900

750

500

Service Revenue

Aug. 16

Aug 31 Bal.

Prepaid Insurance

Aug. 4

1,900

Salaries Expense

Aug. 17

750

Aug 31 Bal. 1,900

Aug. 31 Bal. 750

A. Fisher, Capital

Aug. 1

950

950

A. Fisher, Drawings

7,000 Aug. 29

500

Aug 31 Bal. 7,000

Aug. 31 Bal. 500

Solutions Manual

2-13

Chapter 2

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

BRIEF EXERCISE 2-10

BEIRSDORF COMPANY

Trial Balance

June 30, 2008

Debit

Cash ............................................................... $ 8,400

Accounts receivable ..................................... 3,000

Supplies .........................................................

650

Equipment ..................................................... 14,600

Accounts payable ..........................................

Unearned revenue .........................................

Notes payable ................................................

B. Beirsdorf, capital ......................................

B. Beirsdorf, drawings .................................. 1,200

Service revenue .............................................

Salaries expense ........................................... 4,000

Rent expense .................................................

800

$32,650

Credit

$ 3,900

150

5,000

17,000

6,600

______

$32,650

Solutions Manual

2-14

Chapter 2

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

BRIEF EXERCISE 2-11

1.

The Rent Expense balance was in the wrong column.

Expenses have a debit balance. When this account is

moved the new total in the debit column will be $46,200

($43,800 + $2,400) and the new total in the credit column

will be $47,100 ($49,500 - $2,400).

2.

The trial balance is now out $900 ($46,200 - $47,100). The

only account balance that could have caused a $900

transposition error is the $15,400 balance in L. Bourque,

capital. If balance in that account is transposed to $14,500

this will reduce the total credits by $900 and the trial

balance will now balance. See revised trial balance below:

BOURQUE COMPANY

Trial Balance

December 31, 2007

Debit

Cash ............................................................... $15,000

Accounts receivable ..................................... 1,800

Prepaid insurance ......................................... 3,500

Accounts payable ..........................................

Unearned revenue .........................................

L. Bourque, capital ........................................

L. Bourque, drawings ................................... 4,900

Service revenue .............................................

Salaries expense ........................................... 18,600

Rent expense ................................................. 2,400

$46,200

Credit

$ 2,000

2,200

14,500

27,500

______

$46,200

Solutions Manual

2-15

Chapter 2

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

SOLUTIONS TO EXERCISES

EXERCISE 2-1

(a)

(b)

(c)

(d)

(e)

(f)

(g)

(h)

(i)

(j)

8.

9.

3.

7.

1.

10.

5.

8.

4.

6.

Credit

Analyzing transactions

Posting

Account

Debit

Journalizing

Trial balance

Credit

Chart of accounts

Journal

Solutions Manual

2-16

Chapter 2

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

EXERCISE 2-2

Account

1. Cash

2. M. Kobayashi,

Capital

3. Accounts Payable

4. Building

5. Consulting Fee

Revenue

6. Insurance Expense

7. Interest Earned

8. Notes Receivable

9. Prepaid Insurance

10. Rent Expense

11. Unearned

Consulting Fees

Solutions Manual

(1)

Type of

Account

Asset

Owner’s

Capital

Liability

Asset

Revenue

(2)

Financial Statement

Balance Sheet

Balance Sheet and

Statement of Owner’s

Equity

Balance Sheet

Balance Sheet

Income Statement

Expense

Revenue

Asset

Asset

Expense

Liability

Income Statement

Income Statement

Balance Sheet

Balance Sheet

Income Statement

Balance Sheet

(3)

Normal

Balance

Debit

Credit

(4)

Increase

Debit

Credit

Credit

Debit

Credit

Credit

Debit

Credit

Debit

Credit

Debit

Debit

Credit

Debit

Debit

Debit

Credit

Debit

Credit

Debit

Debit

Debit

Credit

Credit

Debit

Credit

Credit

Credit

Debit

2-17

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

(5)

Decrease

Credit

Debit

Chapter 2

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

EXERCISE 2-3

(a)

Basic

Type

Asset

Account Debited

(b)

(c)

(d)

Effect

Specific

Normal

Account

Balance

Cash

Debit

Increase

6

7

Asset

Asset

Vehicle

Supplies

Debit

Debit

Increase

Increase

12

Asset

Accounts

Receivable

Debit

Increase

21

Advertising

Expense

Debit

Increase

25

Owner’s

Equity—

Expense

Asset

Owner’s

Equity—

Revenue

Asset

Cash

Debit

Increase

Asset

28

Liability

Credit

Decrease

31

Owner’s

Equity—

Drawings

Asset

Accounts

Payable

L. Visser,

Drawings

Debit

Cash

Debit

Transaction

Mar. 3

31

Solutions Manual

(a)

Basic

Type

Owner’s

Equity—

Capital

Asset

Liability

Account Credited

(b)

(c)

Specific

Normal

Account

Balance

L. Visser,

Credit

Capital

Cash

Accounts

Payable

Service

Revenue

(d)

Effect

Increase

Debit

Credit

Decrease

Increase

Credit

Increase

Cash

Debit

Decrease

Debit

Decrease

Asset

Accounts

Receivable

Cash

Debit

Decrease

Increase

Asset

Cash

Debit

Decrease

Increase

Liability

Unearned

Revenue

Credit

Increase

2-18

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Chapter 2

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

EXERCISE 2-4

Oct. 1 Debits increase assets: debit Cash $15,000.

Credits increase owner's equity: credit L. Gardiner,

Capital $15,000.

2 No transaction at this point in time (see Oct. 30).

3 Debits increase assets: debit Office Equipment $3,350.

Credits decrease assets: credit Cash $850

Credits increase liabilities: credit Note Payable $2,500.

10 Debits increase assets: debit Cash $250.

Credits increase revenues: credit Fees Earned $250.

16 Debits increase assets: debit Accounts Receivable

$6,500.

Credits increase revenues: credit Fees Earned $6,500.

27 Debits increase expenses: debit Advertising Expense

$700.

Credits decrease assets: credit Cash $700.

30 Debits increase expenses: debit Salaries Expense

$2,000.

Credits decrease assets: credit Cash $2,000.

31 Debits increase assets: debit Cash $6,500

Credits decrease assets: credit Accounts Receivable

$6,500

Solutions Manual

2-19

Chapter 2

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

EXERCISE 2-5

GENERAL JOURNAL

Date

Mar.

Account Titles and Explanation

J1

Debit

Credit

3 Cash ........................................................ 10,000

L. Visser, Capital ................................

10,000

6 Equipment (or Vehicle) .......................... 6,500

Cash ....................................................

6,500

7 Supplies ..................................................

Accounts Payable ..............................

500

500

12 Accounts Receivable ............................. 2,100

Service Revenue ................................

21 Advertising Expense ..............................

Cash ....................................................

225

25 Cash ........................................................

Accounts Receivable .........................

700

28 Accounts Payable...................................

Cash ....................................................

500

31 L. Visser, Drawings ................................

Cash ....................................................

800

31 Cash ........................................................

Unearned Revenue ............................

750

2,100

225

700

500

800

750

Solutions Manual

2-20

Chapter 2

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

EXERCISE 2-6

GENERAL JOURNAL

Date

Oct.

Account Titles and Explanation Ref.

Debit

Credit

1 Cash ........................................................ 15,000

L. Gardiner, Capital............................

15,000

2 No entry—not a transaction

3 Office Furniture ......................................

Cash ....................................................

Note Payable ......................................

3,350

10 Cash ........................................................

Fees Earned .......................................

250

16 Accounts Receivable .............................

Fees Earned .......................................

6,500

27 Advertising Expense ..............................

Cash ....................................................

700

30 Salaries Expense ....................................

Cash ....................................................

2,000

31 Cash ........................................................

Accounts Receivable .........................

6,500

850

2,500

250

6,500

700

2,000

6,500

Solutions Manual

2-21

Chapter 2

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

EXERCISE 2-7

Cash

Oct. 1

15,000 Oct. 3

850

10

250

27

700

31

6,500

30 2,000

Oct. 31 Bal.18,200

L. Gardiner, Capital

Oct. 1

15,000

Accounts Receivable

Oct. 16

6,500 Oct. 31 6,500

Fees Earned

Oct. 10

250

16

6,500

Oct. 31 Bal. 6,750

Oct. 31 Bal.

Oct.

0

Office Equipment

3

3,350

Oct. 31 Bal. 3,350

Note Payable

Oct. 3

Oct. 31 Bal. 15,000

Salaries Expense

Oct. 30

2,000

Oct.31Bal.2,000

Advertising Expense

2,500 Oct. 27

700

Oct.31 Bal.2,500 Oct. 31 Bal. 700

Solutions Manual

2-22

Chapter 2

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

EXERCISE 2-8

(a)

Date

Oct.

GENERAL JOURNAL

Account Titles and Explanation

J1

Debit

Credit

1 Cash .......................................................... 1,200

A. Fortin, Capital ..................................

Invested cash in business.

1,200

3 Equipment................................................. 5,400

Cash ......................................................

Notes Payable ......................................

Purchased equipment and issued a note.

400

5,000

4 Supplies ....................................................

Accounts Payable ................................

Purchased supplies on account.

800

800

6 Accounts Receivable ............................... 1,000

Service Revenue ..................................

Performed services for credit.

10 Cash ..........................................................

Service Revenue ..................................

Performed services for cash.

650

12 Accounts Payable.....................................

Cash ......................................................

Paid cash on account.

500

650

500

15 Cash .......................................................... 3,000

Service Revenue ..................................

Performed services for cash.

20 Accounts Receivable ...............................

Service Revenue ..................................

Performed services for credit.

1,000

3,000

940

940

Solutions Manual

2-23

Chapter 2

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

EXERCISE 2-8 (Continued)

(a) (Continued)

GENERAL JOURNAL

Date

Account Titles and Explanation

J1

Debit

20 Cash ..........................................................

Accounts Receivable ...........................

Received cash on account.

Credit

800

800

25 Cash .......................................................... 2,000

A. Fortin, Capital ..................................

Invested cash in business.

2,000

28 Advertising Expense ................................ 400

Accounts Payable ................................

Purchased advertising on account.

400

30 A. Fortin, Drawings ..................................

Cash ......................................................

Withdrew cash for personal use.

600

600

31 Rent Expense ...........................................

Cash ......................................................

Paid rent.

250

31 Store Wages Expense ..............................

Cash ......................................................

Paid wages.

500

250

500

Solutions Manual

2-24

Chapter 2

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

EXERCISE 2-8 (Continued)

(b)

FORTIN CO.

Trial Balance

October 31, 2008

Debit

Cash ....................................................... $ 5,400

Accounts receivable ............................. 1,140

Supplies .................................................

800

Furniture ................................................ 5,400

Notes payable ........................................

Accounts payable ..................................

A. Fortin, capital ....................................

A. Fortin, drawings ................................

600

Service revenue .....................................

Advertising expense .............................

400

Store wages expense ............................

500

Rent expense .........................................

250

$14,490

Credit

$ 5,000

700

3,200

5,590

______

$14,490

Solutions Manual

2-25

Chapter 2

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

EXERCISE 2-9

(a) and (b)

Cash

Aug. 1

7,500 Aug. 1 1,200 Aug. 30

12

2,400

25 2,750

31

5,910

30

500

31 4,770

Aug. 31 Bal. 6,590

Accounts Receivable

Aug. 1

2,750 Aug. 12 2,400

25

2,550

Aug. 31 Bal. 2,900

Supplies

Aug. 1

585

10

420

Aug. 31 Bal. 1,005

Aug. 1

10,000

Aug. 31 Bal. 9,500

L. Meche, Capital

Aug. 1

15,000

Aug. 31 Bal. 15,000

L. Meche, Drawings

Aug. 1

5,125

31

4,770

Aug.31 Bal. 9,895

Equipment

14,700

Medical Fee Revenue

Aug. 1

9,410

25

8,460

Aug. 31 Bal. 17,870

Aug. 31Bal. 14,700

Rent Expense

Aug. 1

1,200

1

1,200

Aug. 31 Bal. 2,400

Accounts Payable

Aug. 10

Notes Payable

500 Aug. 1

Salaries Expense

Aug. 1

2,550

25

2,750

Aug.31 Bal. 5,300

420

Aug.31 Bal. 420

Solutions Manual

2-26

Chapter 2

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

EXERCISE 2-9 (Continued)

(c)

LEE MECHE, MD

Trial Balance

August 31, 2008

Cash ............................................................

Accounts receivable ..................................

Supplies ......................................................

Equipment...................................................

Notes payable .............................................

Accounts payable .......................................

L. Meche, capital ........................................

L. Meche, drawings ....................................

Service revenue ..........................................

Rent expense ..............................................

Salaries expense ........................................

Debit

$6,590

2,900

1,005

14,700

Credit

$9,500

420

15,000

9,895

17,870

2,400

5,300

$42,790

$42,790

EXERCISE 2-10

(a) Understated

(b) Correctly stated

(c) Understated (a credit posting was to a debit balance

account, Machinery)

(d) Correctly stated

(e) Incorrect debit column total:

$

?

Add: Reverse credit to Machinery account

7,500

Add: Debit to Machinery for purchase

7,500

Correct debit column total*

$360,000

* Equal to Credit column total given in exercise

? = $345,000

Solutions Manual

2-27

Chapter 2

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

EXERCISE 2-11

(a)

EXPRESS DELIVERY SERVICE

Trial Balance

July 31, 2008

Debit

Credit

Cash ($101,794 – $98,899 total

debits without Cash) ................................ $ 2,895

Accounts receivable .................................. 2,277

Supplies ......................................................

265

Prepaid insurance ......................................

404

Delivery equipment .................................... 36,620

Notes payable .............................................

$19,500

Accounts payable .......................................

3,234

Salaries payable .........................................

925

Unearned revenue ......................................

675

T. Weld, capital ...........................................

39,575

T. Weld, drawings....................................... 24,400

Service revenue ..........................................

37,885

Salaries expense ........................................ 15,563

Gas and oil expense................................... 12,143

Repair expense ........................................... 1,582

Interest expense .........................................

975

Insurance expense ..................................... 2,020

Supplies expense ....................................... 2,650 _______

$101,794 $101,794

Solutions Manual

2-28

Chapter 2

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

EXERCISE 2-11 (Continued)

(b)

EXPRESS DELIVERY SERVICE

Income Statement

Year Ended July 31, 2008

Revenues

Service revenue .................................................... $37,885

Expenses

Salaries expense ..................................... $15,563

Gas and oil expense ................................ 12,143

Repair expense ........................................ 1,582

Interest expense ......................................

975

Insurance expense .................................. 2,020

Supplies expense .................................... 2,650

Total expenses ................................................. 034,933

Net income ................................................................ $ 2,952

EXPRESS DELIVERY SERVICE

Statement of Owner's Equity

Year Ended July 31, 2008

T. Weld, capital, July 31, 2007 .................................. $39,575

Plus: Net income ....................................................

2,952

42,527

Less: Drawings ........................................................ 24,400

T. Weld, capital, July 31, 2008 .................................. $18,127

Solutions Manual

2-29

Chapter 2

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

EXERCISE 2-11 (Continued)

(b) (Continued)

EXPRESS DELIVERY SERVICE

Balance Sheet

July 31, 2008

Assets

Cash ........................................................................... $ 2,895

Accounts receivable .................................................

2,277

Supplies .....................................................................

265

Prepaid insurance ..................................................... 044404

Delivery equipment ................................................... 36,620

Total assets ........................................................... $42,461

Liabilities and Owner's Equity

Liabilities

Notes payable ....................................................... $19,500

Accounts payable .................................................

3,234

Salaries payable....................................................

925

Unearned revenue ................................................

675

Total liabilities .................................................. 24,334

Owner's Equity

T. Weld, capital ..................................................... 18,127

Total liabilities and owner's equity ................. $42,461

Solutions Manual

2-30

Chapter 2

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

SOLUTIONS TO PROBLEMS

PROBLEM 2-1A

(a)

Feb. 1 Debits increase expense: debit Rent Expense $475.

Credits decrease assets: credit Cash $475.

2 Debits increase assets: debit Sewing Supplies $250

Credits increase liabilities: credit Accounts Payable

$250

6 Debits increase assets: debit Accounts Receivable $750

Credits increase revenue: credit Fees Earned $750

7 No transaction at this point in time (see Feb. 15).

10 Debits increase assets: debit Cash $250.

Credits increase liabilities: credit Unearned Revenue

$250.

12 Debits decrease owner’s equity: debit L. Brinan,

Drawings $700.

Credits decrease assets: credit Cash $700.

15 Debits increase assets: debit Cash $385.

Credits increase revenue: credit Fees Earned $385.

17 Debits increase assets: debit Cash $750

Credits decrease assets: credit Accounts Receivable

$750

25 Debits decrease liabilities: debit Accounts Payable $250

Credits decrease cash: credit Cash $250

Solutions Manual

2-31

Chapter 2

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

PROBLEM 2-1A (Continued)

(a) (Continued)

Feb. 28 Debits increase assets: debit Cash $2,000.

Credits increase liabilities: credit Note Payable $2,000.

28 Debits increase assets: debit Equipment $2,500

Credits decrease assets: credit Cash $2,500

(b)

Date

Feb.

GENERAL JOURNAL

Account Titles and Explanation

Debit

1 Rent Expense ........................................

Cash ...................................................

475

2 Sewing Supplies ....................................

Accounts Payable .............................

250

6 Accounts Receivable ............................

Fees Earned ......................................

750

Credit

475

250

750

7 No transaction at this time.

10 Cash .......................................................

Unearned Revenue ...........................

250

12 L. Brinan, Drawings ..............................

Cash ...................................................

700

15 Cash .......................................................

Fees Earned ......................................

385

17 Cash .......................................................

Accounts Receivable ........................

750

250

700

385

750

Solutions Manual

2-32

Chapter 2

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

PROBLEM 2-1A (Continued)

(b) (Continued)

Date

Account Titles and Explanation

Debit

Feb. 25 Accounts Payable..................................

Cash ...................................................

250

28 Cash .......................................................

Notes Payable ...................................

2,000

28 Equipment..............................................

Cash ...................................................

2,500

Credit

250

2,000

2,500

Solutions Manual

2-33

Chapter 2

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

PROBLEM 2-2A

GENERAL JOURNAL

Date

Account Titles and Explanation Ref.

J1

Debit

Credit

June 1 Cash ......................................................... 50,000

D. Tanner, Capital ...............................

50,000

4 Land ...................................................... 174,000

Building ................................................. 101,000

Equipment............................................. 45,000

Cash ..................................................

32,000

Notes Payable ..................................

288,000

8 Advertising Expense ............................... 2,800

Accounts Payable ...............................

2,800

13 Prepaid Insurance ................................... 5,500

Cash .....................................................

5,500

15 Salaries Expense ..................................... 1,800

Cash .....................................................

1,800

17 D. Tanner, Drawings................................

Cash .....................................................

600

20 Cash ......................................................... 2,700

Admissions Revenue ..........................

600

2,700

22 No entry required

25 Cash ......................................................... 7,500

Unearned Admissions Revenue ........

7,500

Solutions Manual

2-34

Chapter 2

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

PROBLEM 2-2A (Continued)

Date

Account Titles and Explanation Ref.

Debit

Credit

30 Cash ......................................................... 5,900

Admissions Revenue ..........................

5,900

30 Accounts Payable.................................... 1,650

Cash .....................................................

1,650

30 Interest Expense...................................... 1,250

Cash .....................................................

1,250

30 Unearned Admissions Revenue .............

Admissions Revenue ..........................

($75 ÷ 10 x 80 = $600)

600

600

Solutions Manual

2-35

Chapter 2

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

PROBLEM 2-3A

(a)

GENERAL JOURNAL

Date

May

Account Titles and Explanation Ref.

Debit

1 Cash ............................................. 101

Office Equipment......................... 151

C. Liu, Capital .......................... 301

18,000

8,500

1 Rent Expense .............................. 729

Cash ......................................... 101

950

Credit

26,500

950

2 No entry—not a transaction.

3 Supplies ....................................... 126

Accounts Payable ................... 201

1,450

11 Accounts Receivable .................. 112

Service Revenue ..................... 400

1,725

12 Cash ............................................. 101

Unearned Revenue ................. 209

3,500

17 Cash ............................................. 101

Service Revenue ..................... 400

1,350

21 Cash ............................................. 101

Accounts Receivable ............. 112

900

23 Accounts Payable........................ 201

Cash ($1,450 x 60%)................ 101

870

31 Telephone Expense ..................... 737

Accounts Payable ................... 201

215

1,450

1,725

3,500

1,350

900

870

215

Solutions Manual

2-36

Chapter 2

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

PROBLEM 2-3A (Continued)

(a) (Continued)

May 31 Salaries Expense ......................... 726

Cash ......................................... 101

2,400

31 C. Lui, Drawings .......................... 306

Cash ......................................... 101

925

2,400

925

(b)

CASH

Date

May

Explanation

1

1

12

17

21

23

31

31

J1

J1

J1

J1

J1

J1

J1

J1

Debit

18,000

950

3,500

1,350

900

870

2,400

925

ACCOUNTS RECEIVABLE

Explanation

Ref. Debit

Date

May

Ref.

11

21

J1

J1

No. 101

Credit Balance

18,000

17,050

20,550

21,900

22,800

21,930

19,530

18,605

No. 112

Credit Balance

1,725

900

1,725

825

Solutions Manual

2-37

Chapter 2

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

PROBLEM 2-3A (Continued)

(b) (Continued)

SUPPLIES

Date

May

Explanation

3

1

3

23

31

12

J1

J1

J1

1

J1

1,450

No. 151

Credit Balance

8,500

8,500

No. 201

Credit Balance

1,450

870

215

J1

C. LIU, CAPITAL

Explanation

Ref.

Date

May

J1

UNEARNED REVENUE

Explanation

Ref. Debit

Date

May

1,450

ACCOUNTS PAYABLE

Explanation

Ref. Debit

Date

May

J1

Debit

OFFICE EQUIPMENT

Explanation

Ref. Debit

Date

May

Ref.

No. 126

Credit Balance

No. 209

Credit Balance

3,500

Debit

1,450

580

795

Credit

26,500

3,500

No. 301

Balance

26,500

Solutions Manual

2-38

Chapter 2

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

PROBLEM 2-3A (Continued)

(b) (Continued)

C. LIU, DRAWINGS

Explanation

Ref.

Date

May

31

SERVICE REVENUE

Explanation

Ref.

Date

May

11

17

31

RENT EXPENSE

Explanation

Ref.

Date

May

1

J1

31

J1

925

No. 400

Credit Balance

1,725

1,350

2,400

Debit

950

TELEPHONE EXPENSE

Explanation

Ref. Debit

Date

May

Debit

J1

J1

J1

Credit

925

SALARIES EXPENSE

Explanation

Ref. Debit

Date

May

J1

Debit

215

No. 306

Balance

1,725

3,075

No. 726

Credit Balance

2,400

No. 729

Credit Balance

950

No. 737

Credit Balance

215

Solutions Manual

2-39

Chapter 2

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

PROBLEM 2-3A (Continued)

(c)

CARLA LIU, CGA

Trial Balance

May 31, 2008

Debit

Credit

Cash ............................................................ $18,605

Accounts receivable ..................................

825

Supplies ...................................................... 1,450

Office equipment ........................................ 8,500

Accounts payable .......................................

$ 795

Unearned revenue ......................................

3,500

C. Liu, capital ..............................................

26,500

C. Liu, drawings .........................................

925

Service revenue ..........................................

3,075

Salaries expense ........................................ 2,400

Rent expense ..............................................

950

Telephone expense ....................................

215 _______

$33,870 $33,870

Solutions Manual

2-40

Chapter 2

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

PROBLEM 2-4A

(a)

Date

July

GENERAL JOURNAL

Account Titles and Explanation

J1

Debit

Credit

3 Rent Expense .......................................... 1,065

Cash .....................................................

1,065

5 Cash ......................................................... 3,285

Accounts Receivable ..........................

3,285

10 Unearned Revenue .................................. 1,160

Dry Cleaning Revenue ........................

1,160

11 Cash ......................................................... 4,730

Dry Cleaning Revenue ........................

4,730

13 Accounts Payable.................................... 9,742

Cash .....................................................

9,742

14 Supplies ...................................................

Accounts Payable ...............................

494

494

24 Accounts Receivable .............................. 5,950

Dry Cleaning Revenue ........................

5,950

25 Cash ......................................................... 5,250

Note Receivable ..................................

Interest Revenue .................................

5,000

250

26 No entry—not a transaction.

27 Cash .........................................................

Unearned Revenue .............................

650

650

Solutions Manual

2-41

Chapter 2

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

PROBLEM 2-4A (Continued)

(a) (Continued)

July 28 Utilities Expense ..................................... 1,222

Cash .....................................................

1,222

29 Salaries Expense ..................................... 5,550

Cash .....................................................

5,550

30 Equipment................................................ 4,000

Cash .....................................................

Note Payable .......................................

1,500

2,500

31 E. Brisebois, Drawings ........................... 3,750

Cash .....................................................

3,750

(b) and (c)

Cash

Jul. 1 11,659 Jul. 3

5 3,285

11 4,730

13

25 5,250

27

650

28

29

30

31

2,745

Notes Receivable

1 5,000 Jul. 25 5,000

0

1,065

Jul.

9,742

Supplies

Jul. 1 3,974

14

494

4,468

1,222

5,550

1,500

3,750

Accounts Receivable

Jul. 1 5,845 Jul. 5 3,285

24 5,950

8,510

Equipment

Jul. 1 31,480

30 4,000

35,480

Notes Payable

Jul. 30 2,500

Solutions Manual

2-42

Chapter 2

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

PROBLEM 2-4A (Continued)

(b) and (c) (Continued)

Accounts Payable

Jul. 13 9,742 Jul. 1 13,089

14

494

3,841

Unearned Revenue

Jul. 10 1,160 Jul. 1 1,920

27

650

1,410

Interest Revenue

Jul. 25

Salaries Expense

Jul. 1 57,750

29 5,550

63,300

Jul.

E. Brisebois, Capital

Jul. 1 55,920

E. Brisebois, Drawings

Jul. 1 37,050

31 3,750

40,800

Dry Cleaning Revenue

Jul. 1 109,461

10

1,160

11

4,730

24

5,950

121,301

250

Jul.

Rent Expense

1 11,385

3 1,065

12,450

Repair Expense

1 1,727

Utilities Expense

Jul. 1 14,520

28 1,222

15,742

Solutions Manual

2-43

Chapter 2

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

PROBLEM 2-4A (Continued)

(d)

BRISEBOIS DRY CLEANERS

Trial Balance

July 31, 2008

Debit

Credit

Cash ............................................................ $ 2,745

Notes receivable .........................................

0

Accounts receivable .................................. 8,510

Supplies ...................................................... 4,468

Equipment................................................... 35,480

Accounts payable .......................................

$ 3,841

Note payable ...............................................

2,500

Unearned revenue ......................................

1,410

E. Brisebois, capital ...................................

55,920

E. Brisebois, drawings ............................... 40,800

Dry cleaning revenue .................................

121,301

Interest revenue .........................................

250

Salaries expense ........................................ 63,300

Rent expense .............................................. 12,450

Repair expense ........................................... 1,727

Utilities expense ......................................... 15,742 _______

$185,222 $185,222

Solutions Manual

2-44

Chapter 2

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

PROBLEM 2-5A

(a)

Date

Apr.

GENERAL JOURNAL

Account Titles and Explanation Ref.

J1

Debit

2 Film Rental Expense ...........................

Cash .................................................

800

2 Advertising Expense ...........................

Cash .................................................

620

Credit

800

620

3 No entry—not a transaction.

9 Cash .....................................................

Admissions Revenue ......................

1,950

10 Mortgage Payable ................................

Interest Expense..................................

Cash .................................................

1,500

500

10 Accounts Payable................................

Cash .................................................

2,800

1,950

2,000

2,800

11 No entry—not a transaction.

15 Cash .....................................................

Unearned Admissions Revenue ....

400

20 Film Rental Expense ...........................

Accounts Payable ...........................

750

25 Cash .....................................................

Admissions Revenue ......................

5,300

400

750

5,300

Solutions Manual

2-45

Chapter 2

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

PROBLEM 2-5A (Continued)

(a) (Continued)

28 Unearned Admissions Revenue .........

Admissions Revenue ......................

100

29 Salaries Expense .................................

Cash .................................................

1,900

30 Cash .....................................................

Accounts Receivable ..........................

Concession Revenue......................

260

260

30 Prepaid Rentals ...................................

Cash .................................................

700

100

1,900

520

700

(b) and (c)

Cash

Date

Apr.

Explanation

1 Balance

2

2

9

10

10

15

25

29

30

30

Ref.

J1

J1

J1

J1

J1

J1

J1

J1

J1

J1

Debit

Credit Balance

800

620

1,950

2,000

2,800

400

5,300

1,900

260

700

6,000

5,200

4,580

6,530

4,530

1,730

2,130

7,430

5,530

5,790

5,090

Solutions Manual

2-46

Chapter 2

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

PROBLEM 2-5A (Continued)

(b) and (c) (Continued)

Accounts Receivable

Explanation

Date

Ref.

Apr. 30

J1

Debit

260

Credit Balance

260

Prepaid Rentals

Explanation

Date

Ref.

Apr. 30

J1

Debit

700

Credit Balance

700

Land

Date

Apr.

Explanation

Ref.

Debit

1 Balance

Credit Balance

100,000

Buildings

Date

Apr.

Explanation

Ref.

Debit

1 Balance

Credit Balance

80,000

Equipment

Date

Apr.

Explanation

1 Balance

Ref.

Debit

Credit Balance

25,000

Solutions Manual

2-47

Chapter 2

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

PROBLEM 2-5A (Continued)

(b) and (c) (Continued)

Unearned Admissions Revenue

Explanation

Date

Apr. 15

28

Ref.

J1

J1

Debit

Credit Balance

400

400

300

100

Accounts Payable

Date

Apr.

Explanation

Ref.

J1

J1

1 Balance

10

20

Debit

Credit Balance

5,000

2,200

2,950

2,800

750

Mortgage Payable

Date

Apr.

Explanation

1 Balance

10

Ref.

J1

Debit

1,500

Credit Balance

125,000

123,500

F. Goresht, Capital

Date

Apr.

Explanation

1 Balance

Ref.

Debit

Credit Balance

*81,000

*Calculated:

$6,000 + $100,000 + $80,000 + $25,000 - $5,000 - $125,000

= $81,000

Solutions Manual

2-48

Chapter 2

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

PROBLEM 2-5A (Continued)

(b) and (c) (Continued)

Admissions Revenue

Explanation

Date

Apr.

9

25

28

Ref.

Debit

J1

J1

J1

Credit Balance

1,950

5,300

100

1,950

7,250

7,350

Concession Revenue

Explanation

Date

Apr. 30

Ref.

Debit

J1

Credit Balance

520

520

Advertising Expense

Explanation

Date

Apr.

2

Ref.

J1

Debit

620

Credit Balance

620

Film Rental Expense

Explanation

Date

Apr.

2

20

Ref.

J1

J1

Debit

800

750

Credit Balance

800

1,550

Salaries Expense

Date

Apr. 29

Explanation

Ref.

J1

Debit

1,900

Credit Balance

1,900

Solutions Manual

2-49

Chapter 2

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

PROBLEM 2-5A (Continued)

(b) and (c) (Continued)

Interest Expense

Date

Apr. 10

Explanation

Ref.

J1

Debit

Credit Balance

500

500

(d)

THE GRAND THEATRE

Trial Balance

April 30, 2008

Debit

Credit

Cash ............................................................ $ 5,090

Accounts receivable ..................................

260

Prepaid rentals ...........................................

700

Land ............................................................ 100,000

Buildings ..................................................... 80,000

Equipment................................................... 25,000

Unearned admissions revenue .................

$ 300

Accounts payable .......................................

2,950

Mortgage payable .......................................

123,500

F. Goresht, capital ......................................

81,000

Admissions revenue ..................................

7,350

Concession revenue ..................................

520

Advertising expense ..................................

620

Film rental expense .................................... 1,550

Salaries expense ........................................ 1,900

Interest expense .........................................

500 _______

$215,620 $215,620

Solutions Manual

2-50

Chapter 2

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is