Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

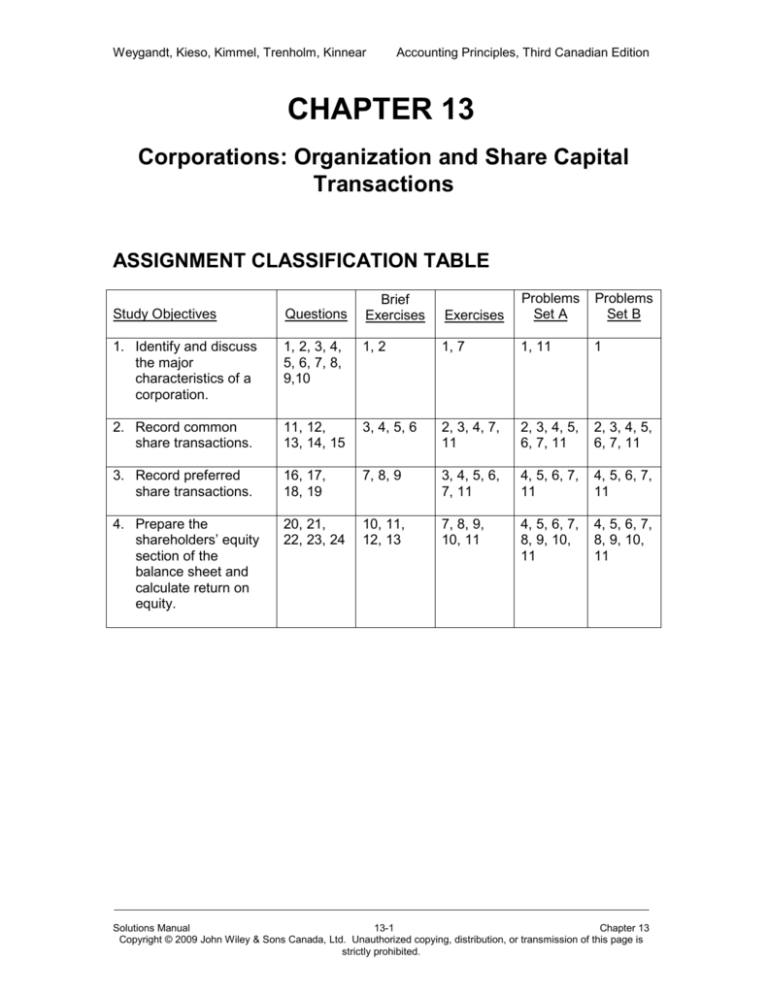

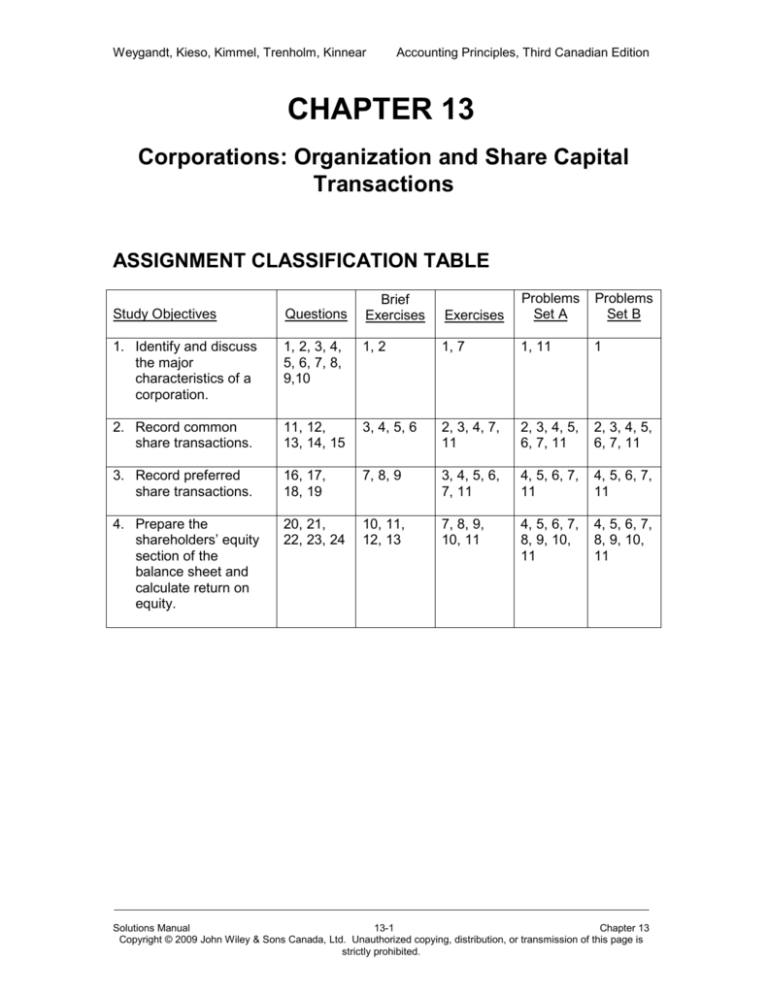

CHAPTER 13

Corporations: Organization and Share Capital

Transactions

ASSIGNMENT CLASSIFICATION TABLE

Brief

Exercises

Exercises

Problems

Set A

Problems

Set B

1, 2, 3, 4,

5, 6, 7, 8,

9,10

1, 2

1, 7

1, 11

1

2. Record common

share transactions.

11, 12,

13, 14, 15

3, 4, 5, 6

2, 3, 4, 7,

11

2, 3, 4, 5,

6, 7, 11

2, 3, 4, 5,

6, 7, 11

3. Record preferred

share transactions.

16, 17,

18, 19

7, 8, 9

3, 4, 5, 6,

7, 11

4, 5, 6, 7,

11

4, 5, 6, 7,

11

4. Prepare the

shareholders’ equity

section of the

balance sheet and

calculate return on

equity.

20, 21,

22, 23, 24

10, 11,

12, 13

7, 8, 9,

10, 11

4, 5, 6, 7,

8, 9, 10,

11

4, 5, 6, 7,

8, 9, 10,

11

Study Objectives

Questions

1. Identify and discuss

the major

characteristics of a

corporation.

Solutions Manual

13-1

Chapter 13

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

ASSIGNMENT CHARACTERISTICS TABLE

Problem

Number

Description

Difficulty

Level

Time

Allotted (min.)

Simple

15-20

Moderate

25-30

1A

Determine form of business organization.

2A

Determine impact of reacquired shares.

3A

Allocate dividends between preferred and common

shares.

Simple

15-20

4A

Show impact of transactions on accounts.

Simple

25-30

5A

Record and post transactions. Prepare

shareholders’ equity section.

Moderate

45-60

6A

Record and post transactions. Prepare

shareholders’ equity section.

Moderate

40-50

7A

Record and post transactions. Prepare

shareholders’ equity section.

Moderate

50-60

8A

Record closing entries and prepare balance sheet.

Simple

30-40

9A

Prepare balance sheet and calculate return on

equity.

Simple

25-35

10A

Calculate return on equity.

Simple

10-15

11A

Answer questions about shareholders’ equity

section.

Simple

15-20

1B

Determine form of business organization.

Simple

15-20

2B

Determine impact of reacquired shares.

Moderate

25-30

3B

Allocate dividends between preferred and common

shares.

Simple

15-20

4B

Show impact of transactions on accounts.

Simple

25-30

5B

Record and post transactions. Prepare

shareholders’ equity section.

Moderate

45-60

6B

Record and post transactions. Prepare

shareholders’ equity section.

Moderate

40-50

7B

Record and post transactions. Prepare

shareholders’ equity section.

Moderate

50-60

Solutions Manual

13-2

Chapter 13

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

ASSIGNMENT CHARACTERISTICS TABLE (Continued)

Problem

Number

Description

Difficulty

Level

Time

Allotted (min.)

8B

Record closing entries and prepare balance sheet.

Simple

30-40

9B

Prepare balance sheet and calculate return on

equity.

Simple

25-35

10B

Calculate return on equity.

Simple

10-15

11B

Answer questions about shareholders’ equity

section.

Simple

15-20

Solutions Manual

13-3

Chapter 13

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

BLOOM’S TAXONOMY TABLE

Correlation Chart between Bloom’s Taxonomy, Study Objectives and End-ofChapter Material.

Study Objectives

1.

Identify and

discuss the

major

characteristics

of a

corporation.

2.

Record

common share

transactions.

3.

Record

preferred share

transactions.

4.

Prepare the

shareholders’

equity section

of the balance

sheet and

calculate return

on equity.

Broadening Your

Perspective

Knowledge

Comprehension

Q13-5

Q13-1

Q13-2

Q13-3

Q13-4

Q13-6

Q13-7

Q13-8

BE13-1

BE13-2

E13-7

Q13-12

Q13-13

Q13-14

Q13-15

E13-7

Q13-20

Q13-22

Application

Q13-9

Q13-10

P13-11A

Analysis

Synthesis

E13-1

P13-1A

P13-1B

Q13-11

BE13-3

BE13-4

BE13-5

BE13-6

E13-2

E13-3

E13-4

P13-2A

P13-3A

P13-4A

P13-5A

P13-6A

P13-7A

P13-11A

P13-2B

P13-3B

P13-4B

P13-5B

P13-6B

P13-7B

P13-11B

E13-11

Q13-16

Q13-17

Q13-18

Q13-19

E13-7

BE13-7

BE13-8

BE13-9

E13-3

E13-4

E13-5

E13-6

P13-4A

E13-11

Q13-21

Q13-23

Q13-24

E13-7

BE13-10

BE13-11

BE13-12

BE13-13

E13-8

E13-9

E13-10

P13-4A

P13-5A

P13-6A

P13-7A

P13-5A

P13-6A

P13-7A

P13-11A

P13-4B

P13-5B

P13-6B

P13-7B

P13-11B

P13-8A

P13-9A

P13-10A

P13-11A

P13-4B

P13-5B

P13-6B

P13-7B

P13-8B

P13-9B

P13-10B

P13-11B

BYP13-1

BYP13-3

BYP13-2

Continuing Cookie

Chronicle

E13-11

BYP13-4

BYP13-5

Solutions Manual

13-4

Chapter 13

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Evaluation

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

ANSWERS TO QUESTIONS

1.

Classified by Purpose: A business may be incorporated to make a profit,

like Tim Hortons. Or, it may be incorporated as a not-for-profit, like the

Canadian Cancer Society. Alternately, a business, like the Yellow Pages

Group, could be created as an income trust, to invest in income-producing

assets.

Classified by Ownership: A corporation can be publicly held or privately

held. A publicly held corporation, like The Forzani Group Ltd., may have

thousands of shareholders, and its shares trade in an organized securities

market. A privately held corporation, like McCain Foods Limited, usually

only has a few shareholders, and its shares are not offered for sale to the

general public.

2.

(a) Limited liability of shareholders. Because of its separate legal

existence, creditors of a corporation ordinarily have recourse only to

corporate assets to satisfy their claims. Thus, the liability of

shareholders is normally limited to their investment in the corporation.

(b) Transferable ownership rights. Ownership of a corporation is held in

capital shares. The shares are transferable units. Shareholders may

dispose of part or all of their interest by simply selling their shares.

The transfer of ownership to another party is usually entirely at the

discretion of the shareholder.

(c)

3.

Ability to acquire capital. A corporation has an easier time raising

capital because of features such as limited liability and the ease of

transferring shares. Also, because only small amounts of money need

to be invested, many individuals can become shareholders. However,

small, privately held corporations can have as much difficulty getting

capital as any proprietorship or partnership.

(a) Income taxation can be an advantage for a corporation because

corporate tax rates are often lower than personal tax rates. Personal

income tax can also be deferred until income is distributed to the

shareholders as dividends. It can also be a disadvantage because the

dividends are subject to “double” taxation—once at the corporate level

and again at the personal rates of the shareholders who receive

them. The impact of these taxes is somewhat reduced by the dividend

tax credit that shareholders can claim on their personal tax returns.

(b) Corporations must pay income tax on its taxable income. Income

earned by proprietorships, partnerships and income trusts is taxed in

the hands the owners. The businesses themselves do not pay income

tax.

Solutions Manual

13-5

Chapter 13

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

QUESTIONS (Continued)

4.

Small, privately held corporations are riskier than large publicly held ones.

As a result, lenders will often require the owners to sign personal

guarantees, thus eliminating the limited liability normally associated with

corporations. Because the shares are not offered for sale to the general

public, it is more difficult to raise capital. Small corporations may be run by

the shareholders, rather than professional managers. This also means that

if one of these shareholders sells his or her ownership interest, the

corporation may be significantly affected.

5.

In the absence of restrictive provisions, the basic ownership rights of

common shareholders are the rights to:

•

•

•

vote in the election of the board of directors and in corporate actions

that require shareholders' approval,

share in corporate income by receiving dividends, and

share in assets upon liquidation.

The basic ownership rights of preferred shareholders are the rights to

receive:

•

•

dividends ahead of the common shareholder, and

assets upon liquidation ahead of the common shareholder.

In exchange for these preferences, preferred shareholders normally are

not entitled to vote.

6.

The total number of shares a company is allowed to sell is called its

authorized shares—it may be an unlimited amount or a specified amount.

No journal entry is recorded when the number of authorized shares is set.

Issued shares are shares that have been sold. A journal entry will be

prepared when shares are issued. The number of issued shares can never

exceed the number of authorized shares.

7.

(a) Legal capital is capital that has been contributed by the shareholders

that must remain in the corporation, to protect creditors.

(b) Legal capital is unavailable for dividends. Retained earnings are

available for dividends. Keeping the two amounts separate on the

balance sheets enables users to see the amount of creditor protection

that exists. The distinction between amounts contributed by the

owners and amounts earned and retained by the company is not

needed for proprietorships because the proprietor has unlimited

personal liability for the debts of the business in any case.

Solutions Manual

13-6

Chapter 13

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

QUESTIONS (Continued)

8.

Income trusts are established to invest in income producing assets. Unit

holders expect regular distributions. As a result, most of the earnings of

the trust are distributed, leaving very little “retained”. On the other hand,

corporations often retain a large portion of their earnings to finance their

continued operations, expansion plans, or to provide a measure of safety.

9.

When Jean-Guy purchases the original shares as part of Innovate.com’s

initial public offering, he is purchasing from the company. The $1,000 (100

X $10) he spends to buy the shares goes directly to Innovate.com and

increases the company’s assets and shareholders’ equity. In the

subsequent purchase, Jean Guy is buying in the secondary market from

another investor. The proceeds from this sale go to the seller and not to

Innovate.com. Therefore there is no impact on Innovate.com’s financial

statements as a result of the second purchase.

10. There will be no impact on Abitibi’s financial statements at the time of the

share price decline. However, should Abitibi decide it would like to raise

capital in the securities market, the price decline means it will have to sell

more shares to raise the same amount of money.

11. When shares are issued for services or noncash assets, the cost should

be measured at the fair market value of the consideration given up (the

shares). If that value cannot be reasonably determined, then the fair

market value of the consideration received should be used (the land). In

this case, the fair market value of the shares is more objectively

determinable, since the shares are actively traded in the securities market.

The appraised value of the land is merely an estimate of the land's value,

while the market price of the shares is the amount the shares were actually

worth on the date of exchange. Therefore, the land should be recorded at

$90,000.

12. A corporation may acquire its own shares: (1) to increase trading of the

company's shares in the securities market in the hope of enhancing its

market value, (2) to increase earnings per share by reducing the number

of shares issued, (3) to eliminate hostile shareholders by buying them out,

(4) to have additional shares available to be reissued to officers and

employees under bonus and stock compensation plans, or for use in the

acquisition of other companies, and (5) to comply with percentage share

ownership requirements.

Solutions Manual

13-7

Chapter 13

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

QUESTIONS (Continued)

13. This transaction:

(a)

decreases total assets,

(b)

has no effect on total liabilities and,

(c)

decreases total shareholders' equity.

14. Share repurchases are transactions between the company and its

shareholders. Therefore, any resulting gains or losses cannot be reported

on the income statement. Such gains and losses are seen as an excess or

deficiency belonging to the original shareholders and are reported as an

increase or decrease in the shareholders’ equity section of the balance

sheet.

15. If there have been gains from similar transactions in the past, the resulting

credit balance of the contributed capital account is available to absorb

some or all of the loss on reacquisition. However, the balance of the

contributed capital account cannot go below zero. If the loss exceeds the

balance in the contributed capital account, the excess amount is debited to

retained earnings.

16. Common shares and preferred shares both represent ownership of the

corporation. Common shares signify the basic residual ownership;

preferred shares represent ownership with certain privileges or

preferences. Preferred shareholders typically have a preference as to

dividends and as to assets in the event of liquidation. However, preferred

shareholders generally do not have voting rights.

17. Cumulative preferred shares are those that require preferred shareholders

be paid both current year dividends and unpaid prior year dividends before

common shareholders receive any dividends. Dividends not declared for

noncumulative preferred shares are lost forever.

Redeemable preferred shares can be purchased from the shareholders,

by the issuing corporation, at the option of the corporation. If the shares

are retractable they can be sold by the shareholder, to the issuing

corporation, at the option of the shareholder.

18. (a) Dividends in arrears are dividends on cumulative preferred shares

that were not declared in a given period.

(b) Dividends in arrears are disclosed in the notes to the financial

statements; they are not recorded as liabilities.

Solutions Manual

13-8

Chapter 13

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

QUESTIONS (Continued)

19. When convertible preferred shares are converted into common shares, the

shareholder simply exchanges preferred shares for common shares,

according to a predetermined rate. To record the conversion, the amount

originally paid for the preferred shares is transferred into the appropriate

common shares account. If multiple share issues have occurred at varying

prices, then the average cost for each preferred share is used instead of

the original cost.

This entry has no effect on (a) total assets, (b) total liabilities, or (c) total

shareholders' equity.

20. The three main components of shareholders' equity are:

Contributed capital,

Retained earnings, and

Accumulated other comprehensive income.

Contributed capital represents the amounts contributed by the

shareholders. Share capital and additional contributed capital (e.g., from

reacquisition of shares) are components of contributed capital.

Retained earnings represent the cumulative net income (or loss) since

incorporation that has been retained in company and not distributed to

shareholders as dividends.

Accumulated other comprehensive income represents gains and losses

not resulting from share transactions, that bypass net income. The most

common example is unrealized gains and losses on investments.

21.

The answers are summarized in the table below:

Account

(a)

(b)

(c)

(d)

(e)

Common Shares

Retained Earnings

Contributed Capital – Reacquired

Shares

Accumulated Other

Comprehensive Income

Preferred Shares

Classification

Share capital—common shares

Retained earnings

Additional contributed capital

Accumulated other

comprehensive income

Share capital—preferred

shares

Solutions Manual

13-9

Chapter 13

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

QUESTIONS (Continued)

22. Comprehensive income includes all changes in shareholders’ equity during

a period except for changes that result from the sale or repurchase of

shares or from the payment of dividends.

Accumulated other comprehensive income is reported separately from

retained earnings to distinguish unrealized gains and losses from realized

gains and losses and other sources of earned income that are

accumulated in retained earnings. Reporting this information separately

insulates income, and consequently retained earnings, from fluctuations in

market value while still informing users of the gain or loss that could have

occurred had the investment been sold.

23. Return on equity is the return earned by all the shareholders – both the

preferred and common shareholders. It is calculated by dividing net

income by the average shareholders’ equity.

Return on common shareholder’s equity is the return earned by the

common shareholders. It is calculated by dividing the net income available

to the common shareholders by the average common shareholders’

equity. Preferred dividends are deducted from net income to determine the

numerator. The legal capital of the preferred shareholders is deducted

from total shareholders equity before calculating the average common

shareholders’ equity.

24. Net income by itself does not provide shareholders with an indication of

their return per dollar of investment. Comparing net income to

shareholders’ equity provides investors with a meaningful measure of how

many dollars are earned for each dollar of their investment. It also provides

shareholders with the information necessary to compare investment

opportunities in the marketplace.

Solutions Manual

13-10

Chapter 13

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

SOLUTIONS TO BRIEF EXERCISES

BRIEF EXERCISE 13-1

Characteristic

Proprietorship Partnership Corporation

1. Continuous life

X

2. Unlimited liability

X

X

3. Ease of formation

X

X

4. Income taxes

X

5. Ability to acquire

X

X

capital

6. Shared skills and

X

resources

7. Fewer government

X

X

regulations

8. Separation of

ownership and

X

management

9. Owners’ acts are

X

X

binding

10. Ease of transfer of

X

ownership rights

BRIEF EXERCISE 13-2

The increase in share price will have no impact on Body Shop’s

financial position. The balance sheet will be unchanged since

the shares are listed at their issue price, not their current

market value. On the other hand, the increased market

valuation of the business would enable the Body Shop to raise

funds more easily.

The shareholders would see the value of their investment

increase and could realize gains by selling some or all of their

shares.

Solutions Manual

13-11

Chapter 13

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

BRIEF EXERCISE 13-3

(a)

June 1

Dec. 15

Cash (2,000 X $6) ..........................

Common Shares .......................

12,000

Cash (1,000 X $9) ..........................

Common Shares .......................

9,000

12,000

9,000

(b) Average issue price: ($12,000 + $9,000) ÷ (2,000 + 1,000) =

$7

BRIEF EXERCISE 13-4

(a)

Dec. 20

Land (5,000 X $14) .........................

Common Shares .......................

70,000

70,000

(b) No, the answer would not change. The market price of the

shares is a reliable indicator of its value; the advertised

price of the land is not.

Solutions Manual

13-12

Chapter 13

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

BRIEF EXERCISE 13-5

(a) Average Repurchase Price = $10.80

($2,000,000 + $4,000,000) ÷ 555,600 shares

(b) Initial Average Issue Price = $3.60

$2,000,000 ÷ 555,600 shares

(c) Cascades may have repurchased some of its own shares

(1) to increase trading of the company's shares in the stock

market, in the hopes of enhancing its market value, (2) to

reduce the number of shares issued and increase earnings

per share, or (3) to comply with percentage share

ownership requirements. Some companies have been

repurchasing their own shares lately because they have

excess cash on hand and no better investments available.

BRIEF EXERCISE 13-6

(a)

Feb. 15

(b)

Feb. 15

Common Shares (5,000 X $3.50*).... 17,500

Contributed Capital – Reacquired

Common Shares ..........................

Cash .............................................

2,500

15,000

Common Shares (5,000 X $3.50*).... 17,500

Retained Earnings............................ 2,500

Cash .............................................

20,000

*Average share price = $122,500 ÷ 35,000 shares = $3.50

Solutions Manual

13-13

Chapter 13

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

BRIEF EXERCISE 13-7

(a)

Jan. 28

June 15

Cash (5,000 X $110) .....................

Preferred Shares .....................

550,000

Cash (1,000 X $125) .....................

Preferred Shares .....................

125,000

550,000

125,000

(b) Average issue price: $112.50

($550,000 + $125,000) ÷ (5,000 + 1,000)

BRIEF EXERCISE 13-8

(a)

Mar. 3

(b)

Oct. 1

Cash (40,000 X $100).................... 4,000,000

Preferred Shares .....................

4,000,000

Preferred Shares (10,000 X $100) 1,000,000

Common Shares ......................

1,000,000

(40,000 shares)

BRIEF EXERCISE 13-9

(a) Dividends are in arrears by $80,000 (40,000 X $2).

(b) If the shares were noncumulative, there would be no

dividends in arrears.

Solutions Manual

13-14

Chapter 13

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

BRIEF EXERCISE 13-10

KAPOSI CORPORATION

Balance Sheet (Partial)

December 31, 2008

Shareholders' equity

Contributed capital

Share capital

Preferred shares, no par value, $5-noncumulative,

unlimited number of shares authorized,

800 shares issued

$ 20,000

Common shares, no par value, unlimited

number of shares authorized,

5,000 shares issued

50,000

Total share capital

70,000

Contributed capital—reacquisition of

common shares

5,000

Total contributed capital

75,000

Retained earnings

29,000

Total shareholders' equity

$104,000

Solutions Manual

13-15

Chapter 13

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

BRIEF EXERCISE 13-11

(a)

KAPOSI CORPORATION

Balance Sheet (Partial)

December 31, 2008

Shareholders' equity

Contributed capital

Share capital

Preferred shares, no par value, $5-noncumulative,

unlimited number of shares authorized,

800 shares issued

$ 20,000

Common shares, no par value, unlimited

number of shares authorized,

5,000 shares issued

50,000

Total share capital

70,000

Contributed capital—reacquisition of

common shares

5,000

Total contributed capital

75,000

Retained earnings

29,000

Accumulated other comprehensive income

6,000

Total shareholders' equity

$110,000

(b) Total shareholders’ equity would be $98,000 ($104,000 $6,000)

Solutions Manual

13-16

Chapter 13

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

BRIEF EXERCISE 13-12

Dec. 31

Revenues ...................................... 2,000,000

Income Summary.....................

2,000,000

31

Income Summary ......................... 1,500,000

Expenses..................................

1,500,000

31

Income Summary .........................

Retained Earnings ...................

500,000

Retained Earnings........................

Dividends .................................

50,000

31

500,000

50,000

BRIEF EXERCISE 13-13

(a) Return on equity

$8,097

($132, 495 + $121,784) ÷ 2

(b)

= 6.4%

It would be the same.

Solutions Manual

13-17

Chapter 13

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

SOLUTIONS TO EXERCISES

EXERCISE 13-1

(a) High $60.85

Low $41.45

(b) $0.75

(c) 1,000 X $60.41 = $60,410

(d) $59.25 + $1.24 = $60.49 (closing price + change)

(e) 9,837 X 100 = 983,700 shares

(f)

Since the share price is up $17.80 over the 365-day low

($59.25 - $41.45) investors are probably looking primarily

for capital appreciation.

EXERCISE 13-2

1.

2.

Dec. 5 Land..........................................

Common Shares .................

120,000

June 1 Land (20,000 X $12) .................

Common Shares .................

240,000

120,000

240,000

Solutions Manual

13-18

Chapter 13

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

EXERCISE 13-3

(a) Jan. 10 Cash (75,000 X $5) ...................

Common Shares .................

375,000

Feb. 24 Cash (1,000 X $105) .................

Preferred Shares .................

105,000

July 1 Cash (50,000 X $6.50) ..............

Common Shares .................

325,000

375,000

105,000

325,000

(b) (1) The average issue price of the preferred shares is $105.

(2) The average issue price of the common shares is $5.60

($375,000 + $325,000) ÷ (75,000 + 50,000).

EXERCISE 13-4

(a) Jan. 6 Cash ........................................

Common Shares ................

(200,000 shares X $1.50)

300,000

12 Cash ........................................

Common Shares .................

(50,000 shares X $1.75)

87,500

Mar. 17 Cash ........................................

Preferred Shares ................

(1,000 shares X $105)

105,000

300,000

87,500

105,000

July 18 Cash ........................................ 2,000,000

Common Shares ................

2,000,000

Solutions Manual

13-19

Chapter 13

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

EXERCISE 13-4 (Continued)

(a) (Continued)

Nov. 17 Common Shares *....................

Retained Earnings ...................

Cash (200,000 X $1.95) .......

382,000

8,000

Dec. 30 Common Shares *.................... 286,500

Contributed Capital –

Reacquisition of Common Shares

Cash (150,000 X $1.80) .......

390,000

16,500

270,000

*Average Cost per Common Share:

Transaction

Date

January 6

January 12

July 18

Total

Number of

Common Shares

Issued

200,000

50,000

1,000,000

1,250,000

Proceeds of

Issue

$ 300,000

87,500

2,000,000

$2,387,500

$2,387,500 ÷ 1,250,000 = $1.91

200,000 X $1.91 = $382,000

150,000 X $1.91 = $286,500

Solutions Manual

13-20

Chapter 13

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

EXERCISE 13-4 (Continued)

(b) There are 900,000 common shares remaining, at an average

cost of $1.91**.

**Average Cost per Common Share:

Transaction

Date

January 6

January 12

July 18

Nov. 17

Dec. 30

Total

Number of

Common Shares

Issued

200,000

50,000

1,000,000

(200,000)

(150,000)

900,000

Proceeds of

Issue

$ 300,000

87,500

2,000,000

(382,000)

(286,500)

$1,719,000

$1,719,000 ÷ 900,000 = $1.91

EXERCISE 13-5

(a) 100,000 X $4 = $400,000

(b)

Regular dividend

Arrears from Year 1

Dividend paid

Arrears

Year 1

$400,000

250,000

$150,000

Year 2

$400,000

150,000

550,000

550,000

$

0

(c) Dividends in arrears should be disclosed in the notes to

the financial statements. They are not recorded in the

books.

(d) The likely amount is $4 per share, for a total of $400,000.

Solutions Manual

13-21

Chapter 13

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

EXERCISE 13-6

(a) Nov. 15

Preferred Shares .................

Common Shares ................

230,000

230,000

Average share price ($1,000,000 + $3,600,000) ÷ (10,000 +

30,000) = $115

2,000 X $115 = $230,000

(b) 10,000 + 30,000 – 2,000 = 38,000 preferred shares

2,000 X 5 = 10,000 common shares

EXERCISE 13-7

(a)

(b)

(c)

(d)

(e)

(f)

(g)

(h)

(i)

(j)

(k)

(l)

(m)

9.

1.

12.

2.

5.

8.

7.

6.

4.

11.

10.

13.

3.

Legal capital

Publicly held corporation

Organization costs

Authorized shares

Issued shares

Initial public offering

Secondary market

Retained earnings

Common shares

Comprehensive income

Contributed capital

Convertible

Cumulative

Solutions Manual

13-22

Chapter 13

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

EXERCISE 13-8

Shareholders’ Equity

Other

Account

Share

Capital

Additional

Contributed

Capital

Retained

Earnings

Accumulated

Other

Comprehensive

Income

1. Cash

2. Common shares

3. Contributed

capital –

reacquisition of

common shares

4. Gain on sale of

property, plant

and equipment

5. Available-forsale security

6. Unrealized gain

on available-forsale security

7. Preferred shares

8. Retained

earnings

9. Legal fees

expense

10. Dividends

Solutions Manual

Financial

Statement

Balance

Sheet

Classification

Current

Assets

X

X

Balance

Sheet

Other

Revenue

(Gain)

Current

Assets

Income

Statement

Operating

Expense

Income

Statement

X

X

X

X

13-23

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Chapter 13

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

EXERCISE 13-9

OZABAL INC.

Partial Balance Sheet

December 31, 2008

Shareholders' equity

Contributed capital

Share capital

Preferred shares $4-noncumulative, no par

value, 100,000 shares authorized,

30,000 issued

Common shares, no par value, unlimited

number of shares authorized, 300,000

shares issued

Total share capital

Contributed capital—reacquisition of

common shares

Total contributed capital

Retained earnings

Accumulated other comprehensive income

Total shareholders’ equity

$ 150,000

300,000

450,000

25,000

475,000

900,000

75,000

$1,450,000

Solutions Manual

13-24

Chapter 13

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

EXERCISE 13-10

(a)

REITMANS (CANADA) LIMITED

Partial Balance Sheet

January 28, 2006

(in thousands)

Shareholders' equity

Share capital

Class A non-voting (preferred) shares, unlimited

number authorized, 56,747 issued ...................... $ 16,892

Common shares, unlimited number

authorized, 13,440 shares issued .......................

482

Total share capital .............................................

17,374

Contributed surplus ...................................................

2,523

Total contributed capital ............................................

19,897

Retained earnings* ..................................................... 370,360

Total shareholders’ equity ................................ $390,257

*$316,191 + $84,889 - $29,345 - $1,375 = $370,360

(b) ($ in thousands)

Return on equity = Net income ÷ Average shareholders’ equity

= $84,889 ÷ [($390,257 + $331,524) ÷ 2]

= 23.52%

Solutions Manual

13-25

Chapter 13

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

EXERCISE 13-11

(a) The average cost of the preferred shares is $60 ($600,000 ÷

10,000 = $60).

The average cost of the common shares is $3 ($1,800,000 ÷

600,000 = $3).

(b) It will be able to sell an additional 150,000 common shares

(750,000 authorized - 600,000 issued).

(c) The company paid $2 per share, for a total of $200,000.

$100,000 ÷ 100,000 = $1 per share was credited to

contributed capital. The average issue price of $3 per share

was debited to the common shares account. The

difference, $2 was the price paid per share.

Common Shares......................................

Contributed Capital..........................

Cash ..................................................

300,000

100,000

200,000

(d) $5 X 10,000 = $50,000.

(e) The retained earnings balance would be $1,208,000

($1,158,000 + $50,000 dividends which were not paid nor

declared). Dividends in arrears are only disclosed in the

notes to the financial statements.

Solutions Manual

13-26

Chapter 13

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

SOLUTIONS TO PROBLEMS

PROBLEM 13-1A

1.

Kyle should run his beer cart business as a proprietorship

because this is the simplest form of business to establish.

It is also the least expensive. He is the only person

involved in the business and is planning to operate for a

short time.

2.

Joseph and Sabra should form a corporation when they

combine their operations. This is the best form of

business for them to choose because they need to raise

significant funds in the coming year and it is easier to

raise funds in a corporation. A corporation may also

receive more favourable income tax treatment.

3.

The professors should form a partnership for their

business. It is simpler to form than a corporation and less

costly. Each professor has contributed a similar amount

of money and expertise, and there is no mention of

additional funds being required.

4.

Abdur should form a corporation. This is the best form of

business for him to choose because he will require

significant funds to finance the chain of stores and it is

easier to raise funds in a corporation. A corporation may

also receive more favourable income tax treatment.

5.

A partnership would be the most likely form of business

for Mary and Richard to choose. It is simpler to form than

a corporation and less costly.

Solutions Manual

13-27

Chapter 13

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

PROBLEM 13-2A

(a) Shares authorized

Shares issued

100,000

11,000

(b) Common shares

Contributed capital – reacquisition of

common shares

Retained earnings

$396,000

$2,600

$161,400

Calculations:

Common

shares

(a)

Bal

1.

2.

3.

4.

5.

$270,000

(12,000)

258,000

147,000

405,000

73,800

478,800

(36,000)

442,800

(46,800)

$396,000

Number Average Contributed

of

issue

capital –

shares

price

reacquisition

of common

(b)

(a) ÷ (b)

shares

9,000

(400)

8,600

3,500

12,100

1,200

13,300

(1,000)

12,300

(1,300)

11,000

$30.00

Retained

earnings

$180,000

30.00

$ 9,000

(3,600)

5,400

33.47

5,400

180,000

36.00

5,400

(5,400)

0

2,600

$2,600

180,000

(18,600)

161,400

0000000

$161,400

36.00

36.00

180,000

Solutions Manual

13-28

Chapter 13

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

PROBLEM 13-3A

(a)

(b)

Dividend Noncumulative

Cumulative

Year

Paid

Preferred

Common Preferred Common

1

$15,000

$15,000

$

0

$15,000

$

0

2

12,000

12,000

0

12,000

0

3

27,000

15,000

12,000

18,000

9,000

4

35,000

15,000

20,000

15,000

20,000

1. Regular dividend is $5 X 3,000 = $15,000

2b. Arrears = $15,000 - $12,000 = $3,000

3b. Preferred dividend = $15,000 (regular) + $3,000 (arrears) =

$18,000

Solutions Manual

13-29

Chapter 13

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

PROBLEM 13-4A

Shareholders' Equity

Assets

Liabilities

Preferred

Shares

Common

Shares

Other

Contributed

Capital

Retained

Earnings

Accumulated

Other

Comprehensive

Income

1.

+$100,000

n/a

n/a

+$100,000

n/a

n/a

n/a

2.

+5,500

n/a

n/a

+5,500

n/a

n/a

n/a

3.

n/a

n/a

-$300,000

+300,000

n/a

n/a

n/a

4.

+150,000

n/a

+150,000

n/a

n/a

n/a

n/a

5.

-72,500

n/a

-75,000

n/a

+$2,500

n/a

n/a

6.

-10,000

n/a

n/a

n/a

n/a

-$10,000

n/a

7.

-5,000

n/a

n/a

n/a

n/a

n/a

-$5,000

3.

5.

6.

$600,000 ÷ 4,000 = $150 $150 X 2,000 = $300,000

($600,000 – $300,000 + $150,000) ÷ (4,000 – 2,000 + 1,000) = $150

$150 X 500 = $75,000

$75,000 - $72,500 = $2,500

2,500 X $4 = $10,000

Solutions Manual

13-30

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Chapter 13

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

PROBLEM 13-5A

(a)

Date

GENERAL JOURNAL

Account Titles and Explanation

J1

Debit

Jan. 10 Cash (100,000 X $2) ........................

Common Shares ........................

200,000

Mar.

1 Cash (10,000 X $42) ........................

Preferred Shares ........................

420,000

1 Land (25,000 X $2.50) .....................

Common Shares ........................

62,500

1 Cash (75,000 X $3) ..........................

Common Shares ........................

225,000

July 24 Cash ...............................................

Equipment.......................................

Common Shares (16,800 X $4) ..

60,000

7,200

Nov.

1 Cash (2,000 X $48) ..........................

Preferred Shares ........................

96,000

Dec. 31 Income Summary ...........................

Retained Earnings .....................

650,000

31 Dividends ........................................

Cash ............................................

36,000

31 Retained Earnings ..........................

Dividends ...................................

36,000

Apr.

May

Credit

200,000

420,000

62,500

225,000

67,200

96,000

650,000

36,000

36,000

Solutions Manual

13-31

Chapter 13

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

PROBLEM 13-5A (Continued)

(b)

Preferred Shares

Date

Mar.

Nov.

Explanation

1

1

Ref.

Debit

J1

J1

Credit

Balance

420,000 420,000

96,000 516,000

Common Shares

Date

Explanation

Jan. 10

Apr. 1

May 1

July 24

Ref.

Debit

J1

J1

J1

J1

Credit

200,000

62,500

225,000

67,200

Balance

200,000

262,500

487,500

554,700

Dividends

Date

Explanation

Dec. 31

31

Closing entry

Ref.

Debit

Credit

J1

J1

36,000

Ref.

Debit

Credit

36,000

650,000 650,000

614,000

36,000

Balance

36,000

0

Retained Earnings

Date

Dec

Explanation

31

31

Closing entry

Closing entry

J1

J1

Balance

Solutions Manual

13-32

Chapter 13

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

PROBLEM 13-5A (Continued)

(c)

HIGHLAND CORPORATION

Balance Sheet (Partial)

December 31, 2008

Shareholders' equity

Share capital

Preferred shares, no par value,

$3-noncumulative, . unlimited number of shares

authorized,12,000* shares issued .................. $ 516,000

Common shares, no par value, unlimited number

of shares authorized, 216,800** shares issued

554,700

Total share capital ..................................................

1,070,700

Retained earnings .................................................

614,000

Total shareholders’ equity................................ $1,684,700

* 10,000 + 2,000 = 12,000 shares

** 100,000 + 25,000 + 75,000 + 16,800 = 216,800 shares

Solutions Manual

13-33

Chapter 13

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

PROBLEM 13-6A

(a)

Date

GENERAL JOURNAL

Account Titles and Explanation

J1

Debit

Feb. 1 Cash ..................................................

Common Shares ...........................

75,000

Sept. 3 Cash ..................................................

Common Shares ...........................

16,500

Oct. 25 Common Shares (10,000 X $2.75*) ..

Contributed Capital—Reacquisition

of Common Shares .......................

Retained Earnings ............................

Cash ...............................................

27,500

Credit

75,000

16,500

1,500

1,000

30,000

*Average Cost per Common Share:

Transaction Date

Beginning balance

February 1

September 3

Total

Number of

Common

Shares Issued

1,000,000

25,000

5,000

1,030,000

Proceeds of

Issue

$2,741,000

75,000

16,500

$2,832,500

$2,832,500 ÷ 1,030,000 = $2.75

Nov. 3 Cash .................................................. 130,000

Preferred Shares ...........................

130,000

Dec. 31 Income Summary ............................. 275,000

Retained Earnings ........................

275,000

Solutions Manual

13-34

Chapter 13

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

PROBLEM 13-6A (Continued)

(a) (Continued)

Dec. 31 Dividends ........................................

Cash ............................................

30,000

30,000

31 Retained Earnings ............................

Dividends.......................................

30,000

30,000

(b)

Preferred Shares

Date

Jan.

Nov.

Explanation

1

3

Balance

Ref.

Debit

Credit

Balance

130,000

500,000

630,000

Common Shares

Date

Jan.

Feb.

Sept.

Oct.

Explanation

1

1

3

25

Balance

Ref.

J1

J1

J1

Debit

27,500

Credit

Balance

2,741,000

75,000 2,816,000

16,500 2,832,500

2,805,000

Contributed Capital—Reacquisition of Shares

Date

Explanation

Jan. 1

Oct. 25

Balance

Ref.

Debit

J1

1,500

Ref.

Debit

J1

J1

30,000

Credit

Balance

1,500

0

Dividends

Date

Dec. 31

31

Explanation

Closing entry

Credit

30,000

Balance

30,000

0

Solutions Manual

13-35

Chapter 13

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

PROBLEM 13-6A (Continued)

(b) (Continued)

Retained Earnings

Date

Jan. 1

Oct. 25

Dec. 31

31

Explanation

Balance

Closing entry

Closing entry

Ref.

J1

J1

J1

Debit

Credit

Balance

1,816,000

1,000

1,815,000

275,000 2,090,000

30,000

2,060,000

(c)

MOUNTAINHI CORPORATION

Balance Sheet (Partial)

December 31, 2008

______________________________________________________

Shareholders' equity

Share capital

$4 preferred shares, cumulative, no par value,

50,000 shares authorized,

10,000 shares issued .....................................

$ 630,000

Common shares, no par value, unlimited number

of shares authorized, 1,020,000* shares issued 2,805,000

Total share capital .......................................

3,435,000

Retained earnings (See Note X) ...........................

2,060,000

Total shareholders' equity ........................................

$5,495,000

Note X: Dividends on preferred shares totalling $10,000 [10,000

X $1 per share] are in arrears.

*1,000,000 + 25,000 + 5,000 – 10,000 = 1,020,000 shares

Solutions Manual

13-36

Chapter 13

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

PROBLEM 13-7A

(a)

Date

GENERAL JOURNAL

Account Titles and Explanation

J1

Debit

Feb. 06 Building (1,000 X $111) ...................

Preferred Shares ..........................

111,000

July 15 Preferred Shares (2,000 X $106*) ...

Common Shares ..........................

212,000

Credit

111,000

212,000

*($525,000 + $111,000) ÷ (5,000 + 1,000) = $106.00

Aug. 22 Cash (500 X $124) ............................

Preferred Shares ..........................

62,000

Nov. 1 Preferred Shares (1,000 X $108**) .

Common Shares ..........................

108,000

62,000

108,000

**($525,000 + $111,000 – $212,000 + $62,000) ÷ (5,000 + 1,000 –

2,000 + 500) = $108

Dec 31 Revenues ..........................................

Income Summary .........................

600,000

31 Income Summary..............................

Expenses ......................................

540,000

31 Income Summary..............................

Retained Earnings........................

60,000

600,000

540,000

60,000

Solutions Manual

13-37

Chapter 13

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

PROBLEM 13-7A (Continued)

(a) (Continued)

Preferred Shares

Date

Explanation

Jan. 1

Feb. 6

July 15

Aug. 22

Nov. 1

Balance

Ref.

J1

J1

J1

J1

Debit

Credit

Balance

525,000

111,000 636,000

424,000

212,000

62,000 486,000

378,000

108,000

Common Shares

Date

Explanation

Jan. 1

July 15

Nov. 1

Balance

Ref. Debit

J1

J1

Credit

Balance

1,050,000

212,000 1,262,000

108,000 1,370,000

Contributed Capital—Reacquisition of Preferred Shares

Date

Jan.

Explanation

1

Balance

Ref.

Debit

Credit

Balance

18,750

Retained Earnings

Date

Explanation

Jan. 1

Dec. 31

Balance

Closing Entry

Ref.

Debit

J1

Credit

Balance

300,000

60,000 360,000

Accumulated Other Comprehensive Income

Date

Jan.

Explanation

1

Balance

Ref.

Debit

Credit

Balance

25,000

Solutions Manual

13-38

Chapter 13

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

PROBLEM 13-7A (Continued)

(c)

DENISON CORPORATION

Balance Sheet (Partial)

December 31, 2008

Shareholders' equity

Contributed capital

Share capital

Preferred shares, no par value,

$3-noncumulative, convertible, 10,000

shares authorized, 3,500* shares issued ...... $ 378,000

Common shares, no par value, unlimited

number of shares authorized, 94,000**

shares issued................................................... 1,370,000

Total share capital .................................................... 1,748,000

Additional contributed capital

Contributed capital- reacquisition of

preferred shares .................................................

18,750

Total contributed capital .......................................... 1,766,750

Retained earnings.....................................................

360,000

Accumulated other comprehensive income ...........

25,000

Total shareholders' equity ............................................ $2,151,750

*5,000 + 1,000 – 2,000 + 500 – 1,000 = 3,500 shares

**70,000 + 16,000 + 8,000 = 94,000 shares

Solutions Manual

13-39

Chapter 13

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

PROBLEM 13-8A

(a)

Date

GENERAL JOURNAL

Account Titles and Explanation

J1

Debit

Credit

Sep. 30 Commission Revenue ...................... 314,850

Income Summary..........................

314,850

30 Income Summary ............................. 245,440

Salaries Expense ..........................

Rent Expense................................

Amortization Expense ..................

Supplies Expense .........................

Utilities Expense...........................

Interest Expense...........................

Income Tax Expense ....................

138,400

25,000

30,080

4,860

18,200

3,900

25,000

30 Income Summary .............................

Retained Earnings ........................

69,410

30 Retained Earnings ............................

Dividends ......................................

2,000

69,410

2,000

Solutions Manual

13-40

Chapter 13

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

PROBLEM 13-8A (Continued)

(b)

MISCOU CORP.

Balance Sheet

September 30, 2008

______________________________________________________

Assets

Current assets

Cash .....................................................................

Accounts receivable .............................................

Supplies ................................................................

Total current assets ......................................

Property, plant and equipment

Equipment .......................................... $150,400

Less: Accumulated amortization......

(60,160)

Franchise ..................................................

Total assets ....................................................

$ 32,500

74,705

1,265

108,470

90,240

225,000

$423,710

Liabilities and Shareholders’ Equity

Current liabilities

Accounts payable .................................................

Salaries payable ...................................................

Interest payable ....................................................

Income tax payable ..............................................

Unearned commission revenue ..........................

Current portion of long-term debt .......................

Total current liabilities ..................................

Long-term debt

Long-term note payable .......................................

Total liabilities ...............................................

$ 43,000

8,400

900

2,000

5,500

5,000

64,800

55,000

119,800

Solutions Manual

13-41

Chapter 13

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

PROBLEM 13-8A (Continued)

(b) (Continued)

MISCOU CORP.

Balance Sheet

September 30, 2008

______________________________________________________

Shareholders’ equity

Contributed capital

Share capital

$4 noncumulative preferred shares unlimited

number of shares authorized, 500 issued .......

Common shares, unlimited number of shares

authorized, 40,000 issued .................................

Total share capital ...................................................

Other contributed capital

Contributed capital – reacquisition of preferred

shares ................................................................

Total contributed capital ............................................

Retained earnings* .....................................................

Total shareholders’ equity ...........................................

Total liabilities and shareholders’ equity ..........

*Retained earnings

Balance, Oct 1, 2007 ...............................

Add: Net income .....................................

Less: Dividends ......................................

Balance, September 30, 2008 ................

$ 50,000

110,000

160,000

1,500

161,500

142,410

303,910

$423,710

$ 75,000

69,410

(2,000)

$142,410

Solutions Manual

13-42

Chapter 13

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

PROBLEM 13-9A

(a)

ANDRÉS WINES LTD.

Balance Sheet

March 31, 2006

(in thousands)

______________________________________________________

Assets

Current assets

Accounts receivable ................................................

$ 18,444

Inventories ...............................................................

70,528

Income taxes recoverable .......................................

911

Prepaid expenses ....................................................

2,447

Total current assets ............................................

92,330

Property, plant, and equipment ..................... $134,697

Less: Accumulated amortization ................. (49,100)

85,597

Goodwill .......................................................................

35,862

Other long-term assets ...............................................

8,298

Total assets ..............................................................

$222,087

Liabilities and Shareholders’ Equity

Current liabilities

Bank indebtedness ..................................................

Accounts payable and accrued liabilities ..............

Dividends payable ...................................................

Current portion of long-term debt ..........................

Total current liabilities ........................................

Long-term liabilities

Long-term debt .......................................... $50,328

Future income tax liability......................... 12,381

Other long-term liabilities .........................

4,224

Total liabilities .....................................................

$ 37,295

21,613

778

5,888

65,574

66,933

$132,507

Solutions Manual

13-43

Chapter 13

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

PROBLEM 13-9A (Continued)

(a) (Continued)

ANDRÉS WINES LTD.

Balance Sheet

March 31, 2006

(in thousands)

______________________________________________________

Shareholders’ equity

Share capital

Class A shares, nonvoting, unlimited authorized,

3,963 issued ....................................................

6,975

Class B shares, voting, convertible into Class A

shares, unlimited authorized, 1,002 issued .

400

Total share capital .....................................

7,375

Retained earnings* ..................................................

82,205

Total shareholders’ equity..................................

89,580

Total liabilities and shareholders’ equity...............

$222,087

*$79,260 + $6,054 – $3,109 = $82,205

(b)

Return on equity = Net income ÷ Average shareholders’ equity

$6,054

= 6.85%

$89,580 + $87,168

2

Solutions Manual

13-44

Chapter 13

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

PROBLEM 13-10A

(a) Return on equity = Net income ÷ Average shareholders’

equity

2004

2005

$128.7

= 7.04%

$1,780.5 + $1,877.4

2

$770.8

= 61.11%

$1,877.4 + $645.3

2

Sears’ return on equity has improved significantly during

the last year.

(b) Sears is performing as well as the industry average in both

years.

Solutions Manual

13-45

Chapter 13

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

PROBLEM 13-11A

(a) Preferred dividends ÷ Preferred dividend per share

$150,000 ÷ $5 = 30,000 preferred shares

(b) Preferred share average price = $3,150,000 ÷ 30,000 shares

issued = $105 per share

Common share average price = $1,000,000 ÷ 250,000 shares

issued = $4 per share

(c) The shares were issued for an average selling price of $4

(see (b) above) which means the company would have

reduced the Common Shares account by $100,000 (25,000

X $4). Since a reduction to retained earnings is shown

relating to this reacquisition for $56,250, this indicates the

company had to pay $156,250 ($100,000 + $56,250) to

reacquire the 25,000 shares.

(d) Limited liability for preferred shareholders

= $3,150,000

Limited liability for common shareholders

= $4,600,000 - $3,150,000 = $1,450,000

(e) It is a loss that bypasses the income statement because it

has not yet been realized. An example is an unrealized loss

on investments that are available for sale.

Solutions Manual

13-46

Chapter 13

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

PROBLEM 13-1B

1.

A partnership would be the most likely form of business

for the students to choose. It is simpler to form than a

corporation and less costly.

2.

Chris will likely operate his lawn maintenance service as a

proprietorship because he is planning on operating it for a

short time period and a proprietorship is the simplest and

least costly to form and dissolve.

3.

Ron would likely form a corporation because he probably

needs to raise funds to buy equipment. It is normally easier

to raise funds through a corporation. A corporation is also

the only form of business that provides limited liability to it

owners. There may also be income tax benefits.

4.

Hervé would likely form a corporation because he needs to

raise funds to invest in inventories and equipment. He has

no savings or personal assets and it is normally easier to

raise funds through a corporation.

5.

A proprietorship would be the most likely form of business

for Johnny. It is simpler to form than a corporation and

less costly. A corporation is the only form of business that

provides limited liability to it owners. However, is unlikely

that incorporating the business would shield Johnny from

personal liability in the event of an accident.

Solutions Manual

13-47

Chapter 13

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

PROBLEM 13-2B

(a) Shares authorized

Shares issued

500,000

200,000

(b) Common shares

Contributed capital – reacquisition of

Common shares

Retained earnings

$830,000

$10,500

$680,000

Calculations:

Common

shares

(a)

Bal

1.

2.

3.

4.

5.

$1,000,000

127,500

1,127,500

(20,500)

1,107,000

55,000

1,162,000

(49,800)

1,112,200

(282,200)

$ 830,000

Contributed

Average

capital –

Number

issue reacquisition

of shares

price

of common

(b)

(a) ÷ (b)

shares

250,000

25,000

275,000

(5,000)

270,000

10,000

280,000

(12,000)

268,000

(68,000)

200,000

Retained

earnings

$4.00

$10,000

$680,000

4.10

10,000

500

10,500

680,000

10,500

(10,200)

300

10,200

$10,500

680,000

4.10

4.15

4.15

4.15

680,000

680,000

000000 0

$680,000

Solutions Manual

13-48

Chapter 13

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

PROBLEM 13-3B

Year Dividend

Paid

1

$20,000

2

15,000

3

30,000

4

35,000

(a)

(b)

Noncumulative Common Cumulative Common

Preferred

Preferred

$20,000

$

0

$20,000 $

0

15,000

0

15,000

0

20,000

10,000

25,000

5,000

20,000

15,000

20,000

15,000

1. Regular dividend is $4 X 5,000 = $20,000

2b. Arrears = $20,000 - $15,000 = $5,000

3b. Preferred dividend = $20,000 (regular) + $5,000 (arrears) =

$25,000

Solutions Manual

13-49

Chapter 13

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is

strictly prohibited.

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

PROBLEM 13-4B

Shareholders' Equity

Assets

Liabilities

Accumulated

Other

Retained

Preferred Common

Other

Contributed

Earnings Comprehensive

Shares

Shares

Capital

Income

n/a +$23,550

n/a

n/a

n/a

1.

+$23,550

n/a

2.

-200,000

n/a

n/a

-160,500

-$30,000

-$9,500

n/a

3.

n/a

n/a

-$70,000

+70,000

n/a

n/a

n/a

4.

+25,000

n/a

n/a

+25,000

n/a

n/a

n/a

5.

+7,500

n/a

+7,500

n/a

n/a

n/a

n/a

6.

-15,000

n/a

n/a

n/a

n/a

-15,000

n/a

7.

+2,500

n/a

n/a

n/a

n/a

n/a

+$2,500

2. Average share price = ($2,400,000 + $23,550) ÷ (150,000 + 1,000) = $16.05

3. $350,000 ÷ 5,000 = $70; $70 X 1,000 = $70,000

Solutions Manual

13-50

Copyright © 2009 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Chapter 13

Weygandt, Kieso, Kimmel, Trenholm, Kinnear

Accounting Principles, Third Canadian Edition

PROBLEM 13-5B

(a)

Date

GENERAL JOURNAL

Account Titles and Explanation

J1

Debit

Credit

Feb. 10 Cash (80,000 X $4) .............................. 320,000

Common Shares ............................

320,000

Mar. 1 Cash (5,000 X $115) ............................ 575,000

Preferred Shares ............................

575,000

Apr.

1 Land (22,000 X $4.25) ......................... 93,500

Common Shares ............................

93,500

Jun. 20 Cash (78,000 X $4.50) ......................... 351,000

Common Shares ............................

351,000

Aug. 1 Legal Fees Expense (10,000 X $4.75) 47,500

Common Shares ............................

47,500

Sep. 1 Cash (10,000 X $5) .............................. 50,000

Common Shares ............................

50,000

Nov. 1 Cash (1,000 X $117) ............................ 117,000

Preferred Shares ............................

117,000

Jan. 31 Income Summary ............................... 500,000

Retained Earnings .........................

500,000