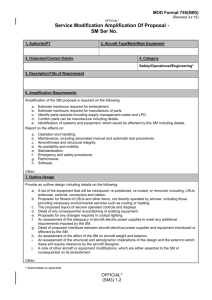

owner's & operator's guide: crj family

advertisement