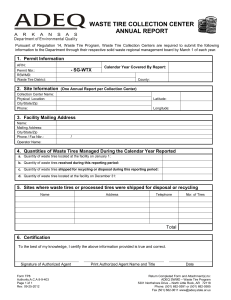

annual report 2014

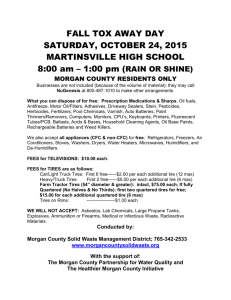

advertisement