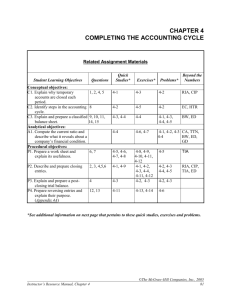

Chapter 4 Completing the Accounting Cycle

advertisement