riverside community college district

advertisement

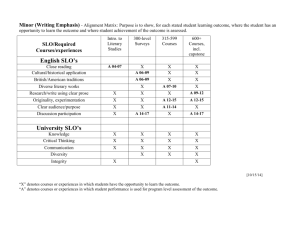

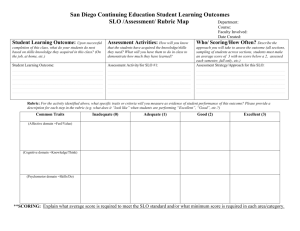

NORCO COLLEGE ANNUAL INSTRUCTIONAL PROGRAM REVIEW Unit: ___ACCOUNTING________ Please give the full title of the discipline or department. You may submit as a discipline or department as is easiest for your unit Contact Person: ___Patty Worsham______ Due in draft: March 15, 2013 Final drafts due: May 15, 2013 Please send an electronic copy to the Vice President; Academic Affairs Norco: Diane.Dieckmeyer@norcocollege.edu If you are CTE: Kevin.Fleming@norcocollege.edu Form Last Revised: December 2012 Norco College Web Resources: http://www.rccd.edu/administration/educationalservices/ieffectiveness/Pages/ProgramReview.aspx 1 Annual Instructional Program Review Update Instructions *Please retain this information for your discipline’s/department’s use (or forward to your chair). The Annual Self-Study is conducted by each unit on each college and consists of an analysis of changes within the unit as well as significant new resource needs for staff, resources, facilities, and equipment. It should be submitted in draft every year by March 15th (or the first working day following the 15th), with final drafts due on May 15th, in anticipation of budget planning for the fiscal year, which begins July 1 of the following calendar year. Extensive data sets have been distributed to all Department Chairs and are linked to the Program Review website (password 11111). Chairs have received training on the use of these data sets. Please consult with your Department Chair or Raj Bajaj for assistance interpreting the data relevant to your discipline. Note that you are only required to mention data relevant to your analysis or requests. Should you wish assistance with research analysis please fill out the form at http://academic.rcc.edu/ir/requestform.html and you will be contacted to schedule a time to discuss analysis of your data. You may also request a labor market analysis using this form. The questions on the subsequent pages are intended to assist you in planning for your unit. The forms that follow are separated into pages for ease of distribution to relevant subcommittees. Please keep the pages separated if possible (though part of the same electronic file), with the headers as they appear, and be sure to include your unit, contact person (this may change from topic to topic) and date on each page submitted. Don’t let formatting concerns slow you down. If you have difficulty with formatting, Nicole C. Ramirez can adjust the document for you. Simply add responses to those questions that apply and forward the document to nicole.ramirez@norcocollege.edu with a request to format it appropriately. If you cannot identify in which category your requests belong or if you have complex-funding requests please schedule an appointment with your college’s Vice President for Business Services right away. They will assist you with estimating the cost of your requests. For simple requests such as the cost of a staff member, please e-mail your Vice President. It is vital to include cost estimates in your request forms. Each college uses its own prioritization system. Inquiries regarding that process should be directed to your Vice President. Norco: VP Business Services 951-372-7157 Mission 2 Norco College serves our students, our community, and its workforce by providing educational opportunities, celebrating diversity, and promoting collaboration. We encourage an inclusive, innovative approach to learning and the creative application of emerging technologies. We provide foundational skills and pathways to transfer, career and technical education, certificates and degrees. Vision Norco – creating opportunities to transform our students and community for the dynamic challenges of tomorrow. Goals and Strategies 2013-2018 Goal 1: Increase Student Achievement and Success Objectives: 1. Improve transfer preparedness (completes 60 transferable units with a 2.0 GPA or higher). 2. Improve transfer rate by 10% over 5 years. 3. Increase the percentage of basic skills students who complete the basic skills pipeline by supporting the development of alternatives to traditional basic skills curriculum. 4. Improve persistence rates by 5% over 5 years (fall-spring; fall-fall). 5. Increase completion rate of degrees and certificates over 6 years. 6. Increase success and retention rates. 7. Increase percentage of students who complete 15 units, 30 units, 60 units. 8. Increase the percentage of students who begin addressing basic skills needs in their first year. 9. Decrease the success gap of students in online courses as compared to face-to-face instruction. 10. Increase course completion, certificate and degree completion, and transfer rates of underrepresented students. Goal 2: Improve the Quality of Student Life Objectives: 3 1. 2. 3. 4. 5. 6. Increase student engagement (faculty and student interaction, active learning, student effort, support for learners). Increase frequency of student participation in co-curricular activities. Increase student satisfaction and importance ratings for student support services. Increase the percentage of students who consider the college environment to be inclusive. Decrease the percentage of students who experience unfair treatment based on diversity-related characteristics. Increase current students’ awareness about college resources dedicated to student success. Goal 3: Increase Student Access Objectives: 1. Increase percentage of students who declare an educational goal. 2. Increase percentage of new students who develop an educational plan. 3. Increase percentage of continuing students who develop an educational plan. 4. Ensure the distribution of our student population is reflective of the communities we serve. 5. Reduce scheduling conflicts that negatively impact student completion of degrees and programs. Goal 4: Create Effective Community Partnerships Objectives: 1. Increase the number of students who participate in summer bridge programs or boot camps. 2. Increase the number of industry partners who participate in industry advisory council activities. 3. Increase the number of dollars available through scholarships for Norco College students. 4. Increase institutional awareness of partnerships, internships, and job opportunities established with business and industry. 5. Continue the success of Kennedy Partnership (percent of students 2.5 GPA+, number of students in co-curricular activities, number of students who are able to access courses; number of college units taken). 6. Increase community partnerships. 7. Increase institutional awareness of community partnerships. 8. Increase external funding sources which support college programs and initiatives. Goal 5: Strengthen Student Learning 4 Objectives: 1. 100% of units (disciplines, Student Support Service areas, administrative units) will conduct systematic program reviews. 2. Increase the percentage of student learning and service area outcomes assessments that utilize authentic methods. 3. Increase the percentage of programs that conduct program level outcomes assessment that closes the loop. 4. Increase assessment of student learning in online courses to ensure that it is consistent with student learning in face-to-face courses. 5. Increase the number of faculty development workshops focusing on pedagogy each academic year. Goal 6: Demonstrate Effective Planning Processes Objectives: 1. Increase the use of data to enhance effective enrollment management strategies. 2. Systematically assess the effectiveness of strategic planning committees and councils. 3. Ensure that resource allocation is tied to planning. 4. Institutionalize the current Technology Plan. 5. Revise the Facilities Master Plan. Goal 7: Strengthen Our Commitment To Our Employees Objectives: 1. Provide professional development activities for all employees. 2. Increase the percentage of employees who consider the college environment to be inclusive. 3. Decrease the percentage of employees who experience unfair treatment based on diversity-related characteristics. 4. Increase participation in events and celebrations related to inclusiveness. 5. Implement programs that support the safety, health, and wellness of our college community. 5 I. Norco College Annual Instructional Program Review Update Unit: Accounting Contact Person: Patty Worsham Date: March 14, 2013 Trends and Relevant Data 1. Have there been any changes in the status of your unit? (if not, skip to #2) a. Has your unit shifted departments? No changes. b. Have any new certificates or complete programs been created by your unit? Yes-the following: i. ACC 67- U.S. and California Income Tax Preparation course. The intent of this class is to educate students on U.S. and California income tax principles and tax return preparation as it relates to individuals, sole proprietorships, and other business entities. This course is certified by the California Tax Education Council (CTEC) as fulfilling the 60-hour qualifying education requirement imposed by the State of California for becoming a Registered Tax Preparer. 72 hours lecture. Appendix C ii. Business Administration AS-T Program. This degree is designed to facilitate the student's passage from Norco College to the California State University System with an Associate Degree in Business Administration. This degree will satisfy the lower division requirements for the eventual conferral of the Bachelor's Degree in Business Administration at CSU. With this degree the student will be prepared for transfer to the university upper division level. Appendix B c. Have activities in other units impacted your unit? For example, a new Multi Media Grant could cause greater demand for Art courses. Yes. Impact from added gaming activities have been felt as we have had to reduce the number of course offerings in Accounting in order to add sections of Gaming. It is my hope and expectation that we will be able to recover the few sections we have lost in this coming academic year and that FTES will be allocated to ACC and BUS fairly and without having to compensate for GAM or CIS. 6 2. List your retention and success rates as well as your efficiency. Have there been any changes or significant trends in the data? If so, to what do you attribute these changes? Please list Distance Education, retention, success and efficiency separately. Norco Success Rates for Accounting: Overall Face-to-Face Hybrid Online 2007-2008 45.32% 56.71% 59.21% 37.46% 2008-2009 48.88% 52.10% 61.39% 45.20% Norco Retention Rates for Accounting: Overall Face-to-Face Hybrid Online 2007-2008 75.53% 83.89% 89.47% 69.26% 2008-2009 80.00% 80.26% 90.10% 78.21% Spring 2012: Retention for Accounting: Overall Lecture Hybrid Online Web Enhanced Norco 74.7% 84.0% 94.0% 65.9% 67.2% 2009-2010 48.14% 55.99% 54.90% 41.94% 2010-2011 51.04% 52.21% 68.78% 44.27% 2011-2012 51.58% 51.45% 73.53% 41.38% 2009-2010 79.22% 81.31% 84.31% 77.24% 2010-2011 76.19% 68.23% 91.01% 76.34% 2011-2012 71.41% 69.77% 89.71% 64.14% Riverside 71.7% No data 73.8% 71.4% 69.1% 7 Moreno Valley 55.6% No data Not offered at MVC Not offered at MVC 55.6% Spring 2012: Success for Accounting: Overall Lecture Hybrid Online Web Enhanced Norco 54.5% 80.0% 82.7% 41.9% 41.4% Spring 2012: Efficiency for Accounting: Overall Lecture Hybrid Online Web Enhanced Norco 542.86 425.00 570.70 417.50 739.50 Riverside 44.9% No data 45.4% 35.9% 55.6% Moreno Valley 40.4% No data Not offered at MVC Not offered at MVC 40.4% Riverside 618.60 No data 687.00 515.00 688.50 Moreno Valley 605.20 No data Not offered at MVC Not offered at MVC 605.20 The data above seems to indicate that the Norco College Accounting department is more efficient, retains more students, and has more successful completers of the accounting courses then Riverside City College and Moreno Valley College. Where we fall a bit short is with our online accounting courses. To that end, we are in the process of implementing some new methodologies to our ACC 1A courses (and will follow up with the others in time) by flipping the classroom. Starting in the Fall of 2013, students will be required to watch a youtube video of my (Patty’s) narrated powerpoint lectures (done with Camtasia software) before the class meeting. Students will then come to class and take a quiz and then class time will be spent working on exercises and problems in isolated areas that students are having them difficulty understanding. Online students will then be able to listen to short lectures on isolated accounting topics. These will be available as podcasts a well as visual narrated and close captioned powerpoint lectures. It will be interesting to see the online data after this is fully implemented. 3. What annual goals does your unit have for 2012-2013 (please list the most important first)? Please indicate if a goal is 8 directly linked to goals in your comprehensive. How do your goals support the college mission and the goals of the Educational Master Plan? List the goals of your unit for 2012-2013 To continue to keep our accounting certificate patterns viable in light of the budget constraints so that we can offer a sound rotation of courses over 2 years. Ensure that 25% of the course offerings at Norco are CTE courses and that we maintain 1314 sections of Accounting course offerings per Fall and Spring semesters List activity(s) linked to the goal Pay close attention to the courses being offered to ensure that the accounting certificate needs are met. Relationship of goal to mission and master plan Goal 4, #2. … 40%-40%-20% distribution (transfercareer/technical-personal enrichment). Indicate if goal is limited to Distance Education No DE limitations. Monitor course offerings on a semester by semester basis to ensure that target percentages are met. Goal 1, #3 … increase the percentage of students who declare degree/and/or transfer as their educational goal… No DE limitations. *Your unit may need assistance to reach its goals. Financial resources should be listed on the subsequent forms. In addition you may need help from other units or Administrators. Please list that on the appropriate form below, or on the form for “other needs.” 9 Norco College Annual Instructional Program Review Update Unit: Accounting Contact Person: Patty Worsham Date: March 14, 2013 Current Human Resource Status 4. Complete the Faculty and Staff Employment Grid below. Please list full and part time faculty numbers in separate rows. Please list classified staff who are full and part time separately: Faculty Employed in the Unit Teaching Assignment (e.g. Math, English) Full-time faculty or staff (give number) Part-time faculty or staff (give number) Distance Education Accounting 0* 5 We all teach DE • *1 Full-time Business Administration faculty member teaches full-time for Accounting, however Accounting itself does not have a full-time dedicated faculty member. Classified Staff Employed in the Unit Staff Title Full-time staff (give number) IDS 1 Part-time staff (give number) 10 Distance Education Unit Name: ACCOUNTING Staff Needs NEW OR REPLACEMENT STAFF (Administrator, Faculty or Classified) 1 List Staff Positions Needed for Academic Year 2013-2014 Please justify and explain each faculty request as they pertain to the goals listed in item #3. Place titles on list in order (rank) or importance. Indicate (N) = New or (R) = Replacement Annual TCP* Distanced Education 1.None Reason: 2. Reason: 3. Reason: 4. Reason: 5. Reason: 6. Reason: * TCP = “Total Cost of Position” for one year is the cost of an average salary plus benefits for an individual. New positions (not replacement positions) also require space and equipment. Please speak with your college Business Officer to obtain accurate cost estimates. Please be sure to add related office space, equipment and other needs for new positions to the appropriate form and mention the link to the position. Please complete this form for “New” Classified Staff only. All replacement staff must be filled per Article I, Section C of the California School Employees Association (CSEA) contract. 1 If your SLO assessment results make clear that particular resources are needed to more effectively serve students please be sure to note that in the “reason” section of this form. 11 Unit Name: 5. Equipment (including technology) Not Covered by Current Budget List Equipment or Equipment Repair Needed for Academic Year_______ Please list/summarize the needs of your unit on your college below. Please be as specific and as brief as possible. Place items on list in order (rank) or importance. 1. Quickbooks Accounting Software Reason: In order to teach ACC 65 (Computerized Accounting) we need to keep current with the software requirements and therefore need to update this software on an annual basis 2.Office Printer (for my office) Reason: I currently have a very old ink jet printer that does not work well. It often jams, prints crookedly requiring several reprints, and requires frequent replacement of the ink jet cartridge. The cost of the ink cartridges is exorbitant and absorbs a large part of our department supplies budget. In short, this printer is not cost-effective. I’d be happy to have a hand-me-down laser jet printer replacement if one is available otherwise, a new printer is desired. *Indicate whether Equipment is for (I) = Instructional or (N) = Non-Instructional purposes ACCOUNTING 2 Annual TCO* Cost per item Number Requested Total Cost of Request EMP GOALS I $1000 1 $1000 Goal #4 & 2 N $1000 1 $1000 Goal #4 & 7 Distance Education * Instructional Equipment is defined as equipment purchased for instructional activities involving presentation and/or hands-on experience to enhance student learning and skills development (i.e. desk for student or faculty use). Non-Instructional Equipment is defined as tangible district property of a more or less permanent nature that cannot be easily lost, stolen or destroyed; but which replaces, modernizes, or expands an existing instructional program. Furniture and computer software, which is an integral and necessary component for the use of other specific instructional equipment, may be included (i.e. desk for office staff). Unit Name: ACCOUNTING 6. Professional or Organizational Development Needs Not Covered by Current Budget* 3 2 If your SLO assessment results make clear that particular resources are needed to more effectively serve students please be sure to note that in the “reason” section of this form. 3 If your SLO assessment results make clear that particular resources are needed to more effectively serve students please be sure to note that in the “reason” section of this form. 12 List Professional Development Needs for Academic Year 2013-2014 Reasons might include in response to assessment findings or the need to update skills to comply with state, federal, professional organization requirements or the need to update skills/competencies. Please be as specific and as brief as possible. Some items may not have a cost per se, but reflect the need to spend current staff time differently. Place items on list in order (rank) or importance. Examples include local college workshops, state/national conferences. 1.TACTYC Conference Reason: This is a national conference of 2-year College Accounting educators. The purpose Annual TCO* Cost per item Number Requested Total Cost of Request EMP Goals 1 $2500 Goal #15&7 1 $1000 Goal #15&7 $2500 of this organization is to advance accounting education. It emphasizes the development of creative and innovative teaching and curriculum. TACTYC was organized to encourage networking on issues of significance to accounting education and serves as a forum for sharing innovative ideas in curriculum, teaching techniques and methodology. The 2014 conference is scheduled for May 2014 in New Orleans, LA 2.CTEC Annual Provider Task Force Meeting Reason: The Curriculum Provider Standards Committee requires that CTEC course providers attend the annual Provider Task Force Meeting so that they may be informed regarding issues impacting CTEC educational requirements, computer technology and updated CTEC policies and procedures. The meeting also provides a forum for providers to discuss issues and concerns they may have regarding the program. New providers (that’s us as we just received approval May 15, 2013) are required to attend a provider orientation session within the first year of their approval. This orientation session will occur Wednesday morning prior to CTEC’s May and November board meetings. Travel expenses to this session will be paid by the provider. Failure to meet this requirement will result in the loss of a provider’s “approval” status. 2 day travel to Sacramento $1000 *It is recommended that you speak with the Faculty Development Coordinator to see if your request can be met with current budget. 13 Distance Education Unit Name: ACCOUNTING 8. Student Support Services, Library, and Learning Resource Center (see definition below**) Services needed by your unit over and above what is currently provided by student services at your college. Requests for Books, Periodicals, DVDs, and Databases must include specific titles/authors/ISBNs when applicable. Do not include textbook requests. These needs will be communicated to Student Services at your college 4 List Student Support Services Needs for Academic Year___________________ Please list/summarize the needs of your unit on your college below. Please be as specific and as brief as possible. Not all needs will have a cost, but may require a reallocation of current staff time. EMP GOALS Distance Education 1. None Needed Reason: 2. Reason: 3. Reason: 4. Reason: 5. Reason: 6. Reason: **Student Support Services include for example: tutoring, counseling, international students, EOPS, job placement, admissions and records, student assessment (placement), health services, student activities, college safety and police, food services, student financial aid, and matriculation. 4 If your SLO assessment results make clear that particular resources are needed to more effectively serve students please be sure to note that in the “reason” section of this form. 14 Unit Name: ACCOUNTING 9. OTHER NEEDS not covered by current budget 5 Annual TCO* List Other Needs that do not fit elsewhere. Please be as specific and as brief as possible. Not all needs will have a cost, but may require a reallocation of current staff time. Place items on list in order (rank) or importance. Cost per item Number Requested Total Cost of Request EMP Goals Distance Education 1.None Needed Reason: 2. Reason: 3. Reason: 4. Reason: 5. Reason: 6. Reason: 5 If your SLO assessment results make clear that particular resources are needed to more effectively serve students please be sure to note that in the “reason” section of this form. 15 II. Annual Assessment Update The primary purpose of this update is to provide an overview of your discipline’s effort to assess learning in your courses and programs since your last annual program review. We also ask that you indicate in some detail your plans for assessing learning in 2013-14. Authentic assessment rests on five basic principles: 1) the use of direct assessment measures as much as possible; 2) the effort to assess courses and programs (rather than simply sections) as much as possible; 3) as much collaboration and dialogue regarding assessment as your circumstances permit; 4) the use of assessment data to improve teaching and learning in the discipline; and 5) tangible documentation (usually in the form of short reports) of your assessment activities and findings. For help with any phase of the assessment process, please contact either Arend Flick at arend.flick@norcocollege.edu or Greg Aycock at greg.aycock@norcollege.edu. Your report will be used for planning and resource allocation purposes at the college, and it will assist us in writing the comprehensive annual college-based assessment report required by ACCJC. Please note: Individual assessment reports on specific projects should be included as appendices to this update, along with any other evidence demonstrating your discipline’s assessment work this year. Please also have discipline faculty send assessment reports to Arend and Greg as you complete them, and please review these reports before you answer these questions. 1. Please provide an overview of your course assessment activities since your last annual program review using the following chart. ii. Because we rotate courses for assessment, this past year ACC 1A was assessed. Course or program assessed ACC 1A SLO(s)/PLO(s) assessed Yes- see App. A & B Method(s) employed Number of faculty involved in assessment Embedded in 1 F/T and 3 tests and now a P/T comprehensive project 16 Brief description of findings/results (and/or attach assessment reports) See Appendix A Relevance of assessment findings to resource requests None identified 1. Please provide an overview of your program assessment activities since your last annual program review (either CTE, AOE, or GE), using the following chart. We are currently planning for this right now. For the AOE assessment project, Accounting is not involved. PLO#5 will be assessed Spring 2013 with CIS 1A, CIS 1B, BUS 10, and Econ 7. Program PLO(s) assessed Method(s) employed Number of faculty involved in the project AOE 5 Scantrons/Questio ns 12-20 Brief description of findings/results (also attach assessment reports) In process Relevance of assessment findings to resource requests 2. Please provide an overview of your effort to assess online courses in the past year. For example, what online courses did you assess and what method did you use? Briefly describe your findings or results. If applicable, how did learning results in your online environment compare to learning results in your face-to-face classes? For our online course offerings see the attached exhibit on assessment. ACC 1A was assessed. It’s the same process as our onground ACC 1A class (and same methodology for all accounting classes). Students complete a comprehensive project that addresses the SLO’s and they upload it for grading in their electronic portfolio. The assignment is graded in CengageNOW (online homework management system) and then the course professor grades the efolio work for completion/aesthetics. Because success and pass rates are lower in online courses (this problem and proposed corrective action was discussed earlier in this document) data here is limited as well. Nonetheless, those that are successful in passing the course generally are successful with this assignment. 17 At the end of the term, I have a telephone conversation with the other faculty member(s) who teach this course and we discuss ways in which we can help the student be more successful based on the findings from the data. I also have an email from our adjunct briefly discussing her findings and proposed solutions. I can provide this as evidence if required. Learning results were definitely lower with regards to the online courses but, again, this is for a whole host of reasons. With the implementation of the “flipped classroom” methodology in the Fall 2013, I expect to see a remarkable improvement in these numbers. Perhaps I shouldn’t get my hopes up BUT since I’ve already moved to quizzing students before lecturing on an assigned chapter, I’ve seen a noticeable increase in test scores with the first exam. This indicates that students can be pushed hard and that many of them will work to this high level of excellence. 3. Please describe and provide evidence of your discipline’s dialogue about assessment, specifically assessment results. Cheryl Honore (full-time accounting faculty member at Moreno Valley College) and I have met several times to discuss our findings and other assorted issues. Her SLO assessment tools are different than ours as she has embedded questions into her tests and she tracks SLO’s that way. Performance between our two colleges is similar and she has a similar teaching style to mine. She also has a similar attitude toward high quality and excellence so together we collaborate and work well to achieve the best results possible for our students. When I spoke with Cheryl we talked about the following: a. without referencing data, we shared our personal observations about topics students have difficulty grasping (long-term liabilities (bonds in particular) and statement of cash flows (how I address it but at a very top level and how she often has difficulty finding time to include it in her course instruction). b. we talked about the fact that we realize that many of our students are business majors and not accounting majors and therefore they don’t need the depth of understanding of this course as would an accounting major. It’s often more a “rite of passage” for many. c. Since I use a comprehensive project that takes students through the accounting cycle and they complete this at the end of the course, students are generally well prepared and able to complete this assignment. I do allow them multiple attempts at this assignment and I know that students do collaborate on their work. I’m often conflicted about this part of this assignment because while I like the notion of students sharing and discussing their approach to doing the work, I don’t like it when students copy the work from one another. Cheryl feels the same way. d. Since Cheryl and I are revising the SLO’s for ACC 1A and ACC 1B it might make sense to utilize a similar assessment tool so that we can better gauge and compare the success and struggles of our students. We can then better strategize on how best to improve our instruction for them. 18 4. Please describe in detail how you have used or plan to use your assessment results to try to improve teaching and learning in your course(s) or program(s). See #3 above. For the Business Administration with a concentration in Accounting certificate, I am assessing the Program Learning Outcome #3 for the Spring 2013 term. PLO #3 states: Apply cost accounting principles to manufacturing and service enterprises within a global society. PLO #3 maps only to SLO #1 for ACC 1B. Note that it doesn’t map to any of the other SLO’s for the courses in this certificate pattern (ACC 62, ACC 63, ACC 65, BUS/MAG 70, ACC 1A, BUS 10, BUS 18A, BUS 20, BUS 22, CIS 1A, CIS 1B). It’s become apparent to myself and the other Business faculty members that our certificate PLO’s don’t make sense and that they need to be revised. To that end, we have decided to revise our entire certificate pattern in the Fall of 2013. At the moment we are thinking we will collapse our certificates down into 3 areas: Business with an emphasis in Accounting, Entrepreneurship, or General Business; Management with an emphasis in Management or Logistics; and Real Estate. With the AS-T Business Administration we will have 4 dominant certificate patterns of choice. PLO dialogue is now also a regular agenda item in our monthly BEIT department meetings. See the appendix of this report for a copy of the May 2013 meeting minutes. 6. Please provide an overview of your assessment plans for 2013-14, using the following chart. (Please note: Every course should be assessed at least once every four years. Rarely taught courses should be routinely assessed during the semester they are taught.) Course or program to be assessed ACC 1B SP13 ACC 38 FA13 ACC 63 FA 13 SLO(s) to be assessed Method(s) employed Faculty involved in Expected date of the project completion ALL ALL ALL Project Project Project 2 1 1 19 July 2013 Jan 2014 Jan 2014 ACC 66 SP14 ALL Project 1 July 2014 APPENDIX A ACC 1A- Principles of Accounting I Fall 2012 SLO Assessment There were six sections of ACC 1A taught at Norco College during the Fall of 2012. Four sections by a full time faculty member (Patty Worsham) and two sections by Adjunct Faculty (Ming Scott and Andy Smith). The data presented is a compilation of the six sections’ GL software project. This project (Exhibit 1 attached) is given at the end of the semester and serves as a ‘capstone’ project for the students where they test their competency in applying their accounting skills via the accounting cycle. Assessment Process The SLO’s for ACC 1A6 are: • Analyze, explain, solve problems and apply the principles of financial accounting to varied economic units. • Identify relevant economic data used in manual and computerized accounting information systems and interpret financial statements. • Analyze corporate equity rights and structure. • Demonstrate the ability to continue in a university program of accounting and acquire the required background in any field of business administration. The SLOs Assessed were • #1: Analyze, explain, solve problems and apply the principles of financial accounting to varied economic units. • #4: Demonstrate the ability to continue in a university program of accounting and acquire the required background in any field of business administration. While SLOs numbers 2 and 3 weren’t assessed using this capstone project they can be assessed as follows: • SLO 2: Identify relevant economic data used in manual and computerized accounting information systems and interpret financial statements. 6 It should be noted here that our SLO’s are going to change. We are currently in the process of implementing a new Transfer Model Curriculum Program for Business. As such our ACC 1A and ACC 1B SLO’s do not align with the C-ID Course Descriptors. As such, Cheryl Honore (full-time Accounting faculty member at Moreno Valley College) and I are working on revising our ACC 1A and 1B COR to match the C-ID course outlines so that our TMC program will be approved. 20 • • Students do identify relevant economic data used when preparing this GL computerized accounting project. Students must analyze the data first (manually) then enter it into the computerized accounting system. To that end, this capstone does capture the students ability to do this. With regard to interpreting financial statements, students calculate and interpret financial ratios in the last chapter of the class (chapter 15) in which they are tested on their final exam, as well as their chapter 15 homework and quiz. However, as a whole this SLO is not addressed in this capstone project. SLO 3: Analyze corporate equity rights and structure. a) Students address this topic in chapter 11 on their third exam as well as their chapter 11 homework and chapter quiz. Assessment Results Summary Sheet of SLO Assessment # 4: GL Project Scores. See comments in the next section to better understand how this data is useable. Section # 38670-OG 38671-OG 38672-OG Night 38673-8WOL 38674-8WOL 38675-8WHY Grade A 90100% 16 35 Grade B 8090% 0 2 Grade C 7080% 4 0 Grade D 6070% 0 0 10 13 7 23 0 0 0 0 0 0 1 1 3 1 1 1 Grade F Below 60% Total # Students 3 9 3 7 4 9 16 21 13 34 50 40 30 otal # Students Below 60% 60-70% 38671-OG 70-80% 10 80-90% 38670-OG 90-100% 20 0 23 46 38672-OG Night 38673-8WOL 21 38674-8WOL 38675-8WHY Evidence All evidence of this assessment can be found on the students Epsilen electronic portfolio as follows: ACC-1A-38671 Fall 2012 Epsilen Site http://www.epsilen.com/aalkaram http://www.epsilen.com/tarmstro12 http://www.epsilen.com/nbagai http://www.epsilen.com/tbangean http://www.epsilen.com/dbriseno9 Did not upload work to Efolio http://www.epsilen.com/jcastro272 http://www.epsilen.com/kcatt1 http://www.epsilen.com/aceja3 Did not upload work to Efolio http://www.epsilen.com/ccorvera http://www.epsilen.com/cday34 http://www.epsilen.com/kdiaz36 http://www.epsilen.com/adupont http://www.epsilen.com/bduronslet Http://www.epsilen.com/regge Did not upload work to Efolio http://www.epsilen.com/rgillesp4 Did not upload work to Efolio GL Prj 50 50 50 50 50 0 50 50 50 50 50 0 44.78 50 50 50 50 50 50 50 49.81 50 22 Did not upload work to Efolio http://www.epsilen.com/khernand525 http://www.epsilen.com/sherzallah http://www.epsilen.com/jhigley3 http://www.epsilen.com/chirt1 http://www.epsilen.com/akumar6 http://www.epsilen.com/mleyzaola Did not upload work to Efolio Did not upload work to Efolio Did not upload work to Efolio Did not upload work to Efolio Did not upload work to Efolio http://www.epsilen.com/mrascon9 http://www.epsilen.com/crivas43 Did not upload work to Efolio http://www.epsilen.com/lsanchez273 http://www.epsilen.com/rshaw22 http://www.epsilen.com/csiems2 Did not upload work to Efolio 50 50 49.67 50 50 50 50 0 23.21 50 0 50 50 0.26 50 50 0.26 50 0 50 50 50 0 ACC-1A-38673 Epsilen http://www.epsilen.com/ebadillo5 http://www.epsilen.com/pdo2 http://www.epsilen.com/aensign Did not upload work to Efolio http://www.epsilen.com/jham6 GL Proj 50 50 50 50 50 23 http://www.epsilen.com/rham5 Did not upload work to Efolio http://www.epsilen.com/dirwin6 http://www.epsilen.com/aleloup Did not upload work to Efolio Did not upload work to Efolio www.epsilen.com/cokezue1 http://www.epsilen.com/rromo16 Did not upload work to Efolio Did not upload work to Efolio http://www.epsilen.com/gtomlins1 Did not upload work to Efolio 50 31 50 0 50 19 0 28 50 0 0 50 50 50 13 50 ACC-1A-38675 Epsilen Site http://www.epsilen.com/iaceves4 http://www.epsilen.com/cariss Did not upload work to Efolio Did not upload work to Efolio http://www.epsilen.com/ecarmichae Did not upload work to Efolio Did not upload work to Efolio http://www.epsilen.com/destrada99 http://www.epsilen.com/theafner GL Proj 50 50 50 50 50 0 0 50 48 50 15 0 24 http://www.epsilen.com/mjordan61 http://www.epsilen.com/kkelly73 http://www.epsilen.com/kkelly72 http://www.epsilen.com/tkpaki http://www.epsilen.com/elam6 http://www.epsilen.com/klechner Did not upload work to Efolio Did not upload work to Efolio http://www.epsilen.com/smathe http://www.epsilen.com/jnajera25 Did not upload work to Efolio http://www.epsilen.com/trosas6 Did not upload work to Efolio Tatianna Did not upload work to Efolio http://www.epsilen.com/rvargas66 Did not upload work to Efolio 50 38 49 50 50 0 50 49 50 50 0 50 34 0 50 50 0 0 0 50 50 50 Our Findings As a whole the data shows that the majority of our students are understanding basic accounting concepts as outlined in SLO’s 1 and 4. Follow up telephone conversations with our adjunct faculty members, Ming Scott and Andy Smith, were in agreement with this notion. We also felt that those who were not successful with this assignment, were also not successful in the class and that for them the problem was systemic meaning that their lack of understanding this concept contributed to their ability to be successful in the class. There were a few students however, who failed at this 25 project but overall were successful in the class and we concluded that for these students they just didn’t manage their time well and were unable to complete the assignment. Using a four-point scale for analyzing the results the data could be interpreted as follows: 4 = strong evident of achievement (scored 85% or higher) 3 = adequate evidence of achievement (scored 70 – 85%) 2 = inadequate evidence of achievement (scored 69-55%) 1 = little or no evidence of achievement (scored 54% or lower) Of the 153 students assessed, the scores totaled as follows: 106 students = 4 6 students = 3 6 students = 2 35 students = 1 Since the project is comprehensive, the numbers achieved from each section of the assignment are included in the following section. Therefore, failure to achieve correct numbers in any previous section will result in failing to achieve the correct numbers in the succeeding section. This means that if student achieved a low score it was either the result of poor time management on their part and they failed to devote the necessary amount of time to the assignment, or they didn’t understand how to do the assignment and therefore did not achievement the outcomes of the assessment. Since an overwhelming majority of the students achieved a 3 or 4 on the assignment it seems to me that these two SLO’s were achieved. The actual Assignment below is listed in detail so that you may see how it ties to both SLO’s 1 and 4. I recognize that SLO 4 is very broad and as such, since each of these SLO’s will be redefined in Fall 2013, it seems unnecessary to belabor the fact that they are broad and or insignificant to the outcomes of the course. Going forward for future assessments… As discussed on page one in footnote 1, we need to change our SLO’s in order to maintain compliance with the C-ID descriptors for the Transfer Model Curriculum degree. Cheryl Honore and I will be working on this revision and updating our SLO’s as follows (although we would like to combine some if possible because we feel that these would be too many to assess individually): 1. Explain the nature and purpose of generally accepted accounting principles (GAAP) and International Financial Reporting Standards (IFRS). Explain and apply the components of the conceptual framework for financial accounting and reporting, including the qualitative characteristics of accounting information, 26 the assumptions underlying accounting, the basic principles of financial accounting, and the constraints and limitations on accounting information; 2. Define and use accounting and business terminology; 3. Explain what a system is and how an accounting system is designed to satisfy the needs of specific businesses and users; summarize the purpose of journals and ledgers; 4. Apply transaction analysis, input transactions into the accounting system, process this input, and prepare and interpret the four basic financial statements; 5. Distinguish between cash basis and accrual basis accounting and their impact on the financial statements, including the revenue recognition and matching principles; 6. Identify and illustrate how the principles of internal control are used to manage and control the firm’s resources and minimize risk; 7. Explain the content, form, and purpose of the basic financial statements (including footnotes) and the annual report, and how they satisfy the information needs of investors, creditors, and other users; 8. Explain the nature of current assets and related issues, including the measurement and reporting of cash and cash equivalents, receivables and bad debts, and inventory and cost of goods sold; 9. Explain the valuation and reporting of current liabilities, estimated liabilities, and other contingencies; 10. Identify and illustrate issues relating to long-term asset acquisition, use, cost allocation, and disposal; 11. Distinguish between capital and revenue expenditures; 12. Identify and illustrate issues relating to long-term liabilities, including issuance, valuation, and retirement of debt;(including the time value of money) 13. Identify and illustrate issues relating to stockholders’ equity, including issuance, repurchase of capital stock, and dividends; 14. Explain the importance of operating, investing and financing activities reported in the Statement of Cash Flows; 15. Interpret company activity, profitability, liquidity and solvency through selection and application of appropriate financial analysis tools; 16. Identify the ethical implications inherent in financial reporting and be able to apply strategies for addressing them. Reporting- Closing the Loop--- to complete this process, the next step needs to be standard reporting and feedback to all those involved with gathering and assessing accounting SLO’s. This will be my objective for next year and I’ll report back then as to how I’ve devised a standard feedback loop and the results of this information process. 27 Appendix 1 Continued ACC 1A Capstone Project used to assess SLOs #1 & 4 Part 1 Comprehensive Problem 1: Kelly Pitney began her consulting business, Kelly Consulting, on April 1, 2012. The chart of accounts for Kelly Consulting is shown below: The post-closing trial balance as of April 30, 2012, is shown below: 28 Journalize each of the May transactions using Kelly Consulting's chart of accounts. (Do not insert the account numbers in the Post. Ref. column of the journal at this time.) For a compound transaction, if an amount box does not require an entry, leave it blank. May 3: Received cash from clients as an advance payment for services to be provided and recorded it as unearned fees, $3,000. May 5: Received cash from clients on account, $2,100. May 9: Paid cash for a newspaper advertisement, $300. May 13: Paid Office Station Co. for part of the debt incurred on April 5, $400. May 15: Recorded services provided on account for the period May 1–15, $7,350. May 16: Paid part-time receptionist for two weeks' salary including the amount owed on April 30, $750. May 17: Recorded cash from cash clients for fees earned during the period May 1–16, $6,150. May 20: Purchased supplies on account, $600. 29 May 21: Recorded services provided on account for the period May 16–20, $6,175. May 25: Recorded cash from cash clients for fees earned for the period May 17–23, $3,125. May 27: Received cash from clients on account, $11,250. May 28: Paid part-time receptionist for two weeks' salary, $750. May 30: Paid telephone bill for May, $120. May 31: Paid electricity bill for May, $290. May 31: Recorded cash from cash clients for fees earned for the period May 26–31, $2,800. May 31: Recorded services provided on account for the remainder of May, $1,900. May 31: Paid dividends of $15,000. Part 2 and Part 3: Note: You must complete part 1 before completing parts 2 and 3. Part 2: Using the working papers, a spreadsheet, or your own paper, post the journal entries from part 1 to a ledger of four-column accounts. Part 3: Prepare an unadjusted trial balance. If an amount box does not require an entry, leave it blank. Part 4: At the end of May, the following adjustment data were assembled. Analyze and use these data to complete parts (5) and (6). a. Insurance expired during May is $300. b. Supplies on hand on May 31 are $750. c. Depreciation of office equipment for May is $330. d. Accrued receptionist salary on May 31 is $300. e. Rent expired during May is $1,600. f. Unearned fees on May 31 are $1,500. Part 5: Journalize the adjusting entries. Then, post the entries to your own paper, working papers or spreadsheet from part 2. a. Insurance expired during May is $300. b. Supplies on hand on May 31 are $750. c. Depreciation of office equipment for May is $330. d. Accrued receptionist salary on May 31 is $300. e. Rent expired during May is $1,600. f. Unearned fees on May 31 are $1,500. Part 6: Enter the unadjusted trial balance on an end-of-period spreadsheet (work sheet) and complete the spreadsheet using the following adjustment data. 1. Insurance expired during May is $300. 30 2. Supplies on hand on May 31 are $750. 3. Depreciation of office equipment for May is $330. 4. Accrued receptionist salary on May 31 is $300. 5. Rent expired during May is $1,600. 6. Unearned fees on May 31 are $1,500. Part 7: Prepare an adjusted trial balance. Part 8: Prepare an income statement, Statement of Retained Earnings, and Balance Sheet Part 9: Prepare the closing entries below. Then, using the working papers, a spreadsheet, or your own paper from part 2, post the entries to your general ledger. (Income Summary is account #33 in the chart of accounts.) If an amount box does not require an entry, leave it blank or enter "0". Part 10: Prepare a post-closing trial balance. 31 Appendix B RIVERSIDE COMMUNITY COLLEGE DISTRICT PROGRAM OUTLINE of RECORD College: R_X__ M_X__ N_X _ TOPs Code: _______________ Business Administration AS-T PROGRAM PREREQUISITE: None SHORT DESCRIPTION of PROGRAM This degree is designed to facilitate the student's passage from Norco College to the California State University System with an Associate Degree in Business Administration. This degree will satisfy the lower division requirements for the eventual conferral of the Bachelor's Degree in Business Administration at CSU. With this degree the student will be prepared for transfer to the university upper division level. The Associate in Arts in Business Administration for Transfer degree will be awarded upon completion of 60 California State University (CSU) transferable units including the above major requirements and the Intersegmental General Education Transfer Curriculum (IGETC) or California State University General Education (CSUGE) requirements with a minimum grade point average of 2.0. All courses in the major must be completed with a grade of “C” or better. (Students completing this degree are not required to fulfill the RCCD graduation requirements found in section VII. Additional degree requirements: Health Education and Self Development). PROGRAM LEARNING OUTCOMES Upon successful completion of this program, students should be able to: • demonstrate use of technology and / or application software to analyze and solve business decisions. • demonstrate mathematical and accounting procedures used for business calculations and decisions. • demonstrate the application of economic and / or business theories to develop effective business processes. Required Core (15 units): ACC 1A Principles of Accounting I Units 3 32 ACC 1B BUS 18A ECON 7/7H ECON 8 Principles of Accounting II Business Law I Macroeconomics Microeconomics 3 3 3 3 List A (Select one course, 3-4 units): MAT 5 Business Calculus OR MAT 4 Finite Math OR MAT 12/12H Statistics Units 4 List B (Select Two courses, 6-7 units): Any course from List A not already chosen Units BUS 10 BUS 22 CIS 1A 3 3 3 3 3 Introduction to Business Management Communications Introduction to Computer Information Systems Total Units 24-25 *Students with more than one target transfer institution should consult their counselor to determine if they should take any additional course(s) 33 Appendix C Riverside Community College District Integrated Course Outline of Record Accounting 67 College: R__ M__ N_X_ Lecture Hours: 72 Lab Hours: 0 Units: 4.00 ACC-67: U.S. and California Income Tax Preparation COURSE DESCRIPTION Prerequisite: None. U.S. and California income tax principles and tax return preparation as it relates to individuals, sole proprietorships, and other business entities. This course is certified by the California Tax Education Council (CTEC) as fulfilling the 60-hour qualifying education requirement imposed by the State of California for becoming a Registered Tax Preparer. 72 hours lecture. SHORT DESCRIPTION FOR CLASS SCHEDULE A CTEC approved course which provides 45 hours of federal credit, 15 hours of California state credit and 2 hours of ethics (included in the 15 hours of state credit) towards the qualifying education requirement for tax preparers. 34 ADVISORY ENTRY SKILLS None. STUDENT LEARNING OUTCOMES Upon successful completion of the course, students should be able to: Prepare federal and state income tax returns for individuals, sole proprietorships and other business entities. Critical Thinking - Analyze and solve complex problems across a range of academic and everyday contexts Critical Thinking- Consider and evaluate rival hypotheses Critical Thinking-Integrate knowledge across a range of contexts Critical Thinking-Identify one’s own and other’s assumptions, biases, and their consequences Communication Skills – Listen thoughtfully and respectfully to the ideas of others Breadth of Knowledge – Understand the basic content and modes of inquiry of the major knowledge fields Application of Knowledge – Maintain and transfer academic and technical skills to the workplace Global Awareness-Demonstrate teamwork skills Conduct tax research on client issues using both manual and computerized methods. Critical Thinking – Analyze and solve complex problems across a range of academic and everyday contexts Critical Thinking- Consider and evaluate rival hypotheses Critical Thinking- Integrate knowledge across a range of contexts Critical Thinking-Identify one’s own and other’s assumptions, biases, and their 35 consequences Communication Skills – Listen thoughtfully and respectfully to the ideas of others Breadth of Knowledge – Understand the basic content and modes of inquiry of the major knowledge fields Application of Knowledge - Maintain and transfer academic and technical skills to workplace Global Awareness-Demonstrate teamwork skills Evaluate and propose strategies that minimize income tax obligations. Critical Thinking – Analyze and solve complex problems across a range of academic and everyday contexts Critical Thinking- Consider and evaluate rival hypotheses Critical Thinking- Integrate knowledge across a range of contexts Critical Thinking-Identify one’s own and other’s assumptions, biases, and their consequences Communication Skills – Listen thoughtfully and respectfully to the ideas of others Breadth of Knowledge – Understand the basic content and modes of inquiry of the major knowledge fields Application of Knowledge - Maintain and transfer academic and technical skills to workplace Global Awareness-Demonstrate teamwork skills COURSE CONTENT TOPICS 1. The Individual Income Tax Return a. History and objectives of the tax system 36 b. Reporting and taxable entities c. The tax formula for individuals d. Who must file e. Filing status and tax computation f. Personal and dependency exemptions g. The standard deduction h. A brief overview of capital gains and losses i. Tax and the internet j. Electronic filing (e-filings) k. Questions and problems 2. Gross Income and Exclusions a. The nature of gross income b. Interest and dividend income c. Alimony d. Prizes and awards e. Annuities f. Life insurance g. Gifts and inheritances h. Scholarships i. Accident and health insurance j. Meals and lodging k. Municipal bond interest l. Unemployment compensation m. Employee fringe benefits n. Social security benefits o. Questions and problems 3. Business Income and Expenses, Part I a. Schedule C b. Inventories 37 c. Transportation d. Travel expenses e. Meals and entertainment f. Educational expenses g. Dues, subscriptions, and publications h. Special clothing and uniforms i. Business gifts j. Bad debts k. Office in the home l. Net operation losses m. Hobby losses n. Questions and problems 4. Business Income and Expenses Part II a. Rental income and expenses b. Passive loss limitations c. Self-employed health insurance deductions d. Health savings accounts e. Moving expenses f. Individual retirement accounts g. Keough (H.R. 10) plans and simplified employee pensions h. Qualified retirement plans including section 401(k) plans i. Rollovers j. Questions and problems 5. Itemized Deductions and Other Incentives a. Medical expenses b. Taxes c. Interest 38 d. Contributions e. Casualty and theft losses f. Miscellaneous deductions g. Classifications of deductions employees h. Educational incentives i. Questions and problems 6. Credits and Special Taxes a. Child tax credit b. Earned income credit c. Child and dependent care credit d. Education tax credits e. Foreign tax credit f. Adoption expenses g. Energy credits h. The individual alternative minimum tax (AMT) i. Unearned income for minor children and certain students j. Community property k. Questions and problems 7. Accounting Periods and Methods and Depreciation a. Accounting periods b. Accounting methods c. Depreciation d. Modified accelerated cost recovery systems (MACRS) e. Election to expense f. Listed property g. Limitation on depreciation of luxury automobiles h. Intangibles i. Related parties (Section 267) 39 j. Questions and problems 8. Capital Gains and Losses a. What is a capital asset? b. Holding period c. Calculation of gain or loss d. Net capital gains e. Net capital losses f. Section 1231 gains and losses g. Depreciation recapture h. Capital gains and casualty gains and losses i. Installment sales j. Like-kind exchanges k. Involuntary conversions l. Sale of personal residence m. Questions and problems 9. Withholding, Estimated Payments, and Payroll Taxes a. Withholding methods b. Estimated payments c. The FICA tax d. Federal tax deposit system e. Employer reporting requirements f. Self-employment tax g. The FUTA tax h. The nanny tax i. Questions and problems 10. Tax administration and Tax Planning a. The internal revenue service b. The audit process c. Interest and penalties 40 d. Statute of limitations e. Preparers, proof, and privilege f. The taxpayer bill of rights g. Tax planning h. Questions and problems 11. Additional Specially Selected Topics a. Selected partnership tax issues and preparation b. Tax credits c. Special California income tax preparation issues d. Special Topics- taxpayer penalties, nonresident and alien issues, legislative update e. Developing tax research skills f. Fundamentals of the most widely used tax preparation software g. The requirements for obtaining and keeping current the Registered Tax Preparer’s Certificate from the State of California METHODS OF INSTRUCTION Methods of instruction used to achieve student learning outcomes may include, but are not limited to: • • Facilitate discussions regarding relevant current issues in business to encourage students to make appropriate connections to the course content. Present lectures to describe the essentials income tax concepts and their applications to business. 41 • • • Create and have students participate in cooperative learning tasks such as small group exercises to identify issues that relate to course content and utilize the content to offer opinions, solutions, and analysis with respect to those issues. Present case studies to provide students with the opportunity to utilize concepts learned in class to analyze income tax preparation situations. Develop and assign tasks/activities such as presentations in order to assess students understanding of income tax concepts. METHODS OF EVALUATION Students will be evaluated for progress in and/or mastery of learning outcomes by methods of evaluation which may include, but are not limited to: • • • • • • Individual or class projects designed to evaluate the application of income tax principles to simulations of real business situations. Individual, small group, or paired activities designed to allow students to demonstrate understanding of basic income tax preparation concepts. Quizzes and in-class participation demonstrating proficiency in the subject matter. Quizzes designed to assess the student learning outcomes. Written reports designed to assess the application of income tax preparation principles. Individual web projects designed to assess student proficiency 42 • in achieving the student learning outcomes. Examination designed to provide objective evidence that students have attained the level of understanding expected in the areas detailed in the student learning outcomes. ASSIGNMENTS Outside-of-Class Reading Assignments • • • • Quizzes/examinations designed to assess ability to formulate income tax preparation decisions. Written reports designed to assess the application of federal and state tax code. Essays presenting detailed material related to federal and state income tax preparation. Final projects designed to demonstrate student mastery of the calculation and analysis of federal and state income tax returns. Outside-of-Class Writing Assignments • Students will prepare an individual federal income tax return. Other Outside-of-Class Assignments • Individual, small group, or paired activities designed to allow students to demonstrate understanding of how to analyze and 43 • • apply tax code. Individual web projects designed to assess student proficiency in income tax return preparation. Individual or small group projects designed to evaluate student ability to prepare individual income tax returns. COURSE MATERIALS All materials used in this course will be periodically reviewed to ensure that they are appropriate for college level instruction. Possible texts include: • • • Whittenburg, Altus-Buller & Gill. Income Tax Fundamentals 2013 . 31st ed. South-Western, Cengage Learning, 2013. Hoffman & Smith. South-Western Federal Taxation 2013: Individual Income Taxes. 36th ed. South-Western, Cengage Learning, 2013. Pope & Anderson. Prentice Hall's Federal Taxation 2013 Individuals. 26th ed. Prentice Hall, 2013. 4646 44 BEIT Department Meeting Tuesday, May 14, 2013 12:50 – 1:50pm IT 218 Minutes Attendance: Patty Worsham, Gail Zwart, Tom Wagner,James Finley, Cathy Brotherton, John Coverdale, Carlos Garcia, Gerald Cordier, Paul Van Hulle, Kevin Fleming, Arend Flick, Greg Aycock Absent: Judy Perry (meeting with Gaming Club), Jim Thomas (personal absence), Rex Beck (personal absence) 1. 2. 3. 4. CTE (Kevin)• This Friday is the annual industry advisory board meeting. 6 more student scribes needed. Please forward the names of any students you think might be good for this role. Be there by 7:45. Breakfast at 7:30. Dr. Parnell will begin talking at 8:00. • In the Fall there will be a separate Manufacturing, Real Estate, and Multimedia advisory meeting. Department Chair Elections- Judy is stepping down therefore we need to elect a new co-chair. Department Chair/Co-Chair terms are 3 – year term positions. Judy nominated John Coverdale and John accepted the nomination. Motion to approve John as department Co-Chair (M/S/P Zwart/Wagner) Curriculum • BUS 22- Add ENG 1A – motion to approve adding ENG 1A as a pre-requisition (M/S/P Worsham/Van Hulle) • BUS 10 – adding a chapter of risk management and a chapter business law to the course in order to be compliant with the CI-D descriptiors for the AS-T Business Administration . (M/S/P Worsham/Van Hulle) • ACC 1A- modify the COR to align with the CI-D description for the AS-T Business Administration (M/S/P Worsham/Van Hulle) • ACC 1B- modify the COR to align with the CI-D descriptor for the AS-T Business Administration( M/S/P Worsham/Van Hulle) PLO Assessment Dialogue • Greg and Arend will attend the meeting to answer any questions we may have on the program assessment process. o Some of the PLO’s are unattainable and part of the process and should be discussed in the write-up. Pick one PLO to assess and go from there. o We need to have completed a cycle of collecting data, analyzing that data, and having meaningful dialogue about that data. The final feedback would be the implementation of changes and tracking the effectiveness of these changes. o The key is pulling the SLO data into one package and relating it to the PLO. o It would be nice to see an example of measureable improvement. o Use assessment for improvement but for now it’s looking for areas where improvement might be possible be via assessment . o CIS has been doing assessment for a long time. o The basic approach Arend is advocating, is going to utilize the software that is not 45 Identify the PLO Identify 3 or 4 course perhaps where you expect that PLO to appear Ask the instructors to look at a late term student artifact in terms of which it demonstrates the student has achieved that outcome (4 point scale is recommended). o Use a spreadsheet and rank the students (4,3,2,1) o That data gets sent to the Deans of Institutional Effectiveness (should include student ID information). Gradesheet works well here. o Then reflect on the data and write a report. o Based on this assessment and PLO mapping assignment, BUS has decided that due to the many problems they’ve had with mapping their PLO’s that it makes more sense to redesign their entire certificate course offerings. In the Fall 3 new certificates will be designed (Business that will offer a concentration in General Business Administration, Entrepreneurship, or Accounting; Management with an option of a concentration in Logistics or Management; and Real Estate). This is subject to change but at the moment this is how the BUS faculty have sketched this out. 5. Roberta Belote Memorial Scholarship (Cathy)- Judy passed around forms for those who would like to sign up for this scholarship fund . Minimum of $25 per month but the individual donor can select the number of months to donate. I 6. 30 Second Committee Reports • ISPC report (Gail)- meets tomorrow. Agenda items – policy for distributing FTES in the Fall. Percentages should stay the same which is 18-20% for CTE). ISPC chair is up for election and Gail will run again. Looking at adding a classified person to round out representation of faculty, administration and staff. • Academic Planning Council (Judy, Paul, Patty) –APC ranked and forwarded the following positions in order of priority (HUM, HES, GAM ART, ELE). For WIN CTE was awarded 17 FTES. Kevin divided the classes equally as follows: BUS, GAM, CIS, ECE, MAN • Academic Senate (Cathy) – Cathy is stepping down so we need to elect a new representative. • District Budget committee (Tom) • Curriculum Committee (Rex/Judy)- Judy is stepping down so we need to elect a new representative. • Safety (Carlos/Paul) • Legacy Committee – (Need a rep) • Library Advisory Committee (Rex) • Business and Physical Resources Committee (Jim) • Norco Assessment Committee (Gerald) • Program Review Committee (Jim)- Jim will be stepping down so we need to elect a new representative. • Technology Committee (Cathy, James) • Transfer Advisory Board Committee (Patty) • CTE/ Perkins District Committee (Patty) 4. Other o o o 46 Next meetings (third Tuesday of every month): • • • • • • • September 17 October 15 November 19 February 18 March 18 April 15 May 20 47