Newsletter June 2015

Newsletter August 2015

VOL. 4

VOL. 4

Two Ways to Boost Your Portfolio’s Income Potential

1. Preferred Securities

Designed for the income-seeking investor with an eye for value

Why we believe you should consider adding preferred securities to your portfolio:

• Potential to earn attractive monthly income with a

lower tax burden

• Gain potential for enhanced total returns from

high income rates

• Diversify your bond portfolio with different security

structures and issuers

• Reduce interest-rate sensitivity with a selection

of limited-duration securities

• Benefit from global regulatory reforms in banking

and insurance

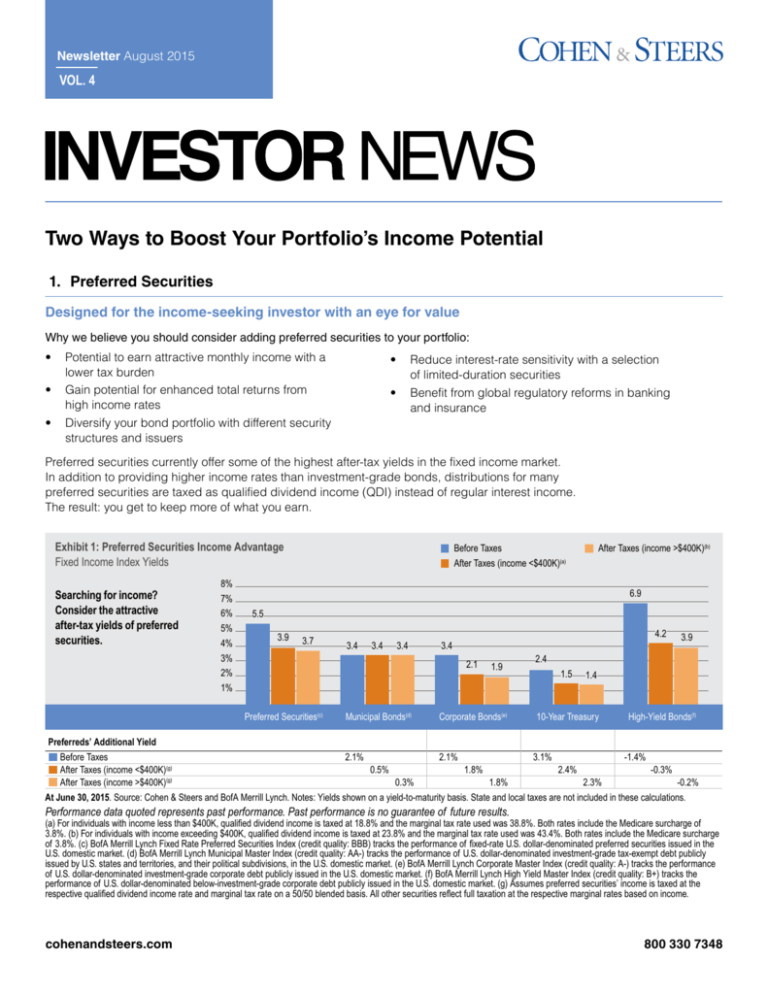

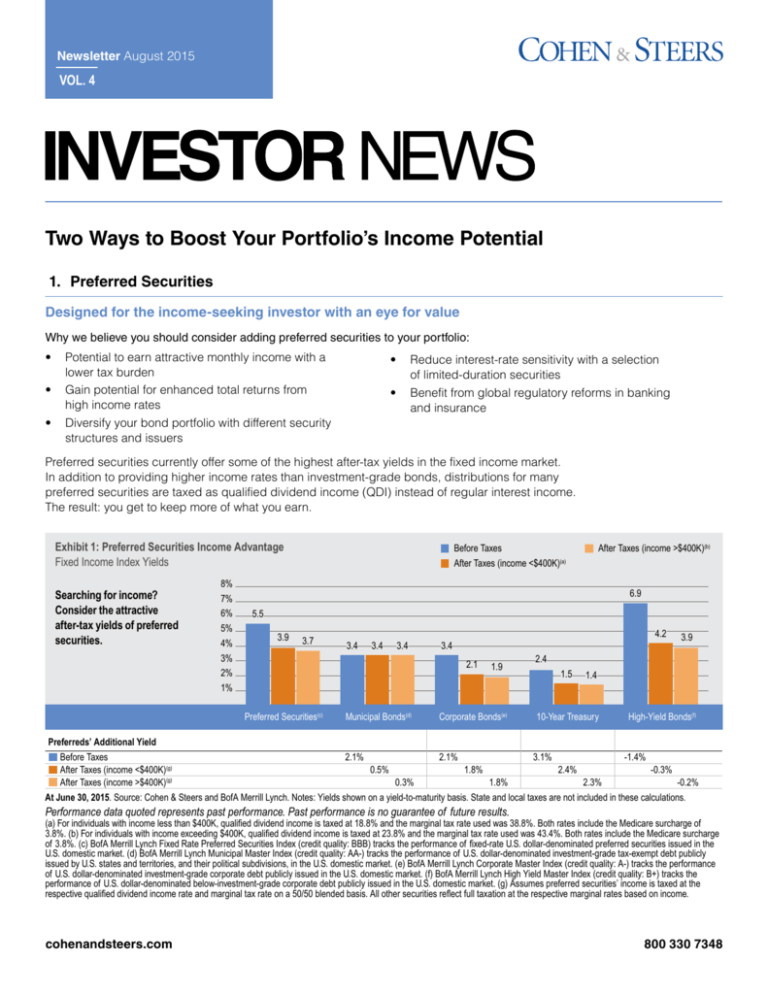

Preferred securities currently offer some of the highest after-tax yields in the fixed income market.

In addition to providing higher income rates than investment-grade bonds, distributions for many

preferred securities are taxed as qualified dividend income (QDI) instead of regular interest income.

The result: you get to keep more of what you earn.

Exhibit 1: Preferred Securities Income Advantage

Fixed Income Index Yields

Searching for income?

Consider the attractive

after-tax yields of preferred

securities.

8%

7%

6%

5%

4%

3%

2%

1%

Before Taxes

After Taxes (income <$400K)(a)

After Taxes (income >$400K)(b)

6.9

5.5

3.9

3.7

4.2

3.4

3.4

3.4

3.4

2.1

Preferred Securities(c)

Municipal Bonds(d)

1.9

Corporate Bonds(e)

3.9

2.4

1.5

1.4

10-Year Treasury

High-Yield Bonds(f)

Preferreds’ Additional Yield

Before Taxes

2.1%

2.1%

3.1%

-1.4%

After Taxes (income <$400K)(g)

0.5%

1.8%

2.4%

-0.3%

After Taxes (income >$400K)(g)

0.3%

1.8%

2.3%

-0.2%

At June 30, 2015. Source: Cohen & Steers and BofA Merrill Lynch. Notes: Yields shown on a yield-to-maturity basis. State and local taxes are not included in these calculations.

Performance data quoted represents past performance. Past performance is no guarantee of future results.

(a) For individuals with income less than $400K, qualified dividend income is taxed at 18.8% and the marginal tax rate used was 38.8%. Both rates include the Medicare surcharge of

3.8%. (b) For individuals with income exceeding $400K, qualified dividend income is taxed at 23.8% and the marginal tax rate used was 43.4%. Both rates include the Medicare surcharge

of 3.8%. (c) BofA Merrill Lynch Fixed Rate Preferred Securities Index (credit quality: BBB) tracks the performance of fixed-rate U.S. dollar-denominated preferred securities issued in the

U.S. domestic market. (d) BofA Merrill Lynch Municipal Master Index (credit quality: AA-) tracks the performance of U.S. dollar-denominated investment-grade tax-exempt debt publicly

issued by U.S. states and territories, and their political subdivisions, in the U.S. domestic market. (e) BofA Merrill Lynch Corporate Master Index (credit quality: A-) tracks the performance

of U.S. dollar-denominated investment-grade corporate debt publicly issued in the U.S. domestic market. (f) BofA Merrill Lynch High Yield Master Index (credit quality: B+) tracks the

performance of U.S. dollar-denominated below-investment-grade corporate debt publicly issued in the U.S. domestic market. (g) Assumes preferred securities’ income is taxed at the

respective qualified dividend income rate and marginal tax rate on a 50/50 blended basis. All other securities reflect full taxation at the respective marginal rates based on income.

cohenandsteers.com

800 330 7348

Investor News August 2015

2. Real Estate Investment Trusts

Diversifying your portfolio with high-quality real estate

How real estate investment trusts (REITs) can help strengthen your portfolio:

• Potential to earn attractive dividend income in

investments structurally designed to grow distributions

• Gain potential for strong total returns derived

from income-producing properties

• Diversify your stock and bond holdings with the

potential to reduce portfolio volatility over time

• Participate in local economic growth through

investments in offices, apartments, shopping

centers, hotels and other real estate

At Cohen & Steers, we focus on investing in real estate companies that we believe are attractively

priced relative to the value of their property holdings and their projected cash flows. Many of these

companies are dominant participants in their markets and have superior management teams. We are

positioned for modest U.S. economic expansion and continued growth in demand. Below are a few

examples of property types in which real estate investment trusts can invest.

Shopping Centers—Developers Diversified Realty,

Village at Stone Oak, San Antonio, TX

Regional Malls—Simon Property Group

The Galleria, Houston, TX

Industrial—Prologis Inc.

Tejon Ranch, Lebec, CA

Hotels—Host Hotels & Resorts, Inc.

The Ritz Carlton, Amelia Island, FL

Self Storage—Public Storage

Located across the United States

Apartments—Equity Residential

425 Mass Apartments, Washington D.C.

Cohen & Steers Open-End Funds

Fund Name & Objective

Symbols

Cohen & Steers Real Assets Fund

The investment objective is to achieve attractive long-term

total returns and maximize real returns during inflationary

environments by investing in “real assets”—global real estate

companies, commodities, natural resource companies, global

infrastructure companies, gold and other precious metals.

RAPAX,

RAPCX,

RAPIX,

RAPRX,

RAPZX

CSEIX,

CSCIX,

CSDIX,

CIRRX,

CSZIX

CSRIX

CSRSX

Distributed by Cohen & Steers Securities, LLC.

DVFAX,

DVFCX,

DVFIX,

DVFRX,

DVFZX

The investment objective is to achieve total return through

investments in U.S. and non-U.S. equity securities issued

by infrastructure companies—those that typically provide a

physical framework defined as utilities, pipelines, toll roads,

airports, railroads, marine ports and telecommunications

companies.

CSUAX,

CSUCX,

CSUIX,

CSURX,

CSUZX

The investment objective is to achieve total return through

high current income and capital appreciation by investing in

preferred and debt securities issued by U.S. and non-U.S.

companies. Issuers include banks, insurance companies,

REITs and other diversified financials, as well as utility,

energy, pipeline and telecommunications companies.

CPXAX,

CPXCX,

CPXIX,

CPRRX,

CPXZX

Cohen & Steers MLP & Energy Opportunity Fund

GRSIX

Cohen & Steers Global Realty Shares

The investment objective is to achieve total return through

investment in global real estate equity securities, including

common stocks and other equity securities issued by U.S.

and non-U.S. real estate companies in REIT and similar

REIT-like structures.

The investment objectives are long-term growth of income

and capital appreciation achieved by investing in largecapitalization dividend-paying common stocks and preferred

stocks. The Fund’s value approach seeks investments that

appear undervalued but have good prospects for capital

appreciation and dividend growth.

Cohen & Steers Preferred Securities and Income Fund

Cohen & Steers Institutional Global Realty Shares

The investment objective is to achieve total return through

investment in global real estate equity securities, including

common stocks and other equity securities issued by U.S.

and non-U.S. real estate companies in REIT and similar

REIT-like structures.

IRFAX,

IRFCX,

IRFIX

Cohen & Steers Global Infrastructure Fund

Cohen & Steers Realty Shares

The investment objective is to achieve total return through

investment in real estate securities, including common

stocks, preferred stocks and other equity securities, as well

as debt securities issued by real estate companies in REIT

and REIT-like structures.

The investment objective of the Fund is to achieve total

return through investment in non-U.S. real estate equity

securities, including common stocks and other equity

securities issued by real estate companies in REIT and

REIT-like structures.

Cohen & Steers Dividend Value Fund

Cohen & Steers Institutional Realty Shares

The investment objective is to achieve total return through

investment in real estate securities, including common

stocks, preferred stocks and other equity securities, as well

as debt securities issued by real estate companies in REIT

and REIT-like structures.

Symbols

Cohen & Steers International Realty Fund

Cohen & Steers Real Estate Securities Fund

The investment objective is to achieve total return through

investment in real estate securities, including common

stocks, preferred stocks and other equity securities, as well

as debt securities issued by real estate companies.

Fund Name & Objective

The investment objective is attractive total return through

investments in energy-related master limited partnerships

(MLPs) and securities of companies that derive at least 50%

of their revenues or operating income from the exploration,

production, gathering, transportation, processing, storage,

refining, distribution or marketing of natural gas, crude oil

and other energy resources.

MLOAX,

MLOCX,

MLOIX,

MLORX,

MLOZX

Cohen & Steers Active Commodities Strategy Fund

CSFAX,

CSFCX,

CSSPX,

GRSRX,

CSFZX

The investment objective is to achieve attractive total

return by investing primarily in exchange-traded commodity

futures contracts and other commodity-related derivative

instruments across principal market sectors including energy,

industrial metals, agricultural, livestock and precious metals.

CDFAX,

CDFCX,

CDFIX,

CDFRX,

CDFZX

Please consider the investment objectives, risks, charges and expenses of the fund carefully before investing. A summary prospectus and prospectus

containing this and other information can be obtained by calling 800 330 7348 or by visiting cohenandsteers.com. Please read the summary prospectus

and prospectus carefully before investing.

Investor News August 2015

Important Disclosures

Performance data quoted represents past performance. Past performance is no guarantee of future results. The views and opinions in the preceding commentary

are as of the date of publication and are subject to change without notice. There is no guarantee that any historical trend illustrated herein will be repeated in the future, and there is no

way to predict precisely when such a trend will begin. There is no guarantee that any market forecast made in this commentary will be realized. This material represents an assessment

of the market environment at a specific point in time, should not be relied upon as investment or tax advice and is not intended to predict or depict performance of any investment. We

consider the information in this commentary to be accurate, but we do not represent that it is complete or should be relied upon as the sole source of suitability for investment. Investors

should consult their own advisors with respect to their individual circumstances. The information presented herein does not reflect the performance of any fund or other account managed

or serviced by Cohen & Steers, and there is no guarantee that investors will experience the type of performance reflected herein. An investor cannot invest directly in an index and index

performance does not reflect the deduction of any fees, expenses or taxes.

Risks of Investing in Preferred Securities. Investing in any market exposes investors to risks. In general, the risks of investing in preferred securities

are similar to those of investing in bonds, including credit risk and interest-rate risk. As nearly all preferred securities have issuer call options, call risk and

reinvestment risk are also important considerations. In addition, investors face equity-like risks, such as deferral or omission of distributions, subordination

to bonds and other more senior debt, and higher corporate governance risks with limited voting rights. Risks associated with preferred securities differ from

risks inherent with other investments. In particular, in the event of bankruptcy, a company’s preferred securities are senior to common stock but subordinated

to all other types of corporate debt. It is important to note that corporate bonds sit higher in the capital structure than preferred securities, and therefore in the

event of bankruptcy will be senior to the preferred securities. Municipal bonds are issued and backed by state and local governments and their agencies, and

the interest from municipal securities is often free from both state and local income taxes. Corporate bonds sit higher in the capital structure and therefore in

the event of bankruptcy will be senior to preferred securities. High-yield bonds, although typically issued by different types of issuers than those that issue

preferred securities and rated below investment grade, also would sit higher in a firm’s capital structure than preferred securities if the issuer did employ both

forms of issuance. 10-Year Treasury bonds are issued by the U.S. government and are generally considered the safest of all bonds since they’re backed

by the full faith and credit of the U.S. government as to timely payment of principal and interest. Below-investment-grade securities or equivalent unrated

securities generally involve greater volatility of price and risk of loss of income and principal, and may be more susceptible to real or perceived adverse

economic and competitive industry conditions than higher-grade securities.

Risks of Investing in Real Estate Securities. Risks of investing in real estate securities are similar to those associated with direct investments in real

estate, including falling property values due to increasing vacancies or declining rents resulting from economic, legal, political or technological developments;

lack of liquidity; limited diversification; and sensitivity to certain economic factors such as interest rate changes and market recessions. No representation or

warranty is made as to the efficacy of any particular strategy or fund or the actual returns that may be achieved.

About Cohen & Steers

Cohen & Steers is a global investment manager specializing in liquid real assets, including real estate securities, listed

infrastructure, commodities and natural resource equities, as well as preferred securities and other income solutions. Founded

in 1986, the firm is headquartered in New York City, with offices in London, Hong Kong, Tokyo and Seattle.

Copyright © 2015 Cohen & Steers, Inc. All rights reserved.

cohenandsteers.com

800 330 7348

INV004 0815