Foundation Research Equities Mari Gas Company Ltd

advertisement

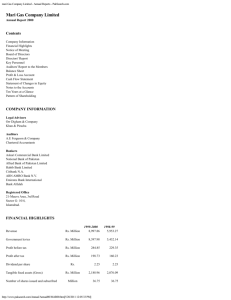

Foundation Research Equities Mari Gas Company Ltd PAKISTAN 30 October 2015 MARI PA Outperform Stock price as of 29 Oct Jun 16 target Upside/dow nside Valuation Rs Rs % Rs 425.5 697.0 63.8 697.0 - Reserve based DCF Oil and gas exploration Market cap 30-day avg turnover Market cap Shares on issue Rs bn US$m US$m m 47 0.7 45 110 Investment fundamentals Year end 30 Jun 2015 2016E To tal revenue mn EB IT mn EB IT Gro wth % Recurring pro fitm n Repo rted pro fitmn 19,376 8,266 (29.4) 5,674 5,674 19,943 8,110 (1.9) 5,256 5,256 28,197 13,637 68.2 8,217 8,217 40,328 20,586 51.0 12,603 12,603 EP S rep Rs EP S rep growth % EP S rec Rs EP S rec growth % 51.25 43.3 51.25 43.3 47.67 (7.0) 47.67 (7.0) 74.52 56.3 74.52 56.3 114.30 53.4 114.30 53.4 P E rep P E rec 2017E 2018E x x 8.3 8.3 8.9 8.9 5.7 5.7 3.7 3.7 To tal DP S Rs To tal div yield % 5.52 1.30 5.03 1.18 5.27 1.24 5.51 1.29 8.6 49.4 3.1 -21.37 4.1 7.6 32.2 3.0 52.38 2.9 10.4 34.2 2.0 37.11 2.0 18.4 34.9 1.4 20.37 1.3 ROA ROE EV/EB ITDA Net debt/equity P rice/bo ok % % x % x MARI PA rel KSE100 performance 2.0 MARI KSE Event Where cap on the dividend has created investors’ discomfort for Mari Petroleum (Mari), we term this as an opportunity for the company to reduce its concentration risk. Retained cash flows would be optimally used to enhance exploration acreage and thus, improve company’s long term growth prospectus, in our view. Moreover, sequential reduction in discount on Mari field wellhead gas prices would significantly dilute the impact of lower oil prices on company’s earnings. Though the stock does not form part of our regular E&P space, we have liking for this stock. The company would deliver 3-year earnings CAGR of 32% driven by (1) reduced Mari field wellhead price discount, (2) improved hydrocarbon production and (3) oil prices moving to our long term price assumption of US$74/bbl. The stock is currently trading at FY16/17 PE of 8.9/5.7x and implied oil price of US$37bbl. Impact Improved dynamics ignored behind oil price slump and dividend cap: To recall, the previous cost plus wellhead gas pricing formula (dated December 22, 1985) was replaced by crude oil price linked formula which provides a discounted wellhead gas price to be gradually achieved in 5 years from July 01, 2014. However, the revised formula retains the cap on the dividend distribution (30% minimum return to investors) for the next 10 years. Where improved pricing mechanism was well received, the cap on the dividend has roped in the excitement for the stock, in our view. Oil price slump has also compounded fears, we believe the investors have completely ignored the improving earning profile and recent positive newsflows (2 discoveries in last 3mths). Our back of the paper calculation suggests a cumulative earning impact of ~Rs14/sh on an annualized basis. Will increase its focus on expanding exploration: Rather than a hindrance, we see the cap on dividends as a potential catalyst to increase its exploration acreage and thus, allowing it to reduce its dependency on the Mari fields (currently contributing ~80% to company’s topline). We see the company to dedicate ~50% of its topline for the new reservoirs during the cap period. The company is currently drilling 1 exploration and 2 development wells. Earnings growth still impressive with oil at US$50/bbl: We expect the 1.0 Oct-15 Sep-15 Aug-15 Jul-15 Jun-15 May-15 Apr-15 Mar-15 Feb-15 Jan-15 Dec-14 Nov-14 Oct-14 0.0 Upcoming star for the E&P space company to deliver an impressive 32% 3-year earnings CAGR based on (1) 4% volumetric growth (29%/4% oil/gas), (2) reduced wellhead gas discount of Mari fields, and (3) recovery in the international oil prices to our long term oil price assumption of US$75/bbl. Factoring in current oil prices, our TP is lowered to Rs534/sh with 3years earnings growth of 22%. Earnings Revision So urce: B loo mberg, Fo undatio n Research, October 2015 (all figures in Rs unless noted) Price Catalyst Analyst Nauman Khan 92 21 35612290- 94 Ext 338 No change nauman.khan@fs.c om.pk Jun-16 Price target: Rs697.0/sh, based on Reserve base DCF methodology. Catalyst: New hydrocarbon discoveries and recovery in the international oil prices. Disclaimer: This report has been prepared by FSL. The information and opinions contained herein have been compiled or arrived at based upon information obtained from sources believed to be reliable and in good faith. Such information has not been independently verified and no guaranty, representation or warranty, express or implied is made as to its accuracy, completeness or correctness. All such information and opinions are subject to change without notice. This document is for information purposes only. Descriptions of any company or companies or their securities mentioned herein are not intended to be complete and this document is not, and should not be construed as, an offer, or solicitation of an offer, to buy or sell any securities or other financial instruments. FSL may, to the extent permissible by applicable law or regulation, use the above material, conclusions, research or analysis before such material is disseminated to its customers. Not all customers will receive the m aterial at the same time. FSL, their respective directors, officers, representatives, employees, related persons may have a long or short position in any of the securities or other financial instruments mentioned or issuers described herein at any time and may make a purchase and/or sale, or offer to make a purchase and/or sale of any such securities or other financial instruments from time to time in the open market or otherwise, either as principal or agent. FSL may make markets in securities or other financial instruments described in this publication, in securities of issuers described herein or in securities underlying or related to such securities. FSL may have recently underwritten the securities of an issuer mentioned herein. This document may not be reproduced, distributed or published for any purposes. Mari Gas Company Limited October 30, 2015 Action and Recommendation Though we do not formally cover this stock, we believe the stock is worth a closer look based on its enhanced earnings profile. We see lower dividend yield a temporary pediment that is to be well compensated by sustained growth in company’s hydrocarbon production. We advise accumulation at current level with stock trading at FY16/17 PE of 8.9x/5.7x respectively. 2 Foundation Securities (Pvt) Limited Mari Gas Company Limited October 30, 2015 About The Company Mari Gas Company Limited is one of the largest gas production company, having approximately 16.2% of gas reserves of Pakistan. MGCL was incorporated on December 04, 1984 as an unlisted public limited company with its IPO taking place in 1994. Fauji Foundation, Oil & Gas Development Company Limited and Government of Pakistan are its major shareholders with 40%, 20% and 18.2% shareholding respectively. The Company is the owner of the production lease and operator of Pakistan’s second largest natural gas reservoir, Mari Gas Field in Sindh, which has been earmarked for provision of natural gas to the fertilizer and power sectors. Recoverable reserves of Mari field including Goru-B reservoir stands at 8.2TCF out of which cumulative production has been 3.82TCF till June 2010. The distributable dividend of MGCL is determined by the GPA made with GoP that guarantees a minimum return of 30% on its shareholder’s fund, plus an additional return of 1% for every additional 20MMCFD over and above 425MMCFD of gas in any period. The company is an associate of FSL. Important disclosures: Target price risk disclosures: Any inability to compete successfully in their markets may harm the business. This could be a result of many factors which may include geographic mix and introduction of improved products or service offerings by competitors. The results of operations may be materially affected by global economic conditions generally, including conditions in financial markets. The company is exposed to market risks, such as changes in interest rates, foreign exchange rates and input prices. From time to time, the company will enter into transactions, including transactions in derivative instruments, to manage certain of these exposures. Analyst certification: The views expressed in this research accurately reflect the personal views of the analyst(s) about the subject securities or issuers and no part of the compensation of the analyst(s) was, is, or will be directly or indirectly related to the inclusion of specific recommendations or views in this research. The analyst principally responsible for the preparation of this research receives compensation based on overall revenues of Foundation Securities and has taken reasonable care to achieve and maintain independence and objectivity in making any recommendations. Recommendations definitions If Expected return >+10% Expected return from -10% to +10% Expected return <-10% 3 Outperform. Neutral. Underperform. Foundation Securities (Pvt) Limited