Globalization in the Wine Industry and the Case of Baja California

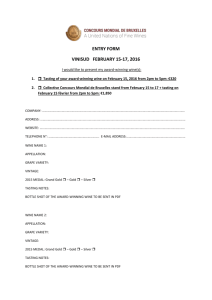

advertisement

Globalization in the Wine Industry and the Case of Baja California Mexico By Carlos O. Trejo-Pecha *, Carmen López-Reynab, Lisa A. Housec, and Francisco Javier SarmientoPerezd Presented at the 20th Annual World Food and Agribusiness Forum and Symposium 2010 Boston, MA, USA June 2010 a Professor, School of Business and Economics, Universidad Panamericana at Guadalajara, Calz. circ. pte. 49, Ciudad Granja, Zapopan, Jalisco, Mexico. b Professor , Colegio de Postgraduados de Ciencias Agrícolas de México, Agribusiness Program, Km. 36.5 Carretera Mexico-Texcoco, Montecillo, Edo. de México, Mexico. c Professor, Food and Resource Economics Department, University of Florida, P.O. Box 110240, Gainesville, Florida, 32611, U.S.A. d Former Director of Agriculture, Secretaria de Fomento Agropecuario del Estado de Baja California, Mexico * Contact author and conference presenter Globalization in the Wine Industry and the Case of Baja California Mexico Abstract Wines from Baja California, Mexico, have started to gain international recognition and win awards for their quality. This case study traces the development of the Mexican wine industry in the State of Baja California. The industry has faced major challenges during the economic crisis of the mid-1980s and when a major wine producer stopped purchasing grapes produced in the region in 2001. However, during these times of crises, other companies were able to take advantage of the opportunities and establish strong companies. Having overcome these challenges together, the wine cluster in Baja California seems on the cusp of success. Will Mexico become the latest of the “New World” producers of wine to continue on a growth pattern, or will the latest series of challenges continue to keep the size of the industry too small to make a real name for itself? Introduction Wines from Baja California Mexico have started to gain international recognition. The Baja California wine cluster was formally integrated in 2006, and several projects shared by the whole supply chain are currently in progress. There are reasons to believe that the Baja California wine cluster has already passed the challenging learning curve of gaining supply chain’s members cohesion. Early in 2000, the wine industry in Baja California faced a challenging crisis, when a major wine producer stopped purchasing grapes grown in the region. However, with the participation of wine grape producers, governmental authorities, and wine producers, the industry overcame the problem and focused on strengthening product quality, number of firms, and industry organization. However, market shares of wines from Baja California are still negligible in international markets and low (30%) domestically. This case study provides information to assess the position of the Baja California wine industry in both the domestic and globally. Baja California The State of Baja California in Mexico (Figure 1), which is bordered on the North by California in the United States, is the largest and most important wine production area in 1 Mexico. With a total of 2,800 hectares of grapes for wine (Table 1), Baja California accounts for approximately 85% of the total area planted in Mexico and more than 90% of total wine produced in the country. This amounts to 13.5 million 750 ml bottles of wine, of which 70% is red wine. Wine production in Baja California takes place mainly in the Valley of Guadalupe (Table 2). This valley has been said to have the perfect climate and soil conditions for grape growing (WineCountry (2007)), and is the house of leading wineries such as LA Cetto and Casa Pedro Domecq. According to a Euromonitor (2010) staff report, wines from Baja California have received much international recognition, and are highly appreciated, mainly in the United States. Figure 1 – Map of Mexico and the State of Baja California Table 1 – Grape-for-Wine Producers in Baja California as of 2008 Category of grape for wine producer Small Mid Big Total Less than 20 hectares From 20 to 50 hectares More than 50 hectares Number of producers Actual 1 hectares 132 22 14 168 1 772 725 1,303 2,800 % 28% 26% 47% 100% Potential hectares2 /////////////////// /////////////////// /////////////////// 8,000.0 Notes: (1) Assembled from the Mexican Cluster of Wine Staff Report, 2008, and SEFOA (2) Projected for 2013 in Sanchez-Zepeda, 2008 (Sánchez-Zepeda (2008)) The Mexican wine industry is far from being considered an important international player in terms of volume (total wine production in Mexico is equivalent to approximately one tenth of wine production in Chile, which is ranked 10th in the world (Castaldi, Cholette and Frederick 2 (2005)). Even within Mexico, in 2008, the estimated market share of Mexican wines in Mexico was only 30%. The remaining 70% of the market was dominated with imported, low priced wines, below $8.50 USD (Wine (2008)). Table 3 provides historical statistics on the Mexican wine industry. Sales volumes, values, price segments and wine by grape varieties are provided from 2004 to 2009. Table 2- Varieties of Grapes for Wine Production by Locations in Baja California as of 2009 (in hectares) Variety Tecate Palmas Tijuana V. de Gpe El Tule San Rafael Uruapan Sto Tomas S.Vicente Total Cabernet Sauvignon 3.54 1.20 372.03 11.36 19.50 55.94 129.27 592.84 Chenin Blanc 2.00 100.48 0.06 6.00 15.29 92.90 216.73 Merlot 1.00 121.03 3.50 9.17 11.00 22.73 36.85 205.28 Grenache 125.96 4.25 0.90 27.69 158.80 Nebbiolo 1.12 106.67 0.06 4.00 0.19 44.13 156.17 Chardonnay 90.10 0.06 33.70 22.00 145.86 Zinfadel 62.90 77.05 139.95 Tempranillo 2.71 63.65 1.29 9.50 20.96 27.98 126.09 Sauvignon Blanc 70.22 4.24 47.32 121.78 Syrah 1.00 62.20 3.81 19.50 15.00 11.30 112.81 Petite Syrah 80.03 2.00 28.32 110.35 Colombard 10.01 2.98 71.50 84.49 Rubi Carbenet 28.32 42.54 70.86 Barbera 7.78 20.25 34.05 62.08 Carignane 41.44 12.19 1.00 54.63 Cabernet Franc 31.51 1.56 3.72 36.79 Sangiovesse 7.45 26.00 33.45 Mission 7.28 9.85 10.12 4.25 31.50 Other 0.30 215.63 4.50 4.65 0.50 11.94 77.95 315.47 Total 14.95 5.20 62.90 1,621.41 34.00 32.02 86.37 224.28 694.80 2,775.93 % 0.5% 0.2% 2.3% 58.4% 1.2% 1.2% 3.1% 8.1% 25.0% 100.0% % 21.4% 7.8% 7.4% 5.7% 5.6% 5.3% 5.0% 4.5% 4.4% 4.1% 4.0% 3.0% 2.6% 2.2% 2.0% 1.3% 1.2% 1.1% 11.4% 100% Source: Assembled from data in Sepúlveda-Betancourt, 2009. Varieties with less that 1% share were grouped as “other”. 3 Table 3 –Selected Statistics on Mexican Wines, 2004/2009 2004 2005 2006 2007 2008 2009 Volume (million liters): Still Light Grape Wine Still Red Wine Still White Wine Still Rosé Wine Sparkling Wine Champagne Other Sparkling Wine Fortified Wine & Vermouth Port/Oporto Sherry Vermouth Total Wine (million liters) 24.9 16.3 7.4 1.3 6.1 0.4 5.8 9.9 0.1 9.4 0.3 40.9 29.9 19.6 8.7 1.6 6.5 0.4 6 9.7 0.1 9.3 0.3 46.1 31.7 20.8 9.2 1.7 7.3 0.5 6.8 10.6 0.1 9.9 0.5 49.6 40 26.4 11.6 1.9 9.3 0.6 8.8 12.4 0.1 11.6 0.7 61.6 41.4 30.3 9.1 2 9.5 0.6 8.9 13.9 0.1 13.2 0.6 64.8 42.4 31.3 9.2 1.9 9.4 0.5 8.9 14.1 0.1 13.4 0.6 66 Off-trade (million liters) On-trade (million liters) 16.5 24.5 19.2 26.8 20.9 28.7 26.1 35.5 27.7 37.1 28.3 37.7 7,081.20 8,077.70 8,908.10 11,274.70 12,938.60 15,608.50 Total Value Wine (Mx$ million) Volume Sales of Still Red Wine by Price (% off-trade should add up 100%) Under MX$35.99 MX$36 to MX$64.99 MX$65 to MX$90.99 MX$91 to MX$119.99 MX$120 to MX$149.99 MX$150 to MX$199.99 MX$200 and above 1.8 11.3 24.4 25.5 15.4 17.5 4.1 1.6 10.2 22.9 26 16.3 18.4 4.7 29.8 20.6 27.4 17.5 17.8 4.9 - - 9.5 19.5 28.1 19.3 18.6 5 8 17.8 28.9 20.5 19.3 5.7 9.2 18 29 20.8 19.8 3.2 2.4 21.6 27.8 29.4 14.6 4.3 1.1 20 26.5 28.6 18 5.8 1 20.8 28.2 29.3 17.4 3.3 Volume Sales of Still White Wine by Price Segment (% off-trade should add up 100%) Under MX$35.99 MX$36 to MX$64.99 MX$65 to MX$90.99 MX$91 to MX$139.99 MX$140 to MX$199.99 MX$200 and above 5.1 24.5 29.7 27.6 10.8 2.3 4 23.6 28.6 28.9 11.3 3.7 3.6 22.4 28.4 29.5 12.3 3.8 Volume Sales of Still Rosé Wine by Price Segment (% off-trade should add up 100%) Under MX$35.99 MX$36 to MX$64.99 MX$65 to MX$71.99 MX$72 to MX$90.99 MX$91 to MX$139.99 MX$140 to MX$199.99 MX$200 and above 2 16.8 19.8 27.1 26.5 5.2 2.7 1.4 16.3 19 27 27.3 5.8 3.3 1.1 14.5 18.4 26.5 28.6 6.9 4 14 17.9 25.4 29 9.1 4.7 Sales of Still Red Wine by Grape/Varietal Type (% of total volume, should add up 100%) Cabernet Sauvignon 57 56 55 54.5 Lambrusco 1 1 2 1.5 Merlot 9 10 10 10.5 Shiraz/Syrah 4 4 4 4.3 Tempranillo 28 28 28 28.3 Others 1 1 1 1 13 16.5 24 29.5 11.6 5.4 14 17.6 26.1 27 12.2 3.1 54.6 1.3 10.4 4.1 28.4 1.4 - Sales of Still White Wine by Grape/Varietal Type (% of total volume, should add up 100%) Chardonnay Chenin Blanc Riesling Sauvignon Blanc Others 33 2 36 26 3 32 2.5 36 26 3.5 32 2.5 36 27 2.5 34 1.8 35 27.3 2 34.2 1.5 35.3 27.3 1.8 - Sales of Still Rosé Wine by Grape/Varietal Type (% of total volume, should add up 100%) Zinfandel Others 38 62 38 62 38 62 38.5 61.5 38.8 61.3 - Source: Assembled with data in Euromonitor (2010) 4 Per capita consumption of wine in Mexico is very low – less than one liter – compared to other countries like the US (almost 7 liters) and France (25 liters). Though both the Mexican wine industry and per capita consumption are small, there is growth in per capita consumption of wine in Mexico. Forecasts predict cumulative growth rates of 10% in the value of the Mexican wine industry for the 2010-2014 period, and 8% cumulative growth in terms of volume (Euromonitor (2010)). Table 4 provides forecasts for volumes and values by Euromonitor, from 2010 to 2014. Table 4 –Forecast for The Mexican Wines Industry by Euromonitor, 2010/2014 Still Light Grape Wine Still Red Wine Still White Wine Still Rosé Wine Sparkling Wine Champagne Other Sparkling Wine Fortified Wine & Vermouth Port/Oporto Sherry Vermouth Total Wine Volume (million liters) Still Light Grape Wine Still Red Wine Still White Wine Still Rosé Wine Sparkling Wine Champagne Other Sparkling Wine Fortified Wine & Vermouth Port/Oporto Sherry Vermouth Total Wine Value (Mx$ million) 2010 2011 2012 2013 2014 45.3 34.1 9.4 1.9 9.5 0.5 9 15 0.1 14.3 0.6 69.9 48.9 37.4 9.6 1.9 9.7 0.5 9.2 16 0.1 15.3 0.6 74.6 53.8 42 9.9 1.9 9.9 0.6 9.3 17.3 0.1 16.6 0.6 81 60 47.9 10.2 1.9 10.1 0.6 9.5 19 0.1 18.2 0.6 89 67.7 55.2 10.5 2 10.3 0.6 9.6 21.1 0.1 20.3 0.6 99 11,483.40 8,927.00 2,147.90 408.5 3,144.80 707.3 2,437.50 2,222.40 53.1 2,010.70 158.6 16,850.60 12,719.90 10,052.70 2,249.30 417.8 3,242.40 742.2 2,500.10 2,401.80 54.4 2,183.90 163.5 18,364.00 14,371.00 11,577.10 2,366.70 427.2 3,373.60 806.8 2,566.80 2,637.90 55.9 2,413.20 168.8 20,382.50 16,348.70 13,447.30 2,463.80 437.5 3,533.30 890.8 2,642.50 2,921.50 57.2 2,690.10 174.1 22,803.50 18,750.30 15,690.40 2,609.30 450.6 3,676.40 955.4 2,720.90 3,272.90 58.5 3,034.20 180.3 25,699.60 Source: Assembled with data in Euromonitor (2010) At the same time, per capita consumption of wine is declining in some countries with the highest per capita consumption (e.g., France, Italy, and Spain) (Table 5). The expected growth in Mexico is attributed in part to an emerging culture for wine, where Mexicans are switching 5 from consumption of spirits to wine. This trend is driven by increases in food consumption away from home and conscious efforts of wine firms to push sales in restaurants. The fastest growing wine category in Mexico is the basic premium red wine segment (Euromonitor (2010)), particularly Cabernet Sauvignon (which accounts for 55% share of sales). Wine tasting events, wine fairs and classes are used by the industry to try to teach consumers and increase demand for wines. Awareness of wine culture is growing fastest amongst women and the younger population. In addition to growth in domestic consumption, there is potential for growth in international recognition of Mexican wines, due in part to recent international awards won by Mexican wines, and the effort by Mexican authorities to boost tourism in the Valley of Guadalupe. Table 5- Year to Year Growth (%) in Per Capita Consumption of Wine, Selected Countries Argentina Australia Belgium Canada Chile France Germany Italy Mexico Netherlands Portugal Russia South Africa Spain United Kingdom USA World 2000-01 2001-02 2002-03 2003-04 2004-05 2005-06 2006-07 2007-08 2008-09 -4.8 -2.1 -0.8 -12.3 -2.5 2.6 -3.5 -5.4 -4.5 2.2 0.5 0.9 1.7 -0.3 -0.7 0.4 0.4 0 1.6 1.5 3.2 -0.4 2.1 2 2.2 2.1 2.3 4.9 4.2 3.8 1.6 4.3 5.1 7.1 4.3 1.8 25 1.4 -0.4 4.5 -2.7 -11.3 4.6 -4.7 1.5 -4 -3.3 -1.5 -2.6 -2.5 -2.2 -1.1 -2 -1.6 2.8 1.8 2.8 0.6 -1.1 0.7 0.4 0.1 0 -4.3 -9.1 -5.1 -3.5 1.3 -2.1 -0.4 -1.5 -1.9 2.7 5 6.9 -12.6 15.7 7.6 23.4 4.8 1.1 5 4.7 4.3 6.2 4.6 3.3 3.4 2.9 2.4 -2.9 -0.7 1 -5 -1.3 -2.1 -1.3 3.2 2.5 10 8.6 9 9.1 8.4 -1.9 10.2 3.7 -5.1 0.7 -1.7 -11.1 -0.3 3.1 1.8 1.8 1.6 1.1 -4.5 -2.8 -3 -1.3 -2.4 -2.6 -3.2 -4.4 -5.7 5.4 5.1 3.2 2.1 3.9 0.9 1.4 0.3 0.4 0.1 4.4 3.1 2.2 1.2 1.7 2.1 2.2 2.6 -0.7 -0.4 0.4 -0.7 0.6 0.1 1.2 0.2 -0.6 Source: Assembled with data from the Euromonitor Data Base - Alcoholic Drinks: Euromonitor from trade sources/national statistics. Accessed on June 7, 2010. The Global Industry The global wine industry is estimated to be worth $256.4 billion USD and accounts for 27 billion liters as of 2009 (this compares to 19 billion liters for spirits and 184 billion for beers) (Euromonitor (2010)). Per capita consumption of wine in some of the historically wine 6 consuming countries has been declining, and the overall global wine industry has not grown in the last decade (Table 5). Figure 2 shows per capita consumption of wines globally. However, the share of wine production that is traded internationally is twice as much as it was two decades ago (Anderson (2004)), with economic gains for the so called New World producers (i.e., represented mainly by Australia, Chile, the US, and South Africa) and drastic reductions in domestic consumption and exports for traditional premium wine producers, also known as Old World producers (i.e., France, Italy, Germany, and Spain). Figure 3 provides wine volumes for the major wine producing countries, importers, and exporters, comparing 2003 and 2008. Though globalization of the wine industry has been occurring, it has not resulted in homogenization of this product (Anderson (2004)). In fact, wine is the most fragmented alcoholic drink category. By 2002, the world market share of the three largest wine companies was 7%, compared to 25% for beer, 27% for coffee, 43% for spirits, and 80% for soft drinks (Deshpandé, Herrero and Reficco (2008)) 1. Figure 2- Per Capita Global Consumption of Wine, 2009 Source: Euromonitor (2010) 1 Exhibit 2 in Deshpandé, Herrero, and Reficco, 2008. 7 Figure 3- Top Ten Wine Countries, 2003 and 2008 Figure 3- Major Wine Producing Countries Source: Euromonitor (2010) Bartlett (2003) illustrates the different views reflected on wine making practices behind that fierce competitive battle between New World and Old World wine producers, quoting the following statements: It’s an art, not a science. We are creating products that are crafted, just as an artist or a chef would create. Jean Claude Boisset, CEO of a French wine company We bring a total commitment to innovation… from wine to palate. Mission Statement, Australia Wine Foundation Old World producers have relied on product attributes to dominate the wine market for centuries, defining tastes and quality (Cholette, Castaldi and Frederick (2005)). European nobility began planting vineyards by the Middle ages as a mark of prestige, creating the niche market for premium wines, and the French nurtured the concept of terroir, the combination of soil, aspect, 8 microclimate, rainfall, and cultivation that they believed provided the unique taste of each region’s wines (Bartlett (2003)). The industry, under the domination of Old Wine producers, had been a producer-centered craft derived from the combination of terroir and tradition (Deshpandé, Herrero and Reficco (2008)). However, New World producers have represented a real threat and headache for Old World producers during late 1990s and 2000s. While the share of global exports is still dominated by Old World producers, beginning in the mid 1990s, the gap between share held by Old World producers and New World producers started to decrease. For instance, in the mid nineties the share of global exports by Old World countries represented 76% compared to 8% by the New World producers. In 2000, those numbers were 71% and 15%, and as of 2004, Old World producers held 62% compared to 24% by the New World producers (Deshpandé, Herrero and Reficco (2008)). By 2003, Old World producers became even more concerned, as for the first time, Australia won the battle with France for the majority of share in the UK market, holding position as the main wine importer both in terms of quantity and value. Cholette, Castaldi and Frederick (2005) identify five key factors needed to compete favorably in the global wine industry: a strong domestic market, domestic market growth potential, economies of scale advantage, industry adaptability to change, and potential to attract foreign investment. They assess the competitive advantage of selected nations considering those key factors. Results are summarized in Table 6. Table 6 – Overall Competitive Advantage of Selected Wine Producing Nations Competitive Advantage Country Australia (NW), Chile (NW), USA (NW) Strong Moderate Argentina (NW), South Africa (NW), Italy (OW), and Spain (OW) Weak France (OW) and Germany (OW) Source: Cholette, Castaldi and Frederick, 2005. Several authors agree that there has been a structural transformation in the global wine industry, and that this transformation is more a result of actions of New World producers rather than by exogenous forces (Bartlett (2003), Roperto (2005), Castaldi, Cholette and Frederick (2005), and Deshpandé, Herrero and Reficco (2008)). Table 7 summarizes some of the main 9 attributes considered as important distinctions in the wine industry for the New World (NW) and the Old World (OW) wine producers. Table 7 – Main Attributes in the Wine Industry Premium Segment While the quality standard was defined by OW, NW producers overcame this attribute by penetrating this segment with high quality wines. Label OW producers based their labeling system according to appellations of origin, which used to represent a competitive advantage for them. This proved to be confusing for consumers (Cholette, Castaldi and Frederick (2005)). NW producers took the opportunity to change this labeling system by using a labeling system based on grape varieties. This gave them the opportunity to educate consumers on grape qualities. In addition, as NW producers were not as highly regulated, therefore, they were able to use colorful and innovative labels (Deshpandé, Herrero and Reficco (2008)). Terroir While this was almost mystified by the French (Bartlett (2003)), some experts believe that the terroirs of NW producers were superior or at least more reliable than those of the OW producers (Porter and Bond (Rev. 2008)). Demand OW countries still have a higher per capita consumption compared to NW countries. However, consumption is decreasing in OW while is increasing in NW countries (Figure 3). Costs There is not a clear cost advantage. While some NW producer countries like Australia have a cost advantage, this is not the case in other nations, like the US. However, in general, economies of scale in NW countries have allowed more concentration, which yield higher margins for those firms. Regulation This is one of the most important constraints for OW nations that are highly regulated in terms of grape and wine production In contrast, NW producers have more freedom to innovate and invest in research and development, and have better flexibility to respond to consumers preferences. Production OW producers have to maintain traditional production methods, and follow conservative oenology practices. In contrast, NW producers are flexible in this regard, which has allowed them to be able to offer easy to drink, fruity wines (Deshpandé, Herrero and Reficco (2008)). Also, due to the fragmentation of wineries in OW countries, they have on average, small and outdated facilities, compared with modern facilities in NW countries. Source: Adapted from Deshpandé, Herrero and Reficco (2008); Bartlett (2003). Other sources are cited accordingly. Viticulture in Baja California and the 2000 crisis The history of viticulture in Baja California Mexico can be traced back to the late eighteen century when Jesuit and Dominican friars first planted grapes and produced wines in 10 that area 2. Because Baja California shares a border with California (US), the region is often impacted by developments in the United States. From 1920 to 1934, the sale, manufacture, and transportation of alcohol in the US was prohibited (Volstead Law), allowing for further development of the wine industry in nearby Baja California. Later, in 1976, California (US) wines won a highly publicized wine tasting competition in France. In the late 1970s, several industries and events in California helped the by then emerging wine industry in the U.S. (development of tourism, development of the “California Cuisine”, increasing demand for wines in America, and so on) (Porter and Bond, 2008). Due to its geographical proximity with Napa Valley, the wine industry of Baja California benefited from these events as well. During this time period, the industry was reconfigured as a more modern industry –with technology imported from Italy, France and the US, and well trained oenologists. Just as the Mexican wine industry started to grow in the late 1970s and early 1980s, the Mexican economic crises of the mid 1980s and mid 1990s occurred, seriously affecting the Mexican wine industry. Between 1984 and 1988, the number of vineyards in Mexico decreased by 36% (Sánchez-Zepeda (2007)) 3. Though the number of vineyards decreased, it was during the same years that some of today’s most competitive wineries entered the Baja California industry by purchasing wineries that went bankrupt due to the economic crises. These new entrants may have perceived Mexico’s “openness” to free trade agreements as an opportunity to move towards quality wines and updated production technology to that industry (Covert (2009)). Firms that entered in this time period include Monte Xanic (founded in 1987), Chateau Camou (1995), Casa de Piedra (1997), Viñas Liceaga (1983), and Cavas Valmar (1983). By the early 2000s, the main wine firms in Baja California were Bodegas Santo Tomas, Casa Pedro Domecq (Domecq), and LA Cetto. The three winemakers were supplied by a large number of small grape producers located mainly in three areas, the Valleys of Guadalupe, San Vicente, and Santo Tomás. It is estimated that more than 2,000 hectares of grapes were planted in Baja California by small producers to supply these three firms. At least 50% of this production, equivalent to approximately 5,000 tons, was contracted by Domecq. Participants of the wine industry in Baja California were shocked in 2001 when Domecq, a subsidiary of the international firm Pernod Ricard, announced to producers and governmental 2 In California, US, the first vintners are documented to come from Spain at the same time (Porter and Bond, 2008) This decrease included States in Mexico with wine tradition other than Baja California (e.g., Aguascalientes, Coahuila, Queretaro and Zacatecas). 3 11 authorities in the State of Baja California that due to market pressures it would stop buying grapes from small producers in Baja California. Domecq’s decision was driven by the market (i.e., imports gave the Mexican consumer more choices), as changes in tastes and preferences of consumers had led to switches in the types of wine being consumed. Thus, Domecq felt they needed new grape varieties and grapes of higher quality to produce wines that satisfy consumer preferences. However, the supply of grapes in Baja California for wines such as Cabernet Sauvignon, Merlot, Tempranillo (red wines); Chardonnay, Riesling, and Sauvignon Blanc (white wines); and Zinfandel (Rosé wines), would require years to develop due to the nature of the production process. Building quality reputation and brand recognition would also require time. As a result of the Domecq decision, in 2001 and 2002 several small grape-for-wine growers went bankrupt and abandoned grape production (Figure 4). Figure 4 – View of fields from grape producer in Baja California as of 2002 Source: Secretaría de Fomento Agropecuario, Baja California Government Support Though Domecq announced they would stop buying grapes, they did try to honor production contracts with growers; however, they did not pay the prices expected by grape producers to cover their costs. To mitigate the problem, the government of the State of Baja California compensated 50 of the most affected producers with $275 Mexican pesos per ton, equivalent to approximately 10% of the market value of grape expected by producers by them (expected market value estimated between $2,600-$3,000 Mexican pesos). While this support by the government alleviated the financial problems faced by small grape producers, it was not enough to keep all farmers from abandoning their fields. 12 The governmental institution in charge of supporting agribusinesses in Baja California, Secretaría de Fomento Agropecuario (SEFOA), estimated that 94 producers, with a total of 1,200 hectares, were affected by Domecq not buying “old” varieties of grape for wine production (Table 8). The total area planted by producers affected by 2001 represented almost one half of the total area planted in the State of Baja California, with approximately 500 hectares of production were located in the Valley of Guadalupe. Due to the magnitude of damage, the recovery of the grape-growing industry would only be achieved by coordination of all the participants in the wine chain supply the following years. Table 8- Small Grape Producers in the State of Baja California, Affected in 2001/2002 Zone Valley of Guadalupe Number of Producers Hectares 40 497 San Antonio De Las Minas 18 152 Santo Tomás 21 289 San Vicente 15 294 Total 94 1,232 Varieties Grenache, Moscatel, Zinfadel, Palomino, Thompsom, Carignane, Mission, and Valdepeñas Chardonay, Zinfandel, Thompsom, Palomino, Carignane, Vioñe, and Moscatel Palomino, Thomsom, Mission, Rosa de Peru, Grenache, and Carignane Chardonay, Grenache, Valpeñas, Barbera, Mission, Moscatel, Thompsom, and Colombard Source: elaborated by authors from information compiled by Secretaria de Fomento Agropecuario of the State of Baja California Opportunities in the crisis As the wine industry in Baja California was in the middle of a crisis, some local entrepreneurs found this to be an opportunity. Aware of the excess supply of grapes, businessmen with economic activities other than wine decided to enter the wine industry. 13 Although these were new participants in the industry, they were advised by oenologists, and learned how to produce wine. These new entrants were known locally as “huatequeros”. The huatequeros focused on producing wines in small quantities. Due to the excess supply of grapes, they were able to negotiate for good quality raw materials at reasonable prices. However, because they were producing only small quantities of wine, they could only survive if they were able to produce high quality products, and thus garner higher margins. At the same time these new producers were focusing on quality grapes, Domecq offered technical help to producers willing to switch their production to the new varieties demanded by consumers. The firm was, however, unable to offer future buying contracts since the market was uncertain. As a result of the efforts of Domecq and the huatequeros, producers established vineyards with grapes that were resistant to plagues and diseases with the purpose of grafting them with the desired varieties. Eventually, Domecq was unable to buy the large quantities of the new varieties everyone expected due to “internal problems.” This created further opportunities for the huatequeros. The Rural Grape Growing Project by SEFOA The Secretaría de Fomento Agropecuario (SEFOA) from the State of Baja California, a governmental institution supporting agribusinesses, realized how difficult it was for wine grape producers to be in such an uncertain situation. To face the problem, SEFOA promoted a “Rural Grape Growing” project. In its first stage, the project focused on learning about the industry by conducting surveys while visiting all grape producers in the State of Baja. This allowed the government to assess the potential for supply in the area, as well as the conditions of the orchards. The technical work was lead by Mr. Reyes, a former production manager from Bodega Santo Tomás, one of the best known firms in Baja California. The work was initiated in September of 2002. After 6 months, the following preliminary actions were considered as a necessity: 1. To provide technical support to growers, 2. To contract scientists with experience to evaluate the current field practices, 3. To orient governmental support programs towards the infrastructure necessities detected on the field visits, and 4. To acquire mobile equipment for the wine production. Such equipment should be transported from farm to farm. Thus, small producers could process grapes without having to invest on their own. 14 The federal and state governments defined as a both production and processing of wine as a priority in the State of Baja California, authorizing exceptional support for the rehabilitation and maintenance of the orchards, and for the acquisition of fixed assets. These actions by SEFOA and the Mexican federal government allowed producers to continue producing and developing the vineyards, even though their harvest revenues were very low, and in some cases zero. In May 2003, representatives of small grape producers, three main buying winery firms, and representative of SEFOA and the Mexican Federal government, met in a farm in the Valley of Guadalupe to discuss the problems the industry was facing. That meeting was considered by participants not only as symbolic, but very important for practical reasons, since players from all parts of the wine supply chain tried to find pragmatic actions to benefit the industry as a whole. After more than four hours of discussions, they identified four possible alternatives worth further exploration: a) find other possible buyer (wineries) in Mexico, b) sell grapes for fresh consumption, as opposed to grapes for wineries, c) produce wine in small quantities (micro wineries), and d) change grape varieties. In 2003, the Mexican government supported nurseries to establish reproduction patterns to produce grafts for the new varieties demanded by the market. The grafting would occur during the years 2004 and 2005 in Baja California orchards. To support this investment in the future of the wine grape industry, 50% of the cost was covered by the government. The varietal reconversion was planned in stages so that grape producers would gradually add the production of the new varieties, while maintaining some “old” varieties to harvest for revenue (with economic support by the government). In Mexico, a System-Product is an official organization (i.e., a committee for rural development) governed by the Mexican Department of Agriculture. This organization is integrated by government officials and by representatives of all the supply chain value of strategic products, as defined by the Mexican Department of Agriculture in their National Plan for Development. The objectives of system-products are: i) achieve consensus on national production programs, ii) establish plans for strategic expansion or reduction of level of production according to conditions in the market, iii) establish strategic alliances and negotiations for the integration of chain values, iv) define norms and procedures for commercial transactions and for derivatives products, v) participate in the definition of tariffs, quotas, and 15 other imports modalities, and vi) generate mechanisms for consensus among producers, marketers, and the government. Based on the cohesion of the industry to work together to deal with the crisis and develop new varieties, an official cluster for the Baja California wine industry was established in 2004 4. The cluster integrated people from the government, the industry, and NGO representative (Table 9), and eventually included people from universities and research institutions. The development of a wine cluster is relevant because one of the goals of the cluster is to o play an active role in state and federal lobbying and promote quality wine production in Baja California. Additionally, Porter and Bond (Rev. 2008) note that some regions in Latin America, Eastern Europe, and China had always had the necessary terroir for wine grape growing but had not developed competitive wine clusters. Table 9- Baja California Cluster of Wine, Created in 2004 Name Representation J. M. Salcedo Ministry of Agriculture Representative F. J. Sarmiento Perez Director of Agriculture, SEFOA, institution in charge of the support for agribusinesses in Baja California F. Mosqueda Ministry of Agriculture Representative E. Aguilar Industry Representative F. Varela NGO Representative M. Torres Distribuitors Representative V. Torres Industrial Representative M. Cobos Responsable for the Product Systems in Baja California Current Status of Wines in Baja California The number of wineries in Baja California grew from twelve to around fifty from 2003 to 2008 (Table 10) 5. As of 2008, around 170 wine grape growers cultivated 2,800 hectares in Baja California (Table 1), a State with a potential or capacity of 8,000 hectares (Wine (2008)). Table 2 provides grape varieties produced in Baja California as of 2009, and Table 8 shows those 4 For additional information refer to the Mexican Department of Agriculture’s web site, http://www.sagarpa.gob.mx/agricultura/Publicaciones/SistemaProducto/Paginas/default.aspx}, accessed on February 2010 5 The Mexican Cluster of Wine (2008) reports 7 wine producers in 1995 and 57 in 2008. 16 varieties that were produced in 2002. Table 10 – Grape-for-Wine Producers in Baja California as of 2008 Category of wine producer Small Mid Big Total Less than 50,000 bottles 50,000 to 500,000 bottles More than 500,000 bottles Number of producers 750 ml Bottles 39 4 3 46 70 1,674 11,456 13,200 % 85% 9% 7% 100% Notes: Assembled from information by SEFOA and estimations in the Mexican Cluster of Wine Staff Report, 2008 Wines from Baja California, and particularly from the municipality of Ensenada 6, have started to be recognized internationally. However, with only 5% of total production in Mexico exported, the domestic market remains the most important market for Mexican wines. In 2008, three firms held more than 30% of market share in Mexico, with two of the firms from Baja California (L.A. Cetto in the top with 12.5%, and Bodegas Santo Tomas with 8%) (Datamonitor (2009)). Wines from Baja California are sold in Mexico at prices fluctuating between $100 to $300 Mexican pesos per 750 ml bottle (from $8.50 to $25 USD). Imported wines are sold, on average, at prices around $10 USD or below in supermarkets and hypermarkets (Table 11 shows the share of wine distribution in Mexico as of 2008). The three leading sources of imports are Chile, Argentina, and Spain, with total imports from all countries accounting for an estimated 70% of consumption of wine in Mexico. Deshpandé, Herrero, and Reficco (2008) cited a study by a Chilean Winery, Montes Wines, that identified the wine price segments with the highest growth prospects as those in the $10-14 range, followed by the $14-25 and $7-10 segments. Major challenges facing the wine industry of Baja California in 2009 include the high level of taxes charged in Mexico to wines; inexpensive imported wines, which accounted for 30% of the total domestic wine market; the problem of water supply shared by most states in the north of the country; the low volume of wine produced in Mexico; and the lack of promotion to boost the culture of wine in the country. Baja California wine participants were proud of having the terroir for wine production; and were willing to find ways to better fulfill the growing domestic demand. 6 The municipality of Ensenada includes the areas Valley of Guadalupe, El Tule, Uruapan, Santo Tomas, and San Vicente, as shown in Table 2 17 Table 11 – Distribution shares in the Mexican wine market Supermarkets & Hypermarkets 41% Specialists Retailers 27% On-trade 27% Other 5% Total 100% Source: Datamonitor (2009) 2009 was a very difficult year for the wine industry in Mexico. Not only was there a global recession that impacted the industry, but an outbreak of swine flu caused all activities to be suspended for two weeks in May, decreasing growth rates seen in previous years (Table 5). The main source of competition remains Chilean wineries that continue to offer low prices and acceptable quality, and to the popular opinion in Mexico that foreign wine is superior. Following the New World labeling strategies, Mexican wineries are using innovative labeling to reach the young market in Mexico. For instance, Bodega Santo Tomas re-launched its ST lines with a new design and a “fresh and young, no complications” slogan. Many brands, such as Cinco Estrellas and Estacion El Porvenir from Baja California are using an atypical label for wines (Figure 5). Figure 5 – Selected labels of Mexican Wines Question Given the current organization and the recent history of Baja California within the context of the global industry, students are asked to discuss the opportunities for the Baja California industry in both the domestic and international markets. 18 Acknowledgements This is an ongoing project on the Mexican wine industry with the collaboration of faculty from Universidad Panamericana, Colegio de Postgraduados de Ciencias Agricolas de Mexico, and the University of Florida. A Master of Agribusiness Management thesis (granted by Colegio de Postgraduados de Ciencias Agricolas de Mexico) has been completed by Francisco Javier Sarmiento under the co-direction of Professors Carlos Trejo-Pech, and Carmen Lopez-Reyna. Also, an undergraduate honors thesis has been completed by Allison Covert (granted by the University of Florida) under the direction of Professor Lisa House. An additional undergraduate thesis is in progress by a student of Universidad Panamericana at Guadalajara. References Anderson, Kym, ed., 2004. The World’s Wine Markets (Edward Elgar Publishing Limited, UK). Bartlett, Christopher A., 2003, Global Wine Wars: New World Challenges Old (A), Harvard Business Publising Case Studies Series Case number 9-303-056. Castaldi, Richard, Susan Cholette, and April Frederick, 2005, Globalization and the Emergence of New Business Models in the Wine Industry, International Business and Economic Research Journal Vol. 4 Issue 3. Covert, Allison M., 2009, The Mexican Wine Industry: Past, Present and a Glance into the Future of Pedro Domecq, Unpublished undergraduate honors thesis under the direction of Lisa House, University of Florida. Cholette, Susan, Richard Castaldi, and April Frederick, 2005, The globalization of the Wine Industry: Implications for Old and New World Producers, Proceedings Fourth International Business and Economy (IBEC) Conference, Honolulu, Hawai, 2005. Datamonitor, 2009, Mexico - Wine, Datamonitor Industry Profile. Accessed at ISI Emerging Markets August 2009. Deshpandé, Rohit, Gustavo Herrero, and Ezequiel Reficco, 2008, Concha y Toro, Harvard Business Publising Case Studies Series Case number 9-509-018. Euromonitor, 2010, Global Wine: Challenges and Oportunities Facing the Wine Industry, Euromonitor International - May 2010 Report Accessed from the Euromonitor data base on June 20, 2010. Euromonitor, 2010, Wine - Mexico, Euromonitor International: Country Sector Briefing January 2010. Porter, Michael, and Gregory Bond, Rev. 2008, The California Wine Cluster, Harvard Business Publising Case Studies Series Case number 9-799-124. Roperto, Michell A., 2005, Robert Mondavi and The Wine Industry, Harvard Business Publising Case Studies Series Case number 9-302-102. Sánchez-Zepeda, Leonardo, 2007, Aproximación a la incidencia de la industria vinícola en el desarrollo del Valle de Guadalupe (Mexico) y la Manchuela (España), Unpublished PhD dissertation, Universidad de Castilla La Mancha, Spain Accessed on August 14, 2008 at: http://www.eumed.net/tesis/2007/tesislsz/9.htm. 19 Sánchez-Zepeda, Leonardo, 2008, Valles Vitivinícolas de Ensenada, Presented at the First Forum of the Viniculture Industry in Mexico (I Foro Legislativo de la Industria Vitivinícola), Ensenada, Baja California Available at vidyvino.org/ponenciaspdf/memoria_del_1er_foro_legislativo.pdf, accesed on May 2010. Wine, Mexican Cluster of, 2008, Sistema Producto Vid de Baja California, A Report by the Mexican Cluster of Wine (Sistema Producto Vid de Baja California) Accesed at http://vidyvino.org/, on June 2010. WineCountry, 2007, Baja Begins - Exploring California's Other Wine Country, http://discover.winecountry.com/wine/2007/09/baja-begins-exploringcaliforn.html#more. 20