Bus 411 assignment three Sp 14

advertisement

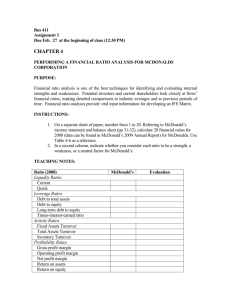

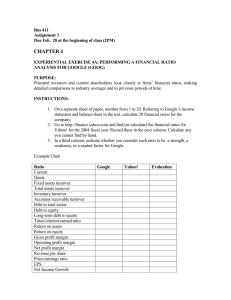

Bus 411 Assignment 3 Due Feb 24 at the beginning of class (2:00 PM) CHAPTER 4 ASSURANCE OF LEARNING EXERCISE 4C: PERFORM A FINANCIAL RATIO ANALYSIS FOR WALT DISNEY PURPOSE: Financial ratio analysis is one of the best techniques for identifying and evaluating internal strengths and weaknesses. Potential investors and current shareholders look closely at firms’ financial ratios, making detailed comparisons to industry averages and to previous periods of time. Financial ratio analyses provide vital input information for developing an IFE Matrix. INSTRUCTIONS: 1. On a separate sheet of paper, number from 1 to 20. Referring to Disney’s income statement and balance sheet (pp. 26–27), calculate 20 financial ratios for 2011 for the company. Use Table 4-6 as a reference. 2. Step 2 In a second column, indicate whether you consider each ratio to be a strength, a weakness, or a neutral factor for Walt Disney. TEACHING NOTES: Ratio (2011) Liquidity Ratios Current Quick Leverage Ratios Debt to total assets Debt to equity Long-term debt to equity Times-interest-earned ratio Activity Ratios Fixed Assets Turnover Total Assets Turnover Inventory Turnover Profitability Ratios Gross profit margin Operating profit margin Net profit margin Return on total assets Return on Stockholders’ equity Price-earnings ratio Walt Disney Evaluation EPS Growth Ratios Sales Growth % (3-year)* Net Income Growth % (3-year)* Earnings per share Growth % (3-year)* Dividends per share Growth % (3-year)* *Use 2008, 2009, 2010 & 2011 Data ASSURANCE OF LEARNING EXERCISE 4D: CONSTRUCTING AN IFE MATRIX FOR DISNEY CORPORATION PURPOSE: This exercise will give you experience in developing an IFE Matrix. Identifying and prioritizing factors to include in an IFE Matrix fosters communication among functional and divisional managers. Preparing an IFE Matrix allows human resource, marketing, production/operations, finance/accounting, R&D, and management information systems managers to articulate their concerns and thoughts regarding the business condition of the firm. This results in an improved collective understanding of the business. INSTRUCTIONS: 1. Develop a IFE Matrix for Walt Disney. Use the complied SWOT generated in class. 1. What strategies do you think would allow Disney to capitalize on its major strengths? What strategies would allow Disney to improve upon its major weaknesses? TEACHING NOTES: The steps for completing an IFE Matrix are as follows: 1. List key internal factors as identified in the internal-audit process. Use a total of ten to twenty internal factors, including both strengths and weaknesses. List strengths first and then weaknesses. 2. Assign a weight that ranges from .0 (not important) to 1.0 (all important) to each factor. The weight assigned to a given factor indicates the relative importance of the factor to being successful in the firm’s industry. The sum of all weights must equal 1.0. 3. Assign a 1-4 rating to each factor to indicate whether that factor represents a major weakness (1), a minor weakness (2), minor strength (3), or major strength (4). Strengths must receive a 3 or 4 and weaknesses must receive a 1 or 2. 4. Multiply each factor’s weight by its rating to determine its weighted score for each variable. 5. Sum the weighted scores for each variable to determine the total weighted score for the organization.