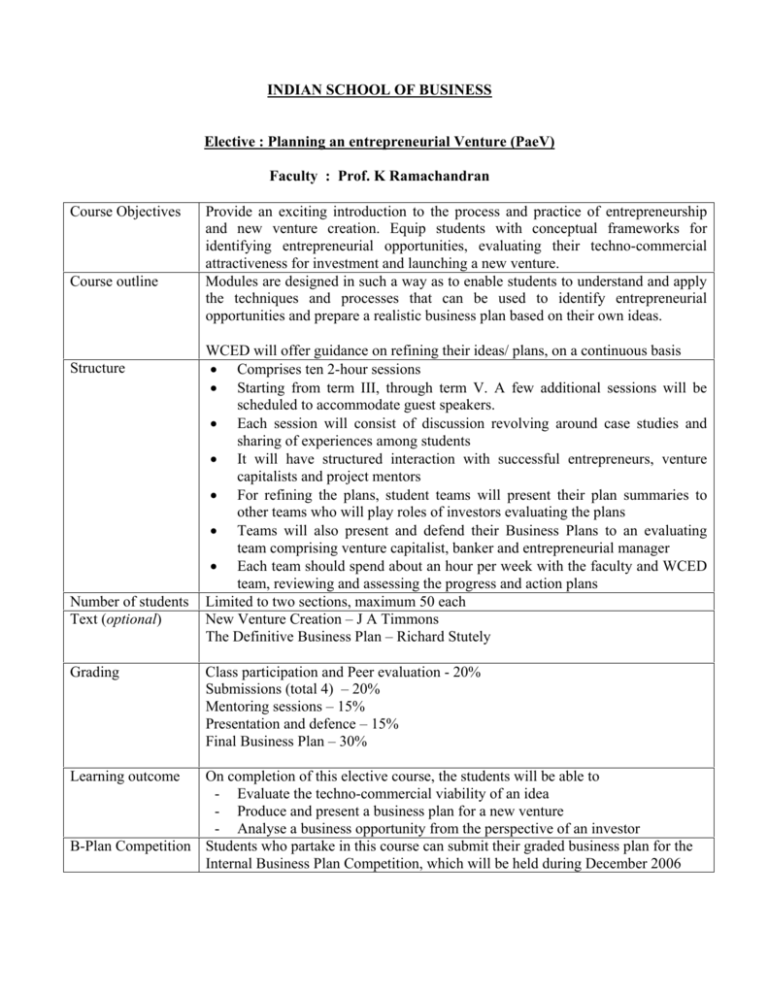

INDIAN SCHOOL OF BUSINESS

advertisement

INDIAN SCHOOL OF BUSINESS Elective : Planning an entrepreneurial Venture (PaeV) Faculty : Prof. K Ramachandran Course Objectives Course outline Structure Number of students Text (optional) Grading Learning outcome Provide an exciting introduction to the process and practice of entrepreneurship and new venture creation. Equip students with conceptual frameworks for identifying entrepreneurial opportunities, evaluating their techno-commercial attractiveness for investment and launching a new venture. Modules are designed in such a way as to enable students to understand and apply the techniques and processes that can be used to identify entrepreneurial opportunities and prepare a realistic business plan based on their own ideas. WCED will offer guidance on refining their ideas/ plans, on a continuous basis • Comprises ten 2-hour sessions • Starting from term III, through term V. A few additional sessions will be scheduled to accommodate guest speakers. • Each session will consist of discussion revolving around case studies and sharing of experiences among students • It will have structured interaction with successful entrepreneurs, venture capitalists and project mentors • For refining the plans, student teams will present their plan summaries to other teams who will play roles of investors evaluating the plans • Teams will also present and defend their Business Plans to an evaluating team comprising venture capitalist, banker and entrepreneurial manager • Each team should spend about an hour per week with the faculty and WCED team, reviewing and assessing the progress and action plans Limited to two sections, maximum 50 each New Venture Creation – J A Timmons The Definitive Business Plan – Richard Stutely Class participation and Peer evaluation - 20% Submissions (total 4) – 20% Mentoring sessions – 15% Presentation and defence – 15% Final Business Plan – 30% On completion of this elective course, the students will be able to - Evaluate the techno-commercial viability of an idea - Produce and present a business plan for a new venture - Analyse a business opportunity from the perspective of an investor B-Plan Competition Students who partake in this course can submit their graded business plan for the Internal Business Plan Competition, which will be held during December 2006 Planning an entrepreneurial Venture – Course outline Date Time slot Session topic Opportunity Identification, evaluation Is there opportunity in the market? Pre-dinner Guest – Manish Sabherwal (Teamlease) Aug, 03 Aug 04 Assessing Market Attractiveness Is there market in the opportunity? Aug, 14 Aug, 14 Pre-dinner Configuring Entry Strategies Gaining a foothold Aug, 17 Aug, 17 Guest – S. Bhikchandani (Naukri.com) Pre-dinner Aug, 21 Guest – C K Ranganathan (Cavinkare) Writing and evaluating Business Plans Building blocks of business roll out Sept, 06 Strategies to manage Working Capital The lifeline of your business Sept, 11 Estimating Working Capital & Capex How much ‘moolah’ should you find? Financing your dream VC-Entrepreneur – a jugalbandhi Sept, 13 Guests – VC-Entrepreneur team Sept , 26 Oct, 21 Nov , 11, 12 Project VC Experience being on the other side Entire day (2 hrs each per team) Entire day (1 hr each per team) Refining Your Plan Peer review process Reading material The questions every entrepreneur must answer (Amar Bhide, HBR – Nov/Dec 1996) Innovation & Entrepreneurship (Peter Drucker, HBR – May/June 1985) Cust omer dissatisfaction as a source of entrepreneurial opportunity (K Ramachandran, Nanyang Business Review, July/Dec 2003) Understanding user needs (HBS 9-695-051, Jan 1995) Four steps to forecast total market demand (F W Barnett, 88401, HBR, Jul-Aug, 1988) WCED Case lets New product commercialization: common mistakes (HBS 9-594 -127) How do you know when pricing is right (HBR, Sept-Oct, 1995) WCED Case lets Chapter 10, New Venture Creation, J A Timmons Milestones for successful venture plans (Z. Bloc, Mac Millan, HBR, Sept-Oct, 1985) Business model analysis for the entrepreneur (HBS 9-802-048, 2002) Fast, Global and Entrepreneurial: Supply chain management, Hong Kong style (Joan Magretta, HBR, Sep-Oct, 1998) Case – Dell’s Working Capital Cash Management Practises in small companies (HBS, 9-699-047, Dec 1998) How fast can your company afford to grow (HBR, May 2001) WCED Case lets How venture capital work (B Zider, HBR, Nov-Dec, 1998) The top ten lies of entrepreneurs (G Kawasaki, HBR – F0101B) Convincing the cash-conscious banker (Jonathan Levie, Mastering Entrepreneurship) What Venture Capitalists look for (Sue Birley, D F Muzyka, Mastering Entrepreneurship) How to write a winning business plan (Rich & Gumpet, HBR - May/June 1985) Vital truths about managing your costs (HBR, Jan-Feb, 1990) Some thoughts on business plan (Bill Sahlman, HBR no 9 – 897 –101) Defending your plan Can it stand investor scrutiny? Guests – VC/Banker/ ISB alumni panel (Guest speakers and dates for their session are tentative) Submissions to be made between August and November Date Timing By 1 Aug, 01 Business ideas Individuals 2 Aug, 10 Preliminary evaluation of ideas Team 3 Aug, 20 Market attractiveness & entry strategies for team’s idea (*) Team 4 Sept, 05 Operational requirements for team’s idea (*) Team 5 Sept, 20 Capex requirements for the project (*) Team 6 Oct, 15 Executive summary of B-Plan Team 7 Nov, 10 Draft Business Plan (*) Team 8 Nov, 30 Final B-Plan (*) Team (*) – These submissions are graded On-going one to one counseling • Guidance and support from the Professor and the Director (Entrepreneurship Development). Each team must attend a one-hour mentoring session, every week • Depending on requirement, WCED team will facilitate interactions with external mentors/ consultants/ entrepreneurs Pre course activities • This phase will be facilitated by the PGP office, EVC Club and WCED 1 Idea Workshops July 2 Registration for the course July 15, 2006 3 Withdrawal from the course August 05, 2006 4 Final list of students August 06, 2006 5 Formation of teams Latest by August 10, 2006 6 Submission of final project ideas August, 20, 2006