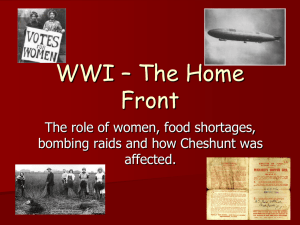

ANNUAL REPORT - ZEPPELIN GmbH

advertisement