2006 - Office of the Controller

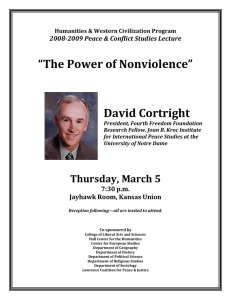

advertisement