Credit card balance transfer application 2014 11

advertisement

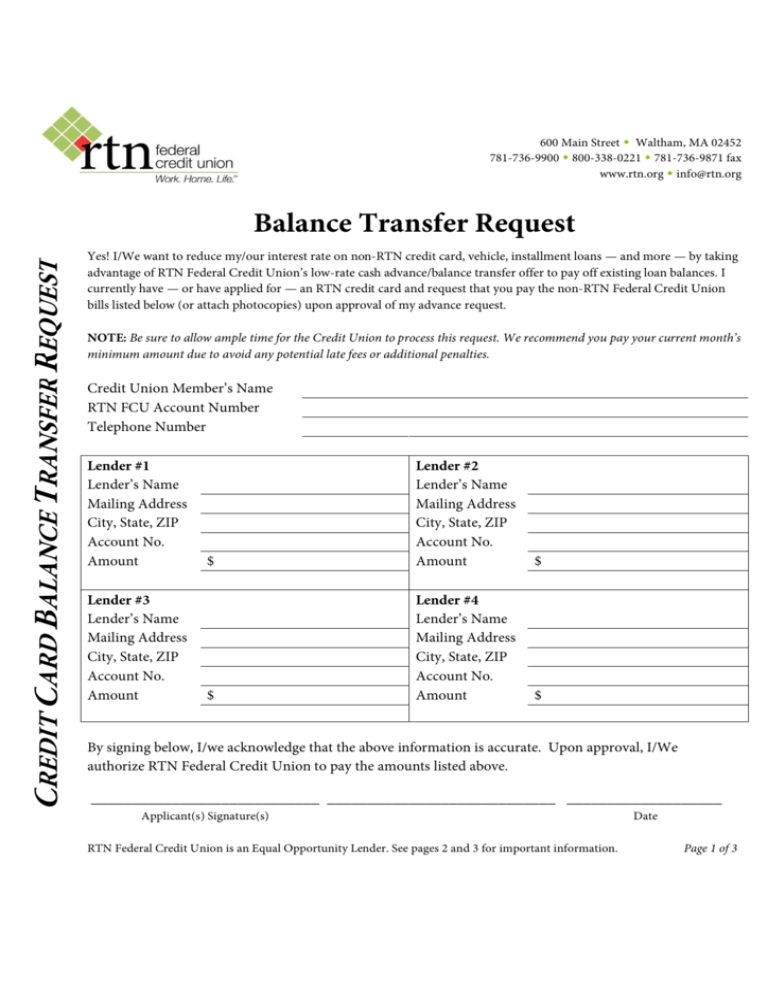

600 Main Street Waltham, MA 02452 781-736-9900 800-338-0221 781-736-9871 fax www.rtn.org info@rtn.org CREDIT CARD BALANCE TRANSFER REQUEST Balance Transfer Request Yes! I/We want to reduce my/our interest rate on non-RTN credit card, vehicle, installment loans — and more — by taking advantage of RTN Federal Credit Union’s low-rate cash advance/balance transfer offer to pay off existing loan balances. I currently have — or have applied for — an RTN credit card and request that you pay the non-RTN Federal Credit Union bills listed below (or attach photocopies) upon approval of my advance request. NOTE: Be sure to allow ample time for the Credit Union to process this request. We recommend you pay your current month’s minimum amount due to avoid any potential late fees or additional penalties. Credit Union Member’s Name RTN FCU Account Number Telephone Number Lender #1 Lender’s Name Mailing Address City, State, ZIP Account No. Amount Lender #3 Lender’s Name Mailing Address City, State, ZIP Account No. Amount $ Lender #2 Lender’s Name Mailing Address City, State, ZIP Account No. Amount $ $ Lender #4 Lender’s Name Mailing Address City, State, ZIP Account No. Amount $ By signing below, I/we acknowledge that the above information is accurate. Upon approval, I/We authorize RTN Federal Credit Union to pay the amounts listed above. ‘ ____________________________ ____________________________ ___________________ Applicant(s) Signature(s) RTN Federal Credit Union is an Equal Opportunity Lender. See pages 2 and 3 for important information. Date Page 1 of 3 DISCLOSURES FOR RTN FCU CREDIT CARD NUMBERS STARTING WITH 4739, 4820, 4756 or 5423 Interest Rates and Interest Charges Annual Percentage VISA Platinum: 9.99% to 18.00% when you open your account, based on your Rate (APR) for creditworthiness. Purchases VISA Gold: 10.99% to 18.00% when you open your account, based on your creditworthiness. VISA Classic: 11.99% to 18.00% when you open your account, based on your creditworthiness. APR for Cash 8.24% The APR will vary. The APR is the prime rate as published in The Wall Street Journal on Advances the last day of the month, plus 4.99%. Established accounts should refer to account statement for the applicable cash advance rate. Penalty APR and When Not applicable it Applies Your due date is at least 25 days after the close of each billing cycle. We will not charge How to Avoid Interest you any interest on purchases if you pay the entire balance by the due date each month. on Purchases Minimum Interest Charge For Credit Card Tips from the Federal Reserve Board Fees Transaction Fees Cash Advances Foreign Transaction Penalty Fees Late Payment Returned Payment Other Fees Annual Fee Card Replacement None To learn more about factors to consider when applying or using a credit card, visit the website of the Federal Reserve Board at http://www.federalreserve.gov/creditcard $2.00 2% of the amount of each foreign currency purchase after its conversion to US currency up to $25.00 up to $25.00 . VISA Classic: $10.00; VISA Gold and Platinum: $20.00. Waived if member has direct deposit. $10.00 How We Will Calculate Your Balance: We use a method called 'average daily balance (including new purchases).' Billing Rights: Information on your rights to dispute transactions and how to exercise those rights is provided in your disclosure agreement. Maximum Credit Limits: VISA Classic: $10,000; VISA Gold or Platinum: $25,000 This information about the costs of the cards describes in this disclosure is accurate as of the date printed below. This information may have changed after that date. To find out what may have changed, contact Member Services at 800-338-0221, ext. 9829, or info@rtn.org. Addendum as of November 24, 2014; Page 2 of 3 RTN FCU CREDIT CARD DISCLOSURE FOR CARD NUMBERS STARTING WITH 4091 OR 4202 Interest Rates and Interest Charges Annual Percentage VISA Platinum, Option 1: 10.25%. This rate will vary with the market based on the Rate (APR) for Prime Rate as published in The Wall Street Journal on the first day of the business cycle Purchases plus 7% VISA Platinum, Option 2: 9.25%. This rate will vary with the market based on the Prime Rate as published in The Wall Street Journal on the first day of the business cycle plus 6% VISA Classic: 14.99%. This rate will vary with the market based on the Prime Rate as published in The Wall Street Journal on the first day of the business cycle plus 11.74% VISA Platinum: Same APR as for purchases (above). VISA Classic: currently 16.99% APR, will vary with the market based on the Prime Rate as published in The Wall Street Journal on the first day of the business cycle plus 13.74%. Penalty APR and When VISA Platinum: 14.99% if you: it Applies Applicable if you (1) make a late payment, (2) go over your credit limit twice in a sixmonth period, (3) make a payment that is returned or (4) you do any of the above on another account with us How long will the penalty APR apply? If your APRs are increased for any of these reasons, the penalty APR will apply until you make six consecutive minimum payments when due. How to Avoid Interest Your due date is at least 25 days after the close of each billing cycle. We will not charge on Purchases you any interest on purchases if you pay the entire balance by the due date each month. We will begin charging interest on cash advances and balance transfers on the transaction date. For Credit Card Tips To learn more about factors to consider when applying or using a credit card, visit the from the Federal website of the Federal Reserve Board at http://www.federalreserve.gov/creditcard Reserve Board APR for Cash Advances Fees Transaction Fees Cash advances Balance Transfers Foreign Transaction Penalty Fees Late Payment Returned Payment Other Fees Annual Fee Not applicable $20.00 $25.00 VISA Platinum — Option 1: None; Option 2: $50.00 How We Will Calculate Your Balance: We use a method called 'average daily balance (including new purchases).' Billing Rights: Information on your rights to dispute transactions and how to exercise those rights is provided in your disclosure agreement. Maximum Credit Limits: VISA Classic: $10,000; VISA Platinum: $25,000 This information about the costs of the cards describes in this disclosure is accurate as of the date printed below. This information may have changed after that date. To find out what may have changed, contact Member Services at 800-338-0221, ext. 9829, or info@rtn.org. Addendum as of November 21, 2014; Pg. 3 of 3