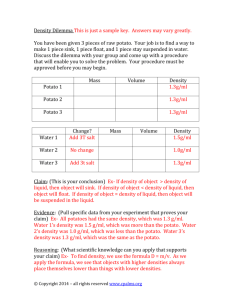

Potatoes Complaint PDF

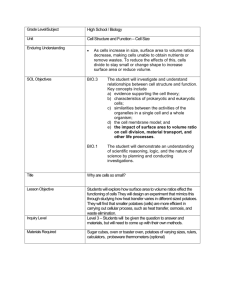

advertisement